It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

8

share:

Greetings, and Happy New Year.

Given that Harris and Biden have promised, repeatedly, to repeal all

Trump administration tax cuts, and to implement tax increases,

the question becomes:

Will such increases apply to Tax Year 2020?

Basis for asking. For myself and others who adjusted their withholding

to be close to or slightly over-withheld to a zero balance, based on

the tax liability that would be incurred during the current tax cuts,

the tax liability will surge much higher as so ordered by Harris and Biden.

Under-withholding by over $500 can cause the tax payer to incur

a penalty as a percent of the over $500 tax liability amount.

Yes, there are certain conditions whereby the IRS will waive the penalty.

If the Harris Biden tax net increase is to apply to the year 2020 return,

then the taxpayer will need to file a quarterly return by Jan 15

to remit the anticipated tax liability increase, and later adjust

withholding (or quarterly filing) to conform to the mandates of Harris and Biden.

And so it becomes financially important to know if Harris and Biden's

plan for us, will apply to Tax Year 2020 or (for sure) 2021 and beyond.

Many thanks, for all your hard work here on ATS.

Given that Harris and Biden have promised, repeatedly, to repeal all

Trump administration tax cuts, and to implement tax increases,

the question becomes:

Will such increases apply to Tax Year 2020?

Basis for asking. For myself and others who adjusted their withholding

to be close to or slightly over-withheld to a zero balance, based on

the tax liability that would be incurred during the current tax cuts,

the tax liability will surge much higher as so ordered by Harris and Biden.

Under-withholding by over $500 can cause the tax payer to incur

a penalty as a percent of the over $500 tax liability amount.

Yes, there are certain conditions whereby the IRS will waive the penalty.

If the Harris Biden tax net increase is to apply to the year 2020 return,

then the taxpayer will need to file a quarterly return by Jan 15

to remit the anticipated tax liability increase, and later adjust

withholding (or quarterly filing) to conform to the mandates of Harris and Biden.

And so it becomes financially important to know if Harris and Biden's

plan for us, will apply to Tax Year 2020 or (for sure) 2021 and beyond.

Many thanks, for all your hard work here on ATS.

If the scam plays out, the scammers won't be in power until after the end of the year.

I don't see how they could back date taxes, the IRS might be a bunch of crooks but they've got a keen sense of order.

I don't see how they could back date taxes, the IRS might be a bunch of crooks but they've got a keen sense of order.

originally posted by: Bluntone22

a reply to: Adonsa

No.

Any tax changes will not effect 2020 retroactively.

But I will say if biden does what I expect we will all be hit hard next year.

Yup. Just making 401k's not deductible equates to a tax increase.

I'd love to see the media ask him about that, and the mental gymnastics he'd reply with.

a reply to: peter_kandra

Hey now.. The American people have spoken.

They will now see that elections have consequences.

Hey now.. The American people have spoken.

They will now see that elections have consequences.

Can't tell you how it is going to work, I know I hardly ever got a refund, I always applied the refund to the next year and paid in quarterly or maybe

if there was a lot of refund I skipped the first quarter payment because of all my business insurances coming due in March. I had to pay a penalty a

couple of times, but it was not much. I was self employed as a residential builder, it is different than being an employee. I learned in the first

few years of business to make sure to have enough paid in so the big payment of taxes coupled to the penalty did not mess things up in the spring when

I had to renew my insurances. Payments for employees taxes I did every three months, and only once was I short in March because of yearly start up

costs and that was a big penalty for being a month late on filing. I had workers laid off for the winter, only one employee, good thing I did not

have all of them working during the time between January and March.

If we believe that our representatives are so inept then why do Americans continue to file their taxes?

Even if a number like 20% of us refused to pay taxes, that would send a big message.

They won't listen until we mess with their money...

OUR MONEY!

Even if a number like 20% of us refused to pay taxes, that would send a big message.

They won't listen until we mess with their money...

OUR MONEY!

a reply to: Adonsa

First - there has been no new tax legislation passed as yet so the existing rules stand and any changes are unlikely to be retroactive.

