It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

I think it's important for people to understand why our money has lost over 97% of it's value since 1971 when Richard Nixon issued Executive Order

11615

From an article in The Atlantic dated Aug 15 2011:

This policy was known as the Nixon Shock, the Office of the State Historian says this:

However, it should be noted that in reality the problems had been created by the previous administration, that is Lyndon B. Johnson when he issued an executive order to remove the gold cover for the federal reserve:

When LBJ removed the gold cover for the Federal Reserve system our national debt stood at around $368 billion

Source: www.usgovernmentdebt.us...

When Nixon issued his executive order 11615 our national debt stood at around $408 billion and today our national debt is almost $21 trillion. This amounts to an annual increase of roughly 8.5% every year in our national debt since 1971

usdebtclock.org...

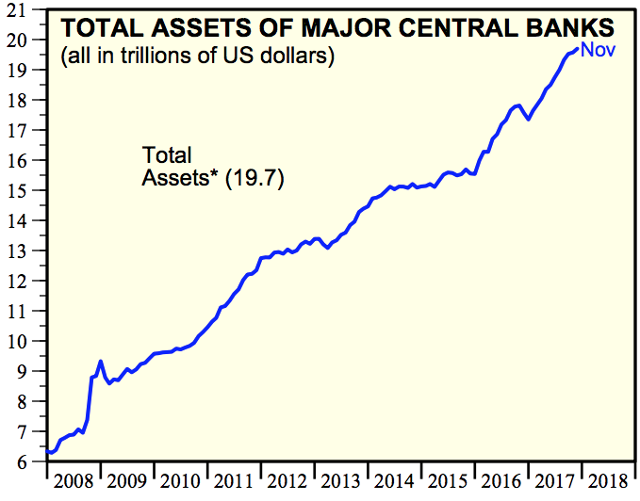

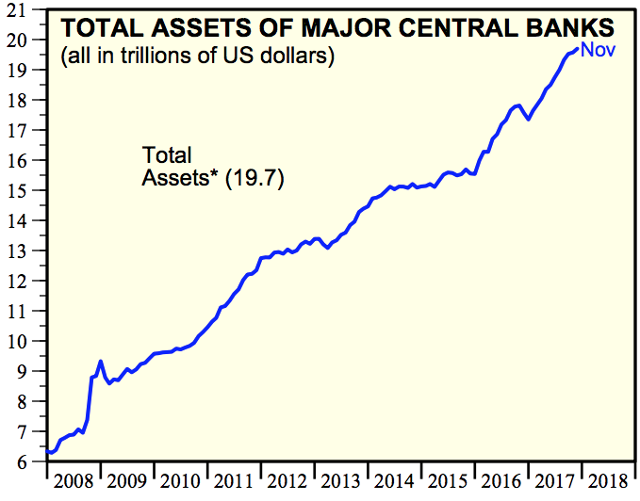

Finally, the worlds central banks have increased their own balance sheets to nearly $20 trillion themselves.

From an article in The Atlantic dated Aug 15 2011:

www.theatlantic.com...

On this very day in 1971, President Richard Nixon announced that U.S. dollars would no longer be redeemable for gold, changing the way the United States did business in what was known as the "Nixon shock." The decision to go off gold spelled the end of the Bretton Woods system of international finance, which had member nations tying their currencies to the dollar. Nixon ended the gold standard, Time reported, "to prevent a run on Fort Knox, which contained only a third of the gold bullion necessary to cover the amount of dollars in foreign hands."

This policy was known as the Nixon Shock, the Office of the State Historian says this:

history.state.gov...

Secretary of the Treasury John Connally on the day that President Richard Nixon announced his New Economic Policy, August 15, 1971. (Nixon Presidential Library) Under the Bretton Woods system, the external values of foreign currencies were fixed in relation to the U.S. dollar, whose value was in turn expressed in gold at the congressionally-set price of $35 per ounce. By the 1960s, a surplus of U.S. dollars caused by foreign aid, military spending, and foreign investment threatened this system, as the United States did not have enough gold to cover the volume of dollars in worldwide circulation at the rate of $35 per ounce; as a result, the dollar was overvalued. Presidents John F. Kennedy and Lyndon B. Johnson adopted a series of measures to support the dollar and sustain Bretton Woods: foreign investment disincentives; restrictions on foreign lending; efforts to stem the official outflow of dollars; international monetary reform; and cooperation with other countries. Nothing worked. Meanwhile, traders in foreign exchange markets, believing that the dollar’s overvaluation would one day compel the U.S. government to devalue it, proved increasingly inclined to sell dollars. This resulted in periodic runs on the dollar.

