It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Crakeur

We need some quality advice from bankers and investment gurus who can advise us on where things are headed in various markets.

funniest thing I've ever heard

you were going good up to that point

edit on 20-9-2013 by Silicis n Volvo because: (no reason given)

reply to post by xuenchen

He is right, it doesn't, but when he start spending that's when the crap hit the roof, but occurs, increasing the debt ceiling doesn't mean that he will spend, or that is what he is trying to say as long as he appropriate funds from other areas where the money is already allocated.

But we know how that works, right?

He is right, it doesn't, but when he start spending that's when the crap hit the roof, but occurs, increasing the debt ceiling doesn't mean that he will spend, or that is what he is trying to say as long as he appropriate funds from other areas where the money is already allocated.

But we know how that works, right?

Crakeur

putting one trillion more dollars into the system would devalue the dollar further which could also provide a blow to the already unstable economy.

This is the conventional wisdom, especially among libertarians, who are heavily represented in the conspiracy theory scene. But this theory has suffered over the past four years: the base money supply has been spiked by something like 200-300%. Meanwhile, measured inflation has held steady and remained low.

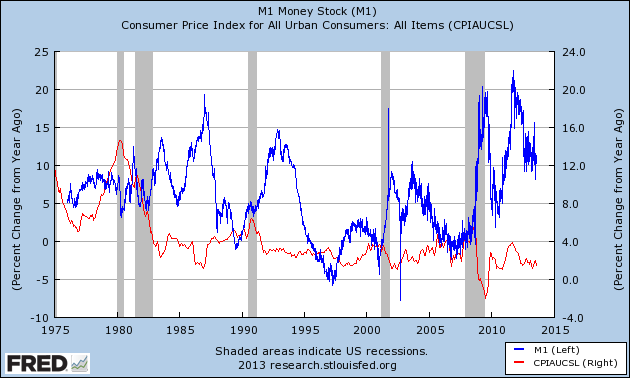

The chart above shows annual percent change in the consumer price index and M1, the 'base money supply'. Charts are from The St. Louis Fed. Note the big spike in M1 ever since the last recession. Inflation fluctuated a bit, but never exceeded 4% annual change, and remains at a low level compared to the last 37 odd years of history. The idea that inflation, or dollar devaluation, as you call it, has a neat relationship to the base money supply is thoroughly discredited.

Crakeur

Obamacare will wind up on the cutting room floor. Obama will not want it to happen but it's inevitable....

He's all bluster and, whenever pushed, he takes a few steps back.

I don't see what's inevitable about the demise of Obamacare. The House of representatives has voted to get rid of it some 42 times, but hasn't gained any traction at all. The present effort is just more of the same; an attempt to impress voters in republican primary elections. Even if Obama wanted to cave in on Obamacare, there isn't a majority to support that action in the senate. Honestly, I don't think repeal or defunding is likely in the least.

It also bears mentioning that if Obama was as spineless as you seem to think, the health care bill would never have become law.

reply to post by DrEugeneFixer

There is two main reasons the inflation is'nt showing on that chart.

First the CPI is rigged to show far less inflation than the actual average citizen experiences. This is being done for two reasons, first to keep treasury investors duped into believing the dollar is stronger than it is, and second to keep cost of living increases down for social security recipients.

The second reason is a huge portion of the new money is getting transferred to banks to hide their investment losses from mortgages. This money is not circulating into the economy it is replacing fraudulent assets on the banks balance sheets.

There is two main reasons the inflation is'nt showing on that chart.

First the CPI is rigged to show far less inflation than the actual average citizen experiences. This is being done for two reasons, first to keep treasury investors duped into believing the dollar is stronger than it is, and second to keep cost of living increases down for social security recipients.

The second reason is a huge portion of the new money is getting transferred to banks to hide their investment losses from mortgages. This money is not circulating into the economy it is replacing fraudulent assets on the banks balance sheets.

reply to post by proximo

If you have any real evidence that the cpi is rigged, please feel free to post it in this thread.

There really isn't any way to do monetary policy without transferring money to or from banks. Since the great recession, the FED has purchased assets from banks, mainly government securities. That's the FED's job. And, as you point out, it hasn't led to detectable inflation, which was exactly my point in the first place.

proximo

There is two main reasons the inflation is'nt showing on that chart.

First the CPI is rigged to show far less inflation than the actual average citizen experiences.

