It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

originally posted by: AugustusMasonicus

originally posted by: SlapMonkey

Let's go with the Fed.

I'd say their decades long easy money policy certainly has something to do with it.

yeah... the Quantitative Easing program that injected 40-80Billion per month is being -Reversed-

also the Fed. had the TBTF Bank stock manipulators & the top hacks at the PPT create several secret Equity Accounts of DOW Stocks for the Fed.

for the purpose to recover some of their (minus) $4Trillion balance sheet the Fed spent bailing out the Fraudulent Banks

The Fed sure had a good Run in increased Stock values with the secret & covert money/stock purchases on the Feds off-the-books Ledger...of course they will never admit it.

Trumps roaring Stock Market was from the same money infusions that Obama had, but Trump was PRO-business/ PRO-economy so his DOW grew some +7 Thousand points, but Hussein Obama's DOW languished in the dismal realm...

for me...on Wednesday, the last Quarter Moon... I liquidated my Stocks... because I see the Market sliding all the way down to 22,000 before reaching a equilibrium-balance of 'true value'... the values are being RE-SET on equities... the USD will soon follow

with the money I get from selling my stocks I guess I can buy about 4 shares of [NYSE: NVDA] = Nividia... that's were i'm parking my future equity wad of dollars... that stock will not get broken up like many other large cap Tech giants.....

edit on th28151813453008022018 by St Udio

because: (no reason given)

a reply to: ClovenSky

The stock market benefits humanity because without it we wouldn't have many of the high-tech toys or miracle drugs we have. Stock is how companies get the capital to produce these things. You mention "selling bonds"; that's what the stock market is doing! Instead of just a promissory note like a bond, stocks are actually a part ownership of the company. Preferred stocks are ownership only of the profits, but common stockholders actually vote on the Board of Directors... one share, one vote.

The stock market is just what publicly traded stocks are selling for at a particular time. I does not always indicate how well the company is making profits, although investors do look at that when deciding what stocks are worth purchasing. It also depends heavily on how many people are looking to buy stock and how many are looking to sell. Right now, there are more looking to sell than to buy, so the price drops.

My previous post shows why big investors are looking to sell. They can make more money elsewhere.

TheRedneck

I have always been curious, how does the stock market benefit humanity? Getting paid for the correct insider information does not grow, produce or mine anything to actually create value. Couldn't a company receive money from profits or at least selling bonds for capitol projects or to grow the company?

The stock market benefits humanity because without it we wouldn't have many of the high-tech toys or miracle drugs we have. Stock is how companies get the capital to produce these things. You mention "selling bonds"; that's what the stock market is doing! Instead of just a promissory note like a bond, stocks are actually a part ownership of the company. Preferred stocks are ownership only of the profits, but common stockholders actually vote on the Board of Directors... one share, one vote.

The stock market is just what publicly traded stocks are selling for at a particular time. I does not always indicate how well the company is making profits, although investors do look at that when deciding what stocks are worth purchasing. It also depends heavily on how many people are looking to buy stock and how many are looking to sell. Right now, there are more looking to sell than to buy, so the price drops.

My previous post shows why big investors are looking to sell. They can make more money elsewhere.

TheRedneck

originally posted by: CriticalStinker

a reply to: conspiracy nut

Are we in a recession or something?

depression.

a reply to: TheRedneck

Do you see any downsides to this scheme, at all?

All of the fraud. All of the insider trading on privileged information that only a few possess? Does it really better society?

Maybe in the before time it was used as an instrument of benevolence and organic growth. But today?

You have investors that own stock in a company with no other responsibilities or loyalty to that company, but they get a share of the pie through price increases and even dividend payouts. It is like a big game of gamble, gamble and gamble. If the company is big enough, they can produce all kinds of inventive ways to hide the numbers. Like stock buybacks, accounting gimmicks and even marking their books to fantasy instead of to the current market, all fully legal now thanks to buying off our wonderful politicians.

These huge conglomerates can completely shut out any type of competitors simply due to the huge financial sword they wield, not by having a better or more innovative product.

Would it be so bad to remove this avenue of greed and corruption? If you wanted to invest in a company, you could still buy their bonds if they floated them, just like buying treasuries.

Knowing and witnessing human nature, even though the tool (markets) could possibly used for good, the other path is usually taken. Then you have all kinds of secondary effects like our wonderful underfunded pensions. What are they still claiming for returns, 7% 8%? I thought that the markets and 401Ks were going to fully replace defined pensions. How is that working out?

