It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

a reply to: enlightenedservant

Actually, if you look closer at those numbers, the owner of the franchise is shown to make $153,900 per year, while paying out $702,000 in wages. That's 22% as much as the wages that they pay, for taking ALL of the risk and being the ultimate "on-call" go-to person if a problem arises.

That does not sound unreasonable to me... it actually sounds low.

That average resale price is not fixed... it is not like you can stick a sign up in front and the next day have your profits. Instead it is worse than trying to sell a house. You might get what you want, but you probably won't, and it might take years to make the sale.

Are we discussing what franchisees make, or what corporate makes? They are two completely different things, you know.

Shareholders are really making a killing. Based on the present stock price of McDonalds ($168.91 per share) and the 2017 return of $6.37 per share, that's a whopping 3.8% annual return on investment. Not what I would consider a windfall. Actually, I would consider it pitiful were I able to invest in a stock portfolio.

Those huge numbers that seem to be sticking in your craw are the result of the fact that there are so many McDonalds out there. It's not that one or two businesses is making all that cash; literally thousands of businesses combined all have their hands in that pie.

TheRedneck

I'm looking at some of the same stats you listed and I'm not feeling bad for them. Not only does that article show that the average McDonald's franchisee owns 6 franchises (so multiply those profits by 6), but it also gives an example of a franchisee selling his McDonald's franchise for more than twice what he purchased it.

Actually, if you look closer at those numbers, the owner of the franchise is shown to make $153,900 per year, while paying out $702,000 in wages. That's 22% as much as the wages that they pay, for taking ALL of the risk and being the ultimate "on-call" go-to person if a problem arises.

That does not sound unreasonable to me... it actually sounds low.

I don't have any stats for the average resell price, but so far it's looking like: Average franchisee makes $150,000-$200,000 per franchise for $900,000 to $1,200,000 a year in profits. But if those yearly profits aren't enough, then the franchisee can just sell one of the stores for the cost of the initial investment (which is what I'm seeing most often) or for around twice the initial investment (going by the anecdotal evidence in the article).

That average resale price is not fixed... it is not like you can stick a sign up in front and the next day have your profits. Instead it is worse than trying to sell a house. You might get what you want, but you probably won't, and it might take years to make the sale.

And that's just the franchisee. McDonald's as a whole makes far money money than that, with this separate article claiming that McDonald's keeps a whopping 82% of the revenue generated by the franchisees.

Are we discussing what franchisees make, or what corporate makes? They are two completely different things, you know.

From my perspective, all of this just reinforces my point when I said "Companies like McDonald's are already making a huge profit; they just want to share as little as possible of those profits with their workers (which means that a higher share of the profits go to investors/shareholders/etc)".

Shareholders are really making a killing. Based on the present stock price of McDonalds ($168.91 per share) and the 2017 return of $6.37 per share, that's a whopping 3.8% annual return on investment. Not what I would consider a windfall. Actually, I would consider it pitiful were I able to invest in a stock portfolio.

Those huge numbers that seem to be sticking in your craw are the result of the fact that there are so many McDonalds out there. It's not that one or two businesses is making all that cash; literally thousands of businesses combined all have their hands in that pie.

TheRedneck

a reply to: Aazadan

You think age is an advantage?

I have finished up my education for now. And I did it on a shoestring, raising a family of four, working part-time, grunt jobs at an age where it hurts to do everything, while caretaking for an elderly mother. To boot, I did it with no student loans. Are you seriously saying that an aging redneck is more capable than a millennial in their prime?

OK, you got me. Since you say so, I guess maybe all millennials are helpless and only survive because nothing has gone wrong for them. That is the most pitiful thing I have read on this site in the time I have been here. Maybe I should invest in grave lots in case Microsoft quits making video games... according to you, they should all drop dead as soon as they hear the news.

TheRedneck

You think age is an advantage?

I have finished up my education for now. And I did it on a shoestring, raising a family of four, working part-time, grunt jobs at an age where it hurts to do everything, while caretaking for an elderly mother. To boot, I did it with no student loans. Are you seriously saying that an aging redneck is more capable than a millennial in their prime?

OK, you got me. Since you say so, I guess maybe all millennials are helpless and only survive because nothing has gone wrong for them. That is the most pitiful thing I have read on this site in the time I have been here. Maybe I should invest in grave lots in case Microsoft quits making video games... according to you, they should all drop dead as soon as they hear the news.

TheRedneck

a reply to: TheRedneck

I said some people take longer than others, you should know that from first hand experience. Not everyone graduates college at the age of 22. As a result, it's foolish to expect everyone to move on from those jobs by their early 20's.

Edit: On a sidenote, congratulations on finishing.

I said some people take longer than others, you should know that from first hand experience. Not everyone graduates college at the age of 22. As a result, it's foolish to expect everyone to move on from those jobs by their early 20's.

Edit: On a sidenote, congratulations on finishing.

edit on 9-6-2018 by Aazadan because: (no reason given)

originally posted by: TheRedneck

a reply to: Aazadan

You think age is an advantage?

You sure do, wherever you live made doing so affordable enough to accomplish. Where I used to live across the Gulf, college OOP was NOT ATTAINABLE no matter what kind of shoestring family budget was concocted.

Your advantage is luck -- in the COL where you are. That's not able to be applied broadbrush across the country. not everything in the 2.9 million square miles of the continental US is as cheap as the Deep South, 'Bama boy.

I have finished up my education for now. And I did it on a shoestring,

Clarify that shoestring. What was you monthly income? Electric bill? Gas/propane if you used them? Water bill? Food? Rent or mortgage? Insurance? Auto payment if you had one? Auto insurance? What did groceries run for 6 people?

