It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

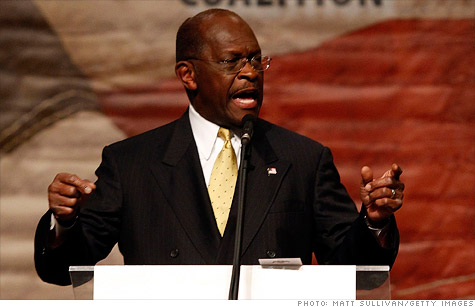

Under Herman Cain's 9-9-9 tax reform plan, 84% of U.S. households would pay more than they do under current tax policies, according to a report released Tuesday by a nonpartisan research group.

Cain's 9-9-9 plan would replace much of the current tax code with a flat-rate system: a 9% individual income tax; a 9% corporate income tax and a 9% national sales tax. Estate and gift taxes would be eliminated, as would the payroll tax, and most tax credits, deductions and exemptions.

money.cnn.com...

I dislike this man there is something about him that i find absolutely evil. but that is my personal opinion.

edit on Wed Oct 19 2011 by DontTreadOnMe because: IMPORTANT: Using Content From

Other Websites on ATS /// MOD NOTE: Posting work written by others

We're all going to be paying more regardless of which clown sits in that office.

Until these idiots stop writing blank checks and we shut down 90%+ of all the ridiculous money pit programs every last American will continue to pay more year after year.

Until these idiots stop writing blank checks and we shut down 90%+ of all the ridiculous money pit programs every last American will continue to pay more year after year.

it wont post my youtube video but i do have the link

www.youtube.com...

Bullsheet!, so I get poorer.

www.youtube.com...

Bullsheet!, so I get poorer.

edit on 19-10-2011 by MissCoyote because: you tube wont post

reply to post by MissCoyote

The reality is that people making $30k or less per year are paying nothing in federal taxes!

He wants everyone to pay a fair share. Why is it that those who pay very little or 0 taxes feel like that is fair???

If anyone must pay income tax, then all should pay...and pay fairly. That means a flat tax is the most fair way to collect taxes. Otherwise we have distribution of income. Which means........

you probably aren't willing to pay for my share- why should you?

Cain's plan is great. Yes people that pay more than 9% now get a break(spending more of their money on stuff creating jobs etc), and people who pay nothing now will have to start supporting our country's spending habits like the rest of us.

The reality is that people making $30k or less per year are paying nothing in federal taxes!

He wants everyone to pay a fair share. Why is it that those who pay very little or 0 taxes feel like that is fair???

If anyone must pay income tax, then all should pay...and pay fairly. That means a flat tax is the most fair way to collect taxes. Otherwise we have distribution of income. Which means........

you probably aren't willing to pay for my share- why should you?

Cain's plan is great. Yes people that pay more than 9% now get a break(spending more of their money on stuff creating jobs etc), and people who pay nothing now will have to start supporting our country's spending habits like the rest of us.

I would LOVE to see the people who currently get the EITC start paying some taxes rather than having the government give them some of mine.

Taxes are collected by the government to provide government services to the citizens. When they collect tax money from me and hand it right back to someone else, how is that not STEALING from me?

I hate the EITC. I think many people who receive it have no idea that it is just a handout--an income redistribution. They actually think they are getting a "refund".

Taxes are collected by the government to provide government services to the citizens. When they collect tax money from me and hand it right back to someone else, how is that not STEALING from me?

I hate the EITC. I think many people who receive it have no idea that it is just a handout--an income redistribution. They actually think they are getting a "refund".

reply to post by dakota1s2

But see its NOT fair I make under 30,000.00 I pay a ton in fed income, but in that plan the rich are still geting richer the poor are even worse off and the systems are strained by impoverrish people. I don't believe this plan is going to help the u.s. as a whole only the mogals that run it will benefit from the spat coming out of his mouth.

But see its NOT fair I make under 30,000.00 I pay a ton in fed income, but in that plan the rich are still geting richer the poor are even worse off and the systems are strained by impoverrish people. I don't believe this plan is going to help the u.s. as a whole only the mogals that run it will benefit from the spat coming out of his mouth.