At some point we have to just remove these schemes. They make far more money for the corrupt and connected than a simple investor will ever see. Shucks, the simple investor is usually the sheep being sheared by the powerful. But I get it, no one is forcing the sheep to enter these shark ridden waters.

I view it like politics. We can change the individual actors time and time again, but until we change the structure itself, we will always get the same results.

Do you see any downsides to this scheme, at all?

All of the fraud. All of the insider trading on privileged information that only a few possess? Does it really better society?

Maybe in the before time it was used as an instrument of benevolence and organic growth. But today?

You have investors that own stock in a company with no other responsibilities or loyalty to that company, but they get a share of the pie through price increases and even dividend payouts. It is like a big game of gamble, gamble and gamble. If the company is big enough, they can produce all kinds of inventive ways to hide the numbers. Like stock buybacks, accounting gimmicks and even marking their books to fantasy instead of to the current market, all fully legal now thanks to buying off our wonderful politicians.

These huge conglomerates can completely shut out any type of competitors simply due to the huge financial sword they wield, not by having a better or more innovative product.

Would it be so bad to remove this avenue of greed and corruption? If you wanted to invest in a company, you could still buy their bonds if they floated them, just like buying treasuries.

Knowing and witnessing human nature, even though the tool (markets) could possibly used for good, the other path is usually taken. Then you have all kinds of secondary effects like our wonderful underfunded pensions. What are they still claiming for returns, 7% 8%? I thought that the markets and 401Ks were going to fully replace defined pensions. How is that working out?

At some point we have to just remove these schemes. They make far more money for the corrupt and connected than a simple investor will ever see. Shucks, the simple investor is usually the sheep being sheared by the powerful. But I get it, no one is forcing the sheep to enter these shark ridden waters.

I view it like politics. We can change the individual actors time and time again, but until we change the structure itself, we will always get the same results.

edit on 8-2-2018 by ClovenSky because: Holy spelling errors batman.

a reply to: ClovenSky

I see a downside to not allowing people to pool their resources... that's all a corporation is.

Insider trading is illegal. Just like murder... but there are still murders. Just like rape... but there are still rapes. Just like theft... but there is still theft. Just like drug use... but people still use drugs.

You're equating making something illegal as making it not happen. The only thing that will stop that dynamic is if we change humanity.

The only thing that has changed is that there are more people and more money. If anything, the "old days" had more insider trading issues.

If I invest my money, which I own, in a company with others, should I not have control over what I invested in? If the owners (stockholders) of a company don't control it, who does? A random guy off the street? My loyalty is to make money, and if I am a good investor I will invest in companies that grow and profit.

You are expecting benevolence from a business agreement. Does your boss expect you to be benevolent enough to work this week for free? Would you do it? Or, like 99.9999% of people, would you refuse, insisting that you earned that paycheck and hell, no, I won't work for free? I know I would.

Why does that not apply to others?

Hiding the numbers is illegal. See above. No one has removed the laws against "cooking the books."

There you have a point, with large multinationals like Wal-Mart. We have anti-trust laws to prevent monopolies. We just haven't been enforcing them. Talk to your elected officials and find out why.

You still don't get it: preferred stock is exactly like a bond in almost every way. The only difference is it pays profits instead of interest and it holds collateral instead of just being a promise.

Think about this: you have the choice of buying bonds from an established government that will likely be in existence in 100 years, or from a company that could close its doors tomorrow. Which one are you going to buy? In addition, there is nothing backing up a bond except the promise of that government entity that issued it. Preferred stock already owns a portion of the profits of that company. If the company closes and gets liquidated, that money gets divided up between the stockholders... the way you want to set things up, I could start up a company, issue bonds, and then close the doors and disappear two weeks later. No one owns anything except me, and I just broke a promise to repay. How exactly is that better?

If one invests money, they expect a profit because there is a risk involved. No risk = no profit. Little risk = little profit. Much risk = much profit. That's how money works, how money worked before there ever was a country and politicians to run it. Use my house, you pay me rent; use my money, you pay me interest; use my time you pay me wages.

You finally got it right in the last sentence I just quoted. Never invest anything you can't afford to lose.

The rest shows the real problem you have with the stock market. You see these rich folks making money hand over fist, many many times what you or I make, and you don't see them doing any real work. But they are. They're watching the tickers all day,every day, reading reports, analyzing trends... it's a full time job to stay ahead of the market, and they have a talent for that job. If you borrowed the money to get started, and spent all your time reading and watching and learned how to work the market, you could do that too. But there's the same chance you might fail as they had to fail when they started. They took that chance and succeeded.

