It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

No offense to the Occupy Wall Street Movement, but I feel this will have more of an impact (not to mention it's hard to paint the act of transferring

money to smaller banks as communist/socialist). That being said, I have some questions. Is there a list of banks that are safe/not safe or is it all

of them? Also, I belong to a credit union already, but I have shared banking with my dad, so what do I do in that situation?

edit on 18-10-2011

by technical difficulties because: (no reason given)

And yes, our puny savings and checking accounts will have an impact on them. Banks also make money on the forex, and our deposits are what they use. Take away our deposits and they don't have as much to play with. BoA has an estimated 25 Million online banking customers. If they take their deposits elsewhere, that's a lot of cash they are going to lose!

Doubtful. Bank of America has roughly $2.26 Trillion in assets.

They have their hands in much, much more than just retail deposits and consumer banking. They are a large, international bank involved in financing international trade, commercial lending to businesses large and small, managing investments (they own Merrill Lynch), not to mention investment banking, credit cards, mortgages, commercial real estate finance, cash management services, etc.

I don't think you have any idea as to the magnitude of this bank and its capacities for generating cash flow.

As I have stated earlier, consumer deposits that are nominal - say a few hundred dollars - are actually unprofitable from a cost structure perspective. The bank actually loses money on these deposits. Losing these paltry deposits is no sweat off the backs of these mega-banks, because they get to offload their unprofitable, high maintenance clients to weaker banks and credit unions that don't understand their true cost structure.

These same credit unions and community banks will eventually either go under or be bought out by larger, more profitable banks because you simply cannot operate a bank by giving away "freebies" and without earning enough income to cover your overhead and infrastructure (ATM machines, bank buildings, etc.).

You just have to look at the hundreds of small community banks that failed in the fast few years to see that they didn't know how to manage risk in their loan portfolios, and they don't have the economies of scale to be profitable. They also don't have the diverse income streams that the mega-banks do.

I say it will make a difference. One it empowers the individual, whose paltry to the Big Bank sum in their checking means the world to them, and their family. It is one person making a statement.

See above. You can cheerlead as much as you like, but your paltry deposits are no match for the deposits of a large percentage of the Fortune 500 mega-corporations that bank with the mega-banks. Sorry to burst your bubble.

Another line of thought, or something for nay sayers to ponder, if our paltry deposits are such a puny amount, and would have no affect on them if pulled, then why do they advertise so heavily to get our business? They must have good reason to need us to become their customers.

All businesses advertise. Banks are no different. Yes, they want your consumer banking business - but, more importantly, they place extraordinary value on securing the entire banking relationship, not just a paltry checking account. They want your mortgage, credit card, deposit account, 401k, etc. They want the full banking relationship.

The average Joe that brags that he took his paltry $250 checking account to his credit union is almost laughable. I am sure your local credit union appreciates Joe's business, even though he generates Zero profit to the credit union.

you have it backwards. Theres more smaller people, meaning more fees from people than from business owners.

The bank charges fees to the clients with meager deposits because there is absolutely NO profit to the bank for these kinds of paltry checking accounts.

Business owners keep substantially more significant deposits, and have much larger banking relationships, including financing on commercial office space, equipment financing, truck and commercial vehicle financing, treasury and cash management services, investment management, etc. Businesses are infinitely more profitable for banks than the average Joe with a paltry $100 in his checking account - I assure you.

reply to post by wayouttheredude

I believe it.I did this myself as soon as I heard wells fargo was considering charging fees for checking accounts.

The banker I talked to...Man did he start kissing my butt when I told him I was there to close my accounts. he was selling like crazy when I told him why I was closing them and where I was taking my money.... His lame sales pitch did not work.

Most people I know are also switching to credit unions. Talked to my mom on the phone today. Her fellow employees are doing the same apparently.

It is spreading for sure.

I believe it.I did this myself as soon as I heard wells fargo was considering charging fees for checking accounts.

The banker I talked to...Man did he start kissing my butt when I told him I was there to close my accounts. he was selling like crazy when I told him why I was closing them and where I was taking my money.... His lame sales pitch did not work.

Most people I know are also switching to credit unions. Talked to my mom on the phone today. Her fellow employees are doing the same apparently.

It is spreading for sure.

edit on 18-10-2011 by gimme_some_truth because: (no reason given)

I actually moved to a CU about 6 months ago just becuase they had very good reviews and I didnt care for chase any longer after they closed massive

lines of open credit for no reason hurting my credit score quite a bit.

I am now banking with Kinecta the Old Howard Hughes credit union and i have been satisfied to this point.

