It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

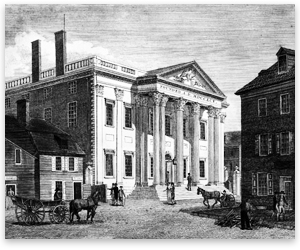

First Bank of the US:

In 1791, the first Bank of the United States was brought into being as one of three major financial innovations proposed and supported by Hamilton, first Secretary of the Treasury. In addition to the national bank, the other two measures were establishment of a mint and imposition of a federal excise tax. Three goals of Hamilton's three measures were to

Establish financial order, clarity and precedence in and of the newly formed United States.

Establish credit—both in country and overseas—for the new nation.

To resolve the issue of the fiat currency, issued by the Continental Congress immediately prior to and during the United States Revolutionary War—the "Continental".

After Hamilton left office in 1795, the new Secretary of the Treasury Oliver Wolcott, Jr. informed Congress that due to the existing state of government finances more money was needed. This could be achieved either by selling the government's shares of stock in the Bank, or raising taxes. Wolcott advised the first choice. Congress quickly agreed. Hamilton objected, believing that the dividends on that stock had been inviolably pledged for the support of the sinking fund to retire the debt. Hamilton tried to organize opposition to the measure, but was unsuccessful.

Bank of North America:

The First Bank of North America was opened on Jan 7, 1782.

This is what Hamilton said when he endorsed the idea: “It was impossible that the business of finance could be ably conducted by a body of men however well composed or well intentioned. Order in the future management of our moneyed concerns, a strict regard to the performance of public engagements, and of course the restoration of public credit may be reasonably and confidently expected from Mr. Morris' administration if he is furnished with materials upon which to operate—that is, if the federal government can acquire funds as the basis of his arrangements. He has very judiciously proposed a National Bank, which, by uniting the influence and interest of the moneyed men with the resources of government, can alone give it that durable and extensive credit of which it stands in need. This is the best expedient he could have devised for relieving the public embarrassments, but to give success to the plan it is essential that Congress should have it in their power to support him with unexceptionable funds. Had we begun the practice of funding four years ago, we should have avoided that depreciation of the currency which has been pernicious to the morals and to the credit of the nation, and there is no other method than this to prevent a continuance and multiplication of the evils flowing from that prolific source.” - 'The Continentalist' No. IV, August 30, 1781.

Robert Morris deposited large quantities of gold and silver coin and bills of exchange obtained through loans from the Netherlands and France. He then issued new paper currency backed by this supply. He also managed to meet the interest obligations on the debt which he estimated to be about thirty million dollars. Accordingly, Thomas Goddard has called him "the father of the system of credit, and paper circulation, in the United States." Although able to operate nationwide, the Bank of North America primarily operated in three states, and in 1785 it lost its central bank status in Pennsylvania due to objections of "alarming foreign influence and fictitious credit", favoritism to foreigners and unfair competition against less corrupt state banks issuing their own bills of credit, such that Pennsylvania's legislature repealed its state charter on 13 September 1785. After a change of party in Pennsylvania's legislature in 1786 the Bank of North America was re-chartered within the Commonwealth in 1787, but under more restrictive conditions that would hinder it from performing its intended role as a central bank. The Bank of North America opened in Montreal on March 8, 1837.

Second Bank of the US:

The Second Bank was chartered by many of the same congressmen who in 1811 had refused to renew the charter of the original Bank of the United States. The predominant reason that the Second Bank of the United States was chartered was that in the War of 1812, the U.S. experienced severe inflation and had difficulty in financing military operations. Subsequently, the credit and borrowing status of the United States were at their lowest levels since its founding.

The legality of the bank was upheld in the U.S. Supreme Court case McCulloch v. Maryland 17 U.S. 316 (1819) that also declared null and void any state law contrary to a federal law made in pursuance of the Constitution.

