It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Manufacturing data came very bad today. I'm honestly not surprised, the dollar has been smashing it in value. With weakening currencies globally this

was not a big surprise to me. The Fed should have dropped rates by at least 1.00 basis points not 2 .25 cuts.

Manufacturing recession

I knew something was up when the repo market started going crazy.

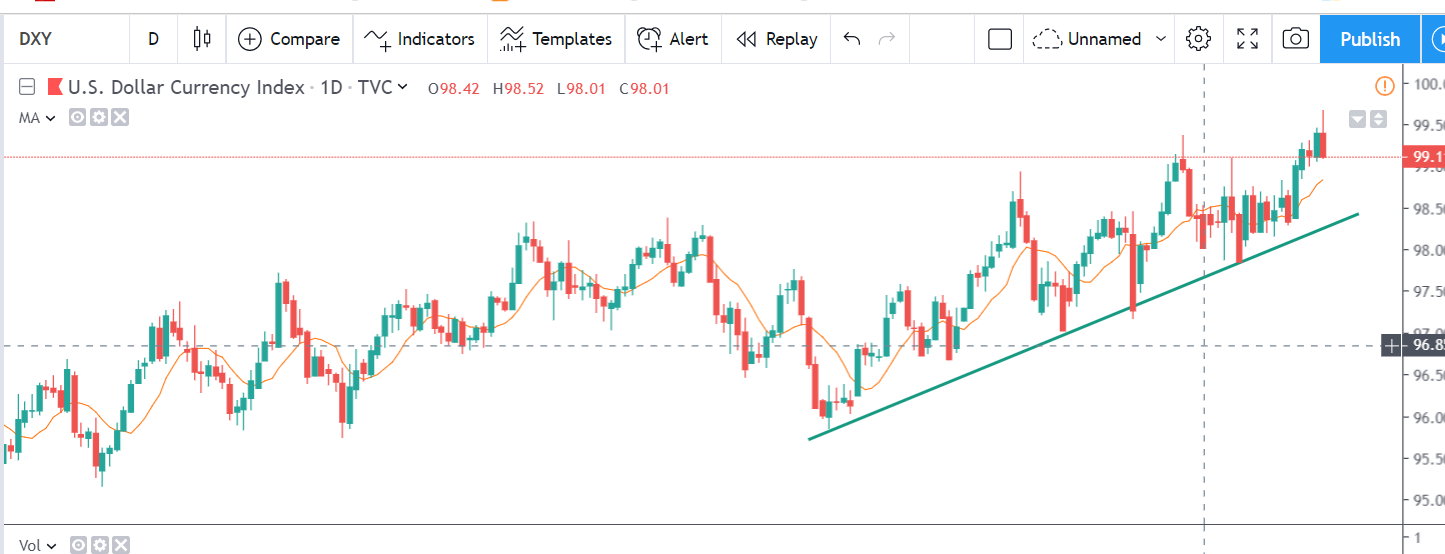

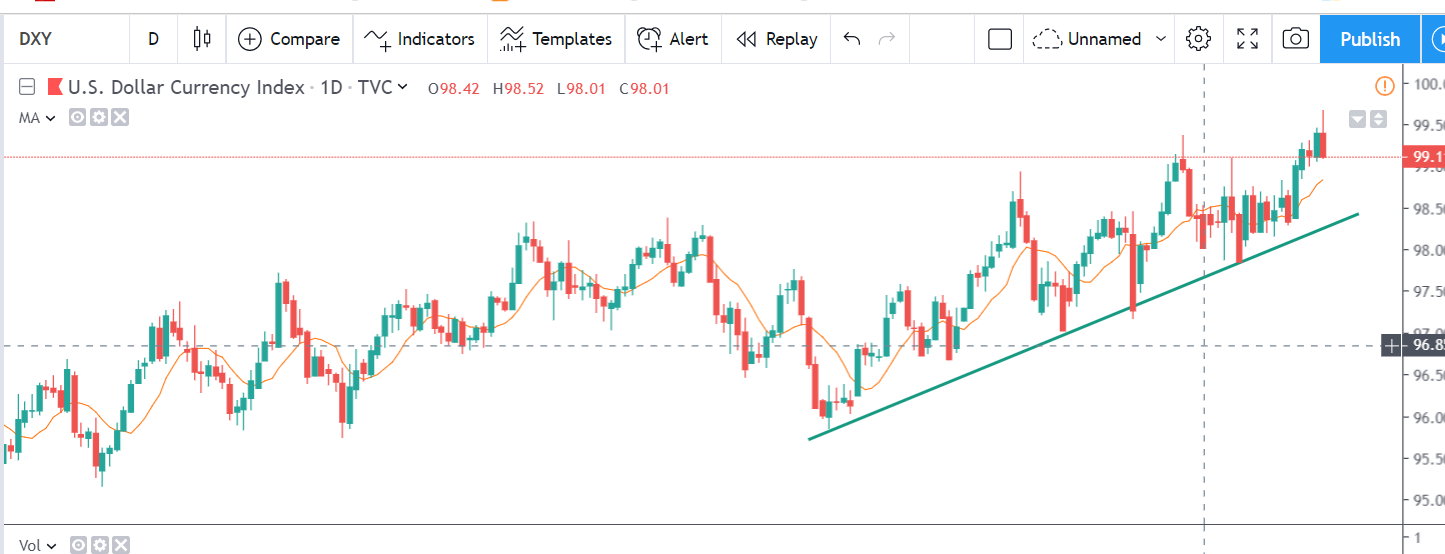

As you can see, the dollar has been gaining tremendous value amid rate cuts. This is due to the fact that the rest of the world is buying into treasuries and bonds in the US (hence the yield curve). They are doing this because their central banks have infinite QE policy devaluing their currency. This in turn makes it impossible for other countries to purchase goods from the US due to exchange rates.

