It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

I grew uo hearing the rich did not pay taxes because of loopholes in the tax system, in later years the lobbied in tax cuts so they no longer needed

to count on those loopholes to pat lower taxes. How do those tax cuts effect the average American and our country in general?

If altruism doesn’t prompt you to care about unfair tax rates and economic inequality, then it seems self-interest should.

source

Feed your mind! READ!

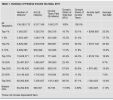

Middle-and low-income Americans are facing far higher state and local tax rates than the wealthy. In all, a comprehensive analysis by the nonpartisan Institute on Taxation and Economic Policy finds that the poorest 20 percent of households pay on average more than twice the effective state and local tax rate (10.9 percent) as the richest 1 percent of taxpayers (5.4 percent).

If altruism doesn’t prompt you to care about unfair tax rates and economic inequality, then it seems self-interest should.

Of course, if you aren’t poor, you may be reading this and thinking that these trends have no real-world impact on your life. But think again: In September, Standard & Poor’s released a study showing that increasing economic inequality hurts economic growth and subsequently reduces public revenue. As important, the report found that the correlation between high inequality and low economic growth was highest in states that relied most heavily on regressive levies such as sales taxes. In other words, regressive state and local tax policies don’t just harm the poor—they end up harming entire economies.

source

Feed your mind! READ!

a reply to: AlaskanDad

well they wont feel so clever when the gears grind to a halt and they get chased out of town by the angry populace

well they wont feel so clever when the gears grind to a halt and they get chased out of town by the angry populace

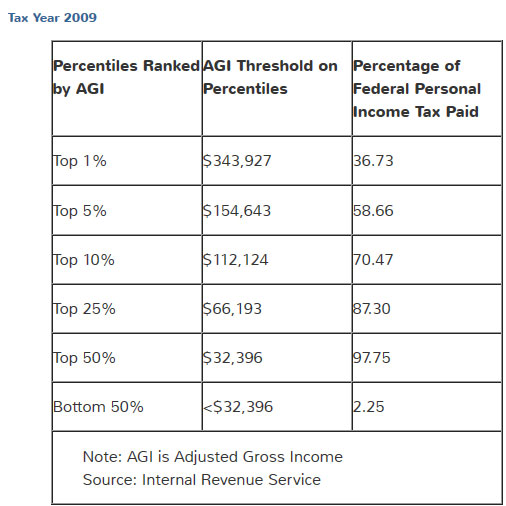

Top 10 Percent of Earners Paid 68 Percent of Federal Income Taxes

Top earners are the main target of tax increases, but the federal income tax system is already highly progressive. The top 10 percent of income earners paid 68 percent of all federal income taxes in 2011 while earning 45 percent of all income. The bottom 50 percent paid 3 percent of income taxes but earned 12 percent of income.

Source.

Source.

In 2009, according to a memo from the Joint Committee on Taxation, a bi-partisan Congressional committee, only 49 percent of Americans owed money on their Federal income tax returns [source: PolitiFact]. So yes, it's true that more than half of all Americans paid no Federal income tax in the tax year 2009, and the number of people who did pay taxes was even lower -- 51 percent, not 53 percent. For tax year 2011, the non-partisan Tax Policy Center estimates that only 54 percent of Americans will pay Federal income tax.

Source.

Source.

From the source in the OP -

In other words, regressive state and local tax policies don’t just harm the poor—they end up harming entire economies. So if altruism doesn’t prompt you to care about unfair tax rates and economic inequality, then it seems self-interest should.

If true, it would appear inequality in state and local taxes is the problem, while none exist in federal taxes since they are already heavily weighted in favor of the poor.

edit on 1/24/2015 by Blaine91555 because: (no reason given)

originally posted by: AlaskanDad

Of course, if you aren’t poor, you may be reading this and thinking that these trends have no real-world impact on your life. But think again: In September, Standard & Poor’s released a study showing that increasing economic inequality hurts economic growth and subsequently reduces public revenue. As important, the report found that the correlation between high inequality and low economic growth was highest in states that relied most heavily on regressive levies such as sales taxes. In other words, regressive state and local tax policies don’t just harm the poor—they end up harming entire economies.

