It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Ron Paul explains what to watch out for to see when the collapse is coming.

He also explains about what`s going on with Saudi Arabia, Syria, Iran and Russia.

Ron Paul Says: Watch the Petrodollar

Source

He also explains about what`s going on with Saudi Arabia, Syria, Iran and Russia.

Ron Paul Says: Watch the Petrodollar

Want to know when the fiat US dollar will collapse? Watch the petrodollar system and the factors affecting it. This is critically important, because once the dollar loses its coveted reserve status, the consequences will be dire for Americans.

The faltering strategic regional position of Saudi Arabia, the rise of Iran (which is not part of the petrodollar system), failed US interventions, Russia’s increasing power as an energy giant, and the emergence of the BRICS nations (which offer the potential of future alternative economic/security arrangements) all affect the sustainability of the petrodollar system.

My colleague Marin Katusa’s mentioned in his book; The Colder War, you need to be aware of what Vladimir Putin is doing. Putin would like nothing more than to sabotage the petrodollar, and he’s forging alliances across the planet that he hopes will help him achieve his goal.

At the same time, you should watch the relationship between the US and Saudi Arabia, which has been deteriorating.

Source

a reply to: BornAgainAlien

The dollar isn't going anywhere. You can talk about a collapse all you want.

The dollar isn't going anywhere. You can talk about a collapse all you want.

originally posted by: onequestion

a reply to: BornAgainAlien

The dollar isn't going anywhere. You can talk about a collapse all you want.

Maybe mail Ron Paul, he`s the one doing it.

a reply to: BornAgainAlien

I'm inclined to believe Ron over any other politician. That being said this is probably just a segway to his many websites and news letters with gold stock Ponzi scheme sponsors.

I'm inclined to believe Ron over any other politician. That being said this is probably just a segway to his many websites and news letters with gold stock Ponzi scheme sponsors.

a reply to: BornAgainAlien

I agree with what Ron Paul said. If the Petrodollar falls, America falls. It is the only reason this ponzi scheme is still standing.

I agree with what Ron Paul said. If the Petrodollar falls, America falls. It is the only reason this ponzi scheme is still standing.

edit on

6-11-2014 by OrphanApology because: (no reason given)

a reply to: nukedog

I wouldn`t bet on it.

I personally have been following and discussing the whole Petrodollar story for many years now, and he could be right on the money with his explanation. That said, there are more things lingering and to look out for what could bring the system down.

I wouldn`t bet on it.

I personally have been following and discussing the whole Petrodollar story for many years now, and he could be right on the money with his explanation. That said, there are more things lingering and to look out for what could bring the system down.

originally posted by: nukedog

a reply to: BornAgainAlien

I'm inclined to believe Ron over any other politician. That being said this is probably just a segway to his many websites and news letters with gold stock Ponzi scheme sponsors.

I thought the FED was the only PONZI scheme that counted?

I don't disagree that Putin would love nothing more than to kill the petro dollar. However to do this he needs to be able to have more affect on

global oil prices than he currently does.

I see three things currently responsible for the drop in oil prices. The soft global economy obviously affects the demand side, but more interesting is what's going on with the supply side.

Two things on the supply side are really impacting global oil prices. North American production and Saudi production. Ten years ago virtually no one would have predicted the amount of oil coming out of the the tar sands and from modern drilling procedures. Peak Oilers have been talking about how Saudi Arabia could not affect oil prices the way they've been able to in the past, that premise is very much in question right now.

What is most interesting about the current excess Saudi production is that it immediately hurts Russia and over the long term hurts North American interests.I've Seen it said that Russia really needs oil around $100/bbl to meet it's budgetary needs. The Saudis are pumping in this excess oil in part because of Russian obstruction to their goals in Syria. Equally interesting is that North American oil is much more expensive to pull out of the ground than Arabian oil. I've seen ranges from $65-$80 on the break even point for the tar sands and oil extracted from fracking. Oil very much below where it's at right now and those boom town in the Dakotas dry up pretty quick. The Saudis have played this game with US oil before during the 70's oil embargo many marginal production sites and new but more expensive technologies came on line only to rapidly become uneconomic when cheap Saudi oil hit the market. Companies using leverage instead of capital to produce in these tar sands and with new techniques are most vulnerable to this cartel manipulation when the price drops and production is no longer profitable.

I'm loving the cheaper gas right now, but there are geopolitical forces at play that are extremely concerning.

I see three things currently responsible for the drop in oil prices. The soft global economy obviously affects the demand side, but more interesting is what's going on with the supply side.

Two things on the supply side are really impacting global oil prices. North American production and Saudi production. Ten years ago virtually no one would have predicted the amount of oil coming out of the the tar sands and from modern drilling procedures. Peak Oilers have been talking about how Saudi Arabia could not affect oil prices the way they've been able to in the past, that premise is very much in question right now.