You never hear of the ones who tried and failed. Who wants to hear the story of a street bum who washes car windows at red lights for change? No one! We want to see successful people, so we do. That just doesn't mean there are not losers out there too... more than there are winners.

I said this in 2008, and I'll say it again:

"Change is not always a good thing."

It all depends on the change. We might make things a little better, or we might make things a whole lot worse. That chance might be worth the risk if things as they are simply are not working, but in this case they are. The capitalism that drives the stock market has existed in some form for centuries. Evrything else that has been tried has failed, often with terrible consequences.

TheRedneck

Do you see any downsides to this scheme, at all?

I see a downside to not allowing people to pool their resources... that's all a corporation is.

All of the fraud. All of the insider trading on privileged information that only a few possess? Does it really better society?

Insider trading is illegal. Just like murder... but there are still murders. Just like rape... but there are still rapes. Just like theft... but there is still theft. Just like drug use... but people still use drugs.

You're equating making something illegal as making it not happen. The only thing that will stop that dynamic is if we change humanity.

Maybe in the before time it was used as an instrument of benevolence and organic growth. But today?

The only thing that has changed is that there are more people and more money. If anything, the "old days" had more insider trading issues.

You have investors that own stock in a company with no other responsibilities or loyalty to that company, but they get a share of the pie through price increases and even dividend payouts. It is like a big game of gamble, gamble and gamble. If the company is big enough, they can produce all kinds of inventive ways to hide the numbers. Like stock buybacks, accounting gimmicks and even marking their books to fantasy instead of to the current market, all fully legal now thanks to buying off our wonderful politicians.

If I invest my money, which I own, in a company with others, should I not have control over what I invested in? If the owners (stockholders) of a company don't control it, who does? A random guy off the street? My loyalty is to make money, and if I am a good investor I will invest in companies that grow and profit.

You are expecting benevolence from a business agreement. Does your boss expect you to be benevolent enough to work this week for free? Would you do it? Or, like 99.9999% of people, would you refuse, insisting that you earned that paycheck and hell, no, I won't work for free? I know I would.

Why does that not apply to others?

Hiding the numbers is illegal. See above. No one has removed the laws against "cooking the books."

These huge conglomerates can completely shut out any type of competitors simple due to the huge financial sword their wield, not buy having a better or more innovative product.

There you have a point, with large multinationals like Wal-Mart. We have anti-trust laws to prevent monopolies. We just haven't been enforcing them. Talk to your elected officials and find out why.

Would it be so bad to remove this avenue of greed and corruption? If you wanted to invest in a company, you could still buy their bonds if they floated them, just like buying treasuries.

You still don't get it: preferred stock is exactly like a bond in almost every way. The only difference is it pays profits instead of interest and it holds collateral instead of just being a promise.

Think about this: you have the choice of buying bonds from an established government that will likely be in existence in 100 years, or from a company that could close its doors tomorrow. Which one are you going to buy? In addition, there is nothing backing up a bond except the promise of that government entity that issued it. Preferred stock already owns a portion of the profits of that company. If the company closes and gets liquidated, that money gets divided up between the stockholders... the way you want to set things up, I could start up a company, issue bonds, and then close the doors and disappear two weeks later. No one owns anything except me, and I just broke a promise to repay. How exactly is that better?

Knowing and witnessing human nature, even though the tool (markets) could possibly used for good, the other path is usually taken. Then you have all kinds of secondary effects like our wonderful underfunded pensions. What are they still claiming for returns, 7% 8%? I thought that the markets and 401Ks were going to fully replace defined pensions. How is that working out?

If one invests money, they expect a profit because there is a risk involved. No risk = no profit. Little risk = little profit. Much risk = much profit. That's how money works, how money worked before there ever was a country and politicians to run it. Use my house, you pay me rent; use my money, you pay me interest; use my time you pay me wages.

At some point we have to just remove these schemes. They make far more money for the corrupt and connected than a simple investor will ever see. Shucks, the simple investor is usually the sheep being sheared by the powerful. But I get it, no one is forcing the sheep to enter these shark ridden waters.

You finally got it right in the last sentence I just quoted. Never invest anything you can't afford to lose.

The rest shows the real problem you have with the stock market. You see these rich folks making money hand over fist, many many times what you or I make, and you don't see them doing any real work. But they are. They're watching the tickers all day,every day, reading reports, analyzing trends... it's a full time job to stay ahead of the market, and they have a talent for that job. If you borrowed the money to get started, and spent all your time reading and watching and learned how to work the market, you could do that too. But there's the same chance you might fail as they had to fail when they started. They took that chance and succeeded.

