It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

This is a good article on economic indicators.

GDP and Unemployment are poor metrics for several reasons.

GDP and Unemployment are poor metrics for several reasons.

originally posted by: Bluntone22

a reply to: Snarl

I said after the election that people better be ready for a bumpy ride.

Dominos start to fall.

It starts with gas prices.

I know rich people who just play one game, money and power. These people are making drastic moves to save money, move money around.

They are preparing for hard times for years to come from the upcoming damage the Democrats will do.

The only way Democrats can hide this If they print those Tubman 20s.

Do you know who had the privy to be president when the new 100s rolled out?

originally posted by: chr0naut

originally posted by: TrulyColorBlind

originally posted by: chr0naut

originally posted by: The2Billies

originally posted by: Nickn3

With the extremely low interest rate, I have been expecting a rapid inflation rate. It’s the only way we can pay back the huge debt, is to do it with inflated dollars.

I clearly remember the horrible inflation in the mid to late 70's, it wasn't until Reagan became President that it finally stopped. It was so bad that if we saw something on a good sale that we used regularly we bought it, even if ours was working fine, or we had some on hand, just in case, because we knew that by the time we needed it the price would have gone way way up.

That stuck with me all these years later as my really "poor" years were the years prior to Reagan taking office. I always have on hand two extra of things I use regularly. I wait until they are on a really good sale and get them and store them in my garage or a closet. Looks like this habit may pay off while the Democrats run the nation once again.

Four years legacy of Trump 'economics' and yet somehow the Dems did this in a month?

Are you blind, stupid or trolling? The economy under President Trump was booming until Democratic governors started wiping it out last March by intentionally shutting it down. So, no, Dems did not do this in a month. It's taken almost a year, but they've just about gotten what they wanted. Are you happy with how it's going?

TCB

I'm not an American, so I can only see things that are published. I don't experience how it feels (which isn't necessarily a good indicator).

The economy under Trump wasn't actually booming. That was what he said about it, but it wasn't entirely true.

What happened is; some indicators looked good, but only because other areas were being borrowed from. The overall economy was about the same as ever, but debt continued to climb. A quick look at GDP growth gives an indicator to overall economy health.

GDP Growth Rate in USA - World Bank

The Democratic governors also don't affect the whole economy. The current situation is nationwide, and its roots are national.

That's wrong. It WAS booming under Trump directly because of his America first platform. It caused massive new employment and companies getting new contracts by the train load, which helped me get a really good job with an aerospace machine shop who builds parts for hundreds of big name aerospace companies as part of their supply chains.

As soon as the democrats shut down the economy to hurt Trump it all started going downhill with layoffs and cancelled contracts. I kept my job only because I am the only employee there that can do what I do. 67 others got the pink slip.

The democrat governors harmed the economy in a very impactful way which has affected the entire country and it is still happening.

originally posted by: lordcomac

If the government decides to retroactively forgive that rent debt, they'd have to cut huge checks to the owners of those properties.

If that happens, I'm out some 15 grand and counting in money I paid out of my hard work where the wanks next door got an extended vacation.

.

Same goes for the 50k student loan forgiveness that the dems want, Joe only want $10k forgiveness...Great, now give everyone who’s paid off the loans $10k, you know just to be fair.

But here’s the kicker, it’s Federal student loan forgiveness, not private! Ha!

originally posted by: chr0naut

originally posted by: TrulyColorBlind

Thank you for an honest attempt at a reply. I appreciate it. Sincerely.

originally posted by: chr0naut

originally posted by: TrulyColorBlind

originally posted by: chr0naut

originally posted by: The2Billies

originally posted by: Nickn3

With the extremely low interest rate, I have been expecting a rapid inflation rate. It’s the only way we can pay back the huge debt, is to do it with inflated dollars.

I clearly remember the horrible inflation in the mid to late 70's, it wasn't until Reagan became President that it finally stopped. It was so bad that if we saw something on a good sale that we used regularly we bought it, even if ours was working fine, or we had some on hand, just in case, because we knew that by the time we needed it the price would have gone way way up.

That stuck with me all these years later as my really "poor" years were the years prior to Reagan taking office. I always have on hand two extra of things I use regularly. I wait until they are on a really good sale and get them and store them in my garage or a closet. Looks like this habit may pay off while the Democrats run the nation once again.

Four years legacy of Trump 'economics' and yet somehow the Dems did this in a month?

Are you blind, stupid or trolling? The economy under President Trump was booming until Democratic governors started wiping it out last March by intentionally shutting it down. So, no, Dems did not do this in a month. It's taken almost a year, but they've just about gotten what they wanted. Are you happy with how it's going?

TCB

I'm not an American, so I can only see things that are published. I don't experience how it feels (which isn't necessarily a good indicator).

The economy under Trump wasn't actually booming. That was what he said about it, but it wasn't entirely true.

What happened is; some indicators looked good, but only because other areas were being borrowed from. The overall economy was about the same as ever, but debt continued to climb. A quick look at GDP growth gives an indicator to overall economy health.

GDP Growth Rate in USA - World Bank

The Democratic governors also don't affect the whole economy. The current situation is nationwide, and its roots are national.

