It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by pause4thought

Some very positive movements have been recorded on this Election Day:

Shares in New York rallied in early trading on Tuesday as people in the US went to the polls. The Dow Jones Industrial Average closed up 305.5 points, or 3.3%, at 9,625.3 amid relatively light trading.

The Wall St gave too much credence to the people who went to the polls. The Wall St liked John McCain. And then, the next morning, it was one way traffic:

Dow sheds 486 points

By Alexandra Twin, CNNMoney.com senior writer

Last Updated: November 5, 2008: 5:46 PM ET

So what's the "offical" explanation of such a turnaround?

Stocks declined as a layer of uncertainty was removed with the presidential election complete, leaving the market to return to worrying about the economy.

It's understandable that lots of people were happy when Barack Obama won the presidential election. That was a truly a special occasion and various

email providers should speedily include his name into the built-in spell check dictionaries to admit the US President-Elect into the world that used

to run on other entries.

Speaking of which . . . lots of pro Obama voters put too much faith in the power of the US President to fix things for them, but that's not the case; there are many other powerful factors that shape the future.

Special occasion met special occasion:

There hasn't been an occasion where the Dow would lose more (percentage) in a couple of days following the Election Day as much as there hasn't been a US President who didn't have an Anglo-Saxon name. That's where special has met another special.

But why it hasn't gone the opposite way; why is it so that the Dow hasn't gained 9.7% in two consecutive days following the election?

That's because the US President shouldn't be mistaken for a saint with divine powers to change things around and install a righteous order upon his land. There is no way to change the the corporate reports and other related news that will affect tomorrow's market performance, which will be . . .?

The market history never repeat itself in an exact manner, so the stats telling us what usually happens after the Dow loses some 10% in two consecutive days may not be binding. With a little confidence, a gain of 1% to a loss of 3% should take place. It's a racetrack out there . . .

[edit on 11/6/2008 by stander]

Speaking of which . . . lots of pro Obama voters put too much faith in the power of the US President to fix things for them, but that's not the case; there are many other powerful factors that shape the future.

Special occasion met special occasion:

The Dow has lost 9.7% in the last two days alone, its biggest two-day percentage loss since 1987 . . .

There hasn't been an occasion where the Dow would lose more (percentage) in a couple of days following the Election Day as much as there hasn't been a US President who didn't have an Anglo-Saxon name. That's where special has met another special.

But why it hasn't gone the opposite way; why is it so that the Dow hasn't gained 9.7% in two consecutive days following the election?

That's because the US President shouldn't be mistaken for a saint with divine powers to change things around and install a righteous order upon his land. There is no way to change the the corporate reports and other related news that will affect tomorrow's market performance, which will be . . .?

The market history never repeat itself in an exact manner, so the stats telling us what usually happens after the Dow loses some 10% in two consecutive days may not be binding. With a little confidence, a gain of 1% to a loss of 3% should take place. It's a racetrack out there . . .

[edit on 11/6/2008 by stander]

reply to post by stander

Thanks for your very informative posts.

Well I'm glad you found a metaphor! I was at a loss for words yesterday (but was too taken up with other business to post, unfortunately). The major indecies were the spitting image of the GM forum icon itself. (Not sure where to dig up a historical chart to show this, but at least you described very well exactly what has been going on.)

Although the slide was halted for the day the overall picture remains extremely erratic, to say the least.

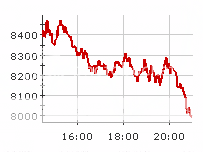

DOW:

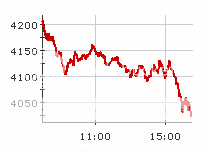

FTSE 100:

Source

[edit on 7/11/08 by pause4thought]

Thanks for your very informative posts.

It's a racetrack out there . . .

Well I'm glad you found a metaphor! I was at a loss for words yesterday (but was too taken up with other business to post, unfortunately). The major indecies were the spitting image of the GM forum icon itself. (Not sure where to dig up a historical chart to show this, but at least you described very well exactly what has been going on.)

Although the slide was halted for the day the overall picture remains extremely erratic, to say the least.

DOW:

FTSE 100:

Source

[edit on 7/11/08 by pause4thought]

As of 10:17 AM or 1:17 PM Eastern US Time, the DJIA was hovering around 8070. After reaching highs of 8400 today, things seem to have cooled off.

1:19 PM EST Dow has moved to 8107. Let's hope the trend continues. Nasdaq also down.

To see real-time market updates click here.

