It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

2

share:

Disclaimer: This is my opinion on the current economic situation worldwide, and on a smaller scale, in Australia and the US. By no means is it

conclusive or 100% accurate. This is just what I think and why. Don't take the following post as being economic fact. I'm not an economist.

First, a quick little economics lesson.

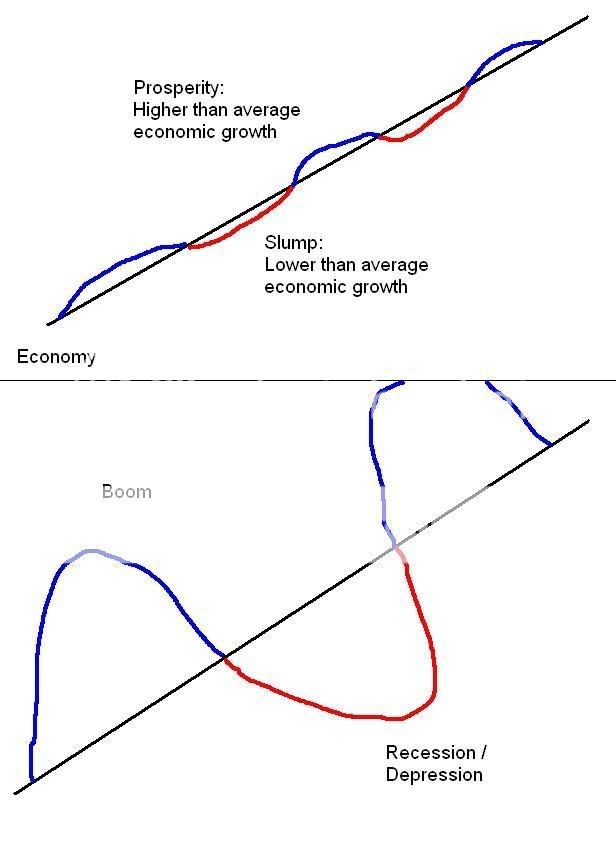

Take a look at this simple (albeit horrible looking) diagram.

The middle line represents constant economic growth. The economy would remain stable and there would be no cycle of high and low growth.

The cycle you see in the top diagram is what most economists agree as being the best way to run an economy. Keep it close to the mean, and allow for small booms and slumps.

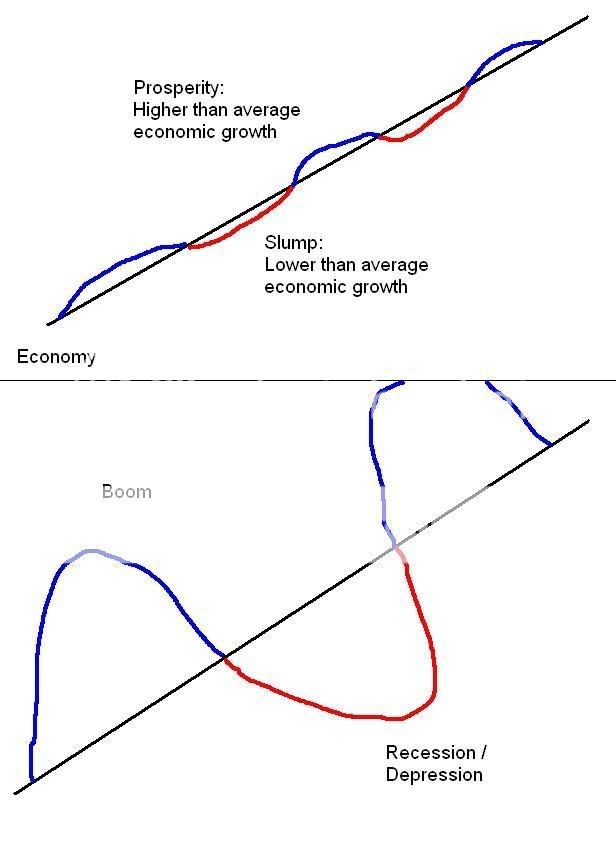

The way Australia and the US, however, have been running their economy, is closer to the 2nd diagram.