I am now banking with Kinecta the Old Howard Hughes credit union and i have been satisfied to this point.

reply to post by HUMBLEONE

oh well, look before i told occupy about it they had a lot of wants but not a lot of how to's. i didnt hear them talking about credit unions until i told them about it so i just put 2 and 2 together, im know i didnt create the idea in a whole but atleast in the sense for uniting the 99%. Ive been a member of a cu my entire life so obviously i know its been around for ages but i only said that i did because someone else put their name behind the idea anyway.

oh well, look before i told occupy about it they had a lot of wants but not a lot of how to's. i didnt hear them talking about credit unions until i told them about it so i just put 2 and 2 together, im know i didnt create the idea in a whole but atleast in the sense for uniting the 99%. Ive been a member of a cu my entire life so obviously i know its been around for ages but i only said that i did because someone else put their name behind the idea anyway.

reply to post by alyoshablue

like i said ive been a member of a credit union my whole life, although ive never seen all of the zeitgeist movies i know people have been talking about it for ages. All i know is that i was telling the occupy movement about it weeks before they were. Think about it, before bank transfer day came out there was a lot of wants, but not many how to's. I dont want to say i 100% came up with it because i know i didnt, i just spread the message to people who wernt talking about it weeks before they brought it up.

like i said ive been a member of a credit union my whole life, although ive never seen all of the zeitgeist movies i know people have been talking about it for ages. All i know is that i was telling the occupy movement about it weeks before they were. Think about it, before bank transfer day came out there was a lot of wants, but not many how to's. I dont want to say i 100% came up with it because i know i didnt, i just spread the message to people who wernt talking about it weeks before they brought it up.

Originally posted by CookieMonster09

And yes, our puny savings and checking accounts will have an impact on them. Banks also make money on the forex, and our deposits are what they use. Take away our deposits and they don't have as much to play with. BoA has an estimated 25 Million online banking customers. If they take their deposits elsewhere, that's a lot of cash they are going to lose!

Doubtful. Bank of America has roughly $2.26 Trillion in assets.

They have their hands in much, much more than just retail deposits and consumer banking. They are a large, international bank involved in financing international trade, commercial lending to businesses large and small, managing investments (they own Merrill Lynch), not to mention investment banking, credit cards, mortgages, commercial real estate finance, cash management services, etc.

I don't think you have any idea as to the magnitude of this bank and its capacities for generating cash flow.

Not too sure about that $2.26 trillion in assets... I suspect that by the time you start accounting for all those trillions of $ in derivatives floating around the system, their actual $2.26 trillion in assets might be totally inadequate to the task of keeping them afloat, when the derivatives bomb goes off.

I read somewhere the four of the largest US banks account for 95% of the whole multi-trillion $ derivative bubble.

This article about sums it all:

dailybail.com...

... and I wouldn't be surprised to see a near-future bank run on BOA, not by the Little people, but by those same fortune 500 companies you mentioned

reply to post by Dagar

Thanks for pointing that out. Consider that the total derivatives exposure of just the hedge funds controlled by the 184,000 government corporation pension funds in the US is something like 224 trillion. This creates a huge conflict of interest between the government employee pension fund investments in these derivatives by the banks they have invested in and the bailouts of said banks that are largely owned by hedge funds that privately control public employee retirement money accounts and other public accounts.

Thanks for pointing that out. Consider that the total derivatives exposure of just the hedge funds controlled by the 184,000 government corporation pension funds in the US is something like 224 trillion. This creates a huge conflict of interest between the government employee pension fund investments in these derivatives by the banks they have invested in and the bailouts of said banks that are largely owned by hedge funds that privately control public employee retirement money accounts and other public accounts.

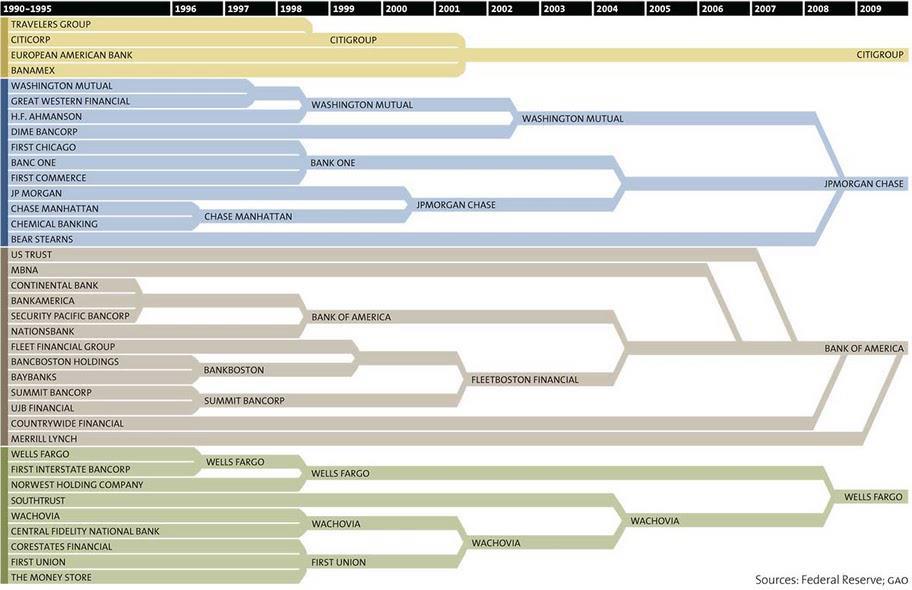

Originally posted by jazzguy

look how these greedy banks consume little banks

edit on 17-10-2011 by jazzguy because: (no reason given)