It took Standard and Poor this long to figure out that if the government and corporations reduce consumers buying power through higher taxes, there will be fewer consumers, consuming, which will result in fewer people gainfully employed and even fewer consumers, consuming, which will result in less taxes collected by the stupids in government, which will result in total economic collapse. These people are retards and actually, they are so stupid, they are an insult to retards.

Cheers - Dave

I am going to just weigh in with the other point of view and I will use extremes to make the point.

Joe sits on his backside doing nothing because it is easier to just take Govt. handouts. He pays zero taxes.

Bill works, his wife works and they pay (say) $10,000 in tax.

Peter grew a successful business. He has to pay $50,000 in tax.

Now, we can all agree that Joe is an a-hole.

The question is, why should Peter have to pay so much more tax? Why not just have everyone provide their fair share.

Peter uses the same resources as bill and his wife.

If you have saved money, why do you have to pay tax on the interest? You already paid tax when you earned it. You are penalized because you want to save it.

The real problem with the taxation system is that companies have so many ways to avoid tax that the average people do not. On the one hand, they have the same rights as citizens except of course when taxation is due.

The biggest shark here are the multinational companies that get Govt grants that they do not need and then manage to pay almost no taxes.

If my father worked hard all his life, was successful and left me 1 million, why should I pay taxes on it. Taxes were paid when he earned it.

The whole taxation regime is out of control. There are so many indirect taxes all based on the user pays crap where once upon a time, all of these came from ordinary tax.

The first place to start is to stop Govt waste because they waste a great deal of your money.

I have always disliked the fact that the more you earn, the more you pay.

Why is that? How is it fair?

A great deal of your taxation goes to dropping bombs on people. Not nice when you think about it.

P

Joe sits on his backside doing nothing because it is easier to just take Govt. handouts. He pays zero taxes.

Bill works, his wife works and they pay (say) $10,000 in tax.

Peter grew a successful business. He has to pay $50,000 in tax.

Now, we can all agree that Joe is an a-hole.

The question is, why should Peter have to pay so much more tax? Why not just have everyone provide their fair share.

Peter uses the same resources as bill and his wife.

If you have saved money, why do you have to pay tax on the interest? You already paid tax when you earned it. You are penalized because you want to save it.

The real problem with the taxation system is that companies have so many ways to avoid tax that the average people do not. On the one hand, they have the same rights as citizens except of course when taxation is due.

The biggest shark here are the multinational companies that get Govt grants that they do not need and then manage to pay almost no taxes.

If my father worked hard all his life, was successful and left me 1 million, why should I pay taxes on it. Taxes were paid when he earned it.

The whole taxation regime is out of control. There are so many indirect taxes all based on the user pays crap where once upon a time, all of these came from ordinary tax.

The first place to start is to stop Govt waste because they waste a great deal of your money.

I have always disliked the fact that the more you earn, the more you pay.

Why is that? How is it fair?

A great deal of your taxation goes to dropping bombs on people. Not nice when you think about it.

P

a reply to: pheonix358

No he doesn't he uses more. He needs more electricity and water to run his business. Not to mention the resources that are used making the products he sells.

Peter uses the same resources as bill and his wife.

No he doesn't he uses more. He needs more electricity and water to run his business. Not to mention the resources that are used making the products he sells.

a reply to: pheonix358

you missed andy...he runs a multi billion dollar company and uses loop holes to avoid tax....not only does he have offshore accounts to do this he ships the labor overseas further hurting the economy

you missed andy...he runs a multi billion dollar company and uses loop holes to avoid tax....not only does he have offshore accounts to do this he ships the labor overseas further hurting the economy

a reply to: buster2010

And he pays for them when he pays his higher utility bills. What's your point?

P

No he doesn't he uses more. He needs more electricity and water to run his business. Not to mention the resources that are used making the products he sells.

And he pays for them when he pays his higher utility bills. What's your point?

P

a reply to: hopenotfeariswhatweneed

No I did not!

P

you missed andy...he runs a multi billion dollar company and uses loop holes to avoid tax....not only does he have offshore accounts to do this he ships the labor overseas further hurting the economy

No I did not!

The real problem with the taxation system is that companies have so many ways to avoid tax that the average people do not. On the one hand, they have the same rights as citizens except of course when taxation is due.