However, it should be noted that in reality the problems had been created by the previous administration, that is Lyndon B. Johnson when he issued an executive order to remove the gold cover for the federal reserve:

nationalinterest.org...

While Nixon is usually blamed, LBJ played a large role in the gold standard's demise. The received truth about the elimination of the gold standard in the United States (and by extension, the U.S. Dollar being the world’s reserve currency, throughout the rest of the world) is that “Nixon did it”. While it is true that President Nixon, on August 15, 1971, suspended the convertibility of the U.S. Dollar into gold in international transactions, thereby ending the Bretton Woods regime and putting the “final nail in the coffin” of the gold standard, Nixon’s action was pre-ordained by what LBJ had done three and a half years earlier. On March 19, 1968, President Johnson signed a bill eliminating the “gold cover” (i.e., the reserve backing by gold) for Federal Reserve notes. Prior to the removal of the gold cover, each Federal Reserve Bank had been required to hold a gold certificate reserve of not less than 25 percent against its Federal Reserve note liability.

When LBJ removed the gold cover for the Federal Reserve system our national debt stood at around $368 billion

Source: www.usgovernmentdebt.us...

When Nixon issued his executive order 11615 our national debt stood at around $408 billion and today our national debt is almost $21 trillion. This amounts to an annual increase of roughly 8.5% every year in our national debt since 1971

usdebtclock.org...

Finally, the worlds central banks have increased their own balance sheets to nearly $20 trillion themselves.

edit on 13-1-2018 by SkeptiSchism because: sp

a reply to: SkeptiSchism

Great thread, I love reading about the silver and gold backed currency.

I always assumed it was Vietnam that broke the "real" money back. Too many $$$ around the world and then (I can't remember the date) gold was $36 in London and $35 in New York.

Anyway, when ever some one suggests a asset backed dollar they are poo pooed as it being unworkable. But what we have now, with $20,000,000,000,000 in untraceable debt is unworkable.

It will take a real leader to sit down with the US citizens and explain that we have a HUGE problem and it is going to take the next 10 years of high taxes and reduced spending/services to pay off. We do not have that leader. In other works it will be a war that will wipe the slate clean.

S+F

Edit: I am also dabbling in crypto-kind of hard to manipulate the supply-of course it can be pumped and dumped. I am wondering when the pissing match will start with the Fed and the king of the hill crypto that may push it's self to the top in 2018.

m

Great thread, I love reading about the silver and gold backed currency.

I always assumed it was Vietnam that broke the "real" money back. Too many $$$ around the world and then (I can't remember the date) gold was $36 in London and $35 in New York.

Anyway, when ever some one suggests a asset backed dollar they are poo pooed as it being unworkable. But what we have now, with $20,000,000,000,000 in untraceable debt is unworkable.

It will take a real leader to sit down with the US citizens and explain that we have a HUGE problem and it is going to take the next 10 years of high taxes and reduced spending/services to pay off. We do not have that leader. In other works it will be a war that will wipe the slate clean.

S+F

Edit: I am also dabbling in crypto-kind of hard to manipulate the supply-of course it can be pumped and dumped. I am wondering when the pissing match will start with the Fed and the king of the hill crypto that may push it's self to the top in 2018.

m

edit on 13-1-2018 by seasonal because: (no reason given)

a reply to: seasonal

Yah economists (paid by the federal reserve) engaged in a very effective campaign to demonize gold as money. Typical examples are there isn't enough gold. But in reality with modern technology like crypto currencies it would be possible to create asset backed cryptos fully backed by gold bullion, that is fungible.

Cryptos could fractionalize the amount of gold as well, so the total amount of gold in reserve isn't a problem because digitally you could have 0.0000001 grams of gold in your account. However, the limitation would be the actual amount of gold you could redeem from an ATM.

But you can spin gold wires to an atomic level, so you could theoretically spin gold around 0.0001 grams say and embed that gold wire in a plastic bill dispensed by an ATM machine.

