It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Let's start with a flat tax and work from there shall we? The fact of the matter is, some of us lower and middle class are paying more than giant

corporations. I go to wal-mart and they have 4 people working the registers, the money that they save on taxes certainly isn't creating jobs and

damn sure isn't going toward increasing the money that the underemployed are making. They want to own the world and they are doing it by paying more

in lobbying than in taxes. Seems like a pretty easy problem to fix, except republicans and democrats are retarded and can't understand that. (That

is a jab at the voters, not the politicians. They know exactly what they are doing.)

reply to post by ventian

Funny you talk about Wal-mart. I just was reading an article about them.

www.mlive.com...

Higher wages, more taxes.

On a related note, Do you feel companies like Walmart should hire people just for the sake of creating jobs? Sometimes, 4 cashiers are warranted.

Funny you talk about Wal-mart. I just was reading an article about them.

According to UC Berkeley's report, Walmart employees earn 14.5 percent less than other workers in large retail companies. Depressing stuff, but there is any easy enough fix: If Walmart implemented a $12 per hour minimum wage for all employees, it would cost the company $3.2 billion. That is a lot of money, unless you're Walmart, in which case it's just 1 percent of your overall annual $305 billion in sales. Even if Walmart passed on the entire burden of the wage increase to customers, it would only average out to a cost increase of 46 cents per shopping trip. That's surely something that most Walmart shoppers can afford.

www.mlive.com...

Higher wages, more taxes.

On a related note, Do you feel companies like Walmart should hire people just for the sake of creating jobs? Sometimes, 4 cashiers are warranted.

reply to post by jam321

Personally when a company controls that much wealth, they probably need to employ as much as they possibly can. These are my personal feelings. Anyone that disagrees can feel free to say so, but make sure that whoever you are, you make sure to keep your mouth shut about people on food stamps, welfare, disability, etc. I live in Bama and get sick and tired hearing about people cussing about other people who ride the system, all the while they stay ignorant about the income of these corporations. Night guys and gals.

Thanks for the reply but be careful of your post. That 1 percent is based on sales, not profit; profit is all wall street cares about.

Personally when a company controls that much wealth, they probably need to employ as much as they possibly can. These are my personal feelings. Anyone that disagrees can feel free to say so, but make sure that whoever you are, you make sure to keep your mouth shut about people on food stamps, welfare, disability, etc. I live in Bama and get sick and tired hearing about people cussing about other people who ride the system, all the while they stay ignorant about the income of these corporations. Night guys and gals.

Thanks for the reply but be careful of your post. That 1 percent is based on sales, not profit; profit is all wall street cares about.

edit on

27-7-2011 by ventian because: (no reason given)

reply to post by ventian

no your not your not even close to paying more in taxes

a business earning 10 million is paying more than you are in fact they are paying $3.5 million just in federal

then the state gets their cut in fact after both get their piece of that pie they loose half of that 10 million

lets say for the sake of arguement that you make 100k you lost 50k in taxes.

those earning less than 100k get their tax credits and etc and result in half this country never paying a dime.

so no.

no your not your not even close to paying more in taxes

a business earning 10 million is paying more than you are in fact they are paying $3.5 million just in federal

then the state gets their cut in fact after both get their piece of that pie they loose half of that 10 million

lets say for the sake of arguement that you make 100k you lost 50k in taxes.

those earning less than 100k get their tax credits and etc and result in half this country never paying a dime.

so no.

edit on 27-7-2011 by neo96 because: (no reason given)

reply to post by GeorgiaGirl

That is incorrect.

50% of WAGE EARNERS pay less than 3% of the taxes. The Employment-Population Ratio was 58.2% in Jun 2011.

The Civilian Labor Force Participation Rate was 64.1% in Jun 2011

The labor force is the sum of employed and unemployed persons. ( includes those 16 years and over who work) The labor force participation rate is the labor force as a percent of the civilian non-institutional population. [Not in prison etc.]

Not in the labor force: Persons who are neither employed nor unemployed are not in the labor force. This category includes retired persons, students, those taking care of children or other family members, and others who are neither working nor seeking work. Information is collected on their desire for and availability for work, job search activity in the prior year, and reasons for not currently searching.

This was 83,941,000 in 2010. In 2010 1,173,00 listed Discouragement over job prospects up from 778,000 in 2009.

The Employment-Population Ratio was 58.2% in Jun 2011

Information from Bureau of Labor Statistics and Tax Policy Center (Democrats)

.....When 50% of citizens don't pay any taxes at all, something's wrong....

That is incorrect.