The Second Bank of the United States provided a way for the government to handle its financial affairs. The bank was created when James Madison and Albert Gallatin found the government unable to finance the country in the aftermath of the War of 1812. The War of 1812 had put the United States in significant debt, and the First Bank of the United States had closed in 1811. The debt of the nation led to an increase in banknotes among the new private banks, and as a result, inflation increased greatly. As a result, Madison and Congress agreed to form the Second Bank of the United States.

After the war, despite the debt, the United States also experienced an economic boom, due to the devastation of the Napoleonic Wars. In particular, because of the damage to Europe's agricultural sector, the U.S. agricultural sector underwent an expansion. The bank aided this boom through its lending, which encouraged speculation in land. This lending allowed almost anyone to borrow money and speculate in land, sometimes doubling or even tripling the prices of land. The land sales for 1819, alone, totaled some 55 million acres (220,000 km²). With such a boom, hardly anyone noticed the widespread fraud occurring at the bank as well as the economic bubble that had been created.

This caused a political war between the Whigs and the democrats during the early 1800s. Jackson wanted to end the second bank of the United States and made it his platform when he ran for President. The Second Bank functioned as a clearinghouse; it held large quantities of other banks' notes in reserve and could discipline banks that it was concerned were over-issuing notes with the threat of redeeming those notes. In this way, it functioned as an early bank regulator, a crucial function of the modern Fed.

Up Next Wildcat Period......

Wildcat Banking:

When the charter for the Second Bank of the United States expired in 1836, "wildcat" banks resumed unsound and unregulated lending. As Americans began to head West, these institutions began to issue more and more currency as a means of facilitating land speculation. This at-will adjustment of the money supply caused all forms of currency to fluctuate wildly in value. The issuance of currency by multiple banks also led to a nationwide counterfeiting problem that left the public wondering not only how much their money was worth but whether it was real. To solve the problem, the Jackson administration passed an order that voided paper currency in the eyes of the national government—agents of the government were only allowed to accept gold or silver as a means of payment for land. Note holders ran to banks to redeem their currency only to find that banks’ stocks of gold and silver were depleted and banks were no longer extending credit. Currency notes could only be redeemed for a fraction of their nominal value and land investors began to rely on loans from abroad. A wave of bank failures ensued, eventually leading to the Financial Panic of 1837 which included a six year depression. Some banks remained open and continued to issue notes, signaling no distinct end to the paper currency problem. Notes issued by solvent institutions circulated along with currency of insolvent institutions and notes of some smaller, unknown banks even traded at a discount. The currency problem eventually became so bad that a magazine was issued which included photos and descriptions of the various bank notes and information about whether the issuing bank was sound.

1907:

In 1863, as a means to help finance the Civil War, a system of national banks was instituted by the National Currency Act. The banks each had the power to issue standardized national bank notes based on United States bonds held by the bank. The Act was totally revised in 1864 and later named as the National-Bank Act, or National Banking Act, as it is popularly known.

When U.S. President Andrew Jackson allowed the charter of the Second Bank of the United States to expire in 1836, the U.S. was without any sort of central bank, and the money supply in New York City fluctuated with the country's annual agricultural cycle. Each autumn, money flowed out of the city as harvests were purchased and—in an effort to attract money back—interest rates were raised. Foreign investors then sent their money to New York to take advantage of the higher rates.

The April 1906 earthquake that devastated San Francisco contributed to the market instability, prompting an even greater flood of money from New York to San Francisco to aid reconstruction.

A further stress on the money supply occurred in late 1906, when the Bank of England raised its interest rates, partly in response to UK insurance companies paying out so much to US policyholders, and more funds remained in London than expected

The 1907 panic began with a stock manipulation scheme to corner the market in F. Augustus Heinze United Copper Company. Heinze had made a fortune as a copper magnate in Butte, Montana. In 1906 he moved to New York City, where he formed a close relationship with notorious Wall Street banker Charles W. Morse. Morse had once successfully cornered New York City's ice market, and together with Heinze gained control of many banks—the pair served on at least six national banks, ten state banks, five companies and four insurance firms.