Yah economists (paid by the federal reserve) engaged in a very effective campaign to demonize gold as money. Typical examples are there isn't enough gold. But in reality with modern technology like crypto currencies it would be possible to create asset backed cryptos fully backed by gold bullion, that is fungible.

Cryptos could fractionalize the amount of gold as well, so the total amount of gold in reserve isn't a problem because digitally you could have 0.0000001 grams of gold in your account. However, the limitation would be the actual amount of gold you could redeem from an ATM.

But you can spin gold wires to an atomic level, so you could theoretically spin gold around 0.0001 grams say and embed that gold wire in a plastic bill dispensed by an ATM machine.

Another interesting thing to note is that FDR first detached the dollar from gold in 1933 by executive order 6102:

This essentially made the dollar a fiat currency within the US economy, that is the dollar wasn't backed by or redeemable in gold coins by the federal reserve who issues the nation's currency. He did this to increase the national debt. When he confiscated gold coins the value on the face of the coin was $20, so a US gold 'double eagle' was worth $20. Then he revalued gold from $20 an ounce to $35 an ounce, in order to increase the value of US reserves to increase the national debt.

At that time in 1933 our national debt was $22.5 billion: www.treasurydirect.gov...

So from the time that FDR issued his executive order in 1933 to the time that Nixon issued his the debt increased from $22.5 billion to $408 billion in 1971 (38 years). That is an annual increase of about 8% a year, nearly the same as the increase rate from 1971 to now.

So, from the time that FDR detached the dollar from gold to when Nixon issued his executive order the dollar should have increased in price (in dollars) from

Price AG (1971) = $35 (1+0.8)^38 = $652 per ounce.

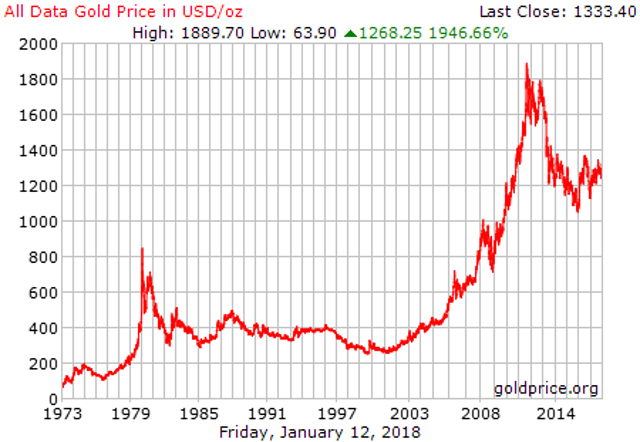

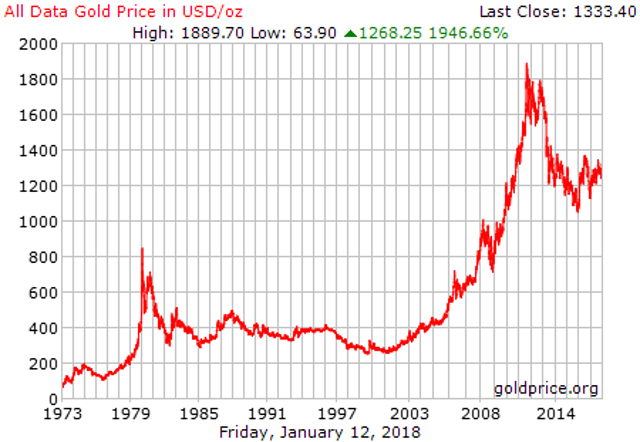

But treasury had pegged it to $35 an ounce. This is why foreign nations were demanding gold from treasury in exchange for the treasury bonds they held and why Nixon issued his EO. Also note how the price of gold skyrocketed after he issued the executive order going from $50 an ounce to almost $800 an ounce.

So you see gold was trying to find it's correct value considering all the debt our government had added. Volker ended that by forcing interest rates down on US treasury bonds. That began the monumental dollar debasement and all the serial financial bubbles blown ever since.

Since our government has continually added to the deficit around 8.5% a year since FDR took it off gold backing the 'true' price of gold in dollars should be:

Gold Price 2018 = $35 (1+0.085)^84

= $33,125 per ounce.

en.wikipedia.org...

