It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by Hx3_1963

USD 76.46

YEN 88.981

EUR 146.941

USD lower...YEN higher...EUR higher=not looking so good at the moment ???

WTI Crude Oil 70.38

[edit on 10/5/2009 by Hx3_1963]

I can see Canada taking a bath too as our currency is tied into the US pretty heavily. I'm not sure gold is safe I have noticed the Un world bank talking about a major release of gold this fall. I suspect they suckered people into gold so they could take away again 80% of the people savings again like they did last fall.

This really isn't a conspiracy theory, it is simply reality happenning.

This is only one of the many trial ballons being floated out there before reality arrives.

J

This is only one of the many trial ballons being floated out there before reality arrives.

J

Consider that if we do fall, China will be hurt too. We are number #1 in consumer spending. So if we drop and can not afford goods outside the US,

then who will buy those goods?

If you look at this link LEFTY HATES AMERICA you can see even it says we are #1 in weaponry,consumer spending and debt.

1) We are safe because we are number 1 in weaponry (and we have not outsourced that)

2) If we are #1 in debt and our interest rates are based on the Fed, and our banks are US banks then the interest rates will be dictated by the government. So guess what, inflation would reduce the value of your debt ensure it can be eliminated faster.

3) Well if we are #1 in consumer spending and our economy collapses, we are no longer going to be spending. So does that mean a Dollar collapse or a world wide depression?

Perhaps that is why they said it will happen over 9 years.

If you look at this link LEFTY HATES AMERICA you can see even it says we are #1 in weaponry,consumer spending and debt.

1) We are safe because we are number 1 in weaponry (and we have not outsourced that)

2) If we are #1 in debt and our interest rates are based on the Fed, and our banks are US banks then the interest rates will be dictated by the government. So guess what, inflation would reduce the value of your debt ensure it can be eliminated faster.

3) Well if we are #1 in consumer spending and our economy collapses, we are no longer going to be spending. So does that mean a Dollar collapse or a world wide depression?

Perhaps that is why they said it will happen over 9 years.

Why do I get the feeling people on ATS only want to see one side of our currency problems. What reasonable person seeing how our economy has worked

over the past 100 years would think it is sustainable? The faster it fails, the faster we have the opportunity to rebuild. Although I think on the

board I am just blowing smoke in the wind.

Nothing will happen.

US of A is still number 1.

You think other banking systems are in a better shape?

At least ours is already exposed...

And have no doubt - our financial system is still the most advanced

when compared to many others.

So petrodollars, or petroeuros - the impact will be minuscule.

US of A is still number 1.

You think other banking systems are in a better shape?

At least ours is already exposed...

And have no doubt - our financial system is still the most advanced

when compared to many others.

So petrodollars, or petroeuros - the impact will be minuscule.

reply to post by TimeTo23

Here's the thing. You are already invested in a sinking ship and no amount of insurance will help when the ship goes down. Better to try and quietly divest your interest and then when the inevitable happens you wont be hurt as much.

The other nations are lowering the lifeboats and they are elbowing for position to be first in when the shtf!

[edit on 5-10-2009 by skepticantiseptic]

Here's the thing. You are already invested in a sinking ship and no amount of insurance will help when the ship goes down. Better to try and quietly divest your interest and then when the inevitable happens you wont be hurt as much.

The other nations are lowering the lifeboats and they are elbowing for position to be first in when the shtf!

[edit on 5-10-2009 by skepticantiseptic]

Originally posted by chi_z

this just in:

Damn! In addition to the raping of trillions off the backs of Americans, the Illuminati are skimming 30 percent off the top in an exchange. How nice!

1 Australian dollar = 0.8771 U.S. dollars

Invest in Aussie dollars lol

just kidding i think the whole worlds will feel the crunch WHEN the us dollar falls. Your cant print trillions of dollars and it not have an impact. Time to pay the piper lads.

Invest in Aussie dollars lol

just kidding i think the whole worlds will feel the crunch WHEN the us dollar falls. Your cant print trillions of dollars and it not have an impact. Time to pay the piper lads.

reply to post by skepticantiseptic

A sinking ship always gives way to sunken treasure. It is up to us to bring what is good back to the land.

