It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

reply to post by Snarl

Don't you think stocking up on food and needed items would be a good prep move - if hyperinflation were to happen that is. I would think that's about it unless a person is able to pay off their mortgage and live dept free with farm animals and gardens. That isn't 99% of us here on ATS I would assume.

Bottom Line: We're all in this together. We're gonna be carried by the flow. Prepping for a collapse isn't possible. Talking about it will get you neither out of the frying pan nor out of the fire.

Don't you think stocking up on food and needed items would be a good prep move - if hyperinflation were to happen that is. I would think that's about it unless a person is able to pay off their mortgage and live dept free with farm animals and gardens. That isn't 99% of us here on ATS I would assume.

camaro68ss

first thing is first. invest in land out in the sticks, food, and water. once that is covered then invest in gold and silver. gold and silver is kind of the overflow fund for me.

once things get back to normal, 5,10,20 years after the crash, gold and silver will have value again.

Gold is worthless as an investment strategy in the event of collapse. If the currency collapses and we create a non fiat currency to replace it, whatever goods are backing it WILL BE CONFISCATED. It happened before with gold. For a period of 40 years it was illegal for a citizen to own gold, they had to give it all to the government. Some people hid theirs but they couldn't use it, it was essentially gone except they got no sale value out of it.

If a new currency is backed by gold which is the logical conclusion if you take the gold pushers claims at face value, the US will have to confiscate all the gold again in order to back the currency. Remember, Fort Knox is empty (or atleast, has very little gold in it... this is easy to prove without getting into conspiracy theory). If that happens all that gold you purchased is gone. Especially if you own paper gold.

Silver probably isn't safe either, there's too much currency in the world. Let me put this into perspective. There is roughly $8.2 trillion worth of gold in the entire world. That's the value of all the gold that has ever been mined throughout all of human history, not just what is in the US. The M2 supply of just the US is $11 trillion. We could have 100% of all the gold in the world and it couldn't cover the existing money supply. Add in that other nations have some of this stuff and we could confiscate all of the gold, silver, and platinum in the US and it still wouldn't cover the existing M2 to say nothing of future money expansion.

The only commodity on the planet of which there is enough to cover the money supply is oil which happens to have far more practical value than gold as well. If you want something to invest in as a hedge incase the world goes to hell, you should be stockpiling barrels of oil not gold.

mbkennel

No, the USA is not a net exporter of fossil fuel or petroleum products. It may be a net exporter of refined products, but there are still large crude petroleum imports.

The US currently exports more oil than it imports. It's a fairly recent thing, the national plan from what I've seen has us being a major player around the year 2020 but for now we export more oil than we import.

Here's an article on it for you america.aljazeera.com...

No, it doens't work like that. Oil is fungible and transportable, and thus the price of oil-derived fuel before taxes (true economic cost) is pretty close to the same everywhere. Pumping your own oil (which will only last for a short time more in the USA) sends less money overseas, but that's a less significant effect.

Nat-gas on the other hand is not a global commodity. If the USA were to transition a large fraction of transportation to nat-gas then the advantages would flow.

Nations that can't afford oil are severely limited in what they can do. In the event of a global collapse it's not too unlikely to see the oil companies temporarily (or perhaps permanently) nationalized. The goal being to provide the nation with oil so that we can produce everything we need. There certainly wouldn't be many imports bought but it would give us tremendous export ability as well as self sufficiency. It's not that different really from the post WW2 scenario where the US was the only manufacturer that still had all of it's factories in tact.

Dianec

The other two people I spoke with said pretty much the same thing with a few variations but not one of them thought it wouldn't be something that would make it look like the 20/30's. However - when reading threads like this here at ATS I see that even though safeguards are in place it doesn't mean they would be available to us. Who would loan us more money after the recent game played in WA?

This is one of the big problems in my opinion, it's blatantly obvious that those who make the laws and set policy in Congress don't actually understand the system they're playing with. That recent game which was played for some minor and temporary political points was the equivalent of putting a loaded gun to someones head and pulling the trigger... but not pulling it far enough to make the bullet fly out.

reply to post by Bassago

I've been touting a correction reminiscent of the 1990 "recession" for almost a year now. At least in the respect that the major American indices will turn down and bottom out well above the support we saw during its' past recession. I definitely jumped the gun but I still think it will happen. Support likely will be well above $12,000 for the DJIA.

