It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

Economic Doom as banks struggle to maintain the illusion when they are significantly overleveraged.

page: 119

share:

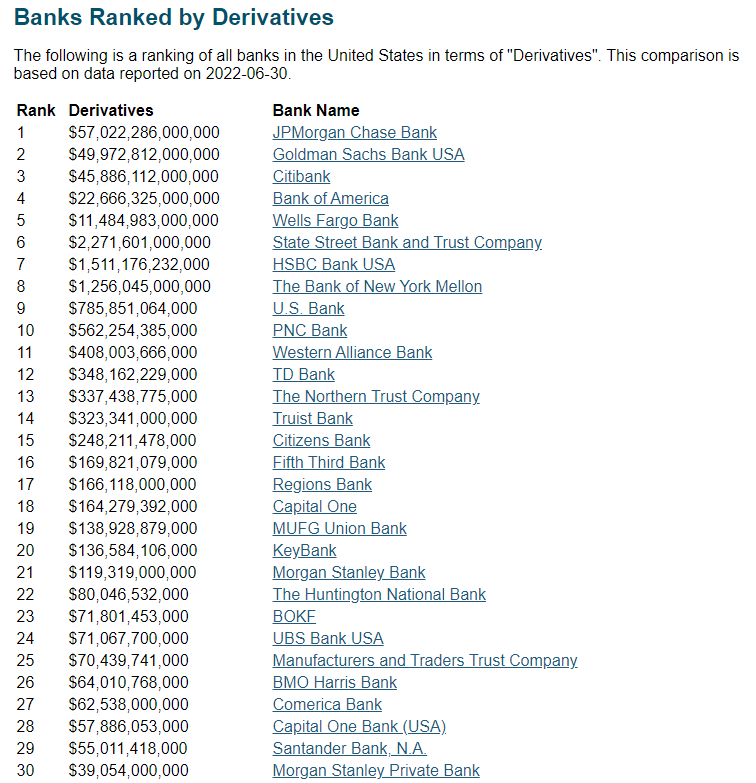

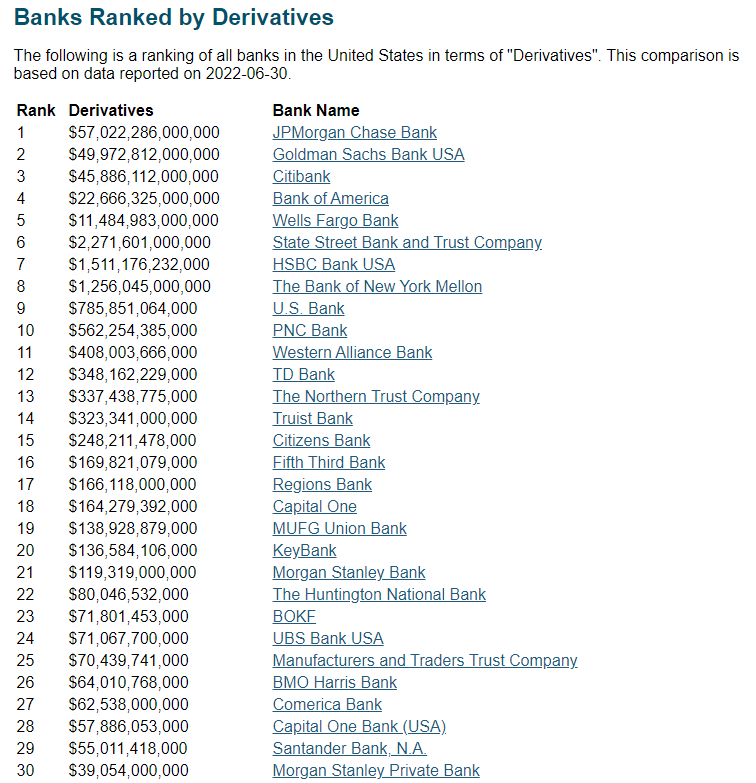

Overleveraged to tune of a QUADRILLION dollars. That is 10 to the power of 15 in terms of dollars in derivatives. The big three holding the

biggest bag once again...

Source

For those that dont know what a financial derivative is;

Based on the risk implied by the sheer scale of these values, the global economy might as well be a perpetual illusion where one final nudge will break the spell sending millions, if not billions, into financial hardship.

This conspiracy is nothing new OfCourse, but one of a repeating cycle. When the house of card falls, big world governments will step in and divert your money to bail out these institutions, the house of cards will be rebuilt, and the cycle begins anew.

I write this OP to highlight the audacity of those in charge to continue to let this happen. Many of y'all are correct, we have been enslaved by an elite caste whereby our day-to-day toiling and savings prop up the incredibly wealthy, while we all struggle to either live with or breakout of the cycle.