For investors:

Good stocks which have faired well thru this downturn are Verizon Communications, McDonald's and Intel (to name a few).

1:19 PM EST Dow has moved to 8107. Let's hope the trend continues. Nasdaq also down.

To see real-time market updates click here.

For investors:

Good stocks which have faired well thru this downturn are Verizon Communications, McDonald's and Intel (to name a few).

can someone please link the thread where some guy on a you tube predicts DOW to crash to below 5k ??

i can't find it since I didn't post to it..

i can't find it since I didn't post to it..

reply to post by Komodo

This guy predicts it will fall farther than that. Not sure if this is what your referring to though..

This guy predicts it will fall farther than that. Not sure if this is what your referring to though..

The DOW seems to be recovering from initial significant losses, although anything could still happen. The FTSE closed down 2.38% at 4132.16.

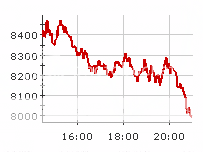

DOW:

(Note: times are GMT)

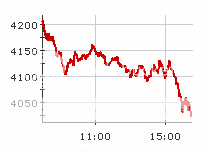

FTSE:

DOW:

(Note: times are GMT)

FTSE:

The direction of the way things have been going lately was a wrong way street for those folks who play the stock market. But for those who make living

the most usual way, the descending numbers was a blessing because the downward movement took the oil and gas prices down as well.

The oil price per barrel peaked on July 11, 2008 when it stood at $145, as opposed to present price around $55. That reflects on the prices of gas: the motorists in the USA pay now almost $2 dollars less for a gallon of gas than they did in the summer. That means filling a 15-gallon gas tank saves you $30. Not bad at all, but since the skyrocketing gas prices caused the food prices to go up as well, some of the saved gas money are absorbed by buying the more expensive food. The price of food goes up with the cost of gas increasing, but doesn't go down when gas becomes cheaper again. That's the reality of things.

The lower gas prices will not stay that way for too long. The OPEC is not overly happy with it, and the economy will not stay suppressed forever. Once there is an improvement, the demand for oil will increase and prices will rise again. Until then, keep on trucking.

Now the dispatch from the battlefield: The last Thursday surprising gain got wiped out by the Friday and today session. There is a good chance that the DJIA will close tomorrow bellow 8000 points sending the clock back to the summer of 2002 when it was the last time DJIA was at this level.

When the traders saw the the Dow sliding bellow 8000 last Thursday, they responded with a huge rally. Are we going to see the same response tomorrow?

I think there is not enough fuel left to keep the plane flying above 8000 feet -- or keeping it in the air at all.

No panic, please. One by one.

The oil price per barrel peaked on July 11, 2008 when it stood at $145, as opposed to present price around $55. That reflects on the prices of gas: the motorists in the USA pay now almost $2 dollars less for a gallon of gas than they did in the summer. That means filling a 15-gallon gas tank saves you $30. Not bad at all, but since the skyrocketing gas prices caused the food prices to go up as well, some of the saved gas money are absorbed by buying the more expensive food. The price of food goes up with the cost of gas increasing, but doesn't go down when gas becomes cheaper again. That's the reality of things.

The lower gas prices will not stay that way for too long. The OPEC is not overly happy with it, and the economy will not stay suppressed forever. Once there is an improvement, the demand for oil will increase and prices will rise again. Until then, keep on trucking.

Now the dispatch from the battlefield: The last Thursday surprising gain got wiped out by the Friday and today session. There is a good chance that the DJIA will close tomorrow bellow 8000 points sending the clock back to the summer of 2002 when it was the last time DJIA was at this level.

When the traders saw the the Dow sliding bellow 8000 last Thursday, they responded with a huge rally. Are we going to see the same response tomorrow?

I think there is not enough fuel left to keep the plane flying above 8000 feet -- or keeping it in the air at all.

No panic, please. One by one.

That was an informative post summing up yesterday's movements, stander. The reminder of the role played by fluctuations in oil prices was a nice

touch. Slick new avatar too. All round duderiffic©.

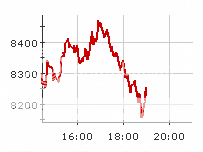

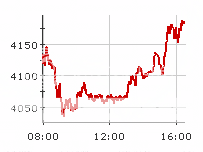

Not for the first time in recent weeks the readings have been reminiscent of an erratic heartbeat:

DOW

FTSE (at close)

All times are GMT.

Not for the first time in recent weeks the readings have been reminiscent of an erratic heartbeat:

DOW

FTSE (at close)

All times are GMT.

