It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Yeah the perma-bulls are sounding downright depressed lately. Been seeing some of their calls from last year (check out the Schiff thread) and they

look like total asses.

Originally posted by stander

Japan stocks dive 6.9 percent after US sell-off

news.yahoo.com...

When you read the article, you can see where the Japanese make a big mistake.

"People are watching U.S. shares closely, and the Japanese market is vulnerable to more falls," he said.

There is only one thing I can say to the Japanese traders: Don't look at the Dow; keep your eyes shut!

I know it helps; it worked before . . .

data.cnbc.com...

Amazing . . .

Don't be surprised to see a big rally today (11/21). There's been some sick action overnight on the futes; we could have a +500 day.

Someone knows something. Might be huge news coming this AM. Autos and/or Citi are the touchiest subjects right now, could be something going on there.

Someone knows something. Might be huge news coming this AM. Autos and/or Citi are the touchiest subjects right now, could be something going on there.

November 21 3:40pm

Dow Jones ~ 7,878.60 +326.31 +4.32%

it went up %4 suddenly for no good reason

I guess they want to wait till Monday for the crash

everyone needs a weekend off...

Dow Jones ~ 7,878.60 +326.31 +4.32%

it went up %4 suddenly for no good reason

I guess they want to wait till Monday for the crash

everyone needs a weekend off...

reply to post by warrenb

Well, good or bad reason...the market increased because of apparent approval of Obama's new Treasury Secretary nomination Timothy Geithner.

Well, good or bad reason...the market increased because of apparent approval of Obama's new Treasury Secretary nomination Timothy Geithner.

Originally posted by warrenb

November 21 3:40pm

Dow Jones ~ 7,878.60 +326.31 +4.32%

it went up %4 suddenly for no good reason

Geithner announcement did it.

We may well hit 8k today. 7999 as I type. Whoops, there's 8001!

Financials aren't following the rally. Very, very strange day.

reply to post by anachryon

well...the system is all controlled anyways so no surprise that it goes up when it should be going down and vice versa

well...the system is all controlled anyways so no surprise that it goes up when it should be going down and vice versa

S&P over 800, DJIA over 8000. Big 6% + on both. Final trades still trickling through.

Citi is still in trouble. $3.78, down 20% on VERY heavy volume.

Citi is still in trouble. $3.78, down 20% on VERY heavy volume.

Final numbers are in.

DJIA 8046.42 +494.13

S&P 800.03 +47.59

NAS 1384.35 +68.23

Those are some big support levels crossed on the Dow & S&P - this could potentially lead in to a big bear rally, possibly even through the end of the year.

^^^Not a bad call!

DJIA 8046.42 +494.13

S&P 800.03 +47.59

NAS 1384.35 +68.23

Those are some big support levels crossed on the Dow & S&P - this could potentially lead in to a big bear rally, possibly even through the end of the year.

Originally posted by anachryon

Don't be surprised to see a big rally today (11/21). There's been some sick action overnight on the futes; we could have a +500 day.

^^^Not a bad call!

Originally posted by anachryon

Don't be surprised to see a big rally today (11/21). There's been some sick action overnight on the futes; we could have a +500 day.

I can see the traders feverishly climbing the Ladder of Holy Rescue tomorrow trying to put as much as distance between them and the Abyss of Inevitable Reckoning.

No, it's not a surprising event, except that the traders made the climb more spectacular after exploring the region deeper bellow 8,000 yesterday. They were surely looking for something down there and inadvertantly stumbled across something that freaked them out big time.

www.google.com...

The world after GM, Ford and Chrysler just unraveled before their eyes.

Climb! Climb! Climb . . . !

And what would be the official cause of the traders getting so much excited at 3:00 pm?

Stocks woke up Friday following news that President-Elect Barack Obama is expected to announce two key cabinet posts.

You got to be kidding me . . .

If someone makes a decision to act at 3 o'clock, that someone thinks about number 3. Like GM + Ford + Chrysler = 3 automakers -- and the Bulgarian chariot.

If someone acts upon 2 key cabinet posts, that someone kicks off the action at 2 o'clock. But that's not what happened. The math is simple, but not acceptable to the market experts who screamed in horror upon realizing that anachryon creamed them big time; the pro market experts were looking down, not up.