However, being an American myself, I know your answer is wrong. We had the lowest unemployment rates in years, had more money and things were doing great.

TCB

OK, here's a hypothetical to demonstrate my point:

You can get a new credit card, and go on a spending spree buying up everything that you want. The thing is, you don't really have any extra money to pay for all those things. It increases your debt while making it appear that you have more money than you actually do. At some stage, however, you have to service that debt and make repayments.

Now, back in the real world, the GDP doesn't show massive increases in whole country economic productivity. So where did all that extra money that you experienced actually come from?

We know that international trade was being suppressed on many fronts as tariffs were placed that increased the cost of extra-nationally sourced goods. Purportedly, this was to protect local industry, but in that market, local suppliers usually push up prices to increase profitability to cover manufacture and warehousing required to support what to them is a vastly expanded market (this leads to price increases, as we are now seeing, the topic of this thread).

The only other place such an increase of money for general citizens would be asset sales. Were there any major (multi-trillion or multi-billion dollar) asset sales during that time?

Do you see what I am saying?

I see exactly what you're saying and understand it. It just doesn't apply to this situation because the last four years under President Trump saw him lowering taxes. That put MORE of our own money back into our pockets, or rather it never left our pockets in the first place. We had more of our very own money to spend, so we spent it. Unemployment was down to it's lowest figures in years. That also meant that those people, who were previously unemployed, now had jobs and had money of their very own in their pockets. They didn't need credit as a crutch as much as before they found a job. When you have more money in your pockets than before, that means life is easier to handle. That's why the economy under President Trump was so good. Do you see what I'm saying?

TCB

p.s. I've never had or used a credit card in my life. If I can afford something I want, I buy it. If I can't afford something I want, I don't go in debt and I don't buy it. It doesn't get any better than that for me.

originally posted by: NoCorruptionAllowed

originally posted by: chr0naut

originally posted by: TrulyColorBlind

originally posted by: chr0naut

originally posted by: The2Billies

originally posted by: Nickn3

With the extremely low interest rate, I have been expecting a rapid inflation rate. It’s the only way we can pay back the huge debt, is to do it with inflated dollars.

I clearly remember the horrible inflation in the mid to late 70's, it wasn't until Reagan became President that it finally stopped. It was so bad that if we saw something on a good sale that we used regularly we bought it, even if ours was working fine, or we had some on hand, just in case, because we knew that by the time we needed it the price would have gone way way up.

That stuck with me all these years later as my really "poor" years were the years prior to Reagan taking office. I always have on hand two extra of things I use regularly. I wait until they are on a really good sale and get them and store them in my garage or a closet. Looks like this habit may pay off while the Democrats run the nation once again.

Four years legacy of Trump 'economics' and yet somehow the Dems did this in a month?

Are you blind, stupid or trolling? The economy under President Trump was booming until Democratic governors started wiping it out last March by intentionally shutting it down. So, no, Dems did not do this in a month. It's taken almost a year, but they've just about gotten what they wanted. Are you happy with how it's going?

TCB

I'm not an American, so I can only see things that are published. I don't experience how it feels (which isn't necessarily a good indicator).

The economy under Trump wasn't actually booming. That was what he said about it, but it wasn't entirely true.

What happened is; some indicators looked good, but only because other areas were being borrowed from. The overall economy was about the same as ever, but debt continued to climb. A quick look at GDP growth gives an indicator to overall economy health.

GDP Growth Rate in USA - World Bank

The Democratic governors also don't affect the whole economy. The current situation is nationwide, and its roots are national.

That's wrong. It WAS booming under Trump directly because of his America first platform. It caused massive new employment and companies getting new contracts by the train load, which helped me get a really good job with an aerospace machine shop who builds parts for hundreds of big name aerospace companies as part of their supply chains.

As soon as the democrats shut down the economy to hurt Trump it all started going downhill with layoffs and cancelled contracts. I kept my job only because I am the only employee there that can do what I do. 67 others got the pink slip.

The democrat governors harmed the economy in a very impactful way which has affected the entire country and it is still happening.

Remember how Trump claimed the upturn in the economy, and specifically unemployment figures, even before he had assumed office?

I mean, how did he do that? Or could it have been yet another example of Trump's 'spin' that you have bought?

And here's something, the purse strings are controlled by Congress, not by the President. It's in the US Constitution, Article I, Section 9, Clause 7 (the Appropriations Clause) and Article I, Section 8, Clause 1 (the Taxing and Spending Clause). So upturns or downturns in the economy are more due to acts of Congress than from anything the President does.

And also, I was suggesting that Trump got these gains on credit, rather than actual increases in overall productivity. We know GDP was shrinking at the time, so where did that apparent growth come from?

originally posted by: TrulyColorBlind

originally posted by: chr0naut

originally posted by: TrulyColorBlind

Thank you for an honest attempt at a reply. I appreciate it. Sincerely.

originally posted by: chr0naut

originally posted by: TrulyColorBlind

originally posted by: chr0naut

originally posted by: The2Billies

originally posted by: Nickn3

With the extremely low interest rate, I have been expecting a rapid inflation rate. It’s the only way we can pay back the huge debt, is to do it with inflated dollars.

