It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by MrXYZ

reply to post by grey580

They have to pay for those tax cuts of their funders...the top 1%

If you're not part of the 1% and vote for the GOP you're a moron...simple as that.

Truer words were never spoken.

Although by the way some of our fellow ATS members support the 1% you'd think they were part of it or at least paid shills.

same here in Spain. Only a couple of days away. This is a world wide effort to piss us off so much we go a little nuts and hit the streets in protest.

IMO

I am guessing here but....

They then send in the heavy hand...on purpose, to cause a mass sense of injustice.

We fall into chaos. they wait until we are really F-ed up, and then poof. The magic solutions start pouring in and we thank them to high heaven for saving us from our depravity.

You would be surprised what a hot shower and warm meal mean after you know what they are and have not had them for 5 years.

IMO

I am guessing here but....

They then send in the heavy hand...on purpose, to cause a mass sense of injustice.

We fall into chaos. they wait until we are really F-ed up, and then poof. The magic solutions start pouring in and we thank them to high heaven for saving us from our depravity.

You would be surprised what a hot shower and warm meal mean after you know what they are and have not had them for 5 years.

edit on 30-7-2012 by BIHOTZ because: (no reason given)

If I had a dollar for every time I got accused of being a paid shill, I would be the 1%.

Originally posted by Procession101

Originally posted by MrXYZ

reply to post by grey580

They have to pay for those tax cuts of their funders...the top 1%

If you're not part of the 1% and vote for the GOP you're a moron...simple as that.

Truer words were never spoken.

Although by the way some of our fellow ATS members support the 1% you'd think they were part of it or at least paid shills.

Originally posted by camaro68ss

Originally posted by MrXYZ

reply to post by camaro68ss

How about you learn the difference between federal and other taxes?

Did you even read what i posted? Ive been talking about federal taxes this whole time. Please highlight the section where im talking about some "other" tax.

Let me give you a hint. you wont find it because its not there.

Here was your post. You didn't say "federal taxes" anyplace...you said "taxes"...

post by camaro68ss

Just saying..."Taxes" includes SS, Medicare, Sales tax, Excise, Property taxes, State and Local etc. etc.

To infer that 50% of the population doesn't pay those taxes is not accurate.

Originally posted by MrXYZ

Originally posted by neo96

reply to post by MrXYZ

If you expect some of us to just be so mad just because other people have more than others?

Well not in kindergarten anymore sometimes people just need to grow up that green eyed monster jealousy is a wasted emotion.

It's not a matter of "having more"...but if Buffet's secretary pays more taxes than him something's clearly wrong. And if over 25 years the income of average Americans grows 23 times (!!!) less than that of the top 5% something is wrong too. This has nothing to do with kindergarden jealousy, it's COMMON SENSE

your watching to much fox news man. lol

buffets secretary gets a salary, she pays taxes based off her wages, its at a higher tax braket. Buffets income is capital gains, I belive thats at 15% right now. Capital gains is gains on money you already paid taxes for when you earned it from some other revenue sorce, via salery, aka income tax. Wages and capital gains are two different taxes because capital gains is money you have already pay taxes on, invested in the market, and paying taxes on those gains. So i guess thats why they call it CAPITAL gains. hahaha. Really Buffet is paying a double tax. The left likes to crop and tell you little white lie.

If the secetary was to invest her money, after wages have already been taxed, in the market, she would also have to pay a capital gain on in income she gains from the market.

Because Buffet is a billionaire, he doesnt withdraw wages to hide from wage income taxes. Instead he "invests" his billions hes already payed taxes on in the market, makes money on that, and pays the 15% capital gains taxes.

I feel like alot of people are learning new things today. well i hope..

But no one is going to read this, call me some right winger and fox news watch. haha

Dang you camaro with all your facts. Now your going to tell me i got that from fox news. lol I would not know, is this something they would say?

edit on 30-7-2012 by camaro68ss because: (no reason given)

edit on 30-7-2012 by camaro68ss because: (no reason

given)

reply to post by grey580

I guess with this impressive news on the GOP "poverty creators" we may have to add the soon to hid more the working class and poor Obamacare 7 tax hikes to support his monstrosity that will only benefit the second largest lobbyist benefactors the Insurance companies.

I guess propaganda forgot to add that one.

www.forbes.com...

