It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Many of us lived through Housing Crash Part I.

Get ready for Housing Crash Part II.

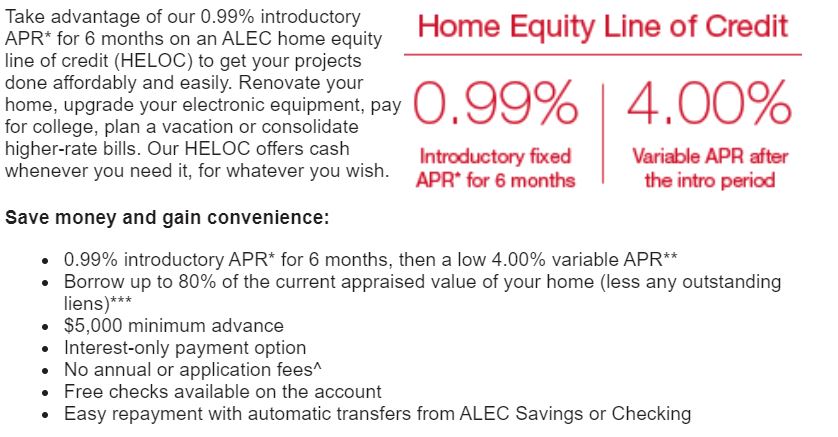

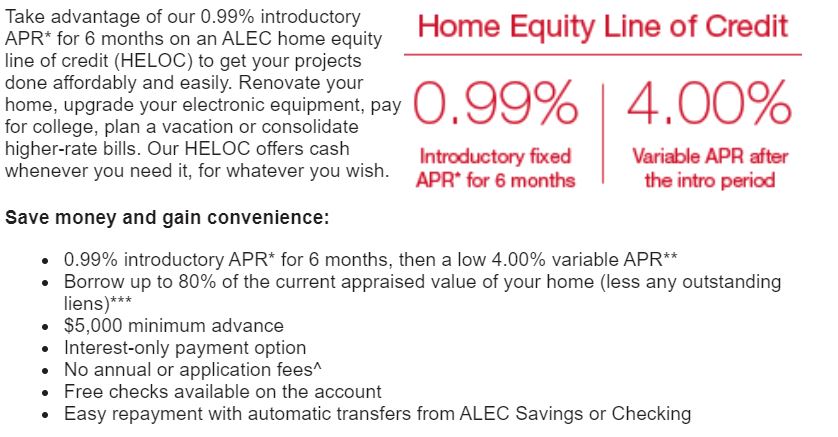

I was sent this by my bank today.

A few months ago I was able to refinance my mortgage to an unbelievable low rate. Pretty

much free money. I could have done a 10 or 15, but I did a 30 year loan because I don't believe I will ever see rates like that again.

The bank tried to convince me to get a home equity loan, they seriously pushed it. I said why would I do that when I could get a low fixed rate for 30 years. I also got in before the added fees to refinancing took place. Not sure if that just a thing in my state or everywhere.

Anyways, enough about me. How many people do you think are taking out these Home Equity loans now? That rate looks catchy doesn't it. What do you think is going to happen when they explode into high interest rates? I see what is going to happen a mile away..

Get ready for another crash.

..See that part, borrow up to 80%%%%%%%!!!!

Rinse, wash, repeat... The older you get the more you see the same crap happening over and over..

Get ready for Housing Crash Part II.

I was sent this by my bank today.

A few months ago I was able to refinance my mortgage to an unbelievable low rate. Pretty

much free money. I could have done a 10 or 15, but I did a 30 year loan because I don't believe I will ever see rates like that again.

The bank tried to convince me to get a home equity loan, they seriously pushed it. I said why would I do that when I could get a low fixed rate for 30 years. I also got in before the added fees to refinancing took place. Not sure if that just a thing in my state or everywhere.

Anyways, enough about me. How many people do you think are taking out these Home Equity loans now? That rate looks catchy doesn't it. What do you think is going to happen when they explode into high interest rates? I see what is going to happen a mile away..

Get ready for another crash.

..See that part, borrow up to 80%%%%%%%!!!!

Rinse, wash, repeat... The older you get the more you see the same crap happening over and over..

edit on 3-3-2021 by JAGStorm because: (no reason given)

originally posted by: AugustusMasonicus

a reply to: JAGStorm

That 4% APR is higher than the rate I got 7 years ago.

My banks is pushing this like I've never seen. I've been with them for decades.

I'm getting weekly emails, and snail mail.

I just get the feeling the cogs are turning in the banking world and it never ends well for most people.

originally posted by: AugustusMasonicus

a reply to: JAGStorm

That 4% APR is higher than the rate I got 7 years ago.

That 4% is probably also in addition to LIBOR. Anyone who refinanced in the past few years should be in a good position from a mortgage perspective.

a reply to: JAGStorm

Sounds like the ol' adjustable rate mortgage scheme to me.

Those that remember how that turned out probably don't have their house anymore. Those that are still in their house, er....the banks house, are probably being held hostage to an upside-down mortgage bank program just to try and save what's left of their credit worthiness.

