It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

reply to post by Hellas

We the US Government is the largest holder of bitcoins thanks to seizures of the digital currency.

I think it has already been planned and will likely be a digital currency that the elites of the world control. We have been seeing in movies for some time now. If implemented TPTB would have total control to see everything most everyone spends their money on. They really can't track cash or private credit cards and bank statements with out a warrant. It is the next logical step to recover from a major world wide collapse.

We the US Government is the largest holder of bitcoins thanks to seizures of the digital currency.

I think it has already been planned and will likely be a digital currency that the elites of the world control. We have been seeing in movies for some time now. If implemented TPTB would have total control to see everything most everyone spends their money on. They really can't track cash or private credit cards and bank statements with out a warrant. It is the next logical step to recover from a major world wide collapse.

reply to post by Hellas

Well, you know they will only let it fall so far.

If the markets open Monday on a downtrend, and the trend continues and worsens, and the inevitable seems to be happening, Obamber will come to the rescue and hit the emergency STOP button and close the markets.

Then, we may see a Greek style bank account raiding take place. That would be my biggest fears if I had any substantial savings.

Didn't some bank just put max limits on monthly cash withdrawals at 50k a month?

Didn't that story just come out that all the richy rich have all their funds stashed in offshore accounts? Not hiding it, but PROTECTING it.

They know what is about to happen.

Didn't they nice it up by calling it "haircuts"?

Lol. Robbery is a "haircut".

Yeah.

Oh, P.S.

It may be the time we all bend over and kiss our 401k's goodbye, too. You know it's coming. The government says they have to take our money because they know how to handle it better than we do, but they will resort to stealing our money, because we seem to be the only ones that really know how to save it.

How ironic is that?

P.S.S. I miss the puke smiley

Well, you know they will only let it fall so far.

If the markets open Monday on a downtrend, and the trend continues and worsens, and the inevitable seems to be happening, Obamber will come to the rescue and hit the emergency STOP button and close the markets.

Then, we may see a Greek style bank account raiding take place. That would be my biggest fears if I had any substantial savings.

Didn't some bank just put max limits on monthly cash withdrawals at 50k a month?

Didn't that story just come out that all the richy rich have all their funds stashed in offshore accounts? Not hiding it, but PROTECTING it.

They know what is about to happen.

Didn't they nice it up by calling it "haircuts"?

Lol. Robbery is a "haircut".

Yeah.

Oh, P.S.

It may be the time we all bend over and kiss our 401k's goodbye, too. You know it's coming. The government says they have to take our money because they know how to handle it better than we do, but they will resort to stealing our money, because we seem to be the only ones that really know how to save it.

How ironic is that?

P.S.S. I miss the puke smiley

edit on 24-1-2014 by Libertygal because: (no reason given)

It wouldn't be the first time I lost money in the stock market. I bet we have lost close to what we have made on it. It seems that the Dow goes up

but the stocks we have never does. Especially the pension funds..