If you have any real evidence that the cpi is rigged, please feel free to post it in this thread.

proximo

The second reason is a huge portion of the new money is getting transferred to banks to hide their investment losses from mortgages.

There really isn't any way to do monetary policy without transferring money to or from banks. Since the great recession, the FED has purchased assets from banks, mainly government securities. That's the FED's job. And, as you point out, it hasn't led to detectable inflation, which was exactly my point in the first place.

reply to post by xuenchen

I have played this game a long time. You make up false math..equations..charts...and then later pretend that you never said the same. BS has become a steady and consistent component of our national discourse. You are welcome to keep up the BS and some will cheer you on, but others, attentive of reality and facts, will remember your falsehoods and propaganda.

I have played this game a long time. You make up false math..equations..charts...and then later pretend that you never said the same. BS has become a steady and consistent component of our national discourse. You are welcome to keep up the BS and some will cheer you on, but others, attentive of reality and facts, will remember your falsehoods and propaganda.

edit on 20-9-2013 by Indigo5 because: (no reason given)

reply to post by proximo

You are so right is not funny, people like I say over and over have short term memories, we are still bailing out the banks at a tune of hum, the last time was about 80+ billions a month, but recently Bernanke announced that he was going to hold back on the easing, Lo and behold he back off of what he said, I guess the economy is not as good as it was predicted, and the Markets had a hiccup when he announced the hold off.

I guess the markets has gotten so used to their monthly money injection like junkies that they can not longer survive without it.

And to make things look better US is not the only and was not the first one to used the QEs, this originated in Japan and we know how well they are doing and has spread as common practice now dependency all over the EU.

en.wikipedia.org...

You are so right is not funny, people like I say over and over have short term memories, we are still bailing out the banks at a tune of hum, the last time was about 80+ billions a month, but recently Bernanke announced that he was going to hold back on the easing, Lo and behold he back off of what he said, I guess the economy is not as good as it was predicted, and the Markets had a hiccup when he announced the hold off.

On June 19, 2013, Ben Bernanke announced a "tapering" of some of its QE policies contingent upon continued positive economic data. Specifically, he said that the Fed would scale back its bond purchases from $85 billion to $65 billion a month during the upcoming September 2013 policy meeting.[50] He also suggested that the bond buying program could wrap up by mid-2014.[51] While Bernanke did not announce an interest rate hike, he suggested that if inflation follows a 2% target rate and unemployment decreases to 6.5%, the Fed would likely start raising rates. The stock markets dropped approximately 4.3% over the three trading days following Bernanke's announcement, with the Dow Jones dropping 659 points between June 19 and 24, closing at 14,660 at the end of the day on June 24.[52]On 18th September 2013, the Fed decided to hold off on scaling back its bond-buying program.

I guess the markets has gotten so used to their monthly money injection like junkies that they can not longer survive without it.

And to make things look better US is not the only and was not the first one to used the QEs, this originated in Japan and we know how well they are doing and has spread as common practice now dependency all over the EU.

en.wikipedia.org...

edit on 20-9-2013 by marg6043 because: (no reason given)

reply to post by DrEugeneFixer

While you have not addressed me directly, while I was researching on the QEs I found this article also.

It may help answer your question on the CPI,

The Four Most Rigged Economic Indicators

moneymorning.com...

I hope it helps a bit.

While you have not addressed me directly, while I was researching on the QEs I found this article also.

It may help answer your question on the CPI,

The Four Most Rigged Economic Indicators

Consumer Price Index: Famed PIMCO bond manager Bill Gross once deemed the U.S. Consumer Price Index an "haute con job." And for good reason.

The CPI measures the price level of goods and services purchased by consumers and is one of two definitions for inflation (the other being a calculated statistic from money supply figures).

Unfortunately, CPI is a very broken economic indicator.

Providing a measure of inflation, the CPI tells us just how much the price of goods is increasing over time.

But here's the problem. The Core CPI number excludes food and energy from its formula. This is done because "these goods show more price volatility than the remainder of the CPI."

But that's very convenient given that rising energy and food costs push up the price of many other products and services that Americans purchase.

One can tell this figure is rigged just by factoring in just how under-reported the cost of energy is alone. In 2008, when oil hit $150 a barrel and food prices were near all-time highs, the official CPI was just 4%. With the cost of food and energy at record highs, the government tried to claim that the CPI was a mere 4% inflation. In reality, the real level of inflation was at least double this figure.

moneymorning.com...