The biggest shark here are the multinational companies that get Govt grants that they do not need and then manage to pay almost no taxes.

P

edit on 24/1/2015 by pheonix358 because: (no reason given)

Oops

edit on 24/1/2015 by pheonix358 because: (no reason given)

originally posted by: Blaine91555

Top 10 Percent of Earners Paid 68 Percent of Federal Income Taxes

Top earners are the main target of tax increases, but the federal income tax system is already highly progressive. The top 10 percent of income earners paid 68 percent of all federal income taxes in 2011 while earning 45 percent of all income. The bottom 50 percent paid 3 percent of income taxes but earned 12 percent of income.

Source.

Source.

In 2009, according to a memo from the Joint Committee on Taxation, a bi-partisan Congressional committee, only 49 percent of Americans owed money on their Federal income tax returns [source: PolitiFact]. So yes, it's true that more than half of all Americans paid no Federal income tax in the tax year 2009, and the number of people who did pay taxes was even lower -- 51 percent, not 53 percent. For tax year 2011, the non-partisan Tax Policy Center estimates that only 54 percent of Americans will pay Federal income tax.

Source.

Source.

From the source in the OP -

In other words, regressive state and local tax policies don’t just harm the poor—they end up harming entire economies. So if altruism doesn’t prompt you to care about unfair tax rates and economic inequality, then it seems self-interest should.

If true, it would appear inequality in state and local taxes is the problem, while none exist in federal taxes since they are already heavily weighted in favor of the poor.

Those of us who are productive can never pay enough for some of these people. Think about it, the top 10% pay 70% of the taxes. If that isn't paying your fair share, someone please tell me WTF is fair? In fact, the bottom earners are actually getting a negative tax rate meaning they get money back from the government even though they didn't pay anything.

I don't have a problem with taxes, but government is inherently inefficient. Government is trying to do too many things. Between the inefficiency, graft, and just outright wastefulness, they aren't effectively spending the money they do get in taxes. So much of the money is pissed away it isn't funny. This what really gets under the skin of the tax payer.

Every time we turn around, you have someone calling for more taxes yet you never see any real cuts in spending or attempts to truly cut out the waste.

originally posted by: buster2010

a reply to: pheonix358

Peter uses the same resources as bill and his wife.

No he doesn't he uses more. He needs more electricity and water to run his business. Not to mention the resources that are used making the products he sells.

Is that really the best you could come up with? Seriously?

What if the business is a consulting business? He just talks on his phone all day and makes $1 million a year? What extra resources is he using? Electrons?

originally posted by: Jamie1

originally posted by: buster2010

a reply to: pheonix358

Peter uses the same resources as bill and his wife.

No he doesn't he uses more. He needs more electricity and water to run his business. Not to mention the resources that are used making the products he sells.

Is that really the best you could come up with? Seriously?

What if the business is a consulting business? He just talks on his phone all day and makes $1 million a year? What extra resources is he using? Electrons?

If he even thought about the premise, he'd know it makes no sense in terms of resources. Think about how much local and state governments spend on police. Who do you think is filling up the jails? It isn't rich folks. It isn't rich folks filling up the ER rooms at big city hospitals either. Nor is it rich people whose kids are being counseled and taken by DCFS. We can go on and on regarding how much money is spent by cities and states on services who primary beneficiaries are the poor.

a reply to: Edumakated

While I do agree with you, it is possible that in some states, state and local taxes are skewed.

One that has always bothered me is property taxes. The working poor live in rentals and it's obvious that landlords add it to the rent, so those who can least afford it are the ones actually paying it.

Landlords are not wrong at all to do that, but I've never heard a local politician address it beyond the owner pays it, which is false on it's face.

I and the OP are lucky enough live in a state without income tax or here where I live zero sales taxes. What we do have though are artificially inflated land values based on nothing to make up for no sales tax. I'd rather see property taxes replaced by sales taxes on the property. As it is the local government has little choice but to push property prices up to increase revenue, which harms the working poor and is self-defeating since it also hurts the landowner.

While I do agree with you, it is possible that in some states, state and local taxes are skewed.

One that has always bothered me is property taxes. The working poor live in rentals and it's obvious that landlords add it to the rent, so those who can least afford it are the ones actually paying it.

