It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

When government spending reaches or exceeds 50% of GDP sustained for longer than half of a fiscal year, factored with REAL economic projections that

will be the point where it all collapses...

My prediction is that it happens just before the end of the fiscal year 2015.

Many rats are going to jump ship between now and then.

Good news is that wise capable people will have just enough time to be prepared for it.

My prediction is that it happens just before the end of the fiscal year 2015.

Many rats are going to jump ship between now and then.

Good news is that wise capable people will have just enough time to be prepared for it.

pavil

reply to post by Indigo5

How do we get our National Government spending in line with revenue we take in?????

I think we all would agree that we need to trim spending to achieve that. We can carry some national debt, but to do it for as long as we are, at the levels we do, is just asking for trouble, do you agree?

By reducing spending...which we are doing.

We had two things happen at once...We spent an ungodly amount to bail-out the economy...banks, auto etc.

AND we had STEEP fall-off in revenues (tax dollars) as the economy nearly collapsed.

So we amassed DEBT.

A good chunk of that Debt was signed off on by the last President just before he left office...thus in 2009 those bills came due...but Pres. Obama did bail out the Auto Industry and had a part in the second smaller stimulas, so yah...Both Bush and Obama were involved in racking up the debt.

How do we change course?...spend less...which we are doing...though it is not politically convenient for the GOP to admit.

The other half of that equation is for the economy to improve....More profits, means more taxes and the Gov. increases revenues along with an improving economy.

What these "hostage taking" tactics...as The Chamber of Commerce (an indisputably pro-capitalist, often GOP supportive org) calls this...What this "hostage taking" does is HURT the economy...decreases revenues...increases the interest the gov pays.

It is Economic political psychopathy...The TP wants what they want...eff the economy...eff the government...and families feel the end consequences.

reply to post by Indigo5

Federal revenues have steadily increased each year since 2009.

Federal spending has been slightly down, up and down since 2009, but tight and steady.

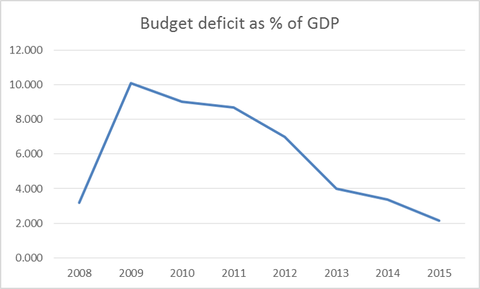

Your graph is showing what ?

Is it just 'budgeted' spending or total spending.

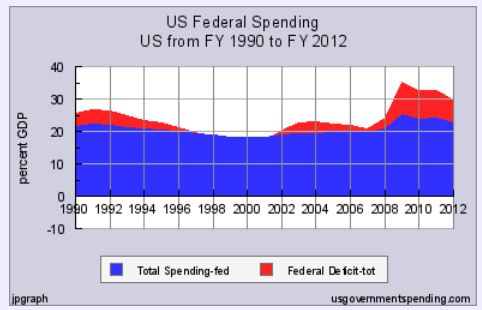

Confusing. This shows total spending and total spending deficits - %GDP;

Federal revenues have steadily increased each year since 2009.

Federal spending has been slightly down, up and down since 2009, but tight and steady.

Your graph is showing what ?

Is it just 'budgeted' spending or total spending.

Confusing. This shows total spending and total spending deficits - %GDP;

edit on Sep-19-2013 by xuenchen because:

reply to post by Indigo5

Subjective and selective math along with fantasy projections are in part how we got in this mess and go a long way to keeping us there.

When looking at government spending, include all... Discretionary, mandatory, defense, and all entitlements... Everything.

It's around 40% of GDP now.

Good luck.

Subjective and selective math along with fantasy projections are in part how we got in this mess and go a long way to keeping us there.

When looking at government spending, include all... Discretionary, mandatory, defense, and all entitlements... Everything.

It's around 40% of GDP now.

Good luck.

reply to post by Crakeur

Either way I will go with "You can't fix stupid for $200.00". Well, I guess your not Alex, but you know. lol

Either way I will go with "You can't fix stupid for $200.00". Well, I guess your not Alex, but you know. lol

I'm no rocket surgeon but...

Doesn't your credit score have something to do with the ratio of debt owed to your overall available credit line?

If I had mostly maxed out credit cards, then I opened a new one and always kept the balance low, it would improve my credit rating because I would now have more already established credit available to me.

