It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

No Way Out ??? Or Nothing to Worry About?

Current Total U.S. Debt and growing.... $16.9 Trillion dollars....see clock below for breakout of components!

Really, all you have to do is click on the real Debt Clock and you can move from category to category and it will give you a description of what it represents.

"You have never seen in the history of the United States the debt ceiling or the threat of not raising the debt ceiling being used to extort a President or a governing party,"

[url=http://www.usdebtclock.org/]Automated U.S. Debt Clock Here

Current Total U.S. Debt and growing.... $16.9 Trillion dollars....see clock below for breakout of components!

Really, all you have to do is click on the real Debt Clock and you can move from category to category and it will give you a description of what it represents.

"You have never seen in the history of the United States the debt ceiling or the threat of not raising the debt ceiling being used to extort a President or a governing party,"

[url=http://www.usdebtclock.org/]Automated U.S. Debt Clock Here

reply to post by ItDepends

Very interesting. I had a look at the debt clock, it looks in bad shape. Makes you wonder how Obama can raise the debt ceiling and not call it debt.

Very interesting. I had a look at the debt clock, it looks in bad shape. Makes you wonder how Obama can raise the debt ceiling and not call it debt.

i tried to get my head round inflation when i was a kid in p6 age 10 or 11 and still dont get it .

but why are the prices going up every year miss i said it is inflation people want more money to cover the cost of the prices going up you just go round and round with that one

30 plus years later and i still get confused thinking about it

but why are the prices going up every year miss i said it is inflation people want more money to cover the cost of the prices going up you just go round and round with that one

30 plus years later and i still get confused thinking about it

reply to post by geobro

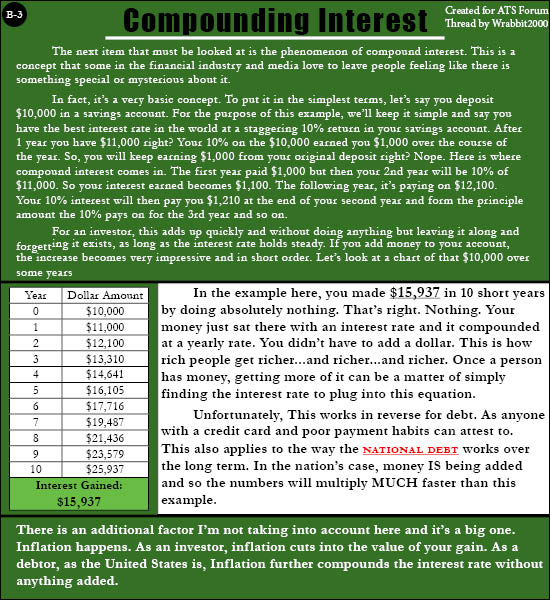

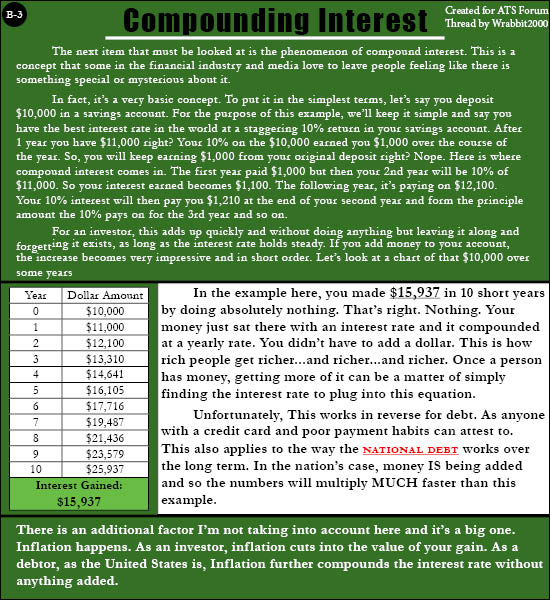

Well, I think the easiest way to explain what inflation will do in terms of real impact is to understand compound interest in a working way...and then, the fact interest is rolled back into the national debt to make it grow. It's how the National debt was still growing, even when the Annual deficit was in surplus during the end of the 90's. That was many trillions of dollars ago in debt and interest to compound.

To say we're screwed would be crude but accurate, IMO. No amount of spin will redefine simple math and that IS math at it's simplest.

Well, I think the easiest way to explain what inflation will do in terms of real impact is to understand compound interest in a working way...and then, the fact interest is rolled back into the national debt to make it grow. It's how the National debt was still growing, even when the Annual deficit was in surplus during the end of the 90's. That was many trillions of dollars ago in debt and interest to compound.

