It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by proximo

reply to post by longlostbrother

This is a huge problem and it cannot be solved by tax increases, there is not enough wealth to tax, and if you tried they will, shut down their businesses, or leave the country.

Good. Let them leave, and open the field up for the next wave of businesses to replace them. This is America. If they leave, someone will immediately replace them, and we'll forget that they ever existed within a year's time. Especially if they folded up their tents and left because they didn't want to pitch in to help our nation's economy improve and our debt to decrease. We don't want businesses that don't care about us as a society, so if (let's say) Poppa John wants to take his pizza business to Dubai (or wherever these tax refugees feel is best for their "freedom") then there are plenty of other pizza makers to fill the tiny gap he'll leave behind. Same with literally everything else that any business owner thinks he or she is contributing to the quality of life here in the US. Plenty of other choices, and it's no sweat off any of our brows if one of these no-tax patriots wants to destroy their company in protest. Their competitors will simply hire their newly-freed employees to cover the sudden increase in market demand for them, now that there are fewer suppliers.

Maybe thinning the herd a little will be a good thing.

edit on 11/15/2012 by NorEaster because: (no reason given)

reply to post by oper8zhin

You really need to calm down.

Conspiracies are everywhere, even in the Obama Administration

top of the page:

Still waiting on your CREDENTIALS!!!!

Credentials please. NO MORE BS!!!!!!!!!!!

You really need to calm down.

Conspiracies are everywhere, even in the Obama Administration

top of the page:

US Political Madness: This forum is dedicated to the discussion of the state of divisive politics in the US including political ideology, politicians, political figures, politics in the media, and speculation of conspiracy theories related to the divisive state. Participants should be aware that this forum is under close staff scrutiny. Because of the inherent distrust of government by conspiracy theorists, discussion topics and follow-up responses in this forum will likely tend to be highly critical of the current administration.

I love these reality threads!!! The denial of said reality always continues to amuse me.

Let's not forget that our nation actually needs Economic GROWTH in order to dig out of the ever deepening hole that we are in. We need balance. Plain and simple... Soaking the super wealthy won't solve the spending problem that has led us to where we are now...

Growth, increased revenue and cuts are inevitable. If you're Secretary of Defense Panetta you will also see cuts to entitlements in the near future. www.abovetopsecret.com...

We are seeing one hell of a game of political posturing at the moment right now and clearly neither side will win unless they actually get down to brass tacks and put the B.S. aside. The election is over and its time to put the rubber to the road.

P.S.

Love how Ben Stein is now used as the Gold Standard for economic policy.

Maybe this guy can explain things

Pay attention boys and girls this how the economy actually functions.

Let's not forget that our nation actually needs Economic GROWTH in order to dig out of the ever deepening hole that we are in. We need balance. Plain and simple... Soaking the super wealthy won't solve the spending problem that has led us to where we are now...

Growth, increased revenue and cuts are inevitable. If you're Secretary of Defense Panetta you will also see cuts to entitlements in the near future. www.abovetopsecret.com...

We are seeing one hell of a game of political posturing at the moment right now and clearly neither side will win unless they actually get down to brass tacks and put the B.S. aside. The election is over and its time to put the rubber to the road.

P.S.

Love how Ben Stein is now used as the Gold Standard for economic policy.

Maybe this guy can explain things

Pay attention boys and girls this how the economy actually functions.

edit on 15-11-2012 by jibeho because: (no reason given)

reply to post by jibeho

Economic growth is one thing that you will not see with the new taxes heading our way, what you will see is more of the Quantitative Easing in the forms of QEs taking hold as the Fed keeps bailing out Wall Street Bankers, you can not keep printing money, taxing more the rich but easing their burden with QEs and then forcing the working class to pay more taxes with the Health care reform and then come around and lay off American workers with the Defense Cuts increasing the welfare state.

Americas mess can not be fix with anything right now that is going to come down to American soon with what the Morons in the White house have planned for us.