Remember, these are the very basics for people, and some places in the country are cheaper to pay for them in than others.

Also, if in any way at all, you had a break via family property or family money, you didn't do it yourself on a shoestring, you did it with familial LUCK. Not everyone has that luck.

raising a family of four, working part-time, grunt jobs at an age where it hurts to do everything, while caretaking for an elderly mother.

Congrats, you are many people. Though I do suspect since you mentioned your mom, that she had contributed moolah your way or you possibly had Caretaker status and thus got government coin for doing so. Again, had you not had a familial leg up, you'd never have made it on your shoestring.

To boot, I did it with no student loans. Are you seriously saying that an aging redneck is more capable than a millennial in their prime?

You aren't more capable, you had a whole lot of CoL good luck on your side others don't get elsewhere.

Let's also reiterate my suspicion here: You took care of your mother, and I'm willing to bet money was exchanged in some fashion. I'm also willing to bet you also didn't have rent/mortgage payments to worry about, and lived on family property. Ergo, no worries to be had about where to live & how to afford it. Look, it's just a gut hunch. If I'm wrong, I'm sorry for jumping to conclusions on the abode, but you're holding back info here while boasting and that's telling.

edit on 6/9/2018 by Nyiah because: Ha, got my water & land square miles mixed up.

a reply to: Aazadan

Expect? Expect? I graduated in my 50s, as you know. I am simply stating that I finished college under conditions that are much more adverse than someone who went earlier.

I have wished many times that I had completed college earlier... it would have been much easier and more exciting.

Thank you. Magna Cum Laude, with a few additional honors. That degree hangs proudly as a reminder to me that yes, I can.

TheRedneck

I said some people take longer than others, you should know that from first hand experience. Not everyone graduates college at the age of 22. As a result, it's foolish to expect everyone to move on from those jobs by their early 20's.

Expect? Expect? I graduated in my 50s, as you know. I am simply stating that I finished college under conditions that are much more adverse than someone who went earlier.

I have wished many times that I had completed college earlier... it would have been much easier and more exciting.

Edit: On a sidenote, congratulations on finishing.

Thank you. Magna Cum Laude, with a few additional honors. That degree hangs proudly as a reminder to me that yes, I can.

TheRedneck

edit on 6/9/2018 by TheRedneck because: (no reason given)

a reply to: TheRedneck

1. McDonald's franchisees don't take all of the risk lol. The whole point in being a franchise owner is that they benefit from corporate promotions, suppliers, branding, and much more.

2. That article also points out that the average franchisee owns 6 franchises. Focusing on a single store is no different than focusing on a single stock or bond in an investor's portfolio.

That's conjecture. Can you show me the stats that show that you "probably won't" get what you want when selling it? I pointed out that I couldn't find reliable stats one way or another, and even pointed out that the resell for twice the amount was an anecdotal case from that article (it's at the bottom of the 1st article). However, at least I brought up a link to back that claim.

Come on, man. I know the difference between a franchise and corporate. But reread the posts and you'll see that I was initially talking about corporate (in this post), yet then Edumakated made it about franchises (in this post). So I then responded to that, while elegantly bringing the post back to my initial point about corporate profits.

You don't just make money from stocks based on dividends. There's also money to be made from the increasing value of each share. A year ago, McDonald's stock was $151 per share. So that's an 11% increase in value (share price) in just one year. You're really going to say that an 11% increase in asset value in a year isn't good? And that didn't even include the 3.8% or so payout in dividends that you mentioned. I even pointed out in my post that you replied to that McDonald's spent around $7.7 billion in stock buybacks, which is a safe way for investors to cash out on that $17 per share increase. (You bought it a year ago at $151, it's value jumps to $168, so then you sell it back to corporate at a $17/share profit.)

note: To see McDonald's share price over the years, go to this link (HERE), click on the "Select the Timeframe" drop down menu, and have at it (it only lists up the 10 years).

Actually, if you look closer at those numbers, the owner of the franchise is shown to make $153,900 per year, while paying out $702,000 in wages. That's 22% as much as the wages that they pay, for taking ALL of the risk and being the ultimate "on-call" go-to person if a problem arises.

That does not sound unreasonable to me... it actually sounds low.

1. McDonald's franchisees don't take all of the risk lol. The whole point in being a franchise owner is that they benefit from corporate promotions, suppliers, branding, and much more.

2. That article also points out that the average franchisee owns 6 franchises. Focusing on a single store is no different than focusing on a single stock or bond in an investor's portfolio.

That average resale price is not fixed... it is not like you can stick a sign up in front and the next day have your profits. Instead it is worse than trying to sell a house. You might get what you want, but you probably won't, and it might take years to make the sale.

That's conjecture. Can you show me the stats that show that you "probably won't" get what you want when selling it? I pointed out that I couldn't find reliable stats one way or another, and even pointed out that the resell for twice the amount was an anecdotal case from that article (it's at the bottom of the 1st article). However, at least I brought up a link to back that claim.

Are we discussing what franchisees make, or what corporate makes? They are two completely different things, you know.

Come on, man. I know the difference between a franchise and corporate. But reread the posts and you'll see that I was initially talking about corporate (in this post), yet then Edumakated made it about franchises (in this post). So I then responded to that, while elegantly bringing the post back to my initial point about corporate profits.

Shareholders are really making a killing. Based on the present stock price of McDonalds ($168.91 per share) and the 2017 return of $6.37 per share, that's a whopping 3.8% annual return on investment. Not what I would consider a windfall. Actually, I would consider it pitiful were I able to invest in a stock portfolio.

