It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

*China considering dropping U.S. Treasuries and Buying Gold Instead*Very Important News- Implication

page: 5share:

Isn't China about to get a third stimulus plan from us in just a few years? I figure that a vast amount of the money we get goes to them, just looks

better when you give it to us then we give it to them.

www.kitco.com...

Commentary today out, from Kitco website.

Commentary today out, from Kitco website.

Gold - Investment Demand Stampedes

By Julian D.W. Phillips

Jan 30 2009 1:16PM

www.goldforecaster.com

On December 17th 2008 the combined gold holdings of the World Gold Council gold Exchange Traded Funds and Barclays Gold Trust stood at 985.59 tonnes. By the 16th January 2009 this had risen to 1009.92. By 30th January early in London time they had grown to 1079.83 a growth of almost 70 tonnes in two weeks. To give one perspective, the Central Bank Gold Agreement signatories [European central banks only] sold only 3.5 tonnes in the last two weeks. There are many other gold bullion-holding funds in the developed world from Canada to Switzerland that are not included in this total. If they were the total would be approaching 1200+ tonnes. Clearly we are seeing a stampede of institutional fund management into gold at present!

The present global economic climate, fraught with uncertainty, fear and currently a savage gauntlet for fund managers is making gold a desirable alternative and counter to such investments. Fund manager after fund manager is weighing the wisdom of holding gold in portfolios as a result. Consequently as the 2009 prospects for the global economy point to deflation of frightening proportions followed likely by explosive inflation as the Tsunami of newly printed money from all parts of the globe hits it, gold has moved to center stage as an investment of note.

It is likely then that these investment vehicles will be at the vanguard of fund management in gold in the years to come.

Well there is definitely a blame game happening right now.Just look at the bickering that went on at the World Economic Forum in Davos today.The US is

taking the blame for it all but yet people forget about the international bankers have had their greedy little hands in all of this for a while as

well. My opinion is a single global currency is on the way...see here.

www.abovetopsecret.com...

www.abovetopsecret.com...

There are 2 things that have not suffered big tumble in this crisis: US Dollar and Gold.

Oil has always been traded in greenback. I'm sure we've heard of Petro-Dollar. It's all about supremecy of US dollar.

No country has attempted to trade oil in other currency except for Iraq under Saddam Hussein's rule. That was why US government went to war in Iraq, toppled Saddam and secured oil fields (restoring trade to greenback).

Right now, people are anticipating US dollar to collapse and gold price to skyrocket. But what we see now is the total manipulation of greenback. Despite all the odds, US dollar remains strong. US government will protect US dollar for whatever reasons.

This latest news that China favoring gold over greenback may backfire. If it really happens, I believe gold price will tumble beyond imagination. People can go mad.

Oil has always been traded in greenback. I'm sure we've heard of Petro-Dollar. It's all about supremecy of US dollar.

No country has attempted to trade oil in other currency except for Iraq under Saddam Hussein's rule. That was why US government went to war in Iraq, toppled Saddam and secured oil fields (restoring trade to greenback).

Right now, people are anticipating US dollar to collapse and gold price to skyrocket. But what we see now is the total manipulation of greenback. Despite all the odds, US dollar remains strong. US government will protect US dollar for whatever reasons.

This latest news that China favoring gold over greenback may backfire. If it really happens, I believe gold price will tumble beyond imagination. People can go mad.

Looks like "Bad" Bank is off the Table for now as per CNBC MSM...Market is Sliding...down 185 @ 3:38 EST

Gold @ $926.89 (rising)

www.livecharts.co.uk...

Euro $1.2798 (falling)

10 Yr Treasury Note over 2.84% (rising)

[edit on 1/30/2009 by Hx3_1963]

Gold @ $926.89 (rising)

www.livecharts.co.uk...

Euro $1.2798 (falling)

10 Yr Treasury Note over 2.84% (rising)

[edit on 1/30/2009 by Hx3_1963]

So what? If we do declare bankruptcy and then was our hands clean of debt, so what? We are not some third world nation without proper infrastructure,

we grow most of the world food and have vast resources. We do not need a global economy that only keeps the fat cats rich and makes it so you can buy

cheap foreign goods.

We can isolate ourselves and in the long run the American people will be fine. Its the foreign investors and multi-national corporations that will fail and I say let them eat debt.

