It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

This one should have you sitting up in your chair!

Waiting for the train wreck

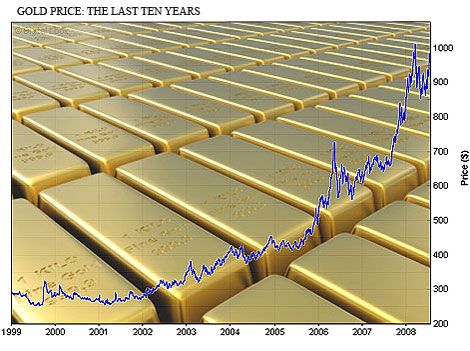

The rise in the gold price above US$1,100 per ounce last week is a pretty good indicator that something has changed. For 18 months, the gold price had been in a trading range topping out around $1,000. It has now broken out decisively from that range. The opportunity for the world's central banks to change policy and affect the economic outcome has been lost. The world economy is now locked on to an undeviating track towards another train wreck.

Keep reading...

At most times, the gold price is not an economically significant indicator. In 1980-2000, it declined irregularly from $850 to around $280, and movements in it seemed to have had little or no effect on the global economy. That's what you'd expect; even at $1,000 per ounce, the global production of gold is only around $100 billion annually, which would put the entire world's gold extraction industry only 17th on the Fortune 500.

...

However, in relatively few periods, gold becomes of immense importance. When investors lose trust in conventional currencies, because monetary policy appears set to debauch them, gold is the immediately available safe haven. During such periods, gold's former importance as a store of value becomes uppermost in the public mind, and its price becomes a major economic indicator.

Gold became important from about July 1978 to early 1980, during which period its price rose from $185 to $850 per ounce. For that 18-month period, the price of gold was the most important factor in day-to-day market fluctuations. The gold price, more than the inflation rate directly, moved markets and by extension moved monetary and to some extent fiscal policy in the major economies. Only after Paul Volcker took over at the US Federal Reserve in late 1979 did M3, a broad measure of money supply, begin to supplant it in investors' analyses.

We now appear to be at the beginning of another such period. The exceptional monetary stimulus entered into around the world during the financial crisis last year has prevented a downward liquidity spiral, but at the cost of destabilizing markets. Both monetary and fiscal policy dials are stuck at settings that would have been unimaginable two years ago.

And in case the gold call is not quite clear, look at these items:

Golden Era for Gold? Maybe, Even at $1,141.40

Wall Street Journal, NOVEMBER 20, 2009.

As frothy as gold has been lately, by some measures it has only just begun to bubble.

Bucking Thursday's broad market selloff, Comex gold futures rose to a record-high $1,141.40.

Up 62% since last November, gold is enjoying a moment that is either the start of an amazing bull run or one of those magazine-cover episodes that precedes a fall.

In recent weeks, everybody from hedge-fund wizard John Paulson to the central bank of India has made a show of buying gold.

They may be on to something. Gold is still well below its inflation-adjusted record high, set in January 1980, of $2,290 an ounce.

And:

India’s bullion buy starts gold bull-run

And:

Wall Street Journal, NOVEMBER 20, 2009.

PRECIOUS METALS: Gold Ends Higher Despite Dollar Rise

Nearby gold futures posted a record settlement as a stronger dollar failed to pierce the bullish momentum that has pushed the metal into uncharted territory this week.

Investor speculation that prices will continue rising has primarily been behind gold's gains of late. But support is broad, with central banks buying and retail investors snapping up gold bars and coins. Any price pullbacks have been brief and shallow.

And some ATS threads on the subject:

Peter Schiff, Max Keiser, and Jim Rogers Weigh in On Gold, China, and Currency

1100 Gold has been achieved

Ok, ok. BUT SO WHAT, one might say?

Returning to the main article...

Fed chairman Ben Bernanke and his team are ignoring this. It insists that it will maintain interest rates at the current near-zero level for an extended period, regardless of what the gold price does. By this, it is ensuring that the present bubble in gold and commodities will play out to its full extent.

...

With current Fed policy, gold is headed rapidly toward $2,000 per ounce, probably within six months. The forecasters who see such a price, but suggest it would take four to five years to get there, are ignoring history. Since gold was able to get from $185 to $850 in 18 months in 1978-80, there is no reason why it cannot get from $1,100 to $2,000 in six months now.