[edit on 11/21/2008 by stander]

Look, there's now only one way this market would support a solid long-term rally. Obama has to appoint anachryon as Secretary of the Treasury.

In a nutshell

In a nutshell

has anyone figured yet

that the other $350+billion of the 'TARP' (troubled assets) monies

might be covertly passed along to the PPT Plunge-Protection-Team

to use for market rallys and for precious metal price suppression through the COMEX

and by monday morning most of those funds will be returned to the 'TARP' funds account, with nobody the wiser??

that the other $350+billion of the 'TARP' (troubled assets) monies

might be covertly passed along to the PPT Plunge-Protection-Team

to use for market rallys and for precious metal price suppression through the COMEX

and by monday morning most of those funds will be returned to the 'TARP' funds account, with nobody the wiser??

St Udio - Sorry you lost me there. I'm sure someone else can comment, or perhaps you might like to comment on what has actually transpired since your

post?

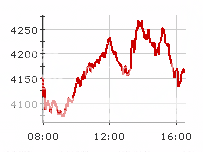

Back to the raw market data:

what on earth is going on???

I'll wager someone, somewhere (black mask & dagger, behind the scenes, etc.) has been making repeated killings on the back of these huge swings. (I realize I'm not the first to say this.)

Ten percent gains so far on the FTSE, Dax & Cac 40.

Can anyone put that in a historical perspective (-not to mention spill the beans with regard to what is driving this today, at least on the face of it?)

EDIT:

20 mins after the above post I came across this brief article:

Shares 10% up on crisis measures

The Citibank bailout + today's unveiling of UK govt. measures to stimulate the economy are credited with driving the market up.

[edit on 24/11/08 by pause4thought]

Back to the raw market data:

what on earth is going on???

I'll wager someone, somewhere (black mask & dagger, behind the scenes, etc.) has been making repeated killings on the back of these huge swings. (I realize I'm not the first to say this.)

Ten percent gains so far on the FTSE, Dax & Cac 40.

Can anyone put that in a historical perspective (-not to mention spill the beans with regard to what is driving this today, at least on the face of it?)

EDIT:

20 mins after the above post I came across this brief article:

Shares 10% up on crisis measures

The Citibank bailout + today's unveiling of UK govt. measures to stimulate the economy are credited with driving the market up.

[edit on 24/11/08 by pause4thought]

Originally posted by pause4thought

Look, there's now only one way this market would support a solid long-term rally. Obama has to appoint anachryon as Secretary of the Treasury.

No one in their right mind would want that position! I may be a little off my rocker, but no way in hell I'd take the appointment.

I believe there is still a chance for a sustained rally at least through Thanksgiving, perhaps until Christmas even. It won't be consistent +5% days, but a general upward trend in the short term is possible.

No, "the bottom" is not in yet.

The behavioral model of the Dow shows that any sudden upward movement resulting in gains above 5% will be caused by the news of the government bailing

out one of those thirty companies that the Dow is made of. Otherwise, the Dow would keep closing plus/minus 2.5% most of the time.

It's a sorrowful state of affairs, but that's how things will work intermittently in the future.

There is an interesting correlation between the price of oil (NYMEX) and the Dow: When Dow finishes up, the price of oil per barrel goes up as well andthe gain equals roughly the percentage that the Dow gained. When the Dow closes bellow, the price of oil follows the suit and the decline is about 1/2 of the percentage that the Dow lost. This kind of makes it unlikely that the oil will ever see its price per barrel at $30, as some of the oil expert predicted.

[edit on 11/24/2008 by stander]

It's a sorrowful state of affairs, but that's how things will work intermittently in the future.

There is an interesting correlation between the price of oil (NYMEX) and the Dow: When Dow finishes up, the price of oil per barrel goes up as well andthe gain equals roughly the percentage that the Dow gained. When the Dow closes bellow, the price of oil follows the suit and the decline is about 1/2 of the percentage that the Dow lost. This kind of makes it unlikely that the oil will ever see its price per barrel at $30, as some of the oil expert predicted.

[edit on 11/24/2008 by stander]

Call it "volatility in opinions."

Not even a week ago, Santa was predicted to have a hard time stopping his sled.