50% of WAGE EARNERS pay less than 3% of the taxes. The Employment-Population Ratio was 58.2% in Jun 2011.

You are looking at 29% of wage earners paying 97% of the income taxes.

The Civilian Labor Force Participation Rate was 64.1% in Jun 2011

The labor force is the sum of employed and unemployed persons. ( includes those 16 years and over who work) The labor force participation rate is the labor force as a percent of the civilian non-institutional population. [Not in prison etc.]

Not in the labor force: Persons who are neither employed nor unemployed are not in the labor force. This category includes retired persons, students, those taking care of children or other family members, and others who are neither working nor seeking work. Information is collected on their desire for and availability for work, job search activity in the prior year, and reasons for not currently searching.

This was 83,941,000 in 2010. In 2010 1,173,00 listed Discouragement over job prospects up from 778,000 in 2009.

The Employment-Population Ratio was 58.2% in Jun 2011

Information from Bureau of Labor Statistics and Tax Policy Center (Democrats)

reply to post by jam321

That isn't even the whole story. Farmers, 2% of the population contributed 16% of the GNP. On top of that:

Appreciate the contribution and all the links you have provided. The farmer one was an eye opener IMO.

That isn't even the whole story. Farmers, 2% of the population contributed 16% of the GNP. On top of that:

According to the U.S. Department of Agriculture, almost 90 percent of the total income of rancher or farmer households now comes from outside earnings.

www.mi-cherries.com...

Originally posted by SlasherOfVeils

Secondly, When trump knows his taxes aren't going to go up 4% from what they currently are, that's enough extra dough to go hire about 100 more joe smiths and sally browns, and he knows he can expand his business, open new stores, and put people to work. Now provided those 100 people aren't 2 kid single mothers working half on the books with unreported cash income, you now have a giant handful of new taxpayers contributing, AND you expanded the economy. Sure if you took his 4% taxes, you have slightly more tax income, but the economy stagnates.

Except, that, if Trump would hire those people now, and open new locations now, he wouldn't pay a cent of income tax on that money spent.

In fact he can depreciate new equipment the year it is bought, so if he buys a 1000$ machine, he can actually deduct 1200$ off his taxable imcome!

So: telling Mr Trump that he can keep less of his money if he doesn't expand, actually encourages him to do that.

Originally posted by neo96

starting with the half of this country who pays no taxes whatsoever.

For the Nth time - The only people who avoid paying all taxes are infants and the dead. If you consume on any level, you're paying taxes (gas, meals tax, sales tax, etc).

All these political debates are a waste of time, both sides are controlled by the same agents, why do people say 'oh no republicans have this track

record' where as democrats have 'this track record' when in reality they both serve the same agenda so why doesnt everyone stop wasting there enrgy

on this pointless S*** and talk about something IMPORTANT.

Originally posted by crimvelvet

reply to post by GeorgiaGirl

.....When 50% of citizens don't pay any taxes at all, something's wrong....

That is incorrect.

50% of WAGE EARNERS pay less than 3% of the taxes. The Employment-Population Ratio was 58.2% in Jun 2011.

You are looking at 29% of wage earners paying 97% of the income taxes.

The Civilian Labor Force Participation Rate was 64.1% in Jun 2011

The labor force is the sum of employed and unemployed persons. ( includes those 16 years and over who work) The labor force participation rate is the labor force as a percent of the civilian non-institutional population. [Not in prison etc.]

Not in the labor force: Persons who are neither employed nor unemployed are not in the labor force. This category includes retired persons, students, those taking care of children or other family members, and others who are neither working nor seeking work. Information is collected on their desire for and availability for work, job search activity in the prior year, and reasons for not currently searching.

This was 83,941,000 in 2010. In 2010 1,173,00 listed Discouragement over job prospects up from 778,000 in 2009.

The Employment-Population Ratio was 58.2% in Jun 2011

Information from Bureau of Labor Statistics and Tax Policy Center (Democrats)

Thanks for the clarification. So actually a WHOLE lot more than 50% of the citizens don't pay taxes. And obviously I'm talking about income taxes, not sales taxes.

Based on your numbers, I'm in that 29% who is tired of taking care of 97% of the tab.

reply to post by ventian

That is a simplistic view of a very complex subject.

Eustace Mullins chronicles the take over of the banking industry and money supply by a Cartel HERE

I am going to show how another Corporate Cartel banded together to take over a market niche. Their take over is now almost complete. The "niche" is the world food supply, and the US government has been very active in HELPING!

