It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

originally posted by: DBCowboy

originally posted by: hopenotfeariswhatweneed

originally posted by: DBCowboy

a reply to: Blue_Jay33

I'd save 2,500.00

But Obama said I'd save that with Obamacare.

So you will save tax on your tax payer funded income. Nice.

Wrong again.

*yawn*

I work in the civilian marketplace now.

Is that some of your socialist sense of humor on display....

a reply to: Blue_Jay33

Nice little calculator there.

We will know for sure on April 15th 2018.

Yet it is fun to speculate.

S&F

Nice little calculator there.

We will know for sure on April 15th 2018.

Yet it is fun to speculate.

S&F

a reply to: Ameilia

Well, thank you!

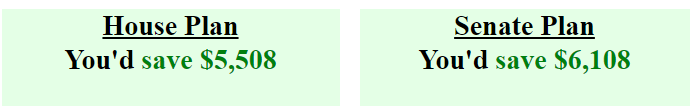

I am going to be cheering for the Senate version based upon this information. I am still not sure why anyone is against tax cuts and an update to the tax code. Right now the tax code is needlessly complicated and stifles business and innovation.

Well, thank you!

I am going to be cheering for the Senate version based upon this information. I am still not sure why anyone is against tax cuts and an update to the tax code. Right now the tax code is needlessly complicated and stifles business and innovation.

I started popping in random numbers just for #s and giggles... oh wowsers.

Honestly, I'm all for a couple hundred bucks a month essentially... but damn, "who benefits," the most from this tax plan?

You'd save $1,131,757

Honestly, I'm all for a couple hundred bucks a month essentially... but damn, "who benefits," the most from this tax plan?

a reply to: Blue_Jay33

It doesn't matter what you pay in taxes. What does matter is the purchasing power of your take home pay. I just got a $500 per month increase on my healthcare insurance premium. The tax break is great and all that but the bigger problem is the cartels and monopolies gouging the consumers.

It doesn't matter what you pay in taxes. What does matter is the purchasing power of your take home pay. I just got a $500 per month increase on my healthcare insurance premium. The tax break is great and all that but the bigger problem is the cartels and monopolies gouging the consumers.

a reply to: Blue_Jay33 I think your title meant to say "How Much Will You Save Under The New Tax Plan After All Is Known About

It?". No one knows exactly what all is in it. All you know is what you have been told. Or did you some how read all of it and even understand it if

you did. Which you did not read it I can assure you of that 100%.

edit on 2/19/2013 by Allaroundyou because: (no reason given)

I don't know. How much did "we" save under the "old tax" plan?.. OP? Sounds like a leading question to me,.. (Looking for an argument, for arguments

sake)? Care to "educate" us? Taxes are a "necessary evil". That said, "Taxes" should be paid by a "Free People ", when/and only when, the "government"

can handle a "budget". That's bassic "elementary".."economics". You'd go to jail for robbing your fellow "citizens". Only "your government" "that

serves you".. can "run up", over $20 trillion of debts, (Never having ever printed, that many dollars)... Come asking/begging you, for "taxes". OP,

sounds like you have a dog in the fight. So give us the run down!

Left always likes to say the wealthier don't pay enough taxes. My situation is I'm on the cusp of buying a business in NY. The first year, as I'll do

some training on a set salary under the current owners to learn their business, would see me paying $6,872 in taxes with the House plan.

But after that, knowing what the current owners make, if I make the same then two years from now I'll pay $43,500 under the House plan.

That's absolutely insane.

And no, it's not some crazy jump in salary from like 50K to 5M. It's a 150% increase in salary.

Yet I've heard the left crying about this plan because the richer skate free.....

My reward from taking on risk and responsibility, jumping into the middle class as well as being ambitious and hunting for success will be 36K per year more in taxes. Yet some dude paying 6K per year will suggest I'm the one not paying my fair share.

But after that, knowing what the current owners make, if I make the same then two years from now I'll pay $43,500 under the House plan.

That's absolutely insane.

And no, it's not some crazy jump in salary from like 50K to 5M. It's a 150% increase in salary.

Yet I've heard the left crying about this plan because the richer skate free.....

