It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

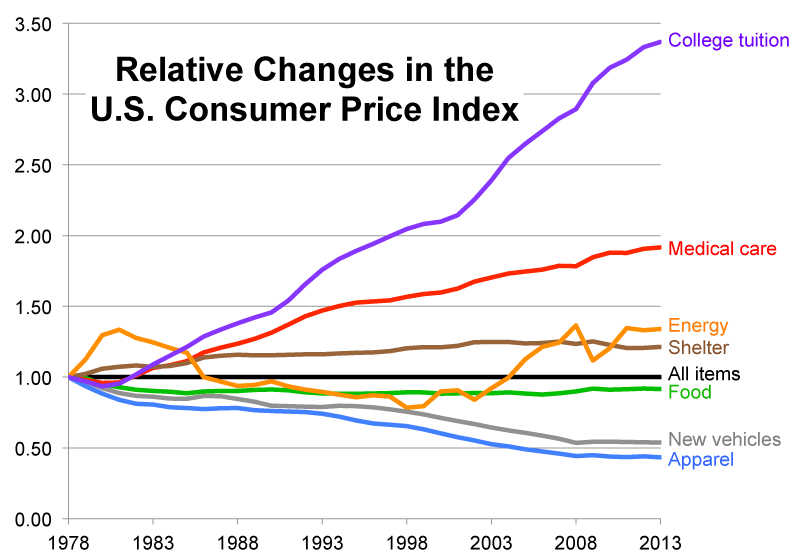

Proof that gov intervention into the economy causes the opposite of the intended result.

Notice the only things that have gone down in price are the things that have no gov give aways.

Food, housing, energy, health care and college all have gov welfare to citizens and the prices are higher.

Clothing and vehicles have no gov welfare and their prices are lower.

Notice the only things that have gone down in price are the things that have no gov give aways.

Food, housing, energy, health care and college all have gov welfare to citizens and the prices are higher.

Clothing and vehicles have no gov welfare and their prices are lower.

a reply to: Semicollegiate

great now that you've pointed that out well be seeing government issued jeans and underwear. I dread the day I'd need to take out a loan to buy boxers.

great now that you've pointed that out well be seeing government issued jeans and underwear. I dread the day I'd need to take out a loan to buy boxers.

Awesome. Always knew the student loan racket was an evil piece of business. This doubles down on that.

I now have a migraine. Thanks SO.

Edit to say, if one takes out a FASFA loan and it defaults for any reason (an ongoing farce and fraudulent scam on the youth) It then becomes a Federal offense as well. So if you are in a seated position or online courses, beware, be cautious and ontop of when the $ is due you. My Son has a nightmare scenario from just this experience. The FASFA loan came in ONE DAY too late, and the debt is on My son now... I have gone crazy trying to fix this, I could go on and on...

Edit to say, if one takes out a FASFA loan and it defaults for any reason (an ongoing farce and fraudulent scam on the youth) It then becomes a Federal offense as well. So if you are in a seated position or online courses, beware, be cautious and ontop of when the $ is due you. My Son has a nightmare scenario from just this experience. The FASFA loan came in ONE DAY too late, and the debt is on My son now... I have gone crazy trying to fix this, I could go on and on...

edit on am229amThu, 18 Feb 2016 11:43:36 -0600 by antar because: (no reason given)

originally posted by: jhn7537

If you really care to clean house, there's only ONE thing needed... TERM LIMITS in the House and Senate... No reason why anyone should be a career politician. You get in, you serve your two terms, you're out... If you want radical change, that's how you'll do it, and not by Bernie's plan...

Term limits will not fix the issue if you do not address the ones with deep pockets putting these people in.

Money backed Lobbying aka legalized bribery needs to end.