Those huge numbers that seem to be sticking in your craw are the result of the fact that there are so many McDonalds out there. It's not that one or two businesses is making all that cash; literally thousands of businesses combined all have their hands in that pie.

You don't just make money from stocks based on dividends. There's also money to be made from the increasing value of each share. A year ago, McDonald's stock was $151 per share. So that's an 11% increase in value (share price) in just one year. You're really going to say that an 11% increase in asset value in a year isn't good? And that didn't even include the 3.8% or so payout in dividends that you mentioned. I even pointed out in my post that you replied to that McDonald's spent around $7.7 billion in stock buybacks, which is a safe way for investors to cash out on that $17 per share increase. (You bought it a year ago at $151, it's value jumps to $168, so then you sell it back to corporate at a $17/share profit.)

note: To see McDonald's share price over the years, go to this link (HERE), click on the "Select the Timeframe" drop down menu, and have at it (it only lists up the 10 years).

edit on 9-6-2018 by enlightenedservant because: (no

reason given)

originally posted by: enlightenedservant

a reply to: TheRedneck

Actually, if you look closer at those numbers, the owner of the franchise is shown to make $153,900 per year, while paying out $702,000 in wages. That's 22% as much as the wages that they pay, for taking ALL of the risk and being the ultimate "on-call" go-to person if a problem arises.

That does not sound unreasonable to me... it actually sounds low.

1. McDonald's franchisees don't take all of the risk lol. The whole point in being a franchise owner is that they benefit from corporate promotions, suppliers, branding, and much more.

2. That article also points out that the average franchisee owns 6 franchises. Focusing on a single store is no different than focusing on a single stock or bond in an investor's portfolio.

That average resale price is not fixed... it is not like you can stick a sign up in front and the next day have your profits. Instead it is worse than trying to sell a house. You might get what you want, but you probably won't, and it might take years to make the sale.

That's conjecture. Can you show me the stats that show that you "probably won't" get what you want when selling it? I pointed out that I couldn't find reliable stats one way or another, and even pointed out that the resell for twice the amount was an anecdotal case from that article (it's at the bottom of the 1st article). However, at least I brought up a link to back that claim.

Are we discussing what franchisees make, or what corporate makes? They are two completely different things, you know.

Come on, man. I know the difference between a franchise and corporate. But reread the posts and you'll see that I was initially talking about corporate (in this post), yet then Edumakated made it about franchises (in this post). So I then responded to that, while elegantly bringing the post back to my initial point about corporate profits.

Shareholders are really making a killing. Based on the present stock price of McDonalds ($168.91 per share) and the 2017 return of $6.37 per share, that's a whopping 3.8% annual return on investment. Not what I would consider a windfall. Actually, I would consider it pitiful were I able to invest in a stock portfolio.

Those huge numbers that seem to be sticking in your craw are the result of the fact that there are so many McDonalds out there. It's not that one or two businesses is making all that cash; literally thousands of businesses combined all have their hands in that pie.

You don't just make money from stocks based on dividends. There's also money to be made from the increasing value of each share. A year ago, McDonald's stock was $151 per share. So that's an 11% increase in value (share price) in just one year. You're really going to say that an 11% increase in asset value in a year isn't good? And that didn't even include the 3.8% or so payout in dividends that you mentioned. I even pointed out in my post that you replied to that McDonald's spent around $7.7 billion in stock buybacks, which is a safe way for investors to cash out on that $17 per share increase. (You bought it a year ago at $151, it's value jumps to $168, so then you sell it back to corporate at a $17/share profit.)

note: To see McDonald's share price over the years, go to this link (HERE), click on the "Select the Timeframe" drop down menu, and have at it (it only lists up the 10 years).

The upfront capital and bank loans is the risk the owner takes on. McDonald's as a corporation is taking very little financial risk. The benefit of a franchise is that you are investing in a business concept that is already proven and that has all the operating systems in place. Investing in a McDonald's is far less risky than starting a new restaurant from scratch.

The fact the average franchise owner has 6 restaurants is irrelevant. So a guy who owns 6 restaurants clears say $1 million a year in income. You act as if that is criminal or obscene. He may have put up several million in debt and capital to build a business. If the business fails, he has nothing.

I got in when the stock was in the mid 20s... I've been very happy with the direction of the company.

a reply to: Edumakated

So right!

You need big bucks for a franchise and follow the rules.

It takes time to get your investment back before you can claim profit, with no guarantees you will.

The Kiosks go beyond the language barrier for human people. lol.

They can be in lots of languages that the counter staff does not have.

As long as one can read.

So less mistakes and quicker.

Order/pay, pick up!

So right!

You need big bucks for a franchise and follow the rules.

It takes time to get your investment back before you can claim profit, with no guarantees you will.

The Kiosks go beyond the language barrier for human people. lol.

They can be in lots of languages that the counter staff does not have.

As long as one can read.

So less mistakes and quicker.

Order/pay, pick up!

originally posted by: enlightenedservant

a reply to: TheRedneck

Actually, if you look closer at those numbers, the owner of the franchise is shown to make $153,900 per year, while paying out $702,000 in wages. That's 22% as much as the wages that they pay, for taking ALL of the risk and being the ultimate "on-call" go-to person if a problem arises.

That does not sound unreasonable to me... it actually sounds low.

1. McDonald's franchisees don't take all of the risk lol. The whole point in being a franchise owner is that they benefit from corporate promotions, suppliers, branding, and much more.