I clearly remember the horrible inflation in the mid to late 70's, it wasn't until Reagan became President that it finally stopped. It was so bad that if we saw something on a good sale that we used regularly we bought it, even if ours was working fine, or we had some on hand, just in case, because we knew that by the time we needed it the price would have gone way way up.

That stuck with me all these years later as my really "poor" years were the years prior to Reagan taking office. I always have on hand two extra of things I use regularly. I wait until they are on a really good sale and get them and store them in my garage or a closet. Looks like this habit may pay off while the Democrats run the nation once again.

Four years legacy of Trump 'economics' and yet somehow the Dems did this in a month?

Are you blind, stupid or trolling? The economy under President Trump was booming until Democratic governors started wiping it out last March by intentionally shutting it down. So, no, Dems did not do this in a month. It's taken almost a year, but they've just about gotten what they wanted. Are you happy with how it's going?

TCB

I'm not an American, so I can only see things that are published. I don't experience how it feels (which isn't necessarily a good indicator).

The economy under Trump wasn't actually booming. That was what he said about it, but it wasn't entirely true.

What happened is; some indicators looked good, but only because other areas were being borrowed from. The overall economy was about the same as ever, but debt continued to climb. A quick look at GDP growth gives an indicator to overall economy health.

GDP Growth Rate in USA - World Bank

The Democratic governors also don't affect the whole economy. The current situation is nationwide, and its roots are national.

However, being an American myself, I know your answer is wrong. We had the lowest unemployment rates in years, had more money and things were doing great.

TCB

OK, here's a hypothetical to demonstrate my point:

You can get a new credit card, and go on a spending spree buying up everything that you want. The thing is, you don't really have any extra money to pay for all those things. It increases your debt while making it appear that you have more money than you actually do. At some stage, however, you have to service that debt and make repayments.

Now, back in the real world, the GDP doesn't show massive increases in whole country economic productivity. So where did all that extra money that you experienced actually come from?

We know that international trade was being suppressed on many fronts as tariffs were placed that increased the cost of extra-nationally sourced goods. Purportedly, this was to protect local industry, but in that market, local suppliers usually push up prices to increase profitability to cover manufacture and warehousing required to support what to them is a vastly expanded market (this leads to price increases, as we are now seeing, the topic of this thread).

The only other place such an increase of money for general citizens would be asset sales. Were there any major (multi-trillion or multi-billion dollar) asset sales during that time?

Do you see what I am saying?

I see exactly what you're saying and understand it. It just doesn't apply to this situation because the last four years under President Trump saw him lowering taxes. That put MORE of our own money back into our pockets, or rather it never left our pockets in the first place.

Tax is just another thing you pay for. The overall national economy doesn't change. Tax and money in pocket are both internal to the economy. You don't get more money unless you earn more money.

We had more of our very own money to spend, so we spent it. Unemployment was down to it's lowest figures in years.

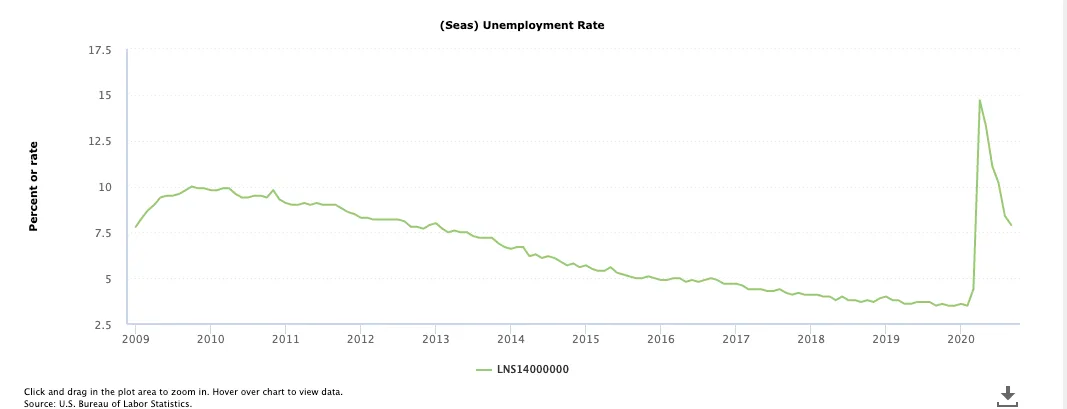

Yes, unemployment was down, but it was following a trend begun under Obama and that didn't change until COVID-19 hit.

That also meant that those people, who were previously unemployed, now had jobs and had money of their very own in their pockets. They didn't need credit as a crutch as much as before they found a job. When you have more money in your pockets than before, that means life is easier to handle. That's why the economy under President Trump was so good. Do you see what I'm saying?

It will take some time until the increased costs of employing more staff and gearing up to more production will have a return of greater profitability. Which is why destabilizing an already tuned and optimized set of parameters will most likely lead to turbulence.

TCB

p.s. I've never had or used a credit card in my life. If I can afford something I want, I buy it. If I can't afford something I want, I don't go in debt and I don't buy it. It doesn't get any better than that for me.