I really REALLY suggest everyone read SHIELDING THE GIANT: USDA's “Don't Look, Don't Know”

This is a bit of info from my studies on the subject:

The Ag cartel wants to take control of the food supply away from the US farmers and transfer it to the World Trade Organization where THEY would have complete control without the pesky details of getting laws passed.

To get this transfer of power they had to give the US citizens a reason. The reason was FOOD POISONING. WTO was ratified in 1995 two years later food poisoning doubled in the USA. The above report details how this was accomplished.

First the USDA/FDA adopted a new method for food inspection HACCP in 1996. Inspectors went from hands on inspection (and lab testing) to inspecting paperwork. In addition older workers were fired and replaced with inspectors who were only trained in the "New Method"

Second the media (controlled by JP Morgan) screamed about food poisoning bringing it to everyone's attention. The real reason of course was never mentioned only points such as the entire Florida tomato crop being destroyed to "protect us" The problem was actually caused by peppers in Mexico and water contaminated with human feces. No action was taken by the US government and the real reason, Mexican peppers and no inspection at the borders per WTO agreement was never publicized. This is just one of many many examples.

Congressional investigations were held and any info about the collusion between big Ag and the USDA/FDA was swept under the carpet.

Senate Hearings

www.access.gpo.gov... Testimony by Mr. Stan Painter, Chairman, National Joint Council of Food Inspection Locals:

www.fsis.usda.gov... Hearing where Stan Painter is called a LIAR by the government. (In a round about way of course)

Next a bill was introduced in 2009 to "fix the problem" - Regulate food production. (HR-875) Farmers alerted by the NAIS campaign jumped on the bill so TPTB trotted out their hidden weapons.

Their puppet organizations Organic Consumers Union and Food & Water Watch removed any information showing the control of the Ag Cartel over the USDA & FDA and the chart showing the doubling of food borne illness after WTO was ratified and HACCP implemented. In addition they came out in support of the bill!

Farmers dug up info and SHOWED the regulations would include home gardens So

the internet was flooded with HR 875: Stop the Hysteria despite this we managed to stall the bill and get it into modification mode.

THEN they brought out the big guns. Barbara Kowalcyk,Co-founder and director of food safety, who states her son, Kevin died in 2001 from food poisoning. LINKY

When THAT did not work, they passed the bill in a rush just before Christmas during the lame duck session after elections in the same way the Federal Reserve Act of 1913 was passed.

...when a company controls that much wealth, they probably need to employ as much as they possibly can....

That is a simplistic view of a very complex subject.

Eustace Mullins chronicles the take over of the banking industry and money supply by a Cartel HERE

I am going to show how another Corporate Cartel banded together to take over a market niche. Their take over is now almost complete. The "niche" is the world food supply, and the US government has been very active in HELPING!

I really REALLY suggest everyone read SHIELDING THE GIANT: USDA's “Don't Look, Don't Know”

This investigative report, as part of an ongoing series on corporate and government accountability, was researched and written by GAP Legal Director, Tom Devine.

This is a bit of info from my studies on the subject:

The Ag cartel wants to take control of the food supply away from the US farmers and transfer it to the World Trade Organization where THEY would have complete control without the pesky details of getting laws passed.

To get this transfer of power they had to give the US citizens a reason. The reason was FOOD POISONING. WTO was ratified in 1995 two years later food poisoning doubled in the USA. The above report details how this was accomplished.

First the USDA/FDA adopted a new method for food inspection HACCP in 1996. Inspectors went from hands on inspection (and lab testing) to inspecting paperwork. In addition older workers were fired and replaced with inspectors who were only trained in the "New Method"

Second the media (controlled by JP Morgan) screamed about food poisoning bringing it to everyone's attention. The real reason of course was never mentioned only points such as the entire Florida tomato crop being destroyed to "protect us" The problem was actually caused by peppers in Mexico and water contaminated with human feces. No action was taken by the US government and the real reason, Mexican peppers and no inspection at the borders per WTO agreement was never publicized. This is just one of many many examples.

Congressional investigations were held and any info about the collusion between big Ag and the USDA/FDA was swept under the carpet.

Senate Hearings

www.access.gpo.gov... Testimony by Mr. Stan Painter, Chairman, National Joint Council of Food Inspection Locals:

www.fsis.usda.gov... Hearing where Stan Painter is called a LIAR by the government. (In a round about way of course)

Next a bill was introduced in 2009 to "fix the problem" - Regulate food production. (HR-875) Farmers alerted by the NAIS campaign jumped on the bill so TPTB trotted out their hidden weapons.

Their puppet organizations Organic Consumers Union and Food & Water Watch removed any information showing the control of the Ag Cartel over the USDA & FDA and the chart showing the doubling of food borne illness after WTO was ratified and HACCP implemented. In addition they came out in support of the bill!