I hope it helps a bit.

Indigo5

reply to post by xuenchen

I have played this game a long time. You make up false math..equations..charts...and then later pretend that you never said the same. BS has become a steady and consistent component of our national discourse. You are welcome to keep up the BS and some will cheer you on, but others, attentive of reality and facts, will remember your falsehoods and propaganda.edit on 20-9-2013 by Indigo5 because: (no reason given)

So all of a sudden all those facts and figures from the White House and the Congressional Budget Office are false !!

And at the same time, you just can't seem to answer the *very simple* question about what your silly graph was based on !!

And btw, where did I say I never said what I said ? The only one claiming that is *You* !!!

So was your graph a comparison of GDP and the "Budget" (whatever that is), or does it include all spending ?

Over-budget means budgeting more than you actually have.

Over-spending means spending more than you actually budgeted.

If you've got both happening, you've dug one hole (over budgeting) and then continued to dig (over spending).

Silicis n Volvo

Crakeur

We need some quality advice from bankers and investment gurus who can advise us on where things are headed in various markets.

funniest thing I've ever heard

you were going good up to that pointedit on 20-9-2013 by Silicis n Volvo because: (no reason given)

No kidding.

Those bankers and investment gurus are only good for lining their own pockets. This entire situation was from "EXPERTS" lining things up so they could make some easy cash.....and if / when things went sour, well they own the politicians, so lets make the people pay for our mistakes.

and here is what Obama had to say:

This is the United States of America, we’re not some banana republic. This is not a deadbeat nation. We don’t run out on our tab. We're the world's bedrock investment, the entire world looks to us to make sure the world economy is stable. We can’t just not pay our bills."

News flash sunshine, you are borrowing trillions every year, you have little means to pay it back, other then "petrol dollar" and your military. Those are the ONLY reason this scam has gone on so long. Yes, the entire world is looking at you because you are the reserve currency - THAT IS IT.

I don't understand how anyone can defend this double talk from the liar and deceiver Obama. I mean, the so called nobel peace prize winner just tried

to start another War and it took Putin to stop it, can you even imagine?

Maybe it was planned this way by the international banksters, but obviously they have almost complete control of both parties. The bankster lap dog Obama right now is clearly nothing more but the latest puppet who is swinging on strings during this circus side show that seems to have no end. ~$heopleNation

Maybe it was planned this way by the international banksters, but obviously they have almost complete control of both parties. The bankster lap dog Obama right now is clearly nothing more but the latest puppet who is swinging on strings during this circus side show that seems to have no end. ~$heopleNation

edit on 20-9-2013 by SheopleNation because: TypO

I really wonder at Obama supporters in these threads, are you paid to be this stupid?

Lets see some examples so far:

1.Well, we are spending less. Still trillion dollar deficits for many years to come, sure hope the bond market doesn't fall apart.

2.Inflation is still low, lets print EVER MOAR money. Holy crap, the US is spending 85 trillion a month to cover up the past mess. Any hints at a taper send the stock market down, not that the stock market is any indication at how regular people are doing these days. Not to mention that any figure can be manipulated to be positive (and even then the best they can manage is "things aren't that bad" "we aren't sinking as fast as we were")

Lets see some examples so far:

1.Well, we are spending less. Still trillion dollar deficits for many years to come, sure hope the bond market doesn't fall apart.

2.Inflation is still low, lets print EVER MOAR money. Holy crap, the US is spending 85 trillion a month to cover up the past mess. Any hints at a taper send the stock market down, not that the stock market is any indication at how regular people are doing these days. Not to mention that any figure can be manipulated to be positive (and even then the best they can manage is "things aren't that bad" "we aren't sinking as fast as we were")

reply to post by MidnightTide

America have oil that is what keep this country from having to hide from the bill collectors, also it have the biggest collateral in the name of the population.

Now wonder how the government wants to grand amnesty to more millions to have them become citizens and like that add them to the share of the national debt for every child born in the US they are already born in debt.

America have oil that is what keep this country from having to hide from the bill collectors, also it have the biggest collateral in the name of the population.

Now wonder how the government wants to grand amnesty to more millions to have them become citizens and like that add them to the share of the national debt for every child born in the US they are already born in debt.

edit on 21-9-2013 by marg6043 because: (no reason given)

marg6043

reply to post by MidnightTide

America have oil that is what keep this country from having to hide from the bill collectors, also it have the biggest collateral in the name of the population.