Even very wealthy people use credit cards. It depends upon interest rates and frequency of payments. Sometimes you can save money by buying on credit at an optimal time and then paying out the debt before interest is due. It depends upon many factors.

But in general, credit cards are a debt trap for most people. This is why the banks push them so hard. They get an assured long term income from them.

edit on 21/2/2021 by chr0naut because: (no reason given)

The worlds debt, like many things, is a joke. Who is owed the 281 trillion or whatever? That money doesn’t exist, it never has.

Money is just the yoke we are tied to and yet it frees the rich beyond belief.

Yes, there will be a reckoning, but it won’t impact any of the elites in their carefully guarded ivory towers. They will just get richer. Currently they die just like we do, but that too will change in the next 20-30 years.

Money is just the yoke we are tied to and yet it frees the rich beyond belief.

Yes, there will be a reckoning, but it won’t impact any of the elites in their carefully guarded ivory towers. They will just get richer. Currently they die just like we do, but that too will change in the next 20-30 years.

originally posted by: chr0naut

originally posted by: TrulyColorBlind

Thank you for an honest attempt at a reply. I appreciate it. Sincerely.

originally posted by: chr0naut

originally posted by: TrulyColorBlind

originally posted by: chr0naut

originally posted by: The2Billies

originally posted by: Nickn3

With the extremely low interest rate, I have been expecting a rapid inflation rate. It’s the only way we can pay back the huge debt, is to do it with inflated dollars.

I clearly remember the horrible inflation in the mid to late 70's, it wasn't until Reagan became President that it finally stopped. It was so bad that if we saw something on a good sale that we used regularly we bought it, even if ours was working fine, or we had some on hand, just in case, because we knew that by the time we needed it the price would have gone way way up.

That stuck with me all these years later as my really "poor" years were the years prior to Reagan taking office. I always have on hand two extra of things I use regularly. I wait until they are on a really good sale and get them and store them in my garage or a closet. Looks like this habit may pay off while the Democrats run the nation once again.

Four years legacy of Trump 'economics' and yet somehow the Dems did this in a month?

Are you blind, stupid or trolling? The economy under President Trump was booming until Democratic governors started wiping it out last March by intentionally shutting it down. So, no, Dems did not do this in a month. It's taken almost a year, but they've just about gotten what they wanted. Are you happy with how it's going?

TCB

I'm not an American, so I can only see things that are published. I don't experience how it feels (which isn't necessarily a good indicator).

The economy under Trump wasn't actually booming. That was what he said about it, but it wasn't entirely true.

What happened is; some indicators looked good, but only because other areas were being borrowed from. The overall economy was about the same as ever, but debt continued to climb. A quick look at GDP growth gives an indicator to overall economy health.

GDP Growth Rate in USA - World Bank

The Democratic governors also don't affect the whole economy. The current situation is nationwide, and its roots are national.

However, being an American myself, I know your answer is wrong. We had the lowest unemployment rates in years, had more money and things were doing great.

TCB

OK, here's a hypothetical to demonstrate my point:

You can get a new credit card, and go on a spending spree buying up everything that you want. The thing is, you don't really have any extra money to pay for all those things. It increases your debt while making it appear that you have more money than you actually do. At some stage, however, you have to service that debt and make repayments.

Now, back in the real world, the GDP doesn't show massive increases in whole country economic productivity. So where did all that extra money that you experienced actually come from?

We know that international trade was being suppressed on many fronts as tariffs were placed that increased the cost of extra-nationally sourced goods. Purportedly, this was to protect local industry, but in that market, local suppliers usually push up prices to increase profitability to cover manufacture and warehousing required to support what to them is a vastly expanded market (this leads to price increases, as we are now seeing, the topic of this thread).

The only other place such an increase of money for general citizens would be asset sales. Were there any major (multi-trillion or multi-billion dollar) asset sales during that time?

Do you see what I am saying?

Here is a hypothetical for you:

People don't run up massive debt with credit cards they cant afford to pay off. Instead they buy things they need because the economy is doing good and people are earning. The end.

Keeping as much manufacturing at home as possible is never a bad thing. More jobs, more money to spend. Increased demand is also a good thing. It does not drive prices up unless the demand is such that capacity needs to increase. With the variety of imported items available consumers still have far too many reasonably priced off-shore options to spend extra money on overpriced US goods. Some people demand Made in the USA goods and are willing to pay for them. I try to as much as I can. But there are times when the imports are just too inexpensive to pass up. As such, scaling up manufacturing does not happen nearly as often as you might think. Remember, after obiwamba there were many businesses not running at full capacity. Scaling up for many was simply a matter of turning machines back on, not building more.