My reward from taking on risk and responsibility, jumping into the middle class as well as being ambitious and hunting for success will be 36K per year more in taxes. Yet some dude paying 6K per year will suggest I'm the one not paying my fair share.

a reply to: bluechevytree

I agree with your points about the debt.

I wouldn’t worry too much about the debt because ultimately the people it’s owed to do not have the means to forcefully retrieve it.

They’ll have to make do with getting what they’re given.

The main concern is the possibility that it could weaken the dollar over time.

I understand why you would feel that way.

But repectfully, I fundamentally disagree with this.

The voters have been demanding responsible spending for as long as I’ve been old enough to comprehend the basics of politics.

Short of storming D.C (or any Government holdings across the world, as this is a global problem) with the pitchforks and guns, there is pretty much nothing more the voters can do.

Sure, do that. I wouldn’t oppose it.

But I don’t think that sort of uprising would have a leg to stand on, because while being disgusting, and an absolute piss take, I don’t think wastefulness can be constituted as a tyrannical scheme.

The only people at fault are the ones who control the Budget.

That’s not you and your family, and it sure as hell isn’t any other citizen.

I agree with your points about the debt.

I wouldn’t worry too much about the debt because ultimately the people it’s owed to do not have the means to forcefully retrieve it.

They’ll have to make do with getting what they’re given.

The main concern is the possibility that it could weaken the dollar over time.

you`re right about one thing, the government pisses away too much money and the voters are the one`s to blame for that.

I understand why you would feel that way.

But repectfully, I fundamentally disagree with this.

The voters have been demanding responsible spending for as long as I’ve been old enough to comprehend the basics of politics.

Short of storming D.C (or any Government holdings across the world, as this is a global problem) with the pitchforks and guns, there is pretty much nothing more the voters can do.

Sure, do that. I wouldn’t oppose it.

But I don’t think that sort of uprising would have a leg to stand on, because while being disgusting, and an absolute piss take, I don’t think wastefulness can be constituted as a tyrannical scheme.

The only people at fault are the ones who control the Budget.

That’s not you and your family, and it sure as hell isn’t any other citizen.

a reply to: Blue_Jay33

Blue_Jay33, that is a wonderful calculator for people who don't own a small business.

But since I do own an Insurance Agency and have a ton of deductions, I can't use it. It's a bad omen that the calculator isn't applicable to me. Gulp!

Blue_Jay33, that is a wonderful calculator for people who don't own a small business.

But since I do own an Insurance Agency and have a ton of deductions, I can't use it. It's a bad omen that the calculator isn't applicable to me. Gulp!

a reply to: Metallicus

I’m sure we would disagree.

But I don’t think there is anything preventing us from agreeing on many of the potential places to cut from.

Military being one.

The many bloated bureaucratic departments would be another, I’m sure.

How about foreign aid? That could do with trimming.

NATO?

Stupid, nonsensical, useless scientific studies that receive grant money?

Probably many more as well.

I would like to stop the pointless military spending most of all, however, I doubt you and I would agree on what constitutes a 'vital' social service.

I’m sure we would disagree.

But I don’t think there is anything preventing us from agreeing on many of the potential places to cut from.

Military being one.

The many bloated bureaucratic departments would be another, I’m sure.

How about foreign aid? That could do with trimming.

NATO?

Stupid, nonsensical, useless scientific studies that receive grant money?

Probably many more as well.

a reply to: MysticPearl

No one cares about your business. At all.

Stop imagining yourself as a target.

The arguments are solely against the mega rich corporations.

When you start raking in billions of dollars of profit annually, you can come back and plead your case.

The only legitimate gripe you could have is if your business is in the same bracket as those mega rich companies, and however they are affected is how you will be affected.

Simple solution for that though, press your Government to not treat the mom & pop businesses and the other middle class establishments the same as the giants of industry.

Because that is clearly not an equitable situation.

No one cares about your business. At all.

Stop imagining yourself as a target.

The arguments are solely against the mega rich corporations.

When you start raking in billions of dollars of profit annually, you can come back and plead your case.

The only legitimate gripe you could have is if your business is in the same bracket as those mega rich companies, and however they are affected is how you will be affected.

Simple solution for that though, press your Government to not treat the mom & pop businesses and the other middle class establishments the same as the giants of industry.

