It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

a reply to: Hazardous1408

The Republican Tax plan gives employers the OPPORTUNITY to pay workers more $$$.

Would NO Tax Cuts afford them that opportunity?

Would Hillary's Tax INCREASE afford them that opportunity?

Hazardous1408, what's wrong? Did you have a bad experience ?

The Republican Tax plan gives employers the OPPORTUNITY to pay workers more $$$.

Would NO Tax Cuts afford them that opportunity?

Would Hillary's Tax INCREASE afford them that opportunity?

Hazardous1408, what's wrong? Did you have a bad experience ?

a reply to: carewemust

And another thing...

Oh. Generalisations.

Can I play?

They’re also the ones who avoid/evade the most taxes, as well as set up shop abroad to avoid hiring Americans that are aware of their human rights and value on the job.

Or as you guys would put it... Globalism.

Ironic thing about the devilish Globalism is that you never hear it’s detractors moaning about foreign companies in America who hire Americans.

To be fair though, they’re probably not smart enough to understand that is Globalism.

And another thing...

Those are who pay the majority of taxes now

Oh. Generalisations.

Can I play?

They’re also the ones who avoid/evade the most taxes, as well as set up shop abroad to avoid hiring Americans that are aware of their human rights and value on the job.

Or as you guys would put it... Globalism.

Ironic thing about the devilish Globalism is that you never hear it’s detractors moaning about foreign companies in America who hire Americans.

To be fair though, they’re probably not smart enough to understand that is Globalism.

originally posted by: Hazardous1408

Pay workers more?

Yeah, sure.

Would that be the workers at the bottom end or at the top of the company?

You know what the answer to that question would be taking into account historical precedents?

I’ll give you a hint...

It can’t be blamed on Hillary Clinton.

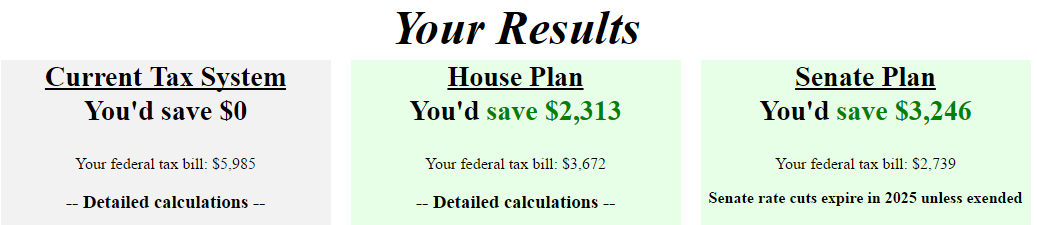

Have you played with the calculator? I get tired of the whole ...oh the rich are holding me back... It is easy to suggest "the other guy" should pay more than me to be an American.

Lets look at a billion dollars...

originally posted by: carewemust

a reply to: Hazardous1408

The Republican Tax plan gives employers the OPPORTUNITY to pay workers more $$$.

Would NO Tax Cuts afford them that opportunity?

Would Hillary's Tax INCREASE afford them that opportunity?

Hazardous1408, what's wrong? Did you have a bad experience ?

Ah yes the old trickle down economics that never actually trickle down.

a reply to: Hazardous1408

Obviously, you feel that you've done your homework. I don't know why Globalism bothers you, though.

Obviously, you feel that you've done your homework. I don't know why Globalism bothers you, though.

originally posted by: hopenotfeariswhatweneed

originally posted by: carewemust

a reply to: Hazardous1408

The Republican Tax plan gives employers the OPPORTUNITY to pay workers more $$$.

Would NO Tax Cuts afford them that opportunity?

Would Hillary's Tax INCREASE afford them that opportunity?

Hazardous1408, what's wrong? Did you have a bad experience ?

Ah yes the old trickle down economics that never actually trickle down.

When I was a young lad, everyone said that about Ronald Reagan's proposed tax-cuts plan.

Two years after it passed, Industry boomed. I remember my dad coming home from his job all excited. The company had done so well that he, a "lowly" assembly line worker, received a $1,600 bonus! We had one of our best family vacations that year.

While large corporations aren't as worker-friendly today as they were 30 years ago, just a LITTLE "trickle down" from a $1.5 Trillion corporate tax-cut, is significant to the little worker bees.

a reply to: carewemust

That’s nothing more than a vague platitude you’re repeating given to you by lying politicians.