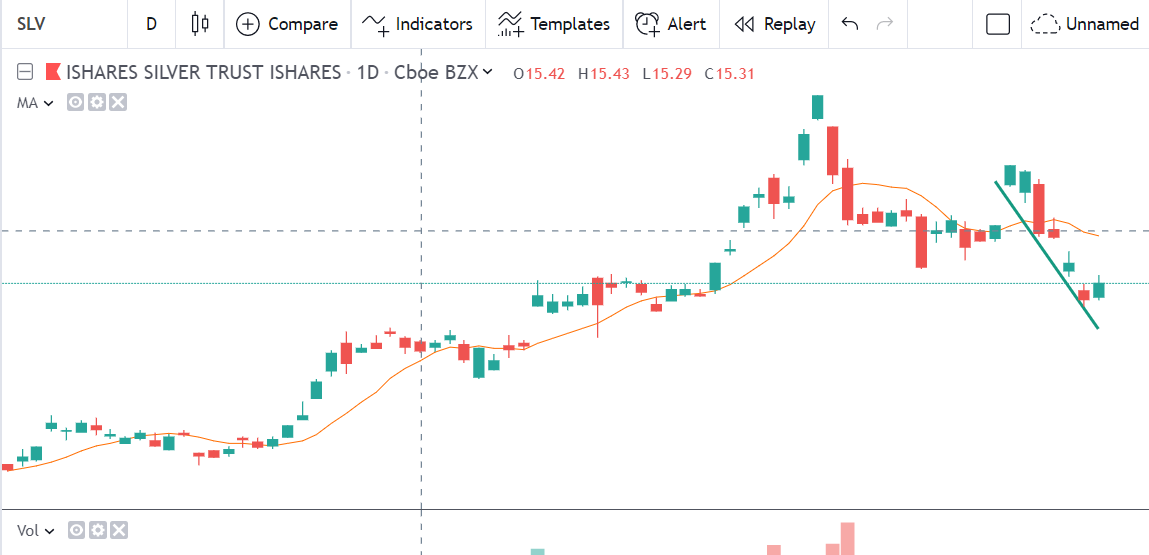

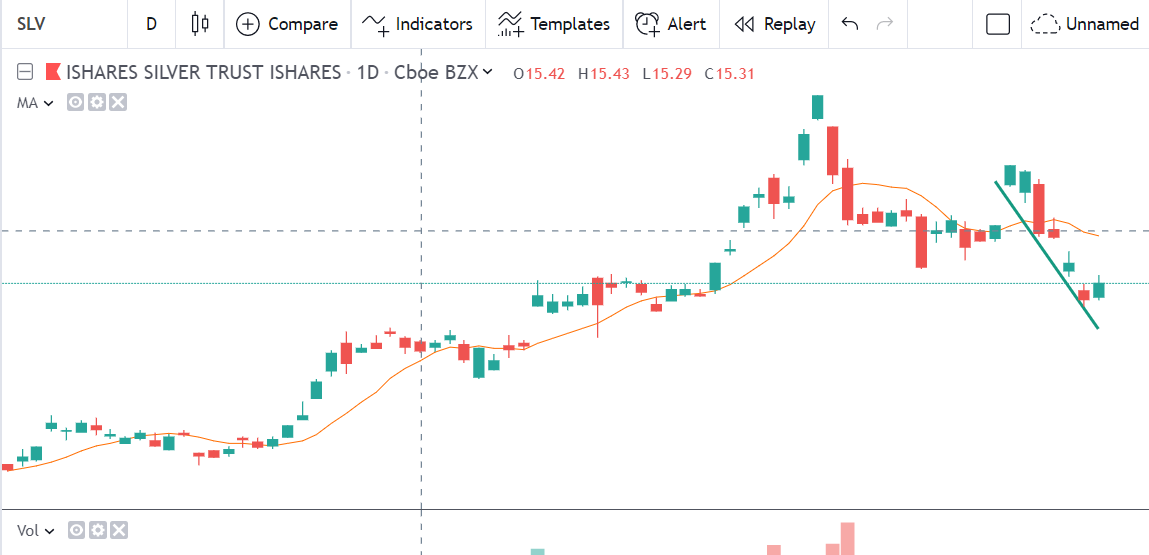

As you can see, the dollar is so strong that it's been crushing the precious metals market for the last 2 weeks.

See the big red candle at the end? That's called a bearish engulfing candle. This is a strong indicator the market sell off is just beginning. Get ready for a rough ride.

Buy GLD, SLV, VIXX, VXX, TVIX, TLT

Manufacturing recession

A gauge of U.S. manufacturing showed the lowest reading in more than 10 years in September as exports dived amid the escalated trade war.

The U.S. manufacturing Purchasing Managers’ Index from the Institute for Supply Management came in at 47.8% in September, the lowest since June 2009, marking the second consecutive month of contraction. Any figure below 50% signals a contraction.

I knew something was up when the repo market started going crazy.

As you can see, the dollar has been gaining tremendous value amid rate cuts. This is due to the fact that the rest of the world is buying into treasuries and bonds in the US (hence the yield curve). They are doing this because their central banks have infinite QE policy devaluing their currency. This in turn makes it impossible for other countries to purchase goods from the US due to exchange rates.

As you can see, the dollar is so strong that it's been crushing the precious metals market for the last 2 weeks.

See the big red candle at the end? That's called a bearish engulfing candle. This is a strong indicator the market sell off is just beginning. Get ready for a rough ride.

Buy GLD, SLV, VIXX, VXX, TVIX, TLT

edit on 1-10-2019 by toysforadults because: (no reason given)

47. something.....dude...didn't know it ever got that low....

Takes my breath a little.....so much cardiac coming at us so fast these days....i feel it in my bones...

Takes my breath a little.....so much cardiac coming at us so fast these days....i feel it in my bones...

a reply to: toysforadults

That's globalism for you...

markets.businessinsider.com...

That's globalism for you...

Data released on Monday showed that Chinese industrial production fell in August — that's after hitting a 17-year low in July, just showing how much the trade war is hurting China's economy.

Pantheon Macroeconomics said that this slowdown in China is "dragging" American manufacturing down with it.

markets.businessinsider.com...

I've been saying for years that we function on an economic model built in the prospect of infinite exponential growth ... And that is simply an

impossibility.

Periodic reality corrections are an inevitability.

