It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Peter Schiff one of the few who predicted the 2008 crash and many events leading up to it and since. Lays out why QE3 seals the fate of the dollar

and the economy and calls it operation screw. He has been scary accurate when it comes to the economy and right to many times to dismiss this.

He says fed just checked into the roach motel you can check in but you can't check out. The fed wants to create a new super housing bubble this is it folks this this is the final run up to the end game of crashing the dollar and the economy.

I can't disagree with him its really a no brainier and to me they are doing this on purpose they know the outcome this will make the 2008 crash look like a pic nic...

Watch to the video and tell me if you think he is wrong and why?

I hope you are all prepared...

He says fed just checked into the roach motel you can check in but you can't check out. The fed wants to create a new super housing bubble this is it folks this this is the final run up to the end game of crashing the dollar and the economy.

I can't disagree with him its really a no brainier and to me they are doing this on purpose they know the outcome this will make the 2008 crash look like a pic nic...

Watch to the video and tell me if you think he is wrong and why?

I hope you are all prepared...

www.youtube.com...

The geniuses at the Federal Reserve have concocted a bold new plan to revive the U.S. economy -- print a bunch of money, loan it to Americans at super low interest rates so they can speculate on rising real estate prices, extract the appreciated equity and spend it on consumer goods. In other words, build an economy of real estate, by real estate, and for real estate. The only problem is we've been there and done that. The last time it almost destroyed the U.S.economy. I guess almost isn't quite good enough for the Fed, so now it's determined to finish the job.

edit on 14-9-2012 by hawkiye because: (no reason given)

Good points made by OP. I will look at the vid later.

The good old phrase of " Quantative Easing" is being thrown around.

This is the politicans and bankers way of saying "your going to get ass whipped again!!!

The good old phrase of " Quantative Easing" is being thrown around.

This is the politicans and bankers way of saying "your going to get ass whipped again!!!

Well, as one would expect, both gold and silver are flying.

As of this post, the dollar is down across the board, gold at 1772, silver 34.61.

There are a couple of things that may slow the dollar's crash. As they step up the rhetoric against the Middle East, investors tend to pile into the dollar. If Europe has another major shake up, that will also help the dollar.

I'm surprised theyre doing this before the election. Prices of everything are going to go up and this will hurt the incumbent.

I suppose it doesnt really matter, whether its Obama or Romney, the Elites still win.

As of this post, the dollar is down across the board, gold at 1772, silver 34.61.

There are a couple of things that may slow the dollar's crash. As they step up the rhetoric against the Middle East, investors tend to pile into the dollar. If Europe has another major shake up, that will also help the dollar.

I'm surprised theyre doing this before the election. Prices of everything are going to go up and this will hurt the incumbent.

I suppose it doesnt really matter, whether its Obama or Romney, the Elites still win.

edit on 14-9-2012 by gladtobehere because: (no reason given)

Thanks for posting, this is what i was trying to say in a earlier thread about QE3.

Getting ready for the next land grab, at the expense of the people.

link source

The policy, known as quantitative easing and often abbreviated as QE3, entails buying $40 billion in mortgage-backed securities each month. The end date remains up in the air, as the Fed will re-evaluate the strength of the economy in coming months. The Fed is wasting no time. The purchases begin Friday and are expected to add up to only $23 billion for the remainder of September.

Getting ready for the next land grab, at the expense of the people.

Originally posted by DIRTYDONKEY

I may be wrong so please correct me if so, but i think you guys are missing something here. The 40 billion is for mortgage securities.LINK

The Fed 's pledge Thursday to buy $40 billion of mortgage securities a month until the economy improves comes a week after the European Central Bank announced its most ambitious plan yet to ease Europe's financial crisis by buying unlimited amounts of government bonds to help countries manage their debts..

So am i wrong in assuming that they are just preparing for the next market crash? If they are investing in property (as collateral on mortgage loans) Wouldn't this be the first step in the next land grab?LINK

A mortgage-backed security (MBS) is an asset-backed security that represents a claim on the cash flows from mortgage loans through a process known as securitization.

So they devalue our currency buy making more, to buy mortgage securities, that will surly fail as our dollar continues to weaken. Hmmm sound kinda familiar. 2008ish.

Again I may be confused on the whole thing but that is what jumped out to me right away. What will be worth the most value if our currency is destroyed? Don't worry tho they will still need us to upkeep the property for them, maybe they will supply room and board for our labor. That too sounds familiar.

Keep it dirty

edit on 14-9-2012 by DIRTYDONKEY because: (no reason given)

Well for those in the know it might be a chance to unload those upside down mortgages while the getting is good. But be careful there is no telling

when it will go over the edge. We will see a temporary rise in housing prices and all the lemmings will rush to buy pushing it up further.