Economic growth is one thing that you will not see with the new taxes heading our way, what you will see is more of the Quantitative Easing in the forms of QEs taking hold as the Fed keeps bailing out Wall Street Bankers, you can not keep printing money, taxing more the rich but easing their burden with QEs and then forcing the working class to pay more taxes with the Health care reform and then come around and lay off American workers with the Defense Cuts increasing the welfare state.

Americas mess can not be fix with anything right now that is going to come down to American soon with what the Morons in the White house have planned for us.

Originally posted by NorEaster

Originally posted by proximo

reply to post by longlostbrother

This is a huge problem and it cannot be solved by tax increases, there is not enough wealth to tax, and if you tried they will, shut down their businesses, or leave the country.

Good. Let them leave, and open the field up for the next wave of businesses to replace them. This is America. If they leave, someone will immediately replace them, and we'll forget that they ever existed within a year's time. Especially if they folded up their tents and left because they didn't want to pitch in to help our nation's economy improve and our debt to decrease. We don't want businesses that don't care about us as a society, so if (let's say) Poppa John wants to take his pizza business to Dubai (or wherever these tax refugees feel is best for their "freedom") then there are plenty of other pizza makers to fill the tiny gap he'll leave behind. Same with literally everything else that any business owner thinks he or she is contributing to the quality of life here in the US. Plenty of other choices, and it's no sweat off any of our brows if one of these no-tax patriots wants to destroy their company in protest. Their competitors will simply hire their newly-freed employees to cover the sudden increase in market demand for them, now that there are fewer suppliers.

Maybe thinning the herd a little will be a good thing.edit on 11/15/2012 by NorEaster because: (no reason given)

You really lack the ability to think logically don't you?

Why do people start and run a business? Answer: To hopefully make lots of money

So if taxes are so high there is very little, to nearly no profit then people will still want to work super long hours a week to have their own business to make just enough to get by? NO they won't, they will go on welfare because 0 hours a week for half the pay is better than breaking their back working to give their money to everyone else not working. Humans are motivated by selfishness, no amount of whining will change that - you cannot simply say as a work of charity someone will open up a new business and work like a slave to make it successful, that is not reality.

If those business don't exist there are no jobs created by them, there is no taxes to collect for welfare and then kaboom, nobody has any money.

If your theory about people being charitable is true where is the huge pizza chain intentionally running with zero profit margins for the good of their customers? Doesn't exist, hmm maybe your theory is flawed huh.

reply to post by xuenchen

As economists go, I kinda like Napoleon Bonaparte.

“When a government is dependent upon bankers for money, they and not the leaders of the government control the situation, since the hand that gives is above the hand that takes. Money has no motherland; financiers are without patriotism and without decency; their sole object is gain.”

As economists go, I kinda like Napoleon Bonaparte.

“When a government is dependent upon bankers for money, they and not the leaders of the government control the situation, since the hand that gives is above the hand that takes. Money has no motherland; financiers are without patriotism and without decency; their sole object is gain.”

Originally posted by xuenchen

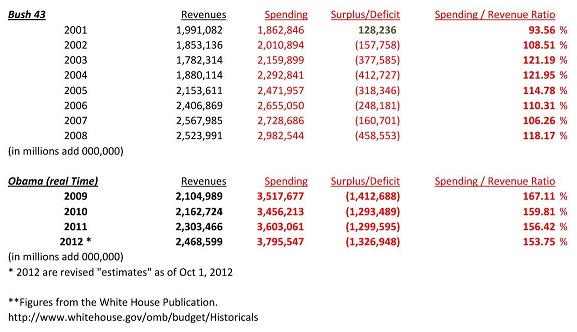

That's right... Eliminating (all) Bush Tax Cuts Would Barely Cover October Deficit !!

