It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

We already have a high tax and we are in this problem. Federal tax 30%, California State tax 10%, 8% Sales tax, Social Security Tax, Disability Tax,

Unemployment Insurance (tax), Property Tax, Auto property tax registration fee (tax), Special taxes on gasoline, services like Universal Service Fund

(tax). How much more to we need to bleed and get squeeze. I know that paying a rediculous amount of tax on my pay and then tax on things I have to buy

to survive makes me really happy. So yes, we should raise them even higher so that those who recklessly spend have more to waste and give themselves

higher salaries. Yayee for taxes!!!

Originally posted by peck420

Originally posted by Indigo5

You represent data the same way most US economists do, like the US is in an isolated bubble. It is not. I would bet my life that if world market averages were used to show disparities between global market changes and tax induced changes, we would find that the higher tax rates influence slower GDP growth and lower tax rates influence faster GDP growth.

And you would be wrong...Looking at other countries? SAME conclusion...Here we have Canada...same results over decades as the USA.

www.brijeshmathur.com...

Ireland

www.irishleftreview.org...

Also here

www.marketoracle.co.uk...

I could list dozens of links for dozens of countries...

edit on 30-11-2012 by Indigo5 because: (no reason given)

reply to post by Indigo5

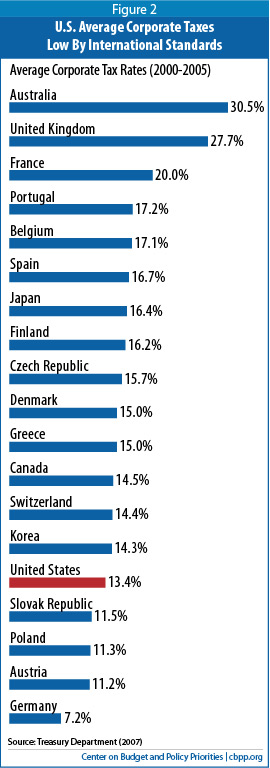

13% is nearly what we pay in sales tax alone.

www.bargaineering.com...

35K/yr gets you to the 28% bracket and that is for Federal Tax alone. Try being independent and living on 35k in California. It's not going to happen.

13% is nearly what we pay in sales tax alone.

www.bargaineering.com...

35K/yr gets you to the 28% bracket and that is for Federal Tax alone. Try being independent and living on 35k in California. It's not going to happen.

Originally posted by GoldenVoyager

reply to post by Indigo5

13% is nearly what we pay in sales tax alone.

www.bargaineering.com...

35K/yr gets you to the 28% bracket and that is for Federal Tax alone. Try being independent and living on 35k in California. It's not going to happen.

I thought we were discussing raising rates on those making 250k or 500k and corporate tax rates?

edit on 30-11-2012 by Indigo5 because: (no

reason given)

Originally posted by Indigo5

And you would be wrong...Looking at other countries? SAME conclusion...Here we have Canada...same results over decades as the USA.

www.brijeshmathur.com...

Ireland

www.irishleftreview.org...

Also here

www.marketoracle.co.uk...

I could list dozens of links for dozens of countries...edit on 30-11-2012 by Indigo5 because: (no reason given)

Do you have any actual empirical data? Or is blogs and articles only?

Aside from the fact that you can't compare country to country (every country's,or even state, Hauser point must be independently studied), how about this:

Fastest growing GDP in Canada? Alberta

Lowest corporate tax rate in Canada? Alberta

Lowest income tax rates in Canada? Alberta

Highest tax receipts per capita? Alberta

And, I can post you dozens of links to economists wondering how one small province in Canada (population wise) can prop up the country?

But, if you want to listen to the same economists that saw no major problems with the current establishment prior to the financial crisis, that is your prerogative.

edit on 30-11-2012 by peck420 because: (no reason given)

edit on 30-11-2012 by peck420 because: (no reason

given)

reply to post by Indigo5

I probably jumped the gun. I sympathise with all of the 99% of which I am merely a slave running on the same treadmill trying to survive and support my two children.

I probably jumped the gun. I sympathise with all of the 99% of which I am merely a slave running on the same treadmill trying to survive and support my two children.

Sometimes taxes forces a company to make choices. Either re-invest in the company with new tooling, more employees, new branches, etc...all of which

are tax deductible...or they tax your profits and take the money. Back in the day of higher tax rates, the corporations were forced to keep the money

in circulation or be taxed at a much higher profit percentage. So they did.

That worked till we opened up back doors to overseas manufacturing, dropped tariffs and allowed money to be stored over seas in tax shelters.

The point in this problem we are facing is...no one is playing completely over the table. The tax haters know how the system used to work...and the tax lovers know that it is all meaningless if you don't reduce spending...

We're pretty much screwed either way....

and yes, there was a time we boomed because all the other industrialized countries had been flattened in war...here's a hint...they're back!

That worked till we opened up back doors to overseas manufacturing, dropped tariffs and allowed money to be stored over seas in tax shelters.

The point in this problem we are facing is...no one is playing completely over the table. The tax haters know how the system used to work...and the tax lovers know that it is all meaningless if you don't reduce spending...

