It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Meh I think the true descrepency in this story, is the fact we still live in a flawed and broken economic system, I understand it exists to develope

growth etc. maintain a system to help us survive and develope ourself into the future. What troubles me thou is it is known it is broken and unfair

and rigged and also artificial. Just like I wonder why we still use fossil fuels for energy, when we literally have had ideas 💡 to evolve

ourselves to a better technology to produce energy that is safer cleaner and cheaper for all making our way of life better, just like this out dated

market here we are still in 1929 dealing with the same market..

Anyhow I am gonna go out on a limb and say the markets will crash further tomorrow worldwide. Wonder if we will see more bailouts to the to big to fail businesses again lol.

Anyhow I am gonna go out on a limb and say the markets will crash further tomorrow worldwide. Wonder if we will see more bailouts to the to big to fail businesses again lol.

originally posted by: Bicent

Meh I think the true descrepency in this story, is the fact we still live in a flawed and broken economic system, I understand it exists to develope growth etc. maintain a system to help us survive and develope ourself into the future. What troubles me thou is it is known it is broken and unfair and rigged and also artificial. Just like I wonder why we still use fossil fuels for energy, when we literally have had ideas 💡 to evolve ourselves to a better technology to produce energy that is safer cleaner and cheaper for all making our way of life better, just like this out dated market here we are still in 1929 dealing with the same market..

Anyhow I am gonna go out on a limb and say the markets will crash further tomorrow worldwide. Wonder if we will see more bailouts to the to big to fail businesses again lol.

Well I'm pretty sure the energy industry will get a big bailout, maybe even nationalized along with a lot of pension funds. Since 2009 energy companies haven't made a dime in profit, they've been subsidized by bond sales enabled by the super low rate interest rate regime from the fed.

Energy companies have something like $200 billion in debt to roll in the next 4 years, without being able to produce a dime of profit. So when the oil price crashes they'll need continual bailouts. My guess is Trump will nationalize most of them.

a reply to: FamCore

Well maybe. Right now I'm sort of burned out on all of it, just sick of the nonsense to tell you the truth. Did you see this graph from Martin Armstrong? His 86 year cycle lines up pretty close with our first default in 1933 when FDR took the dollar off any gold backing.

imgur.com...

IMO all this excessive leverage is the direct result of our government allowing banks to lend non-secured, they can do that because our money isn't backed by anything tangible.

$0.02

Well maybe. Right now I'm sort of burned out on all of it, just sick of the nonsense to tell you the truth. Did you see this graph from Martin Armstrong? His 86 year cycle lines up pretty close with our first default in 1933 when FDR took the dollar off any gold backing.

imgur.com...

IMO all this excessive leverage is the direct result of our government allowing banks to lend non-secured, they can do that because our money isn't backed by anything tangible.

$0.02

a reply to: SkeptiSchism

The drop in the market equates to about four trillion dollars. So where has all this cash gone? nobody seems to know. Physical gold sales have been going up, starting in November. Apparently its gold coins at around spot. Which are not showing up on the Comex.

Which sums up the state of the world economy

The drop in the market equates to about four trillion dollars. So where has all this cash gone? nobody seems to know. Physical gold sales have been going up, starting in November. Apparently its gold coins at around spot. Which are not showing up on the Comex.

Which sums up the state of the world economy

edit on 8-2-2018 by anonentity because: adding

edit on 8-2-2018 by anonentity because: adding

originally posted by: anonentity

a reply to: SkeptiSchism

The drop in the market equates to about four trillion dollars. So where has all this cash gone? nobody seems to know. Physical gold sales have been going up, starting in November. Apparently its gold coins at around spot. Which are not showing up on the Comex.

Which sums up the state of the world economy

Well you know it's all nonsense anyway, for instance they calculate a market cap for any particular stock at it's current price but if 1/2 the people who owned that stock sold it the next day, the price would plummet right?

So you can't say that the market is worth x amount at any given time, you have to account for volume over time and then figure out how much as been gained or lost.

seriously who the # still trust the stock market and the DOW? Buy bitcoin, and cryptos. Your going to lose all your money if you stay in a 401k in

my opinion. Look into the future people. The world is heading to cryptos.

And yes, i will say this at the crash of cryptos because who would you rather trust? A computer programmed to do its job, or a greedy human?

And yes, i will say this at the crash of cryptos because who would you rather trust? A computer programmed to do its job, or a greedy human?

originally posted by: AugustusMasonicus

originally posted by: Justoneman

You forgot the guy who has been saying this for so long we ignored him lately, Alan Greenspan!!