It looks that the region bellow 8000 points is considered hell by the traders -- no one wants to go there.

Today, the DJIA reached the highest altitude at 11:53 am and then began descending for three hours. Then, at 2:50 pm, at the altitude of 8,108 the warning buzzer sounded in the cockpit: hell ahead, pull up, pull up . . .

It would take a specially mixed confluence of news and events to make DJIA close bellow 8000 points. The economy must sin more for that to happen, but there is a theoretical possibility of ailing giant GM helping to drag the Dow under. But there is only a minuscule of chance that GM would be forced to open the Book of Damnation and read Chapter 11; the American people will not let that happen, as their are known for their great generosity. (Ask IGA execs if you don't believe me.)

I received a notice from the ATS regulators saying that my previous avatar was larger than the prescribed dimension permits. That notice was followed by a recommendation to re-size the avatar to fit the legal format. It also said that if I don't comply with the regulation, my avatar would be removed.

I disregarded the notice, because my avatar was too big to fail, like General Motors, and I figured that the ATS regulators would have to look the other way. But they didn't; they took it off the face of the Internet promptly.

Today, the DJIA reached the highest altitude at 11:53 am and then began descending for three hours. Then, at 2:50 pm, at the altitude of 8,108 the warning buzzer sounded in the cockpit: hell ahead, pull up, pull up . . .

It would take a specially mixed confluence of news and events to make DJIA close bellow 8000 points. The economy must sin more for that to happen, but there is a theoretical possibility of ailing giant GM helping to drag the Dow under. But there is only a minuscule of chance that GM would be forced to open the Book of Damnation and read Chapter 11; the American people will not let that happen, as their are known for their great generosity. (Ask IGA execs if you don't believe me.)

Originally posted by pause4thought

Slick new avatar too. All round duderiffic©.

I received a notice from the ATS regulators saying that my previous avatar was larger than the prescribed dimension permits. That notice was followed by a recommendation to re-size the avatar to fit the legal format. It also said that if I don't comply with the regulation, my avatar would be removed.

I disregarded the notice, because my avatar was too big to fail, like General Motors, and I figured that the ATS regulators would have to look the other way. But they didn't; they took it off the face of the Internet promptly.

Someone must have maliciously disabled the warning device, because the historical mark has been reached: the Dow closed bellow 8000 points -- 3 points

bellow to be precise. The Gate of Hell has been cracked open and the traders got a whiff of the sulphur aroma. Nice tan too.

I can see the traders feverishly climbing the Ladder of Holy Rescue tomorrow trying to put as much as distance between them and the Abyss of Inevitable Reckoning.

How could anyone disable the warning device like that?

I think we should open the Device Manager (in System Tools) and look for the GM driver . . .

Aha!

I can see the traders feverishly climbing the Ladder of Holy Rescue tomorrow trying to put as much as distance between them and the Abyss of Inevitable Reckoning.

How could anyone disable the warning device like that?

I think we should open the Device Manager (in System Tools) and look for the GM driver . . .

Aha!

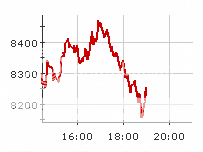

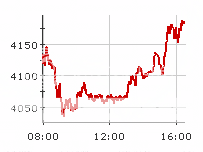

While stander keeps us entertained with his daily cabaret, the rest of the financial world is shaking in its collective boots & wondering where this

will all end...

DOW

FTSE

(All times are GMT)

Source

Stander - I can just see you on a street corner in the aftermath of a nuclear holocaust, sax and all.

DOW

FTSE

(All times are GMT)

Source

Stander - I can just see you on a street corner in the aftermath of a nuclear holocaust, sax and all.

It has become quite customary for NIKKEI to follow suit when the Dow performance draws loud, unfavorable comments. After today's dismal session on

Wall St, the Japanese traders paid respect to their fallen round-eyed comrades once again.

news.yahoo.com...

When you read the article, you can see where the Japanese make a big mistake.

That's right. They are watching the Dow without knowing that there is much more to its performance than mere share selling and buying. The activity is something beyond our comprehension, but we don't have to comprehend; we should accept certain recommendations in good faith and stay cleverly away from the Second Judgement of Souls predicted by German painter Hieronymus Bosch to take place in 2008 - 2009.

There is only one thing I can say to the Japanese traders: Don't look at the Dow; keep your eyes shut!

I know it helps; it worked before . . .

Japan stocks dive 6.9 percent after US sell-off

news.yahoo.com...

When you read the article, you can see where the Japanese make a big mistake.