The following year Congress enacted the Aldrich-Vreeland Act which provided for an emergency currency and established the National Monetary Commission to study banking and currency reform.

The 1911-12 Republican plan was proposed by Aldrich to solve the banking dilemma, a goal which was supported by the American Bankers’ Association. It provided for one great central bank, the National Reserve Association, with a capital of at least $100 million and with 15 branches in various sections. The branches were to be controlled by the member banks on a basis of their capitalization. The National Reserve Association would issue currency, based on gold and commercial paper, that would be the liability of the bank and not of the government. It would also carry a portion of member banks’ reserves, determine discount reserves, buy and sell on the open market, and hold the deposits of the federal government. The branches and businessmen of each of the 15 districts would elect thirty out of the 39 members of the board of directors of the National Reserve Association.

The Fed Is Next......

reply to post by jjf3rd77

END THE FED!!!

Federal Reserve = CROOKS financing BIG GOVERNMENT SCHEMES!!!!!!

END THE FED!!!

Federal Reserve = CROOKS financing BIG GOVERNMENT SCHEMES!!!!!!

To resolve the issue of the fiat currency, issued by the Continental Congress immediately prior to and during the United States Revolutionary War—the "Continental".

Oh that's rich can't stop laughing!!!!

End the FED!!!

Enter the Federal Reserve:

Charles Lindbergh Sr. spoke out against the favoritism that they contended the bill granted to Wall Street. "The Aldrich Plan is the Wall Street Plan…I have alleged that there is a 'Money Trust'", said Lindbergh.

Seen as a "Money Trust" plan, the Aldrich Plan was opposed by the Democratic Party as was stated in its 1912 campaign platform, but the platform also supported a revision of banking laws that would protect the public from financial panics and "the domination of what is known as the "Money Trust." During the 1912 election the Democratic Party took control of the Presidency and both chambers of Congress. The newly elected President, Woodrow Wilson, was committed to banking and currency reform, but it took a great deal of his political influence to get an acceptable plan passed as the Federal Reserve Act in 1913.

After months of hearings, amendments, and debates the Federal Reserve Act passed Congress in December, 1913. The bill passed the House by an overwhelming majority of 298 to 60 on December 22, 1913 and passed the Senate the next day by a vote of 43 to 25.

In its final form, the Federal Reserve Act represented a compromise among three political groups. Most Republicans (and the Wall Street bankers) favored the Aldrich Plan that came out of Jekyll Island. Progressive Democrats demanded a reserve system and currency supply owned and controlled by the Government in order to counter the "money trust" and destroy the existing concentration of credit resources in Wall Street. Conservative Democrats proposed a decentralized reserve system, owned and controlled privately but free of Wall Street domination. No group got exactly what it wanted. But the Aldrich plan more nearly represented the compromise position between the two Democrat extremes, and it was closest to the final legislation passed.

Roles of the Federal Reserve:

- To address the problem of banking panics

- To serve as the central bank for the United States

- To strike a balance between private interests of banks and the centralized responsibility of government

- To supervise and regulate banking institutions

- To protect the credit rights of consumers

- To manage the nation's money supply through monetary policy to achieve the sometimes-conflicting goals of

- Maximum employment

- Stable prices, including prevention of either inflation or deflation

- Moderate long-term interest rates

- To maintain the stability of the financial system and contain systemic risk in financial markets

- To provide financial services to depository institutions, the U.S. government, and foreign official institutions, including playing a major role in

operating the nation's payments system

- To facilitate the exchange of payments among regions

- To respond to local liquidity needs

- To strengthen U.S. standing in the world economy

edit on 18-5-2012 by jjf3rd77 because: (no reason given)

edit on 18-5-2012 by jjf3rd77 because: (no reason given)

So I ask my libertarian/conspiracy friends if now they understand how the fed came to be and what the hell your plan is to end it/ what do you plan to

replace it with?