Executive Order 6102 required all persons to deliver on or before May 1, 1933, all but a small amount of gold coin, gold bullion, and gold certificates owned by them to the Federal Reserve, in exchange for $20.67 (consumer price index, adjusted value of $391 today[3]) per troy ounce

This essentially made the dollar a fiat currency within the US economy, that is the dollar wasn't backed by or redeemable in gold coins by the federal reserve who issues the nation's currency. He did this to increase the national debt. When he confiscated gold coins the value on the face of the coin was $20, so a US gold 'double eagle' was worth $20. Then he revalued gold from $20 an ounce to $35 an ounce, in order to increase the value of US reserves to increase the national debt.

At that time in 1933 our national debt was $22.5 billion: www.treasurydirect.gov...

So from the time that FDR issued his executive order in 1933 to the time that Nixon issued his the debt increased from $22.5 billion to $408 billion in 1971 (38 years). That is an annual increase of about 8% a year, nearly the same as the increase rate from 1971 to now.

So, from the time that FDR detached the dollar from gold to when Nixon issued his executive order the dollar should have increased in price (in dollars) from

Price AG (1971) = $35 (1+0.8)^38 = $652 per ounce.

But treasury had pegged it to $35 an ounce. This is why foreign nations were demanding gold from treasury in exchange for the treasury bonds they held and why Nixon issued his EO. Also note how the price of gold skyrocketed after he issued the executive order going from $50 an ounce to almost $800 an ounce.

So you see gold was trying to find it's correct value considering all the debt our government had added. Volker ended that by forcing interest rates down on US treasury bonds. That began the monumental dollar debasement and all the serial financial bubbles blown ever since.

Since our government has continually added to the deficit around 8.5% a year since FDR took it off gold backing the 'true' price of gold in dollars should be:

Gold Price 2018 = $35 (1+0.085)^84

= $33,125 per ounce.

a reply to: SkeptiSchism

Absolute power corrupts, absolutely.

I often wonder where we end up. I have a sinking feeling it is in a war, and very little is being done to edge away from that particular cliff.

Absolute power corrupts, absolutely.

I often wonder where we end up. I have a sinking feeling it is in a war, and very little is being done to edge away from that particular cliff.

a reply to: seasonal

The thing that held it all together was the petrodollar. That is after Nixon issued his EO and defaulted on US debt in gold specie, they got Saudi Arabia to sell their oil in dollars and the rest of OPEC followed course.

This created a demand for dollars globally as nations had to hold dollars to buy oil. But supposedly this week China is going to start issuing future's contracts in yuan convertible to gold bullion. So, Iran won't be selling oil in dollars, and soon Saudi Arabia won't either and Venezuela said a while back they wouldnt sell their oil for dollars and those are the top 3 oil producers other than Russia. And we know Russia won't sell their oil in dollars, they created a benchmark for their crude in rubles 2 years ago.

So this week marks the beginning of the end of the petrodollar and partly why I created this thread so people can hopefully understand what is happening.

The thing that held it all together was the petrodollar. That is after Nixon issued his EO and defaulted on US debt in gold specie, they got Saudi Arabia to sell their oil in dollars and the rest of OPEC followed course.

This created a demand for dollars globally as nations had to hold dollars to buy oil. But supposedly this week China is going to start issuing future's contracts in yuan convertible to gold bullion. So, Iran won't be selling oil in dollars, and soon Saudi Arabia won't either and Venezuela said a while back they wouldnt sell their oil for dollars and those are the top 3 oil producers other than Russia. And we know Russia won't sell their oil in dollars, they created a benchmark for their crude in rubles 2 years ago.

So this week marks the beginning of the end of the petrodollar and partly why I created this thread so people can hopefully understand what is happening.

edit on 13-1-2018 by SkeptiSchism because: (no reason given)

The real bitch when it comes to the idea of 'a Gold Standard', actual something backing the value of our dollars at least... the trillainaires

have ALL the gold too.

a reply to: IgnoranceIsntBlisss

That's partly true but central banks have been net buyers of gold for several years now. People say China owns almost 20,000 tons of gold because they don't export the gold they mine.

So, rich people own gold yes because they're not stupid but central banks of the world own most of the gold. They hoard it so that people won't use it as money.

That's partly true but central banks have been net buyers of gold for several years now. People say China owns almost 20,000 tons of gold because they don't export the gold they mine.