Your assessment of how prices are driven up is lacking. Much of that scenario is dependent on how overhead is captured. Most US businesses use some form of a COGS (Cost Of Goods Sold) type system. Where, when, and how you capture various tiers of overhead has a huge impact on your cash flow. Not everyone uses a fully burdened rate to determine prices, and, depreciation of critical path assets offsets a significant portion of capital expenditures which again affects bottom line cash flow.

originally posted by: Vroomfondel

originally posted by: chr0naut

originally posted by: TrulyColorBlind

Thank you for an honest attempt at a reply. I appreciate it. Sincerely.

originally posted by: chr0naut

originally posted by: TrulyColorBlind

originally posted by: chr0naut

originally posted by: The2Billies

originally posted by: Nickn3

With the extremely low interest rate, I have been expecting a rapid inflation rate. It’s the only way we can pay back the huge debt, is to do it with inflated dollars.

I clearly remember the horrible inflation in the mid to late 70's, it wasn't until Reagan became President that it finally stopped. It was so bad that if we saw something on a good sale that we used regularly we bought it, even if ours was working fine, or we had some on hand, just in case, because we knew that by the time we needed it the price would have gone way way up.

That stuck with me all these years later as my really "poor" years were the years prior to Reagan taking office. I always have on hand two extra of things I use regularly. I wait until they are on a really good sale and get them and store them in my garage or a closet. Looks like this habit may pay off while the Democrats run the nation once again.

Four years legacy of Trump 'economics' and yet somehow the Dems did this in a month?

Are you blind, stupid or trolling? The economy under President Trump was booming until Democratic governors started wiping it out last March by intentionally shutting it down. So, no, Dems did not do this in a month. It's taken almost a year, but they've just about gotten what they wanted. Are you happy with how it's going?

TCB

I'm not an American, so I can only see things that are published. I don't experience how it feels (which isn't necessarily a good indicator).

The economy under Trump wasn't actually booming. That was what he said about it, but it wasn't entirely true.

What happened is; some indicators looked good, but only because other areas were being borrowed from. The overall economy was about the same as ever, but debt continued to climb. A quick look at GDP growth gives an indicator to overall economy health.

GDP Growth Rate in USA - World Bank

The Democratic governors also don't affect the whole economy. The current situation is nationwide, and its roots are national.

However, being an American myself, I know your answer is wrong. We had the lowest unemployment rates in years, had more money and things were doing great.

TCB

OK, here's a hypothetical to demonstrate my point:

You can get a new credit card, and go on a spending spree buying up everything that you want. The thing is, you don't really have any extra money to pay for all those things. It increases your debt while making it appear that you have more money than you actually do. At some stage, however, you have to service that debt and make repayments.

Now, back in the real world, the GDP doesn't show massive increases in whole country economic productivity. So where did all that extra money that you experienced actually come from?

We know that international trade was being suppressed on many fronts as tariffs were placed that increased the cost of extra-nationally sourced goods. Purportedly, this was to protect local industry, but in that market, local suppliers usually push up prices to increase profitability to cover manufacture and warehousing required to support what to them is a vastly expanded market (this leads to price increases, as we are now seeing, the topic of this thread).

The only other place such an increase of money for general citizens would be asset sales. Were there any major (multi-trillion or multi-billion dollar) asset sales during that time?

Do you see what I am saying?

Here is a hypothetical for you:

People don't run up massive debt with credit cards they cant afford to pay off. Instead they buy things they need because the economy is doing good and people are earning. The end.

Keeping as much manufacturing at home as possible is never a bad thing. More jobs, more money to spend. Increased demand is also a good thing. It does not drive prices up unless the demand is such that capacity needs to increase. With the variety of imported items available consumers still have far too many reasonably priced off-shore options to spend extra money on overpriced US goods. Some people demand Made in the USA goods and are willing to pay for them. I try to as much as I can. But there are times when the imports are just too inexpensive to pass up. As such, scaling up manufacturing does not happen nearly as often as you might think. Remember, after obiwamba there were many businesses not running at full capacity. Scaling up for many was simply a matter of turning machines back on, not building more.

Like in Detroit? They'll just turn the machines back on? LOL. The decline is decades old.

Your assessment of how prices are driven up is lacking. Much of that scenario is dependent on how overhead is captured. Most US businesses use some form of a COGS (Cost Of Goods Sold) type system. Where, when, and how you capture various tiers of overhead has a huge impact on your cash flow. Not everyone uses a fully burdened rate to determine prices, and, depreciation of critical path assets offsets a significant portion of capital expenditures which again affects bottom line cash flow.

So, if we squint our eyes and look at the economy sideways, the outcome is favorable? LOL. Perhaps you could turn the charts upside down so the trends would go up?

Regardless, the US debt clock shows that the USA has more debt than dollars.

Some other comparable countries, like China and Russia for example, have more currency than debt (and a stack of smaller countries do as well).

The math is actually easy, despite the shell game of complexities that people use to hide the truth.

edit on 21/2/2021 by chr0naut because: (no reason given)

Lumber is up about 250% gas is up about 60% All good around here.

edit on 21-2-2021 by mikell because: (no reason given)

originally posted by: ARM1968

The worlds debt, like many things, is a joke. Who is owed the 281 trillion or whatever? That money doesn’t exist, it never has.

Money is just the yoke we are tied to and yet it frees the rich beyond belief.

Yes, there will be a reckoning, but it won’t impact any of the elites in their carefully guarded ivory towers. They will just get richer. Currently they die just like we do, but that too will change in the next 20-30 years.