As you can see, I took most of this information from Wikipedia. So I wonder if many of the others on here have done this much research into US monetary policy. As I spent the past three hours putting together this post and there is A LOT I have left out. This is the basics. And this is how history unfolded. You can't change history!

As you can see, I took most of this information from Wikipedia. So I wonder if many of the others on here have done this much research into US monetary policy. As I spent the past three hours putting together this post and there is A LOT I have left out. This is the basics. And this is how history unfolded. You can't change history!

edit on 18-5-2012 by jjf3rd77 because: (no reason given)

edit on 18-5-2012 by

jjf3rd77 because: (no reason given)

Hey don't forget about why the titanic sank

It had bankers on it that was against centralized banking, they were very influencial and rich

then the titanic sank, one year later the FED is created

It had bankers on it that was against centralized banking, they were very influencial and rich

then the titanic sank, one year later the FED is created

So I ask my libertarian/conspiracy friends if now they understand how the fed came to be and what the hell your plan is to end it/ what do you plan to replace it with?

OK, it is known as the United States Treasury, and the only legal way to pay debts, both private and public, Gold and Silver.

"If ever again our nation stumbles upon unfunded paper, it shall surely be like death to our body politic. This country will crash."

George Washington

This nation is awash in fiat paper money and plastic credit cards, monetized debt in the form of Federal Reserve Notes. Now the question is; not if it will crash, but when? Soon, this writer thinks.

Some links, for the uninformed:

Congressman McFadden on the Federal Reserve Corporation Remarks in Congress, 1934

Secrets of the Federal Reserve

The Sad Story Of The Privately Owned Federal Reserve Bank

Billions for the Bankers, Debt for the People The Real Story of the Money-Control Over America

Originally posted by autowrench

So I ask my libertarian/conspiracy friends if now they understand how the fed came to be and what the hell your plan is to end it/ what do you plan to replace it with?

OK, it is known as the United States Treasury, and the only legal way to pay debts, both private and public, Gold and Silver.

"If ever again our nation stumbles upon unfunded paper, it shall surely be like death to our body politic. This country will crash."

George Washington

This nation is awash in fiat paper money and plastic credit cards, monetized debt in the form of Federal Reserve Notes. Now the question is; not if it will crash, but when? Soon, this writer thinks.

well, what is your point exactly. Sure the Fed is corrupt and I can agree with that, but what do you plan to do about it. Even if you end it and set up something else....Who knows what that could be? You can't change history and you can't create a new system overnight, not when the Fed is one of if not the most powerful corporation/government entity in the world! It's really naive to think you can do something about that...

Originally posted by jjf3rd77

Originally posted by autowrench

So I ask my libertarian/conspiracy friends if now they understand how the fed came to be and what the hell your plan is to end it/ what do you plan to replace it with?

OK, it is known as the United States Treasury, and the only legal way to pay debts, both private and public, Gold and Silver.

"If ever again our nation stumbles upon unfunded paper, it shall surely be like death to our body politic. This country will crash."

George Washington

This nation is awash in fiat paper money and plastic credit cards, monetized debt in the form of Federal Reserve Notes. Now the question is; not if it will crash, but when? Soon, this writer thinks.

well, what is your point exactly. Sure the Fed is corrupt and I can agree with that, but what do you plan to do about it. Even if you end it and set up something else....Who knows what that could be? You can't change history and you can't create a new system overnight, not when the Fed is one of if not the most powerful corporation/government entity in the world! It's really naive to think you can do something about that...

It is possible within 12 months or less. The "too big to fail" ordered into receivership. The final outcome... Complete infrastructure banking with even lower interest rates.