Now wonder the government wants to grand amnesty to more millions to have them become citizens and like that add them to the share of the national debt for every child born in the US they are already born in debt.

As soon as it is widely accepted that you can buy oil from a basket of currencies you can be sure a lot of people are going to be dropping the US dollar.

I always find it funny when the US wants to judge Europes financial crysis. They are on the same level as Greece, but just deny it.

"We have high debts, let's just raise the limit a bit more" a few months later "oh, the limit is reached again, lets just raise it a biiiiit more"

"We have high debts, let's just raise the limit a bit more" a few months later "oh, the limit is reached again, lets just raise it a biiiiit more"

marg6043

while I was researching on the QEs I found this article also.

It may help answer your question on the CPI,

The Four Most Rigged Economic Indicators

.

.

.

Unfortunately, CPI is a very broken economic indicator.

Providing a measure of inflation, the CPI tells us just how much the price of goods is increasing over time.

But here's the problem. The Core CPI number excludes food and energy from its formula. This is done because "these goods show more price volatility than the remainder of the CPI."

moneymorning.com...

I hope it helps a bit.

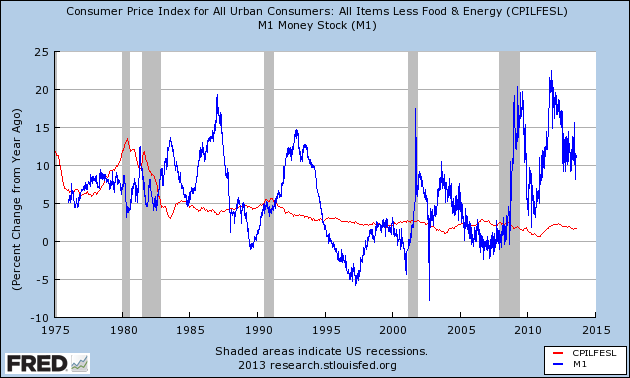

Thanks, Margo. Fortunately, I was already aware of the difference between 'core cpi' and 'broad cpi'. The chart I posted earlier was M1 vs. "broad cpi". below I post the same comparison, but with 'core cpi' just for kicks.

Basically the difference in the charts is that inflation (the red line), doesn't jump around as much when in the 'core cpi' version in this post. Nevertheless, it mostly follows the same track. Basically broad inflation is always jumping around because of a few prices like food and fuel. Usually those few prices go back to about where they were to begin with, or at least don't grow out of control. Anyway, when it comes to looking at short term changes like comparing this month and last month's inflation, you want to look at 'core cpi' because 'broad cpi' jumps up and down so much it's hard to tell if there is an underlying trend. But when you look at the long term trends like the images that I posted, it doesn't make much of a difference. Inflation has not been increasing since the crisis began.

The idea that 'core cpi' is rigged is kind of a joke. Both versions are available online in raw data or chart format within mere minutes to anyone who cares.

research.stlouisfed.org... just a link to play around with.

edit on 9/21/2013 by DrEugeneFixer because: clarification

OpenMindedRealist

To 1104light:

This tired argument does not sway the opinions of thinking people. An analogy would be that the kid who drank all of dad's whiskey deserves only a small part of the blame, because his older brother took the first few sips.

Sorry but your analogy is not even close to reality.

For the politically aware, it is even more absurd due to the fact that Obama has continued all of GW Bush's destructive policies and multiplied some to the tenth power. Wars in the MidEast, domestic spying, and gross overspending are obvious examples. If you want more, then do some reading yourself; I have neither the time nor desire to spoon-feed you reality (and you'd probably spit it back out anyways).

There are more American wars in the middle east? Really? Do tell.

To thinking members/lurkers:

The ratio of those who agree with the OP to those who disagree is hopefully representative of educated America. Still, it is disheartening to see that any person with access to the internet can bring themselves to defend the President's statements about the debt ceiling. I urge everyone to ignore posts like that quoted above, in order to preserve intelligent debate and avoid derailing political threads. Who knows how many shills on ATS are in fact paid...

Look, you can pretend presidents have no lasting effect all you like but I am old enough to remember Carter being blamed for things he started while Clinton was in office. When a president leaves, the damage he has done does not go with him and since I am interested in facts, the amount of money spent by Bush is a littler more important to me since he stuck most of the bill with the next president who somehow gets ALL of the blame. I, unfortunately for you, actually am a thinking person.