Is Obama just trying to increase our available credit limit to improve our national credit rating?

-Dr. Ironlung, Brain Scientist

Doesn't your credit score have something to do with the ratio of debt owed to your overall available credit line?

If I had mostly maxed out credit cards, then I opened a new one and always kept the balance low, it would improve my credit rating because I would now have more already established credit available to me.

Is Obama just trying to increase our available credit limit to improve our national credit rating?

-Dr. Ironlung, Brain Scientist

reply to post by Ironlung

the amount of debt available to you hurts your credit.

Say you have ten credit cards, each with a million dollar limit. even if you don't use them, have zero balance on them, you're credit rating takes a hit because, if you wanted to, you could rack up 10 mill in debt and, unless you have the income, and the assets, to support it, no bank will go near you.

the US was downgraded once this year and, odds are, we'll be downgraded again if we raise our ceiling and borrow more money.

of course, if we have a shutdown we might get tagged as well.

the amount of debt available to you hurts your credit.

Say you have ten credit cards, each with a million dollar limit. even if you don't use them, have zero balance on them, you're credit rating takes a hit because, if you wanted to, you could rack up 10 mill in debt and, unless you have the income, and the assets, to support it, no bank will go near you.

the US was downgraded once this year and, odds are, we'll be downgraded again if we raise our ceiling and borrow more money.

of course, if we have a shutdown we might get tagged as well.

xuenchen

Obama has now proclaimed that raising the debt ceiling doesn't increase the debt.

Anyone that believes that should be held back 'another' grade because they obviously haven't learned.

reply to post by xuenchen

The debt is completely pretend, anyway.

Who exactly is charging the government interest to use the money that "they" supposedly print?

Who could possibly have that kind of power?

Or, even better, who is it that the federal government is "borrowing" from if they are the ones printing the money in the first place?

The "debt ceiling" and this entire charade is such a joke. It's all just smoke and mirrors.

The debt is completely pretend, anyway.

Who exactly is charging the government interest to use the money that "they" supposedly print?

Who could possibly have that kind of power?

Or, even better, who is it that the federal government is "borrowing" from if they are the ones printing the money in the first place?

The "debt ceiling" and this entire charade is such a joke. It's all just smoke and mirrors.

LewsTherinThelamon

reply to post by xuenchen

The debt is completely pretend, anyway.

Who exactly is charging the government interest to use the money that "they" supposedly print?

Who could possibly have that kind of power?

Or, even better, who is it that the federal government is "borrowing" from if they are the ones printing the money in the first place?

The "debt ceiling" and this entire charade is such a joke. It's all just smoke and mirrors.

The government sells Treasury Securities. That's where the 'borrowed' money comes from.

The holders of the securities (bonds, notes, t-bills, etc) get the interest.

Here’s where the Government is different from individual people and businesses. When the Government borrows money, it doesn’t go to the bank and apply for a loan. It "issues debt." This means the Government sells Treasury marketable securities such as Treasury bills, notes, bonds and Treasury inflation-protected securities (TIPS) to other federal government agencies, individuals, businesses, state and local governments, as well as people, businesses and governments from other countries. Savings bonds are sold to individuals, corporations, associations, public and private organizations, fiduciaries, and other entities.

There is a maximum amount of debt the Government can have. This is known as the “debt ceiling.”

To raise that amount, the U.S. Treasury must get Congress to approve a new and higher limit.

Government Borrowing

And the government needs a 'market' to buy the securities.

If and when THAT dries up, it's all she wrote !!

also;

How The Federal Government Prints Money

reply to post by Crakeur

Yeah, I was just joking anyway.

I am pretty sure that your credit score is affected by a few factors, and your debt to available credit ratio is one of them.

If I had $1000 worth of credit available to me and I used $800 of it, I would be using 80% of my available credit.

If I extended my credit limit to $2000 and carried the same $800 debt, I would only be using 40% of my available credit.

Your debt to income ratio is just as valuable but is not calculated in your credit score. Your debt to credit ratio will directly affect your credit score.

Everyone's credit situation is different, and I know this is completely irrelevant to the debt ceiling situation.

Again, I was just joking..... I'm no rocket surgeon, but this isn't brain science were talking about here!

Yeah, I was just joking anyway.

I am pretty sure that your credit score is affected by a few factors, and your debt to available credit ratio is one of them.