Because that is clearly not an equitable situation.

originally posted by: Hazardous1408

So on average, people will probably save about 2k per year...

Which will more than likely be mostly spent at those richest corporations, who by the way will save millions, maybe billions a year...

Now, those two points, along with the yearly rise of the cost of living...

You seeing who the real winners are with these tax cuts, yet?

I’m sure it will sink in eventually.

I HOPE the biggest winners are those who pay Americans and build industry. Those are who pay the majority of taxes now. Giving them a break frees up money to pay workers more, and build additional centers of employment.

HILLARY's tax plan would have screwed everybody. Ref: www.atr.org...

Thank GOD that nasty woman didn't win!

Handy.

As I speculated, under the House plan I would save a whopping $8.

Under the Senate, I lose $131.

This is just for next year though, right?

As I speculated, under the House plan I would save a whopping $8.

Under the Senate, I lose $131.

This is just for next year though, right?

originally posted by: Phage

Handy.

As I speculated, under the House plan I would save a whopping $8.

Under the Senate, I lose $131.

This is just for next year though, right?

Correct. No savings for you in 2017! But patience will bring an increased reward to the inbound cash flow of Phage.

originally posted by: Metallicus

a reply to: Ameilia

Well, thank you!

I am going to be cheering for the Senate version based upon this information. I am still not sure why anyone is against tax cuts and an update to the tax code. Right now the tax code is needlessly complicated and stifles business and innovation.

The Senate version contains the elimination of IRS punishment of those who don't buy ObamaCare authorized health insurance. The House (speaker Ryan) says that eliminating the punishment-tax will remain in the final plan that Trump signs into law.

edit on 12/3/2017 by carewemust because: (no reason given)

originally posted by: Phage

Handy.

As I speculated, under the House plan I would save a whopping $8.

Under the Senate, I lose $131.

This is just for next year though, right?

Really? What kind of income is that? I guess you need to pay tax to save tax...I'm not slamming you Phage, but your numbers suggest you pay basically nothing in taxes...

Hmm here is mind

BTW I would spend it all on cigars and liquor... anyone have a problem with that?

edit on 3-12-2017 by Xtrozero because: (no reason

given)

a reply to: carewemust

Pay workers more?

Yeah, sure.

Would that be the workers at the bottom end or at the top of the company?

You know what the answer to that question would be taking into account historical precedents?

I’ll give you a hint...

It can’t be blamed on Hillary Clinton.

Giving them a break frees up money to pay workers more.

Pay workers more?

Yeah, sure.

Would that be the workers at the bottom end or at the top of the company?

You know what the answer to that question would be taking into account historical precedents?

I’ll give you a hint...

It can’t be blamed on Hillary Clinton.

new topics

-

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 2 hours ago -

1980s Arcade

General Chit Chat: 4 hours ago -

Deadpool and Wolverine

Movies: 5 hours ago -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 6 hours ago -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 7 hours ago -

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics: 10 hours ago

top topics

-

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics: 10 hours ago, 20 flags -

Starburst galaxy M82 - Webb Vs Hubble

Space Exploration: 12 hours ago, 11 flags -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 7 hours ago, 8 flags -

The Superstition of Full Moons Filling Hospitals Turns Out To Be True!

Medical Issues & Conspiracies: 13 hours ago, 8 flags -

IDF Intel Chief Resigns Over Hamas attack

Middle East Issues: 17 hours ago, 6 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 2 hours ago, 6 flags -

15 Unhealthiest Sodas On The Market

Health & Wellness: 12 hours ago, 5 flags -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 6 hours ago, 3 flags -

Deadpool and Wolverine

Movies: 5 hours ago, 3 flags -

1980s Arcade

General Chit Chat: 4 hours ago, 3 flags

active topics

-

1980s Arcade

General Chit Chat • 7 • : Freeborn -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 24 • : annonentity -

Europe declares war on Russia?

World War Three • 59 • : Freeborn -

George Knapp AMA on DI

Area 51 and other Facilities • 38 • : theshadowknows -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 618 • : WeMustCare -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 38 • : baablacksheep1 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 605 • : Ektar -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events • 3 • : Skinnerbot -

So you don't believe in the devil

Paranormal Studies • 143 • : burritocat -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs • 5 • : budzprime69