Periodic reality corrections are an inevitability.

a reply to: toysforadults

Federal income tax rates need to have a variable element to them in order to stimulate the economy. If the economy enters recession the tax revenues would be dramatically decreased. There has to be a knee to these two curves to maximize tax returns to the government.

Federal income tax rates need to have a variable element to them in order to stimulate the economy. If the economy enters recession the tax revenues would be dramatically decreased. There has to be a knee to these two curves to maximize tax returns to the government.

a reply to: toysforadults

The Purchaser's Manufacturing Index is more of a qualitative than a quantitative figure. It indicates how widespread a contraction or expansion is, but not how deep.

The last two quarters have been struggling mainly due to the tariff war with China. I'm not surprised it is occurring, but this tariff war with China is a war of attrition. Whoever can last the longest wins, and wins big. So far, we're still way out in front.

That's why Trump wants the rates to drop. He wants some extra stimulation to combat the problems he knew would come about. The Feds are apparently not comprehending what he is trying to do, though, and are still trying to use Keynesian formulas to set rates. Trump is not using Keynesian economic theory, so those formulas aren't working well.

Still, even though it sounds bad, I don't think the reality is as bad as it sounds. It's a wide contraction, but not a deep one, meaning there are enough companies surveyed to give pretty good confidence that there is some contraction. I wouldn't worry about an overall recession just yet. So far it seems to be just a minor downturn.

TheRedneck

The Purchaser's Manufacturing Index is more of a qualitative than a quantitative figure. It indicates how widespread a contraction or expansion is, but not how deep.

The last two quarters have been struggling mainly due to the tariff war with China. I'm not surprised it is occurring, but this tariff war with China is a war of attrition. Whoever can last the longest wins, and wins big. So far, we're still way out in front.

That's why Trump wants the rates to drop. He wants some extra stimulation to combat the problems he knew would come about. The Feds are apparently not comprehending what he is trying to do, though, and are still trying to use Keynesian formulas to set rates. Trump is not using Keynesian economic theory, so those formulas aren't working well.

Still, even though it sounds bad, I don't think the reality is as bad as it sounds. It's a wide contraction, but not a deep one, meaning there are enough companies surveyed to give pretty good confidence that there is some contraction. I wouldn't worry about an overall recession just yet. So far it seems to be just a minor downturn.

TheRedneck

a reply to: TheRedneck

How is this trade war going by the way?

I read Trump was threatening to de-list some chinese companies from the stock exchange as a tactic for the next round of negotiations.

Isn't anybody worried that the chinese aren't going to bend simply because they can't affort this trade war but because this is more about honor and not wanting to play second fiddle to the US?

I believe they are going to keep this trade war up until Trump bends or their population starves.

Peace

How is this trade war going by the way?

I read Trump was threatening to de-list some chinese companies from the stock exchange as a tactic for the next round of negotiations.

Isn't anybody worried that the chinese aren't going to bend simply because they can't affort this trade war but because this is more about honor and not wanting to play second fiddle to the US?

I believe they are going to keep this trade war up until Trump bends or their population starves.

Peace

a reply to: operation mindcrime

Well, if China wants to play that game, like Iran, they run a bigger risk of their own population turning against them.

Well, if China wants to play that game, like Iran, they run a bigger risk of their own population turning against them.

a reply to: operation mindcrime

That thought has crossed my mind.

A starving population is a dangerous population, though. China is running a risk of an uprising if things get too bad. Not to mention, much of that honor you speak of concerns achieving their plans for the future... failure is not honorable. Without a thriving economy, their dreams all go up in smoke. Add in the uprising in Hong Kong.

As to how it is going, I just heard some news that Saudi Arabia is threatening to raise fuel prices globally... that is a recession in the making right there. But the US, thanks to Trump's energy policy, will survive it better than most; we are a net exporter of oil now and we have the refineries. Of course, the downside to that is that it will strengthen both Iran and Russia, as they depend on oil prices for a great deal of their income.

Interesting times, to be sure. I'm investing in popcorn myself.

TheRedneck

Isn't anybody worried that the chinese aren't going to bend simply because they can't affort this trade war but because this is more about honor and not wanting to play second fiddle to the US?

