It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by Americanist

Substitute corporations for representatives. Crystal clear.

So not even want to discuss the topic? Crystal clear as always with you.

reply to post by Americanist

I'm sure there's a whole industry of tax lawyers and accountants who establish charitable foundations which in reality are tax shelters for mega-corporations. Not saying Romney did anything like this, but it's a possibility.

I'm sure there's a whole industry of tax lawyers and accountants who establish charitable foundations which in reality are tax shelters for mega-corporations. Not saying Romney did anything like this, but it's a possibility.

There are and have been some other types of "IRA's" that allow high amounts.

Historical Tax Qualified Plan Limits

Highly Compensated Employee - Section 414(q)(1)(B)

Key Employee - Section

The "contribution" amounts have been high for a long time.

SEP is one.

Historical Tax Qualified Plan Limits

Highly Compensated Employee - Section 414(q)(1)(B)

Key Employee - Section

The "contribution" amounts have been high for a long time.

SEP is one.

Originally posted by ownbestenemy

Originally posted by Americanist

Substitute corporations for representatives. Crystal clear.

So not even want to discuss the topic? Crystal clear as always with you.

Somehow you confused institutions with representatives. Purposely or not... Doesn't matter. The topic unravels all on its own.

Originally posted by Americanist

Originally posted by ownbestenemy

Originally posted by Americanist

Substitute corporations for representatives. Crystal clear.

So not even want to discuss the topic? Crystal clear as always with you.

Somehow you confused institutions with representatives. Purposely or not... Doesn't matter. The topic unravels all on its own.

While the manipulation of the electoral college is possible, it is far easier to buy off and get a representative. You can do far more damage, especially if that representative is a Senator. You then have 50% of a State's power in Federal rule making at your whim.

But I do see where you are going with it now. You just weren't as crystal clear as you think.

reply to post by xuenchen

Those aren't IRAs.

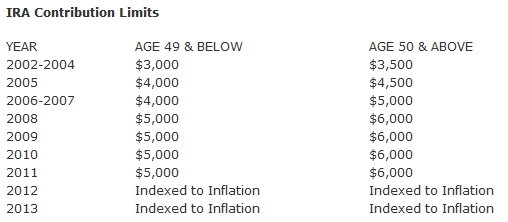

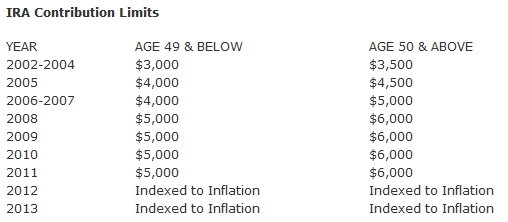

Here are the IRA max contribution levels;

Retirement Topics - IRA Contribution Limits

(irs.gov)

For past years;

There's no such thing as "higher contribution limits" for wealthier people.

Those aren't IRAs.

Here are the IRA max contribution levels;

Retirement Topics - IRA Contribution Limits

(irs.gov)

For 2011 and 2012, the maximum you can contribute to all of your traditional and Roth IRAs is the smaller of:

- $5,000 ($6,000 if you’re age 50 or older), or

- your taxable compensation for the year.

For past years;

There's no such thing as "higher contribution limits" for wealthier people.

reply to post by Blackmarketeer

But a rollover from one of those plans into an IRA isn't illegal or unheard of and many astute investors do it. It also shouldn't count against your contribution limits but still researching that fact.

This is also why I think this story, coming from our Representatives is nothing but blowing smoke and political pandering. Borderline campaigning if you want my opinion.

But a rollover from one of those plans into an IRA isn't illegal or unheard of and many astute investors do it. It also shouldn't count against your contribution limits but still researching that fact.

This is also why I think this story, coming from our Representatives is nothing but blowing smoke and political pandering. Borderline campaigning if you want my opinion.

edit on 5-8-2012 by ownbestenemy because: (no reason given)

reply to post by Blackmarketeer

They allow rollovers from SEP's to IRA's.

IRA Rollover Chart Rules

I think multiple SEP's are allowed as well.

SEP contributions by "employers" have varied in maximums from maybe $30,000 to $50,000 per year.

(it's like a profit sharing plan, but not exactly the same)

Might explain the growth and "profit".

They allow rollovers from SEP's to IRA's.

IRA Rollover Chart Rules

I think multiple SEP's are allowed as well.

SEP contributions by "employers" have varied in maximums from maybe $30,000 to $50,000 per year.

(it's like a profit sharing plan, but not exactly the same)

Might explain the growth and "profit".