To say we're screwed would be crude but accurate, IMO. No amount of spin will redefine simple math and that IS math at it's simplest.

edit on

20-9-2013 by Wrabbit2000 because: (no reason given)

reply to post by Wrabbit2000

wrabbit you got me confused again on the 24th of december the fed id 100 years old and now your goverment does not protect private property which it is on ..

time to storm the fed i think as it is illegal

wrabbit you got me confused again on the 24th of december the fed id 100 years old and now your goverment does not protect private property which it is on ..

time to storm the fed i think as it is illegal

By creating money the ammount of money increases and the currency loses value that is why there is monetary inflation.

Raw materials become more expensive so prices of products go up, to repair purchasing power the salaries must go up.

Raw materials become more expensive so prices of products go up, to repair purchasing power the salaries must go up.

Interests..

I read of a nice short formular for interests: The Rule Of 72.

Divide 72 by the interest (3%?) = 24.

24 is the number of years (rounded) when the money will have doubled.

10%? => 7 years.

Goes for savings and of course for debts, too..

I read of a nice short formular for interests: The Rule Of 72.

Divide 72 by the interest (3%?) = 24.

24 is the number of years (rounded) when the money will have doubled.

10%? => 7 years.

Goes for savings and of course for debts, too..

geobro

i tried to get my head round inflation when i was a kid in p6 age 10 or 11 and still dont get it .

but why are the prices going up every year miss i said it is inflation people want more money to cover the cost of the prices going up you just go round and round with that one

30 plus years later and i still get confused thinking about it

Inflation in low amounts is actually good. Without inflation the economy can't grow because inflation represents an increase in the growth of the money supply. By increasing inflation the economy expands (this is a good thing because our entire economic system is based on growth, not profitability... the system literally falls apart if growth stops), this is what's happening with Quantative Easing. The fed is essentially creating money and buying up bonds which fuels the economies growth. The fed has been keeping inflation rates artificially low while doing this, which is intended to get more money in the hands of everyone and again keep funds moving through the economy. The instant Quantative Easing ends though (and it's an unsustainable practice, it will eventually cause hyper inflation regardless of keeping interest rates low) this money will dry up and the economy will suffer a severe contraction.

If you still don't get it, don't look into it further. Ignorance is bliss... once you actually understand the factors at work in our financial sector you will never have a peaceful nights sleep again. Ironically enough, the debt ceiling is one of the least important factors here (though to not raise it is extremely irresponsible) but it's the issue that gets the most attention.

No one knows when it will happen but the one inevitable truth of our system is that the entire thing WILL collapse at some point in the future. If it's not QE and hyper inflation that does us in it will be the derivatives market. If that doesn't do it, it will be an economic bubble. If that doesn't do it, it will be something else. The entire thing is incredibly fragile, and it's frankly a miracle it hasn't collapsed yet.

edit on

20-9-2013 by Aazadan because: (no reason given)

I say, let us default, better now then later, because it will happen eventually, so why dig ourselves even deeper into a hole?

Stock up on commodities, food and other necessities, because the $ won't be good for much when it loses much of it's value, whether it be sooner or later.

Stock up on commodities, food and other necessities, because the $ won't be good for much when it loses much of it's value, whether it be sooner or later.

America is pointing an economic gun to the rest of the world with its debt. The tipping point may come about as more countries opt out of using the

dollar as the world's reserve currency. America will need a bailout by the rest of the world in order for the rest of the world not to collapse with

America.

This threat gives the Fed confidence to act as it sees fit. It can print all it wants, the dollar is not being allowed to devalue because of the domino effect that would unravel the world's markets. America is the drunken hedonistic sop of the world, and knows that it can act immorally in financial terms and is depending on the threat of global collapse (in similar terms as a protection racket) to ensure that the American financial system doesn't collapse.

The rest of the world will one day say no more, but not before ensuring their own financial safety with each other. So the bailout American thinks it is entitled to in lieu of the threat of global collapse, will not materialise, and the switch is happening right now in phased incrementals.

The inevitability of America's collapse is as sure as the sun rising every morning, the rest of the world will allow America to fall, and simply write off the bad American debt they hold by bailing each other out. In order to fix the world's finances...America has to reap the collapse it had sown long ago.

Western countries are not entitled to the lifestyles they have on the backs of nations whom are now emerging as the new financial superpowers. A number of Western societies will collapse, but not all. America, however, cannot survive on a lesser lifestyle, which is why it has the amount of debt it has.