Now, according to Nadav Baum, Santa may need a hand to push his sled.

push and pull

push and pull

Reindeer said to Bear and Bull

The Dow ended today gaining 0.43%, probably reacting to the announcement made by the 43rd US President George Bush that he has gained some weight while feasting for eight years on White House Chef's culinary art forms.

The oil at NYMEX gained $0.39, so the Dow/oil %-to-$ correlation kind of works.

[edit on 11/25/2008 by stander]

"Sentiment is changing a little bit," said Nadav Baum, managing director of investments at BPU Investment Management in Pittsburgh. "I think the panic is subsiding and people are starting to look at stocks again — and credit markets — based on fundamentals and that's a good thing."

"We may be able to have a Santa Claus rally," Baum said.

Not even a week ago, Santa was predicted to have a hard time stopping his sled.

Expect a further 10%-15% drop in the Dow, predicts Ron Ianieri, chief markets strategist at Options University, adding that the index could slide to 6,500.

The Dow Jones Industrial Average is set to sink to 6,400 within the next few weeks, Nicole Elliott, technical analyst at Mizuho Corporate Bank told CNBC.

Now, according to Nadav Baum, Santa may need a hand to push his sled.

push and pull

push and pull

Reindeer said to Bear and Bull

The Dow ended today gaining 0.43%, probably reacting to the announcement made by the 43rd US President George Bush that he has gained some weight while feasting for eight years on White House Chef's culinary art forms.

The oil at NYMEX gained $0.39, so the Dow/oil %-to-$ correlation kind of works.

[edit on 11/25/2008 by stander]

Anyone check the DOW this morning . . . a rousing drop of more than 300 points straight off the opening bell . . .

I thought Black Friday was a sales success????

I thought Black Friday was a sales success????

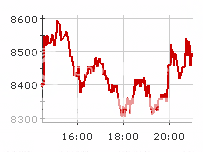

Dec 1 2008, 11:58AM

Dow 8,376.16 -452.88 -5.13%

based mainly on reports of US factory output being the lowest in 26 years...

[edit on 1-12-2008 by warrenb]

Dow 8,376.16 -452.88 -5.13%

based mainly on reports of US factory output being the lowest in 26 years...

[edit on 1-12-2008 by warrenb]

Originally posted by warrenb

Dec 1 2008, 11:58AM

Dow 8,376.16 -452.88 -5.13%

based mainly on reports of US factory output being the lowest in 26 years...

[edit on 1-12-2008 by warrenb]

man, the market is almost as ugly as your avatar . . . .

BWWAAAHAHAHAHAHAHAAHAHA

Just kidding . . . although you do look remarkably like my ex mother-in-law.

new topics

-

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 1 hours ago -

MH370 Again....

Disaster Conspiracies: 1 hours ago -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 3 hours ago -

Chronological time line of open source information

History: 5 hours ago -

A man of the people

Diseases and Pandemics: 6 hours ago -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 6 hours ago -

4 plans of US elites to defeat Russia

New World Order: 8 hours ago -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 11 hours ago

top topics

-

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 15 hours ago, 17 flags -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 1 hours ago, 10 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 11 hours ago, 7 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 14 hours ago, 6 flags -

12 jurors selected in Trump criminal trial

US Political Madness: 14 hours ago, 4 flags -

4 plans of US elites to defeat Russia

New World Order: 8 hours ago, 4 flags -

A man of the people

Diseases and Pandemics: 6 hours ago, 4 flags -

Chronological time line of open source information

History: 5 hours ago, 2 flags -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 3 hours ago, 2 flags -

MH370 Again....

Disaster Conspiracies: 1 hours ago, 1 flags

active topics

-

12 jurors selected in Trump criminal trial

US Political Madness • 47 • : Xtrozero -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 22 • : Xtrozero -

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 69 • : Xtrozero -

4 plans of US elites to defeat Russia

New World Order • 31 • : andy06shake -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News • 3 • : Bluntone22 -

George Knapp AMA on DI

Area 51 and other Facilities • 24 • : Raptured -

Marjorie Taylor Greene Files Motion to Vacate Speaker Mike Johnson

US Political Madness • 63 • : WeMustCare -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works • 23 • : JoelSnape -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology • 13 • : Cvastar -

MH370 Again....

Disaster Conspiracies • 4 • : Vermilion