I don't think the new Fed chairman (chairwoman) will end QE until late quarter 1 at least. Keep in mind that QE has a delayed effect on the economy so this would mean the extra fresh money pipeline that QE basically is will be open for some time after QE ends or is scaled back.

I do expect a correction some time next year but this will not be simply because of QE ending, it will happen simply because of profit taking and the business cycle. Corrections are healthy for the market. Maybe sometime around February the bears will take over and commodities will become the new it spot for traders.

I've been touting a correction reminiscent of the 1990 "recession" for almost a year now. At least in the respect that the major American indices will turn down and bottom out well above the support we saw during its' past recession. I definitely jumped the gun but I still think it will happen. Support likely will be well above $12,000 for the DJIA.

I don't think the new Fed chairman (chairwoman) will end QE until late quarter 1 at least. Keep in mind that QE has a delayed effect on the economy so this would mean the extra fresh money pipeline that QE basically is will be open for some time after QE ends or is scaled back.

I do expect a correction some time next year but this will not be simply because of QE ending, it will happen simply because of profit taking and the business cycle. Corrections are healthy for the market. Maybe sometime around February the bears will take over and commodities will become the new it spot for traders.

edit on 7-12-2013 by On7a7higher7plane because: (no reason given)

edit on 7-12-2013 by On7a7higher7plane

because: (no reason given)

Dianec

reply to post by Snarl

Bottom Line: We're all in this together. We're gonna be carried by the flow. Prepping for a collapse isn't possible. Talking about it will get you neither out of the frying pan nor out of the fire.

Don't you think stocking up on food and needed items would be a good prep move - if hyperinflation were to happen that is. I would think that's about it unless a person is able to pay off their mortgage and live dept free with farm animals and gardens. That isn't 99% of us here on ATS I would assume.

Hyperinflation is one type of economic control ... with control being the operative word. There is no necessary cause for hyperinflation. It looks like some sort of tipping point has been reached, but it is really/simply caused/allowed. The control measure is applied until TPTB have bled the population enough and then it's turned off. 'Economic punishment' would be a better descriptive. Remember what I said earlier in the thread about 'control and 'value.' Must not think about one without considering the other. Also, hyperinflation always ends virtually overnight ... which is a clear indication of what it is ... control.

I grew up on a farm. We raised both crops and livestock. Even under the best conditions, we would not have been able to sustain ourselves comfortably, without the community. Without gas and without pumped water it would be more than a stretch to keep what we had in operation (e.g. scale back to what we could realistically manage).

The term prepping makes me think SHTF and/or WROL. Now you're talking constant manpower to ensure some guy with a deer rifle doesn't come and kill a cow. I don't know how you'd be able to keep the gang-bangers or a motorcycle club at bay once they found out you had established some level of production. How do you keep the mayor from declaring you have a responsibility to provide for 'his' people (I've got a tragic war story I could tell about that one ... and I haven't seen any poop or a fan yet -grin-).

We bought the property (about 60 acres) adjacent to ours. It took almost four years of work to get the fields into reasonable production. Realistically, you might be able to do that in a year, but who would have that kind of time/effort available in a SHTF scenario? How long can one realistically remain prepped once they've tapped their stock?

If you haven't seen this viral video it's worth a laugh and puts things into real perspective.

Hate to be the naysayer on the realities of prepping ... but on the positive side, I'm not the guy rooting for an end-times scenario that once-and-for-all wipes out the wealthy.

This may sound like the strangest thing you've ever heard, but being in debt right now is not entirely a bad thing. Carrying a debt load is a true indication of your value in this debt based economy. One cannot be a total credit risk and take on debt. Being in debt, for debt's sake, is unwise ... but so is being debt free. The wealthy consider you to be a threat if you're living within your means and setting aside appreciable savings. They don't appreciate competition, and that's why I have a war story I could tell ya.

Thanks for your thoughtful questions.