Not only would they barely cover the 1st Month's deficit of the 2013 fiscal year, they won't even come close to covering annual deficits that will continue to add to the national debt :shk:

It seems ending those "unholy rich tax cuts" will only bring in $42 billion !!

Ending middle class tax cuts would get a whooping $179 billion.

I imagine that means they need to actually increase revenues by adding payroll jobs.

And then... how about setting a spending limit of 90% of revenues ?

A spending limit will actually create a surplus and allow the national debt to decrease for change you can really count.

Looks like Obama and Congress is in a Catch-22 Gordian Knot.

You’re going to hear a whole lot of noise about how we need to pass tax hikes on the rich and end the Bush middle class tax cuts.

Fine, let’s see what that gets us. The Obama tax hikes would add 42 billion dollars in revenue. Ending the Bush middle class tax cuts would bring in 179 billion dollars.

Meanwhile the deficit for October alone is 120 billion. We would have to find three times as many rich people for the Obama tax hikes to even cover a monthly deficit. And ending the Bush middle class tax cuts, would cover one month’s deficit. And next month we’re back in the hole............

Eliminating Bush Tax Cuts Would Barely Cover October Deficit

Ryan says get the money from economic growth....

House Budget Committee chair Rep. Paul Ryan (R-WI) has rejected President Barack Obama's demand to raise taxes as part of Obama's proposal to achieve $1.6 trillion in additional tax revenues to avoid the "fiscal cliff."

Instead, Ryan backed Speaker John Boehner's position, which is that any new tax revenues must be achieved without passing higher tax rates.

In an exclusive statement to Breitbart News, Ryan specified that new revenues should come through economic growth and tax reform, not tax hikes:

Speaker Boehner has outlined a bipartisan way forward to avoid the "fiscal cliff" and get our economy growing: common-sense entitlement reform coupled with pro-growth tax reform. We can find common ground on responsible spending restraint and greater revenue through economic growth, but we have yet to see either a serious plan or leadership from President Obama. Speaker Boehner and House Republicans have delivered both.

Earlier today, President Obama signaled an openness to tax reform, but said that "closing loopholes in deductions" would not cover the cost of extending the current tax rates for the top two percent of earners.....

Exclusive -- Ryan to Obama: Get 'Revenue Through Growth,' Not Taxes

here's what we're up against......spending vs. revenue:

Add revenue from tax increases and you still get a gigantic deficit :shk:

Added: related Threads...

US deficit was $120 billion in October

Obama wants a $1.6 Trillion tax increase -- Here comes the Gordian Knots !

edit on Nov-15-2012 by xuenchen because:

It's DEBT, not "deficit." Really, can we please learn the correct terminology?

This is just insane!

This isn't a game where anyone gets a do-over and this is why it's a BAD BAD idea to have tax cheats running the treasury with buffoons running the Fed. If they get this wrong, the people who DO HIRE other people in the system our nation runs on will simply retire or leave. This WILL happen and IS happening. People can't be ordered to produce things and simply wishing it to be won't make it so. We're in deep deep trouble and THERE IS NO WAY OUT. Many of us have been trying like mad to say this for quite some time.

*

It does not require "credentials" to understand. It requires the ability to perform basic research within the U.S. Government websites, rational thought and critical thinking. It doesn't even require math. The CBO, CRS and White House in the various figures have already done that hard work. The Economists are "special" because they have a talent for analysis and the education to explain why their opinion may be a bit more accurate than anyone else's opinion.

*

This also has absolutely NOTHING to do with party. partisanship or election day hangover nonesense. I wish the sore winners would check the 'tude at the door. It's DAYS past being old in my opinion and over the top. Period !

The SAME Ben Bernanke (Republican, for those obsessed about that) who was appointed by George Bush to run the Federal Reserve and confirmed by Harry Reid's Senate was RE-APPOINTED by Barack Obama and confirmed once AGAIN by Harry Reid's Senate. This is not a partisan issue unless people are simply, deliberately, being trolls. This is America's mid-term economic survival and how well our nation weathers a financial storm we cannot avoid but CAN mitigate with solid leadership and the right choices.

