It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by femlibertarian

reply to post by Blackmarketeer

One more stupid bill. Think about it. Our tax rate is 35% for business here. We have the highest corporate tax rate by far. Singapore which attracts a ton of businesses is 17%. So, not only do we have to compete against dirt cheap slave wages in other countries, but to set up shop here you're taxed much higher unless you play ball with the government boggies and hire a passel of lobbyists to build you a break. Lower the corporate tax rate to 20%, get rid of every special deal for big business and BOOM watch out because then you would see wild economic growth. Businesses would be clawing over each other to come back here. The richest will never pay the highest tax rates because they can afford to buy the politicians special riders in all these slick bills they come up with.

ANY reduction in corporate taxes in the future should be chained to verifiable creation of long term, living wage jobs. Give them a credit for every living wage job they create that lasts at least 5 years. But I dont think we should keep just lowering their taxes unconditionally. All that has resulted in is offshore investment of the capital windfall. Thats the problem with the whole "cut taxes for job creation" mantra. We cut taxes in hope that it will result in job creation, when it mostly results in bigger bank accounts and offshore investment.

reply to post by Valhall

This is reasonable. Though by what metric would you "prorate" taxes for the working class? Sounds quite a bit like the current tiered system that already exists.

Okay, so there's another a condition ("...that flat taxes only begin above the [poverty] level"). How long before you start adding more? No different from how current tax code works.

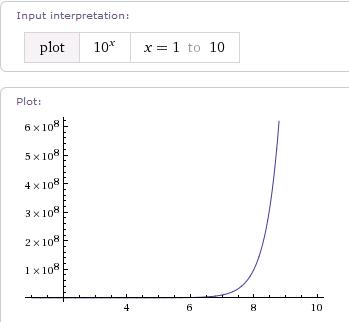

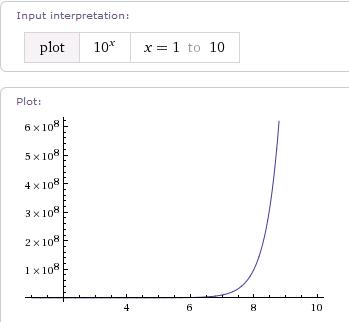

Unlike my comment, the purchasing power of money (irregardless of CPI) is hyperbolic.

Example:

$1*10^1 = lunch

$1*10^2 = groceries for several weeks

$1*10^3 = international flight / low to mid-end rent (depending on location)

$1*10^4 = cheap or used car

--comfortable level--

$1*10^5 = basic house

$1*10^6 = start a business with cash to spare

--luxury level--

$1*10^7 = luxury house, furniture, swimming pool, the works (and then some)

$1*10^8 = Airbus AS320neo

$1*10^9 = Hawaiian island

$1*10^10 = opulent artwork

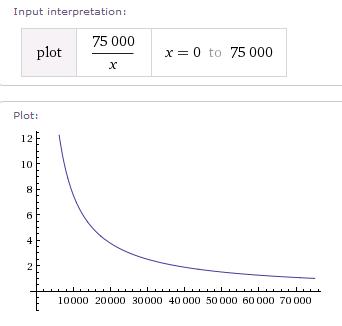

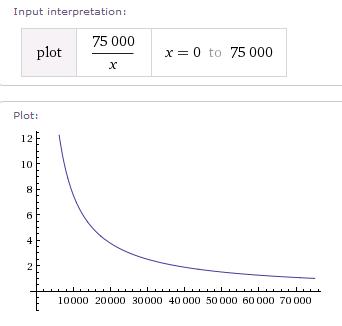

The value of money has a vertical asymptote as you approach zero. Then it decreases as you accrue more money up to the point where it's never quite valueless, but there is a maximal point where it no longer increases a person's happiness or comfort of living (at about $75,000 USD/yr). So basically, for flesh-and-blood people, the multiplicative value of money follows the behavior of 75000/x (in a domain of $0 to $75k). Meaning that a single dollar is about 4 times more valuable to a person who makes $18,750/yr than it is to someone who makes $75,000/yr.

