It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Fluctuation of the price of a barrel of oil in gold in the last 26 years? $6

Fluctuation of the price of a barrel of oil in US Dollars in the last 26 years? $89

Looks like Ron Paul was right...AGAIN. And as long as the Federal Reserve continues to inject currency into the economy through public and SECRET bailouts, gas prices along with prices of goods in general will not stop fluctuating for the WORST.

www.fox19.com...

This guy produces some easily digestible top notch reporting for general population. If only more journalists were like Ben Swann.

Heres his FB page, I liked it and I get updates on all of his reality checks, he puts out great FACTUAL information.

www.facebook.com...

Fluctuation of the price of a barrel of oil in US Dollars in the last 26 years? $89

Looks like Ron Paul was right...AGAIN. And as long as the Federal Reserve continues to inject currency into the economy through public and SECRET bailouts, gas prices along with prices of goods in general will not stop fluctuating for the WORST.

www.fox19.com...

This guy produces some easily digestible top notch reporting for general population. If only more journalists were like Ben Swann.

Heres his FB page, I liked it and I get updates on all of his reality checks, he puts out great FACTUAL information.

www.facebook.com...

edit on 19-7-2012 by eLPresidente because: (no reason given)

I just had to explain to the wife why all these cash for gold places are popping up everywhere.

The dollar can only go down in price.

Gold only goes up.

Trading an asset that appreciates for one that can only go down = perfect business for the one giving you dollars.

The dollar can only go down in price.

Gold only goes up.

Trading an asset that appreciates for one that can only go down = perfect business for the one giving you dollars.

Originally posted by benrl

I just had to explain to the wife why all these cash for gold places are popping up everywhere.

The dollar can only go down in price.

Gold only goes up.

Trading an asset that appreciates for one that can only go down = perfect business for the one giving you dollars.

The cash 4 gold trend is a GREAT argument that I often use to prove my point to people that just don't get monetary policy.

And what did your wife say?

Good video, although what he explained in that video shouldn't need to be explained, it should be common knowledge, a product of simple common sense.

Of course the purchasing power of the dollar plays a huge role in rising prices, and it's the prices of almost everything, not just oil. It should

also be realised that in the last several years the FED has released over 15 trillion dollars in secret loans at near zero interest to large banks and

corporations, including foreign entities. If you think the wall-street bailout was huge then you are missing the real problem at hand. Those trillions

of dollars are going to catch up with the economy sooner or later.

edit on 19/7/2012 by ChaoticOrder because: (no reason given)

reply to post by eLPresidente

"people are stupid, they want immediate pay out and not the promise of future gain."

And what did your wife say?

"people are stupid, they want immediate pay out and not the promise of future gain."

Originally posted by benrl

The dollar can only go down in price.

Really?

I think those that have been Short the EUR/USD pair for over the last year would have a different opinion of that.

If your talking about crude prices then it is important that one have an understanding of the role that speculation on future contracts have had.

reply to post by Classified Info

yes when compared to gold, you will never be able to buy the same amount of gold, for the same dollar amount that you sold it to.

Clearly I was talking in terms of the Cash 4 gold places and their business model.

1 dollar bill at that face value will get you less at the end of a ten year period than the same amount of gold that you sold to the cash 4 gold place.

yes when compared to gold, you will never be able to buy the same amount of gold, for the same dollar amount that you sold it to.

Clearly I was talking in terms of the Cash 4 gold places and their business model.

1 dollar bill at that face value will get you less at the end of a ten year period than the same amount of gold that you sold to the cash 4 gold place.

Great thread!

I could not have said it better myself and it shows how we need to go back to a monetary system that provides stability along with value.

As a side note: Did anyone notice that he said oil production has quadrupled over the last 3 years? That mean's the entire argument against Obama when it comes to oil production is a lie!

Kind of a shock to me..........

I could not have said it better myself and it shows how we need to go back to a monetary system that provides stability along with value.

As a side note: Did anyone notice that he said oil production has quadrupled over the last 3 years? That mean's the entire argument against Obama when it comes to oil production is a lie!

Kind of a shock to me..........

edit on 20-7-2012 by sheepslayer247 because: (no reason given)

Originally posted by benrl

reply to post by eLPresidente

And what did your wife say?

"people are stupid, they want immediate pay out and not the promise of future gain."

She's right about that, but there's more to it. They see dollars as a true form of "money", where as gold is simply a valuable chunk of metal. They know they can buy a house with dollars, they know they can pay their bills with dollars, they know they can pay their taxes in dollars, they know they can go to almost any shop and they will accept dollars... and this is because the FED has a monopoly on legal tender currency, that's why politicians like Ron Paul push for competing currencies, preferably a gold standard currency.