If I had $1000 worth of credit available to me and I used $800 of it, I would be using 80% of my available credit.

If I extended my credit limit to $2000 and carried the same $800 debt, I would only be using 40% of my available credit.

Your debt to income ratio is just as valuable but is not calculated in your credit score. Your debt to credit ratio will directly affect your credit score.

Everyone's credit situation is different, and I know this is completely irrelevant to the debt ceiling situation.

Again, I was just joking..... I'm no rocket surgeon, but this isn't brain science were talking about here!

Some of you are missing the point.

To be fair, he isn't "wrong" like most of you have pointed out. However, a few of you have asked why the ceiling would even need to be raised?

It's all about maintaining credit worthiness to our creditors. If the debt ceiling isn't raised, our creditors KNOW that we have no way of paying them back. Likewise, if it is raised (regardless of whether or not we're taking on more debt) at least our creditors understand that we CAN pay them back.

To be fair, he isn't "wrong" like most of you have pointed out. However, a few of you have asked why the ceiling would even need to be raised?

It's all about maintaining credit worthiness to our creditors. If the debt ceiling isn't raised, our creditors KNOW that we have no way of paying them back. Likewise, if it is raised (regardless of whether or not we're taking on more debt) at least our creditors understand that we CAN pay them back.

strings0305

It really surprises me that no one here seems to understand what the debt ceiling actually is... The money is already spent. That means we owe the money whether we pay it off or not. Whatever damage has been done to the national debt ALREADY EXISTS. Because it exists, it needs to be paid. Raising the debt ceiling allows us to pay those debts.

If you want to rally against spending, go for it. But I'm sure everyone here knows what happens when you don't pay a credit card bill... Your credit rating goes down. Not raising the debt ceiling is the same thing as not paying off your credit card when it comes to the national debt. Sure, next month you can spend less. But RIGHT NOW, it needs to be paid.

If you want to focus on something, focus on SPENDING for next quarter/year. NOT raising the debt ceiling is bad for everyone. Cutting spending just -might- be good for everyone. (I know there's a hundred billion or two in extraneous military contracts that could be cut tomorrow without affecting national security--that might be a good place to start )

You are the one that does not understand the debt limit.

The purpose of it is to give congress the ability to limit the total amount of debt the federal government can commit to.

It has nothing to do with what has been spent despite what Obama says. You have proven you are a stupid sheep as you parrot back his speech as if it is gospel. The only way the statement is even slightly true is this scumbag administration has been ignoring the law and actually has borrowed past the limit for the last 2 months despite it being illegal.

Congress could stop deficit spending immediately by simply refusing to raise the limit. That would cause an immediate forty percent cut in federal spending and instant depression. That is inevitable however and the sooner we begin it the better off we will be.

And for the thousandth time, despite what liberals keep spewing, defense cuts won't even come close to closing the deficit, entitlement spending is beyond out of control, being greater than all tax income by itself already, and set to double within a decade if medical costs continue to increase at 9 percent annually as they have the last 30 years.

TheTalentedMrBryant

Some of you are missing the point.

To be fair, he isn't "wrong" like most of you have pointed out. However, a few of you have asked why the ceiling would even need to be raised?

It's all about maintaining credit worthiness to our creditors. If the debt ceiling isn't raised, our creditors KNOW that we have no way of paying them back. Likewise, if it is raised (regardless of whether or not we're taking on more debt) at least our creditors understand that we CAN pay them back.

This may seem a little ignorant but WHO are these creditors anyway?? And also, WHO decides if this ceiling raise is approved? The creditors or the borrowers?

Peace out.

edit on 19-9-2013 by bigwig22 because: put more stuff

reply to post by bigwig22

Anybody that buys US government bonds. That means most of the debt is actually owed to American citizens, via retirement investments, and the social security fund. The rest is owed to company's many American, foreign investors and countries.

Yes what I am telling you is that zero dollars of social security exists in any form other than iou's from the taxpayers. And the taxpayer dollars are forty percent short of covering our expenses, meaning anyone relying on social security even a decade from now should not be, cause the money does not exist, and our ability to borrow will soon not exist, whether the federal government or you like it or not.

Anybody that buys US government bonds. That means most of the debt is actually owed to American citizens, via retirement investments, and the social security fund. The rest is owed to company's many American, foreign investors and countries.