The past decade has been a huge boom period for both countries. Australia, especially, was pushed higher and higher by the Howard government. The ex-treasurer, Peter Costello, is still praised by most as giving Australia the greatest economy situation in history.

However, that 10 year period comes at a high price.

The bigger the boom, the bigger the recession will be that follows.

That is why it is advised to keep the cycle as close to the mean as possible. To avoid any eras of recession. We are now facing what will probably become the worst economy era in history.

And the previous governments of our countries are to blame.

Both Rudd in Australia and Obama in the US have been left a horrible legacy economically by their predecessors. They pushed the economy so high it broke and began the descent towards the mean.

Right now I'd say we've crossed that line and have maybe another decade of descending to do before we start to climb back up.

I hate to be all doom and gloom, but it technically cannot get any better until it gets worse.

The economy has to plummet for an extended period of time now before it is able to return towards a stable level.

Then, you have to hope that both our countries have someone in power that is at least intelligent enough to realize this situation. What goes up must come down.

To my other point.

No stimulus package can avert this disaster.

Throwing money at it will, if anything, lengthen the free fall. It is like throwing a rock into the air and trying to slow it's decent by throwing dollar bills at it.

The best way to ride it out is to simply go on as normal. Don't panic and run to pull out your investments (unless you intend to retire in less than 12 months time). Let them fall, because like the economy, they will strength again in the future. Pulling them out now is a surefire way of losing money.

The economy will recover.

If anything, in the next 3 - 5 years it is a good time to be buying up shares and investments. Because give them another decade and their value will skyrocket.

Well, if you've read this far well done.

Now you know we are pretty much screwed for the next decade. Thank Bush and Howard. They threw us up, and now we have to ride out the coming down.

[edit on 14-2-2009 by fooffstarr]

[edit on 14-2-2009 by fooffstarr]

First, a quick little economics lesson.

Take a look at this simple (albeit horrible looking) diagram.

The middle line represents constant economic growth. The economy would remain stable and there would be no cycle of high and low growth.

The cycle you see in the top diagram is what most economists agree as being the best way to run an economy. Keep it close to the mean, and allow for small booms and slumps.

The way Australia and the US, however, have been running their economy, is closer to the 2nd diagram.

The past decade has been a huge boom period for both countries. Australia, especially, was pushed higher and higher by the Howard government. The ex-treasurer, Peter Costello, is still praised by most as giving Australia the greatest economy situation in history.

However, that 10 year period comes at a high price.

The bigger the boom, the bigger the recession will be that follows.

That is why it is advised to keep the cycle as close to the mean as possible. To avoid any eras of recession. We are now facing what will probably become the worst economy era in history.

And the previous governments of our countries are to blame.

Both Rudd in Australia and Obama in the US have been left a horrible legacy economically by their predecessors. They pushed the economy so high it broke and began the descent towards the mean.

Right now I'd say we've crossed that line and have maybe another decade of descending to do before we start to climb back up.

I hate to be all doom and gloom, but it technically cannot get any better until it gets worse.

The economy has to plummet for an extended period of time now before it is able to return towards a stable level.

Then, you have to hope that both our countries have someone in power that is at least intelligent enough to realize this situation. What goes up must come down.

To my other point.

No stimulus package can avert this disaster.

Throwing money at it will, if anything, lengthen the free fall. It is like throwing a rock into the air and trying to slow it's decent by throwing dollar bills at it.

The best way to ride it out is to simply go on as normal. Don't panic and run to pull out your investments (unless you intend to retire in less than 12 months time). Let them fall, because like the economy, they will strength again in the future. Pulling them out now is a surefire way of losing money.

The economy will recover.

If anything, in the next 3 - 5 years it is a good time to be buying up shares and investments. Because give them another decade and their value will skyrocket.

Well, if you've read this far well done.

Now you know we are pretty much screwed for the next decade. Thank Bush and Howard. They threw us up, and now we have to ride out the coming down.