Farmers dug up info and SHOWED the regulations would include home gardens So

the internet was flooded with HR 875: Stop the Hysteria despite this we managed to stall the bill and get it into modification mode.

THEN they brought out the big guns. Barbara Kowalcyk,Co-founder and director of food safety, who states her son, Kevin died in 2001 from food poisoning. LINKY

When THAT did not work, they passed the bill in a rush just before Christmas during the lame duck session after elections in the same way the Federal Reserve Act of 1913 was passed.

reply to post by ventian

In the above post I showed how consolidation is being accomplished. In other recent posts here and in other threads, I have shown the integrated farming methods used by small farms produced MORE FOOD per ac then factory farming methods. On the benefits of small farms/Institute for Food and Development Policy

In other posts I have shown small businesses produce more jobs and more patents per employee.

When you think about it, large corporations are like armies. They need generals, and colonels and majors and captains and 1st & 2nd lieutenants and a whole cast of sargeants and specialist just to get a battalion of foot soldiers into the field.

Peter druker showed in the 1980's there were 10 admin tyes for every one factory worker who was actually producing the product.

This need for a "support and management team" is greatly diminished as company becomes smaller and smaller until you hit the one man shop where the owner wears all the hats.

In corporations as in all things there is an optimum size (for horses it is 14 hands 2" not 16+ hand that is now so popular in the show ring)

The optimum size is a size where division of labor can occur without adding layers and layers of managers managing managers until you reach a board of directors who hasn't the foggiest idea of what products are even manufactured!

There is another aspect to size. In a smaller firm the owner/CEO knows ALL the people. he knows who the bull turd artists are and the producers are. This means he can fine tune his operation and his employees can approach him directly with ideas and problems.

I ran into a prime example of the type of idiocy that happens when this person to person connection is not there. A plant manager from a nearby plant took a statistics course with me. As soon as he learn of the Pareto 80%-20% rule, he applied it to his work force. He determined the 20% of the work force that had taken 80% of the sick days that year and fired them!!! The guy never bother to look at whether the worker who broke his leg skiing was also his best producer, he just "went by the numbers" and yes the people in class asked that question of him.

There is a third aspect of the relative sizes of business firms. The large the firm the more reports/written management systems are generated.

This aspect of business, written management systems, has given rise to ISO (International Standards Organization) and ISO 9000 etc. The really interesting thing about ISO 9000 is ASQ had an article REJECTING its usefulness and despite a flood of responses no one in the Quality Society would defend the position!

So why is the idea of written management systems like ISO and HACCP being shoved down the throats of America's small business???

Because it removes the advantages of small business and saddles them with the same PROBLEMS that big business has, floods of paperwork and red tape.

Personally when a company controls that much wealth, they probably need to employ as much as they possibly can.

In the above post I showed how consolidation is being accomplished. In other recent posts here and in other threads, I have shown the integrated farming methods used by small farms produced MORE FOOD per ac then factory farming methods. On the benefits of small farms/Institute for Food and Development Policy

In other posts I have shown small businesses produce more jobs and more patents per employee.

When you think about it, large corporations are like armies. They need generals, and colonels and majors and captains and 1st & 2nd lieutenants and a whole cast of sargeants and specialist just to get a battalion of foot soldiers into the field.

Peter druker showed in the 1980's there were 10 admin tyes for every one factory worker who was actually producing the product.

This need for a "support and management team" is greatly diminished as company becomes smaller and smaller until you hit the one man shop where the owner wears all the hats.

In corporations as in all things there is an optimum size (for horses it is 14 hands 2" not 16+ hand that is now so popular in the show ring)

The optimum size is a size where division of labor can occur without adding layers and layers of managers managing managers until you reach a board of directors who hasn't the foggiest idea of what products are even manufactured!

There is another aspect to size. In a smaller firm the owner/CEO knows ALL the people. he knows who the bull turd artists are and the producers are. This means he can fine tune his operation and his employees can approach him directly with ideas and problems.

I ran into a prime example of the type of idiocy that happens when this person to person connection is not there. A plant manager from a nearby plant took a statistics course with me. As soon as he learn of the Pareto 80%-20% rule, he applied it to his work force. He determined the 20% of the work force that had taken 80% of the sick days that year and fired them!!! The guy never bother to look at whether the worker who broke his leg skiing was also his best producer, he just "went by the numbers" and yes the people in class asked that question of him.

There is a third aspect of the relative sizes of business firms. The large the firm the more reports/written management systems are generated.