2. That article also points out that the average franchisee owns 6 franchises. Focusing on a single store is no different than focusing on a single stock or bond in an investor's portfolio.

That average resale price is not fixed... it is not like you can stick a sign up in front and the next day have your profits. Instead it is worse than trying to sell a house. You might get what you want, but you probably won't, and it might take years to make the sale.

That's conjecture. Can you show me the stats that show that you "probably won't" get what you want when selling it? I pointed out that I couldn't find reliable stats one way or another, and even pointed out that the resell for twice the amount was an anecdotal case from that article (it's at the bottom of the 1st article). However, at least I brought up a link to back that claim.

Are we discussing what franchisees make, or what corporate makes? They are two completely different things, you know.

Come on, man. I know the difference between a franchise and corporate. But reread the posts and you'll see that I was initially talking about corporate (in this post), yet then Edumakated made it about franchises (in this post). So I then responded to that, while elegantly bringing the post back to my initial point about corporate profits.

Shareholders are really making a killing. Based on the present stock price of McDonalds ($168.91 per share) and the 2017 return of $6.37 per share, that's a whopping 3.8% annual return on investment. Not what I would consider a windfall. Actually, I would consider it pitiful were I able to invest in a stock portfolio.

Those huge numbers that seem to be sticking in your craw are the result of the fact that there are so many McDonalds out there. It's not that one or two businesses is making all that cash; literally thousands of businesses combined all have their hands in that pie.

You don't just make money from stocks based on dividends. There's also money to be made from the increasing value of each share. A year ago, McDonald's stock was $151 per share. So that's an 11% increase in value (share price) in just one year. You're really going to say that an 11% increase in asset value in a year isn't good? And that didn't even include the 3.8% or so payout in dividends that you mentioned. I even pointed out in my post that you replied to that McDonald's spent around $7.7 billion in stock buybacks, which is a safe way for investors to cash out on that $17 per share increase. (You bought it a year ago at $151, it's value jumps to $168, so then you sell it back to corporate at a $17/share profit.)

note: To see McDonald's share price over the years, go to this link (HERE), click on the "Select the Timeframe" drop down menu, and have at it (it only lists up the 10 years).

You just can't open one anywhere you want.

That's why it costs, they try to make your franchise successful from the start.

Location X 3.

a reply to: enlightenedservant

Oh, yes they do. They lease the building from McD Corporate, but do you really think if the franchise goes belly up they won't have to fulfill the lease? That's literally millions of dollars on the line for each store that can fly away at the downturn of the local economy.

McD Corporate will probably help a franchisee try to locate a buyer to take a failing franchise off their hands, but that's still going to be difficult. I don't know anybody who is looking to dump a million or so bucks into a business that is losing money.

The percentages, based on average success, are still valid. That may be six stores operating, but that's six stores that have to be kept up with, six stores worth of wages going out, six stores paying taxes.

Surely you're not going to try and tell me a person investing $6,000,000 shouldn't make more from it than a person investing $1,000,000? Sorry, but if you are that's ludicrous.

Nope, and neither can you. Stats in real estate mean very little. Ever tried to sell a house? I have sold two... and neither time did I get what I expected from it, nor when I expected to get it. Commercial real estate is even harder to sell, as it is typically more expensive and there is thus less of a target audience to buy it.

Heck, even selling a used car rarely gives full value with a quick turn-around.

Fair enough; I didn't read the posts leading up to your reply. My apologies.

True enough, but there is no guarantee that the stock price will increase. The chances of receiving a dividend are much more likely, since failure to pay dividends is a sure way to see a stock price plummet.

So let's be generous and say we're looking for income and advancement... 11% advancement plus 3.8% income is 14.8%. That's a reasonable return for a stock portfolio. Not fantastic, just reasonable. Bear in mind that any investor who is looking for both is likely a high-risk investor and will demand 10% return or it might as well be a loss. 20% and up is more realistic, and McD does not meet that criteria.

Most investors are looking for either long-term growth (typically younger workers in IRAs) or income (older workers getting close to retirement). Few look for both.

TheRedneck

1. McDonald's franchisees don't take all of the risk lol. The whole point in being a franchise owner is that they benefit from corporate promotions, suppliers, branding, and much more.

Oh, yes they do. They lease the building from McD Corporate, but do you really think if the franchise goes belly up they won't have to fulfill the lease? That's literally millions of dollars on the line for each store that can fly away at the downturn of the local economy.

McD Corporate will probably help a franchisee try to locate a buyer to take a failing franchise off their hands, but that's still going to be difficult. I don't know anybody who is looking to dump a million or so bucks into a business that is losing money.

2. That article also points out that the average franchisee owns 6 franchises. Focusing on a single store is no different than focusing on a single stock or bond in an investor's portfolio.

The percentages, based on average success, are still valid. That may be six stores operating, but that's six stores that have to be kept up with, six stores worth of wages going out, six stores paying taxes.

Surely you're not going to try and tell me a person investing $6,000,000 shouldn't make more from it than a person investing $1,000,000? Sorry, but if you are that's ludicrous.

That's conjecture. Can you show me the stats that show that you "probably won't" get what you want when selling it?

Nope, and neither can you. Stats in real estate mean very little. Ever tried to sell a house? I have sold two... and neither time did I get what I expected from it, nor when I expected to get it. Commercial real estate is even harder to sell, as it is typically more expensive and there is thus less of a target audience to buy it.

Heck, even selling a used car rarely gives full value with a quick turn-around.

Come on, man. I know the difference between a franchise and corporate. But reread the posts and you'll see that I was initially talking about corporate...