Got him in post #2.

I am not blaming him but the FED, which he was in charge there, has the reigns if we will admit it. Greenspan has been saying for years that not just a correction was coming but an absolute fall of the economy for the whole world based on the way money is spent/borrowed. If I remember that correctly I will defer to you professionals. I guess you could say it has been doom porn so people are quick to dismiss it.

a reply to: anonentity

you ask:

(when you do your return, attach schedules A & B to your tax return, your accumulated losses can carry over to the next year if you do not use all your allowable losses to 'wash' your gains.)

As far as this statement goes:

Sure gold sales are brisk but the price seems locked in a range (determined ?) to stay below $1,400.

& yeah got at 'spot' which includes a $40-60 per oz. Premium

so that in reality your buying Gold for $1400 but can only sell it for $1290. to $1340.

I sure hope the finite number of 'authorized bullion dealers' (with sole access to the US Mint Gold Eagle supply) are being taxed at their maximum for gouging the buyers at the High Premium being charged

you ask:

all that disappeared cash went to the Loss column on my tax return... The $4 Trillion had better be claimed against your taxable Gains or you are gifting the IRS monies it does not deserve to collect...

... So where has all this cash gone? nobody seems to know.

(when you do your return, attach schedules A & B to your tax return, your accumulated losses can carry over to the next year if you do not use all your allowable losses to 'wash' your gains.)

As far as this statement goes:

Physical gold sales have been going up, starting in November. Apparently its gold coins at around spot.

Sure gold sales are brisk but the price seems locked in a range (determined ?) to stay below $1,400.

& yeah got at 'spot' which includes a $40-60 per oz. Premium

so that in reality your buying Gold for $1400 but can only sell it for $1290. to $1340.

I sure hope the finite number of 'authorized bullion dealers' (with sole access to the US Mint Gold Eagle supply) are being taxed at their maximum for gouging the buyers at the High Premium being charged

edit on th28151817825909102018 by St Udio because: (no reason given)

edit on th28151817954809322018 by St Udio because: (no

reason given)

originally posted by: anonentity

a reply to: SR1TX

We are already in a depression , real unemployment is about 20 per cent.

Yes correct, unfortunately. I felt a DJT at the gen election, whom I didn't want but was not Hillary, would have to do.

My hope was as he is a businessman who I think understands when someone is ripping him off , will take a stand for what has been ripping off the public for decades. So far I do see that.

Plus, we would get Mom and Pop business' champion. There never has been a poor man pay top salaries to anyone and we have to build our wealth with our ingenuity or be born with it. Who would not want the builders be successful over those who understands not how to earn honest income in the real world? (ETA: Only those who think they are superior or wish to be so.(

If Mom and Pop's can't make it we will only have oligarchs who lord their opinion over us all and the rest of us. We are almost there now? We with no money have no standing with them and that is what the Constitution resolves. They usurp our trust at every turn is causing this depression.

Stay the course of freedom and justice for ALL and quit spending more than you take should be our goals.

edit on 9-2-2018 by Justoneman because: (no reason given)

DOW Down Over 1,000 Points, Uncertainty in the Markets

Interesting my portfolio is bout to break even.

Interesting my portfolio is bout to break even.

originally posted by: AugustusMasonicus

Who's fault is it today? Trump? Obama? The Russians?

I'm going with the super bloody blue moon

Stocks seemed to enter downtrend right after that rare celestial event on 1/31

a reply to: CainHarmbank

Thanks for the inquiry - I posted that to illustrate the idea of "TPTB" forcing Weak Hands out of the market, and the ensuing chaos that results in a 4% drop after we've seen pretty much continuous rising equities for a full year now it is a great pic though, isn't it?

I'm not sure why the picture of the baby with the sword running from the dragon. But it's hilarious.

Thanks for the inquiry - I posted that to illustrate the idea of "TPTB" forcing Weak Hands out of the market, and the ensuing chaos that results in a 4% drop after we've seen pretty much continuous rising equities for a full year now it is a great pic though, isn't it?

Just a bit of silly numerology to throw into the mix.

Today marks the 8 year and 11 month anniversary of the bull market that started 3/9/09.

Years...

9 to 18

Scramble the numbers and get 9.81

The acceleration rate in meters per second of a falling object.

Today marks the 8 year and 11 month anniversary of the bull market that started 3/9/09.

Years...