"People are watching U.S. shares closely, and the Japanese market is vulnerable to more falls," he said.

That's right. They are watching the Dow without knowing that there is much more to its performance than mere share selling and buying. The activity is something beyond our comprehension, but we don't have to comprehend; we should accept certain recommendations in good faith and stay cleverly away from the Second Judgement of Souls predicted by German painter Hieronymus Bosch to take place in 2008 - 2009.

There is only one thing I can say to the Japanese traders: Don't look at the Dow; keep your eyes shut!

I know it helps; it worked before . . .

3:59pm Nov 20 2008

7,553.48 -443.80 -5.27%

[edit on 20-11-2008 by warrenb]

[edit on 20-11-2008 by warrenb]

7,553.48 -443.80 -5.27%

[edit on 20-11-2008 by warrenb]

[edit on 20-11-2008 by warrenb]

Dow reacting to empty Auto bailout plan ,now absolutely plummeting -417 and counting

historic day on wall street

[edit on 20-11-2008 by all2human]

historic day on wall street

[edit on 20-11-2008 by all2human]

Wow! 444.99 to 7552.29 and the guy on Bloomberg is saying people are pulling their cash as fast as possible and that it will keep falling tomorrow!

- 444.99

nice number, round & full to my senses,

just enough to impel a lot of IRA holders & 401k holders to;

Redeem ! Cash-Out ! Enough-is-Enough !

lets see if the PPT (plunge protection team) has enough purchace power to buy enough stocks & futures to sway the perception of the market.

nice number, round & full to my senses,

just enough to impel a lot of IRA holders & 401k holders to;

Redeem ! Cash-Out ! Enough-is-Enough !

lets see if the PPT (plunge protection team) has enough purchace power to buy enough stocks & futures to sway the perception of the market.

The world was surprised by the Dow today: Instead of extending the ladder mounted on the fire engine and ready to climb up and away from the address

8000 Hell Street, the traders donned asbestos outfits and began to explore the environment deeper bellow the 8,000 points level.

That encouraged some of the professional losers -- who have kept a low profile for some time and refrained from making further predictions about the stock market due to its unpredictability caused by apparent demonic possession -- to leave the Hole of Disgrace to share another of their visions:

In both cases, the experts no longer talk "derivatives, hedge funds" nor other causes that failed to drown the Dow in the past. Now the experts talk economy.

It would be commendable to consult a qualified economist on the future development. Since economy is a legitimate science (you can win the Nobel Price in this field), it only make sense to stop by a university or a reputable school of economics.

www.stateuniversity.com...

We stop here, because Prof. Theresa Hancock is renown for her ability to explain economic issues to a lay person in the most comprehensive manner . . .

[edit on 11/20/2008 by stander]

That encouraged some of the professional losers -- who have kept a low profile for some time and refrained from making further predictions about the stock market due to its unpredictability caused by apparent demonic possession -- to leave the Hole of Disgrace to share another of their visions:

Expect a further 10%-15% drop in the Dow, predicts Ron Ianieri, chief markets strategist at Options University, adding that the index could slide to 6,500.

The Dow Jones Industrial Average is set to sink to 6,400 within the next few weeks, Nicole Elliott, technical analyst at Mizuho Corporate Bank told CNBC.

In both cases, the experts no longer talk "derivatives, hedge funds" nor other causes that failed to drown the Dow in the past. Now the experts talk economy.

It would be commendable to consult a qualified economist on the future development. Since economy is a legitimate science (you can win the Nobel Price in this field), it only make sense to stop by a university or a reputable school of economics.

www.stateuniversity.com...

We stop here, because Prof. Theresa Hancock is renown for her ability to explain economic issues to a lay person in the most comprehensive manner . . .

[edit on 11/20/2008 by stander]

new topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 3 hours ago -

Maestro Benedetto

Literature: 5 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 5 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 8 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 9 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 10 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 11 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 11 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 3 hours ago, 25 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 14 hours ago, 9 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 17 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 13 hours ago, 8 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 14 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 11 hours ago, 7 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 10 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 8 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 11 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 9 hours ago, 4 flags

active topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 14 • : WeMustCare -

Hate makes for strange bedfellows

US Political Madness • 47 • : 19Bones79 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 689 • : daskakik -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 265 • : Astrocometus -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 27 • : ToneD -

Reason of the Existence

The Gray Area • 21 • : BingoMcGoof -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 85 • : Sookiechacha -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 24 • : nugget1 -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 63 • : pianopraze -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 74 • : Justoneman