It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

reply to post by Elfworkz

I believe you have me confuse with somebody else post or either you didn't read my post at all.

Where in my post said that my husband can not find job, my husband is not jobless.

[edit on 1-9-2008 by marg6043]

I believe you have me confuse with somebody else post or either you didn't read my post at all.

Where in my post said that my husband can not find job, my husband is not jobless.

[edit on 1-9-2008 by marg6043]

My bad maybe so but if times are as rough as you say they are why not work?

Avoiding the one liner.......

Avoiding the one liner.......

Here is what a recession looks like. Look at the details.

It was during the Jimmy Carter Presidency (surprised?):

Source

It was during the Jimmy Carter Presidency (surprised?):

The early 1980s recession was a severe recession in the United States which began in July 1981 and ended in November 1982.[1][2] The primary cause of the recession was a contractionary monetary policy established by the Federal Reserve System to control high inflation.[3]

The recession was not only unexpected but was the most serious recession since the Great Depression.[4]

Source

Yeah it was nixie but you both sound the same!

"Actually none of them work flipping burgers we spend too much money on education for that"

What?

Wait?

No I don't get it too good for laboring work?

I read it but you mix in with the whining here.

Sorry about that.

"Actually none of them work flipping burgers we spend too much money on education for that"

What?

Wait?

No I don't get it too good for laboring work?

I read it but you mix in with the whining here.

Sorry about that.

Originally posted by jetxnet

Here is what a recession looks like. Look at the details.

It was during the Jimmy Carter Presidency (surprised?):

The early 1980s recession was a severe recession in the United States which began in July 1981 and ended in November 1982.[1][2] The primary cause of the recession was a contractionary monetary policy established by the Federal Reserve System to control high inflation.[3]

The recession was not only unexpected but was the most serious recession since the Great Depression.[4]

Source

You fail to mention that the Carter admin also had the lowest national debt in our history.

reply to post by jamie83

Jamie, did you notice that the day after Bush took office eight years ago the Media was screaming how he was causing a recession? I could not figure out how someone who had been in office for just a few days had that much power.

Jamie, did you notice that the day after Bush took office eight years ago the Media was screaming how he was causing a recession? I could not figure out how someone who had been in office for just a few days had that much power.

reply to post by crimvelvet

Thanks for that. 8 years ago people where spending like no tomorrow just like the posters here who didnt save anything now they are hurting. With there brilliant minds they are finding other people to blame or to balme in the future then there own stupid spending and wasting money on things they thought they could afford but cant.

People that really saved and prepared are on top. Those who didnt, cant read a mortgage contract, people listening to the news and believe are going to fall.

I think everyone who is looking for a reason to there problems cant admit they failed to prepare. Just like a survival scenario it wont be your fault when you and your family fails because it was them.............Who? God or government who cares.

Tear in your beer you had plenty of time to prepare for the worst, not complain your retirement check will be suffering!

O well get a job then.....No vacation 4 u that sucks.

Thanks for that. 8 years ago people where spending like no tomorrow just like the posters here who didnt save anything now they are hurting. With there brilliant minds they are finding other people to blame or to balme in the future then there own stupid spending and wasting money on things they thought they could afford but cant.

People that really saved and prepared are on top. Those who didnt, cant read a mortgage contract, people listening to the news and believe are going to fall.

I think everyone who is looking for a reason to there problems cant admit they failed to prepare. Just like a survival scenario it wont be your fault when you and your family fails because it was them.............Who? God or government who cares.

Tear in your beer you had plenty of time to prepare for the worst, not complain your retirement check will be suffering!

O well get a job then.....No vacation 4 u that sucks.

reply to post by jamie83

yup, times are hard, but not as hard a they say. we are basicly talking ourselves into a recession.

i dont care what people, say but i am on the lowest band of income, and yet i still have food, on my table, hot cups of coffe in the morning, and a beutiful countryside, to frolic in on a hot summers day.

yup, times are hard, but not as hard a they say. we are basicly talking ourselves into a recession.

i dont care what people, say but i am on the lowest band of income, and yet i still have food, on my table, hot cups of coffe in the morning, and a beutiful countryside, to frolic in on a hot summers day.

reply to post by monkeybus

With you brother.............

Coffee, food, family members not gathered around the TV or playing video games.

Wish I had a Wii.

Damn.....................

With you brother.............

Coffee, food, family members not gathered around the TV or playing video games.

Wish I had a Wii.

Damn.....................

Fudged Numbers are not proof of anything but Fraud. I'm a Republican w/35 yr track record and everyone who is calling out the Neo Cons for their

pernicious lies is not a Liberal.