Fair enough; I didn't read the posts leading up to your reply. My apologies.

You don't just make money from stocks based on dividends. There's also money to be made from the increasing value of each share.

True enough, but there is no guarantee that the stock price will increase. The chances of receiving a dividend are much more likely, since failure to pay dividends is a sure way to see a stock price plummet.

So let's be generous and say we're looking for income and advancement... 11% advancement plus 3.8% income is 14.8%. That's a reasonable return for a stock portfolio. Not fantastic, just reasonable. Bear in mind that any investor who is looking for both is likely a high-risk investor and will demand 10% return or it might as well be a loss. 20% and up is more realistic, and McD does not meet that criteria.

Most investors are looking for either long-term growth (typically younger workers in IRAs) or income (older workers getting close to retirement). Few look for both.

TheRedneck

a reply to: burgerbuddy

The language barrier is another big plus for the kiosks that I hadn't thought about. So I suppose we can thank our dear leaders for the open immigration policies leading to this advantage.

Thank you Chuck Schumer! Thank you Nancy Pelosi! Thank you Barack Obama!

TheRedneck

The language barrier is another big plus for the kiosks that I hadn't thought about. So I suppose we can thank our dear leaders for the open immigration policies leading to this advantage.

Thank you Chuck Schumer! Thank you Nancy Pelosi! Thank you Barack Obama!

TheRedneck

originally posted by: TheRedneck

a reply to: Aazadan

I said some people take longer than others, you should know that from first hand experience. Not everyone graduates college at the age of 22. As a result, it's foolish to expect everyone to move on from those jobs by their early 20's.

Expect? Expect? I graduated in my 50s, as you know. I am simply stating that I finished college under conditions that are much more adverse than someone who went earlier.

I have wished many times that I had completed college earlier... it would have been much easier and more exciting.

Edit: On a sidenote, congratulations on finishing.

Thank you. Magna Cum Laude, with a few additional honors. That degree hangs proudly as a reminder to me that yes, I can.

TheRedneck

So no Toga parties for you?

lol.

Not razzing ya dude, Congrats for completing!

Geeze, I'm only going to driving school now, get my HK licence next month, I hope.

a reply to: burgerbuddy

LOL, no, no toga parties for the old man. I did have an advantage when talking with professors, though... I was older than most of them!

Good luck with driving school.

TheRedneck

LOL, no, no toga parties for the old man. I did have an advantage when talking with professors, though... I was older than most of them!

Good luck with driving school.

TheRedneck

edit on 6/9/2018 by TheRedneck because: (no reason given)

a reply to: TheRedneck

You said franchisees take all of the risk. That's simply untrue. The whole point in getting a franchise instead of starting a new restaurant from scratch is because the original company has a built in customer base, has its own suppliers, has its own tested recipes, has its own brands, has its own advertising, etc. How does that mean the franchisee is taking all of the risk?

But people don't only sell companies when they're losing money. Also, if you check the itemized average costs from the first link, depreciation is included in it.So they're already accounting for a lot of potentially lost value right there.

If that's overwhelming, then don't buy 6 businesses. They know what they're getting themselves into.

What does that even mean? A person investing $6,000,000 at an estimated price of $1,000,000 per franchise is going to be making 6 times as much as the person who only invested $1,000,000 by buying a single franchise (going by these numbers). And if they're good businessmen/businesswomen, they'd make even more because they'd consolidate some of their other costs. Such as having the same accountants & lawyers handling the needs of all of the franchises, instead of hiring a new accountant and law firm for each one.

Ok, but that has nothing to do with selling a McDonald's. The whole appeal of franchises is that have their own brand awareness, customer base, suppliers, etc. And the fact that the number of McDonald's is still growing every year. Here are the stats to prove it (this only shows from 2005 onward, but the number has increased every single year). So clearly McDonald's doesn't fit your scenario.

No worries, man. This is all in good fun anyway.

That's mostly true, though many companies (like Apple) are desired more for the growth of their stock prices instead of dividends. However, there are no guarantees in business. So if people are that antsy about potentially losing value of their investments, then they should simply get out of the investment. Investing is just glorified gambling anyway, meaning that you should only invest what you're willing to lose.

A 14.8% yearly return on investment is great. The most desired investment in the world, US debt, has a measly 2.95% rate over 10 years (HERE). If it was even half of this McDonald's estimate, then it would be amazing. And if you want to see some other realistic rates, look at the rates that investors would get for various US savings accounts and annuities lol. A 14.8% return would be a miracle.