What's more, although 1980's peak seemed madness at the time, and was equivalent to nearly $2,400 today, there is no reason why gold cannot go much higher if it is given another year or so to get there. The supply of gold from new mining is around 1 million ounces per year LESS than in 1980, and the supply of speculative capital that could flow into gold is many times greater. Hence, a $5,000 gold price is possible though not certain, if present monetary policy is continued or only modestly modified - and that price could be reached by the end of 2010.

As was demonstrated by the housing bubble of 2004-06, modest rises in interest rates are not sufficient to stop a bubble once it is well under way....

Which ultimately means:

Hence the bubble will inexorably move to its denouement, at which point gold will probably be north of $3,000 an ounce and oil well north of $150 per barrel. Even though there will be no supply/demand reason why oil should get to those levels, and gold has almost no genuine demand at all, the weight of money behind those commodities in a speculative situation will push their prices inexorably upwards, beyond all reason until something intervenes to stop it.

At some point, probably before the end of 2010, the bubble will burst. The deflationary effect on the US economy of $150 plus oil will overwhelm the modest forces of genuine economic expansion. The Treasury bond market will collapse, overwhelmed by the weight of deficit financing.

...

In the next downturn, the Fed will not be able to cut interest rates because inflation will be spiraling, as in 1980. Instead it will need to raise them while dealing with a profound crisis in the bond markets. Capital in the US will become still more difficult to come by, and unemployment will approach 15%.

...

Not far ahead, 2011 and 2012 will be very unpleasant years...

...

The danger in those years will be that Bernanke will attempt yet again to refloat the US economy through inflation, buying government debt to fund the deficit and forcing short-term rates well below the inflation rate. This danger is exacerbated by the Obama administration's insouciance about deficits.

Bernanke and his predecessor, Alan Greenspan, on their own, bear a large share of responsibility for the 2008 crash, but the Bernanke/Obama combination is potentially even more dangerous. If expansionary monetary and fiscal policies are pursued regardless of market signals, the US will head towards Weimar-style trillion-percent inflation. That would make the government's position easier as its mountain of Treasury debt became worthless, but devastate everybody else's savings and impoverish the American people as Weimar impoverished 1920s Germany.

Of course, all of this is just Martin Hutchinson's opinion. But he ends his chilling analyiss with the following:

As I said, a train wreck. Probability of arrival: close to 100%. Time of arrival: around the end of 2010, or possibly a bit earlier. And at this stage, there's very little anyone can do about it; the definitive rise of gold above $1,000 marked the point of no return.

He certainly seems sure about this, doesn't he?

For more pleasurable reading, see also:

The Three Triggers of the Global Gold Bubble

And this little gem, from earlier in the week:

Bernanke on bubbles: Nothing 'obvious' at the moment

"It’s not obvious to me in any case that there’s any large misalignments currently in the U.S. financial system."

NOW, I'm really worried.

[edit on 22-11-2009 by loam]

I am betting on silver... the gold to silver ratio is insane and I completely expect silver to boom.

seekingalpha.com...

Why is Silver So Cheap? Why is Gold So Expensive?

www.rapidtrends.com...

seekingalpha.com...

Why is Silver So Cheap? Why is Gold So Expensive?

So, why IS silver so cheap? I mean the earth's crust, on average, contains 19 units of silver for every one unit of gold according to the U.S. Geological Survey. If gold and silver were equally accessible, that makes gold three times more expensive than it "ought" to be.

www.rapidtrends.com...

Annual silver demand has exceeded annual planetary production for many of the past 50 years. Until the last 2-3 years, monetary silver investment has been less than zero, due to silver coin melting and other recycling making up the industrial deficit. Yet, the shortfall is unsustainable at current silver prices, because silver in electronics often cannot be recycled economically, so it is simply thrown away. Also, every time the US military explodes a smart bomb, 100’s of ounces of silver are vaporized. Vast stockpiles of silver accumulated over many centuries have now been “consumed” in the last few decades, and it is unclear how much is left. For example, after World War II ended the US Government had stockpiled billions of ounces of silver. As of 2002, this stockpile is completely gone, as are all other official world government stockpiles. In many expert opinions, at least 50% of all silver mined in history is now gone, unrecoverable by any means, while at least 80% of all gold probably remains. So, the current ratio of existing silver to existing gold is probably more like 5:1, and not 10:1. On top of this, most of the remaining silver exists in things like jewelry, silverware, or coins hoarded by people wearing “tinfoil hats,” and I doubt that the “tinfoils” will relinquish their silver at anywhere near current price levels. Therefore, in regards to world bullion stockpiles the 5:1 ratio is flipped, with gold bullion actually being around 5 times more plentiful than silver bullion. So, we now have a price ratio of 70:1, but an availability ratio at current prices of 1:5. In this light, remember that silver (not gold) is the metal that is indispensible for modern society. Can you say “unstable?”