[edit on 14-2-2009 by fooffstarr]

[edit on 14-2-2009 by fooffstarr]

Sorry...the Game is Over...

This could be the "Smoking Gun" for the "Game Over" scenerio...

Welcome to The Real Matrix: Time for The Red Pill?

www.abovetopsecret.com...

This could be the "Smoking Gun" for the "Game Over" scenerio...

Welcome to The Real Matrix: Time for The Red Pill?

www.abovetopsecret.com...

reply to post by fooffstarr

This would be excellent advice, one that most Americans realised before the election. It's a predictable outcome.

However, these are not normal times. There are too many other things interfering in that model. In this case the housing market comes to mind. The shear number of sub-prime loans(socialism) has effected every nation and person on earth, from the richest of banks down to the individual rightful homeowner. This has never happened before, the great depression did not have all the trappings we have today in this market.

Countries have been overthrown(Iceland comes to mind), protests and riots(even in Russia and China!) are occurring worldwide. People are hating their governments and those fat cats supporting them. The same people who caused the problems are still there in our government now tasked to 'fix' it. Our government went against the 80% majority of people who did not want to bail out any one. Politically, it was used to get Obama, a Marxist, elected. McCain/Palin were 12 points ahead before the 'crisis'. So you say- just put your money in there these guys are gonna fix stuff right up! Stock market is rigged, in bed with bankers, make back door pay for play deals with politicians... The economy here will die, because the stimulus page consists of a few (huge) pet projects instead of small business. Next,, the commercial property industry will bust. When that happens there will be nothing left. Where ever you are you better prepare.

This would be excellent advice, one that most Americans realised before the election. It's a predictable outcome.

However, these are not normal times. There are too many other things interfering in that model. In this case the housing market comes to mind. The shear number of sub-prime loans(socialism) has effected every nation and person on earth, from the richest of banks down to the individual rightful homeowner. This has never happened before, the great depression did not have all the trappings we have today in this market.

Countries have been overthrown(Iceland comes to mind), protests and riots(even in Russia and China!) are occurring worldwide. People are hating their governments and those fat cats supporting them. The same people who caused the problems are still there in our government now tasked to 'fix' it. Our government went against the 80% majority of people who did not want to bail out any one. Politically, it was used to get Obama, a Marxist, elected. McCain/Palin were 12 points ahead before the 'crisis'. So you say- just put your money in there these guys are gonna fix stuff right up! Stock market is rigged, in bed with bankers, make back door pay for play deals with politicians... The economy here will die, because the stimulus page consists of a few (huge) pet projects instead of small business. Next,, the commercial property industry will bust. When that happens there will be nothing left. Where ever you are you better prepare.

reply to post by fooffstarr

Your "informed opinion" is Sophomoric at best!

The ENTIRE economy is a ponzi scheme! Simple example: Social Security:

When FDR invented social security, they had no money to pay for the people who were already elderly and disabled, so they decided to pay for Social Security by taxing working individuals at the time to pay for the old and infirm of the time.

This is what happens when government intervenes in the economy. You have idiots making the rules. This idea did not account for population growth and shrinkage.

When you pay FICA, you are not paying towards your retirement. You are paying for the people on social security right now.

Now, when the baby boomers retire, there will be a disproportionate amount of people collecting social security compared the number of people paying into the system.

Simple economics: when you are spending more money than you take in, either you must borrow, or you go bust.

Simple definition of a ponzi scheme: Instead of making money on an investment, you take money from new investors to pay the old investors. When new investors stop bringing you enough money to pay the pre-existing investors, the ponzi scheme collapses. Ask Bernie Madoff.

If you want to blame someone, try FDR, or JP Morgan and the Rockafellers. You can blame Jimmy Carter, Ronald Reagan and Bush the Fisrt.

How about blaming Ike for allowing the Military/industrial complex to take over our country.

BTW, I like your graphs made with Microsoft Paint

Your "informed opinion" is Sophomoric at best!