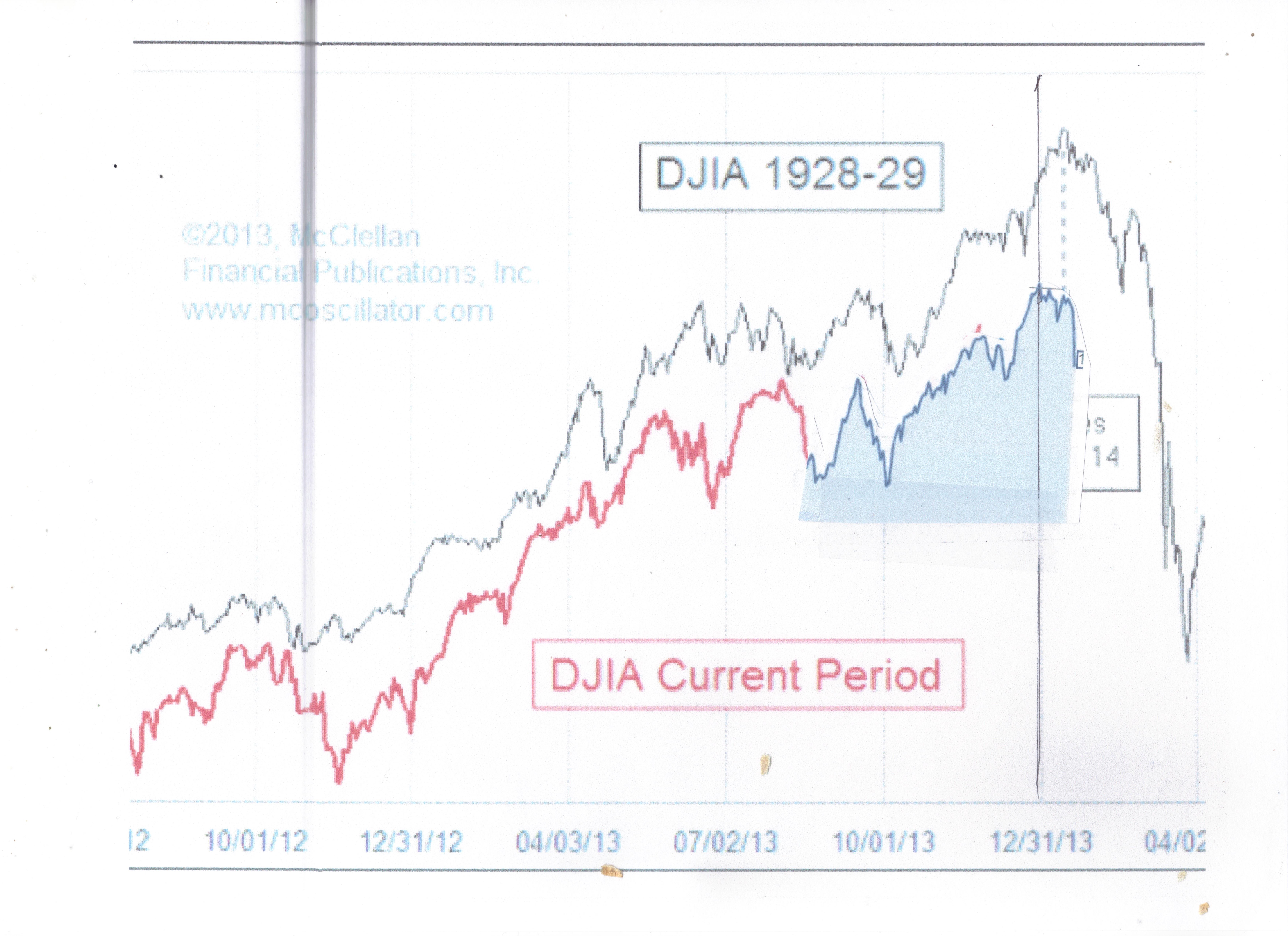

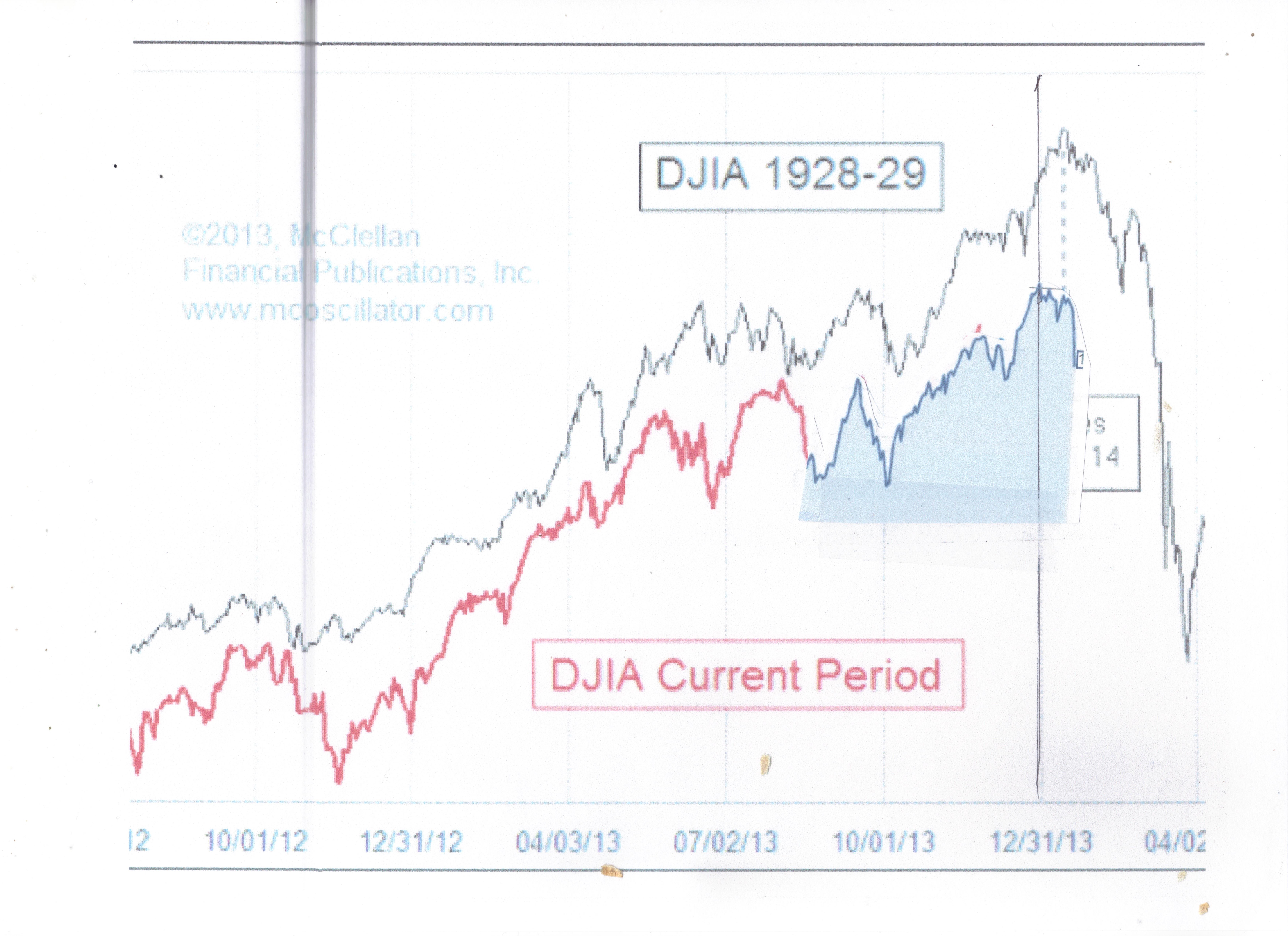

I have been following a previous post back in December about the McClellan Financial publications comparing 1928-29 Stock market crash and the chart

that was provided shows 1928-1929 market and compares it to current market, from the looks of the graph that was provided the market has not reach the

bottom point yet, many say that there will be a 10% correction, well we are 1/3 of the way there. They say History repeats itself so I guess I will

keep watching and wait to make my move when the market hits bottom. Take a look its interesting. I will try to update the chart but as it goes

windows seven and a old scanner don't work that great together.

rickymouse

It wouldn't be the first time I lost money in the stock market. I bet we have lost close to what we have made on it. It seems that the Dow goes up but the stocks we have never does. Especially the pension funds..

Ya know, I noticed this too. It's always "other" stocks that gain, but the everyday people alwys lose. Now, how funny is that. Not haha funny, but odd funny.

I guess thats one of the perks of being on inside trading, eh?

reply to post by 19KTankCommander

I too, saw that article. I found it rather revealing.

I really expected to see it posted here, and if it was, I missed it.

But, I would imagine it would have been labeled 'doom porn', anyways, because those who believe a correction is due or overdue, know it's GOT to happen, and the rest are just blind to it, and think the 'recovery' is real.

Smoke and mirrors. The smoke will blow away, and the mirrors will soon crack.

Maybe not this week, but it will, soon enough. The money will run dry.

I too, saw that article. I found it rather revealing.

I really expected to see it posted here, and if it was, I missed it.

But, I would imagine it would have been labeled 'doom porn', anyways, because those who believe a correction is due or overdue, know it's GOT to happen, and the rest are just blind to it, and think the 'recovery' is real.

Smoke and mirrors. The smoke will blow away, and the mirrors will soon crack.

Maybe not this week, but it will, soon enough. The money will run dry.

I knew someone was going to create a thread on this. Here we go....

Look people, for future reference, it is NOT the point drop you should freak out about, but how high

the percentage of that point drop is. So a -1.96% drop on the Dow is not even a blip on the radar.

The size of the index is too large for a 300 point move to have any real effect. It looks impressive

but its nothing. On Black Monday of 1987, the Dow dropped by 508 points to 1738.74 (22.61%). That was

scary because the Dow was only around 2200 points, whereas the current Dow is over 15,879.

Huge difference.

So a 22.61% drop on the Dow of today's 15,879 would be 3590 points.

Again huge difference.

Please do your fear mongering then when you see a drop over say 2000 points.