Originally posted by oatie

the economy has to be looked at as a whole. jamie doesn't understand that so please admins close this overly conservative thread

This may be perhaps one of the most asinine posts in ATS today and that's really saying something.

Spoken like a typical liberal, you want the thread closed because you disagree with what I'm saying.

Yes, the economy must be looked at as a whole. In fact, I may be the only one posting in this thread who has provided data on the economy as a whole.

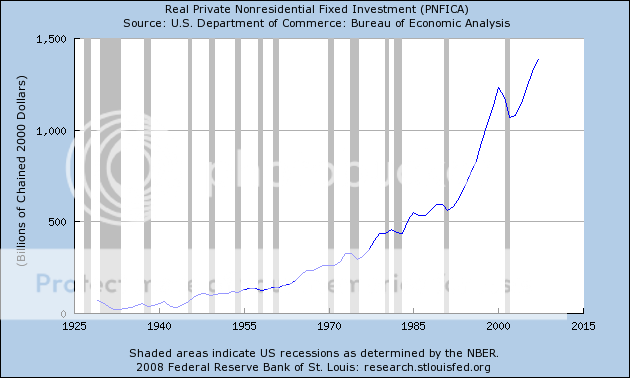

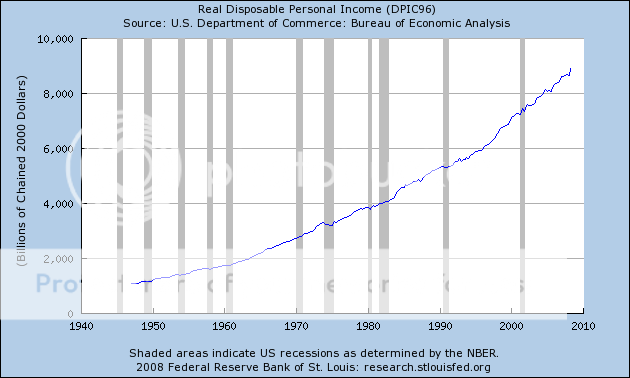

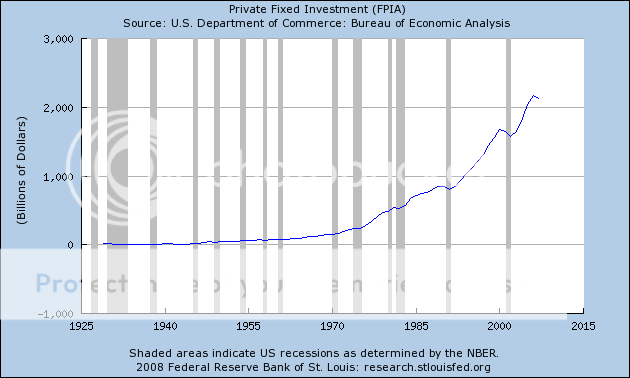

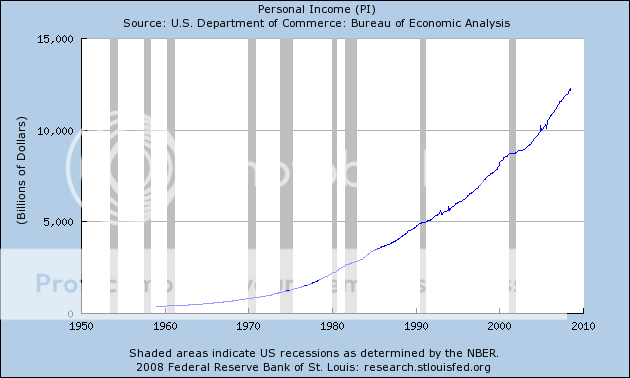

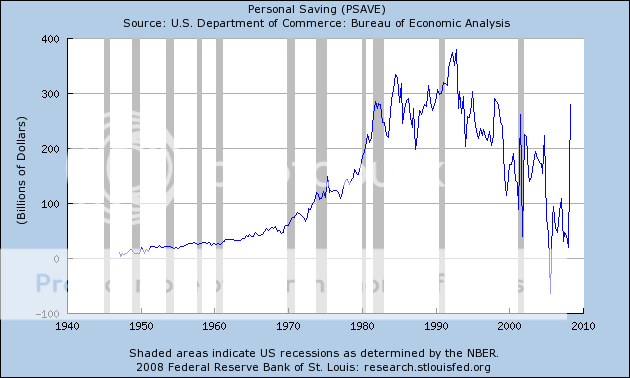

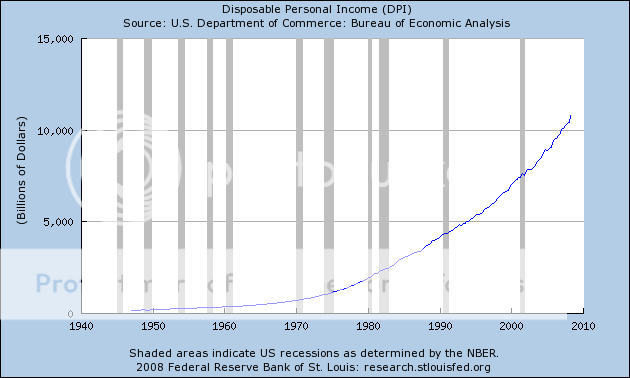

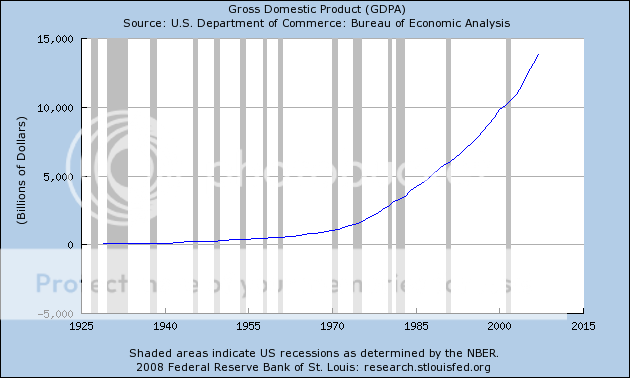

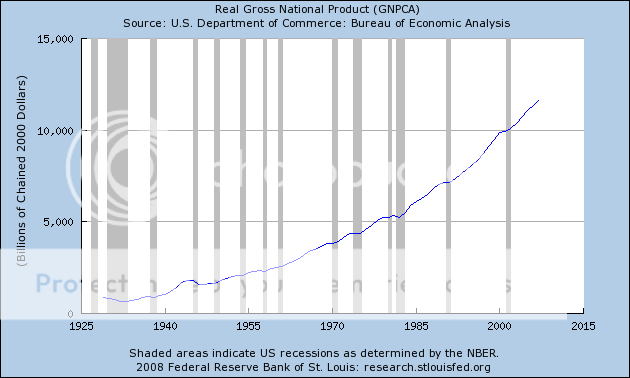

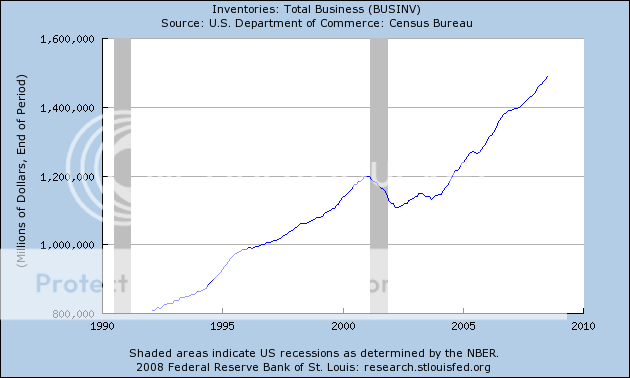

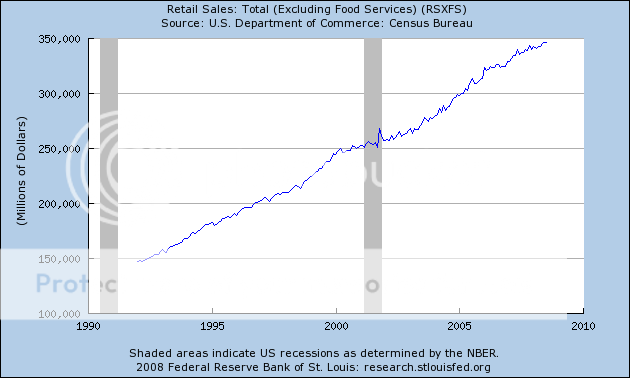

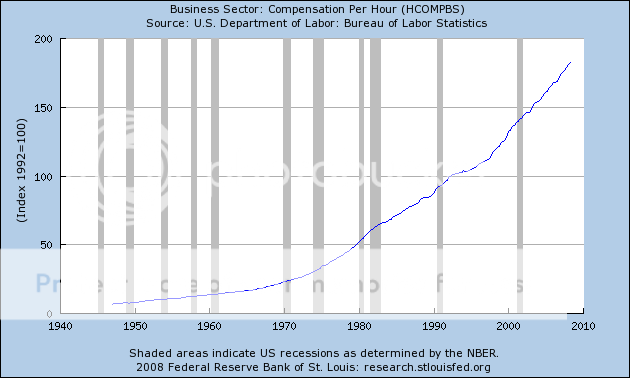

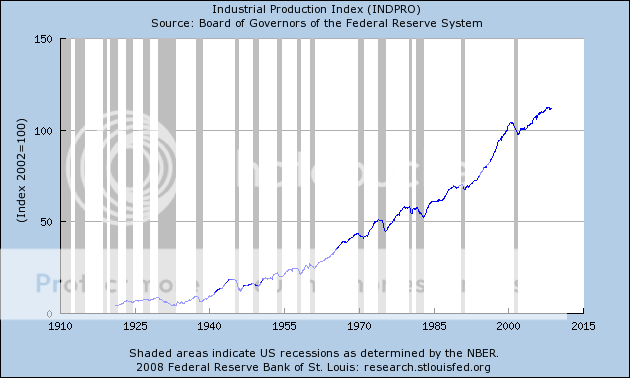

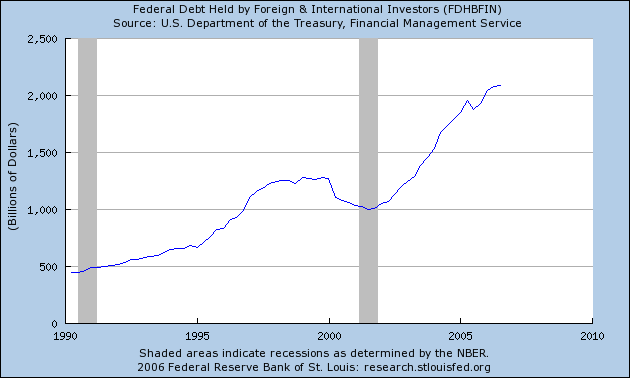

Here is the data. Feel free to explain which data set shows the economy is not doing well:

reply to post by jamie83

Here is the million dollar question Jaime, Mr. Economics here.

You can regurgitate Government numbers all day. I want to see you do this:

Prove to me that the Government Numbers are correct.

You do that, and I will agree with you the economy is fine.