Ya this is not a good thing at all..

9-9-9..

9% tax on people means 9 cents for every dollar you have to pay for..

9% sales tax on things..(State of PA you dont pay tax on food and clothes, which makes this bad for us if These taxes go into that.) so now its 18 cents for every dollar.

9% corporate tax This tax we will probably have to pay because we know how we get tacked wit every tax known possible just as cigarette smokers or people who go drink in a bar.. Now this is 21 cents for every dollar.

Now add state taxes that some states have, 6% in Pa, and some counties have a cent or 2 more, Allegheny has I think 7 or 8% I haven't shopped there in a while so i am not sure last time i bought something there it was 7% so we will go with that.

Now we have 29% tax that we pay on everything..

On a side note I love how people hop on the idea of being taxed out the ass.. I cant wait till it gets up to 50% you guys will be cheering forever on that..

So in the end we end up paying 29 cents on every dollar for taxes. or 29 dollars for every 100 dollars... or 8700 on 30,000 bucks.

9-9-9..

9% tax on people means 9 cents for every dollar you have to pay for..

9% sales tax on things..(State of PA you dont pay tax on food and clothes, which makes this bad for us if These taxes go into that.) so now its 18 cents for every dollar.

9% corporate tax This tax we will probably have to pay because we know how we get tacked wit every tax known possible just as cigarette smokers or people who go drink in a bar.. Now this is 21 cents for every dollar.

Now add state taxes that some states have, 6% in Pa, and some counties have a cent or 2 more, Allegheny has I think 7 or 8% I haven't shopped there in a while so i am not sure last time i bought something there it was 7% so we will go with that.

Now we have 29% tax that we pay on everything..

On a side note I love how people hop on the idea of being taxed out the ass.. I cant wait till it gets up to 50% you guys will be cheering forever on that..

So in the end we end up paying 29 cents on every dollar for taxes. or 29 dollars for every 100 dollars... or 8700 on 30,000 bucks.

edit on

10/19/2011 by ThichHeaded because: (no reason given)

reply to post by GeorgiaGirl

some of that refund is from people the few that are having children get 2000.00 for a newborn so talk to the teens that are robbing you. I will continue to believe that his 999 no middle child hatred plan is a fluke......completely.

some of that refund is from people the few that are having children get 2000.00 for a newborn so talk to the teens that are robbing you. I will continue to believe that his 999 no middle child hatred plan is a fluke......completely.

Originally posted by MissCoyote

NEW YORK (CNNMoney) -- Under Herman Cain's 9-9-9 tax reform plan, 84% of U.S. households would pay more than they do under current tax policies, according to a report released Tuesday by a nonpartisan research group.

Cain's 9-9-9 plan would replace much of the current tax code with a flat-rate system: a 9% individual income tax; a 9% corporate income tax and a 9% national sales tax. Estate and gift taxes would be eliminated, as would the payroll tax, and most tax credits, deductions and exemptions.

Cain's tax plan: More than 9-9-9

According to the Tax Policy Center, households with incomes below $30,000 would have, on average, between 16% and 20% less in after-tax income than they do today.

By contrast, households making more than $200,000 would see their after-tax income grow by between 5% and 22% on average.

There are two reasons for that discrepancy between the poor and the rich.

First, while the Cain campaign has said it is working on ways to lessen the tax burden on low-income households, the Tax Policy Center said it didn't have enough detail to assume what that change would be. One way to address regressivity is to offer a rebate to low-income households.

The Cain plan doesn't exempt very low incomes from taxation. And while it would eliminate the payroll tax, which is the heaviest tax for low-income families, that tax relief would be offset for many by the elimination of the EITC and other tax breaks they qualify for now.

money.cnn.com...

I dislike this man there is something about him that i find absolutely evil. but that is my personal opinion.

yeah, of course they should pay more, not difficult to understand ... and the richest should pay less ....

looks all very cool and simple, but it's just deceiving people with their simplistic theories .....

you know what ? they just talk and talk because it's just simple to talk 9-9-9 but in fact they never come with a real study of the consequences ..... typical neo-liberal out of reality blablabla .....