Please tell me you are a thinking person and that when each president leaves office, there is nothing to blame them for starting that day.

Or concede I am right. Your choice. I cannot wait to see what reality slams in your head.

reply to post by MidnightTide

The "debt" can be paid off, by monetising it. A nation having a non-convertible fiat money system and all of whose debts are denominated in its own currency can never go bankrupt unless it chooses to do so.

Yes, the reason US can continue to borrow from external parties in its own currency is because the US$ is the reserve currency and the US military strength has a significant contribution to maintaining that status. However, it is also important to appear as a solvent economy that can pay its bills for that status to continue, which is what Obama is stating in the part that you quoted.

If the Congress doesn't raise the debt ceiling and Obama doesn't choose the platinum coin route, the US will have to default on payments to employees, contractors etc. The bond holders will continue to get paid (the debt ceiling doesn't affect payments to bond holders), but I am not sure if the ratings agencies can ignore the fact that the government is failing to meet its obligations to its other creditors. If they cannot and are forced to downgrade the US sovereign credit rating, it may cause an exodus of foreign holders of US$ assets.

For the US there are no solutions, within conventional economic theory, that doesn't leave one section or the other as big immediate losers. Those advocating "tough love" and austerity want to preserve the wealth of the currently wealthy at the risk of a societal collapse resulting from withdrawal of social benefits and the others (represented by Obama) are highly averse to that and wish to try new methods that are unlikely but may be able to save the day.

I think Obama is winning and will take the HVPCS route to fund government deficits. From a conventional viewpoint that could lead to extremely high inflation and a consequent devaluation of the US$ and perhaps a loss of reserve currency status. But if the QE experience is any indicator, the risks of that happening are not substantial.

News flash sunshine, you are borrowing trillions every year, you have little means to pay it back, other then "petrol dollar" and your military. Those are the ONLY reason this scam has gone on so long. Yes, the entire world is looking at you because you are the reserve currency - THAT IS IT.

The "debt" can be paid off, by monetising it. A nation having a non-convertible fiat money system and all of whose debts are denominated in its own currency can never go bankrupt unless it chooses to do so.

Yes, the reason US can continue to borrow from external parties in its own currency is because the US$ is the reserve currency and the US military strength has a significant contribution to maintaining that status. However, it is also important to appear as a solvent economy that can pay its bills for that status to continue, which is what Obama is stating in the part that you quoted.

If the Congress doesn't raise the debt ceiling and Obama doesn't choose the platinum coin route, the US will have to default on payments to employees, contractors etc. The bond holders will continue to get paid (the debt ceiling doesn't affect payments to bond holders), but I am not sure if the ratings agencies can ignore the fact that the government is failing to meet its obligations to its other creditors. If they cannot and are forced to downgrade the US sovereign credit rating, it may cause an exodus of foreign holders of US$ assets.

For the US there are no solutions, within conventional economic theory, that doesn't leave one section or the other as big immediate losers. Those advocating "tough love" and austerity want to preserve the wealth of the currently wealthy at the risk of a societal collapse resulting from withdrawal of social benefits and the others (represented by Obama) are highly averse to that and wish to try new methods that are unlikely but may be able to save the day.

I think Obama is winning and will take the HVPCS route to fund government deficits. From a conventional viewpoint that could lead to extremely high inflation and a consequent devaluation of the US$ and perhaps a loss of reserve currency status. But if the QE experience is any indicator, the risks of that happening are not substantial.

reply to post by MidnightTide

The world isn't divided into those supporting Obama and those opposing him.

As long as there is a substantial external demand for US$, there will be a demand for safe US$ assets, meaning US bonds, which will mean there will be sufficient internal demand for the same. Of course, if the US issued a substantially large debt, the supply may outstrip the demand, but the Fed can buy up excess supply by FOM operations.

It is US$ 85 billion per month, not trillion. And no, the US is not spending that much (it spends much more than that every month). That is the value of asset purchases by the Fed. Yes, currently the only effect of the QE has been to push up the prices of assets and this level of asset prices is sustainable only through a constant pumping of liquidity by the Fed through FOM operations. In fact it may require the Fed to increase the size of QE in order for the asset price bubble not to burst and the Fed may do just that. That doesn't mean the bubble can be sustained forever, just that the Fed doesn't want to be blamed for bursting it.