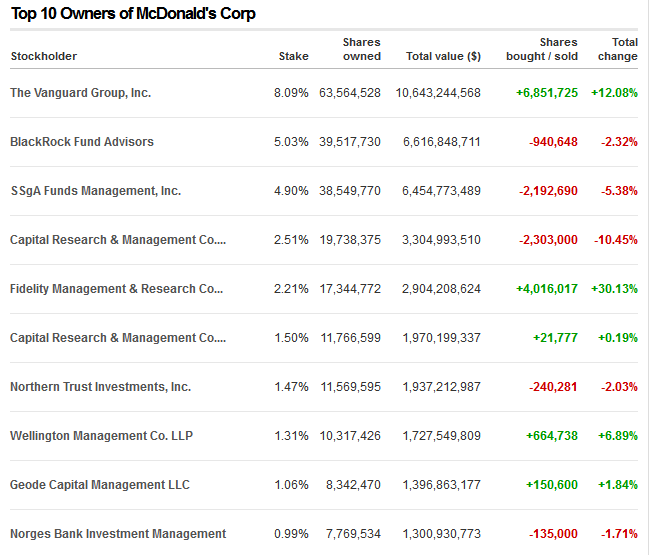

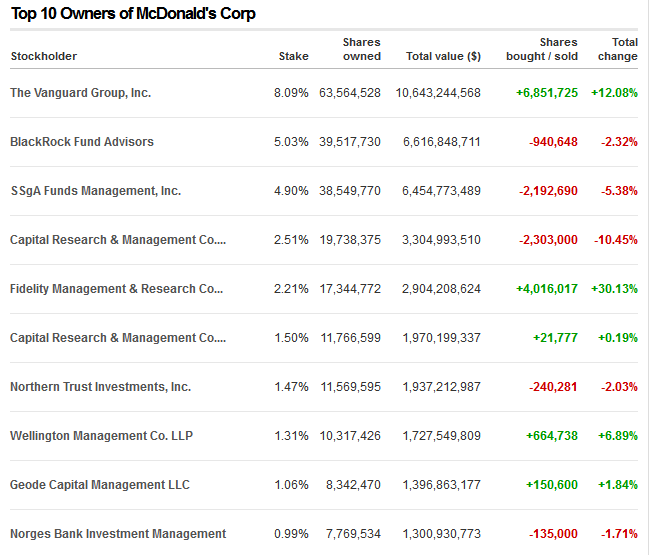

Those are some big assumptions. Let me show you some data that refutes this claim. Here's a list of the 10 largest holders of McDonald's stocks (screenshotted from here because making a graph was tedious). Tell me if you notice the trend.

So I'm curious to see why you made those assumptions?

Though I've noticed one thing about our exchanges. I'm reaching virtually all of my conclusions based on documented facts, but you're seeming to reach your conclusions based on personal assumptions and anecdotal experience. Why should I ignore the stats in favor of your opinions when you refuse to back up your opinions with documented facts?

Oh, yes they do. They lease the building from McD Corporate, but do you really think if the franchise goes belly up they won't have to fulfill the lease? That's literally millions of dollars on the line for each store that can fly away at the downturn of the local economy.

You said franchisees take all of the risk. That's simply untrue. The whole point in getting a franchise instead of starting a new restaurant from scratch is because the original company has a built in customer base, has its own suppliers, has its own tested recipes, has its own brands, has its own advertising, etc. How does that mean the franchisee is taking all of the risk?

McD Corporate will probably help a franchisee try to locate a buyer to take a failing franchise off their hands, but that's still going to be difficult. I don't know anybody who is looking to dump a million or so bucks into a business that is losing money.

But people don't only sell companies when they're losing money. Also, if you check the itemized average costs from the first link, depreciation is included in it.So they're already accounting for a lot of potentially lost value right there.

The percentages, based on average success, are still valid. That may be six stores operating, but that's six stores that have to be kept up with, six stores worth of wages going out, six stores paying taxes.

If that's overwhelming, then don't buy 6 businesses. They know what they're getting themselves into.

Surely you're not going to try and tell me a person investing $6,000,000 shouldn't make more from it than a person investing $1,000,000? Sorry, but if you are that's ludicrous.

What does that even mean? A person investing $6,000,000 at an estimated price of $1,000,000 per franchise is going to be making 6 times as much as the person who only invested $1,000,000 by buying a single franchise (going by these numbers). And if they're good businessmen/businesswomen, they'd make even more because they'd consolidate some of their other costs. Such as having the same accountants & lawyers handling the needs of all of the franchises, instead of hiring a new accountant and law firm for each one.

Nope, and neither can you. Stats in real estate mean very little. Ever tried to sell a house? I have sold two... and neither time did I get what I expected from it, nor when I expected to get it. Commercial real estate is even harder to sell, as it is typically more expensive and there is thus less of a target audience to buy it.

Ok, but that has nothing to do with selling a McDonald's. The whole appeal of franchises is that have their own brand awareness, customer base, suppliers, etc. And the fact that the number of McDonald's is still growing every year. Here are the stats to prove it (this only shows from 2005 onward, but the number has increased every single year). So clearly McDonald's doesn't fit your scenario.

Fair enough; I didn't read the posts leading up to your reply. My apologies.

No worries, man. This is all in good fun anyway.

True enough, but there is no guarantee that the stock price will increase. The chances of receiving a dividend are much more likely, since failure to pay dividends is a sure way to see a stock price plummet.

That's mostly true, though many companies (like Apple) are desired more for the growth of their stock prices instead of dividends. However, there are no guarantees in business. So if people are that antsy about potentially losing value of their investments, then they should simply get out of the investment. Investing is just glorified gambling anyway, meaning that you should only invest what you're willing to lose.

So let's be generous and say we're looking for income and advancement... 11% advancement plus 3.8% income is 14.8%. That's a reasonable return for a stock portfolio. Not fantastic, just reasonable.

A 14.8% yearly return on investment is great. The most desired investment in the world, US debt, has a measly 2.95% rate over 10 years (HERE). If it was even half of this McDonald's estimate, then it would be amazing. And if you want to see some other realistic rates, look at the rates that investors would get for various US savings accounts and annuities lol. A 14.8% return would be a miracle.

Bear in mind that any investor who is looking for both is likely a high-risk investor and will demand 10% return or it might as well be a loss. 20% and up is more realistic, and McD does not meet that criteria.

Those are some big assumptions. Let me show you some data that refutes this claim. Here's a list of the 10 largest holders of McDonald's stocks (screenshotted from here because making a graph was tedious). Tell me if you notice the trend.