Well when you consider half of U.S. households pay NO TAXES WHATSOEVER this statistic comes as no surprise. EVERYONE needs to chip in no matter how

small.

I am apparently in the small 16% minority that would pay less.

Just to clarify I represent middle class family of 4.

I am apparently in the small 16% minority that would pay less.

Just to clarify I represent middle class family of 4.

edit on 19-10-2011 by jjkenobi because: clarify

Originally posted by dakota1s2

reply to post by MissCoyote

The reality is that people making $30k or less per year are paying nothing in federal taxes!

Horse apples. Last year I paid approximately $650 in taxes and I make $20k/yr. That's federal income taxes ONLY. That's not counting state taxes or social security. It's already been pretty much accepted that by the time I am able to collect on social security (40 years from now) that it flat out won't be there. Might I add that I claim single and 1 and the $ for social security that is deducted is roughly 2 times the amount deducted for taxes...per paycheck.

Next uneducated opinion, please.

edit on 19-10-2011 by netwarrior because: deleted a phantom "I"

I just looked at my pay stub for last month. I figured out that by eliminating FICA and the amount I have currently withheld in Federal taxes and

replacing it with a flat 9% deduction of my gross pay, I'd take home about $500 more per month under the 9-9-9 plan than I do currently.

As for the sales tax, let's say I spent $2000 per month on groceries and other items like clothes, gifts, etc. There would be a tax of 9% on that, which would be $180.

So I come out ahead by just over $300 per month. I would have to somehow manage to spend $5500 one month to not come out ahead (which I don't have enough income to do!!!)

Plus, this is just based on my current level withholding. Every year for the past several, my husband and I have OWED more at tax time than was withheld. So the amount they are currently withholding isn't actually my federal tax burden.

Oh, yeah, I'm liking this 9-9-9 plan!!!

As for the sales tax, let's say I spent $2000 per month on groceries and other items like clothes, gifts, etc. There would be a tax of 9% on that, which would be $180.

So I come out ahead by just over $300 per month. I would have to somehow manage to spend $5500 one month to not come out ahead (which I don't have enough income to do!!!)

Plus, this is just based on my current level withholding. Every year for the past several, my husband and I have OWED more at tax time than was withheld. So the amount they are currently withholding isn't actually my federal tax burden.

Oh, yeah, I'm liking this 9-9-9 plan!!!

I just can't believe how you can't see threw the glitter that cain is throwing in the air, and he is obviously the gop fave cuz he's on EVERY

FREAKING HEADLINE. I just think it is funny that americans have gotten more and more blind. 29 cents on EVERY DOLLAR, so whats the paycheck lets say

the average more american under 30,000.00 which means retail sales associates teachers bank tellers and food service workers to keep america fat, and

gas station workers ummmmmmmmmmm lets name some other jobs that make under 30,000.00 dollars bring home every 2 weeks lets say oh 450.00 so now before

you even got to buy or pay anything the government has by law taken 130.00 now that doesn't include social security and medicare and state. wow it

feels great being robbed

Originally posted by netwarrior

Originally posted by dakota1s2

reply to post by MissCoyote

The reality is that people making $30k or less per year are paying nothing in federal taxes!

Horse apples. Last year I paid approximately $650 in taxes and I make $20k/yr. That's federal income taxes ONLY. That's not counting state taxes or social security. It's already been pretty much accepted that by the time I am able to collect on social security (40 years from now) that it flat out won't be there. Might I add that I claim single and 1 and the $ for social security that is deducted is roughly 2 times the amount deducted for taxes...per paycheck.

Next uneducated opinion, please.

edit on 19-10-2011 by netwarrior because: deleted a phantom "I"

I don't know who does your taxes but unless someone else is claiming you as a dependent or you're under 25 the EIC gives people in your situation a refund over and above what you paid in. And if you had any children that would add onto your refund.

reply to post by GeorgiaGirl

Unprepared foods are exempt from taxes. Is it documented somewhere that the 9% would overturn that? Also I heard someone mentioning a credit would be given to families who qualify at the beginning of each month, or something similar.

