It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

This particular 'incident' is according to the Treasury Inspector General for Tax Administration, and it happened in 2011.

There are more of the same too.

Apparently all the I.D. "numbers" used were those neat Individual Taxpayer Identification Numbers, and not S.S. Numbers.

IRS Sent $46,378,040 in Refunds to 23,994 ‘Unauthorized’ Aliens at 1 Atlanta Address

Incompetence Inc.

"What a country" eh?

The IRS had plenty of time and people to stall and classify tax exemptions, but they didn't seem to smell the coffee on these deals

I bet "they" knew and had Orrdazz to keep looking the other way.

There are more of the same too.

Apparently all the I.D. "numbers" used were those neat Individual Taxpayer Identification Numbers, and not S.S. Numbers.

The Internal Revenue Service sent 23,994 tax refunds worth a combined $46,378,040 to “unauthorized” alien workers who all used the same address in Atlanta, Ga., in 2011, according to the Treasury Inspector General for Tax Administration (TIGTA).

That was not the only Atlanta address theoretically occupied by thousands of “unauthorized” alien workers receiving millions in federal tax refunds in 2011. In fact, according to a TIGTA audit report published last year, four of the top ten addresses to which the IRS sent thousands of tax refunds to “unauthorized” aliens were in Atlanta.

The IRS sent 11,284 refunds worth a combined $2,164,976 to unauthorized alien workers at a second Atlanta address; 3,608 worth $2,691,448 to a third; and 2,386 worth $1,232,943 to a fourth.

IRS Sent $46,378,040 in Refunds to 23,994 ‘Unauthorized’ Aliens at 1 Atlanta Address

Incompetence Inc.

"What a country" eh?

The IRS had plenty of time and people to stall and classify tax exemptions, but they didn't seem to smell the coffee on these deals

I bet "they" knew and had Orrdazz to keep looking the other way.

If corporations can do it in Bermuda and South Dakota, why can't individuals do it in Georgia?

Where's the news in this?

Where's the news in this?

Yeah alright enough of that BS abolish the income tax and get rid of the IRS all together.

Second agrees with the first.

Second agrees with the first.

Originally posted by links234

If corporations can do it in Bermuda and South Dakota, why can't individuals do it in Georgia?

Where's the news in this?

What?

did you read the report?

This is the part I didn't like.

As if they really don't care if the application is obviously a fraud.

And this is just stupid.

Ok so 1/3 of the town live at this one address. SURE what are they morons.

The inspector general’s 2012 audit report on the IRS’s handling of ITINs was spurred by two IRS employees who went to member of Congress "alleging that IRS management was requiring employees to assign Individual Taxpayer Identification Numbers (ITIN) even when the applications were fraudulent.”

In an August 2012 press release accompanying the audit report, TIGTA said the report “validated” the complaints of the IRS employees.

“TIGTA’s audit found that IRS management has not established adequate internal controls to detect and prevent the assignment of an ITIN to individuals submitting questionable applications,” said Treasury Inspector General for Tax Administration J. Russell George. “Even more troubling, TIGTA found an environment which discourages employees from detecting fraudulent applications.”

As if they really don't care if the application is obviously a fraud.

And this is just stupid.

Perhaps the most remarkable act of the IRS was this: It assigned 6,411 ITINs to unauthorized aliens presumably using a single address in Morganton, North Carolina. According to the 2010 Census, there were only 16,681 people in Morganton. So, for the IRS to have been correct in issuing 6,411 ITINS to unauthorized aliens at a single address Morganton it would have meant that 38 percent of the town’s total population were unauthorized alien workers using a single address.

Ok so 1/3 of the town live at this one address. SURE what are they morons.

edit on 6/21/2013 by Tankgirl because: (no reason given)

In Processing Year 2011, the IRS processed more than 2.9 million ITIN tax returns resulting in tax refunds of $6.8 billion.

I was unable to find any complete totals of fraud in the report, but the above quote should indicate the possible scope of the problem.

So there were 2.9 million "entities" who could not qualify for a SSN but still felt the need to file a tax return in 2012?

How many didn't feel the need? Quite the mind twister!

As to the IRS and tax exemptions, I wish they would delay or refuse every one of them. There should be no exemptions for anyone, or there should be exemptions for everyone in my opinion. Fair is fair.

reply to post by xuenchen

I did. Well...no, I read the article you linked to. I didn't read the IG report.