This aspect of business, written management systems, has given rise to ISO (International Standards Organization) and ISO 9000 etc. The really interesting thing about ISO 9000 is ASQ had an article REJECTING its usefulness and despite a flood of responses no one in the Quality Society would defend the position!

So why is the idea of written management systems like ISO and HACCP being shoved down the throats of America's small business???

Because it removes the advantages of small business and saddles them with the same PROBLEMS that big business has, floods of paperwork and red tape.

reply to post by ventian

I mentioned Red Tape in the last post and this is THE CRITICAL PROBLEM that is preventing job creation.

I think it deserves it's own post so it stands out.

Yeah I am pro-business, PRO SMALL business not Corporate/government collusion aka Corporatism or Fascism.

Personally when a company controls that much wealth, they probably need to employ as much as they possibly can.

I mentioned Red Tape in the last post and this is THE CRITICAL PROBLEM that is preventing job creation.

I think it deserves it's own post so it stands out.

Small businesses losing out to red tape

cities and states stifle new small businesses at every turn, burying them in mounds of paperwork; lengthy, expensive and arbitrary permitting processes; pointless educational requirements for occupations; or even just outright bans.Today, the Institute for Justice released a series of studies documenting government-imposed barriers to entrepreneurship in eight cities. In every city studied, overwhelming regulations destroyed or crippled would-be businesses at a time when they are most needed.

Time and again, these reports document how local bureaucrats believe they should dictate every aspect of a person's small business. They want to choose who can go into which business, where, what the business should look like, and what signs will be put in the windows. And if that means that businesses fail, or never open, or can operate only illegally, or waste all their money trying to get permits so they have nothing left for actual operations, that's just too bad...

*In Chicago, Esmeralda Rodriguez tried to open a children's play center, paying rent month after month while she waited in vain for the government permits she needed to open her business. After a full year of bureaucratic red tape, she finally exhausted her life savings and closed down for good....

When governments actually get rid of barriers to entrepreneurship, new businesses open almost immediately.

...removing even a single law can unleash entrepreneurial energy and create hundreds of jobs....

America was once known as the Land of Opportunity. It could be again, but not until state and local officials get out of the way of entrepreneurs trying to fulfill their dreams of new business and new prosperity for themselves and their families.

Chip Mellor is president and general counsel of the Institute for Justice.....

So my answer to you is SCREW the big guys remove the barriers and open your OWN business!

Yeah I am pro-business, PRO SMALL business not Corporate/government collusion aka Corporatism or Fascism.

reply to post by neo96

Neo do you have any links for that info??? I would like to add it to my book marks.

...a business earning 10 million is paying more than you are in fact they are paying $3.5 million...

Neo do you have any links for that info??? I would like to add it to my book marks.

Originally posted by spyder550

He's a republican -- what is the track record on republican ideas about money -- argument is invalid.

what do you expect, look at the argument hes making

"taxing the rich doesnt solve the problem"

Of COURSE it doesnt, but it certainly puts us on the right path. the rest of it is that government overspends, and he barely touches on this FACT.

"new taxpayers"

what an idiot. yea lets tax these new taxpayers that will just magically appear out of thin air, and THEN and ONLY then do we care about government spending. spread X amount of money across X amount of people, and THEN tax it instead of taxing the money that's already there.

edit on

27-7-2011 by Question Fate because: (no reason given)

Originally posted by TheWalkingFox

Originally posted by neo96

reply to post by crimvelvet

federal employees in my opinion dont generate wealth remember they get paid by tax revenue from the taxpayer

Then you have absolutely no clue about anything related to economics, and should sit down and shut up, and try to learn from the people who understand the basics rather than spewing your ignorant, malinformed opinion as if it had value to anyone but yourself.

Remedial Economics 1a: Labor generates wealth. Whether it's a guy building a house, a public worker shuffling papers, or a plastic surgeon installing some new tits, these people are performing a service that has value. Wealth is thus generated.

"Fox" I am only commenting because of your rude; condecending "sitdown and shutup" comments:

Labor does not automatically generate "wealth". If I go out in my backyard; dig a large hole;and fill it back in, I have generated "perspiration". Nothing of value.No value changes hands.( economy). Govt employees Are paid by money generated through taxpayers gainful commerce outside of govt.

Added: " As such Govt employment is a sucking leech on the economy. Absorbing real dollars for imagined value."

Originally posted by TheWalkingFox

Would you like to learn about supply and demand while we're in the remedial courses? Maybea small lesson on inflation? C'mon, this is fifth grade stuff, you should know it.

and when and if they ever pay taxes back doesnt even begin to amount to the wealth generation of non government workers.