We can isolate ourselves and in the long run the American people will be fine. Its the foreign investors and multi-national corporations that will fail and I say let them eat debt.

Originally posted by LiquidMirage

Originally posted by questioningall

Though one thing that will keep anyone safe; Seriously purchase gold an silver!

It's been said over and over, but if you have ignored it before..... I advise you doing some research, and STOP ignoring the advice..... Buy metals!

Where and how do you purchase gold and silver. I asked at my local bank but nobody knew. I know you can buy it online but I don't trust that.

I purchase online from www.APMEX.com and www.nwtmint.com and have used them since 2007. They both take debit/credit cards. I found some local dealers, but APMEX generally has the lowest spot price, even lower than Kitco.

One word of advice, the first $10,000 should be silver. Once accumulated then move on to gold.

[edit on 30/1/09 by MikeboydUS]

A switch from Dollars to Gold from China means absolutely ZIP,

NOTHING, NADA...They need us more than we need them.

We could just REPUDIATE all foreign debts and go COMPLETELY ISOLATIONSIST...We have enough OIL, GAS, NUKE POWER and a MILITARY MIGHT that's big enough to pretty much say to the

rest of the world to F*** Off cuz we're taking our toys and

going HOME.

We actually DO have the ability to rebuild our home grown industries. And unlike CHINA, we could do it within 2 years.

In fact the United States provides 60% of the ENTIRE WORLD'S GENERAL FOOD SUPPLY and 75% of it's basic grains.

So what we say and do GOES ... OR ELSE !!!!!!!

Hey China! Go ahead collapse YOUR OWN economy

because WE CAN take our toys and go home and go

COMPLETELY ISOLATIONIST....We don't actually NEED

the rest of the world because we have MOST of what we need

right here in the USA ... and the rest we can get from CANADA!

NOTHING, NADA...They need us more than we need them.

We could just REPUDIATE all foreign debts and go COMPLETELY ISOLATIONSIST...We have enough OIL, GAS, NUKE POWER and a MILITARY MIGHT that's big enough to pretty much say to the

rest of the world to F*** Off cuz we're taking our toys and

going HOME.

We actually DO have the ability to rebuild our home grown industries. And unlike CHINA, we could do it within 2 years.

In fact the United States provides 60% of the ENTIRE WORLD'S GENERAL FOOD SUPPLY and 75% of it's basic grains.

So what we say and do GOES ... OR ELSE !!!!!!!

Hey China! Go ahead collapse YOUR OWN economy

because WE CAN take our toys and go home and go

COMPLETELY ISOLATIONIST....We don't actually NEED

the rest of the world because we have MOST of what we need

right here in the USA ... and the rest we can get from CANADA!

reply to post by StargateSG7

In 20 years the rest of the world will be at the feet of North America when the US and Canada povides the planet with energy. Throw in the fact that we are the breadbasket of the earth, the rest of planet will have little choice but to pay up. The earth will become dependent on North America for its very survival.

As the economy goes south another fact is that industry will return to the US. As the US becomes a cheaper labor market all of the industry overseas will find its way back home. We will switch from the current service/consumer economy back to a manufacturing economy. In the end its really all about the money and getting the biggest profit.

In 20 years the rest of the world will be at the feet of North America when the US and Canada povides the planet with energy. Throw in the fact that we are the breadbasket of the earth, the rest of planet will have little choice but to pay up. The earth will become dependent on North America for its very survival.

As the economy goes south another fact is that industry will return to the US. As the US becomes a cheaper labor market all of the industry overseas will find its way back home. We will switch from the current service/consumer economy back to a manufacturing economy. In the end its really all about the money and getting the biggest profit.

reply to post by LoneGunMan

'

The U.S. has become dependant on other countries, do you realize that most of our food is now imported in? The reason? Because it has been a big tax advantage for U.S. companies to have food processed in China and elsewhere. We even ship over the chickens we raise and kill here, to be processed over in China.

Grains in the U.S. and Canada had piled up at the end of last year due to shipping companies not getting letters of credits - BDI - was down to almost nothing.

So, yes we grow the majority of the world's food, but we no longer process and convert the raw food into grocery store shelves food.

The U.S. does not have the infrastructure right now to do that, we would have to start from scratch almost, to start processing our own food once more.

So, yes, we have the "food", but we stopped being self reliant years ago.

If, China, does stop buying our treasuries - it is a lot more complicated than just saying "fine" no problem, we can take care of ourselves.