I guess we are to get screwed one way or the other and political parties have not distinctions in today corporate dictatorship.

I guess with this impressive news on the GOP "poverty creators" we may have to add the soon to hid more the working class and poor Obamacare 7 tax hikes to support his monstrosity that will only benefit the second largest lobbyist benefactors the Insurance companies.

I guess propaganda forgot to add that one.

Obama’s pledge against any form of tax increase on Americans making less than $250,000 a year “was thrown out the window” when he signed the healthcare law, says John Kartch, communications director with Americans For Tax Reform (founded by anti-tax crusader Grover Norquist).

Here’s a rundown of seven ObamaCare tax hikes that affect the hoi polloi.

www.forbes.com...

I guess we are to get screwed one way or the other and political parties have not distinctions in today corporate dictatorship.

reply to post by neo96

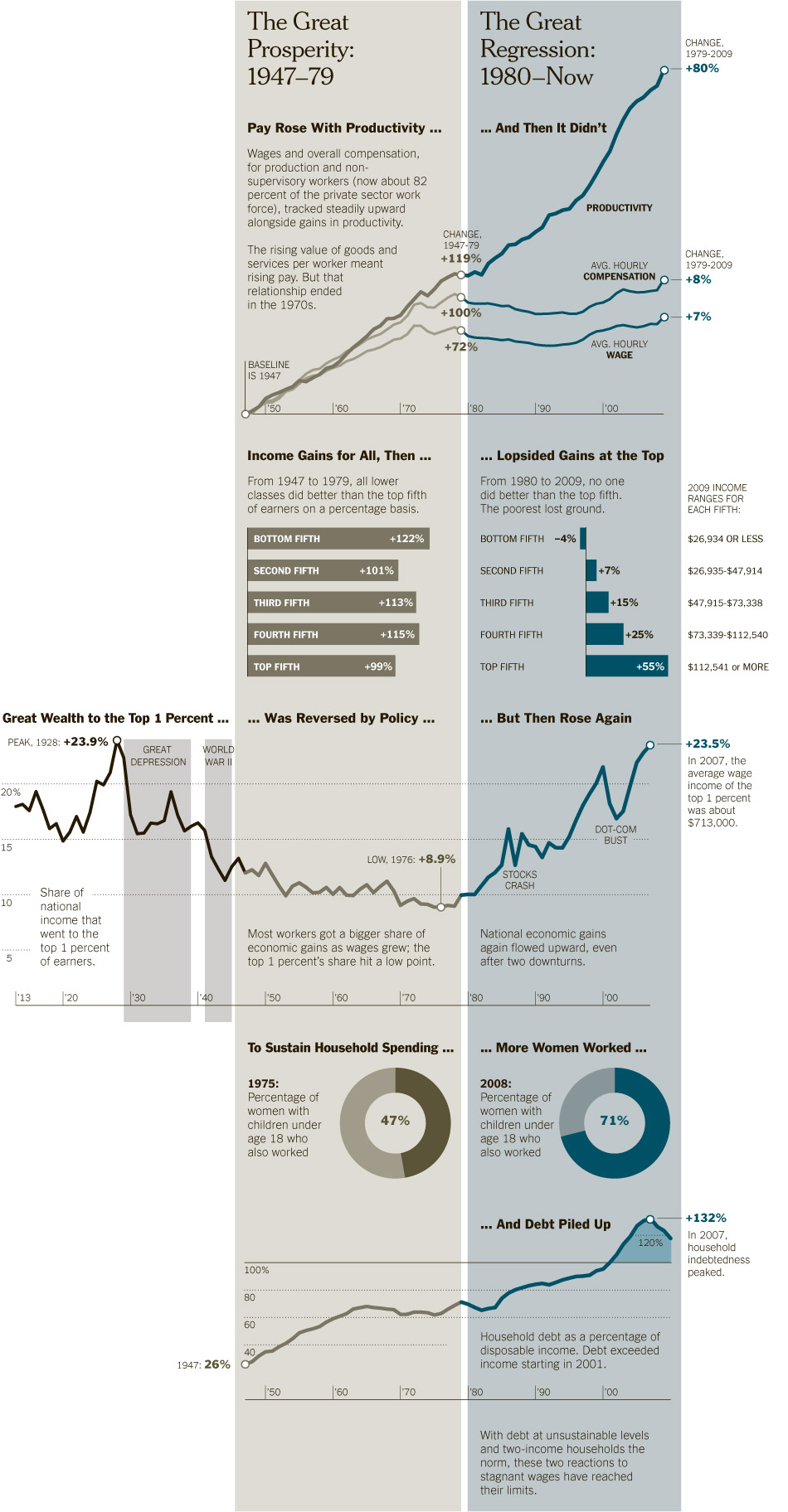

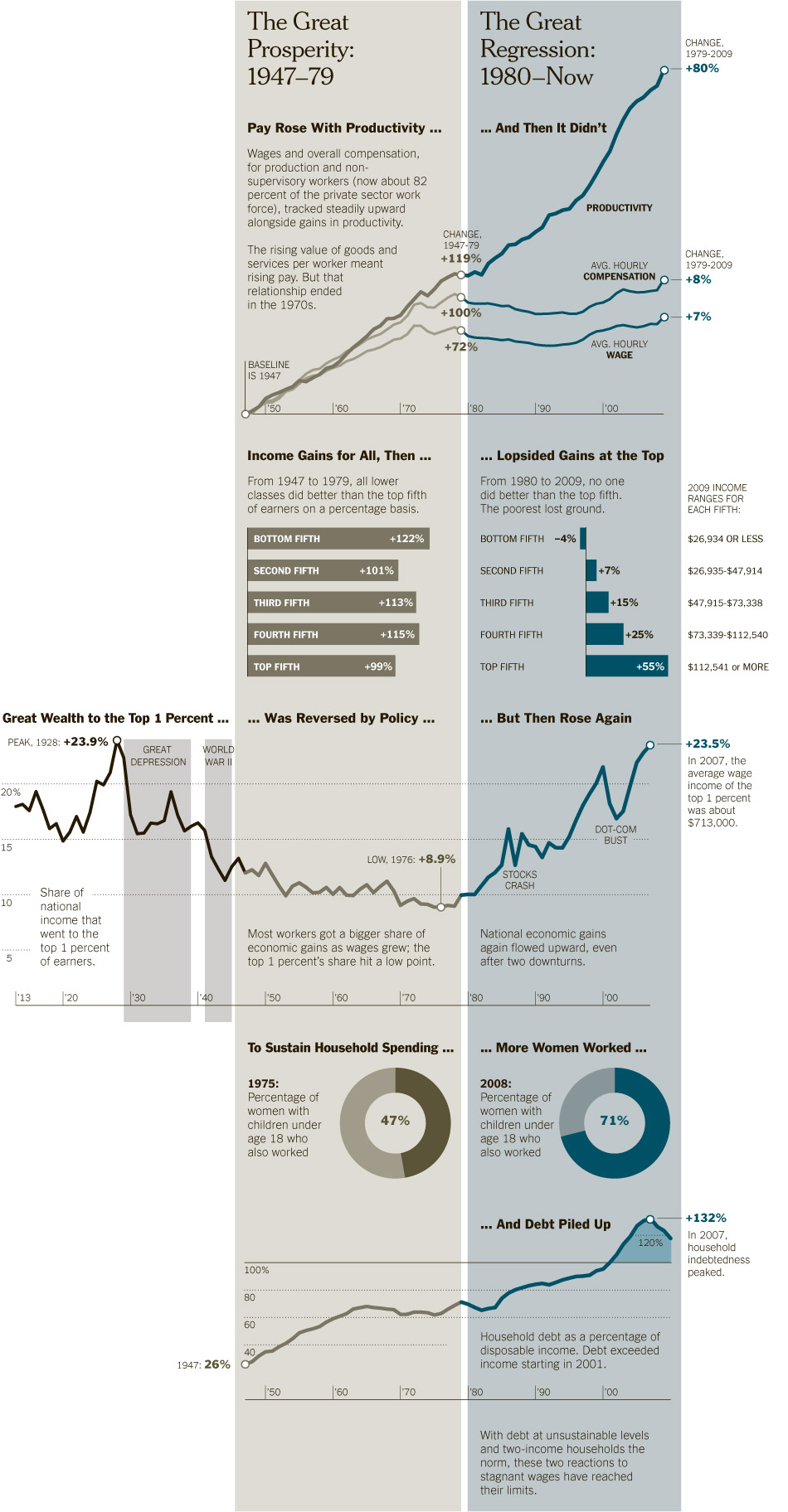

Scroll right...A graphic worth squinting at...