reply to post by loam

Hey,

Nice "Green Shoots" springing up there in your Avatar space

i won't clutter the thread with the links attesting to world-wide Gold mining production falling off a cliff.

deep mine production is in the doledrums everywhere.

So, what i make of the sudden interest by CentralBanks in acquiring Gold instead of selling Gold (as was the norm up till last month)

Is that physical Gold...which has been re-assayed as being real gold and not gold leafed Titanium ingots, will trend into the hyper-valuation zone.

but major producers of gold will not be as volitile as the speculative

'Junior' miners/developers will become in the next 3-6 months

(a new ETF -> GDXJ just was IPO'd on Nov 11th, '09)

Spot Gold ingots ready for delivery might hit those astronomical levels of $2k+, as central banks scurry for 'real assets' to back their promise-to-pay currencies.

for my own actions, i am going to wait for the new ETF=GDXJ to retreat below $25. then i'll buy a few.

All you interested readers, you might gravitate toward the major & secondary gold producers... instead of the more risky 'Juniors' or physical gold... which should have a whole lot of headlines in the coming months,

but those valuations are now/will be a bit too rich for myself ...and likely other serious investors

Hey,

Nice "Green Shoots" springing up there in your Avatar space

i won't clutter the thread with the links attesting to world-wide Gold mining production falling off a cliff.

deep mine production is in the doledrums everywhere.

So, what i make of the sudden interest by CentralBanks in acquiring Gold instead of selling Gold (as was the norm up till last month)

Is that physical Gold...which has been re-assayed as being real gold and not gold leafed Titanium ingots, will trend into the hyper-valuation zone.

but major producers of gold will not be as volitile as the speculative

'Junior' miners/developers will become in the next 3-6 months

(a new ETF -> GDXJ just was IPO'd on Nov 11th, '09)

Spot Gold ingots ready for delivery might hit those astronomical levels of $2k+, as central banks scurry for 'real assets' to back their promise-to-pay currencies.

for my own actions, i am going to wait for the new ETF=GDXJ to retreat below $25. then i'll buy a few.

All you interested readers, you might gravitate toward the major & secondary gold producers... instead of the more risky 'Juniors' or physical gold... which should have a whole lot of headlines in the coming months,

but those valuations are now/will be a bit too rich for myself ...and likely other serious investors

This in just eight minutes ago:

Gold hits fresh record high on safe-haven buying

Gold hit fresh record highs on Monday as economic uncertainty and the potential for inflation drew investors to the relative stability of the asset.

U.S. COMEX December gold rose $10.20 or 0.9 percent to $1,157.00 an ounce on the NYMEX by 2325 GMT (6:25 p.m. EST), in thin Asian trade with Japanese traders sidelined for a public holiday.

Spot gold was bid at $1,156.25 an ounce, above a record $1,152.75 struck last Wednesday.

The metal's price on Friday ended higher for the sixth consecutive session. India's acquisition of 200 tonnes of bullion from the IMF had also boosted interest in gold earlier this month.

Unusual upside momentum tonight given options expiry tomorrow. With a huge number of calls @ 1100 strike , typically Gold would be on the receiving

end of a severe spanking by now. Instead we have a near perfect flagpole/flag pattern emerging in

overseas trade. Tomorrow could be explosive in NY , and if a large enough % of these ITM options holders convert to futures contracts for delivery ,

the potential for a COMEX commercial signal failure becomes a reality.

Magnet is mother-load of calls @ 1200.

To say that tonight's trading activity is atypical would be a major understatement....more like economic warfare playing-out in the Gold arena. There are a few new gladiators in town , and English isn't their native tongue.

Kroosh de Krooked Komeks Chortz!

Magnet is mother-load of calls @ 1200.