My investments are in physical commodities that I hold. My employment is self and not employed by other. This financial crisis has been a boom for my business. So I have done well so far on investments because I understand that this system is based on a mass hypnosis. the reality is it will take Money to crash for people to realize they do not need it.

People accomplish everything. We we need to decide to do is work together for advancement. Let go of the worldly crap that does us no good. It can not sustain itself. It is guaranteed to crumble because it is not real. So I say let it be done. That way we can work with what is real. If not then it is a lost opportunity for our nation. it would be a lost opportunity to light the way for the world to see. People working together for passion of what is needed. Not a dollar that is only an empty promise waiting to blow away like the finest of dust one day.

A sinking ship always gives way to sunken treasure. It is up to us to bring what is good back to the land.

My investments are in physical commodities that I hold. My employment is self and not employed by other. This financial crisis has been a boom for my business. So I have done well so far on investments because I understand that this system is based on a mass hypnosis. the reality is it will take Money to crash for people to realize they do not need it.

People accomplish everything. We we need to decide to do is work together for advancement. Let go of the worldly crap that does us no good. It can not sustain itself. It is guaranteed to crumble because it is not real. So I say let it be done. That way we can work with what is real. If not then it is a lost opportunity for our nation. it would be a lost opportunity to light the way for the world to see. People working together for passion of what is needed. Not a dollar that is only an empty promise waiting to blow away like the finest of dust one day.

I am very suspicious of such massive developments. I just don't think this will result in a dollar collapse.

I think this could be a dupe to lower the dollar value then foreign power brokers will just buy up more America assets then the US starts another war with Iran causing this "new agreement" to be be jeopardized and they will have to go back to the US dollar.

I just don't see this as the hail mary for the New World Order they just aren't this obvious. This looks like a scam. Watch for the next couple of days France to say they have no plan to do this and Japan also and this will eventually disintegrate and the US dollar will actually gain ground.

After of course our rulers have but up more US assets on the cheap.

The more i think about this the more this looks like an attack from the inside on the Shanghai co-operation agreement between Iran China and Russia. The NWO mainstays have put controlled assets (France, Saudi Arabia and Japan) inside this group and when all is said and done they will back out and screw over the SCA.

France will be the first to make the statement that they had no plans to do this then Saudi Arabia then Japan. Just my prediction.

[edit on 6-10-2009 by Beefcake]

I think this could be a dupe to lower the dollar value then foreign power brokers will just buy up more America assets then the US starts another war with Iran causing this "new agreement" to be be jeopardized and they will have to go back to the US dollar.

I just don't see this as the hail mary for the New World Order they just aren't this obvious. This looks like a scam. Watch for the next couple of days France to say they have no plan to do this and Japan also and this will eventually disintegrate and the US dollar will actually gain ground.

After of course our rulers have but up more US assets on the cheap.

The more i think about this the more this looks like an attack from the inside on the Shanghai co-operation agreement between Iran China and Russia. The NWO mainstays have put controlled assets (France, Saudi Arabia and Japan) inside this group and when all is said and done they will back out and screw over the SCA.

France will be the first to make the statement that they had no plans to do this then Saudi Arabia then Japan. Just my prediction.

[edit on 6-10-2009 by Beefcake]

reply to post by Beefcake

hmmm you might be right, i think the US is playing possum with the world. There making up fake figures of economic collapse and unemployment rates they even managed to devalue their currency by printing trillions of dollars all in a genius plot to fool the world.

hmmm you might be right, i think the US is playing possum with the world. There making up fake figures of economic collapse and unemployment rates they even managed to devalue their currency by printing trillions of dollars all in a genius plot to fool the world.

I will be honest, I know absolutely nothing about the stock market. But is the market futures reading Dow -12 mean that possible trouble may be

brewing? Seems like a pretty large drop.

This has actually been going on for some time, most major economies have been distributing their foreign currency reserves as an obvious way to reduce

risk. China began the process of getting rid of dollars about a decade ago, probably in favour of Euro, Japanese Yen etc.

reply to post by Psi-Vampress

Nah -12 ain't not that much...it was +23 a while ago...guess someone saw the news... :shk:

Wait till it gets -100

Hmmm...these were all big + #'s a while ago also...

finance.yahoo.com...

Anyone see this?

