It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

originally posted by: syrinx high priest

most of the too big to fail banks are bigger than they were pre-crisis

trump wants to repeal dodd-frank

the next time this happens and there are warnings given, I am moving everything to cash until the crisis and then buying right back in like buffet does

I agree that Dodd Frank needs to be repealed but I don't think Trump will be doing it.

His words are similar to Obama's Hope and Change Mantra but once in office, the Bankers will be telling him who is Boss.

Given that Trump has met with the Head of the CFR and Kissinger tells me really all there is to know.

It is all theater.

Trump will be Obama 2.0 once in office

originally posted by: jacobe001

The value of real estate in this country is already overpriced.

The historical rule has always been that you should pay no more than 2X your annual income for a house, and there are graphs depicting that historically at the national level, until the bankers and globalists got in the game.

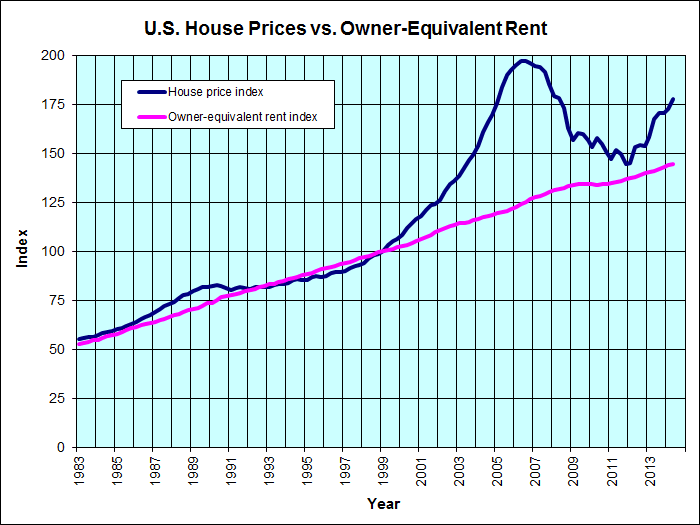

Are you factoring in house size? This has increased on a steady incline for decades. Additionally, the longer term debt instruments were not a factor in the early housing market. This chart shows the blip from the last decade which drove up pricing versus comparable rentals:

Wages have stagnated for most Americans so prices should be dropping not rising.

That is most likely not going to occur.

originally posted by: onequestion

I've read many times that we've only experienced half of the market crash, it has the brakes put on it with the bailouts.

That is because the other half of the equation, Freddie and Fannie, were never addressed. Only the private sector was dicked around with and they made it worse.

originally posted by: AugustusMasonicus

That is most likely not going to occur.

If we had a National Based Free Market, it most certainly would though regardless of the house size.

Supply and Demand and the amount of money the average American has would make it so.

If no one nationally can afford these large houses, then it would spur demand for smaller housing and that is not happening because the bankers and their puppet politicians want it that way.

The Globalists put their well being and wallets above the best interests of the country.

I think Globalists should have some skin in the game from their policies and be taxed 90%

edit on 5-6-2016 by jacobe001 because: (no reason

given)

originally posted by: AugustusMasonicus

originally posted by: jacobe001

If we had a National Based Free Market, it most certainly would though regardless of the house size.

We can talk hypotheticals but the reality is we have what we have and it is not going away any time soon if at all.

Because we have a rigged market that favors the top that need to have some skin in the game.

That is what needs to change.

Corporate and Banking Lobbyists need to be thrown out of the government

www.abovetopsecret.com...

How Corporate Lobbyists Conquered American Democracy

The only thing they love about "Nationalism" is using our military to defend their Globalist Policies

originally posted by: AugustusMasonicus

originally posted by: jacobe001

Corporate and Banking Lobbyists need to be thrown out of the government

I think ALL lobbyists need to go.

Corporate and Banking Lobbyists are the biggest threat to this nation.

They do not even compare to any other lobbyist group.

Washington DC is full of Revolving Door Industry Insiders as well and they need to be thrown out.

The amount of money and influence from non corporate and banking Americans is peanuts

www.opensecrets.org...

TOP LOBBYING SECTORS

Misc Business $6,475,074,239

Health $6,382,737,984

Finance/Insur/RealEst $6,361,287,751

Communic/Electronics $5,206,690,371

Energy/Nat Resource $4,706,049,338

Other $3,350,694,508

Transportation $3,219,680,597

Ideology/Single-Issue $2,073,159,556

Agribusiness $1,910,858,997

Defense $1,819,714,550

Construction $694,573,137

Labor $629,156,951

Lawyers & Lobbyists $429,259,405

originally posted by: AugustusMasonicus

a reply to: jacobe001

Agreed that they are the largest but when you toss them someone else becomes the largest. They all need to go.

Agreed.

Unfortunately like you said in a previous post, it aint gonna happen.

The amount politicians are being showered with is only increasing as well.

Anytime someone says government is the problem or government is too big, I point them at the source of the problem.

It takes a Big Government to serve Crony Capitalists

originally posted by: jacobe001

The amount politicians are being showered with is only increasing as well.

I have long since recognized the politics at the highest level is only a transition point to a much more successful and lucrative career as a lobbyist.