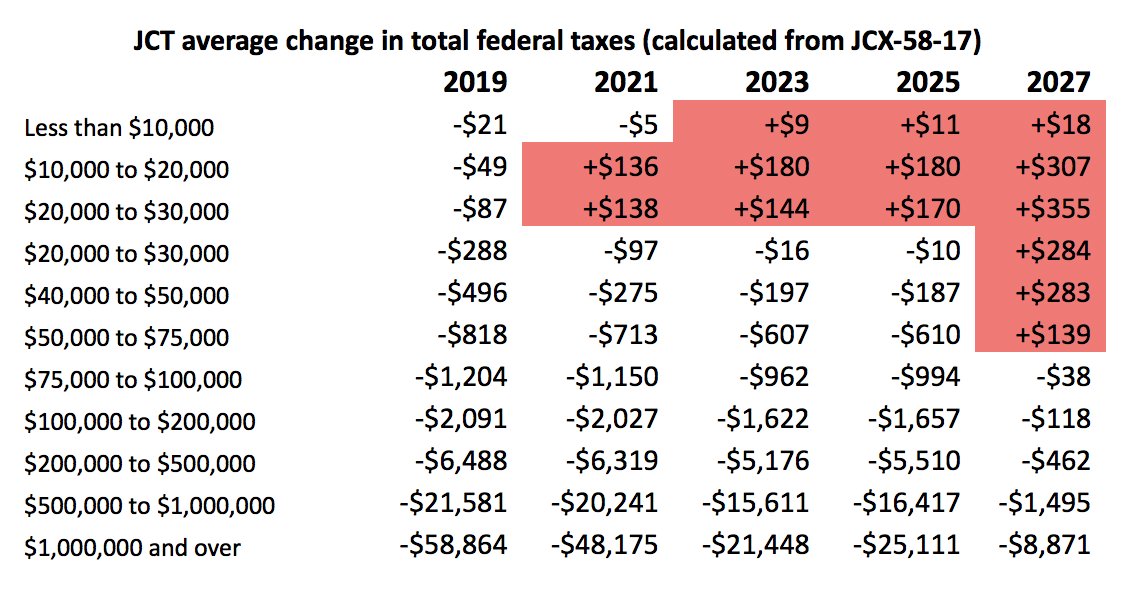

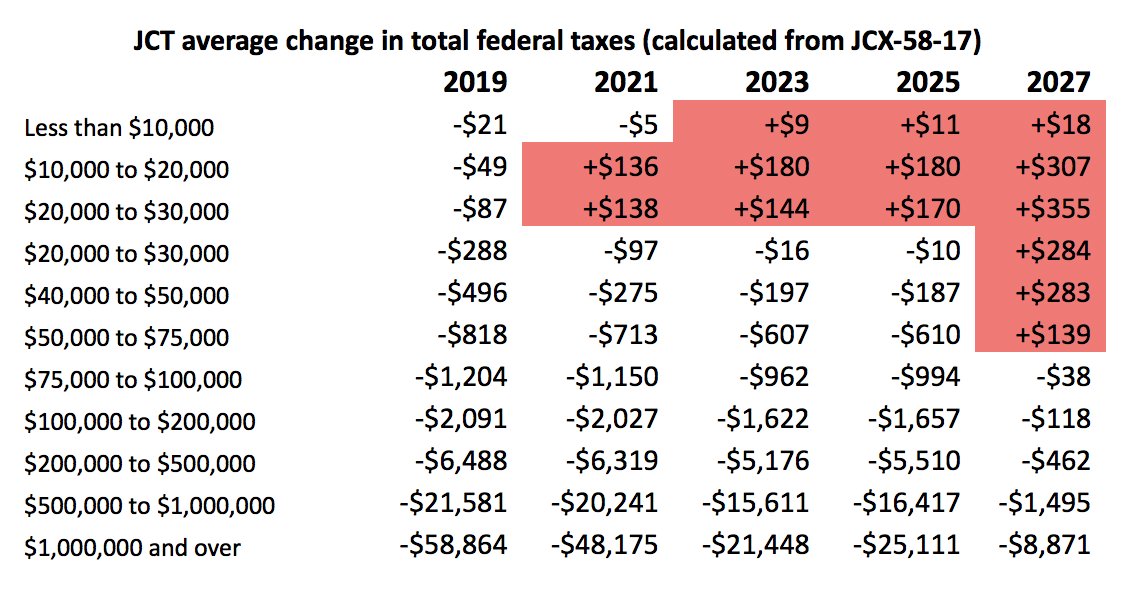

Second - you will be seeing an increase this year in taxes, assuming that you are in a lower tax bracket, that was a part of the Trump tax scheme:

Therefore - worrying about what the incoming administration is going to do is pointless until they actually do something. What is worth looking into, and asking a professional, not ATS members, is how your taxes will go up under the currently existing tax law set into place by the outgoing administration.

First - there has been no new tax legislation passed as yet so the existing rules stand and any changes are unlikely to be retroactive.

Second - you will be seeing an increase this year in taxes, assuming that you are in a lower tax bracket, that was a part of the Trump tax scheme:

Therefore - worrying about what the incoming administration is going to do is pointless until they actually do something. What is worth looking into, and asking a professional, not ATS members, is how your taxes will go up under the currently existing tax law set into place by the outgoing administration.

I have heard from a radio program Trish Reagon hosted that the IRS has plans to increase audits of small businesses by 50%. The feds are trying

really, really hard to shut us down.

new topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 4 hours ago -

Maestro Benedetto

Literature: 6 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 6 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 9 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 10 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 4 hours ago, 26 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 15 hours ago, 9 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 15 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 14 hours ago, 8 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 11 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 13 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 9 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 12 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 10 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 6 hours ago, 3 flags

active topics

-

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 29 • : 19Bones79 -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 90 • : Lumenari -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 12 • : KrustyKrab -

SHORT STORY WRITERS CONTEST -- April 2024 -- TIME -- TIME2024

Short Stories • 23 • : DontTreadOnMe -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 16 • : Astyanax -

Truth Social goes public, be careful not to lose your money

Mainstream News • 130 • : Astyanax -

Is AI Better Than the Hollywood Elite?

Movies • 13 • : Justoneman -

Hate makes for strange bedfellows

US Political Madness • 47 • : 19Bones79 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 689 • : daskakik -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 265 • : Astrocometus

8