Which workers do you expect to be paid more?

What does history tell us?

Would multi-billion dollar companies be able to afford to pay workers more and hire more without a tax break?

Obviously. You’re deluded if you think mega corps needed a tax break to do that.

Your obsession with Hillary is disturbing and sad.

& the answer is still yes.

Nope.

But this isn’t about me anyways.

Do you have a rebuttal to my statements?

Or an answer to my questions?

Do you have a single original thought to share?

Or do you just prefer repeating the mantras of your country’s representatives?

The Republican Tax plan gives employers the OPPORTUNITY to pay workers more $$$.

That’s nothing more than a vague platitude you’re repeating given to you by lying politicians.

Which workers do you expect to be paid more?

What does history tell us?

Would NO Tax Cuts afford them that opportunity?

Would multi-billion dollar companies be able to afford to pay workers more and hire more without a tax break?

Obviously. You’re deluded if you think mega corps needed a tax break to do that.

Would Hillary's Tax INCREASE afford them that opportunity?

Your obsession with Hillary is disturbing and sad.

& the answer is still yes.

Hazardous1408, what's wrong? Did you have a bad experience ?

Nope.

But this isn’t about me anyways.

Do you have a rebuttal to my statements?

Or an answer to my questions?

Do you have a single original thought to share?

Or do you just prefer repeating the mantras of your country’s representatives?

a reply to: Xtrozero

Your post is mostly a strawman.

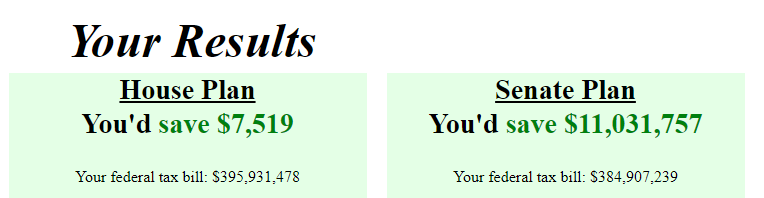

Am I to believe that that measly (to a multi-billion dollar company) $11m saved is going to incentivise the hiring of more workers and a raise in wages?

Wow.

Unfortunately, I’m not convinced in the slightest.

It is much more likely that it will just be dispensed among the top echelon of a company.

Your post is mostly a strawman.

Lets look at a billion dollars...

Am I to believe that that measly (to a multi-billion dollar company) $11m saved is going to incentivise the hiring of more workers and a raise in wages?

Wow.

Unfortunately, I’m not convinced in the slightest.

It is much more likely that it will just be dispensed among the top echelon of a company.

originally posted by: Hazardous1408

Unfortunately, I’m not convinced in the slightest.

It is much more likely that it will just be dispensed among the top echelon of a company.

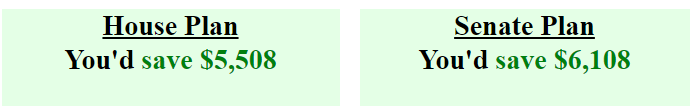

It will save me 5k to 6k...that's a big deal to me...

The big issue is whether America's HUGE tax on companies compared to the REST of the world is good or bad for our continuous growth? This tax change would put us INLINE with the rest of the world with businesses...

You tell me...

edit on 3-12-2017 by Xtrozero because: (no reason given)

a reply to: Xtrozero

There is the very real possibility that it will have no effect whatsoever, good or bad.

You’re probably well aware that the richest mega corps are mostly American.

They are not really at any disadvantage as it stands.

And coincidentally, a huge portion of the rest of the world, including here in Britain, is advocating to change the small taxes of these companies.

If it plays out that way, they won’t be inline for long.

Also, you use the word “us”...

It’s more realistic to say “them”.

I’m genuinely happy for you.

That was surely doable without having to placate to the mega corps, right?

If it wasn’t, and your cuts were dependent on their cuts, you have to wonder if it’s them who are truly in charge.

The big issue is whether America's HUGE tax on companies compared to the REST of the world is good or bad for our continuous growth?

There is the very real possibility that it will have no effect whatsoever, good or bad.

This tax change would put us INLINE with the rest of the world with businesses...

You’re probably well aware that the richest mega corps are mostly American.