-Cheers

Aazadan

Gold is worthless as an investment strategy in the event of collapse.

Silver probably isn't safe either, there's too much currency in the world.

Nations that can't afford oil are severely limited in what they can do.

In the event of a global collapse it's not too unlikely to see the oil companies nationalized.

This is one of the big problems in my opinion, it's blatantly obvious that those who make the laws and set policy in Congress don't actually understand the system they're playing with.

You are one SMART cookie!!

My biggest concern is a terrorist strike/false flag on all of our oil refineries. If there were one thing (short of war) that could bring the US to its very knees ...

Sorry this reply is kind of off topic Bassago, but the timing couldn't be better, and it is flowing with the doom porn.

reply to post by Bassago

What's your estimated low end number for the DOW? Just wondering.

I looked on this thread and I didn't see a hard number predicted ...

Just curious. thanks.

What's your estimated low end number for the DOW? Just wondering.

I looked on this thread and I didn't see a hard number predicted ...

Just curious. thanks.

reply to post by FlyersFan

May I?

The Dow to ~2K

Gold to $32

The question becomes: What will $1 buy?

ETA: The next question is: What stocks are left up for trade?

May I?

The Dow to ~2K

Gold to $32

The question becomes: What will $1 buy?

ETA: The next question is: What stocks are left up for trade?

edit on 7122013 by Snarl because: ETA

reply to post by FlyersFan

Honestly I have no idea though it's probably a moot point anyway. If I had to make a Karnak type prediction I'd go with 75% - 50% loss in the DOW and S&P500 (at least.) That is only if the derivative markets don't collapse. If they go then... well let's just say forget about it.

Can't get my head around what that will do to the currency markets. Anyone?

What's your estimated low end number for the DOW? Just wondering.

I looked on this thread and I didn't see a hard number predicted ...

Honestly I have no idea though it's probably a moot point anyway. If I had to make a Karnak type prediction I'd go with 75% - 50% loss in the DOW and S&P500 (at least.) That is only if the derivative markets don't collapse. If they go then... well let's just say forget about it.

Can't get my head around what that will do to the currency markets. Anyone?

Very very interesting comparison....

While I may not necessarily agree with the "exact date" I do agree that the market is due for a major correction. I was looking for that to occur back in 2008 originally when the credit market began to crash...something I had been expecting for some time.

Over the hast 25 or 30 years our economy has lost approximately 20 TRILLION dollars in wealth (just look at the trade imbalance over the last 30 years) and this cannot possibly continue for long. The so called healthy market has simply been inflated, supported by overly enthusiastic investors and the time is coming for the piper to require payment.

Consider the negative trade balance, consider the absolute destruction of manufacturing in the US (back in the early 60s the US produced 25% of the world's manufactured goods), consider the rapid expansion of our monetary supply (Obama's admin printing money at geometrically increasing rates) and the outlook for our economy is not good.

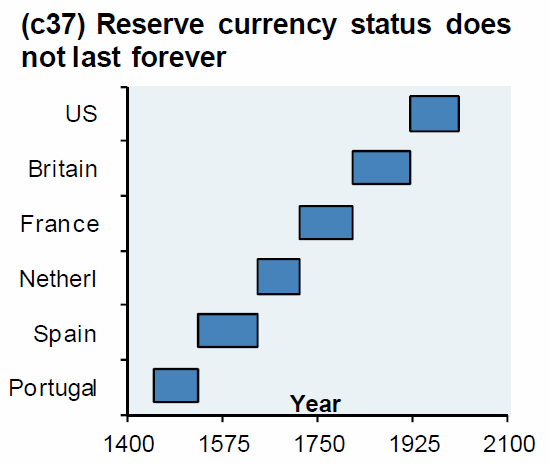

Right now we have very few things holding up the economy...one being that the Dollar is the trading currency of the world. Another being that since we are sooo tied into the world economy (since there really is not another currency, currently, capable of replacing the dollar) that the dollar is being artificially maintained by not only the Fed but also by foreign economies.