To say that tonight's trading activity is atypical would be a major understatement....more like economic warfare playing-out in the Gold arena. There are a few new gladiators in town , and English isn't their native tongue.

Kroosh de Krooked Komeks Chortz!

I can not wait till the bubble bursts.

How many countries like india will burst along with gold.

How many holders of bars and coins that they bought at $900+ a once will lose there shirt when gold falls to less then $500.

After 40 years in gold mining i know it will burst because no one is investing in gold mines in the US. other countries are opening mines right and left.

This means someone in the US knows what is going on and know better then put money in projects that will shortly find there is no profit because gold has dropped to a point it cost more to operate the mine then the gold you get from it.

How many countries like india will burst along with gold.

How many holders of bars and coins that they bought at $900+ a once will lose there shirt when gold falls to less then $500.

After 40 years in gold mining i know it will burst because no one is investing in gold mines in the US. other countries are opening mines right and left.

This means someone in the US knows what is going on and know better then put money in projects that will shortly find there is no profit because gold has dropped to a point it cost more to operate the mine then the gold you get from it.

Loam, you need to take a few days off, I'm starting to run low on antacid!

Seriously thought, another great thread, as usual. Don't know where you find the time to dig all this stuff up, but keep up the good work.

Seriously thought, another great thread, as usual. Don't know where you find the time to dig all this stuff up, but keep up the good work.

I don't know what's going on some say gold will hit $5,000.00 other say it would drop when it hit $1,050.00?

The Chinese, from what I have heard are reneging on their short EFT's if I understand correctly, which should in some way help cause the COMEX to default itself.

So anyhow I'm confused, if I get this right the Gold Bubble will burst when the COMEX is unable to deliver the gold they have sold, because for one thing they sold more Gold than they had to sell, China has backed out on it's short EFT's which will cause Gold to rise, but when people start to want delivery of Gold that does not exist and or cash in on this Gold that has become over inflated, the money wil not be there to pay off everyone?

Will the Gold Bubble burst in part because people are going to lose faith in the Gold maket, or is it going to keep going up?

Everyone stay tuned because I know as soon as I invest in Gold, if I do been thinking about it since $700+, but if I do it will inevitably crash.

Another thing was said Gold is somewhat useless except to hoard, adorn oneself, I did read that each of the precious metals have different properties when dealing with electricty, so we being a bit new at this, Gold, Silver, Platinum, may come to greater use as we make more break thrus in electronics. I know they use lots of silver now but Gold may come into greater use other than what is now, and I always like Platinum myself though I forget what it's electrical properties are.

[edit on 23-11-2009 by googolplex]

The Chinese, from what I have heard are reneging on their short EFT's if I understand correctly, which should in some way help cause the COMEX to default itself.

So anyhow I'm confused, if I get this right the Gold Bubble will burst when the COMEX is unable to deliver the gold they have sold, because for one thing they sold more Gold than they had to sell, China has backed out on it's short EFT's which will cause Gold to rise, but when people start to want delivery of Gold that does not exist and or cash in on this Gold that has become over inflated, the money wil not be there to pay off everyone?

Will the Gold Bubble burst in part because people are going to lose faith in the Gold maket, or is it going to keep going up?

Everyone stay tuned because I know as soon as I invest in Gold, if I do been thinking about it since $700+, but if I do it will inevitably crash.

Another thing was said Gold is somewhat useless except to hoard, adorn oneself, I did read that each of the precious metals have different properties when dealing with electricty, so we being a bit new at this, Gold, Silver, Platinum, may come to greater use as we make more break thrus in electronics. I know they use lots of silver now but Gold may come into greater use other than what is now, and I always like Platinum myself though I forget what it's electrical properties are.

[edit on 23-11-2009 by googolplex]

Ultimately the selling wave will kick in because these people don't really want gold, they want dollars. They are manipulating gold as a vehicle just

like any other vehicle. There is no real interest in gold to hold, just sold.

reply to post by googolplex

If the major bullion banks that collectively hold the large concentrated Comex short position , are unable to deliver physical Gold against their contracts in any given delivery month (default) , the resulting squeeze on available physical supply will send the price of Gold into the stratosphere. Additionally , the CFTC's negligence in enforcing the 90% cover rule on leveraged commodities positions would be spotlighted , severly damaging the credibility of the US futures exchange as a free market enterprise...and yes , many heads would roll. To ameliorate the financial damage to these Fed-agent bullion banks, the exchange would probably declare force majeure and allow a % of these contracts to be settled in cash....small comfort to legitimate hedgers who rely a functioning futures market to supply the physical commodity. They'll be left to renegotiate , incur penalties , and possibly even default on their forward obligations....domino effect.