PS. Most people here do not say the US Economy is in a recession, but rather there are severe underlying problems generating a massive economic crisis within the financial sector that is spilling into other sections of the economy. For instance rising feul prices, interest rates, a restriction on credit and thus buying power, inflation on core good like food not included in inflation calculations and unreported unemployment from flawed statistic reportings. By scholarly definition the US is not in a recession (if we go by Gov numbers) however any good economist would tell you since no recession is alike, you cannot create a standard as to "when we hit the brink".

So again, tell me something I won't read on a Gov site. Prove to me their method of calculating and reporting is correct. Show us all there is nothing to worry about.

Until then, your just another Neocon telling us what the Government has already been trying to tell us. And guess what? I am definitely not a Liberal. And this has NOTHING to do with Party Lines.

Here is the million dollar question Jaime, Mr. Economics here.

You can regurgitate Government numbers all day. I want to see you do this:

Prove to me that the Government Numbers are correct.

You do that, and I will agree with you the economy is fine.

PS. Most people here do not say the US Economy is in a recession, but rather there are severe underlying problems generating a massive economic crisis within the financial sector that is spilling into other sections of the economy. For instance rising feul prices, interest rates, a restriction on credit and thus buying power, inflation on core good like food not included in inflation calculations and unreported unemployment from flawed statistic reportings. By scholarly definition the US is not in a recession (if we go by Gov numbers) however any good economist would tell you since no recession is alike, you cannot create a standard as to "when we hit the brink".

So again, tell me something I won't read on a Gov site. Prove to me their method of calculating and reporting is correct. Show us all there is nothing to worry about.

Until then, your just another Neocon telling us what the Government has already been trying to tell us. And guess what? I am definitely not a Liberal. And this has NOTHING to do with Party Lines.

Here is the million dollar question Jaime, Mr. Economics here.

You can regurgitate Government numbers all day. I want to see you do this:

Prove to me that the Government Numbers are correct.

OMG - so now the government is messing with the economic growth index numbers - I'll tell you, that Bush sure has control over every Department in the government, both Democrat and Republican.

Look at the dip in 2001 and then the rebound - the numbers are correct.

Awesome analysis Jamie.

Originally posted by Rockpuck

Here is the million dollar question Jaime, Mr. Economics here.

You can regurgitate Government numbers all day. I want to see you do this:

Prove to me that the Government Numbers are correct.

You do that, and I will agree with you the economy is fine.

What would you like to see?

Want me to post the earnings of major U.S. companies?