So you're saying that over twenty thousand individuals used the same address to get ~$2,000 each. How is that any differenty than the Ugland house in the Cayman's with 18,000 'entities' for tax purposes? How is that any different than the 285,000+ business' in the single story 1209 North Orange Street Wilmington, Delaware building?

Offshore accounts lose the US $150 billion annually.

Why is it that conservatives are more worried about one person taking $2,000 (even if they have a right to it), but are fine with one company hiding $20,000? Explain that to me.

If you consider this newsworthy I'm sure you'll be fascinated at the pothole down the street from my house.

I did. Well...no, I read the article you linked to. I didn't read the IG report.

So you're saying that over twenty thousand individuals used the same address to get ~$2,000 each. How is that any differenty than the Ugland house in the Cayman's with 18,000 'entities' for tax purposes? How is that any different than the 285,000+ business' in the single story 1209 North Orange Street Wilmington, Delaware building?

Offshore accounts lose the US $150 billion annually.

Why is it that conservatives are more worried about one person taking $2,000 (even if they have a right to it), but are fine with one company hiding $20,000? Explain that to me.

If you consider this newsworthy I'm sure you'll be fascinated at the pothole down the street from my house.

reply to post by links234

While I agree with your sentiments to a point, the inspection found that there were 23,560 tax REFUNDS- not just returns filed- sent to only 10 bank accounts. This is not just individuals claiming refunds, this is organized pre-meditated fraud on the part of a relatively few criminals.

While I agree with your sentiments to a point, the inspection found that there were 23,560 tax REFUNDS- not just returns filed- sent to only 10 bank accounts. This is not just individuals claiming refunds, this is organized pre-meditated fraud on the part of a relatively few criminals.

Who benefits from illegal immigration, besides the criminal immigrants and criminal corporations?

America has been sold out, by our criminal U.S. federal, state, and local governments.

"The Fiscal Burden of Illegal Immigration on U.S. Taxpayers"

source : www.fairus.org...

F.T.G.

America has been sold out, by our criminal U.S. federal, state, and local governments.

"The Fiscal Burden of Illegal Immigration on U.S. Taxpayers"

source : www.fairus.org...

F.T.G.

reply to post by seasoul

I think that illegal immigrants should be immediately deported the first time they are caught and permanently marked for easy identification if they are caught in this country illegally a second time. A tattoo or a brand in the middle of the forehead would do the trick.

But illegal immigrants are not the people committing this fraud. This is systematic fraud being committed against the IRS by criminals (who may or may not be legally in this country).

I think that illegal immigrants should be immediately deported the first time they are caught and permanently marked for easy identification if they are caught in this country illegally a second time. A tattoo or a brand in the middle of the forehead would do the trick.

But illegal immigrants are not the people committing this fraud. This is systematic fraud being committed against the IRS by criminals (who may or may not be legally in this country).

Originally posted by neo96

Yeah alright enough of that BS abolish the income tax and get rid of the IRS all together.

Second agrees with the first.

I am all for that!

I read this and said no freekin way..............

And then they have the time to "target" certain groups?

They are trying to kill the rest of us early with this BS. The veins in my neck hurt after reading this...

The level of incompetence that it takes to be an employee for the IRS gets more staggering by the day. Usually less incompetence is preferred. Different strokes I guess. I keep waiting for Peter Funt to come out and shake my hand.

The level of incompetence that it takes to be an employee for the IRS gets more staggering by the day. Usually less incompetence is preferred. Different strokes I guess. I keep waiting for Peter Funt to come out and shake my hand.

reply to post by neo96

I said it before, Obama is going to grant Illegals, Pardons as his one last gift to this Country.

46 million....Jeez.

That's a lot of Money for under the Table votes, hey?

I said it before, Obama is going to grant Illegals, Pardons as his one last gift to this Country.

46 million....Jeez.