That doesn't mean people would go around bartering with chunks of gold, the Government would convert your gold too and from gold standard notes, meaning each note would have a guaranteed backing of a set amount of gold, and at any point in time it would be possible to convert those notes back into the gold which they are worth. That is what a real gold standard currency should be, and it helps avoid inflation because any new money created must first have real world gold assets to back it, thus you can't create infinite amounts of it out of thin air.

edit on 20/7/2012 by

ChaoticOrder because: (no reason given)

reply to post by ChaoticOrder

There is not enough gold ever mined to equal the current level of US dollars in the open market...

That fact alone should grind the US economy to a hault, its all fake.

IF they switched to a gold standard the Dollars would be worth what? A few atom of gold? maybe a few flakes...

I understand we wouldn't be going around trading gold, Going to the gold standard would kill the economy as fast as anything else.

Needless to say the transition to any other system, will be painful, how painful and to whom, depends all on whose doing the switching.

It could be at gun point with the rest of the world holding the gun and taking our check book away.

There is not enough gold ever mined to equal the current level of US dollars in the open market...

That fact alone should grind the US economy to a hault, its all fake.

IF they switched to a gold standard the Dollars would be worth what? A few atom of gold? maybe a few flakes...

I understand we wouldn't be going around trading gold, Going to the gold standard would kill the economy as fast as anything else.

Needless to say the transition to any other system, will be painful, how painful and to whom, depends all on whose doing the switching.

It could be at gun point with the rest of the world holding the gun and taking our check book away.

Originally posted by benrl

yes when compared to gold, you will never be able to buy the same amount of gold, for the same dollar amount that you sold it to.

If I misread your quote I am sorry, I just dont want you to get burned. You are not suggesting that the price of gold will never drop are you?

Gold was near $1900 not quite a year ago and it is around $1600 now.

Also remember that gold was in a 20 year bear market before the bulls took over. We have seen a parabolic rise in the price of gold and these spikes or bubbles will be followed by a crash. Some contend that there is a 30 year commodity cycle, if this is true then we are in the last leg of this cycle.

Be careful if you are thinking about investing in gold. Retail investors are the last to get on on the way up and unfortunately the last to get off when the bubble crashes. Why are some of the top institutional investors exiting their gold positions?? They have made a good profit and they are cashing in.

Food for thought before making any gold investment .

P.S. Those cash for gold places are a rip off. Avoid them.

edit on 7/20/2012 by Classified Info because: (no reason given)

reply to post by Classified Info

I invest my fiat dollars in two things.

Ammo, Guns.

In the long run, I end up with a bunch of nice antiques to pass down to my grand kids, and well at the worse...

Food for thought before making any gold investment .

I invest my fiat dollars in two things.

Ammo, Guns.

In the long run, I end up with a bunch of nice antiques to pass down to my grand kids, and well at the worse...

Originally posted by benrl

I invest my fiat dollars in two things.

Ammo, Guns.

Hey, it is 2012.......

If TSHF they will be more valuable than gold.

Thanks Prez.

I also saw the Washington Post article on Swann's report, agreeing that the price of gold dictates the price of oil. Explains it a bit further.

I guess these are the reasons they call Ron Paul...Fringe and has...Crazy Ideas!

I also saw the Washington Post article on Swann's report, agreeing that the price of gold dictates the price of oil. Explains it a bit further.

On a sample of daily interval data from January 2, 1986 to March 3, 2012 (6,457 matching intervals), using basic statistics, a 2-sample t test was performed and the results are eye-opening. With 99 percent confidence, the test fails to reject the hypothesis. We can say that .0602 ounces of gold times the price of gold produces the price of a barrel of oil, with an error of just .421%, or an average difference of just $6.10 dollars between the calculated price and the actual price since 1986. For the last 26 years, the price of gold dictated the price of oil with 99.579 percent accuracy. source

I guess these are the reasons they call Ron Paul...Fringe and has...Crazy Ideas!

reply to post by benrl

You are of course correct, if we switched to a gold standard and backed each existing note with a set amount of gold then each note would probably be worth a tiny speck of gold. But I didn't say we should switch did I, I said we should implement a competing currency which operates along side the Federal Reserve money, which is exactly what Ron Paul suggests. He doesn't actually want to destroy the Federal Reserve, he wants to give it competition and make it more transparent.

IF they switched to a gold standard the Dollars would be worth what? A few atom of gold? maybe a few flakes...

You are of course correct, if we switched to a gold standard and backed each existing note with a set amount of gold then each note would probably be worth a tiny speck of gold. But I didn't say we should switch did I, I said we should implement a competing currency which operates along side the Federal Reserve money, which is exactly what Ron Paul suggests. He doesn't actually want to destroy the Federal Reserve, he wants to give it competition and make it more transparent.

edit on 20/7/2012 by ChaoticOrder because: (no reason given)

reply to post by ChaoticOrder

exactly why I invest in bitcoin as well, I love me some gray market action...