And buying used goods should also avoid the 9% ie garage sales, want ads, etc.

Unprepared foods are exempt from taxes. Is it documented somewhere that the 9% would overturn that? Also I heard someone mentioning a credit would be given to families who qualify at the beginning of each month, or something similar.

And buying used goods should also avoid the 9% ie garage sales, want ads, etc.

Originally posted by jjkenobi

*snip*

I don't know who does your taxes but unless someone else is claiming you as a dependent or you're under 25 the EIC gives people in your situation a refund over and above what you paid in. And if you had any children that would add onto your refund.

I'm reading right off of my 1040 from last year. Single, over age 25, no children. I made too much last year to qualify for EIC. Did it last year with Turbotax and that refund I got would have been alot less if it hadn't been for the education credits.

Originally posted by ThichHeaded

9% corporate tax This tax we will probably have to pay because we know how we get tacked wit every tax known possible just as cigarette smokers or people who go drink in a bar..

Do you understand what the corporate tax is? It is not a direct tax on you. It is tax paid by corporations on their earnings. Read on to find out just how high this tax is currently.

But first...isn't the fact that some corporations are not paying their "fair share" of tax one of the problems everyone is having? How would a flat 9% corporate tax NOT take care of the problem with Exxon, GE, etc. not paying their "fair share"?

Here is the number I promised you: currently, the US has got one of the highest corporate tax rates in the WORLD.

www.forbes.com... Keep in mind, this is the median figure, and there are some corporations that pay 0 due to loopholes.

US multinationals have a corporate income tax rate of 35%. But after deductions, the median US domestic company pays 23%, while the MNCs pay 28%. That makes the US No. 2 when it comes to be soaked by its own federal government.

By lowering the corporate tax rate to 9%, and NOT giving loopholes to some of the monster corporations 2 things would happen: first of all, no corporation could "buy" favored treatment and pay $0; and secondly, the US would have such a favored business climate, that businesses would find the US a very attractive place to base their corporations.

I do not think that this would end up costing us more in regards to the products we buy every day.

Originally posted by jjkenobi

reply to post by GeorgiaGirl

Unprepared foods are exempt from taxes. Is it documented somewhere that the 9% would overturn that? Also I heard someone mentioning a credit would be given to families who qualify at the beginning of each month, or something similar.

And buying used goods should also avoid the 9% ie garage sales, want ads, etc.

You're talking about the prebate that is a feature of the FairTax. That's not part of the 9-9-9, to my knowledge. I actually like the FairTax BETTER than 9-9-9, and I believe Herman Cain does, as well.

The problem with going to the FairTax is that it would take YEARS to get the income tax amendment to the Constitution repealed and a new one in place for the FairTax. The 9-9-9 could be put into place immediately. I believe Herman Cain wants to start with what he can do NOW (9-9-9) and then immediately start working toward the implementation of the FairTax.

I don't think foods would be exempt from 9-9-9. We actually do pay sales tax on food in GA...but it is less than the regular sales tax.

Herman Cain's 9-9-9 Plan

Vision for Economic Renewal

•The natural state of our economy is prosperity. Freedom ensures that.

•In order to return to prosperity, Government must get off our backs, out of our pockets and out of our way

Economic Guiding Principles

1.Production drives the economy, not spending. Production is the engine, consumption is the caboose.

◦We can not spend our way to prosperity.

◦Government spending is like taking a bucket of water from the deep end of the pool, pouring it in the shallow end. Then they HOPE that the water level will CHANGE.

2.Risk taking drives growth.

◦Business formation and job creation are dependent on entrepreneurs taking risks.

◦Investors who fund those entrepreneurs likewise take risks.

3.Measurements must be dependable.

◦A dollar must always be a dollar just as an hour is always 60 minutes.

◦Sound money is crucial for prosperity.

UNITE, never DIVIDE; UNITED around ECONOMIC GROWTH

•When one party is so focused on spending so that the other must focus on cutting, we must unite around economic growth

•Unite income tax payers with payroll taxpayers so we all pull for low rates

•Unite those wanting to eliminate deductions with those seeking lower rates.

