It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

I wanted to create a thread regarding ObamaCare because the amount incorrect information out there is getting insane. The plethora of incorrect info

is obfuscating people's true intention of trying to understand what the law really means.

I want this thread for the purpose of stating Factual Pro's and Con's so that people can find all the true information regarding the new law in one place that is not otherwise filled with incorrect talking points.

A few things to start off with are some of the most polarizing statements regarding the law.

1). Is it a Tax Increase?

- Arguable. Some Supreme Court Justices see it as a Tax, while others see it as strictly a penalty if you choose not to acquire insurance. Personally, I see it as a penalty because only the people that refuse to get it will have to pay.

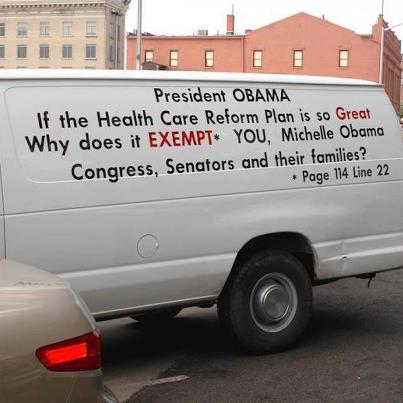

2). Are congressman, Senators, the President and their families exempt? I have seen false images that postulate that Politicians and families are exempt.

- No. Those exempt are as follows: American Indians; people with religious objections; people who can show financial hardship; people without coverage for less than three months; households with income below 100 percent of the poverty level ($22,050 for a family of four in 2009); households that would pay more than 8 percent of their income on premiums for the cheapest available health plan.

Now I will post a couple pro's and con's to get the ball rolling.

Pro's:

1). It now regulates how Insurance companies practice. For example, Ins companies can no longer hike up your premiums for no reason and without telling you in advance.

2). Insurance Companies can no longer deny claims because of pre-existing conditions.

3). You can stay on your parents plan until the ripe age of 26.

4). There is more of a focus on preventative healthcare which will drastically reduce the cost of elderly healthcare as they will be privy to their debilitating conditions earlier for better treatments.

5). States can opt-out of the ObamaCare with no penalty.

6). Supreme Court set in a precedent law that the Government can "Never" (unconstitutional) force you to buy anything it deems necessary (Thank John Roberts for that).

Con's:

1). You have to pay for something you necessarily wouldn't pay for otherwise.

2). Change

3). Reduce quality of Care (allegedly).

I hope this thread takes off in the way it was intended, and posters truly focus on educating people on the "Real Aspects" of the law.

No need to fight, just learn.

AAC

I want this thread for the purpose of stating Factual Pro's and Con's so that people can find all the true information regarding the new law in one place that is not otherwise filled with incorrect talking points.

A few things to start off with are some of the most polarizing statements regarding the law.

1). Is it a Tax Increase?

- Arguable. Some Supreme Court Justices see it as a Tax, while others see it as strictly a penalty if you choose not to acquire insurance. Personally, I see it as a penalty because only the people that refuse to get it will have to pay.

2). Are congressman, Senators, the President and their families exempt? I have seen false images that postulate that Politicians and families are exempt.

- No. Those exempt are as follows: American Indians; people with religious objections; people who can show financial hardship; people without coverage for less than three months; households with income below 100 percent of the poverty level ($22,050 for a family of four in 2009); households that would pay more than 8 percent of their income on premiums for the cheapest available health plan.

Now I will post a couple pro's and con's to get the ball rolling.

Pro's:

1). It now regulates how Insurance companies practice. For example, Ins companies can no longer hike up your premiums for no reason and without telling you in advance.

2). Insurance Companies can no longer deny claims because of pre-existing conditions.

3). You can stay on your parents plan until the ripe age of 26.

4). There is more of a focus on preventative healthcare which will drastically reduce the cost of elderly healthcare as they will be privy to their debilitating conditions earlier for better treatments.

5). States can opt-out of the ObamaCare with no penalty.

6). Supreme Court set in a precedent law that the Government can "Never" (unconstitutional) force you to buy anything it deems necessary (Thank John Roberts for that).

Con's:

1). You have to pay for something you necessarily wouldn't pay for otherwise.

2). Change

3). Reduce quality of Care (allegedly).

I hope this thread takes off in the way it was intended, and posters truly focus on educating people on the "Real Aspects" of the law.