The ENTIRE economy is a ponzi scheme! Simple example: Social Security:

When FDR invented social security, they had no money to pay for the people who were already elderly and disabled, so they decided to pay for Social Security by taxing working individuals at the time to pay for the old and infirm of the time.

This is what happens when government intervenes in the economy. You have idiots making the rules. This idea did not account for population growth and shrinkage.

When you pay FICA, you are not paying towards your retirement. You are paying for the people on social security right now.

Now, when the baby boomers retire, there will be a disproportionate amount of people collecting social security compared the number of people paying into the system.

Simple economics: when you are spending more money than you take in, either you must borrow, or you go bust.

Simple definition of a ponzi scheme: Instead of making money on an investment, you take money from new investors to pay the old investors. When new investors stop bringing you enough money to pay the pre-existing investors, the ponzi scheme collapses. Ask Bernie Madoff.

If you want to blame someone, try FDR, or JP Morgan and the Rockafellers. You can blame Jimmy Carter, Ronald Reagan and Bush the Fisrt.

How about blaming Ike for allowing the Military/industrial complex to take over our country.

BTW, I like your graphs made with Microsoft Paint

Originally posted by fooffstarr

The best way to ride it out is to simply go on as normal. Don't panic and run to pull out your investments (unless you intend to retire in less than 12 months time). Let them fall, because like the economy, they will strength again in the future. Pulling them out now is a surefire way of losing money.

No offense, but that is just silly talk. You must be a broker, So you ride the stock down to the lows, hoping to catch it on the rebound? All that is going to do is get you back to where you started 5 years prior, which is pretty close to the average span between recessions, just so you can spend another 5 years getting back to where you began. Remember it's buy low and sell high. Strange as it seems, many people fail to follow this very commonsense advice.

And your advice about only if you plan on retiring in the next 12 months is horrible. Someone close (within 7-10 years) to retirement, should be gradually moving their money out of the stock market and into more suitable investments. Do you realize how many close to retirement people have lost 35% or more of their nest eggs? It is truly changing the way they will have to retire, your advice would make it even worse for them.

Warren Buffets two rules apply:

Rule #1 Preserve the Principal.

Rule # 2 When in doubt, see Rule #1.

It's not easy, but it can be done and takes mental discipline. Sure, you miss out on the giddy highs, but you also miss the horrible beat downs too. For the most part you can see a recessionary period coming a mile away, if you pay attention. Just move your money to where it won't tank as that time approaches and you will be in great shape. Put it this way, would you rather lose 25% in a year or just not gain anything that year?

Those that manage not to lose their shirts in downturns can manage to buy multiple suits when things pick up. Those that don't, scramble to find a new cheaper shirt when things turn around.

Take your pick.

reply to post by pavil

I'm not a broker or any expert and never claimed to be. I'm just offering my opinion on the situation.

And I'm not claiming to know how each individual should deal with the situation.

My message was: the economic situation is regrettably unavoidable and is most likely caused by the forced boom of the last decade.

Can you disagree with that?

I'm not a broker or any expert and never claimed to be. I'm just offering my opinion on the situation.

And I'm not claiming to know how each individual should deal with the situation.

My message was: the economic situation is regrettably unavoidable and is most likely caused by the forced boom of the last decade.

Can you disagree with that?

Additionally, the economy is not a physical force for which the premise of an action will have an equal and opposite reaction.

There is absolutely no reason why you can't have a boom, and then level off into a Plateau with positive economic growth.

The reason the housing boom turned into a bust is because the Boom was artificial. The Fed, i.e. Greenspan lowered interest rates after the mild recession of post 9/11 to stimulate the economy (more dumb government intervention) and then the banks decided to make a lot of money by giving loans to people who should never have qualified. Why? Because most of the bad loans were made by greedy mortgage brokers who manipulated the system and then were bundled and sold to idiots like Citi and B of A.

People were taken advantage by predatory lenders, and other people where just fooling themselves by taking three year arms at 4% that converted to 7% that they could never afford. They thought they would just refinance every three years and keep their low introductory rate.