•Unite the Flat-Taxers with the Fair-Taxers

Phase One

Our current economic crisis calls for bold action to truly stimulate the economy and Renew America back to its greatness. The 9-9-9 Plan gets Washington D.C. out of the business of picking winners and losers, using the tax code to dole out favors, and dividing the country with class warfare. It is fair, simple, transparent and efficient. It taxes everything once and nothing twice. It taxes the broadest possible base at the lowest possible rates. It is neutral with respect to savings and consumption,capital and labor, imports and exports and whether companies pay dividends or retain earnings.

9% Business Flat Tax

◦Gross income less all purchases from other U.S. located businesses, all capital investment, and net exports.

◦Empowerment Zones will offer deductions for the payroll of those employed in the zone

9% Individual Flat Tax.

◦Gross income less charitable deductions.

◦Empowerment Zones will offer additional deductions for those living and/or working in the zone.

9% National Sales Tax.

◦Unlike a state sales tax, which is an add-on tax that increases the price of goods and services, this is a replacement tax. It replaces taxes that are already embedded in selling prices. By replacing higher marginal rates in the production process with lower marginal rates, marginal production costs actually decline, which will lead to prices being the same or lower, not higher.

Economic Impact

◦According to former Reagan Treasury official Gary Robbins, of Fiscal Associates, the 9-9-9 Plan will expand GDP by $2 trillion, create 6 million new jobs, increase business investment by one third, and increase wages by 10%.

9-9-9 Plan: Summary

•Removes all payroll taxes and unites all tax payers

•Provides the least incentive to evade taxes and the fewest opportunities to do so

•Lifts a $430 billion dead-weight burden on the economy due to compliance, enforcement, collection, etc…

•Is fair, simple, efficient, neutral, and transparent

•Ends nearly all deductions and special interest favors

•Features zero tax on capital gains and repatriated profits

•Exports leave our shores without the Business Tax or the Sales Tax embedded in their cost, making them world class competitive. Imports are subject to the same taxation as domestically produced goods, leveling the playing field.

•Lowest marginal rates on production

•Kills the Death Tax

•Allows immediate expensing of business investments

•Eliminates double taxation of dividends

•Increases capital formation which aids capital availability for small businesses

•Increased capital per worker drives productivity and wage growth

•Features a platform to launch properly structured Empowerment Zones to renew our inner cities

•The pro-growth, pro-job, pro-export economic policies of the 9-9-9 PLAN equals a strong dollar policy

Phase 2 – The Fair Tax

Amidst a backdrop of the economic renewal created by the 9-9-9 Plan, I will begin the process of educating the American people on the benefits of continuing the next step to the Fair Tax.

•Ultimately replaces individual and corporate income taxes

•Ends the IRS as we know it and repeals the 16th Amendment

www.hermancain.com...

straight from the horses mouth

Vision for Economic Renewal

•The natural state of our economy is prosperity. Freedom ensures that.

•In order to return to prosperity, Government must get off our backs, out of our pockets and out of our way

Economic Guiding Principles

1.Production drives the economy, not spending. Production is the engine, consumption is the caboose.

◦We can not spend our way to prosperity.

◦Government spending is like taking a bucket of water from the deep end of the pool, pouring it in the shallow end. Then they HOPE that the water level will CHANGE.

2.Risk taking drives growth.

◦Business formation and job creation are dependent on entrepreneurs taking risks.

◦Investors who fund those entrepreneurs likewise take risks.

3.Measurements must be dependable.

◦A dollar must always be a dollar just as an hour is always 60 minutes.

◦Sound money is crucial for prosperity.

UNITE, never DIVIDE; UNITED around ECONOMIC GROWTH

•When one party is so focused on spending so that the other must focus on cutting, we must unite around economic growth

•Unite income tax payers with payroll taxpayers so we all pull for low rates

•Unite those wanting to eliminate deductions with those seeking lower rates.