I believe they are going to keep this trade war up until Trump bends or their population starves.

That thought has crossed my mind.

A starving population is a dangerous population, though. China is running a risk of an uprising if things get too bad. Not to mention, much of that honor you speak of concerns achieving their plans for the future... failure is not honorable. Without a thriving economy, their dreams all go up in smoke. Add in the uprising in Hong Kong.

As to how it is going, I just heard some news that Saudi Arabia is threatening to raise fuel prices globally... that is a recession in the making right there. But the US, thanks to Trump's energy policy, will survive it better than most; we are a net exporter of oil now and we have the refineries. Of course, the downside to that is that it will strengthen both Iran and Russia, as they depend on oil prices for a great deal of their income.

Interesting times, to be sure. I'm investing in popcorn myself.

TheRedneck

originally posted by: operation mindcrime

a reply to: TheRedneck

I read Trump was threatening to de-list some chinese companies from the stock exchange as a tactic for the next round of negotiations.

Do the president's powers allow this?

a reply to: DictionaryOfExcuses

I wouldn't know but I believe it was never a serieus plan. I guess it would make too many people nervous..

It's Trump's tactic before going into negotiations...raise the ante and drop it as sign of good will. Works surprisingly well..

Peace

I wouldn't know but I believe it was never a serieus plan. I guess it would make too many people nervous..

It's Trump's tactic before going into negotiations...raise the ante and drop it as sign of good will. Works surprisingly well..

Peace

originally posted by: TheRedneck

a reply to: toysforadults

The Purchaser's Manufacturing Index is more of a qualitative than a quantitative figure. It indicates how widespread a contraction or expansion is, but not how deep.

The last two quarters have been struggling mainly due to the tariff war with China. I'm not surprised it is occurring, but this tariff war with China is a war of attrition. Whoever can last the longest wins, and wins big. So far, we're still way out in front.

That's why Trump wants the rates to drop. He wants some extra stimulation to combat the problems he knew would come about. The Feds are apparently not comprehending what he is trying to do, though, and are still trying to use Keynesian formulas to set rates. Trump is not using Keynesian economic theory, so those formulas aren't working well.

Still, even though it sounds bad, I don't think the reality is as bad as it sounds. It's a wide contraction, but not a deep one, meaning there are enough companies surveyed to give pretty good confidence that there is some contraction. I wouldn't worry about an overall recession just yet. So far it seems to be just a minor downturn.

TheRedneck

So, Trump, rather than aiming for stability and even but moderate economic growth, is taking risks with the US economy, in the hopes that China, which is now a larger economy then the US, will fold?

If Trump wins, will it be worth it to the people of the US, or just to Trump?

If he looses...

edit on 1/10/2019 by chr0naut because: (no reason given)

a reply to: chr0naut

china is still the 2nd largest econonmy not the first i think they do have more "purchasing power" though www.cnbc.com...

www.focus-economics.com...

china is still the 2nd largest econonmy not the first i think they do have more "purchasing power" though www.cnbc.com...

China’s economy grew 6.2% in the second quarter from a year ago, the country’s statistics bureau said on Monday. Analysts polled by Reuters expect China’s economy to have grown 6.2% from a year ago in the April to June period. The GDP figure comes as the world’s second largest economy remains locked in a trade war with the U.S.

www.focus-economics.com...

When it comes to the top national economies globally, although the order may shift around slightly from one year to the next, the key players are usually the same. At the top of the list is the United States of America, which according to Investopedia, has been at the head of the table going all the way back to 1871. However, as has been the case for a good few years now, China is gaining on the U.S., with some even claiming that China has already overtaken the U.S. as the world’s Number 1 economy. Nonetheless, going by nominal GDP measured in U.S. dollars alone, the U.S. maintains its spot followed by China and Japan. In this post we take a look at the world’s top economies according to our Consensus Forecasts for 2019 nominal GDP. We also discuss how the top economies change when looking at GDP per capita along with a highlight on emerging markets and their potential to catch up to the big players in the not too distant future.

Sorry, I dont see any predictions of unemployment rising. Probably US manufacturing overseas that is falling off. How are we doing here at home? I

sense numbers being spun.