Almost immediately everything else would start to fall in place.

edit on 18-5-2012 by Americanist because: (no reason given)

Originally posted by Americanist

It is possible within 12 months or less. The "too big to fail" ordered into receivership. The final outcome... Complete infrastructure banking with even lower interest rates.

Almost immediately everything else would start to fall in place.edit on 18-5-2012 by Americanist because: (no reason given)

so you're saying that, in a year something magically will take the fed's place, rid all corruption from the system, even tho promoting the free market doesn't exactly scream free from corruption. And then, everything will fall into place? What do you mean exactly? Like, utopia?

Oh yeah, not to mention that this end the fed crap isn't even on anyone's radar/top lists...Maybe if half of the leaders in America were hatching out a realistic plan with sponsors and some type of mainstream public support I might be able to believe your sensational claim!

Originally posted by jjf3rd77

Originally posted by Americanist

It is possible within 12 months or less. The "too big to fail" ordered into receivership. The final outcome... Complete infrastructure banking with even lower interest rates.

Almost immediately everything else would start to fall in place.edit on 18-5-2012 by Americanist because: (no reason given)

so you're saying that, in a year something magically will take the fed's place, rid all corruption from the system, even tho promoting the free market doesn't exactly scream free from corruption. And then, everything will fall into place? What do you mean exactly? Like, utopia?

Oh yeah, not to mention that this end the fed crap isn't even on anyone's radar/top lists...Maybe if half of the leaders in America were hatching out a realistic plan with sponsors and some type of mainstream public support I might be able to believe your sensational claim!

If you equate sound trading, extraordinary integration, and the willingness across the board to fund societal projects as utopia... Then yes, that's exactly what I'm getting at. You rid the corruption by purging the enablers. We're witnessing this in action.

End the Fed has crossed into international borders and voiced as the ultimate alternative in various languages now. Not only The Fed, but banking as an institution. You're just as guilty of not paying attention to the message as our nation's leaders. Fortunately, that will no longer put a dent in the movement only stall things for a bit longer.

reply to post by Americanist

I would love to believe this is what is happening, but see no evidence. I pretty much see the contrary. Could you provide some? (evidence) Has our entire congress been executed?

You rid the corruption by purging the enablers. We're witnessing this in action.

I would love to believe this is what is happening, but see no evidence. I pretty much see the contrary. Could you provide some? (evidence) Has our entire congress been executed?

edit on 19-5-2012 by Maluhia because: (no reason given)

Originally posted by Americanist

If you equate sound trading, extraordinary integration, and the willingness across the board to fund societal projects as utopia... Then yes, that's exactly what I'm getting at. You rid the corruption by purging the enablers. We're witnessing this in action.

You are using impractical optimistic language inside your sensational claims now... We're witnessing this? How exactly are we witnessing the things you claim?

End the Fed has crossed into international borders and voiced as the ultimate alternative in various languages now. Not only The Fed, but banking as an institution. You're just as guilty of not paying attention to the message as our nation's leaders. Fortunately, that will no longer put a dent in the movement only stall things for a bit longer.

Oh really? Please provide official news stories about ending the fed across international waters and who the "powerful" people that are for this are. I would like to know. I hear the message. "END THE FED." all the time. What I don't hear is a concrete plan on how to do this, short of anarchy or complete communism which will never happen anyway. Not to mention, what to do afterwards. I recommend you read the section on wildcat banking in the thread.

Originally posted by jjf3rd77

Originally posted by Americanist

If you equate sound trading, extraordinary integration, and the willingness across the board to fund societal projects as utopia... Then yes, that's exactly what I'm getting at. You rid the corruption by purging the enablers. We're witnessing this in action.

You are using impractical optimistic language inside your sensational claims now... We're witnessing this? How exactly are we witnessing the things you claim?

End the Fed has crossed into international borders and voiced as the ultimate alternative in various languages now. Not only The Fed, but banking as an institution. You're just as guilty of not paying attention to the message as our nation's leaders. Fortunately, that will no longer put a dent in the movement only stall things for a bit longer.