Scroll right...A graphic worth squinting at...

edit on 30-7-2012 by Indigo5 because: (no reason given)

reply to post by camaro68ss

of this 49.7%.

What percentage of these americans are children that do not work?

What percentage of these americans are retired?

What percentage are due to job loss?

What percentage are disabled?

What percentage homeless?

etc etc.

I'm thinking that percentage is taken out of context. And the number is actually lower.

So are you just going to ignore the fact that 49.7% of americans dont pay taxes? or just ignore my post in me asking you to point out the section where i talk about "other" taxes, because i still cant find it.

of this 49.7%.

What percentage of these americans are children that do not work?

What percentage of these americans are retired?

What percentage are due to job loss?

What percentage are disabled?

What percentage homeless?

etc etc.

I'm thinking that percentage is taken out of context. And the number is actually lower.

reply to post by grey580

Your quote. (That is not another side to this story.

That's a loophole that needs to be closed.

My tax money, nor anyone's, should not be going to illegal aliens with no social security number.)

If you are worried about then you are barking up the wrong tree. The liberal dems are the ones withn the open door policy for illeagle immagrants. Pick a side....

Your quote. (That is not another side to this story.

That's a loophole that needs to be closed.

My tax money, nor anyone's, should not be going to illegal aliens with no social security number.)

If you are worried about then you are barking up the wrong tree. The liberal dems are the ones withn the open door policy for illeagle immagrants. Pick a side....

Originally posted by grey580

reply to post by camaro68ss

So are you just going to ignore the fact that 49.7% of americans dont pay taxes? or just ignore my post in me asking you to point out the section where i talk about "other" taxes, because i still cant find it.

of this 49.7%.

What percentage of these americans are children that do not work?

What percentage of these americans are retired?

What percentage are due to job loss?

What percentage are disabled?

What percentage homeless?

etc etc.

I'm thinking that percentage is taken out of context. And the number is actually lower.

They know but don't care.

Originally posted by grey580

reply to post by camaro68ss

So are you just going to ignore the fact that 49.7% of americans dont pay taxes? or just ignore my post in me asking you to point out the section where i talk about "other" taxes, because i still cant find it.

of this 49.7%.

What percentage of these americans are children that do not work?

What percentage of these americans are retired?

What percentage are due to job loss?

What percentage are disabled?

What percentage homeless?

etc etc.

I'm thinking that percentage is taken out of context. And the number is actually lower.

if you would read my posts before you would see the 49.7% im talking about are those people that filed taxes after have there taxes withheld from there paycheck monthly and had a net return "tax credit" on there withholdings after the tax year. so no the number is high. the 49.7% is based off of tax payers that comes out of the 2011 IRS stats

So 49.7% of tax payers dont pay taxes, i know its hard to wrap your mind around, because they get there money back from the IRS at the end of the year with tax credits. aka no net loss due to taxes. so that leaves you a gap of people that dont even file taxes.

edit on 30-7-2012 by camaro68ss

because: (no reason given)

Originally posted by marg6043

reply to post by grey580

I guess with this impressive news on the GOP "poverty creators" we may have to add the soon to hid more the working class and poor Obamacare 7 tax hikes to support his monstrosity that will only benefit the second largest lobbyist benefactors the Insurance companies.

I guess propaganda forgot to add that one.

Obama’s pledge against any form of tax increase on Americans making less than $250,000 a year “was thrown out the window” when he signed the healthcare law, says John Kartch, communications director with Americans For Tax Reform (founded by anti-tax crusader Grover Norquist).

Here’s a rundown of seven ObamaCare tax hikes that affect the hoi polloi.

www.forbes.com...

I guess we are to get screwed one way or the other and political parties have not distinctions in today corporate dictatorship.

That is not on topic and better left for another thread.

I agree that the Obamacare is nothing but a fiasco.

And should never have been passed.

Originally posted by grey580

reply to post by camaro68ss

So are you just going to ignore the fact that 49.7% of americans dont pay taxes? or just ignore my post in me asking you to point out the section where i talk about "other" taxes, because i still cant find it.

of this 49.7%.

What percentage of these americans are children that do not work?

What percentage of these americans are retired?

What percentage are due to job loss?

What percentage are disabled?

What percentage homeless?

etc etc.