Not everyone in the world is in debt. Usually those people with money lend it to people who don't. Only those who borrow are in debt. It goes the same way for whole economies.

a reply to: chr0naut

In some cases, yes its as easy as turning the machines back on. In others, its not.

I didn't say whether the outlook is good or bad, I said your assessment of it was lacking.

Our economy as it stands right now is in serious danger. Not for any reason you mentioned, but danger none the less. In a stunning variety of calculations we have had more debt than dollars for some time now. Everyone knows the economy has been artificially propped up but many have no idea how long that has been happening or why. For the last 100 years or so we have been setting up our economy as a giant ponzi scheme that is destined to fail. You simply can not solve a credit problem with more credit. At some point the demand for payment of all that credit is made. That is the moment of insolvency. I heard it described once as the US being caught in a sort of a Wile E. Coyote moment where we have stepped off the cliff and our government is shoveling credit under us to keep us from falling. That is finite, no matter how much people want to believe otherwise. There is a financial reckoning coming and things are going to be very different afterward. We have survived several recessions, even a great depression. We are resilient. But that does not mean this isn't going to be painful and difficult. We built out institutions and our expectations on the idea that the recovery and subsequent growth are inevitable. They are not. And now we have built an economy that is no longer sustainable. Now, at this point, you might be thinking that such an event would capture the rich and powerful as well and they would not let this happen. Remember that in every society there is always a form of reserve currency based on tangible value. Precious metals, real estate, goods and services, etc. The people who will benefit most from the eventual downfall are the people who own everything and the people who own nothing. The people who own everything outright will always be fine. Their lives may change dramatically, they may not. But they will be fine. The people who own nothing have the benefit of having nothing to lose. Its the people who are financed and working toward ownership of something, anything, that are going to suffer. That is the majority of the people in the US. The rich and powerful are fully cognizant of that fact.

Beginning with Black Tuesday in 1929 thru the mid 1930's the stock market lost 90% of its value. Out of a population of 120 million roughly 35 million people lived in a family where no one had a job. Imagine if that were repeated today. 110 million people in the US living in a family in which no one has a job. Our current workforce is only around 160 million people. That is the day that the majority of this nation will not know with absolute certainty where their next meal is coming from for any extended period of time. That day is coming. It is inevitable unless there is a major reset and retooling of our economy. And we know who will benefit most from that as well. It won't be you or I.

I am not looking at things through squinty eyes. I am looking at them correctly and with a greater understanding than most.

In some cases, yes its as easy as turning the machines back on. In others, its not.

I didn't say whether the outlook is good or bad, I said your assessment of it was lacking.

Our economy as it stands right now is in serious danger. Not for any reason you mentioned, but danger none the less. In a stunning variety of calculations we have had more debt than dollars for some time now. Everyone knows the economy has been artificially propped up but many have no idea how long that has been happening or why. For the last 100 years or so we have been setting up our economy as a giant ponzi scheme that is destined to fail. You simply can not solve a credit problem with more credit. At some point the demand for payment of all that credit is made. That is the moment of insolvency. I heard it described once as the US being caught in a sort of a Wile E. Coyote moment where we have stepped off the cliff and our government is shoveling credit under us to keep us from falling. That is finite, no matter how much people want to believe otherwise. There is a financial reckoning coming and things are going to be very different afterward. We have survived several recessions, even a great depression. We are resilient. But that does not mean this isn't going to be painful and difficult. We built out institutions and our expectations on the idea that the recovery and subsequent growth are inevitable. They are not. And now we have built an economy that is no longer sustainable. Now, at this point, you might be thinking that such an event would capture the rich and powerful as well and they would not let this happen. Remember that in every society there is always a form of reserve currency based on tangible value. Precious metals, real estate, goods and services, etc. The people who will benefit most from the eventual downfall are the people who own everything and the people who own nothing. The people who own everything outright will always be fine. Their lives may change dramatically, they may not. But they will be fine. The people who own nothing have the benefit of having nothing to lose. Its the people who are financed and working toward ownership of something, anything, that are going to suffer. That is the majority of the people in the US. The rich and powerful are fully cognizant of that fact.

Beginning with Black Tuesday in 1929 thru the mid 1930's the stock market lost 90% of its value. Out of a population of 120 million roughly 35 million people lived in a family where no one had a job. Imagine if that were repeated today. 110 million people in the US living in a family in which no one has a job. Our current workforce is only around 160 million people. That is the day that the majority of this nation will not know with absolute certainty where their next meal is coming from for any extended period of time. That day is coming. It is inevitable unless there is a major reset and retooling of our economy. And we know who will benefit most from that as well. It won't be you or I.

I am not looking at things through squinty eyes. I am looking at them correctly and with a greater understanding than most.

originally posted by: Vroomfondel

a reply to: chr0naut

In some cases, yes its as easy as turning the machines back on. In others, its not.

I didn't say whether the outlook is good or bad, I said your assessment of it was lacking.