Oh my goodness. That's obscene. And I worked as a contractor for WF for a while, so I already knew about Wachovia.

If I lived in the US (which I no longer will), then I would shut my BofA account down on Nov. 5. I would've done it before then though haha. Anyways,

the plane ticket price isn't worth traveling there for a few hundred bucks.

BofA has been terrible for me. They shut down my debit card here numerous times for "security". They want you to call them when you travel overseas so they know the charges aren't fraudulent. Makes sense, but I'm not going to inform my bank of my travel plans, it's none of their business. Also, after calling them and going through their security questions, they unflagged my account so I could withdraw money again. However, this same thing happened about 4 times before they "fixed" my account.

I also called them to put a hold on a recurring payment, and they said they did. 6 months later I'm in overdraft because they didn't. They suck, let them go down along with the other banks.

BofA has been terrible for me. They shut down my debit card here numerous times for "security". They want you to call them when you travel overseas so they know the charges aren't fraudulent. Makes sense, but I'm not going to inform my bank of my travel plans, it's none of their business. Also, after calling them and going through their security questions, they unflagged my account so I could withdraw money again. However, this same thing happened about 4 times before they "fixed" my account.

I also called them to put a hold on a recurring payment, and they said they did. 6 months later I'm in overdraft because they didn't. They suck, let them go down along with the other banks.

Originally posted by ShortMemory

i started this movement

good to see its going somewhere

end the power of banks, join a credit union..edit on 17-10-2011 by ShortMemory because: (no reason given)

You had nothing to do with my decision to switch from Wells Fargo to a credit union. I have never even heard of you.

My decision was one based on common sense. I am not going to let wells fargo reach into my account and take even more money every month, when the money I put in there bank is a loan as it is. My money is my money and I am not going to give the bank a gift on top of my loan to them.

I moved my money to a credit union where they will not screw me over when I loan them MY money.

Please, you started nothing. People just don't like the banks claiming they need more money because they are not making enough profit.

Can you believe that is what the banker at wells fargo told me? They might lose money if they don't do it! He said they had to stay competitive with Bank of America... I was very quick to point out that Wells Fargo, one of the biggest banks in the world is going to make a huge profit with out stealing from our accounts and they can also make a profit with out my loan to them...

I took my money else where and it had NOTHING to do with you.

reply to post by gimme_some_truth

im not talking about every single person that ever joined a credit union

im talking about it in regards to the occupy movement and using it as a tool to get what we need.

you commented on my thread about it (from a different account), which was just over a week before anyone was talking about bank transfer day.

im not talking about every single person that ever joined a credit union

im talking about it in regards to the occupy movement and using it as a tool to get what we need.

you commented on my thread about it (from a different account), which was just over a week before anyone was talking about bank transfer day.

edit on 19-10-2011 by ShortMemory because: (no reason given)

Originally posted by Skorpiogurl

If you do plan on "moving your money", this list and this site might be of interest:

www.fdic.gov...

Also, If you know how to read the trends you'll know that it's a bad idea to go right from a big bank to a credit union. Go to a community bank first and wait until it settles down a bit. Then switch over to a credit union.

We have too big to fail, there is also too small to survive the huge rush of new account openings...

I know I keep reiterating this but, trust me, I've been in the corporate end of banking for over 20 years.

I did that about 2 years ago moving our money from Citibank and BofA to a community bank. We're lucky in that we have 2 or 3 really good community banks in our town in CT. Both have been around for over 100 years are financially very strong and were totally unaffected by the meltdown in '08-'09. I get all of the services I got from the "big" banks with none of the fees and hassles. Also, the people there are terrific - they remember you and go out of their way to help.

When I decided to refinance my mortgage I'll give you 3 guesses as to who got my business....(first 2 guesses don't count)...and btw - they never re-sell their mortgages. The keep and service all of the mortgages they originate.

Glad I made the move and I've never looked back.

reply to post by wayouttheredude

tripnman has a great thread about his experiences trying to close his BoA accounts here:

Bank of America begged me to not to close my accounts - want to help?

tripnman has a great thread about his experiences trying to close his BoA accounts here:

Bank of America begged me to not to close my accounts - want to help?