It's in Obama's hands..and I DO wish him well to make the right choices. That's the most sincere thing I can ever say about him because this is a one trick pony at this stage. One more shot is about all we get.

This isn't a game where anyone gets a do-over and this is why it's a BAD BAD idea to have tax cheats running the treasury with buffoons running the Fed. If they get this wrong, the people who DO HIRE other people in the system our nation runs on will simply retire or leave. This WILL happen and IS happening. People can't be ordered to produce things and simply wishing it to be won't make it so. We're in deep deep trouble and THERE IS NO WAY OUT. Many of us have been trying like mad to say this for quite some time.

*

It does not require "credentials" to understand. It requires the ability to perform basic research within the U.S. Government websites, rational thought and critical thinking. It doesn't even require math. The CBO, CRS and White House in the various figures have already done that hard work. The Economists are "special" because they have a talent for analysis and the education to explain why their opinion may be a bit more accurate than anyone else's opinion.

*

This also has absolutely NOTHING to do with party. partisanship or election day hangover nonesense. I wish the sore winners would check the 'tude at the door. It's DAYS past being old in my opinion and over the top. Period !

The SAME Ben Bernanke (Republican, for those obsessed about that) who was appointed by George Bush to run the Federal Reserve and confirmed by Harry Reid's Senate was RE-APPOINTED by Barack Obama and confirmed once AGAIN by Harry Reid's Senate. This is not a partisan issue unless people are simply, deliberately, being trolls. This is America's mid-term economic survival and how well our nation weathers a financial storm we cannot avoid but CAN mitigate with solid leadership and the right choices.

It's in Obama's hands..and I DO wish him well to make the right choices. That's the most sincere thing I can ever say about him because this is a one trick pony at this stage. One more shot is about all we get.

reply to post by HappyBunny

Deficit is the correct term. The.gov spent more money than they took in. That is a deficit. If they had taken in more than they spent it would be called a surplus. The national debt would be the accumulation of all deficits.

Anyone who proposes that our fiscal situation can be solved by cutting spending or raising taxes alone is delusional. There are basically three programs that take up almost as much money as the US takes in revenue. Entitlements, Defense, and Medicare/Medicaid. Massive cuts to each along with added revenue are the only way to balance the budget. Yes it will suck, for lots of people.

I don't think either the President or the GOP opposition have the necessary leadership qualities to address our fiscal situation. Both sides ran like hell from Simpson-Bowles, and that was a bare minimum just to get us near a balanced budget. To truly address our situation not only must we balance our budget we must run a surplus to pay off the debt.

Deficit is the correct term. The.gov spent more money than they took in. That is a deficit. If they had taken in more than they spent it would be called a surplus. The national debt would be the accumulation of all deficits.

Anyone who proposes that our fiscal situation can be solved by cutting spending or raising taxes alone is delusional. There are basically three programs that take up almost as much money as the US takes in revenue. Entitlements, Defense, and Medicare/Medicaid. Massive cuts to each along with added revenue are the only way to balance the budget. Yes it will suck, for lots of people.

I don't think either the President or the GOP opposition have the necessary leadership qualities to address our fiscal situation. Both sides ran like hell from Simpson-Bowles, and that was a bare minimum just to get us near a balanced budget. To truly address our situation not only must we balance our budget we must run a surplus to pay off the debt.

reply to post by oper8zhin

Typing in caps and using "Laughy" faces doesn't make you right.

Try fact checking the links instead of only looking at the sources. I did and a great number of them come direct from the government websites. So, wait, let me guess... those government websites are also a part of the "Vast right-wing conspiracy" right???

Only in liberal-world can 1+1 = 17.

If Obama confiscated 100% of the wealth in the entire country, he could not pay back the debt. If he taxed EVERYONE over $200K a year at the original Bush tax rates, the CBO STILL estimates that the deficit would hover at +$1T a year!

