It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Another volatile day in US Equities today, with the DOW Jones finishing at around 1,033 points down, or 4.15%.

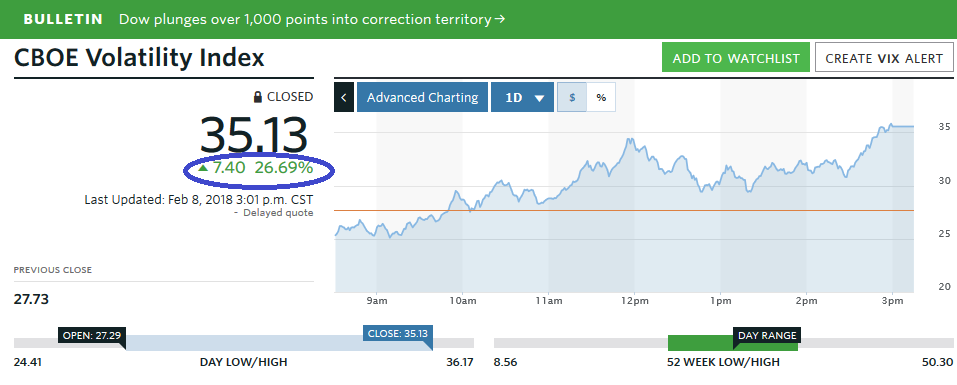

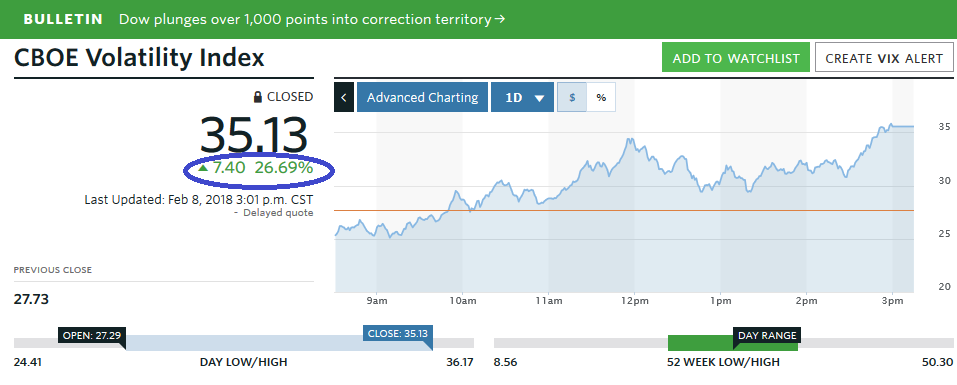

The VIX volatility index also rose to 35+ (up 27%).

I wonder if equities will be even lower before the opening bell tomorrow.

www.latimes.com...

A minor correction would be a 5-10% decline. 10% - 19% decline would indicate a more significant correction, and 20% or more would indicate that we are entering into a bear market.

Treasuries are still rising, but the spread between the 10 Year and 30 Year is staying at around 0.30% (hopefully that yield gap does not lessen much more, although they were separated by only 23 basis points like a week ago)

Is this just another shake up to see who the weak hands are before another brief period of pumping it up, or the advent of something else?

Time will tell

The VIX volatility index also rose to 35+ (up 27%).

I wonder if equities will be even lower before the opening bell tomorrow.

www.latimes.com...

The Dow Jones industrial average slumped more than 1,000 points. The tumult started last Friday as investors worried about signs of rising inflation.

The market fell steadily as the day wore on and is on track for its fifth loss in the last six days. Many of the companies that led the market's gains over the last year have struggled badly in the last week. Those include technology companies, banks, retailers, travel companies and homebuilders.

A minor correction would be a 5-10% decline. 10% - 19% decline would indicate a more significant correction, and 20% or more would indicate that we are entering into a bear market.

Treasuries are still rising, but the spread between the 10 Year and 30 Year is staying at around 0.30% (hopefully that yield gap does not lessen much more, although they were separated by only 23 basis points like a week ago)

Is this just another shake up to see who the weak hands are before another brief period of pumping it up, or the advent of something else?

Time will tell

edit on 8-2-2018 by FamCore because: (no reason given)

a reply to: FamCore

I stopped bleeding last week when I moved my stuff into the Black Rock Money Market Trust. It is like parking it in cash. I just don't know where the bottom is, although I personally am calling it at 18,000 - 19,500 range. If it reaches that number, it would be the end of next week. If it pushes further down, I cant imagine going down to 15,000. That would just be shocking

I stopped bleeding last week when I moved my stuff into the Black Rock Money Market Trust. It is like parking it in cash. I just don't know where the bottom is, although I personally am calling it at 18,000 - 19,500 range. If it reaches that number, it would be the end of next week. If it pushes further down, I cant imagine going down to 15,000. That would just be shocking

originally posted by: chadderson

a reply to: FamCore

Just another 6000 points to lose before returning to pre-Trump levels.

The man gave the market an unprecedented gain.

You may want to sharpen that pencil...

Trump came in at 19,600.... that's 4400, not 6000.

Any comment on this 1,000 point DROP?

That is what the thread is about.

MTUBY

a reply to: ParkerCramer

November 11, 2016 = 18,847

...And it was already on the rise since the 6th. Rose 1000 points between November 4th and November 11th.

November 11, 2016 = 18,847

...And it was already on the rise since the 6th. Rose 1000 points between November 4th and November 11th.

edit on 8-2-2018 by chadderson

because: (no reason given)

originally posted by: AugustusMasonicus

Who's fault is it today? Trump? Obama? The Russians?