The average person has no clue regarding how the economy works. Classic example is the demand by fast food workers for $15/hr wages....holy crap! Insanity...if that were to take place, hyper-inflation would kick in practically overnight. Hyper-inflation is just waiting for a catalyst.

Hyper-inflation of the dollar will result in extreme hardships not only for the US economy and consumers, but also will send ripples throughout the world.

It totally fries my mind everytime I read/hear about some idiot politician appealing to the bottom denominator in our society by claiming that large corporations are the devil. It is this exact philosophy which has resulted in manufacturing leaving the US.

During the early 60s the US produced 25% of the world's manufactured goods. Our economy was healthy and wealth was pouring into the country like never before. Now we produce like 6% of the worlds manufactured goods and that number is continuing to rapidly shrink.

Soo... we have a govt that believes my money is theirs and cannot maintain spending at rational levels, but instead attempts to be all things to all people and spends much more than it takes in and has been doing so for decades....and I would like to add getting worse at it as time passes.

We have personal debt at an all time, unsustainable level at the same time public debt is at an all time, unsustainable, high.

Pretty picture, no?

While I may not necessarily agree with the "exact date" I do agree that the market is due for a major correction. I was looking for that to occur back in 2008 originally when the credit market began to crash...something I had been expecting for some time.

Over the hast 25 or 30 years our economy has lost approximately 20 TRILLION dollars in wealth (just look at the trade imbalance over the last 30 years) and this cannot possibly continue for long. The so called healthy market has simply been inflated, supported by overly enthusiastic investors and the time is coming for the piper to require payment.

Consider the negative trade balance, consider the absolute destruction of manufacturing in the US (back in the early 60s the US produced 25% of the world's manufactured goods), consider the rapid expansion of our monetary supply (Obama's admin printing money at geometrically increasing rates) and the outlook for our economy is not good.

Right now we have very few things holding up the economy...one being that the Dollar is the trading currency of the world. Another being that since we are sooo tied into the world economy (since there really is not another currency, currently, capable of replacing the dollar) that the dollar is being artificially maintained by not only the Fed but also by foreign economies.

The average person has no clue regarding how the economy works. Classic example is the demand by fast food workers for $15/hr wages....holy crap! Insanity...if that were to take place, hyper-inflation would kick in practically overnight. Hyper-inflation is just waiting for a catalyst.

Hyper-inflation of the dollar will result in extreme hardships not only for the US economy and consumers, but also will send ripples throughout the world.

It totally fries my mind everytime I read/hear about some idiot politician appealing to the bottom denominator in our society by claiming that large corporations are the devil. It is this exact philosophy which has resulted in manufacturing leaving the US.

During the early 60s the US produced 25% of the world's manufactured goods. Our economy was healthy and wealth was pouring into the country like never before. Now we produce like 6% of the worlds manufactured goods and that number is continuing to rapidly shrink.

Soo... we have a govt that believes my money is theirs and cannot maintain spending at rational levels, but instead attempts to be all things to all people and spends much more than it takes in and has been doing so for decades....and I would like to add getting worse at it as time passes.

We have personal debt at an all time, unsustainable level at the same time public debt is at an all time, unsustainable, high.

Pretty picture, no?

Bassago

reply to post by FlyersFan

What's your estimated low end number for the DOW? Just wondering.

I looked on this thread and I didn't see a hard number predicted ...

Can't get my head around what that will do to the currency markets. Anyone?

Good question. Very complicated answer as well.

Due to the dollar being an integral part of international trade, there is no real way to extrapolate....

It is quite possible that hyper-inflation could kick in resulting in the meltdown of the world economy as well as the replacement of the US dollar by another currency or currencies, which would result in further bleeding by the US citizens and economy.

It is my opinion that for the last 10-15 years our leaders have known what is coming and every step taken has been merely to postpone the inevitable. Perhaps in the hopes that things would change and the problems would be resolved....the problem is is that NOTHING has been done to address the basic issues. Much the reverse...steps taken by this Admin have created a situation whereby the meltdown of our economy has become inevitable.