We're pretty much screwed either way....

and yes, there was a time we boomed because all the other industrialized countries had been flattened in war...here's a hint...they're back!

Originally posted by peck420

Do you have any actual empirical data? Or is blogs and articles only?

I provided articles for high altitude, blogs for low altitude drilling on the data and numbers. I provided sources from both conservatives and liberals, and yes...all of it founded wholey on empirical data.

Either you have not read my links or you have and decided to ignore the tonnage of data ...either way we are not having an honest discussion.

edit on 1-12-2012 by Indigo5 because: (no reason given)

As long as the billionares and trillionares pay next to nothing because they can get away with it, and as long as we encourage infinite outsourcing,

there isn't a snowball's chance in hell the economy will ever effectively recover.

In fact I am convinced the conspiracy is to sink america and europe, then start world war 3 and start all over. Omission of truth and constantly pushing the wrong ideas is becoming obvious even for the ignorant.

In fact I am convinced the conspiracy is to sink america and europe, then start world war 3 and start all over. Omission of truth and constantly pushing the wrong ideas is becoming obvious even for the ignorant.

Definition of Irony for today:

Obama supporters enjoy equating Obama's (alleged) desire to raise income taxes on the top 2% of Americans with Obama cracking down on those big, bad corporations who rape our fathers and kill our mothers... Reality, however, paints a different picture. Feb, 2012

Uh oh!

I think it is a safe bet that the OWS crowd that voted for Obama and spoke of the man as if he and his party were alligned with their goals failed to do their homework. Obama is a close personal friend of corporate interests. The difference between Obama and, say, a John Boehner, is that Boehner makes no attempt to disguise his friendship with corporations and business. Most of the GOP will happily state that they consider those corporations to be the life blood of America and we should keep their tax burdens low in return. Reality is that neither party has any intention of screwing the wealthy in America UNLESS they are told to do so by foreign entities and interests who are wealthier than America's top percent and/or they have provided an out for the top 1%, making any change cosmetic and imaginary. Proof of that lies in the span of 2008 to 2010 when Obama had his filibusterproof majority and could have raised taxes to whatever "Pay no attention to the man behind the curtain" distraction level he's calling for today with just the snap of his fingers.

It is a sad world when we've gone from the days of people angrily accepting being bent over by the government to a majority of people calling for themselves to be bent over and then asking gleefully for another. It is like the Stockholm Syndrome has invaded the US voter base.

Obama supporters enjoy equating Obama's (alleged) desire to raise income taxes on the top 2% of Americans with Obama cracking down on those big, bad corporations who rape our fathers and kill our mothers... Reality, however, paints a different picture. Feb, 2012

Uh oh!

I think it is a safe bet that the OWS crowd that voted for Obama and spoke of the man as if he and his party were alligned with their goals failed to do their homework. Obama is a close personal friend of corporate interests. The difference between Obama and, say, a John Boehner, is that Boehner makes no attempt to disguise his friendship with corporations and business. Most of the GOP will happily state that they consider those corporations to be the life blood of America and we should keep their tax burdens low in return. Reality is that neither party has any intention of screwing the wealthy in America UNLESS they are told to do so by foreign entities and interests who are wealthier than America's top percent and/or they have provided an out for the top 1%, making any change cosmetic and imaginary. Proof of that lies in the span of 2008 to 2010 when Obama had his filibusterproof majority and could have raised taxes to whatever "Pay no attention to the man behind the curtain" distraction level he's calling for today with just the snap of his fingers.

It is a sad world when we've gone from the days of people angrily accepting being bent over by the government to a majority of people calling for themselves to be bent over and then asking gleefully for another. It is like the Stockholm Syndrome has invaded the US voter base.

reply to post by burdman30ott6

I agree one hundred percent with your analysis. How could I disagree?

"Just tax the rothschilds and rockefellers and leave everyone else the hell alone" should be the slogan of the next 50 years. The first family is said to have at least 100 trillion hide all over the place in secret trust accounts and the second around 30 trillion. Do people know how many zeros that is?

And something NEEDS to be done with outsourcing and automation. I have been crying over this for at least 2 years now. Protectionist policies are good, not bad. When did tariffs become such a dirty word? I like the constitution party which wants mercantilism of the old days. SPUSA or SWPUSA is not bad either although a little too extreme for my liking.

Liberals and conservatives work for the rich!

I agree one hundred percent with your analysis. How could I disagree?

"Just tax the rothschilds and rockefellers and leave everyone else the hell alone" should be the slogan of the next 50 years. The first family is said to have at least 100 trillion hide all over the place in secret trust accounts and the second around 30 trillion. Do people know how many zeros that is?

And something NEEDS to be done with outsourcing and automation. I have been crying over this for at least 2 years now. Protectionist policies are good, not bad. When did tariffs become such a dirty word? I like the constitution party which wants mercantilism of the old days. SPUSA or SWPUSA is not bad either although a little too extreme for my liking.

Liberals and conservatives work for the rich!

What happens when you raise taxes on cigarettes?

Many people stop smoking which actually nullifies the money gained from the tax increase.