For the simple reason there are more non-government workers. Congratulations, you have discovered demographics.edit on 26/7/2011 by TheWalkingFox because: (no reason given)

edit on 27-7-2011 by 46ACE because: (no reason given)

edit on

27-7-2011 by 46ACE because: (no reason given)

edit on 27-7-2011 by 46ACE because: (no reason given)

Originally posted by neo96

reply to post by JustinSee

social security is a scam man in more ways than one

first off its a ponzi scheme

secondly everyone says they pay into ss so they should be getting it but the reality is:

you pay 6 % and you pass the buck off to your employer matches at another 6 % passing that off to federal government who decides who gets who doesnt and then steals it.

the fact is that 6% that you actually pay never amounts to what you receive in total pay.

people are better off taking that 6% and put it elsewhere.

and your right its not your fault americans are the victims here of bad government and bad policies that destroy people instead of doing what they were supposedly designed for.

best of luck man.

OK by definition ponsi scheme is not what this is, not unless your car insurance is a ponsi scheme then we are all screwed. (Yes, if you never have an accident, you never get any of your money back - isn't that what you think ponsi is? LOL) SS is being skimmed off the top by the government who have no legal rights in a public pot - public and government are two seperate billings according to GSA and their schedules. Why? Well public is either the populus or its original governing body/the state. Government, is usually a federal government reference. We have allowed the government little "policy digs" into the SS and because most paid little or no attention, they just kept their hand in the jar, or shall we say Crack Jar! Now be for real - do you think you are gonna take away their crack by getting rid of the program?

The answer is no - that SS money that evaporates from your check is most valued by the rich who don't and never needed it. It will go right back to the bankers because crackheads are great at lying and when they tell you party believers "no we still need that money to come out of your checks to give to the banks so they can trickle it down to you" you will buy it. Why? Well because they hooked you to their own brand of regurgitated crack - affiliate, participate and let the rich do your thinking because they are rich.

If they would have contributed matching funds then the story would have been different.

Now, I have a solution that will change the face of this argument forever - no opt out, if you want to vote it out then it should be completely vaporized! No new funneling of funds from the populace to the government for blank check reforms such as they are doing now. Along with this, an inheritance clause, one generation backwards for financial reimbursement to the populus for their contributions. I've been working more than 30 yrs and would love to see my contribution returned to me - not reinvented. And in actuality, that is exactly what will happen.

Btw, you must be really rich to be able to care for all the people on SS. I'll be dropping my relatives off to you since you seem to think they can work. And I would love to watch you forciblely working with the mentally ill on a daily basis. How productive will that be? Well, I'm sure you have that answer at the ready. If not, then trust me, get ready.

reply to post by Vanishr

Because there is a chance that those of us who agree with you can knock a bit of knowledge about the real state of affairs into some concrete heads ... ON BOTH SIDES!

The two sides are us the people and the elite power mongers. Until their methods of manipulation are uncovered and revealed neither side of the artifical "debate" they have set up will realise that AGAIN the American people have been had and WE LOSE.

The goals and dates have been set if the libs and conservatives can not agree to LOOK at the real problem and come together to fight it we are ALL SCREWED!

A year ago in The Global Journal this article appeared Of What Use is Global Governance? written by Pascal Lamy, Director, World Trade Organization (WTO) He speaks of the European Union as sort of an intermediate stage.

And lastly there is "Global Governance 2025" by by US & EU Intelligence Agencies courtesy of Freedom of Information Act, at cia.gov.

The Atlantic Council has a summary HERE

As we bicker between ourselves wasting time and energy the ELITE, united in purpose, steam straight towards their goal.

All these political debates are a waste of time, both sides are controlled by the same agents, why do people say 'oh no republicans have this track record' where as democrats have 'this track record' when in reality they both serve the same agenda so why doesnt everyone stop wasting there enrgy on this pointless S*** and talk about something IMPORTANT.

Because there is a chance that those of us who agree with you can knock a bit of knowledge about the real state of affairs into some concrete heads ... ON BOTH SIDES!

The two sides are us the people and the elite power mongers. Until their methods of manipulation are uncovered and revealed neither side of the artifical "debate" they have set up will realise that AGAIN the American people have been had and WE LOSE.

The goals and dates have been set if the libs and conservatives can not agree to LOOK at the real problem and come together to fight it we are ALL SCREWED!

A year ago in The Global Journal this article appeared Of What Use is Global Governance? written by Pascal Lamy, Director, World Trade Organization (WTO) He speaks of the European Union as sort of an intermediate stage.