That's a lot of Money for under the Table votes, hey?

reply to post by neo96

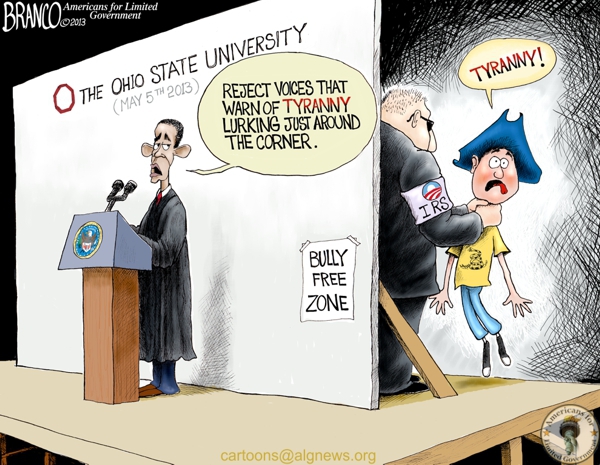

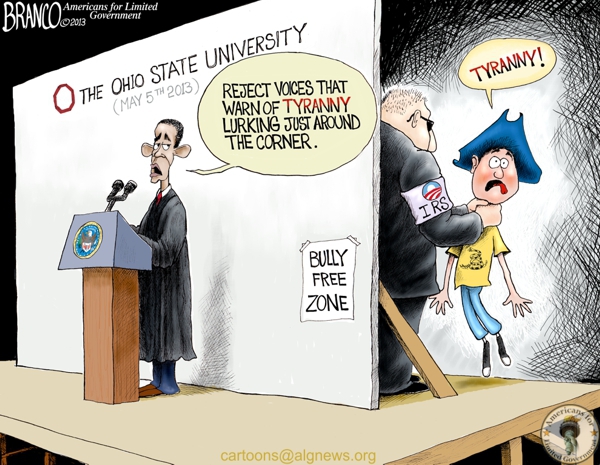

We both know this Country is doomed with Obama at the helm. He has the IRS doing his dirty work.

We both know this Country is doomed with Obama at the helm. He has the IRS doing his dirty work.

reply to post by sonnny1

Just a little truth for you, cause you obviously missed it, this is why those TEA Party organizations were under such scrutiny from the IRS...

Exemption requirements: 501(c)(3) organizations

(underline added just in case you missed it)

Anyway, back to the topic at hand.

If this is true, (not saying it is, cause the "news" site this is from is highly dubious), IF it's true, there needs to be some serious investigation going on.

Just a little truth for you, cause you obviously missed it, this is why those TEA Party organizations were under such scrutiny from the IRS...

Exemption requirements: 501(c)(3) organizations

To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual. In addition, it may not be an action organization, i.e., it may not attempt to influence legislation as a substantial part of its activities and it may not participate in any campaign activity for or against political candidates.

Exemption requirements: 501(c)(3) organizations

(underline added just in case you missed it)

Anyway, back to the topic at hand.

If this is true, (not saying it is, cause the "news" site this is from is highly dubious), IF it's true, there needs to be some serious investigation going on.

edit on 22-6-2013 by HauntWok because: (no reason given)

reply to post by Wildmanimal

Let's start that house cleaning right here. ALL political corruption in the US starts and ends with Democrats and Republicans.

Let's start that house cleaning right here. ALL political corruption in the US starts and ends with Democrats and Republicans.

new topics

-

Where should Trump hold his next rally

2024 Elections: 2 hours ago -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 2 hours ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 3 hours ago -

Falkville Robot-Man

Aliens and UFOs: 3 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 4 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 5 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 5 hours ago -

Biden "Happy To Debate Trump"

2024 Elections: 6 hours ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 6 hours ago -

What is the white pill?

Philosophy and Metaphysics: 7 hours ago

top topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 16 hours ago, 21 flags -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 4 hours ago, 12 flags -

Blast from the past: ATS Review Podcast, 2006: With All Three Amigos

Member PODcasts: 8 hours ago, 12 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 5 hours ago, 10 flags -

Biden "Happy To Debate Trump"

2024 Elections: 6 hours ago, 10 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 8 hours ago, 8 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 5 hours ago, 5 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 6 hours ago, 5 flags -

What is the white pill?

Philosophy and Metaphysics: 7 hours ago, 5 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 11 hours ago, 4 flags

active topics

-

Where should Trump hold his next rally

2024 Elections • 9 • : visitedbythem -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 35 • : Threadbarer -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 813 • : WeMustCare -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 309 • : cherokeetroy -

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections • 58 • : WeMustCare -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion • 8 • : WhitewaterSquirrel -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 28 • : cherokeetroy -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness • 5 • : AwakeNotWoke -

The Acronym Game .. Pt.3

General Chit Chat • 7756 • : bally001 -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs • 8 • : Skinnerbot