It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

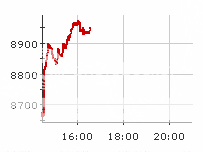

The markets are tanking again today -419 at 8909 and counting, erasing gains last week,here's to hoping 8000 is the bottom,but i not so sure

I think people can expect a lower standard of living,while the world economies continue there downward trajectory, as we experience deflation invariably there will be(if history teaches us)inflation lasting at least a few years, there's is just no buying our way out of this i am afraid

[edit on 1-12-2008 by all2human]

I think people can expect a lower standard of living,while the world economies continue there downward trajectory, as we experience deflation invariably there will be(if history teaches us)inflation lasting at least a few years, there's is just no buying our way out of this i am afraid

[edit on 1-12-2008 by all2human]

Dec 1 2008 3:22pm

Dow 8,338.57 -490.47 -5.56%

Dec 1 2008 3:24pm

Dow 8,317.46 -511.58 -5.79%

[edit on 1-12-2008 by warrenb]

Dow 8,338.57 -490.47 -5.56%

Dec 1 2008 3:24pm

Dow 8,317.46 -511.58 -5.79%

[edit on 1-12-2008 by warrenb]

Big sell off today should extend into the next few treading days. GLD is going down, but can not be kept down. GLD is definitely a buy. Definitely buy

the SDS on the up days, look at how it moves on down days like this.

DOW -517 at 8311 S+P down 64.71! =bad day on wall street

awaiting a slam dunk at the end of the hour.

continuing....

[edit on 1-12-2008 by all2human]

awaiting a slam dunk at the end of the hour.

continuing....

[edit on 1-12-2008 by all2human]

"I think that this market has dispelled any expectations of normal," said Alan Gayle, senior investment strategist at RidgeWorth Investments. "[A]fter a very strong five-day performance it’s not surprising to see some softness in the market but the aggressiveness of the selloff took a lot of people by surprise."

It's nice to hear a sincere word for a change. Yes, the market is full of surprises, because the trading is done during uncertain times, even though many experts cannot part with their expertise easily.

The always subservient Japanese traders followed suit and NIKKEI lost 6.35% being in near sync with the quite unusual hard-come-easy-go 7.7% drop in America (DJIA).

The obvious question is whether the 7.7% drop was a prequel to more substantial blood letting that could take place tomorrow, Dec. 2.

Since there is no shame in being wrong these days, the new oil/Dow formula predicts the Dow to lose 4.3% tomorrow. That means exactly 4.30%. That's weird . . .

Originally posted by stander

The obvious question is whether the 7.7% drop was a prequel to more substantial blood letting that could take place tomorrow, Dec. 2.

Since there is no shame in being wrong these days, the new oil/Dow formula predicts the Dow to lose 4.3% tomorrow. That means exactly 4.30%. That's weird . . .

It didn't work! Why not?

The market's crystal ball is broken

Investors' views of the short- and long-term outlooks are wildly at odds. The uncertainty is causing chaos and creating buying opportunities.

articles.moneycentral.msn.com...

The market kind of resembles this text editor . . .

[edit on 12/2/2008 by stander]

This thread is fairly useless to anyone with access to yahoo finance or even google, but here is my .02 contribution:

9:57PM PST

/ES -4.75

Dow Futs -60

Yen up, you do the math.

9:57PM PST

/ES -4.75

Dow Futs -60

Yen up, you do the math.

There is no reason the Market did what it did today,it should have dumped Royaly,i am just baffled

[edit on 3-12-2008 by all2human]

[edit on 3-12-2008 by all2human]

Market Watch runs "weekend at Bernies" movie ,with the DOW staring as Bernie.

[edit on 3-12-2008 by all2human]

[edit on 3-12-2008 by all2human]

Originally posted by all2human

There is no reason the Market did what it did today,it should have dumped Royaly,i am just baffled

Pure market manipulation...

brought to you by your friends at the PPT

Well, folks. Everything looks hunky dory. Time to break out the champaign:

(NB: All times are GMT)

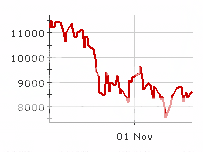

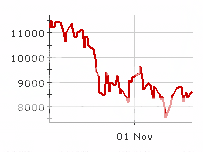

DOW

8951.70

316.28 up (3.66%)

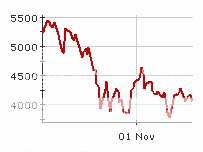

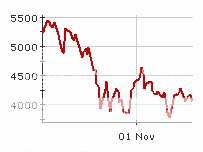

FTSE

4299.25 at close

249.88 up (6.17%)

...Because it's gunna be the last time you taste it for years to come:

DOW (3 months)

FTSE (3 months)

Second thoughts, how about stashing those bottles somewhere safe - you might be able to barter them for a loaf of bread...

(NB: All times are GMT)

DOW

8951.70

316.28 up (3.66%)

FTSE

4299.25 at close

249.88 up (6.17%)

...Because it's gunna be the last time you taste it for years to come:

DOW (3 months)

FTSE (3 months)

Second thoughts, how about stashing those bottles somewhere safe - you might be able to barter them for a loaf of bread...

The market has gone through so many nerve-wrecking news in the past six months or so to the effect of getting immunized against news that would

otherwise send the Dow tumbling down for a couple of days. The most stunning occurrence was a virtually non-existent response to the fact that in

November, additional 533,000(!) workers had joined the increasing number of people that found themselves out of work. Dave Rovelli interprets the

"flu-shot" this way:

The chances of the Dow tripping on top of the stairs have been greatly diminished by the inoculation. As a side-effect, the market now reacts to any positive, albeit obscure news with giddy gains. When the President-elect finally decides on the breed of the First Dog, expect rally followed by the Dow em-barking on its journey to the Plus Terriers -- I mean Territories.