Our economy as it stands right now is in serious danger. Not for any reason you mentioned, but danger none the less. In a stunning variety of calculations we have had more debt than dollars for some time now. Everyone knows the economy has been artificially propped up but many have no idea how long that has been happening or why. For the last 100 years or so we have been setting up our economy as a giant ponzi scheme that is destined to fail. You simply can not solve a credit problem with more credit. At some point the demand for payment of all that credit is made. That is the moment of insolvency. I heard it described once as the US being caught in a sort of a Wile E. Coyote moment where we have stepped off the cliff and our government is shoveling credit under us to keep us from falling. That is finite, no matter how much people want to believe otherwise. There is a financial reckoning coming and things are going to be very different afterward. We have survived several recessions, even a great depression. We are resilient. But that does not mean this isn't going to be painful and difficult. We built out institutions and our expectations on the idea that the recovery and subsequent growth are inevitable. They are not. And now we have built an economy that is no longer sustainable. Now, at this point, you might be thinking that such an event would capture the rich and powerful as well and they would not let this happen. Remember that in every society there is always a form of reserve currency based on tangible value. Precious metals, real estate, goods and services, etc. The people who will benefit most from the eventual downfall are the people who own everything and the people who own nothing. The people who own everything outright will always be fine. Their lives may change dramatically, they may not. But they will be fine. The people who own nothing have the benefit of having nothing to lose. Its the people who are financed and working toward ownership of something, anything, that are going to suffer. That is the majority of the people in the US. The rich and powerful are fully cognizant of that fact.

Beginning with Black Tuesday in 1929 thru the mid 1930's the stock market lost 90% of its value. Out of a population of 120 million roughly 35 million people lived in a family where no one had a job. Imagine if that were repeated today. 110 million people in the US living in a family in which no one has a job. Our current workforce is only around 160 million people. That is the day that the majority of this nation will not know with absolute certainty where their next meal is coming from for any extended period of time. That day is coming. It is inevitable unless there is a major reset and retooling of our economy. And we know who will benefit most from that as well. It won't be you or I.

I am not looking at things through squinty eyes. I am looking at them correctly and with a greater understanding than most.

The way I see it, the US was the worlds biggest and strongest economy, but time and privilege led to an expectation that there was some sort of a right that ensured that the US would always remain at the top, just because.

So people moved away from labor intensive jobs and manufacturing was off-shored to where the labor was cheap.

In the interim, all those primitive backwater countries learnt tech and manufacturing, and realized that they were already doing it on behalf of the US. So, they started their own companies and soon undersold and out manufactured the US.

So the US economy became primarily a consumer one, its main source of economic leverage being how much it could afford to pay for stuff.

In a competitive world market, other nations tried to maximize their profits (even Communist nations! LOL), the difference between manufacturing costs and sale price.

And so when the income for Americans dipped below what they kept paying out, they had to, as an economy, start to put value on debt, and so the banks got very wealthy, because they could preside over vast debt and the economy of the US could continue to pay for stuff, even though the money no longer represented an overall positive value anymore.

And you can hide so much economic non-activity behind wobbly inflation. I mean last year, it was worth only two nega-bucks, now it is worth three of them!

There were long standing efforts to fine-tune and re-balance the US economy but to prevent them being painful, they were slow. However, US politicians swap jobs frequently and the worst of them are the 'new brooms' who sweep away any type of incremental change, with broad-brush smashing around at things. "See, I fixed the economy in only a week" type guys who will be long gone before the mess they caused really bites.

a reply to: chr0naut

We were the worlds leading economy and there was a sort of homogenous belief that we always would be. That was very possible had we not made a few serious mistakes. One of the biggest single events that led to the change in economic leadership was back in the 1970's. We were the worlds number one supplier of quality steel selling quite a bit of it to Japan, who was growing rapidly. Our steel industry was booming. Someone somewhere along the way couldn't pass up the shiny price tag one Japanese company was willing to pay for the technology rather than the product. It wasn't all that long until we were buying Japanese steel because it was better and cheaper than our own. When you look at coil steel, as the source component, the percentage of products that use it is staggering. By virtue of controlling the price of the steel Japan then had a portion of price control of the end user products, which they conveniently manufactured cheaper than we could. By manipulating both ends of the process they continually placed themselves in the highest profit position. Give a little on one end, take a little more on the other.

We were once self sufficient, to a great degree, and a supplier of goods to the world. We have, as you indicated, become a nation of consumers. Trump had the right idea in bringing manufacturing back to US shores. But it is more than just products, it is energy. You cant shut down a pipeline in the US saying it is dirty fuel just to turn around and buy replacement fuel from a country with lower ecological standards than our own and claim you are making progress. Aiming for zero percent carbon emissions in the US is futile in stopping any perceived global warming when the worlds highest carbon emitting nations couldn't care less. Without a genuinely world wide effort global warming is nothing but a cash cow.

And as far as cash cows go, Japan has the best. Kobe Wagyu A5 beef, 10+ on the marbling scale. None better.