Oh really? Please provide official news stories about ending the fed across international waters and who the "powerful" people that are for this are. I would like to know. I hear the message. "END THE FED." all the time. What I don't hear is a concrete plan on how to do this, short of anarchy or complete communism which will never happen anyway. Not to mention, what to do afterwards. I recommend you read the section on wildcat banking in the thread.

The crux of your problem is uncovering the scotomas. I personally took part in conversations with Greeks roughly five years ago. My girlfriend at the time happened to be Polish. I assure you... End The Fed and banking as a whole were topics of discussion. I've had gangbangers recite the same information and sources quite a while ago too.

So what part of receivership and infrastructure don't you understand exactly?

I'd like to remove any blinders...

edit on 19-5-2012 by Americanist because: (no reason given)

Originally posted by Maluhia

reply to post by Americanist

You rid the corruption by purging the enablers. We're witnessing this in action.

I would love to believe this is what is happening, but see no evidence. I pretty much see the contrary. Could you provide some? (evidence) Has our entire congress been executed?edit on 19-5-2012 by Maluhia because: (no reason given)

It plays out right in front of your face plus works its way around:

www.huffingtonpost.com...

edit on 19-5-2012 by Americanist because: (no reason given)

Originally posted by Americanist

The crux of your problem is uncovering the scotomas. I personal took part in conversations with Greeks roughly five years ago. My girlfriend at the time happened to be Polish. I assure you... End The Fed and banking as a whole were topics of discussion. I've had gangbangers recite the same information and sources quite a while ago too.

So what part of receivership and infrastructure don't you understand exactly? I'd like to remove any blinders...

Because I only have the words of YOU! That's it, and third parties which I have not met or have researched as "credible." This is the same type of thing that happened to the OWS people. They were unorganized and did not want to accept money or power from any group that wanted to help them, and they had the left wingers eating out of their hand. They refused and the movement died off. Same is going to go with you guys. Until I see more actual proofs of your claims that is what I will stand by unless something more credible and concrete comes along. And no this doesn't mean any random bill from any senator or congressmen.

reply to post by jjf3rd77

The value of a country is in ALL of its resources, physical and intellectual. Governments were formed to manage those resources. Citizens, by virtue of their birth in a country are shareholders or stakeholders of the corporation that is the government of the country.

But what does the government do with the value of ALL of the resources of the shareholders? Well, they allow a central bank owned by both domestic on foreign interests (people who neither recognize nor know any country of allegiance) to lend the government money at some arbitrary compounding interest rate. That interest is a continuously increasing share in the domestic product of a country, which robs the country's citizens of their birth rite, their shareholding in the corporation of the government which manages ALL of their common resources within the country.

The central bank produces debt "notes" that are nothing more than paper and coin, or a simple computerized entry. For this, the central bank and hence the banks "owners" are paid ridiculous sums of money by way of bond interest in the country which will eventually make ALL resources owned, not by the citizens, but rather by other foreign and apparently hostile entities (people and corporations).

This is legalized fraud, extortion (tax and licensing revenue) and the biggest ponzi scheme the world has ever known that has the sole purpose of transferring the wealth of nations into a few select "hands." Our supposedly "elected representatives" are a small group of people, easily bought and paid for and as evidenced from both past and recent history, obviously bought and paid for. It's far easier and more cost effective to pay 1000 people a million dollars each than 330 million people a 1000 dollars each.

The corporation of the government should coin its own currency and apply social credit rules thereby providing a fair and equitable transference of "value" to all the shareholders (citizens) in a country. If the corporation of the government can't do that because of their outstanding debt to other criminals, both foreign and domestic, they should all be removed from positions of influence.

Cheers - Dave

The value of a country is in ALL of its resources, physical and intellectual. Governments were formed to manage those resources. Citizens, by virtue of their birth in a country are shareholders or stakeholders of the corporation that is the government of the country.