Never bought a home because I was never in a position to handle the payments. Glad I never did.

People should look into avoiding and eliminating excess liabilities when and where they can. Now is not the time to be spread thin.

Sounds like the ol' adjustable rate mortgage scheme to me.

Those that remember how that turned out probably don't have their house anymore. Those that are still in their house, er....the banks house, are probably being held hostage to an upside-down mortgage bank program just to try and save what's left of their credit worthiness.

Never bought a home because I was never in a position to handle the payments. Glad I never did.

People should look into avoiding and eliminating excess liabilities when and where they can. Now is not the time to be spread thin.

originally posted by: peter_kandra

Anyone who refinanced in the past few years should be in a good position from a mortgage perspective.

Yeah, I can't imagine the amount of time spent and all the paperwork I need to pull together will be worth the fraction of a percent savings and the extended years I'll end up with. Plus my mortgage isn't the bulk of my monthly payment, it's my property taxes.

originally posted by: EternalShadow

Those that remember how that turned out probably don't have their house anymore.

Started with a 12% ARM, went to a 8% ARM then a 5% fixed and finally a sub 3% fixed. If you're smart you can really make out on the deal.

It'll be another year or two but yeah. The housing market will crash again.

originally posted by: BoxerBrawler

It'll be another year or two but yeah. The housing market will crash again.

I have a feeling it will go much deeper than just the housing market, and before labor day.

originally posted by: AugustusMasonicus

a reply to: JAGStorm

That 4% APR is higher than the rate I got 7 years ago.

That says "variable"....lol

Noop..ill pass

originally posted by: KKLOCO

a reply to: JAGStorm

The states that don’t release their lockdown orders soon, will all have mass exodus’s. Which is already happening. Creating major real estate losses. People are leaving California in droves. Mostly moving to AZ and TX.

It is absolutely crazy trying to find a home in AZ right now. My wife and I have been renters for a while now and have a pretty good bankroll saved up but supply is so low and demand so high you have to bid 50k more than a house is worth just to be considered.

My wife and I saw a house we really liked last month sellers were asking 410k we offered 425k, we waived the inspection, we waived the appraisal contingency and we were still outbid by 40k. Someone came in and offered 465k for the home 55k more than the asking price.

My little brother is in the same boat. He made an offer of 350k on an asking price of 325k. Someone came in with a cash offer of 410k. They offered 85k more than the asking price in CASH.

Too many Californians are selling their Craphole homes for a million dollars and pocketing 250k cash then moving here and taking all the good homes we native Arizonans built. I am so SICJ of Californians. I literally hate them. 1 in 4 cars on our freeways are now CA plates and they all drive like # and have Biden bumper stickers.

a reply to: JAGStorm

I work in housing finance.

The first crash was mostly from lack of underwriting creating a lot a fraud / speculation. All the stated and no income verification loans did was invite fraud. It allowed individuals to buy a lot of property without the means to service the debt and when housing values finally crashed, those properties went into foreclosure.

Most of the loan products and other issues that caused the first crash have been corrected. Current mortgage underwriting is far more strict which eliminates insolvent speculators (by in large). You still have some crappy FHA and VA loans at the margins, but by in large mortgage underwriting these days is pretty solid.

The next crash will be because rates have been so low that home values have sky rocketed. Any increase in rates will cause pressure on values. In addition, the dark horse in many cities will be property taxes. With all these high cost blue cities already being insolvent, property taxes are only going to increase. Not only that, many of the cities will find many people simply don't want to live in them anymore which will increase supply (lower prices) as many people are trying to sell and move.

Generally, you should buy a house to live in, not because you are making an investment. Buying really doesn't make sense if your time horizon is less than five years imho. There are better shorter term rental options most of the time, particularly if you are a first time buyer.

I work in housing finance.

The first crash was mostly from lack of underwriting creating a lot a fraud / speculation. All the stated and no income verification loans did was invite fraud. It allowed individuals to buy a lot of property without the means to service the debt and when housing values finally crashed, those properties went into foreclosure.

Most of the loan products and other issues that caused the first crash have been corrected. Current mortgage underwriting is far more strict which eliminates insolvent speculators (by in large). You still have some crappy FHA and VA loans at the margins, but by in large mortgage underwriting these days is pretty solid.

The next crash will be because rates have been so low that home values have sky rocketed. Any increase in rates will cause pressure on values. In addition, the dark horse in many cities will be property taxes. With all these high cost blue cities already being insolvent, property taxes are only going to increase. Not only that, many of the cities will find many people simply don't want to live in them anymore which will increase supply (lower prices) as many people are trying to sell and move.

Generally, you should buy a house to live in, not because you are making an investment. Buying really doesn't make sense if your time horizon is less than five years imho. There are better shorter term rental options most of the time, particularly if you are a first time buyer.

originally posted by: Bluntone22

originally posted by: AugustusMasonicus

a reply to: JAGStorm

That 4% APR is higher than the rate I got 7 years ago.