Bassago

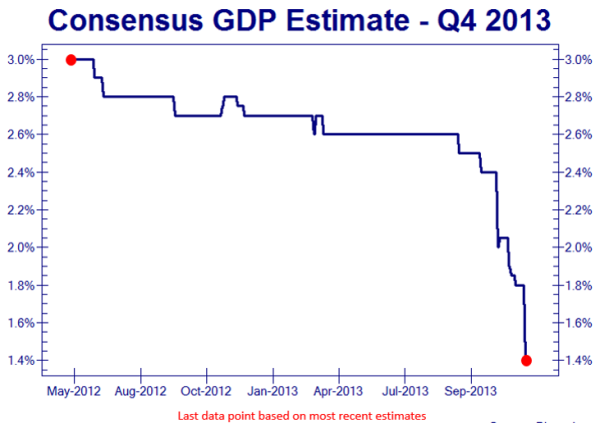

Personally I believe we are in for a correction. That said, with the Fed printing $85 billion per month I'm unsure how that will happen. With the incoming new Fed boss saying she likes QE looks like the monopoly money will keep coming. But I found the chart interesting.

I have seen this graph before...

the OP chart comparison is interesting...but strictly coincidental there is no synchronicity between the zeitgeist of 1929 & 2013-2014..

the issues are vastly different, the markets are now controlled by big-money and HFT algorithms and not by the Greenspan 'Irrational Exuberance' of 1920 when even shoe-shine guys were buying stocks

the DOW & S&P are only the best, timely places to store your cash at the present... Bonds, commodities including PMs & real-estate are all secondary to owning equities (until that balloon pops)

I think there's more of a chance of a bail-in or even private retirement accounts being seized in January 2014 than getting a market crash of 50-75%

~considering the need for getting revenue to support Municipal...State & Federal Unfunded Pensions...

money rates will need to rise BUT I also see the incoming Ms. Yellen keeping Federal rates at the present .25% while leaving non-Strategic interest rates by private banks operate in a capitalistic fashion while US Treasuries are allowed to rise to 3-4-5% over time,,,, wage-&-price controls are on the horizon folks)

i would buy some YUAN if you can... because the Chinese are soon going to play hardball in 'DE-Americanizing' the global financial system...

do prudent things like having a well on your property...you will likely need the private water source to be secret from the govt & the neighbors

the issues are vastly different, the markets are now controlled by big-money and HFT algorithms and not by the Greenspan 'Irrational Exuberance' of 1920 when even shoe-shine guys were buying stocks

the DOW & S&P are only the best, timely places to store your cash at the present... Bonds, commodities including PMs & real-estate are all secondary to owning equities (until that balloon pops)

I think there's more of a chance of a bail-in or even private retirement accounts being seized in January 2014 than getting a market crash of 50-75%

~considering the need for getting revenue to support Municipal...State & Federal Unfunded Pensions...

money rates will need to rise BUT I also see the incoming Ms. Yellen keeping Federal rates at the present .25% while leaving non-Strategic interest rates by private banks operate in a capitalistic fashion while US Treasuries are allowed to rise to 3-4-5% over time,,,, wage-&-price controls are on the horizon folks)

i would buy some YUAN if you can... because the Chinese are soon going to play hardball in 'DE-Americanizing' the global financial system...

do prudent things like having a well on your property...you will likely need the private water source to be secret from the govt & the neighbors

edit on 7-12-2013 by St Udio because: (no reason given)

reply to post by St Udio

Good points and with the Feds current interventions I also doubt an immediate stock correction. The bail-in or nationalization of retirement accounts is a definite possibility if things go south. TPTB will do anything it seems to prop up a sinking ship.

I think there's more of a chance of a bail-in or even private retirement accounts being seized in January 2014 than getting a market crash of 50-75%

Good points and with the Feds current interventions I also doubt an immediate stock correction. The bail-in or nationalization of retirement accounts is a definite possibility if things go south. TPTB will do anything it seems to prop up a sinking ship.

Link

A recent hearing sponsored by the Treasury and Labor Departments marked the beginning of the Obama Administration’s effort to nationalize the nation’s pension system and to eliminate private retirement accounts including IRA’s and 401k plans, NSC is warning.