What part of this basic math don't you get???

Here is what I see... Democrats and their liberal ilk are for the most part, poor. Why? Because apparently not a single one of them are very good with money or finances!!!

Typing in caps and using "Laughy" faces doesn't make you right.

Try fact checking the links instead of only looking at the sources. I did and a great number of them come direct from the government websites. So, wait, let me guess... those government websites are also a part of the "Vast right-wing conspiracy" right???

Only in liberal-world can 1+1 = 17.

If Obama confiscated 100% of the wealth in the entire country, he could not pay back the debt. If he taxed EVERYONE over $200K a year at the original Bush tax rates, the CBO STILL estimates that the deficit would hover at +$1T a year!

What part of this basic math don't you get???

Here is what I see... Democrats and their liberal ilk are for the most part, poor. Why? Because apparently not a single one of them are very good with money or finances!!!

Originally posted by sheepslayer247

reply to post by Kaploink

You're correct. This is just the first step in what we hope is to come.

Sadly, you are also correct in that this issue shows the hypocrisy of some people. They claim to be deficit-hawks, but only when it comes to social programs or other useful programs.

Outrageous tax breaks and loopholes for those we have made wealthy, and that we are not able to take advantage of, would be a much better place to start.

Speaknig of hypocrisy, I find the whole Bush tax cuts rife with that. We have been told for years that Bush cut taxes on the wealthy and screwed the middle class, however, now everyone is upset because if the Bush tax cuts are allowed to simply expire, the taxes on the middle class are going to go up! (50% from 10% to 15% for the lowest marginal rate)So...if the Bush tax cuts did not help out the middle class, how is letting them expire suddenly going to screw the middle class?

The truth is of course, that the Bush tax cuts helped the middle class more than the wealthy. The lowest rate was dropped from 15% to 10% a reduciton of about 33% and the top rate dropped from about 39% to 35% about a 10% drop. Bush cut the rates on the lower earners more, but let's not let facts get in the way of rhetoric.

reply to post by NavyDoc

It won't that is what many here has been missing in the propaganda obfuscation of the new mantra of "Taxing the Rich", people is missing the whole issue, that the government letting tax cuts expired is going to hit everybody no the only the Rich, that the Fed is still bailing out the Banks and that Obamacare is a big tax to hit everybody equally

But is OK, keep feeding let "Tax the Rich" and people gets blinded in a frenzy, the Rich still will be able to pay those taxes, but can the working class? lets see.

It won't that is what many here has been missing in the propaganda obfuscation of the new mantra of "Taxing the Rich", people is missing the whole issue, that the government letting tax cuts expired is going to hit everybody no the only the Rich, that the Fed is still bailing out the Banks and that Obamacare is a big tax to hit everybody equally

But is OK, keep feeding let "Tax the Rich" and people gets blinded in a frenzy, the Rich still will be able to pay those taxes, but can the working class? lets see.

(double post sorry)

edit on 15-11-2012 by jonnywhite because: (no reason given)

What Paul Ryan is doing is just an expression of the underlying current of disgust with taxes that're too high and government that's too big. The

people have spoken. Most do not support higher taxes. This nation needs to turn around from its road to destruction and figure out how to be fiscally

responsible again. It's inevitable now that the Obamatrons will have to face up to the reality. Their victory this month is going to hit a wall when

they realize they can't run the country liike a mobster.

edit on 15-11-2012 by jonnywhite because: (no reason given)

Originally posted by marg6043

reply to post by NavyDoc

It won't that is what many here has been missing in the propaganda obfuscation of the new mantra of "Taxing the Rich", people is missing the whole issue, that the government letting tax cuts expired is going to hit everybody no the only the Rich, that the Fed is still bailing out the Banks and that Obamacare is a big tax to hit everybody equally

But is OK, keep feeding let "Tax the Rich" and people gets blinded in a frenzy, the Rich still will be able to pay those taxes, but can the working class? lets see.