This threat gives the Fed confidence to act as it sees fit. It can print all it wants, the dollar is not being allowed to devalue because of the domino effect that would unravel the world's markets. America is the drunken hedonistic sop of the world, and knows that it can act immorally in financial terms and is depending on the threat of global collapse (in similar terms as a protection racket) to ensure that the American financial system doesn't collapse.

The rest of the world will one day say no more, but not before ensuring their own financial safety with each other. So the bailout American thinks it is entitled to in lieu of the threat of global collapse, will not materialise, and the switch is happening right now in phased incrementals.

The inevitability of America's collapse is as sure as the sun rising every morning, the rest of the world will allow America to fall, and simply write off the bad American debt they hold by bailing each other out. In order to fix the world's finances...America has to reap the collapse it had sown long ago.

Western countries are not entitled to the lifestyles they have on the backs of nations whom are now emerging as the new financial superpowers. A number of Western societies will collapse, but not all. America, however, cannot survive on a lesser lifestyle, which is why it has the amount of debt it has.

edit on 20/9/13 by elysiumfire because: (no reason given)

Amazing the worry people work up over debt.

It's all make believe, people.

Our current, dysfunctional monetary system requires that, in order to have a money supply to conduct the economy with, it has to be rented into existence from banks, which constantly issue it out of nothing.

Banks are institutions chartered to legally embezzle, defraud people and counterfeit monies.

Why don't you people understand this?

Nearly every developed nation on earth is up to its ears in debt.

The handful of nations that aren't or weren't got invaded, are on the way to get invaded or have had an internal cue orchestrated or in the works.

How can all developed nations be in debt at the same time?

To whom are they all in debt at the same time to?

Why don't any one of you asks yourselves these?

The debt is onerous, odious and fake.

Banks lend money of nothing, at interest.

Why should debt to banks be upheld and enforced?

Why should institutions of legalised fraud and counterfeiting be allowed to continue to exist?

Why doesn't the government issue the physical currency and electronic money, respectively, instead of the central and commercial banks?

Why do you call and cheer for cuts to social expenditures that benefit you, indirectly, or vulnerable people in need?

All the while you cheer for socialism for the rich.

Why?

Why do you that?

Don't you realise that the rich directly or indirectly became rich because of the inherent upward redistributive effect of the banking-financial monetary system?

How the hell do you think Donald Trump or people like got so rich?

By curing cancer?

Inventing the warp engine?

Or just profiting, either directly () or indirectly (speculating with money loaned from banks), from the legalised fraud that is banking.

Why don't people understand that the same money can not exist in two or more places simultaneously and that that is why banking, all banking (not just central banks), is inherently fraudulent?

It's all make believe, people.

Our current, dysfunctional monetary system requires that, in order to have a money supply to conduct the economy with, it has to be rented into existence from banks, which constantly issue it out of nothing.

Banks are institutions chartered to legally embezzle, defraud people and counterfeit monies.

Why don't you people understand this?

Nearly every developed nation on earth is up to its ears in debt.

The handful of nations that aren't or weren't got invaded, are on the way to get invaded or have had an internal cue orchestrated or in the works.

How can all developed nations be in debt at the same time?

To whom are they all in debt at the same time to?

Why don't any one of you asks yourselves these?

The debt is onerous, odious and fake.

Banks lend money of nothing, at interest.

Why should debt to banks be upheld and enforced?

Why should institutions of legalised fraud and counterfeiting be allowed to continue to exist?

Why doesn't the government issue the physical currency and electronic money, respectively, instead of the central and commercial banks?

Why do you call and cheer for cuts to social expenditures that benefit you, indirectly, or vulnerable people in need?

All the while you cheer for socialism for the rich.

Why?

Why do you that?

Don't you realise that the rich directly or indirectly became rich because of the inherent upward redistributive effect of the banking-financial monetary system?

How the hell do you think Donald Trump or people like got so rich?

By curing cancer?

Inventing the warp engine?

Or just profiting, either directly () or indirectly (speculating with money loaned from banks), from the legalised fraud that is banking.

Why don't people understand that the same money can not exist in two or more places simultaneously and that that is why banking, all banking (not just central banks), is inherently fraudulent?

edit on 2013/9/20 by Pejeu because: (no reason given)

geobro

i tried to get my head round inflation when i was a kid in p6 age 10 or 11 and still dont get it .

but why are the prices going up every year miss i said it is inflation people want more money to cover the cost of the prices going up you just go round and round with that one

30 plus years later and i still get confused thinking about it

It is very simple.

Inflation is by excellence a monetary phenomenon.