If Gold is really useless googolplex , ask yourself why central banks continue to hold approx 30,000 tonnes as official currency reserves , and have recently become net buyers , as opposed to traditional net sellers.

Since 2001 , annual Gold production continues to decrease , no major Gold discoveries in over a decade , and for the better part of two decades annual demand has already exceeded supply by approx 50%. Central bank Gold sales/Gold leasing was always there to cover the shortfall , or Gold would have soared much sooner. As previously mentioned , CB's became net buyers this year....and the market is reacting appropriately to unfettered supply/demand fundamentals.

You might also ask yourself why the major Gold miners are frantically covering their hedge-books this year....absorbing huge , and I mean HUGE embarrassing losses. I can give you a hint; it isn't because they expect to see prices to fall in the foreseeable future

If the major bullion banks that collectively hold the large concentrated Comex short position , are unable to deliver physical Gold against their contracts in any given delivery month (default) , the resulting squeeze on available physical supply will send the price of Gold into the stratosphere. Additionally , the CFTC's negligence in enforcing the 90% cover rule on leveraged commodities positions would be spotlighted , severly damaging the credibility of the US futures exchange as a free market enterprise...and yes , many heads would roll. To ameliorate the financial damage to these Fed-agent bullion banks, the exchange would probably declare force majeure and allow a % of these contracts to be settled in cash....small comfort to legitimate hedgers who rely a functioning futures market to supply the physical commodity. They'll be left to renegotiate , incur penalties , and possibly even default on their forward obligations....domino effect.

If Gold is really useless googolplex , ask yourself why central banks continue to hold approx 30,000 tonnes as official currency reserves , and have recently become net buyers , as opposed to traditional net sellers.

Since 2001 , annual Gold production continues to decrease , no major Gold discoveries in over a decade , and for the better part of two decades annual demand has already exceeded supply by approx 50%. Central bank Gold sales/Gold leasing was always there to cover the shortfall , or Gold would have soared much sooner. As previously mentioned , CB's became net buyers this year....and the market is reacting appropriately to unfettered supply/demand fundamentals.

You might also ask yourself why the major Gold miners are frantically covering their hedge-books this year....absorbing huge , and I mean HUGE embarrassing losses. I can give you a hint; it isn't because they expect to see prices to fall in the foreseeable future

reply to post by FortAnthem

Thank you for the kind compliments...

TODAY:

European Stocks Surge; Gold Prices Hit Record

[edit on 23-11-2009 by loam]

Originally posted by FortAnthem

Loam, you need to take a few days off, I'm starting to run low on antacid!

Seriously thought, another great thread, as usual. Don't know where you find the time to dig all this stuff up, but keep up the good work.

Thank you for the kind compliments...

TODAY:

European Stocks Surge; Gold Prices Hit Record

Gold, which has a strong inverse relationship to the dollar, rocketed. Late Monday in London, spot gold was trading at $1,170.5 a troy ounce, up 2.1%. The metal hit a record high of $1,174 an ounce on the Comex division of the New York Mercantile Exchange earlier in the day. Gold is up nearly 12% this month and analysts said while the metal is increasingly susceptible to a correction, the rally still has legs. Platinum, silver and copper also touched fresh highs.

[edit on 23-11-2009 by loam]

More on today's gold performance:

Doesn't all of this seem oddly familiar?

See also: Gold Jumps to Record as Slumping Dollar Spurs Investment Demand

[edit on 23-11-2009 by loam]

Gold surges to a fresh record: The precious metal continues its run on concerns about the dollar and economic jitters. Analysts see $1,200 an ounce before year's end.

Gold rallied to an all-time high Monday, climbing ever closer to $1,200 an ounce, as the U.S. dollar slid and investors showed nervousness about the economy.

December gold rose $18 to settle at an all-time high of $1,164.80 an ounce, after climbing as high as $1,173.50 earlier in the session.

...