That will be singing in the streets ding dong the recession/depression is dead and then BLAM!

That will be singing in the streets ding dong the recession/depression is dead and then BLAM!

How is it that there are so few comments/responses to this thread and video?

Is it the general community's lack of understanding? Lack of concern?

Both are equally damning. News of the QE3 is huge and should have our attention. The Fed's plan is ridiculous and impossible at the same time. And the response in the commodity markets reflect this.

S&F OP

Is it the general community's lack of understanding? Lack of concern?

Both are equally damning. News of the QE3 is huge and should have our attention. The Fed's plan is ridiculous and impossible at the same time. And the response in the commodity markets reflect this.

S&F OP

I'm an Englishman but I'm well aware of Schiff, he's a hero and he really knows his onions.

It used to wind me up no end to see that moron Mike Norman (and Larry Laugher, and the long haired IDIOT who looked like a wrestler who'd indulged in far too many steroids) laughing at him and telling him he was talking nonsense, it was obvious to anyone with a brain that he was bang on the money.

I ended up putting all of our money into gold and made a good chunk of money, but unfortunately had to sell it all to get a mortgage to buy a house.

Buying a house was the last thing I wanted to do, but sometimes family and personal reasons have to out weigh economic sense.

Anyway, I believe that Peter Schiff is bang on the money again and people who can would be wise to listen to what he has to say, think about it, and do their own research, then act accordingly.

It used to wind me up no end to see that moron Mike Norman (and Larry Laugher, and the long haired IDIOT who looked like a wrestler who'd indulged in far too many steroids) laughing at him and telling him he was talking nonsense, it was obvious to anyone with a brain that he was bang on the money.

I ended up putting all of our money into gold and made a good chunk of money, but unfortunately had to sell it all to get a mortgage to buy a house.

Buying a house was the last thing I wanted to do, but sometimes family and personal reasons have to out weigh economic sense.

Anyway, I believe that Peter Schiff is bang on the money again and people who can would be wise to listen to what he has to say, think about it, and do their own research, then act accordingly.

That was a long video to get across his points.

1. Peter does not like Bernanke

2. Peter has no alternate suggestions, other than allowing interest rates to rise.

3. Peter would appreciate it if you buy his book, that apparently tells you to buy gold and exit the dollar.

Fascinating stuff.

1. Peter does not like Bernanke

2. Peter has no alternate suggestions, other than allowing interest rates to rise.

3. Peter would appreciate it if you buy his book, that apparently tells you to buy gold and exit the dollar.

Fascinating stuff.

The only real solid final solution to the financial woes of the world is for people to stop buying anything except the most essential items. Learn to

cook. Learn to sew. Use the time you would normally spend in front of the tv for doing those things. Utilize the minutes of your day for valuable

things instead of the crap that's called "the good life". Don't buy another soda. Don't buy cigarettes. Don't buy new anything. Buy

everything used. Get rid of your tv. Don't subscribe to magazines or newspapers at all. Get rid of anything extraneous. Downgrade your vehicle.

It won't take long for several things to happen as a result of all of this: You will realize that you don't need all that crap, that it was littering and clogging up your life. You will see how eating home-cooked, pure foods (be sure to use only whole foods, whole dairy products, and make sure they're fresh from the farm) will make your health infinitely better so you will no longer need medications nor their pushers. Start drinking spring water. If you must smoke, find plants in nature that are free and clean. You'll be amazed how far your money will go. You will want for nothing.

The American Dream has become the American Nightmare. Wake up.

It won't take long for several things to happen as a result of all of this: You will realize that you don't need all that crap, that it was littering and clogging up your life. You will see how eating home-cooked, pure foods (be sure to use only whole foods, whole dairy products, and make sure they're fresh from the farm) will make your health infinitely better so you will no longer need medications nor their pushers. Start drinking spring water. If you must smoke, find plants in nature that are free and clean. You'll be amazed how far your money will go. You will want for nothing.

The American Dream has become the American Nightmare. Wake up.

reply to post by CosmicEgg

Once you stop believing the dream, the whole thing falls apart.

Your advice is good for people with no expendable income.

Once you stop believing the dream, the whole thing falls apart.

Your advice is good for people with no expendable income.

reply to post by Zarniwoop

Listen to what Schiff says there. No one has expendable income anymore. You're just kidding yourself and so is he when he gives the advice to invest offshore. It's the same the world over, my friend. All the banks are so tightly intertwined that when one ship sinks, the entire armada is going down. It's all over.

You don't have to live my suggestion eternally. Just do it long enough to make the Fed sweat. Live well below your means. It's obviously what they're working hard to prevent.

Listen to what Schiff says there. No one has expendable income anymore. You're just kidding yourself and so is he when he gives the advice to invest offshore. It's the same the world over, my friend. All the banks are so tightly intertwined that when one ship sinks, the entire armada is going down. It's all over.