You never hear of the ones who tried and failed. Who wants to hear the story of a street bum who washes car windows at red lights for change? No one! We want to see successful people, so we do. That just doesn't mean there are not losers out there too... more than there are winners.

I view it like politics. We can change the individual actors time and time again, but until we change the structure itself, we will always get the same results.

I said this in 2008, and I'll say it again:

"Change is not always a good thing."

It all depends on the change. We might make things a little better, or we might make things a whole lot worse. That chance might be worth the risk if things as they are simply are not working, but in this case they are. The capitalism that drives the stock market has existed in some form for centuries. Evrything else that has been tried has failed, often with terrible consequences.

TheRedneck

originally posted by: ClovenSky

a reply to: TheRedneck

Do you see any downsides to this scheme, at all?

All of the fraud. All of the insider trading on privileged information that only a few possess? Does it really better society?

Maybe in the before time it was used as an instrument of benevolence and organic growth. But today?

You have investors that own stock in a company with no other responsibilities or loyalty to that company, but they get a share of the pie through price increases and even dividend payouts. It is like a big game of gamble, gamble and gamble. If the company is big enough, they can produce all kinds of inventive ways to hide the numbers. Like stock buybacks, accounting gimmicks and even marking their books to fantasy instead of to the current market, all fully legal now thanks to buying off our wonderful politicians.

These huge conglomerates can completely shut out any type of competitors simply due to the huge financial sword they wield, not by having a better or more innovative product.

Would it be so bad to remove this avenue of greed and corruption? If you wanted to invest in a company, you could still buy their bonds if they floated them, just like buying treasuries.

Knowing and witnessing human nature, even though the tool (markets) could possibly used for good, the other path is usually taken. Then you have all kinds of secondary effects like our wonderful underfunded pensions. What are they still claiming for returns, 7% 8%? I thought that the markets and 401Ks were going to fully replace defined pensions. How is that working out?

At some point we have to just remove these schemes. They make far more money for the corrupt and connected than a simple investor will ever see. Shucks, the simple investor is usually the sheep being sheared by the powerful. But I get it, no one is forcing the sheep to enter these shark ridden waters.

I view it like politics. We can change the individual actors time and time again, but until we change the structure itself, we will always get the same results.

The traders who make profits from buying and selling are how portfolios are able to get return on capital. For instance, huge institutional investors like insurance companies or pension funds are able to pay out to their customers because they have large sums of capital being traded earning profits.

In other words, your Uncle's pension is able to keep paying benefits to retirees because some trader is realizing large profits. Big universities have traders on staff to get the best returns on their endowments. Harvard University has $37 billion endowment that funds the schools. They were paying their portfolio manager like $20 million a year to get outsized returns on that money.

Yes, there are people who scheme and commit fraud. I work in mortgages and see it everyday. No industry is immune from people committing fraud. Pick any industry and we can find examples. However, that does not mean the industry as a whole is not providing a public good.

originally posted by: TheRedneck

Insider trading is illegal.

Except if you're a member of Congress. Then you can legally take advantage of insider tips and become wealthy.

originally posted by: AugustusMasonicus

Who's fault is it today? Trump? Obama? The Russians?

Nah this one is clearly the fault of Bernanke/Yellen keeping rates too low for too long. Although all of our booms are the fault of the fed issuing credit at below market rates of interest, that cheap credit almost always flows into asset prices.

But what can service the increased debt? Only continually rising asset prices, therefore eventually the bubbles pop.

originally posted by: conspiracy nut

this might be the beginning, the ups and downs, the peaks and valleys of a downward spiral. will trump own it or pass the blame to obama? i'm just saying since trump likes to claim all good economic news as his creation.

Yah watch for relief rallies with lower highs and lower lows, that's the tell we are entering a bear market.

Markets are cyclical, bull and bear markets. For some reason people only think bull markets are justifiable and that bear markets are undeserved or happen for some unknown reason.

Would a government shutdown have a negative impact on the market?

originally posted by: AugustusMasonicus

originally posted by: TheRedneck

Insider trading is illegal.

Except if you're a member of Congress. Then you can legally take advantage of insider tips and become wealthy.

Better yet, you can legally create your own tips, and introduce and pass laws to benefit your own portfolio.

Like Trump, who just gave himself a huge tax break, on his stash of overseas money.

Politics has its privileges.

originally posted by: dianajune

Would a government shutdown have a negative impact on the market?

That depends.

If the shutdown was because the alternative was a "Yuge" overspending budget, then the market might favor the shutdown and go up.