No need to fight, just learn.

AAC

I'd like to comment on the state's right to opt out.

I think we are going to see a trend. That trend being that states governed by republicans are going to cry foul and say they're going to opt out.

Since the federal government pays for the expansion of Medicaid 100% for the first two years, there is no reason to opt out initially. After that the state is only obligated to spend up to 10% I believe. So essentially they'd be throwing away millions and millions of federal dollars.

In the end..........there will be no republican states opting out of the ACA. It's all chest pounding and happy horse-sh%&.

I think we are going to see a trend. That trend being that states governed by republicans are going to cry foul and say they're going to opt out.

Since the federal government pays for the expansion of Medicaid 100% for the first two years, there is no reason to opt out initially. After that the state is only obligated to spend up to 10% I believe. So essentially they'd be throwing away millions and millions of federal dollars.

In the end..........there will be no republican states opting out of the ACA. It's all chest pounding and happy horse-sh%&.

reply to post by AnAbsoluteCreation

300 + pages of Obamacare abound.

Then your thread labeled with "facts", and no love for it?

Guess ATS isn't interested in facts.

You probably would have received 20 stars and flags by now had you titled your thread

"0bamacare Is Evil Smelly Cacca Sewage Giant Taxes Kenya Commie!"

300 + pages of Obamacare abound.

Then your thread labeled with "facts", and no love for it?

Guess ATS isn't interested in facts.

You probably would have received 20 stars and flags by now had you titled your thread

"0bamacare Is Evil Smelly Cacca Sewage Giant Taxes Kenya Commie!"

Just some I found:

Pros

Cons

Source:

useconomy.about.com...

Pros

The Act was designed to reduce overall health care costs by making services available to the 32 million who currently can't get insurance. They often use a hospital emergency room as their primary care physician, increasing costs for everyone. This starts in 2014. For people who can't afford health insurance, the Federal government will pay the states to add them to Medicaid. The income requirement will be expanded to include more of the working poor.

Cons

New taxes, penalties, and fees will discourage businesses from growing, lowering economic growth by $706 billion and costing 800,000 jobs. The Federal government will force 18 million of the uninsured to go on Medicaid. Despite this, millions will still remain uninsured. Each year, $125 million will go towards subsidizing school-based health centers and programs to reduce teen pregnancy, with no requirement to reduce abortions. Parents won't know what services their children will receive.

Source:

useconomy.about.com...

Originally posted by AnAbsoluteCreation

1). Is it a Tax Increase?

- Arguable. Some Supreme Court Justices see it as a Tax, while others see it as strictly a penalty if you choose not to acquire insurance. Personally, I see it as a penalty because only the people that refuse to get it will have to pay.

If it is a penalty, then why do the accounting and enforcement provisions lie with the IRS and the additional 4,000 agents provided for in this Act? OSHA penalties are enforced by OSHA (not a tax), EPA enforces its own penalties (not a tax), SEC enforces its own penalties (not a tax), etc.

2). Are congressman, Senators, the President and their families exempt? I have seen false images that postulate that Politicians and families are exempt.

ETA: I didn't have a lot of time, but thought I'd hit the high spots, for now.

- No. Those exempt are as follows: American Indians; people with religious objections; people who can show financial hardship; people without coverage for less than three months; households with income below 100 percent of the poverty level ($22,050 for a family of four in 2009); households that would pay more than 8 percent of their income on premiums for the cheapest available health plan.

How is that relevant, since WE pay for 75% of their insurance premiums? Why would they need to be exempted from something they don't even pay for? I believe you are obfuscating the meaning of "exempt". "Exempt" from what? If you mean "exempt" from the penalty/tax, there are three. You mentioned one, religious reasons. The other two are "those not lawfully present" and those who are incarcerated. The others you mentioned are not actually "exempt" from anything. They will be covered in the exchanges and through the "credits" given them, based on financial need. Again, their coverage will be provided by the taxpayer, so "exemption" is unnecessary.

6). Supreme Court set in a precedent law that the Government can "Never" (unconstitutional) force you to buy anything it deems necessary (Thank John Roberts for that).