No one is taking away their "$$Freedom of Speech$$" They can grab a picket sign and parade in Washington DC like every other citizen

The defaulter went to court and signed on to a repayment plan. This isn't the end of the world and the government is not planning debtors'

prisons.

edit on 2/18/2016 by pteridine because: (no reason given)

I had 100k in student loans from when I was 17 over culinary arts school of all things. I felt as if I was f***** for quite some time because the

payment was like 800 a month and I didn't even have a job after school. Feeling like I would never get anything in my name or they would snatch funds

from not paying the loans. I woke up one day, checked my credit and saw all loans were paid off by insurance. Apparently there was a law suit against

the school and people in my year were waived of all loans. Thank GOD. Had that not have happened....I'd be in that lower frequency of debt still and

that my friends is hella poop.

I'm not sure if this was mentioned, but I don't see the government going after large companies who "legally" don't pay their fair share of taxes.

Maybe they should go after the real crooks and bring the high cost of tuition into discussion. Not everyone is born with a silver spoon in their

mouth. For some, seeking an education requires extreme sacrifice all held together by threads of uncertainty. This is sickening, especially when

compared to what EVERYONE ELSE gets away. Lets audit the Fed and see where these loans really come from, shall we?

Well, they need SOMEone to replace all the marijuana prisoners, don't they?

a reply to: jhn7537

Since you claim Wall Street will never allow Bernie Sanders to change the regulations, what do you suggest? Keep letting Wall Street and the banking industry rip off the average American?

At least Bernie has a plan of action that is better than any other plan I have seen.

My understanding is the student loan bubble will pop soon. I don't know what to make of the OP, I always thought if one's student loans go into default they have the power to garnish wages and take tax returns.

Many of us, including myself feel like we were conned into taking out student loans because going to college is what we were supposed to do.

I have learned there is much more to life than working as an indentured servant and paying bills every month.

Since you claim Wall Street will never allow Bernie Sanders to change the regulations, what do you suggest? Keep letting Wall Street and the banking industry rip off the average American?

At least Bernie has a plan of action that is better than any other plan I have seen.

My understanding is the student loan bubble will pop soon. I don't know what to make of the OP, I always thought if one's student loans go into default they have the power to garnish wages and take tax returns.

Many of us, including myself feel like we were conned into taking out student loans because going to college is what we were supposed to do.

I have learned there is much more to life than working as an indentured servant and paying bills every month.

edit on 19-2-2016 by jrod because: missing word

edit on 19-2-2016 by jrod because: swypo

took me twelve years to pay off my student loans. my degree never helped me get a job or a raise. its a scam.

a reply to: SkepticOverlord

I just want to call BS on the graph in the OP. The cost of new vehicles has not dropped since the 1970's. The cost has increased, partly because of the addition of stupid safety features that aren't needed (anti-lock brakes, airbags, etc.) and the addition of unnecessary electronics (you shouldn't need a computer to start your car).

Personally I would love to get a new car with no electronics. Should the US ever come under EMP attack pretty much all of the vehicles made today would be useless lumps of plastic and fried circuit board.

You shouldn't need to go into over $10,000 of debt to get a new car. I don't think I will ever own a new car for that very reason - used lunkers are all I will ever be able to afford. I guess this is the new American dream, huh?

The cost of everything has risen. I agree that college and healthcare in particular have risen the most, but everything is more expensive today than they were 40 or 50 years ago.

I just want to call BS on the graph in the OP. The cost of new vehicles has not dropped since the 1970's. The cost has increased, partly because of the addition of stupid safety features that aren't needed (anti-lock brakes, airbags, etc.) and the addition of unnecessary electronics (you shouldn't need a computer to start your car).

Personally I would love to get a new car with no electronics. Should the US ever come under EMP attack pretty much all of the vehicles made today would be useless lumps of plastic and fried circuit board.

You shouldn't need to go into over $10,000 of debt to get a new car. I don't think I will ever own a new car for that very reason - used lunkers are all I will ever be able to afford. I guess this is the new American dream, huh?

The cost of everything has risen. I agree that college and healthcare in particular have risen the most, but everything is more expensive today than they were 40 or 50 years ago.

originally posted by: peskyhumans

a reply to: SkepticOverlord

I just want to call BS on the graph in the OP. The cost of new vehicles has not dropped since the 1970's. The cost has increased, partly because of the addition of stupid safety features that aren't needed (anti-lock brakes, airbags, etc.) and the addition of unnecessary electronics (you shouldn't need a computer to start your car).