Let's start with Proctor and Gamble. This is a retail consumer company that reflects the overall economy. PG's quarterly revenue is growing at 10.3% per quarter. PG's quarterly earnings growth year-over-year is 33%. PG's overall profits are in the range of $20 billion per year.

Next let's look at United States Steel. USS's profts are $2 billion and there quarterly earnings growth is 129%.

I could go on and on with these individual company statistics. Major U.S. companies are consistently showing strong earnings.

And just FYI, it's a bogus tactic to ask me to prove the data I'm using is accurate. I produced raw data from the Federal Reserve. If you think the Fed's data is incorrect then show some evidence of such.

reply to post by jamie83

Jamie, governmentt stats have been modified many times since the '70s in order to make things look better for those in power, and also to 'manage expectations' as per popular economic theory. John Williams has been monitoring these changes since he first noticed them in the early '80s, (perhaps around the time you were born ;-). Check out www.shadowstats.com... for more info.

GDP is largely a measure of consumption. Nearly 70% of the GDP consumption is from individuals, 20% is from the Govt, 15% is for investment (i.e., equipment, inventory, structures, computers, sw), -5% accounts for the excess of imports over exports. But the bulk of GDP is due to the 70% of spending by individuals.

A major problem in this country is that our consumption is financed by debt. The average household balance sheet is in terrible shape. Many people are living paycheck to paycheck. 81% pay less than half of the balance due on their credit cards each month. The average 401K has only about 50K in it. Many mortgages are underwater right now and more are likely to go under water in the coming year (meaning the value of their debt will exceed the value of their homes) as the cost of owning vs cost of renting reverts to historical norms (and likely overshoots it). This will cause more people to walk away from mortgages, which willl force more writeoffs of structured finance products (e.g., MBS and CDOs), which will further impair the ability of banks to make loans, which will slow the economy further, leading to more layoffs, less spending and lower GDP.

We are definitely not out of the woods yet. Benanke, Dimon and many others have made this clear. It is not a liberal plot. As MBS and CDOs fail, credit default swaps further pressure the balance sheets of insurance companies and broker dealers who wrote those products.

At the heart of our financial woes is the massive amount of debt we have racked up. Individuals and financial companies were leveraged way beyond prudence, and this debt is failing; deleveraging is going on. Check out home.att.net... for more on our debt woes.

It's too bad that the Republicans abandoned the financial conservatism of Reagan. The Republicans of today have exchanged those admirable principles for goals focused on concentrating more wealth in the hands of the few (i.e., the rich supporters and corporate backers that fund them). Bush has rung up the biggest deficits in the history of our nation (and the largest weath disparity between rich and poor). What's more, even the reported deficit numbers are being massaged and under reported (e.g., war spending is considered a 'special appropriation' not counted as part of the deficit numbers quoted).

Meanwhile, in an effort to 'live the American dream', America is liquidating its assets and going into debt in order to buy 'stuff' from overseas (and to fund ruinous wars). While we rack up debt, other nations around the world are running surpluses that enable them to create huge sovereign wealth funds. Internally, many of these nations are spending their money wisely on capital formation--not on retail malls and the like--but on infrastructure (roads, bridges, pipes...), factories, technologies and businesses that can help them sell more effectively in the future to the rest of the world.

Look for continued economic malaise in the coming year and a tough road for the average family in America over the next few decades.

Jamie, governmentt stats have been modified many times since the '70s in order to make things look better for those in power, and also to 'manage expectations' as per popular economic theory. John Williams has been monitoring these changes since he first noticed them in the early '80s, (perhaps around the time you were born ;-). Check out www.shadowstats.com... for more info.

GDP is largely a measure of consumption. Nearly 70% of the GDP consumption is from individuals, 20% is from the Govt, 15% is for investment (i.e., equipment, inventory, structures, computers, sw), -5% accounts for the excess of imports over exports. But the bulk of GDP is due to the 70% of spending by individuals.

A major problem in this country is that our consumption is financed by debt. The average household balance sheet is in terrible shape. Many people are living paycheck to paycheck. 81% pay less than half of the balance due on their credit cards each month. The average 401K has only about 50K in it. Many mortgages are underwater right now and more are likely to go under water in the coming year (meaning the value of their debt will exceed the value of their homes) as the cost of owning vs cost of renting reverts to historical norms (and likely overshoots it). This will cause more people to walk away from mortgages, which willl force more writeoffs of structured finance products (e.g., MBS and CDOs), which will further impair the ability of banks to make loans, which will slow the economy further, leading to more layoffs, less spending and lower GDP.

We are definitely not out of the woods yet. Benanke, Dimon and many others have made this clear. It is not a liberal plot. As MBS and CDOs fail, credit default swaps further pressure the balance sheets of insurance companies and broker dealers who wrote those products.