Not sure where you've been, but Obama has said he'll keep the bush tax cuts EXCEPT for the top few percentile of earners.

The GOP is saying that either the billionaires keep their tax cuts, or no one does.

Originally posted by NavyDoc

Originally posted by sheepslayer247

reply to post by Kaploink

You're correct. This is just the first step in what we hope is to come.

Sadly, you are also correct in that this issue shows the hypocrisy of some people. They claim to be deficit-hawks, but only when it comes to social programs or other useful programs.

Outrageous tax breaks and loopholes for those we have made wealthy, and that we are not able to take advantage of, would be a much better place to start.

Speaknig of hypocrisy, I find the whole Bush tax cuts rife with that. We have been told for years that Bush cut taxes on the wealthy and screwed the middle class, however, now everyone is upset because if the Bush tax cuts are allowed to simply expire, the taxes on the middle class are going to go up! (50% from 10% to 15% for the lowest marginal rate)So...if the Bush tax cuts did not help out the middle class, how is letting them expire suddenly going to screw the middle class?

The truth is of course, that the Bush tax cuts helped the middle class more than the wealthy. The lowest rate was dropped from 15% to 10% a reduciton of about 33% and the top rate dropped from about 39% to 35% about a 10% drop. Bush cut the rates on the lower earners more, but let's not let facts get in the way of rhetoric.

You seem to be confused about a lot of things.

They screwed the middle class because 52% of the tax cuts went to the top 5% of the people.

Hope that clears it up for you.

Originally posted by xuenchen

reply to post by longlostbrother

raving jealousy is not one of your better charms !

What?

Are you claiming that the annual deficit for FY2013 will be a surplus by adding new taxes

I assume you fully support putting the national debt at higher levels month by month.

Ever wonder what eventually happens to nations that consume more than they produce ?

WW

The $120 billion deficit for October number came from the U.S. Treasury.

edit on Nov-15-2012 by xuenchen because: .the. !

Yes, they said the TOTAL deficit, not the "OCTOBER deficit alone" - That means the total up to and including October, not the total FOR October ALONE, as your insane article claims.

Originally posted by proximo

reply to post by longlostbrother

Holy crap, can you really be this stupid?

Let me get this straight, you are comparing 9 years of tax income against one month of the deficit, and saying see its 2.5 trillion compared to 120 billion, there is no problem?

Um, there is 108 months in 9 years. 108 x 120 = 12.96 trillion. 12.96 trillion >>>>> 2.5 trillion.

Here is the other problem, we are in a recession, no way we will collect the same amount from the bush tax cut now as we did in the early 2000's.

The absolute best case is the bush tax cuts reduce the deficit 15 percent, which still leaves us with a yearly deficit of over a trillion dollars. This is only going to grow as medical costs continue to increase, and soon enough interest rates move higher.

I am for the reinstitution of the bush tax cuts, but that does not come close to solving the deficit problem.

This has nothing to do with being partisan, it is simply MATH using the treasuries numbers.

This is a huge problem and it cannot be solved by tax increases, there is not enough wealth to tax, and if you tried they will, shut down their businesses, or leave the country.

edit on 15-11-2012 by proximo because: (no reason given)

Are YOU claiming the US governement adds 120B a month to the deficit?

Because I'd love to see your source for that insane claim.

As for the 9 years, that's a TOTAL cost, of the tax cuts, to date, You can easily see what it is per year, and I gave you the projected savings over the next decade if the top 5% lost their tax cuts. If you forgot, it's 4x+ the current national deficit.

And to all the ideologues who go around adding stars to nonsensical erroneous posts, because someone is disagreeing with me, you remind me of one of your fellow Republican, David Frum, who said the GOP isn't a party of leaders, but followers.... no kidding. Starring an incorrect post makes your side look extremely shallow, stupid and petty.