So I'm curious to see why you made those assumptions?

Though I've noticed one thing about our exchanges. I'm reaching virtually all of my conclusions based on documented facts, but you're seeming to reach your conclusions based on personal assumptions and anecdotal experience. Why should I ignore the stats in favor of your opinions when you refuse to back up your opinions with documented facts?

when you go to a mcdonalds with a kiosk there is a person there standing next to the kiosk encouraging you to use it and helping you to use it as they

are new and most people dont know how to use it.

so their data is flawed to begin with, whatever.

so their data is flawed to begin with, whatever.

Does this all mean we can burn every gawd darn McDonalds down to the ground yet? Even mold will not eat their crap.

a reply to: enlightenedservant

Consider this: if the business fails, do the employees pony up the lease payments and business costs? NO. Does McD Corporate? NO. The franchise owner does. Just because the use of the brand does mitigate some of the risks, it does not follow that the franchise owner does not still accept all of the risk. No one else is losing money if something goes wrong.

No, sometimes they sell companies when they're doing well, to cash out their equity profit, or sometimes just because they're tired of running it. But none of that guarantees that one can get 100% assumed value within a specified time. Real estate just doesn't work like that.

Depreciation is not cash. Depreciation is an accounting tool to spread cost out over an assumed lifetime. You can't buy a loaf of bread with $10,000,000 of depreciation.

A McDonalds is still commercial real estate. I am well aware of the appeal of a franchise, but that appeal does not change what the franchise is or how it profits. It is still a business and still subject to the same dynamics as any other business. The only difference is that it comes with a certain amount of public goodwill and name recognition, so it has a higher chance of success. The franchise owner pays for that increased chance of success via franchise fees and compliance with franchise requirements.

Is it easier to sell a profiting McDonalds than a Mom-and-Pop convenience store? Probably. But that is still no guarantee.

Most franchises (including McDonalds) come with a specified coverage area. That means if you buy a franchise, you are guaranteed by the parent company that you will not have another franchise opening up in your target area. Ever. The growth in the number of franchises is not because the density of restaurants (I hate calling a McDs that) is increasing; it is because open territories are becoming populous enough to support one. It's not like you can just pick out a spot, send in your money, and get the franchise... everything from location to your own business experience and local population must be approved by Corporate. A failing business hurts their bottom line too, since they can charge more for the success ratio of their stores, and they have legal requirements to other franchisees to consider.

Exactly. And in a franchise, who is doing the gambling? The franchise owner. So who stands to win or lose? The franchise owner. All the risk is through them, regardless of how much risk is involved.

As to stocks, yes, there is a risk and investors all have their own concept of how much risk they are willing to take for how much and what kind of reward they get. Generally speaking, the stock market is much less risky than operating a franchise... but the reward is less as well. One can get into the stock market with a few thousand dollars; a McD franchise costs much more and promises a much higher return. Same principle with growth vs. income. If I am going to need my money in a few months or years, I don't care as much about growth as I do income. If not, I may be more interested in growth.

My point is that taking both into account means you also have to consider how few investors are looking for both and what kind of returns are available to them from other investments.

Not considering the risk; that is the missing component of your argument. US Savings Bonds carry almost no risk and offer (as you point out) very low reward. Savings accounts offer almost no reward, but almost no risk. On the other hand, the riskiest investments (start-ups) can offer 100%-200% or higher potential returns, but come with extreme risk.

Most people never even consider high-risk investments. Most people concern themselves with a few percent return but little to no risk. but then again, that is not the type of people who open or run franchises. I stand by my figures. If you want a real-life metaphor that most are familiar with, look at loan interest rates... the better your credit (lower risk) the lower the interest rate (return) the bank demands. Get below a certain credit rating, and the number of banks willing to take that much risk drops.

None of that disputes anything. You are taking it out of context.

Those are institutional investors. They manage retirement accounts and portfolios. Very few people (although a few do admittedly) invest directly and actively in the stock market. Most investment in the stock market is via IRAs and annuities... average people who pay institutional investors to manage their funds. As such, they are looking for a better than average return and yet low risk. These companies manage this by diversifying. If one stock drops in price, another rises... over time, they are able to achieve better results, because they are also continually watching the markets and outside influences.

I'm sorry; I simply don't have the time to educate you on the intricacies of investing here... and even if I did, I am not an expert. I am familiar with the mechanics, but that is far from being expert in the field. Most of my investment knowledge is based around start-ups and research investment, the highest possible risk and also the highest rewards. In that field, 15% return is laughable.

TheRedneck

You said franchisees take all of the risk. That's simply untrue. The whole point in getting a franchise instead of starting a new restaurant from scratch is because the original company has a built in customer base, has its own suppliers, has its own tested recipes, has its own brands, has its own advertising, etc. How does that mean the franchisee is taking all of the risk?

Consider this: if the business fails, do the employees pony up the lease payments and business costs? NO. Does McD Corporate? NO. The franchise owner does. Just because the use of the brand does mitigate some of the risks, it does not follow that the franchise owner does not still accept all of the risk. No one else is losing money if something goes wrong.

But people don't only sell companies when they're losing money. Also, if you check the itemized average costs from the first link, depreciation is included in it.So they're already accounting for a lot of potentially lost value right there.

No, sometimes they sell companies when they're doing well, to cash out their equity profit, or sometimes just because they're tired of running it. But none of that guarantees that one can get 100% assumed value within a specified time. Real estate just doesn't work like that.

Depreciation is not cash. Depreciation is an accounting tool to spread cost out over an assumed lifetime. You can't buy a loaf of bread with $10,000,000 of depreciation.