Can I roll my SEP IRA into a Traditional IRA or should I convert to a Roth?

Technically, the SEP IRA and the Traditional IRA are the same type of account. The only difference is that the SEP IRA is allowed to receive employer contributions. Therefore, you can combine the SEP IRA into the Traditional IRA without any ramifications. When doing so, move the assets as a (nonreportable) trustee-to-trustee transfer.

Whether a conversion is good for you depends of your financial profile. In general, if you can afford to pay the taxes that would be due on the conversion and your tax bracket during retirement will be higher than your tax bracket now, then it makes sense to convert your assets to the Roth IRA. That may sound very general, but only someone familiar with your finances could make a specific recommendation.

At a minimum, you can combine the SEP and Traditional IRA to reduce any administrative and trade related fees that may be charged to the account.

Can I roll my SEP IRA into a Traditional IRA or should I convert to a Roth?

It also may be possible to place "after tax" money into IRA's so they can grow "tax deferred" ?

The point is congress wants to know how Romney did this, and not just mere speculation.

The amount in his IRA is extreme and un reachable for regular citizens. Were laws broken? if not what loopholes were used.

Romney releasing his taxes will be the end of him, and soon he might not have a choice.

The amount in his IRA is extreme and un reachable for regular citizens. Were laws broken? if not what loopholes were used.

Romney releasing his taxes will be the end of him, and soon he might not have a choice.

Originally posted by LDragonFire

The point is congress wants to know how Romney did this, and not just mere speculation.

The amount in his IRA is extreme and un reachable for regular citizens. Were laws broken? if not what loopholes were used.

Romney releasing his taxes will be the end of him, and soon he might not have a choice.

Since companies that "contribute" to people's SEP IRA's fill out IRS reports, I would think Congress can simply request those records and compare the investments to performance.

A general figure should be easily arrived at by accountants.

Unless this is all considered "private".

Are they asking Romney himself for an explanation ?

Congress may not have full authority ?

reply to post by RealSpoke

Romney's gone on record claiming to only be worth 100 million, but his IRA alone is worth that much. So it doesn't take a genius to see he is worth a lot more than that. As the announcer in the video says, his interest payments on his investments indicate he is more likely to be a billionaire, but knows how sensitive people will be about his extreme wealth when the rest of the country is sliding into poverty.

Another reason Romney won't release his taxes came from his claim back when he ran for governor of Massachusetts in 2002 that he was a resident of MA. - when in fact he was still listing his residency as Utah. MA.'s state constitution requires a person be a resident of that state for 7 years before being eligible to run for office. Romney refused to release his returns then because he would have been ineligible to run for governor.

Yet in that 2002 election he demanded his opponent Shannon O'Brien's husband release his return. O'Brien had released several years of her return, but that wasn't good enough, Romney demanded the return from her husband too. Go figure.

Republicans demand Obama release his grades from college, for whatever bizarre reason (do we have to know what grade someone got in Chemistry 101?), yet the Republicans refuse to look at their own candidate.

Romney's gone on record claiming to only be worth 100 million, but his IRA alone is worth that much. So it doesn't take a genius to see he is worth a lot more than that. As the announcer in the video says, his interest payments on his investments indicate he is more likely to be a billionaire, but knows how sensitive people will be about his extreme wealth when the rest of the country is sliding into poverty.

Another reason Romney won't release his taxes came from his claim back when he ran for governor of Massachusetts in 2002 that he was a resident of MA. - when in fact he was still listing his residency as Utah. MA.'s state constitution requires a person be a resident of that state for 7 years before being eligible to run for office. Romney refused to release his returns then because he would have been ineligible to run for governor.

In the 2002 gubernatorial campaign, it was alleged that Romney had gamed his taxes to qualify to run for governor. The Massachusetts Democratic Party said that Romney had lied about filing jointly as a resident of Massachusetts and Utah, a charge that the Romney campaign denied and denied and denied until the very last minute when they were forced to admit that yes, the charge had merit and that Romney had filed retroactively.

Yet in that 2002 election he demanded his opponent Shannon O'Brien's husband release his return. O'Brien had released several years of her return, but that wasn't good enough, Romney demanded the return from her husband too. Go figure.

Republicans demand Obama release his grades from college, for whatever bizarre reason (do we have to know what grade someone got in Chemistry 101?), yet the Republicans refuse to look at their own candidate.

I'm calling on Treasury Secretary Timothy Geitner to investigate Romney's tax returns....yes doesn't matter that Geitner himself cheated on his tax

returns and still found a way into Obama's administration.