Really? Well, I do not wish to purchase health care coverage. What happens to me now?

edit on 2-7-2012 by WTFover because: Last line

I have read that some people have fear of a couple things:

Death Committees (Government Committees deciding who lives and who dies)

Truth is, this already exists in the Hospital Administrations. There are already boards where people decide who gets organs and who doesn't. Yet, no body is bothered by those arbitrary standards at the local level.

Government dictating how to practice (i.e. Surgeries to perform, drugs to prescribe).

This already happens as well at the Insurance level. If a doctor prescribes an MRI of the Brain to rule out Dimensia, they have to call the insurance company for the patient to see if they will authorize that procedure. A lot of times they deny it as "NOT MEDICALLY NECESSARY."

I think this all boils down to two things:

1). Nobody likes change, for better or worse.

2). It's ObamaCare

PS. This bill is almost identical to the one Romney pushed through MA while he was there as governor. I have been surprised to find out a lot of rep. didn't even know this while calling Romney the savior.

AAC

Death Committees (Government Committees deciding who lives and who dies)

Truth is, this already exists in the Hospital Administrations. There are already boards where people decide who gets organs and who doesn't. Yet, no body is bothered by those arbitrary standards at the local level.

Government dictating how to practice (i.e. Surgeries to perform, drugs to prescribe).

This already happens as well at the Insurance level. If a doctor prescribes an MRI of the Brain to rule out Dimensia, they have to call the insurance company for the patient to see if they will authorize that procedure. A lot of times they deny it as "NOT MEDICALLY NECESSARY."

I think this all boils down to two things:

1). Nobody likes change, for better or worse.

2). It's ObamaCare

PS. This bill is almost identical to the one Romney pushed through MA while he was there as governor. I have been surprised to find out a lot of rep. didn't even know this while calling Romney the savior.

AAC

Originally posted by WTFover

Really? Well, I do not wish to purchase health care coverage. What happens to me now?

Right now? Nothing. Two years from now? Nothing...three years or more? You lose a little bit of your tax refund.

Originally posted by WTFover

If it is a penalty, then why do the accounting and enforcement provisions lie with the IRS and the additional 4,000 agents provided for in this Act? OSHA penalties are enforced by OSHA (not a tax), EPA enforces its own penalties (not a tax), SEC enforces its own penalties (not a tax), etc.

This semantical question does not prove it is a tax. Seems like a work flow decision to me.

How is that relevant, since WE pay for 75% of their insurance premiums? Why would they need to be exempted from something they don't even pay for?

Well, sir, I was referring to Rep. disinfo like this:

6). Supreme Court set in a precedent law that the Government can "Never" (unconstitutional) force you to buy anything it deems necessary (Thank John Roberts for that).

Well, I do not wish to purchase health care coverage. What happens to me now?

Talk to your State governor. They opted into the program.

AAC

That van is wrong:

useconomy.about.com...

Starting in 2014, you will be required to purchase insurance or pay a penalty of as much as 2.5% of your income. You can shop for the insurance that meets your needs on a state-run exchange.If it's any consolation, members of Congress will also be mandated to get their health insurance through the same exchanges, instead of the government-provided health insurance they get now. (Source: Affordable Care Act) Exchanges will allow you to compare health plans before you buy one. The exchanges will also help you find out if you qualify for tax credits or other government health benefits. States are being given substantial Federal grants to fund the exchanges. Find out your state's status.

useconomy.about.com...

Since the federal government pays for the expansion of Medicaid 100% for the first two years, there is no reason to opt out initially

Two years the feds finance healthcare and then after 2 years the states are on their own sounds great doesn't it?

Unless you factor in that states are already having a hard time meeting medicaid payouts, where many states who got "stimulus" funds chose to pay their own government balance.

Basically in a country who already could not pay for medicare, and medicaid, they added 30 million new "patients" when they already could not afford the patients already covered.

Instead of well funded programs we have the opposite.

Just the facts,

67 million Americans on medicare who have that healthcare fee deducted automatically from that other government check SS which amounts to one program funding another one.

60 million Americans are on medicaid

www.dailyfinance.com...

www.medicaid.gov...

Both medicare and medicad spending $1.2 trillion per year figure in the spending on SS cause again that medicare is being paid out of that SS check near an additional $1 trillion dollars.

Most children under 18 are already covered under SSI now til 26.

Those are the facts:

www.usdebtclock.org...

The current adminstration should have concentrated on funding what people already had instead of adding more to that payroll that could not be funded in the first place.

reply to post by EvilSadamClone

I know the van is wrong. I was posting it showing another posters how the wrong information is running rampant.