I'm thinking that percentage is taken out of context. And the number is actually lower.

Percentages how about the real numbers:

70 million on SS that same 70 million is receiving Medicare but that medicare is automatically deducted from the SS check.

50 million are on Medicaid with 30 million new people added since the scotus ruling.

50 million on the program called welfare.

Now if they are receiving those benefits most are not paying income taxes since the average SS check is $1000 bucks.

That is not counting the 1 trillion student loan or the trillions paid to Fanny and freddy.

So the number is lower?

Laughable.

The population of this country is 310 plus million meaning over half is receiving that tax revenue

www.usdebtclock.org...

money.cnn.com...

edit on 30-7-2012 by neo96 because: (no reason given)

Originally posted by beezzer

If I had a dollar for every time I got accused of being a paid shill, I would be the 1%.

Originally posted by Procession101

Originally posted by MrXYZ

reply to post by grey580

They have to pay for those tax cuts of their funders...the top 1%

If you're not part of the 1% and vote for the GOP you're a moron...simple as that.

Truer words were never spoken.

Although by the way some of our fellow ATS members support the 1% you'd think they were part of it or at least paid shills.

its because you use facts and logic. people dont like facts and logic when there shown its the truth.

Originally posted by Diisenchanted

reply to post by grey580

Your quote. (That is not another side to this story.

That's a loophole that needs to be closed.

My tax money, nor anyone's, should not be going to illegal aliens with no social security number.)

If you are worried about then you are barking up the wrong tree. The liberal dems are the ones withn the open door policy for illeagle immagrants. Pick a side....

I'm moderate. I'm for America.

I'm not for any particular party.

And as for immigration. Get those illegals and make em legal and paying taxes.

But I digress. Let's stay on topic.

reply to post by Procession101

So you really believe that the left REALLY CARES about the less fortunate??? Don't tell me you buy into the good guy bad guy routine perfected by Vince McMahon and carried out by the likes of Hulk Hogan and Sgt Slaughter!? You know, the same tactics that are used by our elected officials???

Anyone who follows a partisan line when it is so obvious as to how fake the two party system is, should really go take some of big pharms drugs!

To bitch and moan about how one party is soooooo evil and bad while supporting the other shows how brainwashed we as Americans have become, and it also shows how we have allowed these criminals in Washington D.C. to ruin the United States of America!!!!

Regardless of this info shills here at ATS will still defend thier ultra rich masters, tooth and nail claiming that they earned thier obscenely large bank account totals.

So you really believe that the left REALLY CARES about the less fortunate??? Don't tell me you buy into the good guy bad guy routine perfected by Vince McMahon and carried out by the likes of Hulk Hogan and Sgt Slaughter!? You know, the same tactics that are used by our elected officials???

Anyone who follows a partisan line when it is so obvious as to how fake the two party system is, should really go take some of big pharms drugs!

To bitch and moan about how one party is soooooo evil and bad while supporting the other shows how brainwashed we as Americans have become, and it also shows how we have allowed these criminals in Washington D.C. to ruin the United States of America!!!!

reply to post by neo96

its so much harder to be a truth teller Neo, you and I have to back up our truths with facts and stats. Being a mud slinger is so much easier. Take a few talking point here, take some from there, spit them out and dont ever read what the rebuttal has to say, as this seems to be the trend here on this thread.

close your eyes, plug your ears, and just keep saying the talking points over and over and over until you feel there true.

Saddest part is these people, as a nation, get to vote.

its so much harder to be a truth teller Neo, you and I have to back up our truths with facts and stats. Being a mud slinger is so much easier. Take a few talking point here, take some from there, spit them out and dont ever read what the rebuttal has to say, as this seems to be the trend here on this thread.

close your eyes, plug your ears, and just keep saying the talking points over and over and over until you feel there true.

Saddest part is these people, as a nation, get to vote.

edit on 30-7-2012 by camaro68ss because: (no reason given)

reply to post by camaro68ss

They wouldn't know the truth if came out chanting "Yes We Can" or "hope and change" or Forward" or "our plan worked".

The only weapon in their "arsenal" is dogma so I would have to agree now back to the regualr scheduled topic of "evil gopers" creating poverty!!!

They wouldn't know the truth if came out chanting "Yes We Can" or "hope and change" or Forward" or "our plan worked".