Landlords are not wrong at all to do that, but I've never heard a local politician address it beyond the owner pays it, which is false on it's face.

I and the OP are lucky enough live in a state without income tax or here where I live zero sales taxes. What we do have though are artificially inflated land values based on nothing to make up for no sales tax. I'd rather see property taxes replaced by sales taxes on the property. As it is the local government has little choice but to push property prices up to increase revenue, which harms the working poor and is self-defeating since it also hurts the landowner.

originally posted by: buster2010

a reply to: pheonix358

Peter uses the same resources as bill and his wife.

No he doesn't he uses more. He needs more electricity and water to run his business. Not to mention the resources that are used making the products he sells.

He pays for those services. You don't think businesses pay utility bills? Phone bills? Property tax bills? Waste disposal bills? Last time I checked, those bills increase with the size of the business. Some corporations spend millions on utility bills alone. The direct resources used to make the product are part of the final cost of production.

a reply to: pheonix358

Then there is Paul He is a struggling half starved CEO working for Actvis and has a loophole:

source

Meet Mitt:

source

Then there is Paul He is a struggling half starved CEO working for Actvis and has a loophole:

Ten years ago, Congress passed a law intended to penalize chief executive officers whose companies shift their legal addresses to tax havens. It hasn’t worked out as planned. Companies have found ways around the law that create new rewards for executives. When Actavis Inc. (ACT) changed its incorporation to Ireland in October, the New Jersey-based drugmaker helped CEO Paul Bisaro avoid the law’s bite by handing him more than $40 million of stock as much as three years ahead of its schedule, then promising him an additional $5 million to remain with the company.

source

Meet Mitt:

As part of his presidential campaign, the former Massachusetts governor released two years of income tax returns. They showed that in 2010, he paid 13.9 percent of his reported income in federal taxes and in 2011, 15.3 percent. Those rates were a bit less than the national average.

source

originally posted by: Edumakated

originally posted by: Jamie1

originally posted by: buster2010

a reply to: pheonix358

Peter uses the same resources as bill and his wife.

No he doesn't he uses more. He needs more electricity and water to run his business. Not to mention the resources that are used making the products he sells.

Is that really the best you could come up with? Seriously?

What if the business is a consulting business? He just talks on his phone all day and makes $1 million a year? What extra resources is he using? Electrons?

If he even thought about the premise, he'd know it makes no sense in terms of resources. Think about how much local and state governments spend on police. Who do you think is filling up the jails? It isn't rich folks. It isn't rich folks filling up the ER rooms at big city hospitals either. Nor is it rich people whose kids are being counseled and taken by DCFS. We can go on and on regarding how much money is spent by cities and states on services who primary beneficiaries are the poor.

Great points!

And let's extrapolate some more....

The business owner may be paying employees. Those employees pay taxes, and both the employer and the employees pay Social Security taxes.

The employees have to eat and live somewhere, right? They pay sales taxes and property taxes.

Do the math. Poor people who pay little in taxes get a hugely disproportionate amount of services and resources they never contributed to.

The myth that the "rich" somehow take advantage of the system by using more resources is idiotic.

originally posted by: Edumakated

originally posted by: buster2010

a reply to: pheonix358

Peter uses the same resources as bill and his wife.

No he doesn't he uses more. He needs more electricity and water to run his business. Not to mention the resources that are used making the products he sells.

He pays for those services. You don't think businesses pay utility bills? Phone bills? Property tax bills? Waste disposal bills? Last time I checked, those bills increase with the size of the business. Some corporations spend millions on utility bills alone. The direct resources used to make the product are part of the final cost of production.

I spent nearly 10k last year on accountant and lawyer fees. The taxes I pay just make me want to cry.

That 10k was a tax deduction though,,,, it helped,,,,,a little

a reply to: Blaine91555

In the case of rentals, property taxes are a pass through to the renter. Of course, this is the problem with the whole notion of even taxing corporations. It gets passed on to the consumer in the form of higher prices. Why some of these money grabbing leftist can't understand this is beyond me. Like you said, you see this most clearly with rental properties.

Property taxes are tricky in that they do serve a purpose. I live in a fairly high property tax community. We have excellent schools and other services, so I really don't mind as I can see where the money is going and believe I am getting good value for the money. What sucks is when you live in an area with high property taxes and the schools still suck so you then have to pay for private school too!