Originally posted by Riffrafter

Originally posted by Skorpiogurl

If you do plan on "moving your money", this list and this site might be of interest:

www.fdic.gov...

Also, If you know how to read the trends you'll know that it's a bad idea to go right from a big bank to a credit union. Go to a community bank first and wait until it settles down a bit. Then switch over to a credit union.

We have too big to fail, there is also too small to survive the huge rush of new account openings...

I know I keep reiterating this but, trust me, I've been in the corporate end of banking for over 20 years.

I did that about 2 years ago moving our money from Citibank and BofA to a community bank. We're lucky in that we have 2 or 3 really good community banks in our town in CT. Both have been around for over 100 years are financially very strong and were totally unaffected by the meltdown in '08-'09. I get all of the services I got from the "big" banks with none of the fees and hassles. Also, the people there are terrific - they remember you and go out of their way to help.

When I decided to refinance my mortgage I'll give you 3 guesses as to who got my business....(first 2 guesses don't count)...and btw - they never re-sell their mortgages. The keep and service all of the mortgages they originate.

Glad I made the move and I've never looked back.

Exactly. Which is why on all of the bank threads I keep urging people to go with a small regional bank vs. a credit union.

reply to post by soficrow

I am subscribed to that thread as well but just have not had anything to add to the discussion. I think it is a great story the OP has and I have noticed some weirdness with my accounts of late which spurred me to get out of the big banks.

I am subscribed to that thread as well but just have not had anything to add to the discussion. I think it is a great story the OP has and I have noticed some weirdness with my accounts of late which spurred me to get out of the big banks.

Well I have gone and done it now. I have opened my own account with the credit union where I live. And is slowly beginning to transfer money from my

Bank Account to my credit union account. Went into the bank, withdrew over £3000, and put that into my union account.

Bye bye Banks don't need your services anymore!

Bye bye Banks don't need your services anymore!

Looks like They have called a secret meeting to discuss these looming issues before them.

Treasury calls a secret meeting of the .01%

I would like to be a fly on the wall at that meeting. It would be more interesting than the chanting mob and police presence outside the Hay-Adams Hotel where the secret meeting will be held on Nov 1st.

Treasury calls a secret meeting of the .01%

I would like to be a fly on the wall at that meeting. It would be more interesting than the chanting mob and police presence outside the Hay-Adams Hotel where the secret meeting will be held on Nov 1st.

Feedback from the front lines in the infowar. This is from a redditor. It is another little site I like. In any event the story is that they called

Wells Fargo and complained about the $3 fee they have for debit cards.

My Wife Called Wells Fargo today

This is some relevant feedback from this program and how it has rattled the banks.

My Wife Called Wells Fargo today

This is some relevant feedback from this program and how it has rattled the banks.

new topics

-

BIDEN Admin Begins Planning For January 2025 Transition to a New President - Today is 4.26.2024.

2024 Elections: 1 hours ago -

Big Storms

Fragile Earth: 3 hours ago -

Where should Trump hold his next rally

2024 Elections: 5 hours ago -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 6 hours ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 7 hours ago -

Falkville Robot-Man

Aliens and UFOs: 7 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 8 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 8 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 9 hours ago -

Biden "Happy To Debate Trump"

2024 Elections: 10 hours ago

top topics

-

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 8 hours ago, 14 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 8 hours ago, 13 flags -

Blast from the past: ATS Review Podcast, 2006: With All Three Amigos

Member PODcasts: 12 hours ago, 13 flags -

Biden "Happy To Debate Trump"

2024 Elections: 10 hours ago, 12 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 12 hours ago, 8 flags -

What is the white pill?

Philosophy and Metaphysics: 11 hours ago, 6 flags -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 6 hours ago, 6 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 10 hours ago, 5 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 9 hours ago, 5 flags -

Where should Trump hold his next rally

2024 Elections: 5 hours ago, 5 flags

active topics

-

Big Storms

Fragile Earth • 12 • : Lumenari -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 47 • : cherokeetroy -

BIDEN Admin Begins Planning For January 2025 Transition to a New President - Today is 4.26.2024.

2024 Elections • 8 • : NoCorruptionAllowed -

ALERT - U.S. President JOE BIDEN Examined and Found NOT OF SOUND MIND.

2024 Elections • 65 • : SchrodingersRat -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents • 13 • : theatreboy -

Where should Trump hold his next rally

2024 Elections • 21 • : Dandandat3 -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs • 9 • : Degradation33 -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 38 • : SchrodingersRat -

Joe Biden and Donald Trump are both traitors

2024 Elections • 65 • : MrMez -

Mood Music Part VI

Music • 3112 • : underpass61