The hearing, held in the Labor Department’s main auditorium, was monitored by NSC staff and featured a line up of left-wing activists including one representative of the AFL-CIO who advocated for more government regulation over private retirement accounts and even the establishment of government-sponsored annuities that would take the place of 401k plans.

Bassago

Link

A recent hearing sponsored by the Treasury and Labor Departments marked the beginning of the Obama Administration’s effort to nationalize the nation’s pension system and to eliminate private retirement accounts including IRA’s and 401k plans, NSC is warning.

The hearing, held in the Labor Department’s main auditorium, was monitored by NSC staff and featured a line up of left-wing activists including one representative of the AFL-CIO who advocated for more government regulation over private retirement accounts and even the establishment of government-sponsored annuities that would take the place of 401k plans.

i need to read that link... i am sweating my ROTH account --at least for the 1st half of 2014 which is before i will have determined just how i will dismantle my ROTH account held in a official, approved, "Custodial" Management Institution (aka officially sanctioned thieves)

perhaps the link you cite will tell us more about this confiscation method --- will 20-30% of your account value [up to 100k] be taken or exchanged for the nominal value in US Treasuries (aka: worthless paper in the world's eyes by 2015)

Yuan &/or commodities look to be an escape route or at least a way around a forced separation from your wealth

good topics

edit on 7-12-2013 by St Udio because: (no reason given)

This thread is cracking me up.

The stock market is not going to crash.

Majority of stock is owned by investment banks (which are owned by consumers)

They aren't just going to pull out...

The US is fine and the USD is fine for another 10-15 years... Around 2033 when Social Security bankrupts we will have major problems them.

Unless a meteor kills a large amount of population or disease or a violent civil uprise happens... We will be fine.

America is a great country to live in.

The stock market is not going to crash.

Majority of stock is owned by investment banks (which are owned by consumers)

They aren't just going to pull out...

The US is fine and the USD is fine for another 10-15 years... Around 2033 when Social Security bankrupts we will have major problems them.

Unless a meteor kills a large amount of population or disease or a violent civil uprise happens... We will be fine.

America is a great country to live in.

truthinfact

This thread is cracking me up.

The stock market is not going to crash.

Majority of stock is owned by investment banks (which are owned by consumers)

They aren't just going to pull out...

I see...so if their investments begin to drop like a sack of potatoes they will choose to not limit their exposure? I think not...

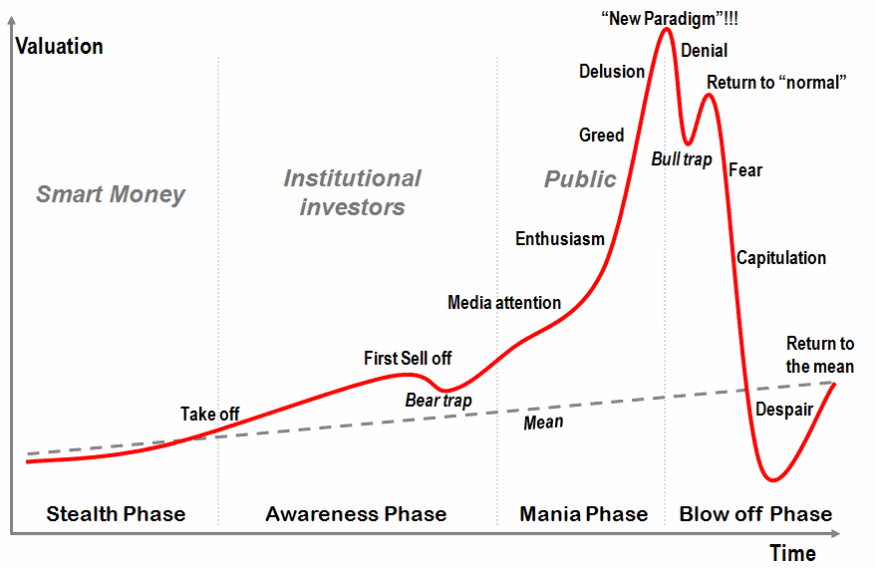

Have you forgotten we exist in a bubble economy? The stock market is just another bubble aspect. If confidence plummets, so will the market. Period.

America is a great country to live in.