You don't have to live my suggestion eternally. Just do it long enough to make the Fed sweat. Live well below your means. It's obviously what they're working hard to prevent.

They are still beating that dead horse, the debt based monetary system.

That's the real problem.

But of course if you get rid of that system, how the heck are their pals in the banking industry going to get rich?

Anything I read about the fed and the banking system in general my thoughts are "this BS is all made up!" Big fancy words to make things sound 'important' and complicated so as to appear to the layman that this whole thing 'Mus-be ran by sum perty smart fellers'

It's all made up, a whole self serving system by privately run greed mongers whereas they sell printed money, assign it value and charge us interest on it until we are bled dry while the rich folks wipe their hinies with $5.00 dollar bills.

A swindle perpetrated that your own constitution forbids, yet somehow that's OK, and guess what, they ruined your economy and they take your land.

A quote: In red added by me.

from here

So, why do I go into a store and walk out with nothing? The cost of things! Like I'm paying $2.00 for a 591ml bottle of pop, why are the reese's BP cups so tiny now, and more expensive. Why do I pay so much more for everything while my ability to pay does not go up and if it does it does not keep up with inflation?

Thomas Jefferson was right.

How did we let this happen?

That's the real problem.

But of course if you get rid of that system, how the heck are their pals in the banking industry going to get rich?

Anything I read about the fed and the banking system in general my thoughts are "this BS is all made up!" Big fancy words to make things sound 'important' and complicated so as to appear to the layman that this whole thing 'Mus-be ran by sum perty smart fellers'

It's all made up, a whole self serving system by privately run greed mongers whereas they sell printed money, assign it value and charge us interest on it until we are bled dry while the rich folks wipe their hinies with $5.00 dollar bills.

A swindle perpetrated that your own constitution forbids, yet somehow that's OK, and guess what, they ruined your economy and they take your land.

A quote: In red added by me.

If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks…will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered…. Good thing that's not happening! Eh? The issuing power should be taken from the banks and restored to the people, to whom it properly belongs. – Thomas Jefferson in the debate over the Re-charter of the Bank Bill (1809) “I believe that banking institutions are more dangerous to our liberties than standing armies.” – Thomas Jefferson … The modern theory of the perpetuation of debt has drenched the earth with blood, and crushed its inhabitants under burdens ever accumulating. -Thomas Jefferson

If congress has the right under the Constitution to issue paper money, it was given them to use themselves, not to be delegated to individuals or corporations. -Andrew Jackson

from here

So, why do I go into a store and walk out with nothing? The cost of things! Like I'm paying $2.00 for a 591ml bottle of pop, why are the reese's BP cups so tiny now, and more expensive. Why do I pay so much more for everything while my ability to pay does not go up and if it does it does not keep up with inflation?

Thomas Jefferson was right.

How did we let this happen?

I think people are tired of hearing about how screwed we are, we have been told this too long so now people just don't heed any of it much attention.

"Can't it just crash already and be over with?".. Well it's not like the US or the EU will ever get out of this crisis without something drastic

like seizing crooked privately owned banks or writing off debt.

A crash will probably be for the better in the long run, tough times ahead though. Let's just hope that it won't hurt the people too much while eradicating the current US and EU monstrosities, their crook politicians and bankers and the oppressive policies all in one fell swoop.

A crash will probably be for the better in the long run, tough times ahead though. Let's just hope that it won't hurt the people too much while eradicating the current US and EU monstrosities, their crook politicians and bankers and the oppressive policies all in one fell swoop.

Originally posted by anno141

I think people are tired of hearing about how screwed we are, we have been told this too long so now people just don't heed any of it much attention. "Can't it just crash already and be over with?".. Well it's not like the US or the EU will ever get out of this crisis without something drastic like seizing crooked privately owned banks or writing off debt.

A crash will probably be for the better in the long run, tough times ahead though. Let's just hope that it won't hurt the people too much while eradicating the current US and EU monstrosities, their crook politicians and bankers and the oppressive policies all in one fell swoop.