They are not really at any disadvantage as it stands.

And coincidentally, a huge portion of the rest of the world, including here in Britain, is advocating to change the small taxes of these companies.

If it plays out that way, they won’t be inline for long.

Also, you use the word “us”...

It’s more realistic to say “them”.

It will save me 5k to 6k...that's a big deal to me...

I’m genuinely happy for you.

That was surely doable without having to placate to the mega corps, right?

If it wasn’t, and your cuts were dependent on their cuts, you have to wonder if it’s them who are truly in charge.

edit on 3-12-2017 by Hazardous1408 because: (no reason given)

originally posted by: Xtrozero

originally posted by: Phage

Handy.

As I speculated, under the House plan I would save a whopping $8.

Under the Senate, I lose $131.

This is just for next year though, right?

Really? What kind of income is that? I guess you need to pay tax to save tax...I'm not slamming you Phage, but your numbers suggest you pay basically nothing in taxes...

Hmm here is mind

BTW I would spend it all on cigars and liquor... anyone have a problem with that?

depends on the brand.

a reply to: Blue_Jay33

I have to pay in now. Both the wife and I claim zero. I have no interest on our home as it is paid for. No deductibles for children as they are to old and have left the nest. For me seeing is believing.

I have to pay in now. Both the wife and I claim zero. I have no interest on our home as it is paid for. No deductibles for children as they are to old and have left the nest. For me seeing is believing.

edit on 3-12-2017 by Tarzan the apeman. because: Because they let me.

originally posted by: Hazardous1408

There is the very real possibility that it will have no effect whatsoever, good or bad.

Well the trillions of dollars sitting offshore and the the businesses with headquarters out of the country all for tax reasons will not change unless we try something else. This tax cut just makes it so companies are motivated to stay home with their money and jobs.

ETA:

House: $0

Senate: $0

House: $0

Senate: $0

edit on 3-12-2017 by denybedoomed because: (no reason given)

a reply to: Blue_Jay33

There's another question that is perhaps more relevant...how much will your quality of life decline under the new tax plans? How much will infrastructure decay? How much more expensive will health care be? How much stuff that the government normally provides will see cuts?

The following is not another brag sheet from the Great Pink North...but it does speak to the up side of taxation.

Why Canada Is Able to Do Things Better

There's another question that is perhaps more relevant...how much will your quality of life decline under the new tax plans? How much will infrastructure decay? How much more expensive will health care be? How much stuff that the government normally provides will see cuts?

The following is not another brag sheet from the Great Pink North...but it does speak to the up side of taxation.

Why Canada Is Able to Do Things Better

originally posted by: JohnnyCanuck

a reply to: Blue_Jay33

There's another question that is perhaps more relevant...how much will your quality of life decline under the new tax plans? How much will infrastructure decay? How much more expensive will health care be? How much stuff that the government normally provides will see cuts?

You're looking at this from the "glass half empty" perspective. The cynical view.

I'm looking at about $5K either way--pretty significant. I'll believe it when TurboTax shows it in big green numbers.

Is it?

originally posted by: carewemust

originally posted by: JohnnyCanuck

a reply to: Blue_Jay33

There's another question that is perhaps more relevant...how much will your quality of life decline under the new tax plans? How much will infrastructure decay? How much more expensive will health care be? How much stuff that the government normally provides will see cuts?

You're looking at this from the "glass half empty" perspective. The cynical view.

new topics

-

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 1 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 5 hours ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 11 hours ago, 28 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 5 hours ago, 11 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 17 hours ago, 8 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 16 hours ago, 7 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 17 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 13 hours ago, 3 flags -

Maestro Benedetto

Literature: 13 hours ago, 1 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 1 hours ago, 1 flags

active topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 270 • : Xtrozero -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 38 • : brodby -

ChatGPT Beatles songs about covid and masks

Science & Technology • 24 • : iaylyan -

The Acronym Game .. Pt.3

General Chit Chat • 7754 • : bally001 -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 96 • : andy06shake -

Rupert Murdoch engaged at 92

People • 8 • : brodby -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 287 • : FlyersFan -

Skinwalker Ranch and the Mystery 1.6GHz Signal

Aliens and UFOs • 144 • : brodby -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 11 • : brodby -

European court rules human rights violated by climate inaction

Fragile Earth • 62 • : iaylyan