It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

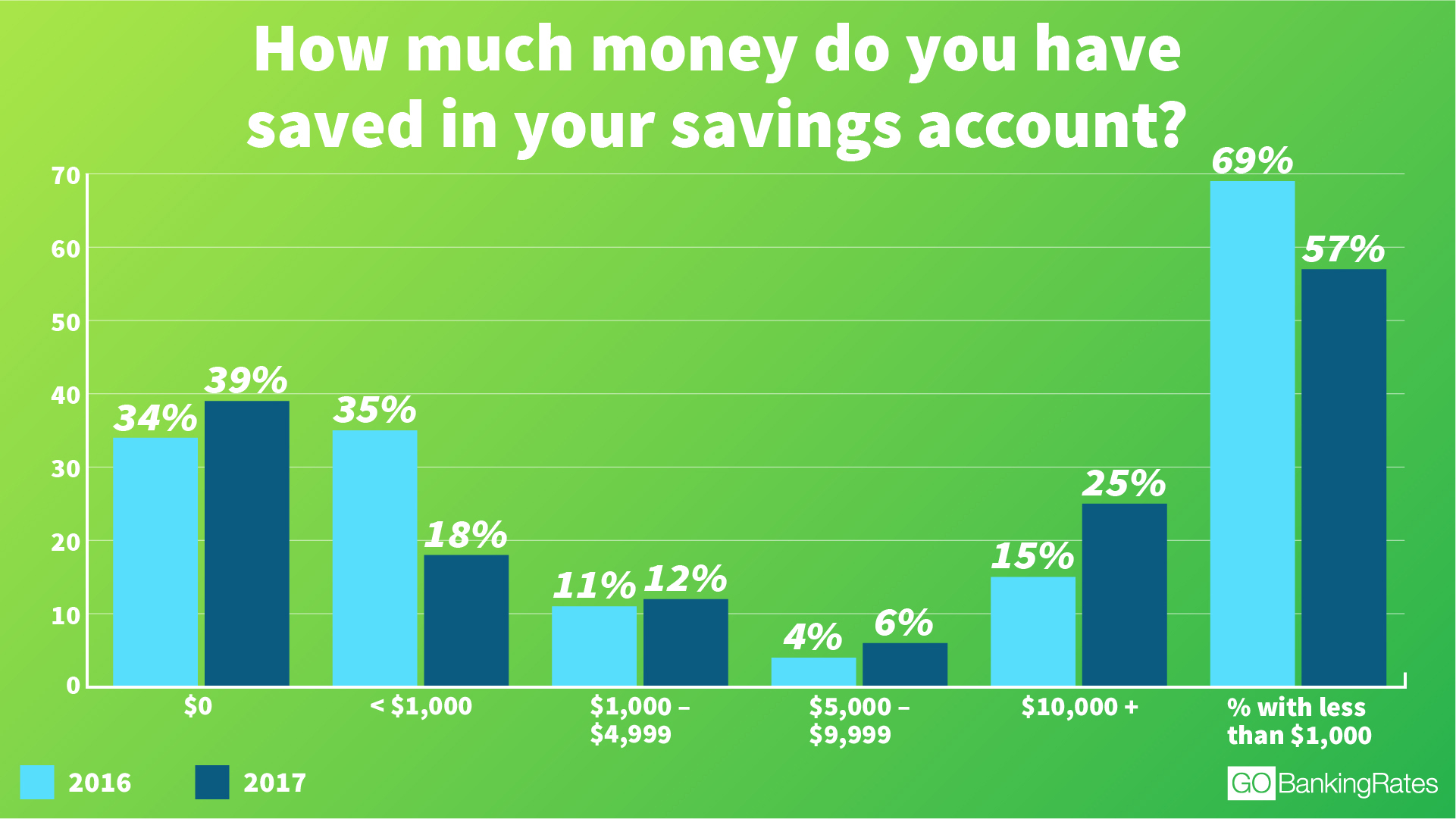

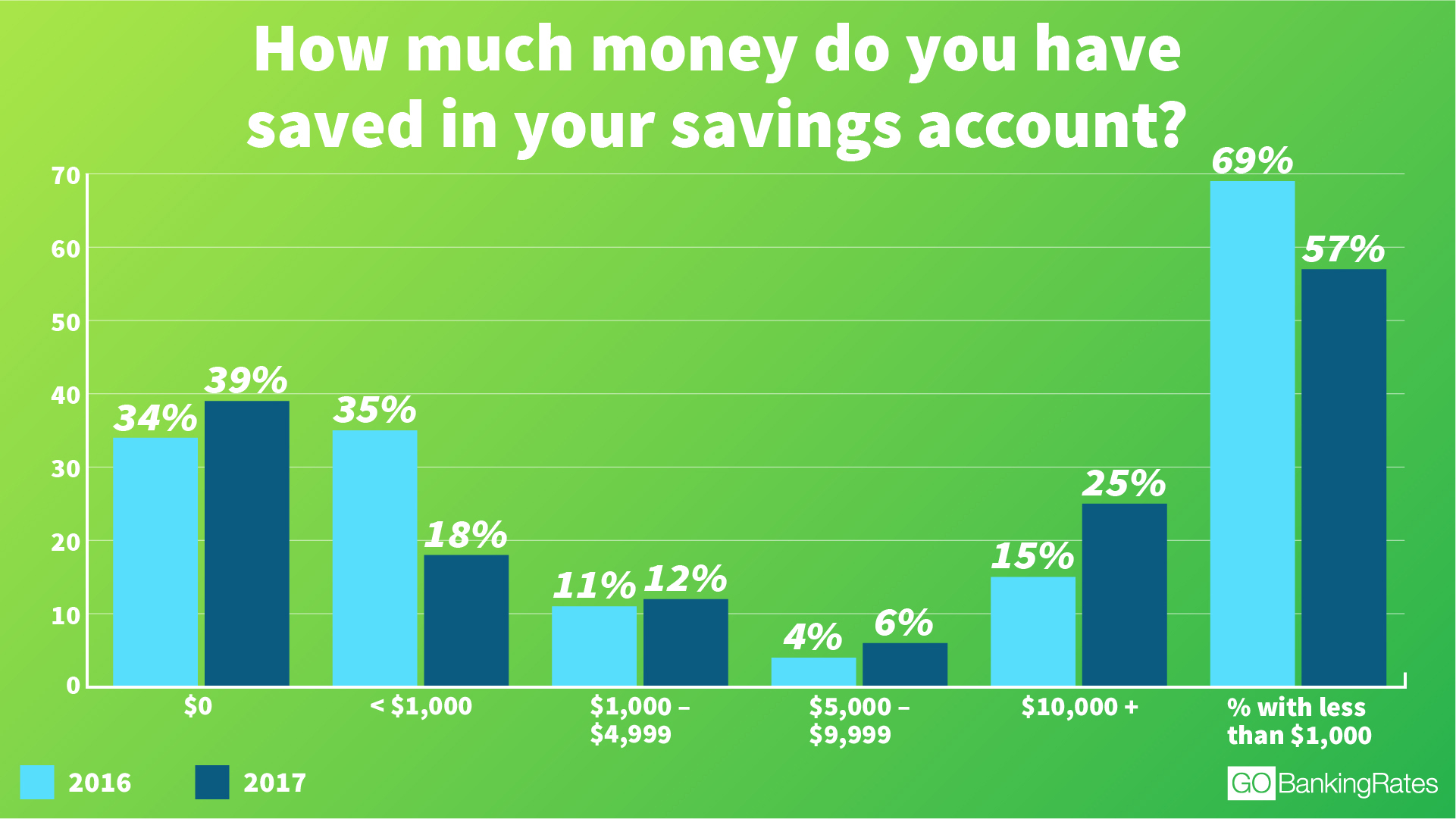

According to several articles, more than half (57 %) of the US population has less than $1000 in total savings in 2017, and 39% have $0 savings!

Well if you're broke, at least you're not alone.

I was very surprised to find that out.

It tells you a lot about our current economy despite other reports.

Here's how much money Americans have in their savings accounts

6 in 10 Americans don't have $500 in savings

Most Americans have less than $1,000 in savings

How Much Money Does the Average American Have in Their Bank Account?

Well if you're broke, at least you're not alone.

I was very surprised to find that out.

It tells you a lot about our current economy despite other reports.

Here's how much money Americans have in their savings accounts

6 in 10 Americans don't have $500 in savings

Most Americans have less than $1,000 in savings

How Much Money Does the Average American Have in Their Bank Account?

It is an improvement from 2016 where 69% of the US population had less than $1000.

a reply to: AugustusMasonicus

I don't know how anyone survives without one. Do you hide money under your bed?

I don't know how anyone survives without one. Do you hide money under your bed?

a reply to: nOraKat

And yet that's an improvement over 2016, according to the article, when it was 69% that had less than a thousand in savings. 12% increase in one year is reason for some optimism.

Maybe people prefer to purchase real estate or other investment assets rather than stick it in a low-interest savings account where all it does is just sit there.

And yet that's an improvement over 2016, according to the article, when it was 69% that had less than a thousand in savings. 12% increase in one year is reason for some optimism.

Maybe people prefer to purchase real estate or other investment assets rather than stick it in a low-interest savings account where all it does is just sit there.

originally posted by: queenofswords

Maybe people prefer to purchase real estate or other investment assets rather than stick it in a low-interest savings account where all it does is just sit there.