GDP - does not cover our expenses etc.

We would be in a world of hurt, and other countries ; ie: Japan, can not come over and fund our debt anymore, they are spinning themselves in a bad way.

I think - you would see govt. employee lay offs - besides many govt. services shut down, if China stopped supporting us, by buying our treasuries.

[edit on 30-1-2009 by questioningall]

'

The U.S. has become dependant on other countries, do you realize that most of our food is now imported in? The reason? Because it has been a big tax advantage for U.S. companies to have food processed in China and elsewhere. We even ship over the chickens we raise and kill here, to be processed over in China.

Grains in the U.S. and Canada had piled up at the end of last year due to shipping companies not getting letters of credits - BDI - was down to almost nothing.

So, yes we grow the majority of the world's food, but we no longer process and convert the raw food into grocery store shelves food.

The U.S. does not have the infrastructure right now to do that, we would have to start from scratch almost, to start processing our own food once more.

So, yes, we have the "food", but we stopped being self reliant years ago.

If, China, does stop buying our treasuries - it is a lot more complicated than just saying "fine" no problem, we can take care of ourselves.

GDP - does not cover our expenses etc.

We would be in a world of hurt, and other countries ; ie: Japan, can not come over and fund our debt anymore, they are spinning themselves in a bad way.

I think - you would see govt. employee lay offs - besides many govt. services shut down, if China stopped supporting us, by buying our treasuries.

[edit on 30-1-2009 by questioningall]

Originally posted by traderjack

Now, if you'll excuse me, I will be boarding a seaplane for a small unihabited island in the South Pacific...

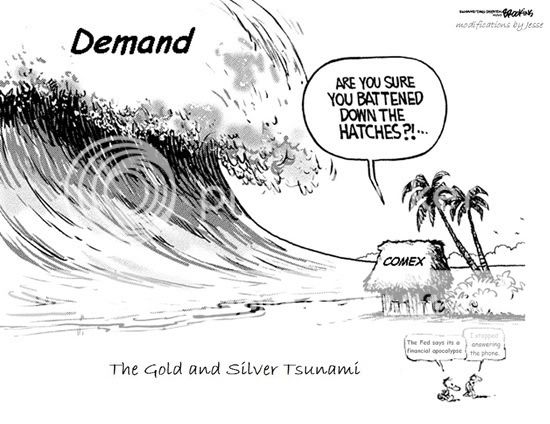

Just make sure it isn't this island TJ

Great OP questioningall. The attention this thread is generating is precisely the reason our monetary authorities, both here & in London work so diligently at capping the price of Gold. A rising POG generates awareness...WAKES PEOPLE UP...signals inflation, and represents a LOUD vote of no confidence in respective global currencies. They, in collaboration with their bullion bank agents have, and will do everything in their power to diminish enthusiasm for precious metals. We are witnessing a global race to devalue...Gold rising in all major currencies...new records in Pound Sterling, Euro, AUD.

A couple of BIG buyers have been showing-up at key support levels...possibly foreign. Yesterday, Gold indicated a key upside reversal, a technical pattern that is never allowed confirmation, so today's NY price action tells me the BOYZ are determined to discourage this rally...but they're really up against it. A break above $940 = all hell is unleashed to the upside...and they know it.

****

How about China dropping the dollar to begin settling overseas trade with Asian satellite regions in yuan. As if he needed it, this under-reported news will only place additional stress on Uncle Buck.

Yuan-settlement test to start

[edit on 30-1-2009 by OBE1]

Originally posted by MikeboydUS

[I purchase online from www.APMEX.com and www.nwtmint.com and have used them since 2007. They both take debit/credit cards. I found some local dealers, but APMEX generally has the lowest spot price, even lower than Kitco.

One word of advice, the first $10,000 should be silver. Once accumulated then move on to gold.

I agree with you completely, actually, silver is suppose to do much better than gold in the long run, due to it being inexpensive and thus the money invested will increase many times over compared to gold. Basically, a 75% silver to 25% gold, is a ratio I look at.

To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down.

above from link:goldprice.org...

obviously, he is biased, as he is a metals person, but this is not the only place I have read these type numbers. In fact, I have read much higher numbers in the long run for silver and gold.

Originally posted by disgustedbyhumanity

Gold forecasts, market forecasts,etc. are just forecasts. This China dropping the dollar stuff is just nothing but rumors.