The only weapon in their "arsenal" is dogma so I would have to agree now back to the regualr scheduled topic of "evil gopers" creating poverty!!!

reply to post by neo96

According to this.

en.wikipedia.org...

0-14 years: 20.2% (male 31,639,127/female 30,305,704)

of the 300+ million americans.

a full 20% of are under 14 years of age.

So of course they don't pay taxes. So that percentage is wrong.

I think that the quoted number needs to be adjusted to reflect the number of working age americans that could be working and paying taxes.

According to this.

en.wikipedia.org...

0-14 years: 20.2% (male 31,639,127/female 30,305,704)

of the 300+ million americans.

a full 20% of are under 14 years of age.

So of course they don't pay taxes. So that percentage is wrong.

I think that the quoted number needs to be adjusted to reflect the number of working age americans that could be working and paying taxes.

id say that is pretty fair.

you libs love fairness right?

whats more fair than more people paying into the system?

you do all realize that 35% of $5,000,000 is far, far, far more than the 15% of $30,000 you may have to pay right?

by A LOT.

seems to me this is a step towards liberal fairness.

you libs love fairness right?

whats more fair than more people paying into the system?

you do all realize that 35% of $5,000,000 is far, far, far more than the 15% of $30,000 you may have to pay right?

by A LOT.

seems to me this is a step towards liberal fairness.

new topics

-

REAL ID now a reality

General Conspiracies: 8 minutes ago -

'I couldn't cope with Britain anymore': Kurdish man pays smuggler to return him to France

Social Issues and Civil Unrest: 2 hours ago -

Former Hamas member goes OFF on ‘low grade’ lefty journalist

US Political Madness: 5 hours ago -

An Apple a Day

General Chit Chat: 5 hours ago -

Oh, Have I got a Goody for You Guys!!!

General Conspiracies: 6 hours ago -

Woman In Her 60s Stabbed To Death In London Street By Thief Who Tried To Steal Her Bag.

Social Issues and Civil Unrest: 8 hours ago -

"The Fool" - A short video featuring a harmonica-playing guy blasted by a UFO

Aliens and UFOs: 11 hours ago

top topics

-

Oh, Have I got a Goody for You Guys!!!

General Conspiracies: 6 hours ago, 16 flags -

Multipal Solar Storms Coming Our Way This Weekend

Fragile Earth: 16 hours ago, 10 flags -

Former Hamas member goes OFF on ‘low grade’ lefty journalist

US Political Madness: 5 hours ago, 9 flags -

Woman In Her 60s Stabbed To Death In London Street By Thief Who Tried To Steal Her Bag.

Social Issues and Civil Unrest: 8 hours ago, 6 flags -

Kirkpatrick vs Fugal - Skinwalker ranch briefing.

Aliens and UFOs: 15 hours ago, 3 flags -

Lemon-aid and lime-aid

General Chit Chat: 16 hours ago, 3 flags -

"The Fool" - A short video featuring a harmonica-playing guy blasted by a UFO

Aliens and UFOs: 11 hours ago, 1 flags -

An Apple a Day

General Chit Chat: 5 hours ago, 1 flags -

REAL ID now a reality

General Conspiracies: 8 minutes ago, 1 flags -

'I couldn't cope with Britain anymore': Kurdish man pays smuggler to return him to France

Social Issues and Civil Unrest: 2 hours ago, 0 flags

active topics

-

"The Fool" - A short video featuring a harmonica-playing guy blasted by a UFO

Aliens and UFOs • 4 • : MindBodySpiritComplex -

Murder Suicide Investigation Still Active 4 months later?

Other Current Events • 5 • : ByeByeAmericanPie -

Skinwalker Ranch and the Mystery 1.6GHz Signal

Aliens and UFOs • 169 • : Flyingclaydisk -

Oh, Have I got a Goody for You Guys!!!

General Conspiracies • 45 • : Flyingclaydisk -

US food sources declining becoming non edible .

Social Issues and Civil Unrest • 22 • : Caver78 -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 1468 • : Zanti Misfit -

REAL ID now a reality

General Conspiracies • 0 • : burritocat -

Judas Iscariot Slips The Hangman's Noose

Political Issues • 39 • : CriticalStinker -

Bibi’s Dilemma

Middle East Issues • 121 • : jofafot -

The Acronym Game .. Pt.3

General Chit Chat • 7821 • : bally001