The market cares more about the future impact of the government action, than the temporary turmoil of political fights.

edit on 8-2-2018 by AMPTAH because: (no reason given)

Meh the current market, as we know it still has never properly fixed, nor will it ever be I think, we still have the Great Depression code in this

market, we never corrected it, pretty much everything about the Dow is artificial and fake, it’s as REAL as our green backs. When you take a step

back to look at it all, and get outside of the box, you just may see it’s all a facade designed to control the mind. Only then perhaps you can look

up to the stars and realize we are meant to be somewhere or part of something much bigger....

Ahem back to reality I think we will end up have to deal with that 20 plus trillion dollar deficit we have in debt sooner or later how the hell we can continue telling ourselves we are doing great even thou we grow deeper and deeper in debt makes me giggle. Maybe it really is a facade...

Today’s market reminds me of the roaring 20’s..

Ahem back to reality I think we will end up have to deal with that 20 plus trillion dollar deficit we have in debt sooner or later how the hell we can continue telling ourselves we are doing great even thou we grow deeper and deeper in debt makes me giggle. Maybe it really is a facade...

Today’s market reminds me of the roaring 20’s..

edit on 8-2-2018 by Bicent because: (no reason given)

a reply to: SkeptiSchism

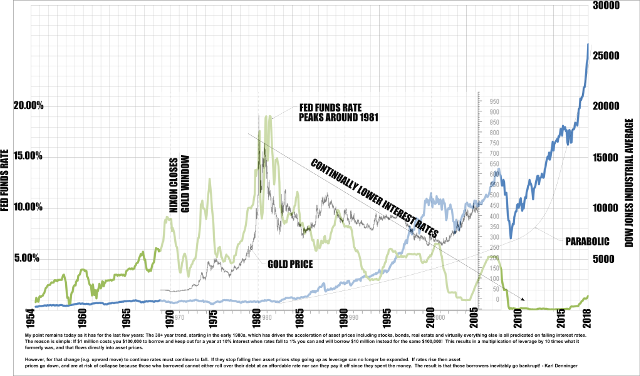

Nice charts - that 2nd chart really helps illustrate how low the Fed Funds rate is and how overvalued and pretty much parabolic growth the DJIA has sustained... it's incredible.

Thanks for your contributions, as always SkeptiSchism - I reached out to you the other day because I appreciate your knowledge and insights on the markets. Would love to collaborate on research/documenting with you if you'd be interested at some point.

Nice charts - that 2nd chart really helps illustrate how low the Fed Funds rate is and how overvalued and pretty much parabolic growth the DJIA has sustained... it's incredible.

Thanks for your contributions, as always SkeptiSchism - I reached out to you the other day because I appreciate your knowledge and insights on the markets. Would love to collaborate on research/documenting with you if you'd be interested at some point.

new topics

-

I hate dreaming

Rant: 11 minutes ago -

Is the origin for the Eye of Horus the pineal gland?

Philosophy and Metaphysics: 1 hours ago -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 2 hours ago -

Biden says little kids flip him the bird all the time.

2024 Elections: 2 hours ago -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 2 hours ago -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest: 2 hours ago -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 4 hours ago -

MH370 Again....

Disaster Conspiracies: 5 hours ago -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 7 hours ago -

Chronological time line of open source information

History: 8 hours ago

top topics

-

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 4 hours ago, 14 flags -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 2 hours ago, 9 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 15 hours ago, 8 flags -

A man of the people

Medical Issues & Conspiracies: 10 hours ago, 8 flags -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 2 hours ago, 7 flags -

Biden says little kids flip him the bird all the time.

2024 Elections: 2 hours ago, 6 flags -

4 plans of US elites to defeat Russia

New World Order: 11 hours ago, 4 flags -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 7 hours ago, 3 flags -

Is the origin for the Eye of Horus the pineal gland?

Philosophy and Metaphysics: 1 hours ago, 3 flags -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest: 2 hours ago, 3 flags

active topics

-

12 jurors selected in Trump criminal trial

US Political Madness • 89 • : ImagoDei -

Is the origin for the Eye of Horus the pineal gland?

Philosophy and Metaphysics • 4 • : JoelSnape -

Man sets himself on fire outside Donald Trump trial

Mainstream News • 18 • : nugget1 -

Biden says little kids flip him the bird all the time.

2024 Elections • 9 • : FlyersFan -

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 72 • : Xtrozero -

I hate dreaming

Rant • 0 • : FlyersFan -

MH370 Again....

Disaster Conspiracies • 8 • : Lazy88 -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works • 27 • : purplemer -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 27 • : Xtrozero -

911 emergency lines are DOWN across multiple states

Breaking Alternative News • 8 • : nugget1