•Unite the Flat-Taxers with the Fair-Taxers

Phase One

Our current economic crisis calls for bold action to truly stimulate the economy and Renew America back to its greatness. The 9-9-9 Plan gets Washington D.C. out of the business of picking winners and losers, using the tax code to dole out favors, and dividing the country with class warfare. It is fair, simple, transparent and efficient. It taxes everything once and nothing twice. It taxes the broadest possible base at the lowest possible rates. It is neutral with respect to savings and consumption,capital and labor, imports and exports and whether companies pay dividends or retain earnings.

9% Business Flat Tax

◦Gross income less all purchases from other U.S. located businesses, all capital investment, and net exports.

◦Empowerment Zones will offer deductions for the payroll of those employed in the zone

9% Individual Flat Tax.

◦Gross income less charitable deductions.

◦Empowerment Zones will offer additional deductions for those living and/or working in the zone.

9% National Sales Tax.

◦Unlike a state sales tax, which is an add-on tax that increases the price of goods and services, this is a replacement tax. It replaces taxes that are already embedded in selling prices. By replacing higher marginal rates in the production process with lower marginal rates, marginal production costs actually decline, which will lead to prices being the same or lower, not higher.

Economic Impact

◦According to former Reagan Treasury official Gary Robbins, of Fiscal Associates, the 9-9-9 Plan will expand GDP by $2 trillion, create 6 million new jobs, increase business investment by one third, and increase wages by 10%.

9-9-9 Plan: Summary

•Removes all payroll taxes and unites all tax payers

•Provides the least incentive to evade taxes and the fewest opportunities to do so

•Lifts a $430 billion dead-weight burden on the economy due to compliance, enforcement, collection, etc…

•Is fair, simple, efficient, neutral, and transparent

•Ends nearly all deductions and special interest favors

•Features zero tax on capital gains and repatriated profits

•Exports leave our shores without the Business Tax or the Sales Tax embedded in their cost, making them world class competitive. Imports are subject to the same taxation as domestically produced goods, leveling the playing field.

•Lowest marginal rates on production

•Kills the Death Tax

•Allows immediate expensing of business investments

•Eliminates double taxation of dividends

•Increases capital formation which aids capital availability for small businesses

•Increased capital per worker drives productivity and wage growth

•Features a platform to launch properly structured Empowerment Zones to renew our inner cities

•The pro-growth, pro-job, pro-export economic policies of the 9-9-9 PLAN equals a strong dollar policy

Phase 2 – The Fair Tax

Amidst a backdrop of the economic renewal created by the 9-9-9 Plan, I will begin the process of educating the American people on the benefits of continuing the next step to the Fair Tax.

•Ultimately replaces individual and corporate income taxes

•Ends the IRS as we know it and repeals the 16th Amendment

www.hermancain.com...

straight from the horses mouth

Do you understand what the corporate tax is? It is not a direct tax on you. It is tax paid by corporations on their earnings. Read on to find out

just how high this tax is currently.

Do you work for a corp. what do corps. do to avoid any and all costs to them. thay tack it onto the comsumers so ass THEY pay nothing.

Do you work for a corp. what do corps. do to avoid any and all costs to them. thay tack it onto the comsumers so ass THEY pay nothing.

new topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 4 hours ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 9 hours ago -

Maestro Benedetto

Literature: 11 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 9 hours ago, 28 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 16 hours ago, 8 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 4 hours ago, 8 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 15 hours ago, 6 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 15 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 11 hours ago, 3 flags -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 17 hours ago, 1 flags -

Maestro Benedetto

Literature: 11 hours ago, 1 flags

active topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 20 • : theatreboy -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 6 • : theatreboy -

Supreme Court to decide if states can control fate of social media

Education and Media • 14 • : SMMPanelPro -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 35 • : Lazy88 -

Definitive 9.11 Pentagon EVIDENCE.

9/11 Conspiracies • 426 • : Lazy88 -

Alternate Electors vs Fake Electors - What is the Difference.

2024 Elections • 117 • : ADVISOR -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 691 • : Imbackbaby -

Victoria government has cancelled the commmonwealth games, no money.

Regional Politics • 3 • : nazaretalazareta -

When an Angel gets his or her wings

Religion, Faith, And Theology • 22 • : AcrobaticDreams1 -

King Charles 111 Diagnosed with Cancer

Mainstream News • 321 • : FlyersFan