What is most interesting about the current excess Saudi production is that it immediately hurts Russia and over the long term hurts North American interests.I've Seen it said that Russia really needs oil around $100/bbl to meet it's budgetary needs. The Saudis are pumping in this excess oil in part because of Russian obstruction to their goals in Syria. Equally interesting is that North American oil is much more expensive to pull out of the ground than Arabian oil. I've seen ranges from $65-$80 on the break even point for the tar sands and oil extracted from fracking. Oil very much below where it's at right now and those boom town in the Dakotas dry up pretty quick. The Saudis have played this game with US oil before during the 70's oil embargo many marginal production sites and new but more expensive technologies came on line only to rapidly become uneconomic when cheap Saudi oil hit the market. Companies using leverage instead of capital to produce in these tar sands and with new techniques are most vulnerable to this cartel manipulation when the price drops and production is no longer profitable.

I'm loving the cheaper gas right now, but there are geopolitical forces at play that are extremely concerning.

a reply to: jefwane

Russia can cope with prices in the 70/80 $ range. It`s more other oil producing countries who are getting into trouble, including the whole USA fracking Ponzi.

Has Washington Just Shot Itself in the Oily Foot?

Source

Source

Saudi Cut In Oil Price For US May Lead To Price War

Source

Russia can cope with prices in the 70/80 $ range. It`s more other oil producing countries who are getting into trouble, including the whole USA fracking Ponzi.

Has Washington Just Shot Itself in the Oily Foot?

Source

Remarkably, the impact of lower oil for Russia’s economic growth is not as severe as might be expected. Sustained oil at USD80/bbl would see growth slow by 1.8pp to 0.6%. This compares with the worst hit economies of Angola (where growth is nearly 8pp lower at -2%), Iraq (GDP slows to -1.6% from 4.5% growth), Kazakhstan and Azerbaijan (growth falls to -0.9% from 5.8%).

Source

Saudi Cut In Oil Price For US May Lead To Price War

Source

edit on 6 11 2014 by

BornAgainAlien because: (no reason given)

originally posted by: onequestion

a reply to: BornAgainAlien

The dollar isn't going anywhere. You can talk about a collapse all you want.

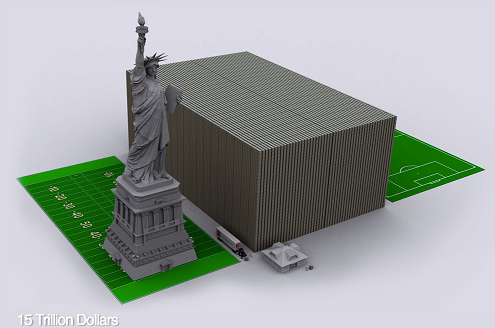

Here's what Fifteen Trillion Dollars looks like in $100 Dollar Bills.

Don't worry?

The debt is now almost 18 Trillion. US Debt Clock

Might wanna stock up on that toilet paper and beans.

edit on 6-11-2014 by James1970 because: (no reason given)

a reply to: jefwane

I knew fracking was more expensive but never heard the numbers before. I will say for a fact that refining fracking oil is a whole nother ball game than fracking sweet Saudi oil. Talking about whole new units in the refinery and a whole new level of safety precautions. The waste streams alone will kill you dead as a door nail

I knew fracking was more expensive but never heard the numbers before. I will say for a fact that refining fracking oil is a whole nother ball game than fracking sweet Saudi oil. Talking about whole new units in the refinery and a whole new level of safety precautions. The waste streams alone will kill you dead as a door nail

a reply to: BornAgainAlien

Great links and an interesting read. A question i have after reading those is did Obama and Kerry not realize The affect on US and canadian production or is that part of The plan?

Great links and an interesting read. A question i have after reading those is did Obama and Kerry not realize The affect on US and canadian production or is that part of The plan?

a reply to: jefwane

I don`t know what the plans exactly are. I have been reading a lot today (lots of interesting news), but haven`t been able to figure out some stuff. Heck, I have been reading for years really lots about these matters, but things sometimes just slowly reveal itself about what`s really going on.

For instance, I know about Goldman Sachs and selling lots of derivatives to Italian, Greece, Portugal and Spain its local governments and wrecking Southern Europe that way. I also know there are lots of GS puppets who are now a bit in control in the EU (Mario Draghi, etc.), but I have no idea what the master plan is/was regarding that.

So I would be speculating about what is going on (I have no inside information), for instance it also could be Saudi Arabia is blackmailing the US somewhat.

I don`t know what the plans exactly are. I have been reading a lot today (lots of interesting news), but haven`t been able to figure out some stuff. Heck, I have been reading for years really lots about these matters, but things sometimes just slowly reveal itself about what`s really going on.