This is all fraud. There will be no recovery. The reason we recovered in the 30's is because of WWII. Unless someone starts WWIII, say good bye to the economy.

There is absolutely no reason why you can't have a boom, and then level off into a Plateau with positive economic growth.

The reason the housing boom turned into a bust is because the Boom was artificial. The Fed, i.e. Greenspan lowered interest rates after the mild recession of post 9/11 to stimulate the economy (more dumb government intervention) and then the banks decided to make a lot of money by giving loans to people who should never have qualified. Why? Because most of the bad loans were made by greedy mortgage brokers who manipulated the system and then were bundled and sold to idiots like Citi and B of A.

People were taken advantage by predatory lenders, and other people where just fooling themselves by taking three year arms at 4% that converted to 7% that they could never afford. They thought they would just refinance every three years and keep their low introductory rate.

This is all fraud. There will be no recovery. The reason we recovered in the 30's is because of WWII. Unless someone starts WWIII, say good bye to the economy.

I understand your graph, and it does a good job of illustrating how the market could work depending on the way you play it.

Heres the thing I have a problem with though...(and there might be holes in this example as to im not too sure where I am going with this just yet so let me try to put it into words as I go)....I think that we are on the downside of the graph like it shows, Im not indisagreement with that part at all....But what I am concerned with is the "bouncing back".. Because that graph represents the U.S, but that graph doesnt include the rest of the worlds problems as well. I think that our depression is going to last a lot longer due to the fact that our future isnt written, and the fact that much of the world is in the same boat as us(we are not theonly ones)..so in order for a comeback of this country, there must be other nations out there that have to be doing well in order to assist us in the bouncing back of our economy, right now, I dont see it. There may not be any "bounceback" at all....we may just stay on the downturn of the graph until we can 'WAR' our way out of it, by then, we might not be the United States of America anymore. Hopefully, I am wrong. but thats just my interpretation of your graph.

Heres the thing I have a problem with though...(and there might be holes in this example as to im not too sure where I am going with this just yet so let me try to put it into words as I go)....I think that we are on the downside of the graph like it shows, Im not indisagreement with that part at all....But what I am concerned with is the "bouncing back".. Because that graph represents the U.S, but that graph doesnt include the rest of the worlds problems as well. I think that our depression is going to last a lot longer due to the fact that our future isnt written, and the fact that much of the world is in the same boat as us(we are not theonly ones)..so in order for a comeback of this country, there must be other nations out there that have to be doing well in order to assist us in the bouncing back of our economy, right now, I dont see it. There may not be any "bounceback" at all....we may just stay on the downturn of the graph until we can 'WAR' our way out of it, by then, we might not be the United States of America anymore. Hopefully, I am wrong. but thats just my interpretation of your graph.

reply to post by Common Good

Indeed.

The graph (which is as close as I could get it in paint to the real thing in the books ) is one of those theoretical models that don't take in outside factors.

It doesn't factor in the world mindset, wars, political powerstruggles etc.

So in all reality, the world (or US) markets could go against the theory. However, it is one of those laws that tends to show up regardless of the outcome.

It is the old adage of every action having an equal and opposite reaction. Taking no action sometimes (as opposed to the current trend of bailouts) may be a better deal than throwing money at the problem.

To take no action on a national scale would mean, in my opinion, that over time the economy would right itself.

But by spending over a trillion dollars trying to flood the market, you risk turning a bad downturn into a permanent downturn.

Indeed.

The graph (which is as close as I could get it in paint to the real thing in the books ) is one of those theoretical models that don't take in outside factors.

It doesn't factor in the world mindset, wars, political powerstruggles etc.

So in all reality, the world (or US) markets could go against the theory. However, it is one of those laws that tends to show up regardless of the outcome.

It is the old adage of every action having an equal and opposite reaction. Taking no action sometimes (as opposed to the current trend of bailouts) may be a better deal than throwing money at the problem.