I agree....to a degree.

We are living in a country that is printing money like there is no tomorrow.

We are living in a country that has, currently, very little in the way of exportable product. Natural gas, once in full swing and being exported, will alleviate this somewhat, but not enough.

How long can a House buy more than it sells continue business as usual? We have lost 20 trillion dollars worth of wealth in the last 25 years or so...

As soon as confidence (the only thing propping it up) in the USD falls, so will it's value. Should another currency step forward with a brighter future to take the USD's place in global trading, we will (there is no doubt of this) be hurting big time.

Stick your head in the sand (right next to our leaders) all you want, but the facts are certain and clear.

Our economic outlook is not rosy...it is rather bleak. The so-called "recovery" we are currently experiencing is not based on real economic factors. Therefore our trend downward will resume shortly.

Will the market crash in January? I doubt it will be January, but it is coming soon. The piper will demand payment. Personal debt is at an all time, unsustainable, high as is public debt. The piper will demand a painful payment.

reply to post by beezzer

I got out of individual stocks and into bond funds a year ago, when I was warned of a crash. Since then, the bonds have been a loss. They soon went down, then seem to follow the Dow Jones, not going back up to what they were when I bought them. Though they have been improving, I am still waiting to make a profit. However, I have done very well with BitCoin and LiteCoin, lately. Although they seem to be crashing right now, I plan to buy more when they seem to have settled at some sort of bottom. Better than gold.

I got out of individual stocks and into bond funds a year ago, when I was warned of a crash. Since then, the bonds have been a loss. They soon went down, then seem to follow the Dow Jones, not going back up to what they were when I bought them. Though they have been improving, I am still waiting to make a profit. However, I have done very well with BitCoin and LiteCoin, lately. Although they seem to be crashing right now, I plan to buy more when they seem to have settled at some sort of bottom. Better than gold.

reply to post by Aazadan

Why wouldn't oil be taken away like gold? In my case they just stop sending me checks.

You weren't suggesting literally storing barrels of oil were you?

I was getting a little depressed reading all this doom porn, until it was suggested that

owning oil would be a good thing....but then depressed again.

(I am aware that I can literally receive my oil interest in physical oil, but that seems insane.)

Why wouldn't oil be taken away like gold? In my case they just stop sending me checks.

You weren't suggesting literally storing barrels of oil were you?

I was getting a little depressed reading all this doom porn, until it was suggested that

owning oil would be a good thing....but then depressed again.

(I am aware that I can literally receive my oil interest in physical oil, but that seems insane.)

There is a global currency event coming within 90 days:

By the end of February 2014 it will have happened.

The event was due by mid 2013 but the strongly rising stock market and asset prices delayed the onset. No-one wants to be blamed for the event so the stock market crash will be the cover story, now expected early January 2014.

The elites don't wish to damage the underlying economy of physical good and services or the infrastructure of the planet. They still want private jets and everything else a global economy brings them.

For us there will however be three to six months of empty supermarket shelves during the reset so get ready for disruption. As long as you and your community can make it through then then next global monetary system will bring life back to the economy but with a lowering of living standards rather than outright mad max collapse hopefully.

The best way to survive will be to have supplies to last, skills and co-operative neighbors. Beyond those vital things any extra reserve wealth you may have (people worth a million or more) benefit most from physical gold. Physical gold will be a reference point in the new global economy, this means gold will trade in only physical form as a tool of final trade settlement between currency zones. Or even inside currency zones between millionaires and large entities that don't trust each other. Expect this new function for physical gold combined with the shedding of the paper gold market to bring an overnight revaluation of 30-40x, as Jim Rickards writes in his book 'Currency Wars' $44,000 per ounce. This is the one event of our life where we can gain something along with the millionaires and elites, $10,000 of gold coins today will be worth about $350,000 or an average house next year. This is it, once it starts it will be too late to get gold, better a few months too early rather than a day late for this event, it's a once only event.

Currency reset in 90 days!

www.youtube.com...

"The greatest event in the financial world in the past 1,000 years is about to take place. Two hundred and four nations have agreed with the IMF (International Monetary Fund) to reset their currency. Christine Lagarde is the new financial head of the IMF. If she and the Elite have their way, this event will take place within the next ninety days (three months)."