...the very incarnation of an international organization of integration in which Member States have agreed to relinquish sovereignty in order to strengthen the coherence and effectiveness of their actions.

...If there is one place on earth where new forms of global governance have been tested since the Second World War, it is in Europe. European integration is the most ambitious supranational governance experience ever undertaken. It is the story of interdependence desired, defined, and organized by the Member States. In no respect is the work complete—neither geographically nor in terms of depth (i.e., the powers conferred by the Member States to the E.U.), nor, obviously, in terms of identity....

Our challenge today is to establish a system of global governance that provides a better balance between leadership, effectiveness, and legitimacy on the one hand, and coherence on the other...

And lastly there is "Global Governance 2025" by by US & EU Intelligence Agencies courtesy of Freedom of Information Act, at cia.gov.

The Atlantic Council has a summary HERE

This report analyzes the gap between current international governance institutions, organizations and norms and the demands for global governance likely to be posed by long-term strategic challenges over the next 15 years. The report is the product of research and analysis by the NIC and EUISS following a series of international dialogues co-organized by the Atlantic Council, TPN, and other partner organizations in Beijing, Tokyo, Dubai, New Delhi, Pretoria, Sao Paulo & Brasilia, Moscow, and Paris. ....

As we bicker between ourselves wasting time and energy the ELITE, united in purpose, steam straight towards their goal.

Originally posted by crimvelvet

reply to post by neo96

...a business earning 10 million is paying more than you are in fact they are paying $3.5 million...

Neo do you have any links for that info??? I would like to add it to my book marks.

He multiplied 10 with 35%.

I wouldn't be suprised if in neo96s world "making 10 million" actually means a turnover of 10 million...

It's a little hard to quote, but watch this video and listen to the numbers on income. From WWII to 1981, the bottom 90 percent earned 65 percent of

national income. The top ten percent earned 35 percent. The top 1 percent earned 9 percent. From 1981 to 2011, that changed, the bottom 90 fell to 52,

the top 10 went up to 48 percent. And the 1 percent rose to 22 percent. So, see how not only are the bottom 90 falling behind, but within the top ten,

the earnings are gravitating to the 1 percent.

NOW, let's talk about 2000 to 2008 only. The bottom 90 percent only had 10 percent income gains in those 8 years. The top one percent had 40.

Increasingly, a small and smaller number of americans control all of the wealth. And this is not about being smarter, or working harder, but simply, as we all know, that you need money to make money.

And in a world where wealth dictates policy and law, and all the legal advantages game the system for the wealthy, how can anyone feel this is fair? I think sometimes people mistake and think that the ire is directed towards people who are well off, but that's not the case, we're really talking about the very wealthy here.