"We're seeing significant dollar weakness, and I think that's the main driver today," said Joe Foster, portfolio manager for the Van Eck Global International Investors Gold Fund.

The weak dollar has sent gold surging more than 10% this month as investors flocked to a safe-haven investment. b[]Demand for gold and other so-called tangible assets, which tend to store value better than equity-based investments, often rises in times of economic uncertainty.

Gold is also being supported by a growing expectation in the market that central banks around the world will move to increase their hoards.

India's central bank bought 200 metric tones of gold from the International Monetary Fund earlier this month, and the central bank of Mauritius bought a smaller amount last week.

"We believe the activity of central banks and seasonal weakness in the U.S. dollar in the final four weeks of the year will sustain the strong rally in gold prices," analysts at Deutsche Bank wrote in a recent research report.

Meanwhile, gold is benefiting from a "break-down of confidence" as investors fret about growing fiscal deficits and the ability of governments around the world to oversee the financial system, Foster said.

Given the current momentum in the gold market, and the growing interest from big investment funds, analysts expect prices to continue rising.

"We might have a bit of a pull-back, but the long-term trend is higher," Foster said. Gold will probably top $1,200 some time in December and could climb to $1,300 early next year, he added.

Doesn't all of this seem oddly familiar?

See also: Gold Jumps to Record as Slumping Dollar Spurs Investment Demand

[edit on 23-11-2009 by loam]

So I tried to post this earlier, but was side tracked and forgot to push reply.

Any how I was thinking of buying 50 ozs of gold and 25 grand in silver, I have some Cds I need to get rid of.

So will the Gold bubble burst, or might I make a few bucks< I know my Cds are going down because the dollars is doomed anyhow.

I also thought about the euro, any comments of would be appreciated.

[edit on 24-11-2009 by googolplex]

Any how I was thinking of buying 50 ozs of gold and 25 grand in silver, I have some Cds I need to get rid of.

So will the Gold bubble burst, or might I make a few bucks< I know my Cds are going down because the dollars is doomed anyhow.

I also thought about the euro, any comments of would be appreciated.

[edit on 24-11-2009 by googolplex]

reply to post by googolplex

We're not here to give investment advice.

You'll have to get that somewhere else, or better yet, rely on your own decision making after you educate yourself.

FYI, finding out which company to bet on is NOT part of that education.

Anyway...

Thanks for the great read Loam, OBE1 etc.

Got the grey matter juices flowing...

.

We're not here to give investment advice.

You'll have to get that somewhere else, or better yet, rely on your own decision making after you educate yourself.

FYI, finding out which company to bet on is NOT part of that education.

Anyway...

Thanks for the great read Loam, OBE1 etc.

Got the grey matter juices flowing...

.

reply to post by googolplex

To be honest, the first investment is canned food. Have you seen the prices jump in the last 18 months? That 6 oz /.50 cent can of tuna is now 5 oz / .75 cent can of tuna. Same goes for almost all canned food nowadays.

Buy food, rotate it. The tuna I eat today I bought 2 years ago before the 50% mark-up. Do you expect the price of food to go down?

Buy what you eat and eat what you buy before the expiration. Easy model to save a ton of money.

To be honest, the first investment is canned food. Have you seen the prices jump in the last 18 months? That 6 oz /.50 cent can of tuna is now 5 oz / .75 cent can of tuna. Same goes for almost all canned food nowadays.

Buy food, rotate it. The tuna I eat today I bought 2 years ago before the 50% mark-up. Do you expect the price of food to go down?

Buy what you eat and eat what you buy before the expiration. Easy model to save a ton of money.

reply to post by Gools

Hey was really not looking of making a move on what someone says but just trying to get the jist of this what is going or their thought's on

the matter of what is going on in the world today.

If there is ten people who say it is going up, you could just as well find ten people say it will go down and some one s bubble will burst.

I should have went to the physchic threads and ask what someone sees in the stars, if my investments would pay off or a asstroid would strike the earth and ruin my plans.

Who do you think is going to win?

[edit on 24-11-2009 by googolplex]

If there is ten people who say it is going up, you could just as well find ten people say it will go down and some one s bubble will burst.

I should have went to the physchic threads and ask what someone sees in the stars, if my investments would pay off or a asstroid would strike the earth and ruin my plans.

Who do you think is going to win?