Banks brace for Latvia's collapse

www.telegraph.co.uk...

[edit on 10/6/2009 by Hx3_1963]

Wait till it gets -100

Hmmm...these were all big + #'s a while ago also...

finance.yahoo.com...

Anyone see this?

Banks brace for Latvia's collapse

www.telegraph.co.uk...

[edit on 10/6/2009 by Hx3_1963]

Originally posted by TiM3LoRd

reply to post by Beefcake

hmmm you might be right, i think the US is playing possum with the world. There making up fake figures of economic collapse and unemployment rates they even managed to devalue their currency by printing trillions of dollars all in a genius plot to fool the world.

It is a little about that in that i don't think the US is as weak as everyone is made to think(make them think you are weak when you are strong) but i think it is more about dissolving or weakening the shanghai co-operation organization(Russia, China, Iran).

The shanghai co-operation organization just like any group depends on trust and if they take others in at least on the dropping of the dollar plan then the story gets conveniently "leaked" and countries back peddle like France, saudi Arabia and Japan. This will hurt them deeply it will almost prevent them from trying it again because they won't know who to trust.

If they can't trust anyone then maybe they will see themselves as a hopeless group and will just say "screw it lets just go along to get along The shanghai co-operation organization is over. Once this group is over...

Iran is all alone and a sitting duck then we have

War

And while we're at it might as well throw a Bloomberg in the mix...

More at Link...

Dollar Falls on Report Gulf States May Stop Using Greenback

www.bloomberg.com...

Oct. 6 (Bloomberg) -- The dollar fell for a second day against the yen as the Independent newspaper said Gulf states may switch to a basket of currencies for oil trading. The yen rose after Japan’s finance minister said he told Group of Seven leaders weak-currency policies were undesirable.

The dollar declined against 14 of its 16 major counterparts as Asian stocks rallied and the Independent cited banking sources in Hong Kong as saying Gulf states along with Japan and China are discussing dropping the dollar for oil trades. The euro rose before a report forecast to show German factory orders increased for a sixth month. Australia’s dollar surged after the nation’s central bank raised benchmark interest rates.

“I do think that eventually there will be a move to non- dollar commodity contracts, and it may be the next big risk for the dollar,” said Ben Simpfendorfer, chief China economist for Royal Bank of Scotland Group Plc in Hong Kong. “At the same time I don’t want to overplay the importance of the story. There’s no credible sources there.”

The move would see oil priced not in dollars but in a unit based on a basket of currencies including the Chinese yuan, the Japanese yen, and a new currency intended for use by the Gulf emirates, according to a report in Tuesday's Independent newspaper. The paper added that the transistion from the dollar to a new currency will take almost a decade.

Finance ministers and central bankers have held meetings in Russia, China, Japan and Brazil to discuss the idea, which the Americans are aware of, the Independent said.

"Eventually there will be a move to non-dollar commodity contracts, and it may be the next big risk for the dollar," Ben Simpfendorfer, chief China economist for Royal Bank of Scotland, told Bloomberg. "At the same time, I don't want to overplay the importance of the story. There's no credible sources there."

The financial crisis has intensified speculation about the eventual demise of the dollar as the world's reserve currency. In the last six months, Russia, Brazil, India and China have already discussed buying each other's debt as a way of cutting their dependence on the dollar, while the United Nations last month proposed a new global currency to replace the greenback.

The dominant role of the dollar in world trade and financial markets - a position it inherited from sterling - has already been under threat since the formation of the euro and the emergence of China as a major economic power.

The amount of the the world's currency reserves held in dollars has fallen over the past decade, with the it declining to a record low of 62.8pc in the second quarter, figures from the International Monetary Fund showed last week. The euro's share climbed to 27.5pc from 25.9pc.

But few experts expect the dollar's status to be quickly eclipsed.

Niall Ferguson, a Harvard University Professor, said yesterday that there wouldn't be a dollar collapse given the lack of proper alternatives. “There are enormously strong arguments for maintaining a substantial pile of your reserves in dollar form,” according to Professor Ferguson. "That is still the currency of choice for most of the trade that goes on in the world.”