9 to 18

Scramble the numbers and get 9.81

The acceleration rate in meters per second of a falling object.

edit on 9-2-2018 by CainHarmbank because: (no reason given)

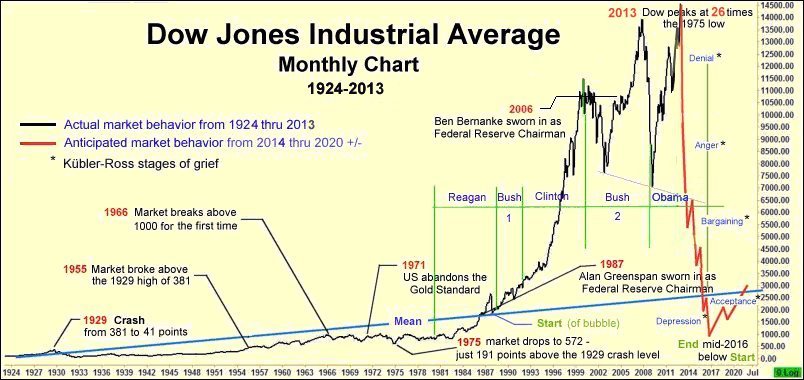

originally posted by: SkeptiSchism

Hey OP I updated this chart to include the bull since 2013

Larger size: i.imgur.com...

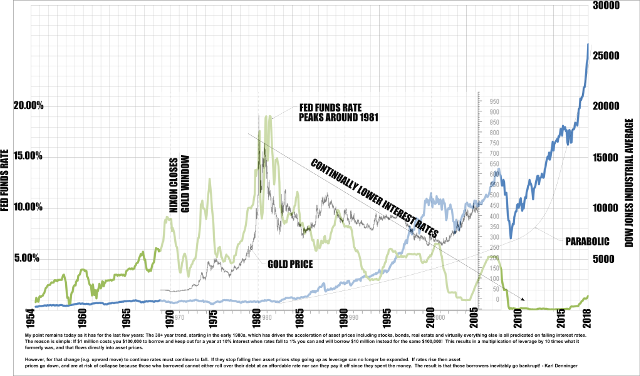

Saw this on ZH today, fits in with this idea

www.zerohedge.com...

And yes, i will say this at the crash of cryptos because who would you rather trust? A computer programmed to do its job, or a greedy human?

Well, greedy humans are at the helm of cryptos too. Hell, there are STILL fake coins that are still legitimately on the exchanges.

Best bet is to diversify.

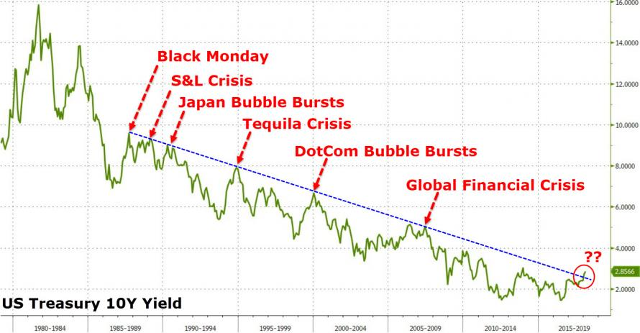

a reply to: SkeptiSchism

What's their point? Crashes occur after some spikes in the bond yield, but not after others? Gee, that helps a lot.

What's their point? Crashes occur after some spikes in the bond yield, but not after others? Gee, that helps a lot.

new topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 1 hours ago -

Maestro Benedetto

Literature: 3 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 3 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 6 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 7 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 8 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 9 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 9 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 9 hours ago -

Weinstein's conviction overturned

Mainstream News: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 1 hours ago, 13 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 12 hours ago, 9 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 15 hours ago, 8 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 12 hours ago, 8 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 8 hours ago, 7 flags -

Weinstein's conviction overturned

Mainstream News: 11 hours ago, 7 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 9 hours ago, 7 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 9 hours ago, 5 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 6 hours ago, 4 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 7 hours ago, 3 flags

active topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 263 • : cherokeetroy -

Is AI Better Than the Hollywood Elite?

Movies • 9 • : 5thHead -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 13 • : ToneD -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 26 • : nugget1 -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 168 • : Annee -

Manly P. Hall says Freemasonry is a religion?

Secret Societies • 22 • : Therealbeverage -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry • 11 • : Therealbeverage -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 48 • : Therealbeverage -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology • 3 • : Therealbeverage -

Weinstein's conviction overturned

Mainstream News • 23 • : Therealbeverage