For instance, I know about Goldman Sachs and selling lots of derivatives to Italian, Greece, Portugal and Spain its local governments and wrecking Southern Europe that way. I also know there are lots of GS puppets who are now a bit in control in the EU (Mario Draghi, etc.), but I have no idea what the master plan is/was regarding that.

So I would be speculating about what is going on (I have no inside information), for instance it also could be Saudi Arabia is blackmailing the US somewhat.

a reply to: onequestion

Remember what I said...the sudden drop in gas prices...this is not natural supply and demand. There is a trap being set up for the US economy.

Remember what I said...the sudden drop in gas prices...this is not natural supply and demand. There is a trap being set up for the US economy.

R.Paul seems to have noticed something.

The end of an era: the U.S. petrodollar under threat

It's a pretty good article that explains what's happening. Just like putting a puzzle together, once you start w/ the borders first, later it's easier to see how the rest of the puzzle goes.

Russia & China Cozy up:

Russia & China, wheeling’ and dealin’ quietly - while U.S. chest thumps:

So what, who cares if dollars aren’t being used as the currency of choice:

Wait. What? Saudi & U.S. aren’t getting along? But they’re our buddies. Oops, "Rerouting":

Oil Slump Continues as Saudi Arabia Targets U.S.

U.S. Returns Fire in Saudi Arabia's Oil War

Saudi Cut In Oil Price For US May Lead To Price War

Ah thats just great- Saudi & U.S. are now slitting each other’s throats behind closed doors.

Well, it's a good thing Saudi’s pipelines aren’t being targeted:

Shots Fired at Saudi Pipeline Hint at Larger Concerns

Come on - there’s gotta be some good news, right?

Whew! We needed some good news. Those pesky Ruskies, Chinese & Saudis! But, hold yer horses:

You mean like this?:

Qatar to become Middle East clearing hub for China's yuan

It wouldn’t be a true ATS post without the Conspiracy angle (Total CEO Christophe de Margeri ‘snowplowed’):

Seems like we got ourselves a ball game folks! The biggest HOLE in the U.S.’s ponzi scheme is Saudi’s pipelines/refineries vulnerabilities (aka “Soft Spots”). If they go - so does the U.S. economy along w/ the world’s.

Stay tuned.

The end of an era: the U.S. petrodollar under threat

It's a pretty good article that explains what's happening. Just like putting a puzzle together, once you start w/ the borders first, later it's easier to see how the rest of the puzzle goes.

Russia & China Cozy up:

China and Russia have been furiously signing energy deals that indicate their mutual energy interests. The most obvious is the $456 billion gas deal that Russian state-owned Gazprom signed with China in May, but that was just the biggest in a string of energy agreements going back to 2009. That year, Russian oil giant Rosneft secured a $25 billion oil swap agreement with Beijing, and last year, Rosneft agreed to double oil supplies to China in a deal valued at $270 billion.

Russia & China, wheeling’ and dealin’ quietly - while U.S. chest thumps:

"If Russia’s 'pivot to Asia' results in Moscow and Beijing trading oil between them in a currency other than the dollar, that will represent a major change in how the global economy operates and a marked loss of power for the U.S. and its allies," Halligan wrote in May. "With China now the world’s biggest oil importer and the U.S. increasingly stressing domestic production, the days of dollar-priced energy, and therefore dollar-dominance, look numbered."

So what, who cares if dollars aren’t being used as the currency of choice:

"Taken alone, these actions do not mean the end of the dollar as the leading global reserve currency," Jim Rickards, portfolio manager at West Shore Group and partner at Tangent Capital Partners, told CNBC. “But taken in the context of many other actions around the world including Saudi Arabia's frustration with U.S. foreign policy toward Iran, and China's voracious appetite for gold, these actions are meaningful steps away from the dollar."

Wait. What? Saudi & U.S. aren’t getting along? But they’re our buddies. Oops, "Rerouting":

Oil Slump Continues as Saudi Arabia Targets U.S.

U.S. Returns Fire in Saudi Arabia's Oil War

Saudi Cut In Oil Price For US May Lead To Price War

Ah thats just great- Saudi & U.S. are now slitting each other’s throats behind closed doors.

Well, it's a good thing Saudi’s pipelines aren’t being targeted:

Shots Fired at Saudi Pipeline Hint at Larger Concerns

“DUBAI/RIYADH—

A small fire erupted on a gas pipeline in eastern Saudi Arabia on Tuesday after assailants shot at a security patrol, security and oil industry sources said, in an incident that may heighten concern about the vulnerability of Saudi energy infrastructure.”

Come on - there’s gotta be some good news, right?

“However, the Chinese have a problem in their plans for the yuan. The government has not yet removed capital controls that would allow full convertibility, for fear of unleashing a torrent of speculative flows that could damage the Chinese economy.”