Personally I would love to get a new car with no electronics. Should the US ever come under EMP attack pretty much all of the vehicles made today would be useless lumps of plastic and fried circuit board.

You shouldn't need to go into over $10,000 of debt to get a new car. I don't think I will ever own a new car for that very reason - used lunkers are all I will ever be able to afford. I guess this is the new American dream, huh?

The cost of everything has risen. I agree that college and healthcare in particular have risen the most, but everything is more expensive today than they were 40 or 50 years ago.

Strictly comparing average prices you are right, the average new car purchase is higher today. More folks buy SUVs and 4x4s, and dual rear axels than did back in the 1970's. Nothing else on the graph has changed as much as cars have. Maybe they used a conversion factor for that.

Or maybe they used the median prices. In housing the average price can be as much as 50% higher than the median price. The median price is the price of the house in the dead center of the list. The average is the total amount spent on housing by every one in the country (including all of the super mega rich) divided by the number of houses sold. The average house is $333,3333, whereas the median house is $222,222. The average new car price is $33,000. The median price is lower than that, probably something like $25,000 to $28,000, maybe lower.

Anyway, the price of cars went up because of goverment regulations, import duties, and inflation. Gov makes the price of everything go up.

a reply to: SkepticOverlord

This is wrong. Arresting people for not being able to pay their student loans is simply wrong. Instead they should be denied credit until they are able to pay the debt, except in some strenuous situations.

This is wrong. Arresting people for not being able to pay their student loans is simply wrong. Instead they should be denied credit until they are able to pay the debt, except in some strenuous situations.

Story of somebody's life...

I once had a contractor repaint the house...

The guy has a few young folks as helping hand. One of them, while on the ladder, chatted with me for a bit.

Turned out that he is a graduate of UC Berkeley.

True story, debt up the ass, then can't find jobs once they're out.

College was never about taking courses... it's about "Networking" and "Getting Hooked Up" by knowing and mingling with the right people.

There's dozens of BS, BA, MBS, MBA's out there. With recent flux of crap load of Asian immigrants, literally EVERYONE's got some type of Master's Degree. Why should a fortune 1000 company hire you over 2000 applicants that applied? Simple, because you know people and they're willing to "Hook You Up".

I once had a contractor repaint the house...

The guy has a few young folks as helping hand. One of them, while on the ladder, chatted with me for a bit.

Turned out that he is a graduate of UC Berkeley.

True story, debt up the ass, then can't find jobs once they're out.

College was never about taking courses... it's about "Networking" and "Getting Hooked Up" by knowing and mingling with the right people.

There's dozens of BS, BA, MBS, MBA's out there. With recent flux of crap load of Asian immigrants, literally EVERYONE's got some type of Master's Degree. Why should a fortune 1000 company hire you over 2000 applicants that applied? Simple, because you know people and they're willing to "Hook You Up".

Seems like a caste-system is the long term plan. A minority of untouchables separated and forever protected by a gulf in education from the slave

majority too dumb to see beyond their programming.

Many will say that is already the case, but it's a moving landscape manipulated by the powerful forever broadening that gulf to protect and increase their assets.

Many will say that is already the case, but it's a moving landscape manipulated by the powerful forever broadening that gulf to protect and increase their assets.

edit on 20-2-2016 by McGinty because: poor spelling due to the broadening gulf

a reply to: SkepticOverlord

This is a video of Sen. Elisabeth Warren

about the Gov. PROFITS from student loans

m.facebook.com...

This is a video of Sen. Elisabeth Warren

about the Gov. PROFITS from student loans

m.facebook.com...

edit on 21-2-2016 by fshrrex because: (no reason given)

Constitutional Attorney Krisanne Hall's latest video is about this

edit on 21-2-2016 by Semicollegiate because: (no reason given)

As a couple other posters pointed out, the man was

arrested for failure to appear in court — not for his unpaid debt alone.

continuing on....