Prices continually go up because the money supply grows exponentially perpetually with every single loan a bank issues (and each new loan is issued out of nothing, not out of existing deposits)

Be it a home loan, car loan, student loan, whatever.

Banks loan new money into existence out of nothing each and every single time they issue a loan.

Because the same money can not exist in two places at the same time and you can not loan money over years that you yourself were lent from someone else for months or weeks. Unless you're the banking system, that is.

As new money enters the economy it immediately starts to devalue the old money that was already there, circulating for some time before.

Which means that future car, student and home loans have to be ever bigger amounts. Which means the growth has to continue just to keep the growth rate constant.

While the median (not average) income consistently lags behind the curve (wages don't grow as fast as the ).

It is perpetual redistribution of real wealth and real income, upwards, to the banking and financial system, pure and simple.

But most of the plebs are simply too thick to realise.

They worry over debt and other make-believe non-sense and clamour for (classic) liberalism while the rich have always enjoyed unfettered socialism.

That is because most people have an irrational and misguided belief that they too will some day be rich.

Only poor people work and worry over money.

Rich people just conjure it up or loan it at a low interest rate from the rich people that conjure it up.

It really is that simple.

And you'll almost never grow rich by hard work alone.

Wrabbit2000To say we're screwed would be crude but accurate, IMO. No amount of spin will redefine simple math and that IS math at it's simplest.edit on 20-9-2013 by Wrabbit2000 because: (no reason given)

The debt is make-believe.

A tool for keeping in bondage those that believe it is actually real.

edit on 2013/9/20 by Pejeu because: (no reason

given)

edit on 2013/9/20 by Pejeu because: (no reason given)

reply to post by ItDepends

I don't buy into the "don't worry about the make believe debt" issue. I think our very financial system is likely on the verge of collapse.

If you look at what QE is doing, it is nothing but crack coc aine for the stock market. It feels good while doing it, but eventually it is going to crash. IMHO.

I think our time of financial reckoning is upon us. Maybe a financial crash before the end-2013.

I don't buy into the "don't worry about the make believe debt" issue. I think our very financial system is likely on the verge of collapse.

If you look at what QE is doing, it is nothing but crack coc aine for the stock market. It feels good while doing it, but eventually it is going to crash. IMHO.

I think our time of financial reckoning is upon us. Maybe a financial crash before the end-2013.

When I was with Occupy at St Louis, we had guest speakers come into camp fairly regularly. One day, it was a group from the University of Illinois

with an Economics Professor in tow. I always imagined, growing up, what it must have felt like to be a peasant among a group sitting there, enthralled

by communist propaganda. That IS what this particular man was selling and it was impossible to miss. It could have literally come right out of Mao's

little red book or even the Viet political officers during a distant war in both time and place.

What struck me the most and I'll never forget? I was keeping my tongue very well, being someone volunteering with camp and all...I had to. However, I couldn't hold my tongue entirely and I stumped him with the debt question ...but only for a moment.

You see, he was pushing the idea of one world Government, one world Currency all with a State control from cradle to grave across everything from medical to choice of work in life. I asked him flat out...what about the 16 trillion in debt? Will the world just forgive this for us? (He didn't appreciate the straight question in front of his....less than intellectual audience, either. lol)

His answer was as shocking as it was simple, for how these people think. "They'll simply have to." That was his answer to whether the world would just FORGIVE all US debt in the end? (He seemed to miss the fact, the majority is NOT held by anyone but average citizens...but then..he wasn't missing a damn thing. He just chose what to talk about very very carefully)

That was a tenured professor saying that and from an Economics unit of a State University. This is their thinking as they literally break us in half, financially. Somehow, it''l work out in the end ...'because it has to'.

I'd like to meet that man, in a few years ...if he survives the initial chaos, that is. I'd love to ask him, as we're munching mash off scrap plates in the ruins...how that whole forgiveness thing is working out? I might get shot by then tho...even by someone like him. lol

What struck me the most and I'll never forget? I was keeping my tongue very well, being someone volunteering with camp and all...I had to. However, I couldn't hold my tongue entirely and I stumped him with the debt question ...but only for a moment.

You see, he was pushing the idea of one world Government, one world Currency all with a State control from cradle to grave across everything from medical to choice of work in life. I asked him flat out...what about the 16 trillion in debt? Will the world just forgive this for us? (He didn't appreciate the straight question in front of his....less than intellectual audience, either. lol)

His answer was as shocking as it was simple, for how these people think. "They'll simply have to." That was his answer to whether the world would just FORGIVE all US debt in the end? (He seemed to miss the fact, the majority is NOT held by anyone but average citizens...but then..he wasn't missing a damn thing. He just chose what to talk about very very carefully)

That was a tenured professor saying that and from an Economics unit of a State University. This is their thinking as they literally break us in half, financially. Somehow, it''l work out in the end ...'because it has to'.