[edit on 24-11-2009 by googolplex]

reply to post by infolurker

Yes I saw that in the wall street journal about a little over a year ago, buy food with rate of increase of food prices, your investment would

far exceed what you could gain in most banks.

But thanks for advice, I think I'm just going to buy VeriChip stock their a lot of people that will need chips and PositiveID Corp / VeriChip will be supplying them, that stock is going up once they start chipping everyone.

[edit on 24-11-2009 by googolplex]

But thanks for advice, I think I'm just going to buy VeriChip stock their a lot of people that will need chips and PositiveID Corp / VeriChip will be supplying them, that stock is going up once they start chipping everyone.

[edit on 24-11-2009 by googolplex]

[A] Technical Perspective:

[atsimg]http://files.abovetopsecret.com/images/member/0393d71677a0.jpg[/atsimg]

Chart illustrating the stair-step pattern in monthly Gold. After a powerful 19 month consolidation (inverse head & shoulders/cone shaped cup & handle) , Gold broke decisively above the 2008 1000 high in early October.

In a nutshell , the potential exists for an advance to the 1500+ range across the next 3/5 months before we see the next major pullback and correction.

*Posted for entertainment value...not advice. Smart people can , and will disagree with this simple pattern analysis*

By the way , great effort on the OP loam

[atsimg]http://files.abovetopsecret.com/images/member/0393d71677a0.jpg[/atsimg]

Chart illustrating the stair-step pattern in monthly Gold. After a powerful 19 month consolidation (inverse head & shoulders/cone shaped cup & handle) , Gold broke decisively above the 2008 1000 high in early October.

In a nutshell , the potential exists for an advance to the 1500+ range across the next 3/5 months before we see the next major pullback and correction.

*Posted for entertainment value...not advice. Smart people can , and will disagree with this simple pattern analysis*

By the way , great effort on the OP loam

Well irregardless of whether or not I buy gold or not, I would be interested in what is going on with this bubble that is going to burst or not

burst.

I myself am going to be buying Gold and Silver, Diamonds> For the past 5 months, I have been working on opening a Gold and Silver store, buy , sell I have gotten my Jewelry liscense, the only problem has been getting to C of O from the building department. I will be buying broken, unwanted Gold and Silver for about 50 cents on the dollar which is still more than what most of these places pay.

Looks like we will open next monday.

But anyhow a burst bubble could effect many different things.

I live a somewhat no frills life and spend most of my free time helping those in need, I myself really have little concern for the things of material existance, so really in my concept of existance I could give a flying F### as to what really occurs.

[edit on 24-11-2009 by googolplex]

I myself am going to be buying Gold and Silver, Diamonds> For the past 5 months, I have been working on opening a Gold and Silver store, buy , sell I have gotten my Jewelry liscense, the only problem has been getting to C of O from the building department. I will be buying broken, unwanted Gold and Silver for about 50 cents on the dollar which is still more than what most of these places pay.

Looks like we will open next monday.

But anyhow a burst bubble could effect many different things.

I live a somewhat no frills life and spend most of my free time helping those in need, I myself really have little concern for the things of material existance, so really in my concept of existance I could give a flying F### as to what really occurs.

[edit on 24-11-2009 by googolplex]

reply to post by OBE1

Gee thanks OBE1 I see grafts, that works I'm going to track and drop a half a mil on that fillie, what was her name, Right on time or Dank's

it. Stay away from Ceedee she sprained her foot in the mud last week, she aren't right.

new topics

-

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 2 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 7 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 12 hours ago, 31 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 7 hours ago, 13 flags -

Is AI Better Than the Hollywood Elite?

Movies: 14 hours ago, 4 flags -

Maestro Benedetto

Literature: 14 hours ago, 1 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 2 hours ago, 1 flags

active topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 15 • : jidnum2 -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 44 • : FlyersFan -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 25 • : RazorV66 -

Skinwalker Ranch and the Mystery 1.6GHz Signal

Aliens and UFOs • 145 • : Ophiuchus1 -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 273 • : HerbertWest -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest • 6 • : FlyersFan -

Hate makes for strange bedfellows

US Political Madness • 50 • : 19Bones79 -

Weinstein's conviction overturned

Mainstream News • 28 • : burritocat -

Sunak spinning the sickness figures

Other Current Events • 25 • : Ohanka -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 24 • : NoviceStoic4