AAC

I know the van is wrong. I was posting it showing another posters how the wrong information is running rampant.

AAC

reply to post by neo96

This isn't true though. The states would be required to pay up to 10% of the cost by 2020. Not sure where you came up with "On their own".

www.forbes.com...

Two years the feds finance healthcare and then after 2 years the states are on their own sounds great doesn't it?

This isn't true though. The states would be required to pay up to 10% of the cost by 2020. Not sure where you came up with "On their own".

www.forbes.com...

edit on 2-7-2012 by spinalremain

because: (no reason given)

There are RFID chips in the Obamacare Law that would make anyone getting hospitalized under Obamacare to have an RFID chip implanted.

This is the beginning of The Mark of the Beast.

If you don't believe me read the whole law. It's in there!

2012indyinfo.com...

This is the beginning of The Mark of the Beast.

If you don't believe me read the whole law. It's in there!

2012indyinfo.com...

edit on

2-7-2012 by JohnPhoenix because: addition

Originally posted by AnAbsoluteCreation

This semantical question does not prove it is a tax. Seems like a work flow decision to me.

If you read the Roberts opinion, it is purely a matter of semantics. If you wish to accept the individual mandate as Constitutional, you must accept the penalty for non-compliance with the individual mandate is a "tax". For Roberts's opinion (the deciding vote) clearly states the individual mandate is not Constitutional as anything but a "tax". If you decline to accept it as a "tax", you necessarily must accept the mandate as not Constitutional. So, my friend, it is purely semantics. And a load of manure, I might add.

Additionally, if it was a "work flow decision", why do all the other agencies do their own work, rather than assign it to the IRS? Also, if your premise is accurate, why choose the IRS, of all the enforcement possibilities? Rest assured, it was not the result of the toss of a coin. No, it was a deliberate decision.

Talk to your State governor. They opted into the program.

The states have no opt in/out of the individual mandate. You are confusing completely separate issues. The option concerns the Medicaid and exchange requirement. So, it does no good to talk to a governor about the mandate. Nice try though. I thought you indicated, in your OP, you wanted this thread to be free from obfuscation?

reply to post by WTFover

That's the thing. It is all based on opinion. For instance, both presidential candidates' opinion is that it is NOT a tax.

And I said talk to your gov. cause there is no answer to your question without seeing the implementations being applied first.

I am sure there will be many addendum's/ratifications to this before all the kinks are worked out. But it's not like other countries are falling apart because of their healthcare reform.

It's nowhere near perfect, but in Washington, D.C there is no perfect. Only do the best with what you're allowed.

AAC

That's the thing. It is all based on opinion. For instance, both presidential candidates' opinion is that it is NOT a tax.

And I said talk to your gov. cause there is no answer to your question without seeing the implementations being applied first.

I am sure there will be many addendum's/ratifications to this before all the kinks are worked out. But it's not like other countries are falling apart because of their healthcare reform.

It's nowhere near perfect, but in Washington, D.C there is no perfect. Only do the best with what you're allowed.

AAC

Originally posted by links234

Originally posted by WTFover

Really? Well, I do not wish to purchase health care coverage. What happens to me now?

Right now? Nothing. Two years from now? Nothing...three years or more? You lose a little bit of your tax refund.

Did you notice that I posed that question in response to the OP's claim that the Roberts court ruled the government can "never force you to buy anything it deems necessary"?

So, let's truthfully examine your response. Beginning in 2014, if you fail to prove you have the "minimum essential coverage", you will be fined/taxed the greater of $95 or 1% of your annual income. The following year the fine/tax will be the greater of $325 or 2% of your annual income. In 2016, the fine/tax rises to 2.5%.

It is pretty unclear, but it seems these figures apply to each member of your household, since the household numbers top out at the greater of $2,085 or 2.5%. That would mean, for the median U.S. income of $52,000, the 2016 fine/tax would be $1300 per family member.

reply to post by AnAbsoluteCreation

I am unclear why you keep referring me to my governor. The state has nothing to do with the individual mandate.

Anyway, you can expect the courts to become even more bogged down, as each aspect of this law is challenged by individuals and groups who are harmed by its implementation.

I am unclear why you keep referring me to my governor. The state has nothing to do with the individual mandate.