Look people, for future reference, it is NOT the point drop you should freak out about, but how high

the percentage of that point drop is. So a -1.96% drop on the Dow is not even a blip on the radar.

The size of the index is too large for a 300 point move to have any real effect. It looks impressive

but its nothing. On Black Monday of 1987, the Dow dropped by 508 points to 1738.74 (22.61%). That was

scary because the Dow was only around 2200 points, whereas the current Dow is over 15,879.

Huge difference.

So a 22.61% drop on the Dow of today's 15,879 would be 3590 points.

Again huge difference.

Please do your fear mongering then when you see a drop over say 2000 points.

reply to post by Hellas

Not really big news in my opinion! You have to put things in perspective. Equities have rallied quite significantly for the better part of 8yrs. Corrections are expected, it's the markets way of taking a breather. You have to understand that market movements don't go in a straight line. Just pull up a 5 or 10yr chart of the Dow Jones and you'll see that corrections of this magnitude and greater happen all the time before resuming the trend again. Great investors know how to play both sides of the market. Long/short positions.

If anyone can tell me why a 300pt drop at this point is significant, I'm all ears.

Not really big news in my opinion! You have to put things in perspective. Equities have rallied quite significantly for the better part of 8yrs. Corrections are expected, it's the markets way of taking a breather. You have to understand that market movements don't go in a straight line. Just pull up a 5 or 10yr chart of the Dow Jones and you'll see that corrections of this magnitude and greater happen all the time before resuming the trend again. Great investors know how to play both sides of the market. Long/short positions.

If anyone can tell me why a 300pt drop at this point is significant, I'm all ears.

Well, over the last week (5 days) the market went -580 points. (3.52%). Not a big deal.

How ever, what happens next week will be the real fun stuff, and going forward.

If the drop continues for the next week or two, it could be rather.... amusing.. and I use that term rather.. sarcastically.

If you like down and dirty market info, I like ZeroHedge. It's doom porn for the market and global politics, and other news that doesn't always make it to the MSM.

How ever, what happens next week will be the real fun stuff, and going forward.

If the drop continues for the next week or two, it could be rather.... amusing.. and I use that term rather.. sarcastically.

If you like down and dirty market info, I like ZeroHedge. It's doom porn for the market and global politics, and other news that doesn't always make it to the MSM.

This drop is only very significant to someone who bought a leveraged stock at the top and held it during the last two days. I suspect my older

brother did this. I can tell him I was expecting a drop but he never seems to pay much attention unless he hears I'm expecting the market to rally

and I put everything in it. I think he hears blah, blah, blah, market rally, could drop though, blah, blah, could go up, maybe down, blah, blah,

blah.

Looking back over the past two years you can literally draw lines going up. Sp500 is up over 20% last year and up over 50% going back not too far. Fed bond buying coincides with it all. Remove the easy money and we left the top but we are still about 10 feet from the summit. It's like people are shouting, wow, look at the big drop.

Looking back over the past two years you can literally draw lines going up. Sp500 is up over 20% last year and up over 50% going back not too far. Fed bond buying coincides with it all. Remove the easy money and we left the top but we are still about 10 feet from the summit. It's like people are shouting, wow, look at the big drop.

WOW my wife still writes checks. I'm pretty sure she is going to go through some form of withdrawals. S&F Peace

SWCCFAN

reply to post by Hellas

We the US Government is the largest holder of bitcoins thanks to seizures of the digital currency.

I think it has already been planned and will likely be a digital currency that the elites of the world control. We have been seeing in movies for some time now. If implemented TPTB would have total control to see everything most everyone spends their money on. They really can't track cash or private credit cards and bank statements with out a warrant. It is the next logical step to recover from a major world wide collapse.

edit on 25-1-2014 by Tarzan the apeman. because: Had to be done.

muse7

I've been hearing the doomsayers predict the dreaded "stock market collapse" since I joined.

and you will regret ignoring them.

One day, the most valuable thing you can get your hands on will be food and water. Now I'm not saying you need to prep for the end of the world, but if you don't have a suitable stash water and non-perishables then you are going to find life very difficult.

Looks like a normal market correction to me. Now if it had dropped 3,000 points instead of 300 ... we'd be talking about a meltdown or a major

correction or something. But 300 ?? Just a normal 'bad day' on the market. IMHO

reply to post by Libertygal

I finally got that scanner to work, sorry about the quality of pic running low on ink as well, so here is the updated chart, I guess one has to think history will be repeating itself, since we had almost a 500 point loss in two days.