Exactly. You are never going to grow your investment with a 1.5% APY.

Anther question is how quickly can those that DO have more than $1K keep it in the bank? Money can disappear really quickly.

originally posted by: AugustusMasonicus

originally posted by: nOraKat

I don't know how anyone survives without one. Do you hide money under your bed?

I have a checking account, not a savings account.

Same here. I have a retirement account and investments. Savings accounts are a joke.

I remember an article from 2015 that said Barack and Michelle had less than $1,001 in savings. Look at them now in just two short years!!

Also, when the Clintons left the White House they were "dead broke", wondering how they could make it. Look at them now!

It just goes to show you.....Broke today, a multi-millionaire tomorrow. Always hope.

Also, when the Clintons left the White House they were "dead broke", wondering how they could make it. Look at them now!

It just goes to show you.....Broke today, a multi-millionaire tomorrow. Always hope.

edit on 26-11-2017 by queenofswords because: (no reason

given)

Well, We do have some money in the bank, and we do have social security income. But all of that can dissappear if we were to have a depression. We

could eventually get the money from the savings account, and understand we need some cash all the time to tide us through till things get back in

line. As far as Social Security, if the economy collapsed, so does our social security for a while.

originally posted by: Skywatcher2011

originally posted by: nOraKat

According to several articles, more than half (57 %) of the US population has less than $1000 in total savings in 2017, and 39% have $0 savings!

Are these stats taken AFTER BLACK FRIDAY store sales?

That was before, also it did not include negative deductions of all types for money you owe. So, the vast majority of Americans are basically under water.

a reply to: nOraKat

Wonder how large the debt is for those same people?

The system is working fine. It has realized its goal of stripping the wealth from the many and handing it to the few.

To make the circle complete now all we need are debtors prisons and a Robbin Hood.

Ever see the film, Wisdom? Put it under the tree, its all you're bank will give you this year for Christmas.

Wonder how large the debt is for those same people?

The system is working fine. It has realized its goal of stripping the wealth from the many and handing it to the few.

To make the circle complete now all we need are debtors prisons and a Robbin Hood.

Ever see the film, Wisdom? Put it under the tree, its all you're bank will give you this year for Christmas.

originally posted by: rickymouse

Well, We do have some money in the bank, and we do have social security income. But all of that can dissappear if we were to have a depression. We could eventually get the money from the savings account, and understand we need some cash all the time to tide us through till things get back in line. As far as Social Security, if the economy collapsed, so does our social security for a while.

Going to retire in 25 years or so, and at that time social security will probably be gone as we currently know it. I am trying to plan as if it just won't be there.

Having a savings account is how people use to stay off welfare or getting loans for fixing the car or cover missed wages.

a reply to: AugustusMasonicus

a reply to: annoyedpharmacist

I think "savings" means not a savings account, but money saved regardless of the account.

But to be fair, prob 24% of the population is under 18 so its not as bad if that is the case.

a reply to: annoyedpharmacist

I think "savings" means not a savings account, but money saved regardless of the account.

But to be fair, prob 24% of the population is under 18 so its not as bad if that is the case.

a reply to: nOraKat

How can anyone save anything when the cost of living is so high!!

The problems with our country are NOT rocket science. The lobbyists force the politicians to pass laws creating cartels and monopolies in exchange for campaign financing. The lobbyist own the politicians. And the CEOs own the lobbyists.

It doesn't matter what you pay in taxes. What DOES matter is the purchasing power of your take home pay. If the CEOs are gouging the consumers by keeping wages low and the prices high the middle class will suffer. Every year the rich get richer and the median worker's wage is being driven deeper and deeper into a poverty wage.

We need to get back to FDR like thinking about government:

Speech before the 1936 Democratic National Convention

Laissez faire capitalism needs to be tempered by public policy.

How can anyone save anything when the cost of living is so high!!

The problems with our country are NOT rocket science. The lobbyists force the politicians to pass laws creating cartels and monopolies in exchange for campaign financing. The lobbyist own the politicians. And the CEOs own the lobbyists.

It doesn't matter what you pay in taxes. What DOES matter is the purchasing power of your take home pay. If the CEOs are gouging the consumers by keeping wages low and the prices high the middle class will suffer. Every year the rich get richer and the median worker's wage is being driven deeper and deeper into a poverty wage.

We need to get back to FDR like thinking about government:

An old English judge once said: 'Necessitous men are not free men.' Liberty requires opportunity to make a living - a living decent according to the standard of the time, a living which gives man not only enough to live by, but something to live for.