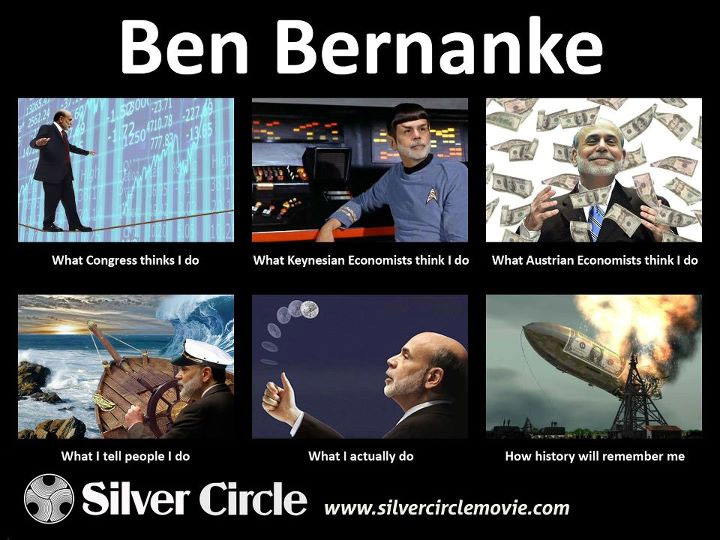

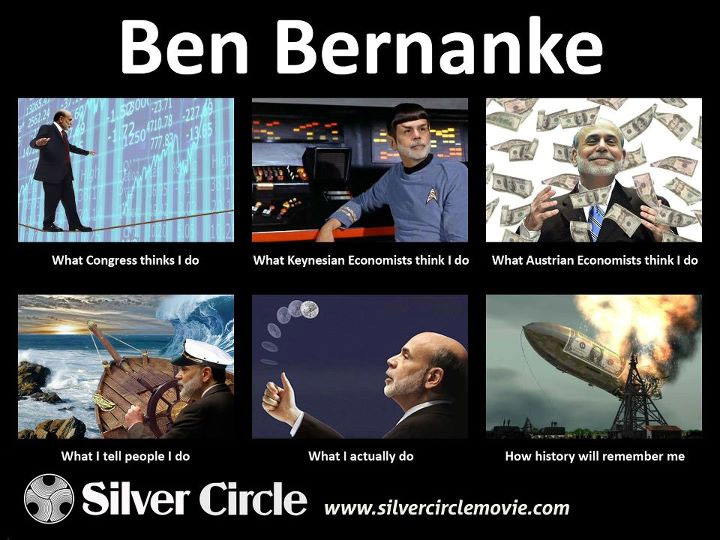

The thing about that picture is, Bernanke is only a front man. He is the PR guy or the fall guy chosen by the Federal Reserve's private ownership. The families that own the Fed need to be thrown in prison, if not publicly lynched. We know who they are, the Rothschild's, Rockefeller's, Morgan's, etc.

Things that drive confidence and economic recovery:

People.

People.

People.

Hmmm.

This thread is more fear mongering from a guy who wants to capitalise on the situation.

Can't blame him really everyone is trying to earn a buck these days.

People.

People.

People.

Hmmm.

This thread is more fear mongering from a guy who wants to capitalise on the situation.

Can't blame him really everyone is trying to earn a buck these days.

Originally posted by Zarniwoop

That was a long video to get across his points.

1. Peter does not like Bernanke

2. Peter has no alternate suggestions, other than allowing interest rates to rise.

3. Peter would appreciate it if you buy his book, that apparently tells you to buy gold and exit the dollar.

Fascinating stuff.

Um you forgot one thing. Peter has been right on the money with his economic forecasts!... Geeze people do some research or put a sock in it...

edit on 17-9-2012 by hawkiye because: (no reason given)

Originally posted by magma

Things that drive confidence and economic recovery:

People.

People.

People.

Hmmm.

This thread is more fear mongering from a guy who wants to capitalise on the situation.

Can't blame him really everyone is trying to earn a buck these days.

Ah no this is one of the few guys who has been dead on accurate in predicting the economy. The idiots in the MSM that claim to be economist and financial gurus are the ones selling BS. Do your research before opening your mouth and inserting foot...

reply to post by hawkiye

Peter, and many thousands of others with common sense, I suppose.

The dude is just trying to sell a book.

Place your sock where it fits.

Um you forgot one thing. Peter has been right on the money with his economic forecasts!... Geeze people do some research or put a sock in it...

Peter, and many thousands of others with common sense, I suppose.

The dude is just trying to sell a book.

Place your sock where it fits.

new topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 25 minutes ago -

America's Greatest Ally

General Chit Chat: 1 hours ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 6 hours ago -

Maestro Benedetto

Literature: 7 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 7 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 6 hours ago, 27 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 17 hours ago, 9 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 12 hours ago, 8 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 17 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 15 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 14 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 11 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 14 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 12 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 7 hours ago, 3 flags

active topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 1 • : 727Sky -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 15 • : tarantulabite1 -

America's Greatest Ally

General Chit Chat • 1 • : BingoMcGoof -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 35 • : annonentity -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 49 • : Freeborn -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 30 • : Asher47 -

Electrical tricks for saving money

Education and Media • 8 • : anned1 -

Is AI Better Than the Hollywood Elite?

Movies • 16 • : 5thHead -

Hate makes for strange bedfellows

US Political Madness • 48 • : Terpene -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 17 • : BingoMcGoof