Anyone want to look for themselves go to McCellan.com and Dow charts, put the same start date listed on chart and you can match them up. Its to eerie to see them and make one think. I will continue to watch this.

I finally got that scanner to work, sorry about the quality of pic running low on ink as well, so here is the updated chart, I guess one has to think history will be repeating itself, since we had almost a 500 point loss in two days.

Anyone want to look for themselves go to McCellan.com and Dow charts, put the same start date listed on chart and you can match them up. Its to eerie to see them and make one think. I will continue to watch this.

Looks like they are planning to reset up to 4 counties money issues this weekend

CNBC Currency Reset over this weekend

Not sure which currency will be affected but most likely Argentina.

We will see if Lindsey Williams is really telling the truth now

Start at the 24 minute mark

CNBC Currency Reset over this weekend

Not sure which currency will be affected but most likely Argentina.

We will see if Lindsey Williams is really telling the truth now

Start at the 24 minute mark

edit on 25/1/14 by sirric because: (no reason given)

I heard a panel on MSNBC that wealthy Chinese quit the markek, left China. Something about the emerging markets not doing good and money getting real

tight for loans.

Markets could be further whipped up ahead of the Fed

CNBC

What are you up to Ben?

Markets could continue to be whipsawed in the week ahead, as investors await the Fed's statement and watch the emerging markets selloff to see if a more dire story is brewing.

The Fed issues its post-meeting statement Wednesday afternoon and is widely expected to announce a second phase of tapering, with another $10 billion cut to its once $85 billion bond-buying program. The meeting is also the last to be chaired by Fed Chairman Ben Bernanke, who leaves Friday. Fed Vice Chair Janet Yellen will take over the role.

CNBC

What are you up to Ben?

edit on 25-1-2014 by Hellas because: (no reason given)

19KTankCommander

reply to post by Libertygal

I finally got that scanner to work, sorry about the quality of pic running low on ink as well, so here is the updated chart, I guess one has to think history will be repeating itself, since we had almost a 500 point loss in two days.

Anyone want to look for themselves go to McCellan.com and Dow charts, put the same start date listed on chart and you can match them up. Its to eerie to see them and make one think. I will continue to watch this.

Awesome observation. It's remarkable how these psychological patterns repeat over time... and ironic how frustrating it is that we appear doomed to repeat the same pattern of economic mistakes, yet it is at the same time a relief to have time-tested records available for preparation. When the stock market crashed in 1929, it paved the way for governments, gangsters and racketeers to wage wars on every level (leading to WW2). Provided that history does repeat itself in this juncture, perhaps WW3 is closer than we think?

This is worth keeping an eye on...

edit on 25-1-2014 by HeyAHuman because: (no reason given)

new topics

-

Big Storms

Fragile Earth: 49 minutes ago -

Where should Trump hold his next rally

2024 Elections: 3 hours ago -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 4 hours ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 5 hours ago -

Falkville Robot-Man

Aliens and UFOs: 5 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 5 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 6 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 7 hours ago -

Biden "Happy To Debate Trump"

2024 Elections: 7 hours ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 7 hours ago

top topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 17 hours ago, 21 flags -

Blast from the past: ATS Review Podcast, 2006: With All Three Amigos

Member PODcasts: 10 hours ago, 13 flags -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 5 hours ago, 12 flags -

Biden "Happy To Debate Trump"

2024 Elections: 7 hours ago, 12 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 6 hours ago, 12 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 10 hours ago, 8 flags -

What is the white pill?

Philosophy and Metaphysics: 9 hours ago, 6 flags -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 4 hours ago, 5 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 7 hours ago, 5 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 7 hours ago, 5 flags

active topics

-

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 34 • : cherokeetroy -

Ireland VS Globalists

Social Issues and Civil Unrest • 7 • : boatguy12 -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 292 • : TheWoker -

I am beholden to my truth, of which I share with you now.

Dreams & Predictions • 24 • : BrotherKinsMan -

Big Storms

Fragile Earth • 6 • : lilzazz -

Starburst galaxy M82 - Webb Vs Hubble

Space Exploration • 11 • : Arbitrageur -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 817 • : RazorV66 -

Post A Funny (T&C Friendly) Pic Part IV: The LOL awakens!

General Chit Chat • 7137 • : PorkChop96 -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 21 • : ToneD -

Biden "Happy To Debate Trump"

2024 Elections • 49 • : TheMisguidedAngel