To take no action on a national scale would mean, in my opinion, that over time the economy would right itself.

But by spending over a trillion dollars trying to flood the market, you risk turning a bad downturn into a permanent downturn.

Originally posted by fooffstarr

reply to post by pavil

I'm not a broker or any expert and never claimed to be. I'm just offering my opinion on the situation.

And I'm not claiming to know how each individual should deal with the situation.

My message was: the economic situation is regrettably unavoidable and is most likely caused by the forced boom of the last decade.

Can you disagree with that?

But you did claim to have an expert opinion prior to your edit of the Original post or something very close to those words. Why did you edit that?

I would also disagree with your basic assumption that little gains and little losses work better long term than bigger fluctuations. Look at the slow economic growth of Europe compared to the US over the last Century or the rise of China this past 20 years or so..

I would agree that boom is inevitably followed by bust. All booms are in some manner forced, what do you think this current stimulus bill is?

The Matrix - is that the one with the guy in the long trenchcoat who can't act worth a dime?

It's really game over when your worldview is formed not by reading and experience but by some crappy big budget Hollywood movie.

MF

It's really game over when your worldview is formed not by reading and experience but by some crappy big budget Hollywood movie.

MF

Originally posted by finemanm

There is absolutely no reason why you can't have a boom, and then level off into a Plateau with positive economic growth.

It's actually pretty hard to achieve that given the political aspects that creep in. The only recent example being the Reagan years followed by the downturn of Bush I, then the Clinton Years. The Bush years were a relatively mild recession and it still cost him the White House. Bush I probably could have spent himself into a second term if he was really determined to.

reply to post by pavil

I said 'informed opinion'. That opinion, as has been proven so far in this thread, was not informed enough, so I have stated as such in the opening post.

Europe and China, in my opinion, are also due for a downturn. They've been in the black too long, and will most likely get hit as hard as the US in the coming years.

As far as the stimulus packages go, I think it is economically unwise, reckless even, to attempt to manufacture a boom this soon after the end of the previous one.

The markets need time to settle and readjust to a sound level of growth. Trying to force another boom now, once again in my opinion, is disastrous.

I said 'informed opinion'. That opinion, as has been proven so far in this thread, was not informed enough, so I have stated as such in the opening post.

Europe and China, in my opinion, are also due for a downturn. They've been in the black too long, and will most likely get hit as hard as the US in the coming years.

As far as the stimulus packages go, I think it is economically unwise, reckless even, to attempt to manufacture a boom this soon after the end of the previous one.

The markets need time to settle and readjust to a sound level of growth. Trying to force another boom now, once again in my opinion, is disastrous.

reply to post by fooffstarr

No I agree that by throwing a trillion dollars at a charging rhinosaurus isnt going to help much, But I dont think, however; that by standing by and doing nothing will make it better, but only make it much more worse.

On the same token, I dont know if there is much we can do about the problem besides kicking the people out behind all of this instead offeeding their pockets with more of our tax payer bailout dollars(because we all know thats where the money is going anyways). So in allr eality, we are damnedif we do, and we are damned if we dont, we just have to be wise enough to choose he lesser of evils, which I dont think we are doing right now.

No I agree that by throwing a trillion dollars at a charging rhinosaurus isnt going to help much, But I dont think, however; that by standing by and doing nothing will make it better, but only make it much more worse.

On the same token, I dont know if there is much we can do about the problem besides kicking the people out behind all of this instead offeeding their pockets with more of our tax payer bailout dollars(because we all know thats where the money is going anyways). So in allr eality, we are damnedif we do, and we are damned if we dont, we just have to be wise enough to choose he lesser of evils, which I dont think we are doing right now.

What caused it was interest rate changes. Too low for too long and then they were raised much too quickly. Everytime interest rates are raised quickly

inflation shows her ugly head which eventually leads to economic recession. Everytime they are lowered quickly it ends in economic bubbles. The powers

to be want you to believe it works the other way around, i disagree. What we need is a fixed fed funds rate and adjustments to bank reserve and

capital ratios to slow down or speed up the economy.