Source

For those that dont know what a financial derivative is;

The term derivative refers to a type of financial contract whose value is dependent on an underlying asset, group of assets, or benchmark. A derivative is set between two or more parties that can trade on an exchange or over-the-counter (OTC).

These contracts can be used to trade any number of assets and carry their own risks. Prices for derivatives derive from fluctuations in the underlying asset. These financial securities are commonly used to access certain markets and may be traded to hedge against risk. Derivatives can be used to either mitigate risk (hedging) or assume risk with the expectation of commensurate reward (speculation). Derivatives can move risk (and the accompanying rewards) from the risk-averse to the risk seekers.

Based on the risk implied by the sheer scale of these values, the global economy might as well be a perpetual illusion where one final nudge will break the spell sending millions, if not billions, into financial hardship.

This conspiracy is nothing new OfCourse, but one of a repeating cycle. When the house of card falls, big world governments will step in and divert your money to bail out these institutions, the house of cards will be rebuilt, and the cycle begins anew.

I write this OP to highlight the audacity of those in charge to continue to let this happen. Many of y'all are correct, we have been enslaved by an elite caste whereby our day-to-day toiling and savings prop up the incredibly wealthy, while we all struggle to either live with or breakout of the cycle.

This isn't man's system, and it's deliberate.

It'll be clear soon, when the mark is rolled out and the people clamour to recieve it, that or starve.....

The banking system in the UK has already collapsed and now we're playing peekaboo with inflation through the control of interest rates.

People are willfully ignorant of the reality of a fiat currency system. That ignorance will, soon, cost them everything, including their salvation....

It'll be clear soon, when the mark is rolled out and the people clamour to recieve it, that or starve.....

The banking system in the UK has already collapsed and now we're playing peekaboo with inflation through the control of interest rates.

People are willfully ignorant of the reality of a fiat currency system. That ignorance will, soon, cost them everything, including their salvation....

a reply to: Overseeall

As a comparison to the banks back in 2008, just prior to the collapse. The top 30 banks in 2008 = $181T, 2022 = $196T

As a comparison to the banks back in 2008, just prior to the collapse. The top 30 banks in 2008 = $181T, 2022 = $196T

But whatabout The Basel Committee at the BIS and all their "stress tests" ?? 😎

Stress testing principles

The Basel Committee - overview

Stress testing principles

The Basel Committee - overview

The Basel Committee on Banking Supervision (BCBS) is the primary global standard setter for the prudential regulation of banks and provides a forum for regular cooperation on banking supervisory matters. Its 45 members comprise central banks and bank supervisors from 28 jurisdictions.

Hey look, mostly the same names at the top.

If there is another crisis let them fail and then throw the criminals who ran them in prison. Any bailout should be for the victims of this massive fraud and not the perpetrators.

If they did that back in ‘08 this wouldn’t be a problem now.

If there is another crisis let them fail and then throw the criminals who ran them in prison. Any bailout should be for the victims of this massive fraud and not the perpetrators.

If they did that back in ‘08 this wouldn’t be a problem now.

You think another depression is coming? I don't know if i should sell my crypto at a loss or hold.

a reply to: Overseeall

Welcome to the boondogle of 2007 that's been kicked down the road. This article from 2010 also talks about it. I've heard that it's possibly an even higher number.

Can't wait for the bubble to pop.

seekingalpha.com...

Welcome to the boondogle of 2007 that's been kicked down the road. This article from 2010 also talks about it. I've heard that it's possibly an even higher number.

Can't wait for the bubble to pop.

seekingalpha.com...

There won't be another 2008 bail out due to the Dodd Frank Act, but there can be a bail in. Bail outs were paid from outside sources so that means a

bail in is paid by inside sources. Stockholder or account holders of these banks are going to help pay for the next financial down turn.

You'll know when it's about to happen when the rats abandon ship. Watch for any large corporations to start pulling away from those top 3 or more banks.

You'll know when it's about to happen when the rats abandon ship. Watch for any large corporations to start pulling away from those top 3 or more banks.

a reply to: anonentity

Here's a tip for ya. When things go sideways. Start bidding on government contracts. Or look for the companies with Government contracts from HUD, Freddie, Fannie and FDIC. They will be hiring. Or better yet you can sub contract for them doing various work. Awesome if you already have a company that can do remodeling work. Or a company that can do property winterization. Property inspections. Even in a down economy you can make money if you know where to look.