However, there seems little doubt that China's fears over the fate of the dollar have increased recently. Timothy Geither, the US Treasury Secretary, has sought to ease China's worry that America's combination of record low interest rates and a policy of printing money will spark a sharp decline in the currency. China is America's biggest international creditor.

The dollar was weaker in early morning trading in London, losing half a cent against the euro at $1.4722 and weaker against the pound.

www.telegraph.co.uk...

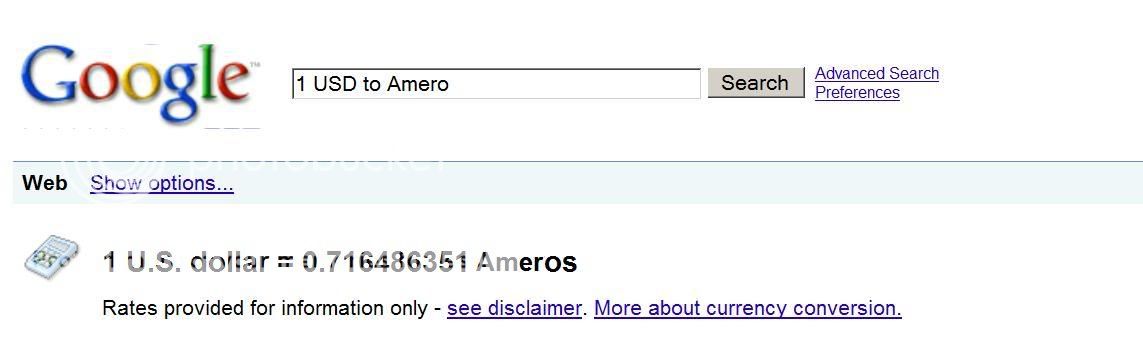

Haha............and we are surprised? I definitely see the Amero or some sort of North American Union currency coming into play in the next decade to

combat this. It's the only option. America has hit an iceberg and all the talking heads and out of touch politicians can say is everything is going

to be ok.....don't worry. LMAO! Typical big government charlatans.

Photoshopped google images notwithstanding, the desire to create a competing currency to frustrate the ascendancy of rival currencies is a much more

attractive concept now.

Moving to another currency would also bury other sins...and offer real opportunity for those on the inside or in the right place at the right time.

The only question I wonder about is whether the shift will happen abruptly or more slowly over time?

[edit on 6-10-2009 by loam]

Moving to another currency would also bury other sins...and offer real opportunity for those on the inside or in the right place at the right time.

The only question I wonder about is whether the shift will happen abruptly or more slowly over time?

[edit on 6-10-2009 by loam]

Now CNBC is reporting the story is completely untrue...

All the indicators are trying to do a 180 now...

All is right in the World once again...(Birds singing...Rainbows appearing...)

What else would we expect TPTB to say...after all it was a ~secret~ ...

[edit on 10/6/2009 by Hx3_1963]

All the indicators are trying to do a 180 now...

All is right in the World once again...(Birds singing...Rainbows appearing...)

What else would we expect TPTB to say...after all it was a ~secret~ ...

[edit on 10/6/2009 by Hx3_1963]

new topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 1 hours ago -

America's Greatest Ally

General Chit Chat: 1 hours ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 6 hours ago -

Maestro Benedetto

Literature: 8 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 8 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 6 hours ago, 27 flags -

Weinstein's conviction overturned

Mainstream News: 16 hours ago, 8 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 13 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 15 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 12 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 15 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 12 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 8 hours ago, 3 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 1 hours ago, 3 flags -

Maestro Benedetto

Literature: 8 hours ago, 1 flags

active topics

-

Russia Ukraine Update Thread - part 3

World War Three • 5732 • : F2d5thCavv2 -

The Acronym Game .. Pt.3

General Chit Chat • 7751 • : F2d5thCavv2 -

Salvador Dali's Moustaches

People • 28 • : zosimov -

Is AI Better Than the Hollywood Elite?

Movies • 17 • : ThePsycheaux -

The best Rice dish i've ever tasted... Kimchi Rice

Food and Cooking • 26 • : lamhaocc -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 1 • : 727Sky -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 15 • : tarantulabite1 -

America's Greatest Ally

General Chit Chat • 1 • : BingoMcGoof -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 35 • : annonentity -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 49 • : Freeborn