So, rich people own gold yes because they're not stupid but central banks of the world own most of the gold. They hoard it so that people won't use it as money.

The process of stripping americans of their tangible wealth has been ongoing . Another major milestone was making everyone turn in their gold in

1933.

en.wikipedia.org...

Big Banks been stealing gold since forever.

en.wikipedia.org...

Big Banks been stealing gold since forever.

edit on 13-1-2018 by intrptr because: (no reason given)

a reply to: SkeptiSchism

They use it as collateral amongst themselves.

Banks don't loan each other money of they don't have "Reserves" of gold.

..central banks of the world own most of the gold. They hoard it so that people won't use it as money.

They use it as collateral amongst themselves.

Banks don't loan each other money of they don't have "Reserves" of gold.

a reply to: SkeptiSchism

Thanks much for all that.

I've saved some gold coins over the years. I know it has been manipulated low for years now, but it will take some sort of catastrophe to change that.

Thanks much for all that.

I've saved some gold coins over the years. I know it has been manipulated low for years now, but it will take some sort of catastrophe to change that.

The New World Order, a picture so incredible, few could imagine :

www.youtube.com...

When you are a western reader, I strongly advice you to hear-out the above video (43:14 minutes).

You'll then find out about ISIS its CIA-rooted startup and financing, and their intended destabilization of Europe's inevitable economic expansion, by flooding their southern, economically weaker countries with refugees from the by your CIA started endless wars in the Middle East and Africa.

You'll also learn about the incredible but silent buildup of the Russian and Chinese military in the last 15 years.

And the fact that China and Russia are the number 1 and 2 gold mining countries now, while South Africa is number 7 now. Which is a clear move by them to return again to a Gold Standard driven financial economy, lingering behind the horizon.

Which would immediately bankrupt the USA, since it is for a long time now build on an immense debt mountain that grew exponentially in the last 85 years.

But they can't be held responsible for their debt, since they compensated that debt by the build-up of the by far biggest and strongest army on earth, which they keep using on countries that try to stay independent from them and their oil backed dollar. Or that try to collect their loans in full.

Both China and Russia and a few more now, know that they first have to combine their military forces, able to withstand the usual response of the leading capitalists inside the US decision making military circuitry, before they can make that to be expected move to a different market valuator than the US dollar. Gold again, or bitcoin backed by gold, or anything other related that will not bankrupt the whole world economy.

SkeptiSchism, that's really frightening :

This is some further frightening remark by you :

There's much more in that above interview with F. William Engdahl, that will let you start wondering about, and give you real insight into, the back-door politics of the USA and its western and eastern Allies.

The US real hidden powerbrokers shall have no other options anymore to negotiate themselves out of this developing fiat money quagmire, and that will cost us all a tremendous amount of money.

Or, less expensive, blood....

www.youtube.com...

When you are a western reader, I strongly advice you to hear-out the above video (43:14 minutes).

You'll then find out about ISIS its CIA-rooted startup and financing, and their intended destabilization of Europe's inevitable economic expansion, by flooding their southern, economically weaker countries with refugees from the by your CIA started endless wars in the Middle East and Africa.

You'll also learn about the incredible but silent buildup of the Russian and Chinese military in the last 15 years.

And the fact that China and Russia are the number 1 and 2 gold mining countries now, while South Africa is number 7 now. Which is a clear move by them to return again to a Gold Standard driven financial economy, lingering behind the horizon.

Which would immediately bankrupt the USA, since it is for a long time now build on an immense debt mountain that grew exponentially in the last 85 years.

But they can't be held responsible for their debt, since they compensated that debt by the build-up of the by far biggest and strongest army on earth, which they keep using on countries that try to stay independent from them and their oil backed dollar. Or that try to collect their loans in full.

Both China and Russia and a few more now, know that they first have to combine their military forces, able to withstand the usual response of the leading capitalists inside the US decision making military circuitry, before they can make that to be expected move to a different market valuator than the US dollar. Gold again, or bitcoin backed by gold, or anything other related that will not bankrupt the whole world economy.

SkeptiSchism, that's really frightening :

So this week marks the beginning of the end of the petrodollar and partly why I created this thread so people can hopefully understand what is happening.

This is some further frightening remark by you :

People say China owns almost 20,000 tons of gold because they don't export the gold they mine.