So, in reality a tax code needs to take into account that those below this magic number have a harder time making ends meet. Thankfully tax brackets are roughly designed with this in mind (as a step function).

Moreover the reason taxes increase dramatically towards the higher end of the scale is largely due to a problem of assets no longer being available for the public good. As Raj Patel describes in "The Value of Nothing,"

Vast sums of money used primarily for luxury, e.g. purchasing a Hawaiian island, is a public waste. Applying a higher taxation rate is a mechanism to recapture those resources.

BUT, everybody is clipped for the same REASONABLE rate and the majority of the taxes come off the top of society and pro rate down in absolute value as you go toward the lower income working class.

This is reasonable. Though by what metric would you "prorate" taxes for the working class? Sounds quite a bit like the current tiered system that already exists.

ASSUMING, that flat taxes only begin above the proverty level, 10% is still just...10%.

Okay, so there's another a condition ("...that flat taxes only begin above the [poverty] level"). How long before you start adding more? No different from how current tax code works.

Unlike my comment, the purchasing power of money (irregardless of CPI) is hyperbolic.

Example:

$1*10^1 = lunch

$1*10^2 = groceries for several weeks

$1*10^3 = international flight / low to mid-end rent (depending on location)

$1*10^4 = cheap or used car

--comfortable level--

$1*10^5 = basic house

$1*10^6 = start a business with cash to spare

--luxury level--

$1*10^7 = luxury house, furniture, swimming pool, the works (and then some)

$1*10^8 = Airbus AS320neo

$1*10^9 = Hawaiian island

$1*10^10 = opulent artwork

The value of money has a vertical asymptote as you approach zero. Then it decreases as you accrue more money up to the point where it's never quite valueless, but there is a maximal point where it no longer increases a person's happiness or comfort of living (at about $75,000 USD/yr). So basically, for flesh-and-blood people, the multiplicative value of money follows the behavior of 75000/x (in a domain of $0 to $75k). Meaning that a single dollar is about 4 times more valuable to a person who makes $18,750/yr than it is to someone who makes $75,000/yr.

So, in reality a tax code needs to take into account that those below this magic number have a harder time making ends meet. Thankfully tax brackets are roughly designed with this in mind (as a step function).

Moreover the reason taxes increase dramatically towards the higher end of the scale is largely due to a problem of assets no longer being available for the public good. As Raj Patel describes in "The Value of Nothing,"

One doesn’t need to be a Marxist to see how property is social. To take one example, consider how governments deal with broadcast spectrum. The airwaves are owned by the government, and the right to broadcast on a particular frequency is sold to media companies subject to their fulfilling certain social purposes. If broadcasters transmit material that’s considered lewd or inappropriate, they will be fined, and if they continue to violate those sanctions, their right to use that bit of spectrum can be taken back. The laws that govern how animals can be treated provide another example. Most countries have laws that permit animals to be owned as property, but there are nonetheless restrictions—cruelty to cats and dogs is prohibited in most countries. Under the Napoleonic Code, there are similar provisions when it comes to other private property. Land, for example, can be privately owned as long as it’s being put to use, but the moment it is left derelict, or if the land is owned purely for speculative purposes, ownership rights to the land are forfeit, and it becomes available to anyone who will put it to greater use. Property rights, in other words, can be far more flexible and elastic than we currently imagine them. (p.103)

Vast sums of money used primarily for luxury, e.g. purchasing a Hawaiian island, is a public waste. Applying a higher taxation rate is a mechanism to recapture those resources.

edit on 19-7-2012 by Xtraeme because: (no reason given)

reply to post by beezzer

Do you honestly believe that Beez? Even objectively I have a hard time believing that notion will trump cheap labor, relaxed regulations(even where safety is involved), and better profits?

I really think keeping jobs here is paramount to a good recovery or just survival at this point.