Whew! We needed some good news. Those pesky Ruskies, Chinese & Saudis! But, hold yer horses:

“However, "[It] is clear that China is laying foundations for wider acceptance of the yuan," said Karl Schamotta, a senior market strategist at Western Union Business Solutions," as quoted in an International Business Times article.”

You mean like this?:

Qatar to become Middle East clearing hub for China's yuan

“Qatar will become the Middle East's first hub for clearing transactions in the Chinese yuan, in a step that could over the long run help Gulf oil exporting countries reduce their dependence on the US dollar.”

"It's a clear signal that there is demand from Qatar and some of the surrounding Middle Eastern countries," said Candy Ho, global head of yuan business development at HSBC.”

It wouldn’t be a true ATS post without the Conspiracy angle (Total CEO Christophe de Margeri ‘snowplowed’):

“According to Katusa, de Margerie was "a total liability" due to Total's involvement in plans to build an LNG plant on the Yamal Peninsula along with partner Novatek. The company was also seeking financing for a gas project in Russia despite Western sanctions.

"It planned to finance its share in the $27-billion Yamal project using euros, yuan, Russian rubles, and any other currency but U.S. dollars," Katusa writes, then entices the reader with this: "Did this direct threat to the petrodollar make this 'true friend of Russia'—as Putin called de Margerie - some very powerful and dangerous enemies amongst the power that be, whether in the French government, the EU, or the U.S.?"

That may be a stretch, but Katusa's U.S. dollar reference shows that any developments that point to a move away from the dominance of the greenback are not going unnoticed.

Seems like we got ourselves a ball game folks! The biggest HOLE in the U.S.’s ponzi scheme is Saudi’s pipelines/refineries vulnerabilities (aka “Soft Spots”). If they go - so does the U.S. economy along w/ the world’s.

Stay tuned.

Anyone interested in some more background regarding the Petrodollar, Iraq War, Libya and Iran, this is a good watch:

Warning Graphic !

The Petrodollar | War Machine

Warning Graphic !

The Petrodollar | War Machine

edit on 7 11 2014 by BornAgainAlien because: (no reason given)

a reply to: BornAgainAlien

Ron Paul is 100% wrong............This is why. It will not be the petrodollar collapsing the system it will be the lowest wage earners not being able to afford food and housing because of inflation. Anyone making under 15 dollars an hour will be screwed in the next couple of years. This is coming fast dear readers and nothing will stop it.

I have been saying this for about a year now on ATS. When the lower 50%-60% can not afford to live anymore the collapse will come in short order. This is already happening with lower wage earners demanding higher pay. Many signs point to me sadly being correct on this prediction. Mix people not being able to afford living costs with college grads awakening to the lie sold to them and you get...............EPIC.

Ron Paul is 100% wrong............This is why. It will not be the petrodollar collapsing the system it will be the lowest wage earners not being able to afford food and housing because of inflation. Anyone making under 15 dollars an hour will be screwed in the next couple of years. This is coming fast dear readers and nothing will stop it.

I have been saying this for about a year now on ATS. When the lower 50%-60% can not afford to live anymore the collapse will come in short order. This is already happening with lower wage earners demanding higher pay. Many signs point to me sadly being correct on this prediction. Mix people not being able to afford living costs with college grads awakening to the lie sold to them and you get...............EPIC.

originally posted by: BornAgainAlien

a reply to: SubTruth

When the Petrodollar is losing its status, that`s exactly what will happen quickly.

Inflation will beat out the failing reserve status I believe. The cost of everything is rising and rising fast. They have to give out 10 year car loans just to sell new cars. Look at your grocery bill week to week and see this simplest of truths.

new topics

-

What is the white pill?

Philosophy and Metaphysics: 1 hours ago -

Mike Pinder The Moody Blues R.I.P.

Music: 1 hours ago -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 5 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 9 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 15 hours ago, 34 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 9 hours ago, 18 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 1 hours ago, 5 flags -

Is AI Better Than the Hollywood Elite?

Movies: 16 hours ago, 4 flags -

What is the white pill?

Philosophy and Metaphysics: 1 hours ago, 4 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 5 hours ago, 2 flags -

Maestro Benedetto

Literature: 16 hours ago, 1 flags

active topics

-

Russia Ukraine Update Thread - part 3

World War Three • 5734 • : Arbitrageur -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 72 • : CarlLaFong -

So this is what Hamas considers 'freedom fighting' ...

War On Terrorism • 264 • : FlyersFan -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 792 • : Threadbarer -

What is the white pill?

Philosophy and Metaphysics • 6 • : kwaka -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works • 19 • : FlyersFan -

Starburst galaxy M82 - Webb Vs Hubble

Space Exploration • 7 • : Scratchpost -

Truth Social goes public, be careful not to lose your money

Mainstream News • 134 • : lilzazz -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry • 11 • : Therealbeverage -

Ditching physical money

History • 21 • : SprocketUK