"I guess a lot of people feel all the bad news is built in," Dave Rovelli, managing director of US equities for Canaccord Adams, said on CNBC. "It's nice to see these stocks rally on bad news."

The chances of the Dow tripping on top of the stairs have been greatly diminished by the inoculation. As a side-effect, the market now reacts to any positive, albeit obscure news with giddy gains. When the President-elect finally decides on the breed of the First Dog, expect rally followed by the Dow em-barking on its journey to the Plus Terriers -- I mean Territories.

Some people view tomorrow's stock trading with apprehension; it doesn't happen often that a staple of US industry faces a bankruptcy. The GM shares

will go down when the Senate has rejected the rescue package to the point that one of the company that makes the Dow list would lose its eligibility

to remain in the index.

But since the traders had to sell and buy under the cloud of financial meltdown great uncertainties, they shouldn't freak out and send the Dow to the cellar tomorrow.

But what if the GM & Chrysler bad news is the last straw that broke the camel's back? Would the Dow suffer a nervous breakdown?

No let up, huh?

But since the traders had to sell and buy under the cloud of financial meltdown great uncertainties, they shouldn't freak out and send the Dow to the cellar tomorrow.

But what if the GM & Chrysler bad news is the last straw that broke the camel's back? Would the Dow suffer a nervous breakdown?

Senate's failure to reach an agreement on the auto bailout package looks set to drive markets lower Friday and that could most certainly mean a bankrupt General Motors. There is also economic news that is expected to ring in a negative tone before the bell. Retail sales for November are forecast to be down 2 percent when they are reported at 8:30 a.m.

No let up, huh?

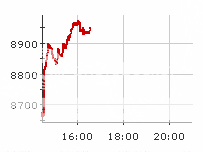

No surprises at the outset:

Source

U.S. stocks begin lower as auto bailout hits wall in Senate

NEW YORK (MarketWatch) - U.S. stocks slid at Friday's start after plans for a rescue of the auto industry fell apart in the Senate, intensifying worries that additional layoffs would deepen the recession.

The Dow Jones Industrial Average ($INDU: 8,565.09, -196.33, -2.2%) fell 189.25 points to 8,375.84.

The S&P 500 ($SPX: 861.88, -11.71, -1.3%) declined 19.7 points to 853.89, and the Nasdaq Composite (COMP: 1,500.13, -7.75, -0.5%) dropped 19.68 points to 1,488.2.

Source

The traders are about to have lunch -- usually between noon and 12:30. Most of them liquidate some of the shares to pay cash for Sesame Chicken or

whatever they pick.

No, don't buy too much, or there would be no cash left for lunch . . .

Well, the traders have really became hardened by the events of the past six months and are not responding to any chicken sh-t predictions. GM shares are holding steady at this moment. It's a new ball game.

The Dow should lose some points out of respect for Detroit. But you know how it goes: Expect rally.

The traders reacted to the news about the Senate saying no to the bailout yesterday, so why to dwell on old news?

No, don't buy too much, or there would be no cash left for lunch . . .

Well, the traders have really became hardened by the events of the past six months and are not responding to any chicken sh-t predictions. GM shares are holding steady at this moment. It's a new ball game.

The Dow should lose some points out of respect for Detroit. But you know how it goes: Expect rally.

The traders reacted to the news about the Senate saying no to the bailout yesterday, so why to dwell on old news?

Well, the so much anticipated carnage didn't materialize.

That makes it really hard to describe the 12/12/08 action:

It's funny to see the qualified onlookers lying their fillings out. The fact that Ron Gettelfinger (yes, that's the dude who gotthefinger from the Senate) blamed the Senate GOP wouldn't scare a fly sitting on the ticker tape.

The traders have become hardened warriors and it would take a combined Martian-Venusian invasion of Earth to give up 8% in one day.

That makes it really hard to describe the 12/12/08 action:

Friday's trading action was topsy-turvy: Stocks had opened lower, dragged down by the Senate's rejection of the $14 billion auto bailout and news of a $50 billion fraud scheme on Wall Street. Stocks pared their losses after the Treasury said it was willing to jump in to help prop up auto makers until Congress reconvenes and President Bush said he would consider using TARP funds to help bail out auto makers. Though, the market lost some ground after UAW President Ron Gettelfinger blamed the Senate GOP for the collapse of the deal.

It's funny to see the qualified onlookers lying their fillings out. The fact that Ron Gettelfinger (yes, that's the dude who gotthefinger from the Senate) blamed the Senate GOP wouldn't scare a fly sitting on the ticker tape.

The traders have become hardened warriors and it would take a combined Martian-Venusian invasion of Earth to give up 8% in one day.

new topics

-

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 1 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 5 hours ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 11 hours ago, 28 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 5 hours ago, 11 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 16 hours ago, 7 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 17 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 13 hours ago, 3 flags -

Maestro Benedetto

Literature: 13 hours ago, 1 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 1 hours ago, 1 flags

active topics

-

Weinstein's conviction overturned

Mainstream News • 25 • : brodby -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 270 • : Xtrozero -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 38 • : brodby -

ChatGPT Beatles songs about covid and masks

Science & Technology • 24 • : iaylyan -

The Acronym Game .. Pt.3

General Chit Chat • 7754 • : bally001 -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 96 • : andy06shake -

Rupert Murdoch engaged at 92

People • 8 • : brodby -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 287 • : FlyersFan -

Skinwalker Ranch and the Mystery 1.6GHz Signal

Aliens and UFOs • 144 • : brodby -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 11 • : brodby