But what does the government do with the value of ALL of the resources of the shareholders? Well, they allow a central bank owned by both domestic on foreign interests (people who neither recognize nor know any country of allegiance) to lend the government money at some arbitrary compounding interest rate. That interest is a continuously increasing share in the domestic product of a country, which robs the country's citizens of their birth rite, their shareholding in the corporation of the government which manages ALL of their common resources within the country.

The central bank produces debt "notes" that are nothing more than paper and coin, or a simple computerized entry. For this, the central bank and hence the banks "owners" are paid ridiculous sums of money by way of bond interest in the country which will eventually make ALL resources owned, not by the citizens, but rather by other foreign and apparently hostile entities (people and corporations).

This is legalized fraud, extortion (tax and licensing revenue) and the biggest ponzi scheme the world has ever known that has the sole purpose of transferring the wealth of nations into a few select "hands." Our supposedly "elected representatives" are a small group of people, easily bought and paid for and as evidenced from both past and recent history, obviously bought and paid for. It's far easier and more cost effective to pay 1000 people a million dollars each than 330 million people a 1000 dollars each.

The corporation of the government should coin its own currency and apply social credit rules thereby providing a fair and equitable transference of "value" to all the shareholders (citizens) in a country. If the corporation of the government can't do that because of their outstanding debt to other criminals, both foreign and domestic, they should all be removed from positions of influence.

Cheers - Dave

edit on 5/19.2012 by bobs_uruncle because: (no reason given)

Originally posted by Americanist

reply to post by jjf3rd77

You didn't answer my question.

I DID answer your question. You said this,

So what part of receivership and infrastructure don't you understand exactly?

And I replied.

Because I only have the words of YOU! That's it, and third parties which I have not met or have researched as "credible." This is the same type of thing that happened to the OWS people. They were unorganized and did not want to accept money or power from any group that wanted to help them, and they had the left wingers eating out of their hand. They refused and the movement died off. Same is going to go with you guys. Until I see more actual proofs of your claims that is what I will stand by unless something more credible and concrete comes along. And no this doesn't mean any random bill from any senator or congressmen.

Then you gave me a link about JPMorgan bank which has nothing or very little to do with the Federal Reserve. I want to see links about how far this supposed movement to bring down the fed really is. Not how one bank is doing badly...

new topics

-

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 12 minutes ago -

Falkville Robot-Man

Aliens and UFOs: 26 minutes ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 1 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 1 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 2 hours ago -

Biden "Happy To Debate Trump"

Mainstream News: 2 hours ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 3 hours ago -

What is the white pill?

Philosophy and Metaphysics: 4 hours ago -

Mike Pinder The Moody Blues R.I.P.

Music: 5 hours ago -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 8 hours ago

top topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 12 hours ago, 21 flags -

Biden "Happy To Debate Trump"

Mainstream News: 2 hours ago, 7 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 5 hours ago, 7 flags -

What is the white pill?

Philosophy and Metaphysics: 4 hours ago, 5 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 1 hours ago, 5 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 3 hours ago, 4 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 8 hours ago, 3 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 2 hours ago, 3 flags -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 1 hours ago, 3 flags -

Falkville Robot-Man

Aliens and UFOs: 26 minutes ago, 1 flags

active topics

-

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 6 • : Vermilion -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works • 25 • : SchrodingersRat -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 795 • : Threadbarer -

Ditching physical money

History • 22 • : StudioNada -

Biden "Happy To Debate Trump"

Mainstream News • 33 • : YourFaceAgain -

Falkville Robot-Man

Aliens and UFOs • 3 • : KKLOCO -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 296 • : KrustyKrab -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest • 10 • : xuenchen -

Russia Ukraine Update Thread - part 3

World War Three • 5736 • : YourFaceAgain -

Manor Lords - Medieval City Builder with RTS Combat - Early Access 26th April

Video Games • 7 • : gortex