Already up up 15% on the GLD Jan 90 puts I bought when gold traded at its day high.

You all know about P.T. Barnum I suppose.

With ATS being a conspiracy theory website, I would expect (and I'm sure you do, too) that people here would be familiar with the concept of psychological warfare. Hm, how many people here are too young to remember the Cold War?

[edit on 30-1-2009 by regeya]

I would go for things you can barter with instead of gold and silver, If it came down to the worst case scenario I'd rather have a basement full of

can goods, non power hand tools, tarps, nails, wood stoves,tents, sleeping bags and the like. If the SHTF you could find yourself trading more in

gold than what it would have cost you to buy the item in the first place, Even if you just have a closet for storage, for the price of an ounce of

gold you could set yourself up with some pretty good camping supplies and extra food. If China wants to mess around with the economy, we stop

importing their junk and they got millions of unemployed standing around. I guess they could go back to farming, too bad most of their water ways are

so polluted from industry it's unfit to drink, (not sure how that would affect the crops.)

reply to post by OBE1

LOVE the cartoon. Isn't that the truth, there was hope in Dec. last year that the comex manipulation would be busted, but it was not!

I am VERY MUCH HOPING that this next week - we might actually get a BUST! I can only hope the thousands and thousand of ounces of futures sold in Dec. for Feb delivery will actually happen!

In Dec. many people/companies did take delivery - which was unheard of before. Due to the fact, companies purchase futures than let them drop normally, and never take actual physical possession.

The fraud that has occured for years - has to stop at some point in this economy.

So.... considering the prices are what they are today for gold.... They are up about $200 per ounce than the futures sold for this coming month.

So.... if people demand the physical of the gold, Comex sold................

well, as some analysis, say, Comex does NOT HAVE all the gold they have sold on futures........... some say.... gold in one day.... could double it's price!

Other countries want to bust Comex's fraud and manipulation, lets only hope they have purchased tons of gold futures and demand the physical soon.

If people/countries would only demand the physical instead of letting their futures drop, or letting Comex keep it in their vault, there would be no more manipulation.

LETS HOPE IT HAPPENS!

[edit on 30-1-2009 by questioningall]

LOVE the cartoon. Isn't that the truth, there was hope in Dec. last year that the comex manipulation would be busted, but it was not!

I am VERY MUCH HOPING that this next week - we might actually get a BUST! I can only hope the thousands and thousand of ounces of futures sold in Dec. for Feb delivery will actually happen!

In Dec. many people/companies did take delivery - which was unheard of before. Due to the fact, companies purchase futures than let them drop normally, and never take actual physical possession.

The fraud that has occured for years - has to stop at some point in this economy.

So.... considering the prices are what they are today for gold.... They are up about $200 per ounce than the futures sold for this coming month.

So.... if people demand the physical of the gold, Comex sold................

well, as some analysis, say, Comex does NOT HAVE all the gold they have sold on futures........... some say.... gold in one day.... could double it's price!

Other countries want to bust Comex's fraud and manipulation, lets only hope they have purchased tons of gold futures and demand the physical soon.

If people/countries would only demand the physical instead of letting their futures drop, or letting Comex keep it in their vault, there would be no more manipulation.

LETS HOPE IT HAPPENS!

[edit on 30-1-2009 by questioningall]

Originally posted by korath

I would go for things you can barter with instead of gold and silver, If it came down to the worst case scenario I'd rather have a basement full of can goods, non power hand tools, tarps, nails, wood stoves,tents, sleeping bags and the like. If the SHTF you could find yourself trading more in gold than what it would have cost you to buy the item in the first place, Even if you just have a closet for storage, for the price of an ounce of gold you could set yourself up with some pretty good camping supplies and extra food. If China wants to mess around with the economy, we stop importing their junk and they got millions of unemployed standing around. I guess they could go back to farming, too bad most of their water ways are so polluted from industry it's unfit to drink, (not sure how that would affect the crops.)

Nobody said not to do that too. You have to cover yourself in ALL areas!

I have just finished, waxing about 35 pounds of cheese (cheese will last years, being waxed), I have spent days and days, dehydrating foods, I have experimented with making a solar oven, I have all neccessary camping gear, I purchased a wood/coal whole house heater, I have stored gallons and gallons of water.