At the heart of our financial woes is the massive amount of debt we have racked up. Individuals and financial companies were leveraged way beyond prudence, and this debt is failing; deleveraging is going on. Check out home.att.net... for more on our debt woes.

It's too bad that the Republicans abandoned the financial conservatism of Reagan. The Republicans of today have exchanged those admirable principles for goals focused on concentrating more wealth in the hands of the few (i.e., the rich supporters and corporate backers that fund them). Bush has rung up the biggest deficits in the history of our nation (and the largest weath disparity between rich and poor). What's more, even the reported deficit numbers are being massaged and under reported (e.g., war spending is considered a 'special appropriation' not counted as part of the deficit numbers quoted).

Meanwhile, in an effort to 'live the American dream', America is liquidating its assets and going into debt in order to buy 'stuff' from overseas (and to fund ruinous wars). While we rack up debt, other nations around the world are running surpluses that enable them to create huge sovereign wealth funds. Internally, many of these nations are spending their money wisely on capital formation--not on retail malls and the like--but on infrastructure (roads, bridges, pipes...), factories, technologies and businesses that can help them sell more effectively in the future to the rest of the world.

Look for continued economic malaise in the coming year and a tough road for the average family in America over the next few decades.

Originally posted by jamie83

And just FYI, it's a bogus tactic to ask me to prove the data I'm using is accurate. I produced raw data from the Federal Reserve. If you think the Fed's data is incorrect then show some evidence of such.

I have not talked to one single person on real life that does not think this is a slow train wreck except for the Neo-Cons.

My bet is that you are an young evangelical Christian pizza delivery driver taking a marketing course.

reply to post by jamie83

So ... basically your saying two things.

1. Business wealth increasing means a good economy?

2. You cannot prove the Governments numbers are correct?

And in actuality your admitting you don't know how they even come up with their numbers, eh?

And it has nothing to do with Bush, it has nothing to do with parties.

Now, I patiently await a response. One worth reading this time.

So ... basically your saying two things.

1. Business wealth increasing means a good economy?

2. You cannot prove the Governments numbers are correct?

And in actuality your admitting you don't know how they even come up with their numbers, eh?

And it has nothing to do with Bush, it has nothing to do with parties.

Now, I patiently await a response. One worth reading this time.

We're safe, for the moment. As I opened this too reply, that's what the random song I was playing on my ITunes said...And Yes, I think it's true.

And here is why.

We should have gone into a recession back around 02' or maybe even before. Recessions are a GOOD thing, they clear out the system and are perfectly natural, in the sense of economics. The scary part is, by putting off this recession, we are only making things worse for ourselves in the long-term. You've got to think long-term, you can't just think short-term economics.

First, let's look at a few new graphs. Graphs that don't simply represent the national reported GDP, which can be manipulated in many ways. Such as rolling-over debt until the next fiscal year, to make it look like more short-term earning. This is how we currently calculate GDP in the US.

Y = C + I + E + G

where

Y = GDP

C = Consumer Spending

I = Investment made by industry

E = Excess of Exports over Imports

G = Government Spending

So, this includes all foreign manufactured goods in the United States. For example all cars manufactured in a Toyota plant in Alabama would be included in our GDP calculations, even if they were then shipped back to Japan. Also, government spending on things such as hurricane Gustav relief, would also add to our current GDP calculations. Even money borrowed from foreign sources, and spent WITHIN the United States will also add to the GDP figure. There are also other more obscure 'accounting tricks' that you could point to as well.