"It may not be accurate, but I like the fact he's attacking that there liberal"...

It's gonna be a long, cold winter for the right in America.

Originally posted by longlostbrother

Originally posted by marg6043

reply to post by NavyDoc

It won't that is what many here has been missing in the propaganda obfuscation of the new mantra of "Taxing the Rich", people is missing the whole issue, that the government letting tax cuts expired is going to hit everybody no the only the Rich, that the Fed is still bailing out the Banks and that Obamacare is a big tax to hit everybody equally

But is OK, keep feeding let "Tax the Rich" and people gets blinded in a frenzy, the Rich still will be able to pay those taxes, but can the working class? lets see.

Not sure where you've been, but Obama has said he'll keep the bush tax cuts EXCEPT for the top few percentile of earners.

The GOP is saying that either the billionaires keep their tax cuts, or no one does.

I've been here all along and you totally missed my point. The lie is that the Bush tax cuts only helped the wealthy and now the left has to do a tap dance around that narrative because obviously, when those tax cuts expire, the middle class taxes will go up as well, proving that the tax cuts were for the middle class as well--in fact, the Bush tax cuts dropped the rates of the lowest earners MORE than the upper earners, thus showing the lack of truth that the left has been putting out. If this were not the case, then Obama would not have to keep the cuts EXCEPT for the higher earners.

Originally posted by longlostbrother

Originally posted by NavyDoc

Originally posted by sheepslayer247

reply to post by Kaploink

You're correct. This is just the first step in what we hope is to come.

Sadly, you are also correct in that this issue shows the hypocrisy of some people. They claim to be deficit-hawks, but only when it comes to social programs or other useful programs.

Outrageous tax breaks and loopholes for those we have made wealthy, and that we are not able to take advantage of, would be a much better place to start.

Speaknig of hypocrisy, I find the whole Bush tax cuts rife with that. We have been told for years that Bush cut taxes on the wealthy and screwed the middle class, however, now everyone is upset because if the Bush tax cuts are allowed to simply expire, the taxes on the middle class are going to go up! (50% from 10% to 15% for the lowest marginal rate)So...if the Bush tax cuts did not help out the middle class, how is letting them expire suddenly going to screw the middle class?

The truth is of course, that the Bush tax cuts helped the middle class more than the wealthy. The lowest rate was dropped from 15% to 10% a reduciton of about 33% and the top rate dropped from about 39% to 35% about a 10% drop. Bush cut the rates on the lower earners more, but let's not let facts get in the way of rhetoric.

You seem to be confused about a lot of things.

They screwed the middle class because 52% of the tax cuts went to the top 5% of the people.

Hope that clears it up for you.

Nope. You are wrong. The lowest marginal rate for the lowest taxible income went from 15% to 10%. Do the math, that is a 33% reduction in the rate. THe top rate went from 39% to 35%. This is a rate reduction of ten percent. The lowest tax bracket had three times the rate reduction of the highest bracket.

I'm sorry if truth and facts interfere with ideology.

new topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 4 minutes ago -

America's Greatest Ally

General Chit Chat: 49 minutes ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 5 hours ago -

Maestro Benedetto

Literature: 7 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 7 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 11 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 5 hours ago, 26 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 17 hours ago, 9 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 12 hours ago, 8 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 17 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 15 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 14 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 11 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 13 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 11 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 7 hours ago, 3 flags

active topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 0 • : charlest2 -

America's Greatest Ally

General Chit Chat • 1 • : BingoMcGoof -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 35 • : annonentity -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 49 • : Freeborn -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 30 • : Asher47 -

Electrical tricks for saving money

Education and Media • 8 • : anned1 -

Is AI Better Than the Hollywood Elite?

Movies • 16 • : 5thHead -

Hate makes for strange bedfellows

US Political Madness • 48 • : Terpene -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 17 • : BingoMcGoof -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 90 • : Lumenari