Elon Musk. Rocket goes up, stock market goes down. There's a clear correlation.

this might be the beginning, the ups and downs, the peaks and valleys of a downward spiral. will trump own it or pass the blame to obama? i'm just

saying since trump likes to claim all good economic news as his creation.

originally posted by: AugustusMasonicus

Who's fault is it today? Trump? Obama? The Russians?

Depends who you ask

originally posted by: AugustusMasonicus

Who's fault is it today? Trump? Obama? The Russians?

It's Lebron's fault. Huge trades at the NBA trade deadline. Everyone's fantasy team is thrown off, hence the market drop.

edit on 8-2-2018 by enlightenedservant because: (no reason given)

originally posted by: conspiracy nut

i'm just saying since trump likes to claim all good economic news as his creation.

Yeah. No president has ever blamed the bad things on his predecessor before.

This is only the beginning of the disaster that is trump. Anyone who can think on their own knows what’s coming. Meanwhile I’m sure the trump

sycophants are off eagerly awaiting their rebuttal programming. Smh...

originally posted by: chadderson

a reply to: ParkerCramer

November 11, 2016 = 18,847

...And it was already on the rise since the 6th. Rose 1000 points between November 4th and November 11th.

Trump was in office in November??

Or are you claiming that Trump is responsible for EVERYTHING, good and bad since last November 2016?

😁

MTUBY

a reply to: Blue Shift

i think trump and his pro business/corporation tax plan helped to temporarily spike the economy, now it is uncertain and will dive temporarily. i will wait to judge trumps tax plan til the dust settles.

i think trump and his pro business/corporation tax plan helped to temporarily spike the economy, now it is uncertain and will dive temporarily. i will wait to judge trumps tax plan til the dust settles.

a reply to: FamCore

"Signs of inflation"

AKA: The Federal Reserve is dicking with the American economy again.

But to be fair, the gains that the market has seen since Trump took hold have, in my relatively uneducated opinion on the stock market, been too much too fast, and the market has been primed for a "correction" for months now.

I don't think that this is anything other than that, plus the dicking with inflation that is a result of the federal reserve (or, at least, a lot of it is). All of the hype, IMO, is just that, as the signs of the actual economy are still looking good. The thing that I noticed is that it seemed that the market was being artificially inflated back when Obama was in office, where it was obviously outpacing the true betterment of the economy, yet it was being used as a metric to claim that the economy was doing much better.

Like I said, I don't think that this is anything other than a correction that will bring the market back to where it actually should be, as it has had a couple of years at least of what I feel was inaccurate gains in relation to the actual economy.

"Signs of inflation"

AKA: The Federal Reserve is dicking with the American economy again.

But to be fair, the gains that the market has seen since Trump took hold have, in my relatively uneducated opinion on the stock market, been too much too fast, and the market has been primed for a "correction" for months now.

I don't think that this is anything other than that, plus the dicking with inflation that is a result of the federal reserve (or, at least, a lot of it is). All of the hype, IMO, is just that, as the signs of the actual economy are still looking good. The thing that I noticed is that it seemed that the market was being artificially inflated back when Obama was in office, where it was obviously outpacing the true betterment of the economy, yet it was being used as a metric to claim that the economy was doing much better.

Like I said, I don't think that this is anything other than a correction that will bring the market back to where it actually should be, as it has had a couple of years at least of what I feel was inaccurate gains in relation to the actual economy.

I wonder how much the high speed trading and other black box tech stuff is having on the market volatility. The market appears to be reacting badly

to rising bond yields. Usually equities move counter to bonds. When market is up, bonds are down. However, now that yields are rising, it is

causing equities to collapse because investors are thinking higher yields may choke off lending.

Mortgage rates are up about .5% since December. Given the price of homes nowadays in many urban areas, that is some real money. We just hit 4 year highs rate wise.

Mortgage rates are up about .5% since December. Given the price of homes nowadays in many urban areas, that is some real money. We just hit 4 year highs rate wise.

1000 points today is like 200 points 10 years ago. Those in the media who are whining about points, are fairly ignorant.

Large portfolio Investors drive down the stock market and then repurchase stocks after it reaches predetermined floor levels.

Another 10% drop would be fantastic for those of us who have additional money that we would like to invest.

Large portfolio Investors drive down the stock market and then repurchase stocks after it reaches predetermined floor levels.

Another 10% drop would be fantastic for those of us who have additional money that we would like to invest.

new topics

-

Where should Trump hold his next rally

2024 Elections: 1 hours ago -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 2 hours ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 2 hours ago -

Falkville Robot-Man

Aliens and UFOs: 3 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 3 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 4 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 5 hours ago -

Biden "Happy To Debate Trump"

2024 Elections: 5 hours ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 5 hours ago -

What is the white pill?

Philosophy and Metaphysics: 7 hours ago

top topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 15 hours ago, 21 flags -

Blast from the past: ATS Review Podcast, 2006: With All Three Amigos

Member PODcasts: 7 hours ago, 11 flags -

Biden "Happy To Debate Trump"

2024 Elections: 5 hours ago, 10 flags -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 3 hours ago, 8 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 8 hours ago, 8 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 4 hours ago, 7 flags -

What is the white pill?

Philosophy and Metaphysics: 7 hours ago, 5 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 5 hours ago, 5 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 5 hours ago, 4 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 11 hours ago, 3 flags

active topics

-

Where should Trump hold his next rally

2024 Elections • 7 • : spacedoubt -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 307 • : CriticalStinker -

Biden "Happy To Debate Trump"

2024 Elections • 41 • : TheLieWeLive -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs • 6 • : Degradation33 -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness • 4 • : WeMustCare -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 78 • : Terpene -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 811 • : Oldcarpy2 -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 28 • : yuppa -

Russia Ukraine Update Thread - part 3

World War Three • 5737 • : Arbitrageur -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 26 • : CarlLaFong