For too many of us the political equality we once had won was meaningless in the face of economic inequality. A small group had concentrated into their own hands an almost complete control over other people's property, other people's money, other people's labor - other people's lives. For too many of us life was no longer free; liberty no longer real; men could no longer follow the pursuit of happiness.

Against economic tyranny such as this, the American citizen could appeal only to the organized power of government."

Speech before the 1936 Democratic National Convention

Laissez faire capitalism needs to be tempered by public policy.

I have a savings account with USAA, but it certainly isn't there for performance factors. I also have CDs and they have made me a whopping 12 bucks

in the last 4 years.

Neither of those accounts are there for much more than to hold onto my cash for me in a fairly restrictive fashion where I cant just spend it.

If you're using these types of accounts to make money, then you'll be at it for a few hundred years before you see a reasonable change.

The interest rates just aren't there. They could be soon, but I wouldn't count on those rate changes to have any immediate effects on interest earning accounts of any kind. The truth is most people don't have any savings because the value of the dollar is declining, the cost of living is going up, and wages are generally stagnant. There are many factors to why this is happening, but in the interest of remaining topical, you can't have savings in an environment that actively discourages savings.

The truth is the capital in capitalism comes from savings. Without it we can't have capitalism. Capital for the purposes of starting or growing a business, or to invent or innovate on existing ideas across an entire economy can't be sustained very long on debt, but so long as we continue to do so the rate of savings for Americans will continue to be low.

Luckily I have some savings. Considerably higher than the national average. That money is my SHTF money. It isn't an investment, and it loses value to inflation the longer I let it sit in our low interest rate environment. But that rate of change is slowed a little by the 24-25c per cycle, whereas hiding it under your mattress would ensure that no buffer exists at all while your savings devalues.

I also buy silver and have some gold. Now I'm not a Peter Schiff/Ron Paul 'everything must be gold or back by gold' idea. But if you want to protect your buying power over the long haul, hanging on to metals is a damned good idea.

Neither of those accounts are there for much more than to hold onto my cash for me in a fairly restrictive fashion where I cant just spend it.

If you're using these types of accounts to make money, then you'll be at it for a few hundred years before you see a reasonable change.

The interest rates just aren't there. They could be soon, but I wouldn't count on those rate changes to have any immediate effects on interest earning accounts of any kind. The truth is most people don't have any savings because the value of the dollar is declining, the cost of living is going up, and wages are generally stagnant. There are many factors to why this is happening, but in the interest of remaining topical, you can't have savings in an environment that actively discourages savings.

The truth is the capital in capitalism comes from savings. Without it we can't have capitalism. Capital for the purposes of starting or growing a business, or to invent or innovate on existing ideas across an entire economy can't be sustained very long on debt, but so long as we continue to do so the rate of savings for Americans will continue to be low.

Luckily I have some savings. Considerably higher than the national average. That money is my SHTF money. It isn't an investment, and it loses value to inflation the longer I let it sit in our low interest rate environment. But that rate of change is slowed a little by the 24-25c per cycle, whereas hiding it under your mattress would ensure that no buffer exists at all while your savings devalues.

I also buy silver and have some gold. Now I'm not a Peter Schiff/Ron Paul 'everything must be gold or back by gold' idea. But if you want to protect your buying power over the long haul, hanging on to metals is a damned good idea.

edit on 26 11 17 by projectvxn because: (no reason

given)

new topics

-

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 7 minutes ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 53 minutes ago -

Falkville Robot-Man

Aliens and UFOs: 1 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 1 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 2 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 3 hours ago -

Biden "Happy To Debate Trump"

Mainstream News: 3 hours ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 3 hours ago -

What is the white pill?

Philosophy and Metaphysics: 5 hours ago -

Mike Pinder The Moody Blues R.I.P.

Music: 6 hours ago

top topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 13 hours ago, 21 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 6 hours ago, 7 flags -

Biden "Happy To Debate Trump"

Mainstream News: 3 hours ago, 7 flags -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 1 hours ago, 5 flags -

What is the white pill?

Philosophy and Metaphysics: 5 hours ago, 5 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 2 hours ago, 5 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 3 hours ago, 4 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 3 hours ago, 4 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 9 hours ago, 3 flags -

Falkville Robot-Man

Aliens and UFOs: 1 hours ago, 1 flags

active topics

-

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 20 • : YourFaceAgain -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works • 26 • : RussianTroll -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness • 0 • : FlyersFan -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 803 • : xuenchen -

Re-election Tactic - JOE BIDEN Hints He May Put Books in the Homes of Black People.

2024 Elections • 30 • : WeMustCare -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order • 3 • : Athetos -

Biden "Happy To Debate Trump"

Mainstream News • 35 • : WeMustCare -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 297 • : cherokeetroy -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 699 • : Thoughtful3 -

Ditching physical money

History • 22 • : StudioNada