Now replace "cigarettes" with "the rich" and tell me what logical conclusion you come up with.

Many people stop smoking which actually nullifies the money gained from the tax increase.

Now replace "cigarettes" with "the rich" and tell me what logical conclusion you come up with.

edit on 5-12-2012 by solidguy because: (no reason given)

You can tax the worker all you want, as they have no option but to pay it, check the rate of tax on businesses. I bet they are very low, low tax on

businesses encourages new start-up businesses which then provides more jobs.

There is no point giving tax breaks to large multinationals though, as like the workers, they have no choice but to pay it is the start up companies you need very little tax on.

There is no point giving tax breaks to large multinationals though, as like the workers, they have no choice but to pay it is the start up companies you need very little tax on.

edit on 5-12-2012 by dmsuse because: (no reason given)

Where I live (B.C. Canada) we have high taxes

2/3 of our population cross into the USA to shop where things can be 30% cheaper

Things are cheaper due to higher purchasing power of the US plus lower taxes for business and normally lower sales tax

As a Canadian business owner it normally costs $1.20 for every $1 item I purchased due to higher shipping fees, brokerage fees, exchange rates and import duties.

After I mark up a small 10 percent margin I then have to charge a 12% HST (sales tax)

No wonder so many people want to shop down south and save

So no, higher taxes are not the answer

2/3 of our population cross into the USA to shop where things can be 30% cheaper

Things are cheaper due to higher purchasing power of the US plus lower taxes for business and normally lower sales tax

As a Canadian business owner it normally costs $1.20 for every $1 item I purchased due to higher shipping fees, brokerage fees, exchange rates and import duties.

After I mark up a small 10 percent margin I then have to charge a 12% HST (sales tax)

No wonder so many people want to shop down south and save

So no, higher taxes are not the answer

Originally posted by 11235813213455

You can tax pretty heavily during the boom times but it is fools errand to keep the rates the same during the bust.

Taxation should ALWAYS lag behind private and corporate prosperity. You're never going to convince any correct thinking individual that taking more money from them makes them richer. You're also never going to convince any correct thinking individual that taxing the company they work for will make their job more stable or make it easier for them to get a raise in salary.

Thats the point, a healthy economy isnt about the single individual or one single buissness. Its about keeping the system flush with cash so there can be the merrygoround. Essentially you beat profits out of the economy, then it needs to be nursed back to health somehow. The lower wages you can get away with and the more profits you get to keep after reinvesting and buying essentials and luxuries, the sooner the point is reached where the economy stalls and it needs to be fixed through new money (inflation) or somehow accessing all that money the successfull managed to stash away from the system.

Originally posted by Merinda

I looked up the 60s, when America was on the way to the moon muscle cars were being dreamed up that sold for 5000 Dollars back then and go for 80.000 Euros in Sweden now (in good condition) and the economy was growing like crazy and employment was good. So I assumed tax rates would be really really low because the job creators were so busy and the middleclass was rocking.

Well turns out back in the day America had some of the highest taxation. The income tax went as high as 91% for the top bracket, that would give even the most socialist countries in Europe a stomach age. Capital gain tax went up to 35%. Now we are being told, high tax baaad, low tax good. However taxes have been low and things have not been so great. Now we are being told we just did not lower them enough.

So how do taxes really impact an economy? Do high taxes for the rich flush fresh capital back into the system without the inflation of the printing press?

Hard to say Merinda.

After WW2 50% of the worlds wealth were pooled in USA. (Money from europe and planed economy in war time USA.) Much of the good times 50s and 60s came from that wealth.

But the propaganda today about tax cuts is a tool that worked and works for the GOP. So it will take much to get over it.

If people just took a hard look at the time line of US debt and the Friedmans economic experiment, the neoliberal free economic agenda would go and die.

forexnewsnow.com...

You can see how both Bush and Obama piles on the US debt. That's because they work for the same people -

wall street. And Friedmans economic experiment is also called Reaganomics in the US - that's when it all started.

Crazy stuff....

new topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 1 hours ago -

America's Greatest Ally

General Chit Chat: 1 hours ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 6 hours ago -

Maestro Benedetto

Literature: 8 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 8 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 6 hours ago, 27 flags -

Weinstein's conviction overturned

Mainstream News: 16 hours ago, 8 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 13 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 15 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 12 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 15 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 12 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 8 hours ago, 3 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 1 hours ago, 3 flags -

Maestro Benedetto

Literature: 8 hours ago, 1 flags

active topics

-

Russia Ukraine Update Thread - part 3

World War Three • 5732 • : F2d5thCavv2 -

The Acronym Game .. Pt.3

General Chit Chat • 7751 • : F2d5thCavv2 -

Salvador Dali's Moustaches

People • 28 • : zosimov -

Is AI Better Than the Hollywood Elite?

Movies • 17 • : ThePsycheaux -

The best Rice dish i've ever tasted... Kimchi Rice

Food and Cooking • 26 • : lamhaocc -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 1 • : 727Sky -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 15 • : tarantulabite1 -

America's Greatest Ally

General Chit Chat • 1 • : BingoMcGoof -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 35 • : annonentity -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 49 • : Freeborn