Yes, the stock market stopped being an indicator of the health of the economy a while ago. For the same reason, when it bursts it shouldn't have any serious negative impact on the economy either. Yes, a lot of people feeling rich and secure looking at the value of their stock portfolios won't feel the same anymore, but that's about it.

I really wonder at Obama supporters in these threads, are you paid to be this stupid?

The world isn't divided into those supporting Obama and those opposing him.

Lets see some examples so far:

1.Well, we are spending less. Still trillion dollar deficits for many years to come, sure hope the bond market doesn't fall apart.

As long as there is a substantial external demand for US$, there will be a demand for safe US$ assets, meaning US bonds, which will mean there will be sufficient internal demand for the same. Of course, if the US issued a substantially large debt, the supply may outstrip the demand, but the Fed can buy up excess supply by FOM operations.

2.Inflation is still low, lets print EVER MOAR money. Holy crap, the US is spending 85 trillion a month to cover up the past mess. Any hints at a taper send the stock market down, not that the stock market is any indication at how regular people are doing these days. Not to mention that any figure can be manipulated to be positive (and even then the best they can manage is "things aren't that bad" "we aren't sinking as fast as we were")

It is US$ 85 billion per month, not trillion. And no, the US is not spending that much (it spends much more than that every month). That is the value of asset purchases by the Fed. Yes, currently the only effect of the QE has been to push up the prices of assets and this level of asset prices is sustainable only through a constant pumping of liquidity by the Fed through FOM operations. In fact it may require the Fed to increase the size of QE in order for the asset price bubble not to burst and the Fed may do just that. That doesn't mean the bubble can be sustained forever, just that the Fed doesn't want to be blamed for bursting it.

Yes, the stock market stopped being an indicator of the health of the economy a while ago. For the same reason, when it bursts it shouldn't have any serious negative impact on the economy either. Yes, a lot of people feeling rich and secure looking at the value of their stock portfolios won't feel the same anymore, but that's about it.

edit on 21-9-2013 by Observor because: (no reason given)

aLLeKs

I always find it funny when the US wants to judge Europes financial crysis. They are on the same level as Greece, but just deny it.

"We have high debts, let's just raise the limit a bit more" a few months later "oh, the limit is reached again, lets just raise it a biiiiit more"

The world bank would have been ALL OVER the usa like the damm plague, if not for the fact usa dollars are the worlds reserve currency. Its a status symbol based on hot air now-a-days. Sure 30 years ago our GDP was strong and we exported much more than what we imported.

www.census.gov...

I dare people to look at these horrible trade deficits with china ALONE, not to mention korea, india, taiwan, etc. What the hell is made in america anymore?????

The usa dollar is NOT a strong currency. Its a second world currency and will eventually become a third world currency when middle eastern countries start selling their oil in chineese yan or euros. Man are some people going to GET FLOORED when this happens. All their ILLUSIONS busted like ballons with nothing but hate at their elected officials. THIS is why usa hates iran and constantly threatens them, because iran WANTS EURO! Is usa going to invade the whole damm middle east, with the exception of israel and saudi arabia to keep up its illusion of dominance? Are they going to nuke russia and china?

Greece had no petro-dollar to fall back to and the IMF has been hammering them into the ground now for 3 years at least. Basically parliament have become complete lackeys to EU, IMF, germany. They ended up giving a haircut by about 50% of all outstanding debt.

edit on 21/9/13 by

EarthCitizen07 because: (no reason given)

new topics

-

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 1 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 6 hours ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 11 hours ago, 29 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 6 hours ago, 12 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 17 hours ago, 7 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 17 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 13 hours ago, 3 flags -

Maestro Benedetto

Literature: 13 hours ago, 1 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 1 hours ago, 1 flags

active topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 271 • : CriticalStinker -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 12 • : ColeYounger2 -

Weinstein's conviction overturned

Mainstream News • 27 • : brodby -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 38 • : brodby -

ChatGPT Beatles songs about covid and masks

Science & Technology • 24 • : iaylyan -

The Acronym Game .. Pt.3

General Chit Chat • 7754 • : bally001 -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 96 • : andy06shake -

Rupert Murdoch engaged at 92

People • 8 • : brodby -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 287 • : FlyersFan -

Skinwalker Ranch and the Mystery 1.6GHz Signal

Aliens and UFOs • 144 • : brodby