In other words, don't neglect one thing, but look at everything, you have to have neccessities, but you also have to protect any U.S. dollars right now too.

Im no monetary expert but it appears that the more the western governments buy out the banks bad debts, the less appealing their respective national

currency becomes as a whole to potential buyers. I dont want to sound big-headed but if I can see this happening why can't the government?

[edit on 30-1-2009 by freeradical]

[edit on 30-1-2009 by freeradical]

On top of psychological warfare, does anyone else smell a plot within a plot?

I mean, let's assume that the fearmongering about the gold in the US being gone is just that, fearmongering. Further, let's assume China's about to stop buying treasuries and other governments are about to buy gold like crazy. First, with the U.S. backing toxic debt, if they declare bankruptcy, does that not mean the debt will be wiped clean? Second, if other countries start buying gold like crazy, does that not mean the price of gold will skyrocket? Third, isn't the currently reported "money supply" vastly overrepresented by debt? Let's say the price of gold goes to an astronomical price like $15k USD. If foreigners started ditching treasury notes, the U.S. were to declare bankruptcy, and pegged the dollar to the amount of gold that's supposed to be in Knox, would there be enough gold to back the dollars currently in circulation?

I don't particularly care for the notion of going back to the gold standard, and I'll admit I'm probably totally wrong about this, but isn't a lot of the nightmare scenario based on a lot of assumptions?

[edit on 30-1-2009 by regeya]

I mean, let's assume that the fearmongering about the gold in the US being gone is just that, fearmongering. Further, let's assume China's about to stop buying treasuries and other governments are about to buy gold like crazy. First, with the U.S. backing toxic debt, if they declare bankruptcy, does that not mean the debt will be wiped clean? Second, if other countries start buying gold like crazy, does that not mean the price of gold will skyrocket? Third, isn't the currently reported "money supply" vastly overrepresented by debt? Let's say the price of gold goes to an astronomical price like $15k USD. If foreigners started ditching treasury notes, the U.S. were to declare bankruptcy, and pegged the dollar to the amount of gold that's supposed to be in Knox, would there be enough gold to back the dollars currently in circulation?

I don't particularly care for the notion of going back to the gold standard, and I'll admit I'm probably totally wrong about this, but isn't a lot of the nightmare scenario based on a lot of assumptions?

[edit on 30-1-2009 by regeya]

Check out 'XCon 2005 - Jim Marrs - US Govt Secret Remote Viewing Program' on Google Video. Start watching at 30:09 till 30:55... You may hear

something disquietingly pertinent to this discussion.

Originally posted by questioningall

reply to post by LoneGunMan

'

The U.S. has become dependant on other countries, do you realize that most of our food is now imported in? The reason? Because it has been a big tax advantage for U.S. companies to have food processed in China and elsewhere. We even ship over the chickens we raise and kill here, to be processed over in China.

This sounds of hyperbole.

Where I live most of our food is not imported in. We get our share of fresh vegetables and fruit during the off season, but nearly everything else is grown, packed shipped and packaged here in the USA.

I am not sure what portion of the nation you are in but its almost all done here in America in Michigan.

I understand it is more complicated than blowing it iff, but to act like its the end of America that is no where near the truth. The factories that are idle still stand, the machines can be manned for a large part and start producing again.

Before WWII we had nearly no military it had been dismantled for the most part after WWI. In a very short order we had converted it all over and became the largest producer of war machinery in the world.

Do not underestimate the American people we are the best of the best. We attracted the best from every country and tamed this land and then nearly conquered the hearts and minds of the world, until recently.

new topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 3 hours ago -

Maestro Benedetto

Literature: 5 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 5 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 8 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 9 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 10 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 11 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 3 hours ago, 25 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 15 hours ago, 9 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 17 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 13 hours ago, 8 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 14 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 12 hours ago, 7 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 10 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 8 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 11 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 9 hours ago, 4 flags

active topics

-

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 11 • : AwakeNotWoke -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 15 • : AwakeNotWoke -

Is AI Better Than the Hollywood Elite?

Movies • 13 • : Justoneman -

Hate makes for strange bedfellows

US Political Madness • 47 • : 19Bones79 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 689 • : daskakik -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 265 • : Astrocometus -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 27 • : ToneD -

Reason of the Existence

The Gray Area • 21 • : BingoMcGoof -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 85 • : Sookiechacha -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 24 • : nugget1