Of course, I know nothing about any of this.

Of course, I know nothing about any of this.

originally posted by: RalagaNarHallas

a reply to: chr0naut

china is still the 2nd largest econonmy not the first i think they do have more "purchasing power" though www.cnbc.com...

China’s economy grew 6.2% in the second quarter from a year ago, the country’s statistics bureau said on Monday. Analysts polled by Reuters expect China’s economy to have grown 6.2% from a year ago in the April to June period. The GDP figure comes as the world’s second largest economy remains locked in a trade war with the U.S.

www.focus-economics.com...

When it comes to the top national economies globally, although the order may shift around slightly from one year to the next, the key players are usually the same. At the top of the list is the United States of America, which according to Investopedia, has been at the head of the table going all the way back to 1871. However, as has been the case for a good few years now, China is gaining on the U.S., with some even claiming that China has already overtaken the U.S. as the world’s Number 1 economy. Nonetheless, going by nominal GDP measured in U.S. dollars alone, the U.S. maintains its spot followed by China and Japan. In this post we take a look at the world’s top economies according to our Consensus Forecasts for 2019 nominal GDP. We also discuss how the top economies change when looking at GDP per capita along with a highlight on emerging markets and their potential to catch up to the big players in the not too distant future.

Look at the economic growth of China and the closeness in size of both economies. Even if some will not concede that China has already exceeded the US this year, it inevitably will, and in the relatively short term.

While the US economy isn't done for by any means, trying to out play a rival by taking risks is also not particularly prudent. You can't just mint more cash and expect reality to follow through, even confidence in the economy can only go so far to making the economy stronger.

To really grow the economy, the US has to make, buy and sell more stuff per person than it does now. The thing is, it is a fairly optimized system already, I don't think that there are any incredible gains to be had. Risk, in that situation, is just a bad idea.

My entire family is in the auto industry or aerospace. I'm in Detroit when things get bad we're the first ones to take a hit. I'm not seeing much of a

slowdown around here. It's not to say there isn't anything bad on the horizon.

The freeways around here are bumper to bumper traffic at 5 pm. When the market crashed in 08 the roads were a ghost town. I was spooky I never saw anything like it before. It's was like the apocalypse I have a GM and Crystler plant within a mile of my house. The entire area is manufacturing.

In 2005 leading up to 2008 I could see it coming. I saw entire industrial complexes go out of business over night. There were for sale signs everywhere on buildings.

I'm not talking about the inner city that looks like a bomber out war zone. Detroit and it's suburbs span 50 miles. There are factories all over the suburbs.

My cousin works at the local grocery store and he said things have slowed there.

The freeways around here are bumper to bumper traffic at 5 pm. When the market crashed in 08 the roads were a ghost town. I was spooky I never saw anything like it before. It's was like the apocalypse I have a GM and Crystler plant within a mile of my house. The entire area is manufacturing.

In 2005 leading up to 2008 I could see it coming. I saw entire industrial complexes go out of business over night. There were for sale signs everywhere on buildings.

I'm not talking about the inner city that looks like a bomber out war zone. Detroit and it's suburbs span 50 miles. There are factories all over the suburbs.

My cousin works at the local grocery store and he said things have slowed there.

new topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 4 hours ago -

Maestro Benedetto

Literature: 6 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 6 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 9 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 10 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 4 hours ago, 26 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 16 hours ago, 9 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 15 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 14 hours ago, 8 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 11 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 13 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 9 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 12 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 10 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 6 hours ago, 3 flags

active topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 17 • : BingoMcGoof -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 29 • : 19Bones79 -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 90 • : Lumenari -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 12 • : KrustyKrab -

SHORT STORY WRITERS CONTEST -- April 2024 -- TIME -- TIME2024

Short Stories • 23 • : DontTreadOnMe -

Truth Social goes public, be careful not to lose your money

Mainstream News • 130 • : Astyanax -

Is AI Better Than the Hollywood Elite?

Movies • 13 • : Justoneman -

Hate makes for strange bedfellows

US Political Madness • 47 • : 19Bones79 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 689 • : daskakik -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 265 • : Astrocometus