Yes, we need more people, continuing this discussion, we need more average citizens who give a damn, and thats why RP has already won.

We wouldn't be having this discussion if not for him.

exactly why I invest in bitcoin as well, I love me some gray market action...

Yes, we need more people, continuing this discussion, we need more average citizens who give a damn, and thats why RP has already won.

We wouldn't be having this discussion if not for him.

reply to post by maddog99

Thanks for finding that article, I was interested to read it in more detail.

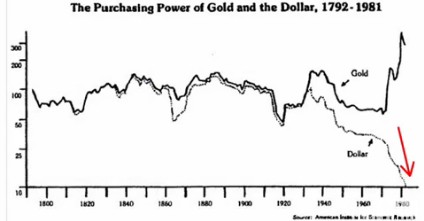

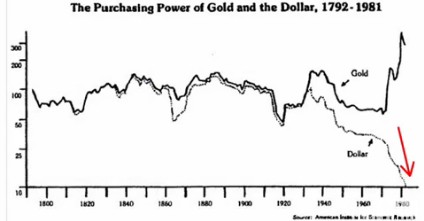

Now knowing that, consider the following graph:

Now ask yourself why oil prices are always rising... along with the prices all other commodities.

That is why I hate those ads on TV which are like "Sick of the rising prices? Economy got you by the balls? We've got the deal for you!". What they should actually be saying is "Sick of the falling dollar? Inflation got you by the balls?". Imagine if they all said that, people would be pissed if they knew the truth.

EDIT: posted wrong graph, fixed

Thanks for finding that article, I was interested to read it in more detail.

For the last 26 years, the price of gold dictated the price of oil with 99.579 percent accuracy.

Now knowing that, consider the following graph:

Now ask yourself why oil prices are always rising... along with the prices all other commodities.

That is why I hate those ads on TV which are like "Sick of the rising prices? Economy got you by the balls? We've got the deal for you!". What they should actually be saying is "Sick of the falling dollar? Inflation got you by the balls?". Imagine if they all said that, people would be pissed if they knew the truth.

EDIT: posted wrong graph, fixed

edit on 20/7/2012 by ChaoticOrder because: (no reason given)

Originally posted by benrl

reply to post by ChaoticOrder

exactly why I invest in bitcoin as well, I love me some gray market action...

Yes, we need more people, continuing this discussion, we need more average citizens who give a damn, and thats why RP has already won.

We wouldn't be having this discussion if not for him.

...Amen to that

reply to post by benrl

Exactly, bitcoin is a great alternative currency, however it's still not a legal tender, you can't pay taxes with it, there are hardly any real world shops which accept it (there are some though), and so it really is much more like gold then a real currency. The Federal Reserve banking cabal needs to let go of their monopoly on money and open the market to competing legal tenders.

exactly why I invest in bitcoin as well, I love me some gray market action...

Originally posted by Classified Info

Originally posted by benrl

The dollar can only go down in price.

Really?

I think those that have been Short the EUR/USD pair for over the last year would have a different opinion of that.

If your talking about crude prices then it is important that one have an understanding of the role that speculation on future contracts have had.

Thank you! The primary reason for gas prices has to do with speculators hired by the oil companies, who's only job is to find reasons to raise the price of gas. That's why gas prices always go down slowly, but rise sharply.

The valuation of the dollar is way down the list for reasons ANY prices for any product rise.

new topics

-

What is the white pill?

Philosophy and Metaphysics: 33 minutes ago -

Mike Pinder The Moody Blues R.I.P.

Music: 1 hours ago -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 4 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 8 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 14 hours ago, 33 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 8 hours ago, 15 flags -

Is AI Better Than the Hollywood Elite?

Movies: 16 hours ago, 4 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 1 hours ago, 3 flags -

What is the white pill?

Philosophy and Metaphysics: 33 minutes ago, 2 flags -

Maestro Benedetto

Literature: 16 hours ago, 1 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 4 hours ago, 1 flags

active topics

-

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 19 • : Threadbarer -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 27 • : Threadbarer -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 20 • : jidnum2 -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 62 • : CarlLaFong -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 69 • : Ophiuchus1 -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works • 16 • : CristianVictoria -

Alternate Electors vs Fake Electors - What is the Difference.

2024 Elections • 123 • : frogs453 -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 17 • : ToneD -

Hate makes for strange bedfellows

US Political Madness • 51 • : network dude -

The Acronym Game .. Pt.3

General Chit Chat • 7755 • : F2d5thCavv2