Anyway, you can expect the courts to become even more bogged down, as each aspect of this law is challenged by individuals and groups who are harmed by its implementation.

reply to post by WTFover

So then I'd have to ask, would you rather pay the tax/fine or would you rather get something for your money and have health insurance?

I'm sure the 'freedom loving' Americans would rather not pay anything at all...but a responsible American adult would want to know that they're covered in the event of a medical emergency/problem. Just like a responsible American adult will have a gun safe and know when to not drink and drive.

If you're irresponsible, that's not my fault but it is my problem. You make my insurance rates go up because of your negligience and willful ignorance.

So then I'd have to ask, would you rather pay the tax/fine or would you rather get something for your money and have health insurance?

I'm sure the 'freedom loving' Americans would rather not pay anything at all...but a responsible American adult would want to know that they're covered in the event of a medical emergency/problem. Just like a responsible American adult will have a gun safe and know when to not drink and drive.

If you're irresponsible, that's not my fault but it is my problem. You make my insurance rates go up because of your negligience and willful ignorance.

reply to post by AnAbsoluteCreation

Op, this statement is a bit unclear regarding who is exempt.

It should read if:

healthreform.kff.org...

I am Catholic and object vehemently to the idea of my federal tax dollars being used to fund elective abortions, but at this time we are not exempted from the mandate.

Op, this statement is a bit unclear regarding who is exempt.

people with religious objections;

It should read if:

.

you are a part of a religion opposed to acceptance of benefits from a health insurance policy

healthreform.kff.org...

I am Catholic and object vehemently to the idea of my federal tax dollars being used to fund elective abortions, but at this time we are not exempted from the mandate.

reply to post by AnAbsoluteCreation

Op, this statement is a bit unclear regarding who is exempt.

It should read if:

healthreform.kff.org...

I am Catholic and object vehemently to the idea of my federal tax dollars being used to fund elective abortions, but at this time we are not exempted from the mandate.

Op, this statement is a bit unclear regarding who is exempt.

people with religious objections;

It should read if:

.

you are a part of a religion opposed to acceptance of benefits from a health insurance policy

healthreform.kff.org...

I am Catholic and object vehemently to the idea of my federal tax dollars being used to fund elective abortions, but at this time we are not exempted from the mandate.

new topics

-

BIDEN Admin Begins Planning For January 2025 Transition to a New President - Today is 4.26.2024.

2024 Elections: 1 hours ago -

Big Storms

Fragile Earth: 3 hours ago -

Where should Trump hold his next rally

2024 Elections: 5 hours ago -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 6 hours ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 7 hours ago -

Falkville Robot-Man

Aliens and UFOs: 7 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 8 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 9 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 9 hours ago -

Biden "Happy To Debate Trump"

2024 Elections: 10 hours ago

top topics

-

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 8 hours ago, 14 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 9 hours ago, 13 flags -

Blast from the past: ATS Review Podcast, 2006: With All Three Amigos

Member PODcasts: 12 hours ago, 13 flags -

Biden "Happy To Debate Trump"

2024 Elections: 10 hours ago, 12 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 12 hours ago, 8 flags -

What is the white pill?

Philosophy and Metaphysics: 11 hours ago, 6 flags -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 6 hours ago, 6 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 10 hours ago, 5 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 9 hours ago, 5 flags -

Where should Trump hold his next rally

2024 Elections: 5 hours ago, 5 flags

active topics

-

Big Storms

Fragile Earth • 13 • : AwakeNotWoke -

SHORT STORY WRITERS CONTEST -- April 2024 -- TIME -- TIME2024

Short Stories • 26 • : Encia22 -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 50 • : AwakeNotWoke -

Biden "Happy To Debate Trump"

2024 Elections • 50 • : Lumenari -

Falkville Robot-Man

Aliens and UFOs • 9 • : CosmicFocus -

BIDEN Admin Begins Planning For January 2025 Transition to a New President - Today is 4.26.2024.

2024 Elections • 8 • : NoCorruptionAllowed -

ALERT - U.S. President JOE BIDEN Examined and Found NOT OF SOUND MIND.

2024 Elections • 65 • : SchrodingersRat -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents • 13 • : theatreboy -

Where should Trump hold his next rally

2024 Elections • 21 • : Dandandat3 -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs • 9 • : Degradation33