What’s really causing the student debt crisis...

Also...

IMO from observations over the years, as the nature of American jobs changed and insourcing of workers by corporations/business became popular to fill jobs traditionally done by American labor, Americans were told to "go to college", to make up for these changes in the labor market. A sad fraud.

continuing on....

What’s really causing the student debt crisis...

“You have this dynamic of declining real wages and an increased need for a college degree,” she said. “And so what you end up having is more and more young people applying to college with fewer families able to pay for it.”

.....

Over the past several years, various federal government agencies and state law-enforcement officials have accused many for-profit college companies of using heavy advertising and inflated graduation and job placement statistics to lure students into taking on loans. The increase in the percentage of students borrowing to attend for-profit college -- and two-year community colleges to a lesser extent -- accounts for a large share of the growth in the number of students struggling to pay off their loans or not paying them off at all

Right now, the bad actors in the college space have “misaligned” incentives, Bair said. Their aim is to enroll as many students as possible in order to get the federal loan dollars that come with them, “and if the kids can’t pay it, they don’t care. It’s not their problem, it’s the taxpayers’ problem,” she said.

Also...

The Great Recession, which reduced family income and assets, may have left families with fewer resources available to pay directly for college and may have lead to greater reliance on student loans.

The sharp contraction in the availability of many other forms of credit during and after the financial crisis—from personal loans to second mortgages—made it more difficult to borrow from traditional sources and therefore may have encouraged families to rely more on student loans instead of other means of borrowing.

Student loans may have become relatively more available because of changes in the laws protecting creditors, which may have encouraged lenders to offer loans to a broader set of less creditworthy borrowers.

The increase in enrollment in for-profit colleges, whose students rely more on federal aid and student loans, may have shifted the composition of students toward groups more likely to take out student loans.

Changes in the composition of the student body more generally, such as an increase in enrollment of students from lower- or middle-income households may have increased the proportion of students taking out loans.

IMO from observations over the years, as the nature of American jobs changed and insourcing of workers by corporations/business became popular to fill jobs traditionally done by American labor, Americans were told to "go to college", to make up for these changes in the labor market. A sad fraud.

new topics

-

BIDEN Admin Begins Planning For January 2025 Transition to a New President - Today is 4.26.2024.

2024 Elections: 1 hours ago -

Big Storms

Fragile Earth: 2 hours ago -

Where should Trump hold his next rally

2024 Elections: 5 hours ago -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 6 hours ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 6 hours ago -

Falkville Robot-Man

Aliens and UFOs: 7 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 7 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 8 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 9 hours ago -

Biden "Happy To Debate Trump"

2024 Elections: 9 hours ago

top topics

-

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 7 hours ago, 14 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 8 hours ago, 13 flags -

Blast from the past: ATS Review Podcast, 2006: With All Three Amigos

Member PODcasts: 11 hours ago, 13 flags -

Biden "Happy To Debate Trump"

2024 Elections: 9 hours ago, 12 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 12 hours ago, 8 flags -

What is the white pill?

Philosophy and Metaphysics: 11 hours ago, 6 flags -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 6 hours ago, 6 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 9 hours ago, 5 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 9 hours ago, 5 flags -

Where should Trump hold his next rally

2024 Elections: 5 hours ago, 5 flags

active topics

-

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 43 • : Lumenari -

Where should Trump hold his next rally

2024 Elections • 20 • : WannabeeAuCourant -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs • 9 • : Degradation33 -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 38 • : SchrodingersRat -

Big Storms

Fragile Earth • 11 • : GENERAL EYES -

BIDEN Admin Begins Planning For January 2025 Transition to a New President - Today is 4.26.2024.

2024 Elections • 7 • : WannabeeAuCourant -

Joe Biden and Donald Trump are both traitors

2024 Elections • 65 • : MrMez -

Mood Music Part VI

Music • 3112 • : underpass61 -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents • 12 • : pianopraze -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order • 6 • : Scratchpost