Here's a tip for ya. When things go sideways. Start bidding on government contracts. Or look for the companies with Government contracts from HUD, Freddie, Fannie and FDIC. They will be hiring. Or better yet you can sub contract for them doing various work. Awesome if you already have a company that can do remodeling work. Or a company that can do property winterization. Property inspections. Even in a down economy you can make money if you know where to look.

edit on 3-10-2022 by grey580 because: (no reason given)

originally posted by: Ohanka

a reply to: CptGreenTea

Crypto is one of their many scams now.

Why do you think that? If its decentralized and unable to be controlled directly by banks then how is it a scam?

a reply to: CptGreenTea

It was also supposed to be uncrackable to some degree and yet the Fed has managed to confiscate quite a bit last couple of years.

at inception yes it was decentralized but your smoking the good stuff if you think the big banks arent hip deep in it by now.

It was also supposed to be uncrackable to some degree and yet the Fed has managed to confiscate quite a bit last couple of years.

at inception yes it was decentralized but your smoking the good stuff if you think the big banks arent hip deep in it by now.

a reply to: CptGreenTea

That was true 10+ years ago. Definitely not today.

The big name cryptos are all de-facto owned by banking cartels now.

That was true 10+ years ago. Definitely not today.

The big name cryptos are all de-facto owned by banking cartels now.

We live in an illusion. One built by belief and controlled by a small number of people.

Our home is supposedly worth like two hundred seventy thousand...but in reality it is probably not worth a fifth of that. Houses go for almost nothing if a Depression happens, but it is all paid off and is in pretty decent shape. I know a lot of people who will probably lose their homes if something major does happen.

Our home is supposedly worth like two hundred seventy thousand...but in reality it is probably not worth a fifth of that. Houses go for almost nothing if a Depression happens, but it is all paid off and is in pretty decent shape. I know a lot of people who will probably lose their homes if something major does happen.

originally posted by: xuenchen

But whatabout The Basel Committee at the BIS and all their "stress tests" ?? 😎

Stress testing principles

The Basel Committee - overview

The Basel Committee on Banking Supervision (BCBS) is the primary global standard setter for the prudential regulation of banks and provides a forum for regular cooperation on banking supervisory matters. Its 45 members comprise central banks and bank supervisors from 28 jurisdictions.

So ironic, banks force mortgage applicants to go through stress tests to determine if their household income can withstand interest rates, inflation, etc. Yet, they over leverage themselves freely and when things go bad it's the serfs that suffer the consequences.

a reply to: TheLieWeLive

You mean like the Vatican, who just pulled all their money out of everywhere?

You mean like the Vatican, who just pulled all their money out of everywhere?

new topics

-

US Air Force Secretary Kendall flies in cockpit of plane controlled by AI

Aircraft Projects: 2 hours ago -

Messages of Hope – Unity through AI

Dreams & Predictions: 2 hours ago -

Happy Cinco de mayo.

General Chit Chat: 3 hours ago -

The BEAST System of Revelation has been awoken and has assumed control, at least since COVID.

New World Order: 7 hours ago

top topics

-

HOUSE VOTES 320-91 TO BAN CHRISTIAN BELIEFS IN AMERICA

Political Issues: 17 hours ago, 10 flags -

The Department of Justice Spies on Congress with Google Assisting.

Political Conspiracies: 13 hours ago, 8 flags -

The BEAST System of Revelation has been awoken and has assumed control, at least since COVID.

New World Order: 7 hours ago, 6 flags -

Messages of Hope – Unity through AI

Dreams & Predictions: 2 hours ago, 1 flags -

US Air Force Secretary Kendall flies in cockpit of plane controlled by AI

Aircraft Projects: 2 hours ago, 1 flags -

Happy Cinco de mayo.

General Chit Chat: 3 hours ago, 0 flags

active topics

-

Mood Music Part VI

Music • 3156 • : Hellmutt -

SC Jack Smith is Using Subterfuge Tricks with Donald Trumps Upcoming Documents Trial.

Dissecting Disinformation • 128 • : Vermilion -

Now is The Time to Tell Americans What Really Happened on 1.6.2021 at our U.S. Capitol.

Political Conspiracies • 198 • : WeMustCare -

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections • 67 • : WeMustCare -

Russia Ukraine Update Thread - part 3

World War Three • 5759 • : bastion -

Really Unexplained

General Chit Chat • 120 • : andy06shake -

The adventure of publishing books

People • 11 • : DISRAELI2 -

Messages of Hope – Unity through AI

Dreams & Predictions • 3 • : WeMustCare -

Happy Cinco de mayo.

General Chit Chat • 1 • : 5thHead -

US Air Force Secretary Kendall flies in cockpit of plane controlled by AI

Aircraft Projects • 0 • : Ophiuchus1

19