90 day reset

"The issue is why has the US$ not collapsed as it should have by now?

When we apply common sense and logic to the state of affairs, the answer is so simple and it is staring at you.

But, you have not been able to see the obvious because the global mass media, specifically the global financial mass media controlled mainly from London and New York, has created a smokescreen to hide the truth from you."

beforeitsnews

"There IS a global event that has been unfolding during the past ten-plus years. The Basel III Protocols (which includes the Global Currency Reset) have required the cooperation of many nations — 198, to be exact.

. . . . . . .

So instead of a crash – which is inevitable given the current fiscal structure, there will be a Global Currency Reset which is in the works."

investmentwatchblog.com...

By the end of February 2014 it will have happened.

The event was due by mid 2013 but the strongly rising stock market and asset prices delayed the onset. No-one wants to be blamed for the event so the stock market crash will be the cover story, now expected early January 2014.

The elites don't wish to damage the underlying economy of physical good and services or the infrastructure of the planet. They still want private jets and everything else a global economy brings them.

For us there will however be three to six months of empty supermarket shelves during the reset so get ready for disruption. As long as you and your community can make it through then then next global monetary system will bring life back to the economy but with a lowering of living standards rather than outright mad max collapse hopefully.

The best way to survive will be to have supplies to last, skills and co-operative neighbors. Beyond those vital things any extra reserve wealth you may have (people worth a million or more) benefit most from physical gold. Physical gold will be a reference point in the new global economy, this means gold will trade in only physical form as a tool of final trade settlement between currency zones. Or even inside currency zones between millionaires and large entities that don't trust each other. Expect this new function for physical gold combined with the shedding of the paper gold market to bring an overnight revaluation of 30-40x, as Jim Rickards writes in his book 'Currency Wars' $44,000 per ounce. This is the one event of our life where we can gain something along with the millionaires and elites, $10,000 of gold coins today will be worth about $350,000 or an average house next year. This is it, once it starts it will be too late to get gold, better a few months too early rather than a day late for this event, it's a once only event.

Currency reset in 90 days!

www.youtube.com...

"The greatest event in the financial world in the past 1,000 years is about to take place. Two hundred and four nations have agreed with the IMF (International Monetary Fund) to reset their currency. Christine Lagarde is the new financial head of the IMF. If she and the Elite have their way, this event will take place within the next ninety days (three months)."

90 day reset

"The issue is why has the US$ not collapsed as it should have by now?

When we apply common sense and logic to the state of affairs, the answer is so simple and it is staring at you.

But, you have not been able to see the obvious because the global mass media, specifically the global financial mass media controlled mainly from London and New York, has created a smokescreen to hide the truth from you."

beforeitsnews

"There IS a global event that has been unfolding during the past ten-plus years. The Basel III Protocols (which includes the Global Currency Reset) have required the cooperation of many nations — 198, to be exact.

. . . . . . .

So instead of a crash – which is inevitable given the current fiscal structure, there will be a Global Currency Reset which is in the works."

investmentwatchblog.com...

edit on 8-12-2013 by inthewinterdark because: link fix

new topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 4 hours ago -

Maestro Benedetto

Literature: 6 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 6 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 9 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 10 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 10 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 4 hours ago, 26 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 15 hours ago, 9 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 15 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 14 hours ago, 8 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 10 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 12 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 9 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 12 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 10 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 6 hours ago, 3 flags

active topics

-

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 90 • : Lumenari -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 12 • : KrustyKrab -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 28 • : firerescue -

SHORT STORY WRITERS CONTEST -- April 2024 -- TIME -- TIME2024

Short Stories • 23 • : DontTreadOnMe -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 16 • : Astyanax -

Truth Social goes public, be careful not to lose your money

Mainstream News • 130 • : Astyanax -

Is AI Better Than the Hollywood Elite?

Movies • 13 • : Justoneman -

Hate makes for strange bedfellows

US Political Madness • 47 • : 19Bones79 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 689 • : daskakik -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 265 • : Astrocometus