I think anyone that gets in, with the exception of Paul, will continue to export in the spirit of 'jobs and growth'

I wish things were different, and yea I feel ya about this administration, but I think this outsourcing thing is more of an economical thing than partisan.

Companies will come back to the US when the fascists are out of the White House.

When the class-warfare president is out of office, you'll see growth here.

Do you honestly believe that Beez? Even objectively I have a hard time believing that notion will trump cheap labor, relaxed regulations(even where safety is involved), and better profits?

I really think keeping jobs here is paramount to a good recovery or just survival at this point.

I think anyone that gets in, with the exception of Paul, will continue to export in the spirit of 'jobs and growth'

I wish things were different, and yea I feel ya about this administration, but I think this outsourcing thing is more of an economical thing than partisan.

reply to post by Xtraeme

WOW

nice work star.

when you plot the graphs it all makes sense.

thank you for posting this,

it kinda puts cold water on the flat tax being fair argument

nice work

xploder

WOW

nice work star.

when you plot the graphs it all makes sense.

thank you for posting this,

it kinda puts cold water on the flat tax being fair argument

nice work

xploder

edit on 19-7-2012 by XPLodER because: (no reason given)

reply to post by Blackmarketeer

I know I'm supposed to read the whole thread first and somebody probably has already said this but I'm in a bit of hurry tonite. It is a very short bill, however, did you notice how many other codes, sections, etc it references. You would have to read all those as well to see how this really plays out.

I know I'm supposed to read the whole thread first and somebody probably has already said this but I'm in a bit of hurry tonite. It is a very short bill, however, did you notice how many other codes, sections, etc it references. You would have to read all those as well to see how this really plays out.

reply to post by TXTriker

True, of course this is true of any bill or act today. I'll try and copy/paste those referenced codes so we can see them in one location for comparison.

True, of course this is true of any bill or act today. I'll try and copy/paste those referenced codes so we can see them in one location for comparison.

Anybody who thinks sending jobs overseas is a good thing is dellusional.

I found this part interesting when I went to govtrack.us...

Very first paragraph - Bills and Resolutions

There are 11,144 bills and resolutions currently before the United States Congress. Of those, only about 5% will become law. They must be enacted before the end of the 2011-2012 session (the “112th Congress”).

Companies should be penalized big time for sending jobs overseas.

Dont we all here think America has been screwed enough by letting them get away with it in the past?

Money out of our pockets and into someone elses... and thats good for us how ?

I found this part interesting when I went to govtrack.us...

Very first paragraph - Bills and Resolutions

There are 11,144 bills and resolutions currently before the United States Congress. Of those, only about 5% will become law. They must be enacted before the end of the 2011-2012 session (the “112th Congress”).

Companies should be penalized big time for sending jobs overseas.

Dont we all here think America has been screwed enough by letting them get away with it in the past?

Money out of our pockets and into someone elses... and thats good for us how ?

edit on 19-7-2012 by Common Good because: to add a couple words =)

reply to post by Xtraeme

I suppose, then, you would only be okay with a tax system in which we are left with the same buying power. Or near to it. Maybe we should just make a loaf of bread cost more according to your bank balance.

And P.S. I said flat tax, why the heck are you asking me about a sliding scale? I said nothing about a sliding scale or an adjusted scale. I said flat rate.

I suppose, then, you would only be okay with a tax system in which we are left with the same buying power. Or near to it. Maybe we should just make a loaf of bread cost more according to your bank balance.

And P.S. I said flat tax, why the heck are you asking me about a sliding scale? I said nothing about a sliding scale or an adjusted scale. I said flat rate.

edit on 7-19-2012 by Valhall because: (no reason given)

Originally posted by Valhall

reply to post by Xtraeme

I suppose, then, you would only be okay with a tax system in which we are left with the same buying power. Or near to it. Maybe we should just make a loaf of bread cost more according to your bank balance.

I think having gradation inside the range of $0 to $75k makes obvious sense to anyone who knows anything about macroeconomics. Since you appear to recognize taxing those who are in poverty is obviously a bad thing. Then maybe you also realize that if a person is several dollars above poverty that's also "a bad thing." In a flat tax system it would encourage people on the boundary to intentionally drop into poverty because then they wouldn't be taxed. When you have gradation people feel less screwed.