Anytime someone says government is the problem or government is too big, I point them at the source of the problem.

It takes a Big Government to serve Crony Capitalists

Until people realize the both parties are two sides of the same coin and start a grassroots revolution we will have more of the same old.

a reply to: AugustusMasonicus

Can you give a long term projection or predict a future outcome?

Bubble bursting soon or are we on the beginning of a bubble forming?

Can you give a long term projection or predict a future outcome?

Bubble bursting soon or are we on the beginning of a bubble forming?

a reply to: onequestion

There are certainly housing booms occurring in several key geographies; Portland, Seattle, San Francisco and Denver being the most obvious. The limited inventory and multiple offers on properties is spurring the growth. It would be worthwhile to watch those markets to see what the next year or so holds and possibly apply it to the broader real estate market. One of the people I follow feels we are transitioning into the 'expansion' phase with the next phase being 'hyper supply' and then 'recession' which he feels will be in the 2022-2024 range. He has tracked a regular 18 year cycle to this boom-bust housing market phenomenon and is well researched.

Just to be clear, my opinion is solely my own and no one should make investment strategies based on what I write.

There are certainly housing booms occurring in several key geographies; Portland, Seattle, San Francisco and Denver being the most obvious. The limited inventory and multiple offers on properties is spurring the growth. It would be worthwhile to watch those markets to see what the next year or so holds and possibly apply it to the broader real estate market. One of the people I follow feels we are transitioning into the 'expansion' phase with the next phase being 'hyper supply' and then 'recession' which he feels will be in the 2022-2024 range. He has tracked a regular 18 year cycle to this boom-bust housing market phenomenon and is well researched.

Just to be clear, my opinion is solely my own and no one should make investment strategies based on what I write.

edit on 5-6-2016 by AugustusMasonicus because: never go in against a Sicilian with death is on the line

a reply to: AugustusMasonicus

I agree there is definitely a massive surge in commercial real estate projects because we've been getting more business this year than we have since before 2008.

Whats getting me though is that the foundation of our economy hasn't changed any so where's the money coming from?

The average person hasn't on average experienced growth, the job market is still the same, and the labor market is still in decline.

So whats really happening?

I agree there is definitely a massive surge in commercial real estate projects because we've been getting more business this year than we have since before 2008.

Whats getting me though is that the foundation of our economy hasn't changed any so where's the money coming from?

The average person hasn't on average experienced growth, the job market is still the same, and the labor market is still in decline.

So whats really happening?

originally posted by: onequestion

Whats getting me though is that the foundation of our economy hasn't changed any so where's the money coming from?

From what I have seen it is somewhat localized and other areas are still moribund. New York and Jersey City are booming right now. Rents and new construction are through the roof but further out in the suburbs it is much slower.

What I do ties into both the residential and commercial/mixed use market and we have several geographies that are doing much better than others.

a reply to: AugustusMasonicus

Its definitely based on location.

Santa Barbara, San Fran, Dallas, Austin, and other cities are booming while other areas are totally dieing so there is a shift happening.

The residential market where I'm at isnt very strong but it never is. However we are a hub for industrial and distribution activities so lots of companies are investing in the area. We have a 4 person crew doing about 12,000 sq feet a week right now.

Its definitely based on location.

Santa Barbara, San Fran, Dallas, Austin, and other cities are booming while other areas are totally dieing so there is a shift happening.

The residential market where I'm at isnt very strong but it never is. However we are a hub for industrial and distribution activities so lots of companies are investing in the area. We have a 4 person crew doing about 12,000 sq feet a week right now.

originally posted by: onequestion

Its definitely based on location.

Santa Barbara, San Fran, Dallas, Austin, and other cities are booming while other areas are totally dieing so there is a shift happening.

Which is why I tend to agree with my friend that we are still transitioning into the expansion phase. I think there is still some good upside to the market and the next 4-6 years could be very strong for the housing industry.

originally posted by: onequestion

Whats getting me though is that the foundation of our economy hasn't changed any so where's the money coming from?

It depends on the area, New York is pretty healthy since it's diversified, the financial sector doing well helps too. All the west coast cities have the new tech boom (seriously, what's going on with mobile devices right now is similar to the dot com of the 90's), and the middle of the country has experienced a boost from fracking. All of that has lead to well paying jobs for a portion of the population.

new topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 4 minutes ago -

America's Greatest Ally

General Chit Chat: 49 minutes ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 5 hours ago -

Maestro Benedetto

Literature: 7 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 7 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 11 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 5 hours ago, 26 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 17 hours ago, 9 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 12 hours ago, 8 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 17 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 15 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 14 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 11 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 13 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 11 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 7 hours ago, 3 flags

active topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 0 • : charlest2 -

America's Greatest Ally

General Chit Chat • 1 • : BingoMcGoof -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 35 • : annonentity -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 49 • : Freeborn -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 30 • : Asher47 -

Electrical tricks for saving money

Education and Media • 8 • : anned1 -

Is AI Better Than the Hollywood Elite?

Movies • 16 • : 5thHead -

Hate makes for strange bedfellows

US Political Madness • 48 • : Terpene -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 17 • : BingoMcGoof -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 90 • : Lumenari