The economy can be fixed. Slowly. Well at least a good attempt can be made.

The government can just replace the Federal Reserve and print its own fiat money.

That would equal to billions of dollars in instant savings on interest that go to bankers. Money would not be based on interest and debt, and therefore the economy will have a fighting chance not to go into huge debts.

All the government has to do is pay government employees and bills a government printed currency rather than Fed currency and force it to be honored by fiat at the same level of value as the Fed notes.

The government is already printing trillions, why not print trillions that don't have to be paid back again with interest to the Federal Reserve and all its banker owners. At the very least it would give us a fighting chance.

The government can just replace the Federal Reserve and print its own fiat money.

That would equal to billions of dollars in instant savings on interest that go to bankers. Money would not be based on interest and debt, and therefore the economy will have a fighting chance not to go into huge debts.

All the government has to do is pay government employees and bills a government printed currency rather than Fed currency and force it to be honored by fiat at the same level of value as the Fed notes.

The government is already printing trillions, why not print trillions that don't have to be paid back again with interest to the Federal Reserve and all its banker owners. At the very least it would give us a fighting chance.

reply to post by fooffstarr

I'm not trying to pick on you, it just some of the things you said needed correction. The rest of the world will not escape without recession as well. The U.S. is usually the first to feel it's effects and the first to turn around. Like it or not, the U.S. economy is the oil that lubes the world's economy, without it, everything grinds to a halt eventually.

I agree that the current stimulus plan will not solve the underlying problems. it's just a band aid, albeit a very expensive one, that doesn't get to the root of the disease, which is Lack of savings and spending beyond our means.

We can not deficit spend our way out of every economic situation. All it does is make you deeper and deeper in the hole. Peter Schiff pretty much has it diagnosed right, the solution is very hard to come up with, without a lot of hardship.

I'm not trying to pick on you, it just some of the things you said needed correction. The rest of the world will not escape without recession as well. The U.S. is usually the first to feel it's effects and the first to turn around. Like it or not, the U.S. economy is the oil that lubes the world's economy, without it, everything grinds to a halt eventually.

I agree that the current stimulus plan will not solve the underlying problems. it's just a band aid, albeit a very expensive one, that doesn't get to the root of the disease, which is Lack of savings and spending beyond our means.

We can not deficit spend our way out of every economic situation. All it does is make you deeper and deeper in the hole. Peter Schiff pretty much has it diagnosed right, the solution is very hard to come up with, without a lot of hardship.

new topics

-

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 11 minutes ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 57 minutes ago -

Falkville Robot-Man

Aliens and UFOs: 1 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 1 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 2 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 3 hours ago -

Biden "Happy To Debate Trump"

Mainstream News: 3 hours ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 3 hours ago -

What is the white pill?

Philosophy and Metaphysics: 5 hours ago -

Mike Pinder The Moody Blues R.I.P.

Music: 6 hours ago

top topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 13 hours ago, 21 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 6 hours ago, 7 flags -

Biden "Happy To Debate Trump"

Mainstream News: 3 hours ago, 7 flags -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 1 hours ago, 5 flags -

What is the white pill?

Philosophy and Metaphysics: 5 hours ago, 5 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 2 hours ago, 5 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 3 hours ago, 4 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 3 hours ago, 4 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 9 hours ago, 3 flags -

Falkville Robot-Man

Aliens and UFOs: 1 hours ago, 1 flags

active topics

-

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 804 • : Threadbarer -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 700 • : Thoughtful3 -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 20 • : YourFaceAgain -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works • 26 • : RussianTroll -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness • 0 • : FlyersFan -

Re-election Tactic - JOE BIDEN Hints He May Put Books in the Homes of Black People.

2024 Elections • 30 • : WeMustCare -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order • 3 • : Athetos -

Biden "Happy To Debate Trump"

Mainstream News • 35 • : WeMustCare -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 297 • : cherokeetroy -

Ditching physical money

History • 22 • : StudioNada

2