Ok, but that has nothing to do with selling a McDonald's. The whole appeal of franchises is that have their own brand awareness, customer base, suppliers, etc. And the fact that the number of McDonald's is still growing every year.

A McDonalds is still commercial real estate. I am well aware of the appeal of a franchise, but that appeal does not change what the franchise is or how it profits. It is still a business and still subject to the same dynamics as any other business. The only difference is that it comes with a certain amount of public goodwill and name recognition, so it has a higher chance of success. The franchise owner pays for that increased chance of success via franchise fees and compliance with franchise requirements.

Is it easier to sell a profiting McDonalds than a Mom-and-Pop convenience store? Probably. But that is still no guarantee.

Most franchises (including McDonalds) come with a specified coverage area. That means if you buy a franchise, you are guaranteed by the parent company that you will not have another franchise opening up in your target area. Ever. The growth in the number of franchises is not because the density of restaurants (I hate calling a McDs that) is increasing; it is because open territories are becoming populous enough to support one. It's not like you can just pick out a spot, send in your money, and get the franchise... everything from location to your own business experience and local population must be approved by Corporate. A failing business hurts their bottom line too, since they can charge more for the success ratio of their stores, and they have legal requirements to other franchisees to consider.

That's mostly true, though many companies (like Apple) are desired more for the growth of their stock prices instead of dividends. However, there are no guarantees in business. So if people are that antsy about potentially losing value of their investments, then they should simply get out of the investment. Investing is just glorified gambling anyway, meaning that you should only invest what you're willing to lose.

Exactly. And in a franchise, who is doing the gambling? The franchise owner. So who stands to win or lose? The franchise owner. All the risk is through them, regardless of how much risk is involved.

As to stocks, yes, there is a risk and investors all have their own concept of how much risk they are willing to take for how much and what kind of reward they get. Generally speaking, the stock market is much less risky than operating a franchise... but the reward is less as well. One can get into the stock market with a few thousand dollars; a McD franchise costs much more and promises a much higher return. Same principle with growth vs. income. If I am going to need my money in a few months or years, I don't care as much about growth as I do income. If not, I may be more interested in growth.

My point is that taking both into account means you also have to consider how few investors are looking for both and what kind of returns are available to them from other investments.

A 14.8% yearly return on investment is great. The most desired investment in the world, US debt, has a measly 2.95% rate over 10 years. If it was even half of this McDonald's estimate, then it would be amazing. And if you want to see some other realistic rates, look at the rates that investors would get for various US savings accounts and annuities lol. A 14.8% return would be a miracle.

Not considering the risk; that is the missing component of your argument. US Savings Bonds carry almost no risk and offer (as you point out) very low reward. Savings accounts offer almost no reward, but almost no risk. On the other hand, the riskiest investments (start-ups) can offer 100%-200% or higher potential returns, but come with extreme risk.

Most people never even consider high-risk investments. Most people concern themselves with a few percent return but little to no risk. but then again, that is not the type of people who open or run franchises. I stand by my figures. If you want a real-life metaphor that most are familiar with, look at loan interest rates... the better your credit (lower risk) the lower the interest rate (return) the bank demands. Get below a certain credit rating, and the number of banks willing to take that much risk drops.

Those are some big assumptions. Let me show you some data that refutes this claim.

None of that disputes anything. You are taking it out of context.

Those are institutional investors. They manage retirement accounts and portfolios. Very few people (although a few do admittedly) invest directly and actively in the stock market. Most investment in the stock market is via IRAs and annuities... average people who pay institutional investors to manage their funds. As such, they are looking for a better than average return and yet low risk. These companies manage this by diversifying. If one stock drops in price, another rises... over time, they are able to achieve better results, because they are also continually watching the markets and outside influences.

I'm sorry; I simply don't have the time to educate you on the intricacies of investing here... and even if I did, I am not an expert. I am familiar with the mechanics, but that is far from being expert in the field. Most of my investment knowledge is based around start-ups and research investment, the highest possible risk and also the highest rewards. In that field, 15% return is laughable.

TheRedneck

Because some jobs require more pay than others.

originally posted by: Aazadan

originally posted by: NarcolepticBuddha

Well yeah. So where's my raise? Why do unskilled workers deserve 15/ hour for something a kiosk can do for them? Explain this to me.

I think the real question is, why does your so called skilled labor deserve more than them?

Why do you believe yourself to be their better?

Thats like paying a Nuclear physicist the same pay as a McDs worker.

Higher skill and knowledge tier results in higher pay.

Simple really.

new topics

-

America's Greatest Ally

General Chit Chat: 22 minutes ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 5 hours ago -

Maestro Benedetto

Literature: 6 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 7 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 10 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 11 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 5 hours ago, 26 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 16 hours ago, 9 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 11 hours ago, 8 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 16 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 15 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 13 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 10 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 13 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 11 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 7 hours ago, 3 flags

active topics

-

Is AI Better Than the Hollywood Elite?

Movies • 16 • : 5thHead -

Hate makes for strange bedfellows

US Political Madness • 48 • : Terpene -

America's Greatest Ally

General Chit Chat • 0 • : 19Bones79 -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 17 • : BingoMcGoof -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 29 • : 19Bones79 -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 90 • : Lumenari -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 12 • : KrustyKrab -

SHORT STORY WRITERS CONTEST -- April 2024 -- TIME -- TIME2024

Short Stories • 23 • : DontTreadOnMe -

Truth Social goes public, be careful not to lose your money

Mainstream News • 130 • : Astyanax -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 689 • : daskakik