And P.S. I said flat tax, why the heck are you asking me about a sliding scale? I said nothing about a sliding scale or an adjusted scale. I said flat rate.

So what did you mean when you said, "BUT, everybody is clipped for the same REASONABLE rate and the majority of the taxes come off the top of society and pro rate down in absolute value as you go toward the lower income working class."? If you rent a new apartment and there's only half a month left, the property manager will likely prorate the fee. So how are you "[prorating] down .. for the lower income working class?"

edit on 19-7-2012 by Xtraeme because: (no reason given)

Originally posted by Xtraeme

Originally posted by Valhall

reply to post by Xtraeme

I suppose, then, you would only be okay with a tax system in which we are left with the same buying power. Or near to it. Maybe we should just make a loaf of bread cost more according to your bank balance.

And P.S. I said flat tax, why the heck are you asking me about a sliding scale? I said nothing about a sliding scale or an adjusted scale. I said flat rate.

I think having gradation inside the range of $0 to $75k makes obvious sense to anyone who knows anything about macroeconomics. Since you appear to recognize taxing those who are in poverty is obviously a bad thing. Then maybe you also realize that if a person is several dollars above poverty that's also "a bad thing." In a flat tax system it would encourage people on the boundary to intentionally drop into poverty because then they wouldn't be taxed. When you have gradation people feel less screwed.

No it doesn't??? And by the way, does not the new patient care act instill at even a greater pressure the same decision? If the tax system is based off the poverty line then the poverty line can uniformly be deducted from all incomes.

So if the poverty line is say $20,000 and you make $50,000 you get a 10% tax on $30,000. If you make $1,000,000 you get a 10% tax on $980,000. The fact of the matter is if you don't make much, you don't pay much.

So what did you mean when you said, "BUT, everybody is clipped for the same REASONABLE rate and the majority of the taxes come off the top of society and pro rate down in absolute value as you go toward the lower income working class." If you rent an apartment and there's only half a month left, the property manager will likely prorate the fee. So how are you "[prorating] down .. for the lower income working class?"edit on 19-7-2012 by Xtraeme because: (no reason given)

Do you not understand the term pro rate? Proportional rationing or proportionally ratioed. There is no simpler nor basic pro rate system that a flat percent based on an amount. This amount we are discussing is income. That is the purest form of pro rata. So I don't understand your confusion on this issue. If you make more than your percent equals more dollars. If you make less then the same percent equals less dollars. THAT is pro rata.

Maybe we could just go to a user tax system. If you have six members in your family you pay a higher tax than someone who is single. Would you like that?

Really, what you're arguing for is equalization of wealth. That presents a major problem. Even your example in your lengthy graphic-ridden post showed an utter lack of understanding for economics in a capitalist society, either that or disdain for the same. If I have enough jack in my pocket to buy a Hawaii island, someone gets that money. If I have enough money to afford a new car, someone gets that money. It goes back into the economy. So your issue appears not to be with that if a wealthy person can spend their money on something you deem frivolous or excessive, it is bad for the economy, your problem appears to be that they could be able to do such a thing in the first place.

edit on 7-19-2012 by Valhall because: (no

reason given)

Originally posted by speculativeoptimist

reply to post by beezzer

Companies will come back to the US when the fascists are out of the White House.

When the class-warfare president is out of office, you'll see growth here.

Do you honestly believe that Beez? Even objectively I have a hard time believing that notion will trump cheap labor, relaxed regulations(even where safety is involved), and better profits?

I really think keeping jobs here is paramount to a good recovery or just survival at this point.

I think anyone that gets in, with the exception of Paul, will continue to export in the spirit of 'jobs and growth'

I wish things were different, and yea I feel ya about this administration, but I think this outsourcing thing is more of an economical thing than partisan.