There's much more in that above interview with F. William Engdahl, that will let you start wondering about, and give you real insight into, the back-door politics of the USA and its western and eastern Allies.

The US real hidden powerbrokers shall have no other options anymore to negotiate themselves out of this developing fiat money quagmire, and that will cost us all a tremendous amount of money.

Or, less expensive, blood....

Executive Order 6102 is a United States presidential executive order signed on April 5, 1933, by President Franklin D. Roosevelt "forbidding the

Hoarding of gold coin, gold bullion, and gold certificates within the continental United States. After most of the public’s gold was turned in, FDR

raised the official price from $20.67 to $35.00 per troy ounce. It was to bail out the Federal Reserve. Gold-clause Federal Reserve notes were not

recalled and remained in circulation. They could no longer be exchanged for gold, except by certain foreign central banks. Those with connections were

able to buy valuable assets with mere paper. Wealth was concentrated in fewer hands. Surprise surprise.

a reply to: SkeptiSchism

a reply to: SkeptiSchism

a reply to: LaBTop

That is another reason I started the thread to identify who it was that began this whole mess. Well to begin with it was the federal reserve created in 1913, they were created to finance WW1. Prior to WW1 the world was on a gold standard or rather gold bills of credit were used for trade.

Those bills of credit circulated in the economy, so in essence they were self liquidating. Merchants who wanted to finance international trade could use the gold bills as money and that paid for services and materials needed to accomplish the trade. But with credit bills of credit exist with the banking system, if the banking system were to go on a holiday then trade would essentially stop.

Luckily nations like Russian and China have been developing a parallel system for the past few years, BRICs in order to maintain liquidity should the US dollar suffer a cataclysmic collapse in value.

So I think what is happening is that China will begin to issue these bonds slowly over time, whoever owns the future's contracts can at any time demand gold bullion in exchange for the bond making them fully backed by gold. But the yuan itself won't be backed by gold. So this means to me that they want to slowly transition over to a gold backed yuan system but it won't happen over night.

People have said they have too much debt in their banking system, they've issued like $20 trillion in commercial debt since 2008. So they risk having a deflationary collapse but perhaps they want that since the yuan is currently pegged to the dollar. The new future's contracts are denominated in yuan but backed by gold.

And another reason I started the thread was the link between LBJ and the CIA. Since we left the gold standard we wanted to make sure other nations of the world used the dollar for trade, that creates a demand for dollars overseas the CIA's job was to ensure they kept using those dollars.

So the possibility of war is very real and dangerous hopefully China devalues the US dollar slowly over time as they issue more and more future's contracts in gold. But if attacked North Korea they could at any time dump all their treasuries and then switch to a gold backed yuan that would destroy the dollar in a short period of time.

They hold all the cards because we've been so irresponsible for decades.

That is another reason I started the thread to identify who it was that began this whole mess. Well to begin with it was the federal reserve created in 1913, they were created to finance WW1. Prior to WW1 the world was on a gold standard or rather gold bills of credit were used for trade.

Those bills of credit circulated in the economy, so in essence they were self liquidating. Merchants who wanted to finance international trade could use the gold bills as money and that paid for services and materials needed to accomplish the trade. But with credit bills of credit exist with the banking system, if the banking system were to go on a holiday then trade would essentially stop.

Luckily nations like Russian and China have been developing a parallel system for the past few years, BRICs in order to maintain liquidity should the US dollar suffer a cataclysmic collapse in value.

So I think what is happening is that China will begin to issue these bonds slowly over time, whoever owns the future's contracts can at any time demand gold bullion in exchange for the bond making them fully backed by gold. But the yuan itself won't be backed by gold. So this means to me that they want to slowly transition over to a gold backed yuan system but it won't happen over night.

People have said they have too much debt in their banking system, they've issued like $20 trillion in commercial debt since 2008. So they risk having a deflationary collapse but perhaps they want that since the yuan is currently pegged to the dollar. The new future's contracts are denominated in yuan but backed by gold.

And another reason I started the thread was the link between LBJ and the CIA. Since we left the gold standard we wanted to make sure other nations of the world used the dollar for trade, that creates a demand for dollars overseas the CIA's job was to ensure they kept using those dollars.