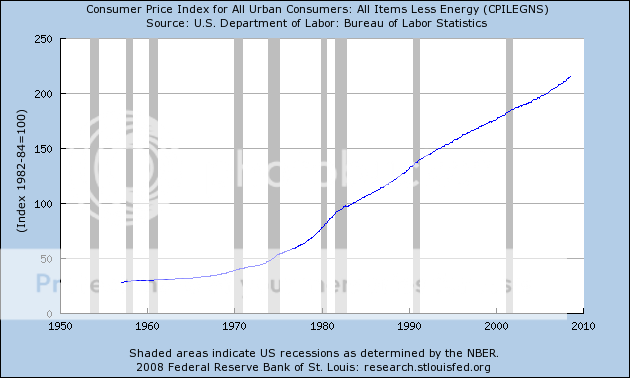

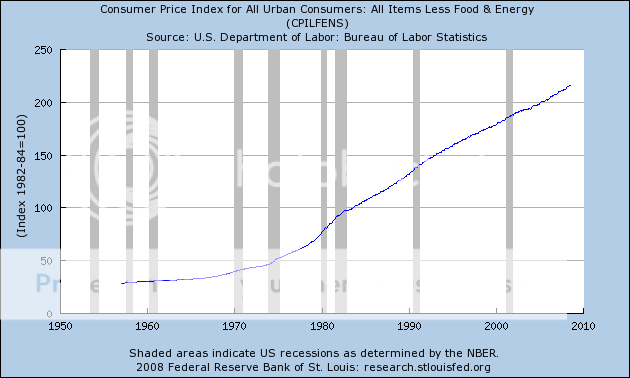

Not only the GDP is the problem but core CPI (Consumer Price Index) also ignores increases in the costs of food and energy (oil). Which we all know have increased a hell of a lot. So, things like inflation are actually higher than the government reports.

Here are some other important charts, that should be factored in the equation of just how well our economy is doing.

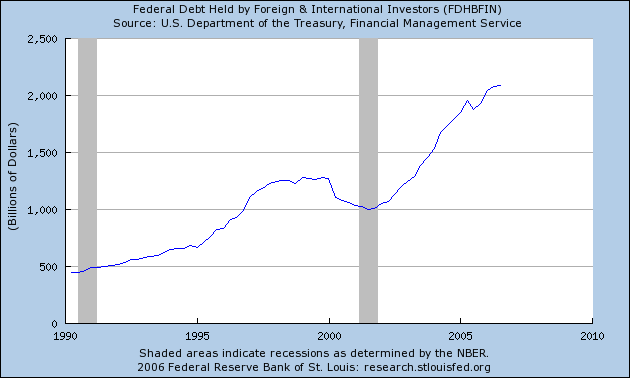

Foreign Holdings of U.S. Assets as % of GDP

Net Foreign Holdings of U.S. Assets

Trade Deficit

Current Balance of Assets

Personal Savings Rate

And the Boston Globe is reporting consumer debt rose 14.3 billion, to a total of 2.6 trillion dollars...

GDP is one thing, but you have to look at the big picture friend. We're coming off a period where people were borrowing more because of their home equity that was artificially inflated. Now people are paying the price. Not only that, you have the Fed. bailing out companies that should FAIL. The only thing they're doing by all of theses bail-outs and stimulus packs, is creating a bigger, deeper hole for the average American. They are increasing the money supply (M3, which the don't even release anymore..wonder why), this COULD ultimately lead to hyperinflation if steps aren't taken NOW.

We have been living beyond our means, in a fantasy world. Of course people aren't saving money, interest rates are pathetic and gives no incentive to save, only consume. They should be raising interest rates, and we SHOULD be in a recession, but we're not doing that and we're going to see massive inflation as a result.

So, if you look at things from a long-term perspective, things have been going downhill for a while now. Look beyond mere GDP, we're broke.

Cheers

Edit: If there isn't a Conspiracy behind our economics over the past 30 years, then it is the single largest, disgusting, mismanagement of funds i've ever seen. At both the individual and governmental level of things. The stage has been set for hyper-inflation, and i pray to god that it doesn't come about...

[edit on 2-9-2008 by Blacknapkins]

We should have gone into a recession back around 02' or maybe even before. Recessions are a GOOD thing, they clear out the system and are perfectly natural, in the sense of economics. The scary part is, by putting off this recession, we are only making things worse for ourselves in the long-term. You've got to think long-term, you can't just think short-term economics.

First, let's look at a few new graphs. Graphs that don't simply represent the national reported GDP, which can be manipulated in many ways. Such as rolling-over debt until the next fiscal year, to make it look like more short-term earning. This is how we currently calculate GDP in the US.

Y = C + I + E + G

where

Y = GDP

C = Consumer Spending

I = Investment made by industry

E = Excess of Exports over Imports

G = Government Spending

So, this includes all foreign manufactured goods in the United States. For example all cars manufactured in a Toyota plant in Alabama would be included in our GDP calculations, even if they were then shipped back to Japan. Also, government spending on things such as hurricane Gustav relief, would also add to our current GDP calculations. Even money borrowed from foreign sources, and spent WITHIN the United States will also add to the GDP figure. There are also other more obscure 'accounting tricks' that you could point to as well.

Not only the GDP is the problem but core CPI (Consumer Price Index) also ignores increases in the costs of food and energy (oil). Which we all know have increased a hell of a lot. So, things like inflation are actually higher than the government reports.

Here are some other important charts, that should be factored in the equation of just how well our economy is doing.

Foreign Holdings of U.S. Assets as % of GDP

Net Foreign Holdings of U.S. Assets

Trade Deficit

Current Balance of Assets

Personal Savings Rate

And the Boston Globe is reporting consumer debt rose 14.3 billion, to a total of 2.6 trillion dollars...