I'd like to meet that man, in a few years ...if he survives the initial chaos, that is. I'd love to ask him, as we're munching mash off scrap plates in the ruins...how that whole forgiveness thing is working out? I might get shot by then tho...even by someone like him. lol

reply to post by Pejeu

i was joking when i said i did not get it at 11 i could have figured out a better way to run the economy .

in a closed system how can interest exist was my thought .jeebus had the right idea about throwing the money changers out of the temple

i was joking when i said i did not get it at 11 i could have figured out a better way to run the economy .

in a closed system how can interest exist was my thought .jeebus had the right idea about throwing the money changers out of the temple

reply to post by Aazadan

the petro dollar is on it's way out america's friend saudi arabia will pull the rug one day and it will get like the u.k did when they lost the pound as reserve currency . but they survived i just dont know how america will take it when foreign troops come over to protect their nations interests with everything they own in the u.s.a .

just about everything is now controlled by foreign powers as like the u.k roads bridges energy companies housing even parking meters all foreign owned .

the end is in sight if you look into the gold of 9-11 and where it went it is all sleight of hand to keep things ticking over till the new world order get things up and running

the petro dollar is on it's way out america's friend saudi arabia will pull the rug one day and it will get like the u.k did when they lost the pound as reserve currency . but they survived i just dont know how america will take it when foreign troops come over to protect their nations interests with everything they own in the u.s.a .

just about everything is now controlled by foreign powers as like the u.k roads bridges energy companies housing even parking meters all foreign owned .

the end is in sight if you look into the gold of 9-11 and where it went it is all sleight of hand to keep things ticking over till the new world order get things up and running

took me ten seconds on usdc.org to realize...

the debt/gdp is spinning backwards.

epic fail

the debt/gdp is spinning backwards.

epic fail

the original content doesn't surprise me, but someone who has been at ATS since 2012 finding this information to be a surprise, now that's strange.

geobro

reply to post by Aazadan

the petro dollar is on it's way out america's friend saudi arabia will pull the rug one day and it will get like the u.k did when they lost the pound as reserve currency . but they survived i just dont know how america will take it when foreign troops come over to protect their nations interests with everything they own in the u.s.a .

just about everything is now controlled by foreign powers as like the u.k roads bridges energy companies housing even parking meters all foreign owned .

the end is in sight if you look into the gold of 9-11 and where it went it is all sleight of hand to keep things ticking over till the new world order get things up and running

The petro dollar doesn't matter. The system at it's core is unsustainable. You cannot have a debt based system. If $100 are created $101 must be repaid to pay off the interest on the initial sum. This is how our system currently works. The ultimate result of such a system is that the banks ultimately own everything. For example, what if the banks refuse to create that extra dollar to pay off the interest? You have two options, either default and have collapse happen or sell other assets you have to the bank for that dollar.

This is why concern over the debt is ultimately flawed, it's not a representation of what we owe, but rather how much money is in circulation. A reduction in the debt (like the talking point of paying down the debt) actually represents a severe contraction in the money supply. The only solution is to get away from debt based money and instead focus on currencies backed by value, but not by items rare enough to be monopolized. Silver and the work of a bitcoin chain are examples of good things to back currency with. Gold and oil are not. Fiat however can actually work (see the greenback for an example).

Well seeing how the debt really doesn't exist because the money is really make believe with nothing to back it like gold just tell the Fed to go get

screwed. Then America can print it's own debt free money like we should have been doing all along.

new topics

-

America's Greatest Ally

General Chit Chat: 36 minutes ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 5 hours ago -

Maestro Benedetto

Literature: 7 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 7 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 10 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 5 hours ago, 26 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 16 hours ago, 9 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 12 hours ago, 8 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 16 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 15 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 13 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 10 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 13 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 11 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 7 hours ago, 3 flags

active topics

-

America's Greatest Ally

General Chit Chat • 1 • : BingoMcGoof -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 35 • : annonentity -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 49 • : Freeborn -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 30 • : Asher47 -

Electrical tricks for saving money

Education and Media • 8 • : anned1 -

Is AI Better Than the Hollywood Elite?

Movies • 16 • : 5thHead -

Hate makes for strange bedfellows

US Political Madness • 48 • : Terpene -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 17 • : BingoMcGoof -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 90 • : Lumenari -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 12 • : KrustyKrab