So the possibility of war is very real and dangerous hopefully China devalues the US dollar slowly over time as they issue more and more future's contracts in gold. But if attacked North Korea they could at any time dump all their treasuries and then switch to a gold backed yuan that would destroy the dollar in a short period of time.

They hold all the cards because we've been so irresponsible for decades.

Here is another interesting factoid. The US treasury currently 'books' gold at $48 an ounce. That means treasury is intentionally understating the

value of our gold reserves by about 2600%.

To put it to numbers, treasury says they own about 8,500 tons of gold or 258 million ounces.

258 million ounces x $48 /ounce = $12 billion

258 billion ounces x $1,335/ounce = $344 billion.

So treasury is intentionally understating our gold assets by $332 billion when our national debt is more than $20 trillion.

Some real geniuses at work here folks.

To put it to numbers, treasury says they own about 8,500 tons of gold or 258 million ounces.

258 million ounces x $48 /ounce = $12 billion

258 billion ounces x $1,335/ounce = $344 billion.

So treasury is intentionally understating our gold assets by $332 billion when our national debt is more than $20 trillion.

Some real geniuses at work here folks.

a reply to: SkeptiSchism

Now, if treasury were to revalue our gold to what I calculated above, $33,000 per ounce our gold reserves would be:

258 billion ounces x $33,000/ounce = $8.5 trillion.

wth?

Now, if treasury were to revalue our gold to what I calculated above, $33,000 per ounce our gold reserves would be:

258 billion ounces x $33,000/ounce = $8.5 trillion.

wth?

And another thing to note is that all of these debasements to the dollar in terms of gold have been done by executive order. None of them have

officially modified the constitution.

We're living in a constant state of emergency to placate our commercial banking system. They run this show by emergency order only.

Just food for thought.

We're living in a constant state of emergency to placate our commercial banking system. They run this show by emergency order only.

Just food for thought.

a reply to: SkeptiSchism

True, everyone in the US has been pimped out to enrich the few.

Now this system has in the short term created a short window of relative wealth for many, sort of. But we are dealing with people who do not seem to have the best interest of the US citizens in mind.

What is the average investor to do?

True, everyone in the US has been pimped out to enrich the few.

Now this system has in the short term created a short window of relative wealth for many, sort of. But we are dealing with people who do not seem to have the best interest of the US citizens in mind.

What is the average investor to do?

If that value of 258 billion ounces x $33,000/ounce = $8.5 trillion would be activated when China and their followers would change to gold backed

currency, everything is perfectly okay again, against that debt of 20 trillion dollars, when we regard this earlier excerpt of yours :

But only when China and its followers would revalue their gold reserves to that same troy ounce gold value.

And the US and the rest of the world would agree on that.

I don't see that happen. Or there must be a lot more at stake we really don't know about.

Prior to the removal of the gold cover, each Federal Reserve Bank had been required to hold a gold certificate reserve of not less than 25 percent against its Federal Reserve note liability.

But only when China and its followers would revalue their gold reserves to that same troy ounce gold value.

And the US and the rest of the world would agree on that.

I don't see that happen. Or there must be a lot more at stake we really don't know about.

edit on 13/1/18 by LaBTop because: (no reason

given)

edit on 13/1/18 by LaBTop because: (no reason given)

new topics

-

What is the white pill?

Philosophy and Metaphysics: 45 minutes ago -

Mike Pinder The Moody Blues R.I.P.

Music: 1 hours ago -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 4 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 8 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 14 hours ago, 33 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 8 hours ago, 17 flags -

Is AI Better Than the Hollywood Elite?

Movies: 16 hours ago, 4 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 1 hours ago, 3 flags -

What is the white pill?

Philosophy and Metaphysics: 45 minutes ago, 3 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 4 hours ago, 2 flags -

Maestro Benedetto

Literature: 16 hours ago, 1 flags

active topics

-

So this is what Hamas considers 'freedom fighting' ...

War On Terrorism • 263 • : ToneD -

What is the white pill?

Philosophy and Metaphysics • 1 • : Astyanax -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 20 • : WeMustCare -

Mood Music Part VI

Music • 3107 • : TheWoker -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 21 • : MetalThunder -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 63 • : ToneD -

Truth Social goes public, be careful not to lose your money

Mainstream News • 133 • : Astyanax -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 70 • : baablacksheep1 -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 27 • : Threadbarer -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works • 16 • : CristianVictoria