GDP is one thing, but you have to look at the big picture friend. We're coming off a period where people were borrowing more because of their home equity that was artificially inflated. Now people are paying the price. Not only that, you have the Fed. bailing out companies that should FAIL. The only thing they're doing by all of theses bail-outs and stimulus packs, is creating a bigger, deeper hole for the average American. They are increasing the money supply (M3, which the don't even release anymore..wonder why), this COULD ultimately lead to hyperinflation if steps aren't taken NOW.

We have been living beyond our means, in a fantasy world. Of course people aren't saving money, interest rates are pathetic and gives no incentive to save, only consume. They should be raising interest rates, and we SHOULD be in a recession, but we're not doing that and we're going to see massive inflation as a result.

So, if you look at things from a long-term perspective, things have been going downhill for a while now. Look beyond mere GDP, we're broke.

Cheers

Edit: If there isn't a Conspiracy behind our economics over the past 30 years, then it is the single largest, disgusting, mismanagement of funds i've ever seen. At both the individual and governmental level of things. The stage has been set for hyper-inflation, and i pray to god that it doesn't come about...

[edit on 2-9-2008 by Blacknapkins]

Did anyone look at the name at the bottom of the pretty little blue boxes.The "federal reserve bank"....a private for profit organization.It is not

held to government audits...they basically have free reign to do as they wish when they wish.The worst thing I think our country has ever done was to

give over our monetary policy to a bunch of greedy bankers.One of the next worst things financially was going off the gold standard care of tricky

Dick Nixon.....what a piece of work he was.All you neocons who want to cling to your faith in the federal reserve and their figures go read your

history books and see what the fore fathers said about putting the countries monetary policy in the hands of private bankers.The same ones who have no

problem with this are the very same ones who will say look,look,look at what our forefathers said about the right to bare arms.If you want to go all

the way back to the fore fathers for your right to bare arms , then also take into account what they had to say about our monetary matters.

I have a pretty decent job but have struggled more and more each year and I am not the least bit better off than I was eight years ago, as a matter of fact it is so tight now there is no savings going on right now.I see many less fortunate than myself and really feel for them.We may not be in a recession according to the "charts" but I am here to tell you something isnt going right and it aint bad "karma" because people are having negative thoughts about the economy.....that is just lame thinking.

I have a pretty decent job but have struggled more and more each year and I am not the least bit better off than I was eight years ago, as a matter of fact it is so tight now there is no savings going on right now.I see many less fortunate than myself and really feel for them.We may not be in a recession according to the "charts" but I am here to tell you something isnt going right and it aint bad "karma" because people are having negative thoughts about the economy.....that is just lame thinking.

new topics

-

BIDEN Admin Begins Planning For January 2025 Transition to a New President - Today is 4.26.2024.

2024 Elections: 1 hours ago -

Big Storms

Fragile Earth: 2 hours ago -

Where should Trump hold his next rally

2024 Elections: 5 hours ago -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 6 hours ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 7 hours ago -

Falkville Robot-Man

Aliens and UFOs: 7 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 8 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 8 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 9 hours ago -

Biden "Happy To Debate Trump"

2024 Elections: 9 hours ago

top topics

-

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 8 hours ago, 14 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 8 hours ago, 13 flags -

Blast from the past: ATS Review Podcast, 2006: With All Three Amigos

Member PODcasts: 12 hours ago, 13 flags -

Biden "Happy To Debate Trump"

2024 Elections: 9 hours ago, 12 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 12 hours ago, 8 flags -

What is the white pill?

Philosophy and Metaphysics: 11 hours ago, 6 flags -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 6 hours ago, 6 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 10 hours ago, 5 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 9 hours ago, 5 flags -

Where should Trump hold his next rally

2024 Elections: 5 hours ago, 5 flags

active topics

-

Big Storms

Fragile Earth • 12 • : Lumenari -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 47 • : cherokeetroy -

BIDEN Admin Begins Planning For January 2025 Transition to a New President - Today is 4.26.2024.

2024 Elections • 8 • : NoCorruptionAllowed -

ALERT - U.S. President JOE BIDEN Examined and Found NOT OF SOUND MIND.

2024 Elections • 65 • : SchrodingersRat -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents • 13 • : theatreboy -

Where should Trump hold his next rally

2024 Elections • 21 • : Dandandat3 -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs • 9 • : Degradation33 -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 38 • : SchrodingersRat -

Joe Biden and Donald Trump are both traitors

2024 Elections • 65 • : MrMez -

Mood Music Part VI

Music • 3112 • : underpass61