We were the worlds leading economy and there was a sort of homogenous belief that we always would be. That was very possible had we not made a few serious mistakes. One of the biggest single events that led to the change in economic leadership was back in the 1970's. We were the worlds number one supplier of quality steel selling quite a bit of it to Japan, who was growing rapidly. Our steel industry was booming. Someone somewhere along the way couldn't pass up the shiny price tag one Japanese company was willing to pay for the technology rather than the product. It wasn't all that long until we were buying Japanese steel because it was better and cheaper than our own. When you look at coil steel, as the source component, the percentage of products that use it is staggering. By virtue of controlling the price of the steel Japan then had a portion of price control of the end user products, which they conveniently manufactured cheaper than we could. By manipulating both ends of the process they continually placed themselves in the highest profit position. Give a little on one end, take a little more on the other.

We were once self sufficient, to a great degree, and a supplier of goods to the world. We have, as you indicated, become a nation of consumers. Trump had the right idea in bringing manufacturing back to US shores. But it is more than just products, it is energy. You cant shut down a pipeline in the US saying it is dirty fuel just to turn around and buy replacement fuel from a country with lower ecological standards than our own and claim you are making progress. Aiming for zero percent carbon emissions in the US is futile in stopping any perceived global warming when the worlds highest carbon emitting nations couldn't care less. Without a genuinely world wide effort global warming is nothing but a cash cow.

And as far as cash cows go, Japan has the best. Kobe Wagyu A5 beef, 10+ on the marbling scale. None better.

originally posted by: Bluntone22

a reply to: Snarl

I said after the election that people better be ready for a bumpy ride.

Dominos start to fall.

It starts with gas prices.

Update - July 22, 2021

Your everyday working-stiff Democrat is beginning to feel the effects of INFLATION, because Joe Biden and his team are "delivering on campaign promises".

Democrat voters chose HIGHER FOOD PRICES.

Democrat voters chose HIGHER TRANSPORTATION PRICES.

Democrat voters chose HIGHER ENERGY (Gas, Electric) PRICES.

Democrat voters chose HIGHER RENT.

Democrats say, "We didn't vote for this. Biden didn't say he'd be raising our cost of living!"

Democrat LEADERS know their constituents are too "dull" to understand that these words, "I promise to save our Earth by eliminated fossil fuels", means HIGHER PRICES. Prices that will just keep going UP and UP and UP and UP and.....

Update 9.23.2021

The Federal Reserve has just cut its projection of growth for the year.

Source: www.msn.com...

Democrats are destroying the economic recovery.

The Federal Reserve has just cut its projection of growth for the year.

Source: www.msn.com...

Democrats are destroying the economic recovery.

new topics

-

Kingdom of the Planet of the Apes

Movies: 1 hours ago -

Jean Michel and Brian May Live from Bratislava

General Chit Chat: 7 hours ago -

Iranian Lawmaker Declares Iran Has Nuclear Weapons

Mainstream News: 8 hours ago -

Biden Withholding Sensitive US Intelligence on Hamas Leaders From Israel

US Political Madness: 10 hours ago -

Anybody else go to the movie theater a lot? Have you noticed how dead they are?

General Chit Chat: 11 hours ago -

Trump Record Breaking Campaign Rally 5/11 in New Jersey Draws 100,000 People

2024 Elections: 11 hours ago -

something falls in Canada

Aliens and UFOs: 11 hours ago

top topics

-

Trump Record Breaking Campaign Rally 5/11 in New Jersey Draws 100,000 People

2024 Elections: 11 hours ago, 14 flags -

Biden Withholding Sensitive US Intelligence on Hamas Leaders From Israel

US Political Madness: 10 hours ago, 10 flags -

Anybody else go to the movie theater a lot? Have you noticed how dead they are?

General Chit Chat: 11 hours ago, 7 flags -

Iranian Lawmaker Declares Iran Has Nuclear Weapons

Mainstream News: 8 hours ago, 5 flags -

Jean Michel and Brian May Live from Bratislava

General Chit Chat: 7 hours ago, 5 flags -

US mistakes in assessing the military potential of China and Russia

ATS Skunk Works: 14 hours ago, 4 flags -

something falls in Canada

Aliens and UFOs: 11 hours ago, 4 flags -

Kingdom of the Planet of the Apes

Movies: 1 hours ago, 0 flags

active topics

-

Trump Record Breaking Campaign Rally 5/11 in New Jersey Draws 100,000 People

2024 Elections • 83 • : DBCowboy -

REAL ID now a reality

General Conspiracies • 49 • : tkwaz -

Christianity superior to other faiths for very specific reasons. Awaken to true FREEDOM..!!

Conspiracies in Religions • 29 • : RAY1990 -

Kingdom of the Planet of the Apes

Movies • 3 • : Bluntone22 -

Multipal Solar Storms Coming Our Way This Weekend

Fragile Earth • 44 • : Toastyr1 -

Iranian Lawmaker Declares Iran Has Nuclear Weapons

Mainstream News • 19 • : Mantiss2021 -

Excess deaths persist

Diseases and Pandemics • 101 • : Nesterfield -

The Acronym Game .. Pt.3

General Chit Chat • 7833 • : RAY1990 -

SHORT STORY WRITERS CONTEST -- April 2024 -- TIME -- TIME2024

Short Stories • 37 • : argentus -

Breaking--Hamas Accepts New Cease Fire

Middle East Issues • 450 • : cherokeetroy