Yes what I am telling you is that zero dollars of social security exists in any form other than iou's from the taxpayers. And the taxpayer dollars are forty percent short of covering our expenses, meaning anyone relying on social security even a decade from now should not be, cause the money does not exist, and our ability to borrow will soon not exist, whether the federal government or you like it or not.

one day soon

the interest will be so high.

that it will be Never pay'd off.

or has that been and gone?

the interest will be so high.

that it will be Never pay'd off.

or has that been and gone?

reply to post by Crakeur

Exactly.

It's like maximg out a credit card and the bank continues raising the cards debt limit & I keep maxing out. Same thing is happening in DC.

Exactly.

It's like maximg out a credit card and the bank continues raising the cards debt limit & I keep maxing out. Same thing is happening in DC.

buddha

one day soon

the interest will be so high.

that it will be Never pay'd off.

or has that been and gone?

That point has already come and gone. The whole reason they are "easing" - which is code for stealing money from citizens through inflation, is to attempt to keep the interest rates artificially low by buying our own debt with new printed money at the low rates.

In other words without rigging the market, the rates would go up. But the Feds ability to rig the market is becoming increasingly ineffective, and we are entering a death spiral. They have to keep the rates low because every percent increase is 170 billion more in intrest expense we don't have - 170 billion more we have to borrow.

Rates are still historically very low, 5 percent is the norm and we are at 2.5 percent now.

The fact the fed is so desperate to keep rates low, tells you they know the deficit will not be fixed politically, which means a major depression is eminent as soon as the rates rise, or easing gets so out of control the dollar becomes Monopoly money.

reply to post by xuenchen

I have to wonder what form of psychopathy has inflicted Obama, McCain, Biden, Feinstein, Hilary, Kerry, etc etc. They all act like they are completely out of their minds and are possessed by evil. I never thought I would think this or say this, but I honestly believe that they are all either on drugs, insane, or possessed. Perhaps, all of the above.

This country is heading into a collapse. A big one. The house just voted to cut SNAP benefits even further, and this will send a lot of our working poor into a bigger crisis than what some were already in. On top of that, Obama care. I don't see how this is going to work.

I have to wonder what form of psychopathy has inflicted Obama, McCain, Biden, Feinstein, Hilary, Kerry, etc etc. They all act like they are completely out of their minds and are possessed by evil. I never thought I would think this or say this, but I honestly believe that they are all either on drugs, insane, or possessed. Perhaps, all of the above.

This country is heading into a collapse. A big one. The house just voted to cut SNAP benefits even further, and this will send a lot of our working poor into a bigger crisis than what some were already in. On top of that, Obama care. I don't see how this is going to work.

Technically, your debt is increased in the eyes of a bank. when applying for a loan they take into account how much credit you have. So if you can pay back 100,00$ with the amount you make and you have credit card that have a credit limit that totals 90,000$ then you can have a loan for 10,00$ even if your balance is zero.

benrl

Seriously? It doesnt?

Well shoot I gotta go tell all my Credit cards to increase My limits cause Obama says it won't increase my debt.

While technically correct, its beyond stupid.

The way the USA does their credit is totally backwards. It would be like me maxing out my cards then have the limits raised so I could pay them. The question is how much credit does the USA have the ability to pay? I think it would be dependant on our interest rate. If rates go up then we are screwed

edit on 20-9-2013 by jlafleur02 because: (no reason given)

new topics

-

Weinstein's conviction overturned

Mainstream News: 1 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 2 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 2 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 3 hours ago -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 5 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 7 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 16 hours ago, 11 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 2 hours ago, 7 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 17 hours ago, 6 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 2 hours ago, 5 flags -

Weinstein's conviction overturned

Mainstream News: 1 hours ago, 5 flags -

Electrical tricks for saving money

Education and Media: 15 hours ago, 5 flags -

Sunak spinning the sickness figures

Other Current Events: 17 hours ago, 5 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 5 hours ago, 3 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 7 hours ago, 2 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 12 hours ago, 1 flags

active topics

-

Weinstein's conviction overturned

Mainstream News • 12 • : CristianVictoria -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 106 • : DBCowboy -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 82 • : gortex -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 39 • : xuenchen -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 13 • : mysterioustranger -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 283 • : FlyersFan -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 747 • : Justoneman -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness • 73 • : CarlLaFong -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 671 • : daskakik -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 46 • : CarlLaFong