Romney earned his money, Obama cheated and deceived many people to earn his millions.

1. Allowed his literary biography to say he was born in Kenya to sell books.

2. Put out 2 supposedly "non-fiction" books that Obama didn't write and now claims many parts of these book were not true.

Romney earned his money, Obama cheated and deceived many people to earn his millions.

1. Allowed his literary biography to say he was born in Kenya to sell books.

2. Put out 2 supposedly "non-fiction" books that Obama didn't write and now claims many parts of these book were not true.

Originally posted by Blackmarketeer

Republicans demand Obama release his grades from college, for whatever bizarre reason (do we have to know what grade someone got in Chemistry 101?), yet the Republicans refuse to look at their own candidate.

College transcripts would include his application, and on his application it would include his place of birth.

No wonder Obama has these transcripts sealed.

Has nothing to do with grades at all.

Originally posted by charles1952

OK, I may be simple-minded, but does anyone believe that this administration's IRS isn't poring over every comma on Romney's returns?

Since the Fed ownes both the IRS and Both candidates I think the IRS is letting Romneys tax returns (or lack thereof) be swept under the rug.

Repubs think congress should only investige people's sex lives.

That repubs oppose Romney providing his tax records demonstrates how morally bankrupt they are.

Crooks like Romney destroyed our economy, only a fool would support Romney in this election.

That repubs oppose Romney providing his tax records demonstrates how morally bankrupt they are.

Crooks like Romney destroyed our economy, only a fool would support Romney in this election.

I really just wish Romney would release his tax records in great detail. No, I don't think he is REQUIRED to do so, but I just WANT him to do

so. He could easily turn this whole argument against Democrats by simply showing the truth. The truth could vindicate him of any false rumors and

even give him a good argument by saying that Democrats were just flat out wrong.

Yet he doesn't anyway.

I think he is mistaken if he think these kind of issues will just go away and that people don't care about them.

They do.

He is 100% correct when he says there is no evil in being rich. But people will look down upon your character if they feel you cheated and abused the system in order to amass that wealth while they get #ed over by not having the vast resources and external tax firms to game the system in the same way.

What man doesn't want to vindicate himself and tell the truth?

Yet he doesn't anyway.

I think he is mistaken if he think these kind of issues will just go away and that people don't care about them.

They do.

He is 100% correct when he says there is no evil in being rich. But people will look down upon your character if they feel you cheated and abused the system in order to amass that wealth while they get #ed over by not having the vast resources and external tax firms to game the system in the same way.

What man doesn't want to vindicate himself and tell the truth?

reply to post by Carseller4

Are you kidding me? Romney inherited his money, then raped companies to make more.

Romney earned his money, Obama cheated and deceived many people to earn his millions.

Are you kidding me? Romney inherited his money, then raped companies to make more.

reply to post by Blackmarketeer

Do they realize how ridiculous it sounds? Tax forms vs. Report card. One is completely relevant, the other one isn't.

Republicans demand Obama release his grades from college, for whatever bizarre reason (do we have to know what grade someone got in Chemistry 101?), yet the Republicans refuse to look at their own candidate.

Do they realize how ridiculous it sounds? Tax forms vs. Report card. One is completely relevant, the other one isn't.

new topics

-

Biden "Happy To Debate Trump"

Mainstream News: 8 minutes ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 17 minutes ago -

What is the white pill?

Philosophy and Metaphysics: 1 hours ago -

Mike Pinder The Moody Blues R.I.P.

Music: 2 hours ago -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 5 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 10 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 15 hours ago, 34 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 10 hours ago, 18 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 2 hours ago, 6 flags -

What is the white pill?

Philosophy and Metaphysics: 1 hours ago, 5 flags -

Is AI Better Than the Hollywood Elite?

Movies: 17 hours ago, 4 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 17 minutes ago, 3 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 5 hours ago, 2 flags -

Biden "Happy To Debate Trump"

Mainstream News: 8 minutes ago, 2 flags -

Maestro Benedetto

Literature: 17 hours ago, 1 flags

active topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 25 • : theatreboy -

ChatGPT Beatles songs about covid and masks

Science & Technology • 25 • : ArMaP -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 77 • : KrustyKrab -

Biden "Happy To Debate Trump"

Mainstream News • 2 • : nugget1 -

What is the white pill?

Philosophy and Metaphysics • 12 • : nerbot -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 91 • : Sookiechacha -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 30 • : xuenchen -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 692 • : 777Vader -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 71 • : introufo2 -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 276 • : cherokeetroy