The reality though is that no tax system is going to be totally fair. There is always somebody somewhere who is going to feel like they are getting screwed. The best tax systems though imho are those that are simplest. I want a flat tax that everyone pays regardless of income. EVERYONE needs to have some skin in the game so they care about what the politicians are doing with the money, no matter how poor or how rich.

In the case of rentals, property taxes are a pass through to the renter. Of course, this is the problem with the whole notion of even taxing corporations. It gets passed on to the consumer in the form of higher prices. Why some of these money grabbing leftist can't understand this is beyond me. Like you said, you see this most clearly with rental properties.

Property taxes are tricky in that they do serve a purpose. I live in a fairly high property tax community. We have excellent schools and other services, so I really don't mind as I can see where the money is going and believe I am getting good value for the money. What sucks is when you live in an area with high property taxes and the schools still suck so you then have to pay for private school too!

The reality though is that no tax system is going to be totally fair. There is always somebody somewhere who is going to feel like they are getting screwed. The best tax systems though imho are those that are simplest. I want a flat tax that everyone pays regardless of income. EVERYONE needs to have some skin in the game so they care about what the politicians are doing with the money, no matter how poor or how rich.

new topics

-

The Great Reckoning

Rant: 4 hours ago -

The Inconvenient Bellwether County Dilemma

Education and Media: 4 hours ago -

Elite Universities Are Coddling Students Grieving Over Trump's Victory

Mainstream News: 4 hours ago -

Witnesses who will testify in next week's hearing on UAPs

Aliens and UFOs: 4 hours ago -

Qatar kicks out HAMAS

Middle East Issues: 5 hours ago -

leftwing wymen shaving their head in protest

US Political Madness: 7 hours ago -

Racist Text Messages Mass Distributed

Social Issues and Civil Unrest: 7 hours ago -

No, the election results aren't reminiscent of 1930s Germany. But this is.

US Political Madness: 8 hours ago -

Agree or Disagree

2024 Elections: 10 hours ago -

Leaving the US due to severe TDS?

US Political Madness: 11 hours ago

top topics

-

The Inconvenient Bellwether County Dilemma

Education and Media: 4 hours ago, 26 flags -

Leaving the US due to severe TDS?

US Political Madness: 11 hours ago, 14 flags -

The Great Reckoning

Rant: 4 hours ago, 14 flags -

No, the election results aren't reminiscent of 1930s Germany. But this is.

US Political Madness: 8 hours ago, 14 flags -

Qatar kicks out HAMAS

Middle East Issues: 5 hours ago, 12 flags -

leftwing wymen shaving their head in protest

US Political Madness: 7 hours ago, 10 flags -

Elite Universities Are Coddling Students Grieving Over Trump's Victory

Mainstream News: 4 hours ago, 10 flags -

Agree or Disagree

2024 Elections: 10 hours ago, 7 flags -

Witnesses who will testify in next week's hearing on UAPs

Aliens and UFOs: 4 hours ago, 6 flags -

Racist Text Messages Mass Distributed

Social Issues and Civil Unrest: 7 hours ago, 4 flags

active topics

-

President-Elect DONALD TRUMP's 2nd-Term Administration Takes Shape.

Political Ideology • 56 • : MetalThunder -

Racist Text Messages Mass Distributed

Social Issues and Civil Unrest • 16 • : xuenchen -

The Great Reckoning

Rant • 14 • : lilzazz -

Where ARE the 20 million votes??? Where ARE they????? WHERE???

US Political Madness • 47 • : xuenchen -

The Inconvenient Bellwether County Dilemma

Education and Media • 6 • : putnam6 -

leftwing wymen shaving their head in protest

US Political Madness • 61 • : gort69 -

Liberal women going on sex strike over Trump win

US Political Madness • 62 • : matafuchs -

Qatar kicks out HAMAS

Middle East Issues • 9 • : marg6043 -

Witnesses who will testify in next week's hearing on UAPs

Aliens and UFOs • 3 • : JJproductions -

No links No news source Just a message WE MADE IT TRUMP WON!!

Breaking Alternative News • 79 • : Xtrozero