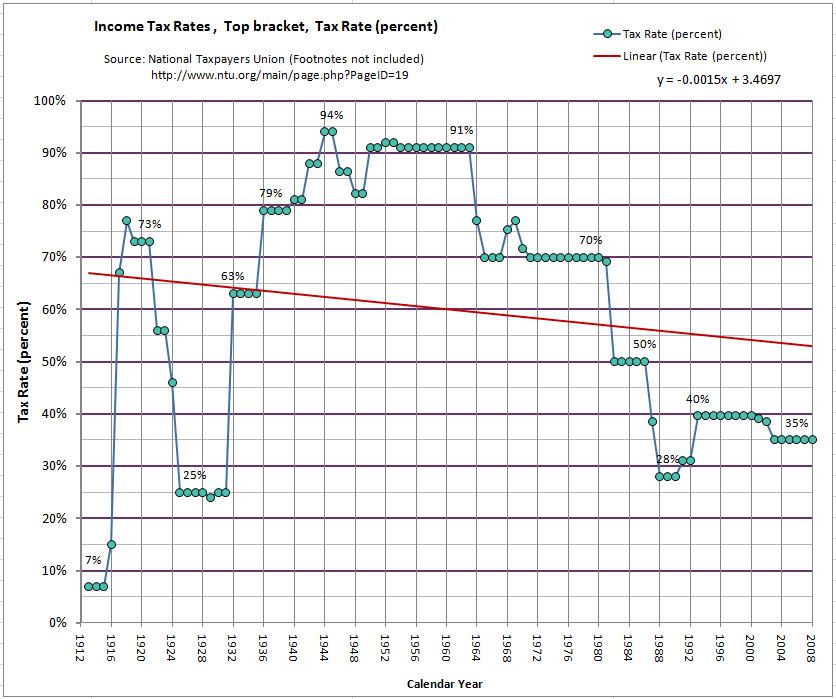

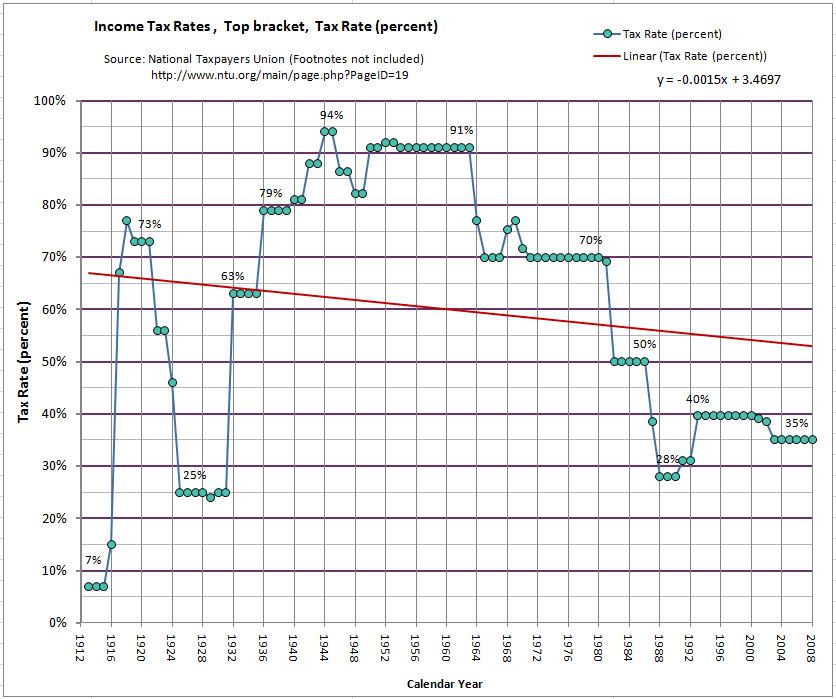

Historically, the wealthy have paid a LOT more than they are now and the US had plenty of jobs and innovation and so forth. 91 percent in the 50s! 70 percent in the 70s!

Cut the capital gains loops and corporate welfare before you start complaining about feeding the poor. You could change the tax laws to tax the lower income folks, but you wouldn't solve anything - they don't make enough to make a difference at all. Also, when you make over a 1 million dollars a year, paying taxes doesn't threaten keeping a roof over your head, or a car running, or food on the table. Or ruining your children's chances for going to college. It's the BURDEN that should be equal, not the amount.

situationroom.blogs.cnn.com...

NOW, let's talk about 2000 to 2008 only. The bottom 90 percent only had 10 percent income gains in those 8 years. The top one percent had 40.

Increasingly, a small and smaller number of americans control all of the wealth. And this is not about being smarter, or working harder, but simply, as we all know, that you need money to make money.

And in a world where wealth dictates policy and law, and all the legal advantages game the system for the wealthy, how can anyone feel this is fair? I think sometimes people mistake and think that the ire is directed towards people who are well off, but that's not the case, we're really talking about the very wealthy here.

Historically, the wealthy have paid a LOT more than they are now and the US had plenty of jobs and innovation and so forth. 91 percent in the 50s! 70 percent in the 70s!

Cut the capital gains loops and corporate welfare before you start complaining about feeding the poor. You could change the tax laws to tax the lower income folks, but you wouldn't solve anything - they don't make enough to make a difference at all. Also, when you make over a 1 million dollars a year, paying taxes doesn't threaten keeping a roof over your head, or a car running, or food on the table. Or ruining your children's chances for going to college. It's the BURDEN that should be equal, not the amount.

situationroom.blogs.cnn.com...

edit on 27-7-2011 by Jadette because: Video link

wasn't working.

new topics

-

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 2 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 7 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 13 hours ago, 31 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 7 hours ago, 13 flags -

Is AI Better Than the Hollywood Elite?

Movies: 14 hours ago, 4 flags -

Maestro Benedetto

Literature: 14 hours ago, 1 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 2 hours ago, 1 flags

active topics

-

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 47 • : FlyersFan -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area • 11 • : mysterioustranger -

Ode to Artemis

General Chit Chat • 1 • : Encia22 -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 15 • : jidnum2 -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 25 • : RazorV66 -

Skinwalker Ranch and the Mystery 1.6GHz Signal

Aliens and UFOs • 145 • : Ophiuchus1 -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 273 • : HerbertWest -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest • 6 • : FlyersFan -

Hate makes for strange bedfellows

US Political Madness • 50 • : 19Bones79 -

Weinstein's conviction overturned

Mainstream News • 28 • : burritocat