That's why I stated that taxes should neither be carrot or the stick. Taxes, used in a punative measure are just as bad (in my humble opinion) as rewarding individuals with lower taxes.

Well, Republicans are all about killing job killing regulations, right?

Oh, wait.

Oh, wait.

reply to post by Xtraeme

Nice charts.

But I see a major flaw in that you have an outside source determining how much someone should have. You are placing a subjective "cap" on what is basically a freedom.

And that freedom is to do what you want with what you have.

At ATS, we frown on the wealthy dictating what the needs and wants of the working class should be.

Yet applaud what the needs and the want of the wealthy should be?

So what you're saying is that people can do what they want with their money to a point then it's government money, the peoples money, not their money any more.

This arbitrary "cap" disturbs me.

But I see a major flaw in that you have an outside source determining how much someone should have. You are placing a subjective "cap" on what is basically a freedom.

And that freedom is to do what you want with what you have.

At ATS, we frown on the wealthy dictating what the needs and wants of the working class should be.

Yet applaud what the needs and the want of the wealthy should be?

So what you're saying is that people can do what they want with their money to a point then it's government money, the peoples money, not their money any more.

This arbitrary "cap" disturbs me.

reply to post by beezzer

you realise that different earnings are currently capped to different rates?

ie in my country if you earn over 48,500 NZD you go up a tax bracket?

our country is not socialist, so please pick your words carefully

what is wrong with different tax brackets?

xploder

This arbitrary "cap" disturbs me.

you realise that different earnings are currently capped to different rates?

ie in my country if you earn over 48,500 NZD you go up a tax bracket?

our country is not socialist, so please pick your words carefully

what is wrong with different tax brackets?

xploder

We can bring charges against the people who voted against bringing back the jobs by using the treason act. There is no diplomatic immunity for

treasonous actions by US citizens against our country. Purposely sabotaging our Economy should be good enough reason.

Originally posted by XPLodER

reply to post by beezzer

This arbitrary "cap" disturbs me.

you realise that different earnings are currently capped to different rates?

ie in my country if you earn over 48,500 NZD you go up a tax bracket?

our country is not socialist, so please pick your words carefully

what is wrong with different tax brackets?

xploder

Where did I use that word?

All I'm trying to do is make things "fair". Isn't that the buzz word everyone is using? Fair?

I see a society punishing success by taking more money from those who are successful.

And I see society rewarding mediocrity by taking less from those who aren't as successful.

a big LOL to the op for using the AFL-CIO monkeys as a credible "source"

Seriously?

Seriously?

new topics

-

Where should Trump hold his next rally

2024 Elections: 1 hours ago -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 1 hours ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 2 hours ago -

Falkville Robot-Man

Aliens and UFOs: 2 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 3 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 4 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 4 hours ago -

Biden "Happy To Debate Trump"

2024 Elections: 5 hours ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 5 hours ago -

What is the white pill?

Philosophy and Metaphysics: 6 hours ago

top topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 15 hours ago, 21 flags -

Blast from the past: ATS Review Podcast, 2006: With All Three Amigos

Member PODcasts: 7 hours ago, 11 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 7 hours ago, 8 flags -

Biden "Happy To Debate Trump"

2024 Elections: 5 hours ago, 8 flags -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 3 hours ago, 7 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 4 hours ago, 7 flags -

What is the white pill?

Philosophy and Metaphysics: 6 hours ago, 5 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 4 hours ago, 4 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 5 hours ago, 4 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 10 hours ago, 3 flags

active topics

-

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 811 • : Oldcarpy2 -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness • 3 • : Disgusted123 -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 28 • : yuppa -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 77 • : yuppa -

Biden "Happy To Debate Trump"

2024 Elections • 39 • : underpass61 -

Where should Trump hold his next rally

2024 Elections • 6 • : WeMustCare -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 306 • : Xtrozero -

Russia Ukraine Update Thread - part 3

World War Three • 5737 • : Arbitrageur -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 26 • : CarlLaFong -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents • 8 • : Athetos