That says "variable"....lol

Noop..ill pass

Home Equity lines of credit are considered revolving debt (just like a credit card). The rates are determined by a margin plus PRIME RATE. The prime rate right now is 3.25%. So that 4% rate being advertised has a margin of .75% which is pretty good. This is how they get to the 4%. The prime rate moves in lock step with the federal reserve. So when you hear the fed lowers or raises interest rates, the rate on the HELOC will go up or down with fed decisions.

originally posted by: EternalShadow

a reply to: JAGStorm

Sounds like the ol' adjustable rate mortgage scheme to me.

Those that remember how that turned out probably don't have their house anymore. Those that are still in their house, er....the banks house, are probably being held hostage to an upside-down mortgage bank program just to try and save what's left of their credit worthiness.

Never bought a home because I was never in a position to handle the payments. Glad I never did.

People should look into avoiding and eliminating excess liabilities when and where they can. Now is not the time to be spread thin.

The vast majority of people are better off taking an ARM instead of a fixed rate mortgage. The 30 year fixed is generally the most expensive mortgage you can take.

90% of mortgage loans are less than 7 years old. No one keeps a mortgage for 30 years. Most arms are fixed for 5, 7, or 10 years. Only then is the rate subject to adjustment.

If a 7/1 ARM is say 2.5% and a 30 year fixed is 3.5%; unless you plan to keep the home longer than 7 years, it makes no sense to take the 30 year. So most first time buyers who will likely upgrade to a bigger home, should be considering their future plans.

During the first housing crash, the people that got burned by ARMs were sub-prime (bad credit) borrowers. The common product at that time was a 2/28 ARM or a pay option ARM. The 2/28 was fixed for 2 years and then subject to adjustment. The thinking was that people would get those loans, fix their credit, and then get into a traditional mortgage. So they would only have the loans say 2 or 3 years at most.

What actually happened was these people never fixed their credit continuing their same bad financial mismanagement. Stupidly too, banks were putting 3 year prepay penalties on these loans as well. So what would happen is the person couldn't refinance out of the loan. Basically, you got a situation where:

Rates started rising increasing the borrower's payment. Borrower couldn't refinance into traditional mortgage because they never fixed their credit. IN many cases, the subprime loans they were in disappeared too as housing market started correcting. So they were essentially stuck. Not only that, as home values fell, they also couldn't' sell the property for more than they owed. So you owe $200k, but can only sell for $150k. So now you have a short sale.

a reply to: PraetorianAZ

Amen brother. At least 50% of the plates are CA in Sedona.

And yes, they drive AND act like assholes when they aren’t driving.

Self entitlement is through the roof with those people.

Amen brother. At least 50% of the plates are CA in Sedona.

And yes, they drive AND act like assholes when they aren’t driving.

Self entitlement is through the roof with those people.

I took out a loan for a pool, hot tub and outdoor kitchen. The rate was so low it was hard to pass up but it will be paid off in a year. I figured why

the hell not. Done traveling, done with vacations, sports. Creating my own oasis and invite friends over. The little I pay in interests in a year

will be far less than all the trips I would have taken. After I pay this one off getting another one to build the ultimate kitchen and prepper area.

Everything else is paid off. Funny thing is the loan was approved in a day online LOL. This was a lot of money and it was in my account in a day. I do

have outstanding credit and we both do well but that was crazy easy. Pool build starts next month.

a reply to: Edumakated

We are under contract now for our first house and I must say I am scared. If we lose our jobs we are screwed. I suppose we could always rent it out and move to a studio?

Waiting on the appraisal... Its a 30 year VA loan.

We are under contract now for our first house and I must say I am scared. If we lose our jobs we are screwed. I suppose we could always rent it out and move to a studio?

Waiting on the appraisal... Its a 30 year VA loan.

originally posted by: Edumakated

a reply to: JAGStorm

You still have some crappy FHA and VA loans at the margins

Could you please explain what you mean by this statement? I was thinking about getting a VA loan and am curious as to what that might entail. Thanks in advance.

TCB

new topics

-

New House GOP Bill To Send Pro Hamas College Law Breakers to Gaza for 6 Months

Social Issues and Civil Unrest: 45 minutes ago -

Pentagon UFO Hunter Reveals What He Knows About Aliens: Nothing

Aliens and UFOs: 2 hours ago -

President Bidens Health is Declining Faster 5.8.2024 - He Should Stay Home.

2024 Elections: 3 hours ago -

Court of Appeals Agrees to Hear Trump Appeal to Flush Fani Willis

US Political Madness: 4 hours ago -

I "lost" a manuscript.

Rant: 6 hours ago -

Crocodile Reported in Water near a Buckinghamshire village in the UK

Pets: 7 hours ago -

Chris Cuomo, who pushed vaccine shots on CNN, admits Moderna vaccine destroyed his health

Mainstream News: 9 hours ago -

History Shows; Many Crisis Are Artificial I'm Order To Enslave People

Political Conspiracies: 9 hours ago

top topics

-

Chris Cuomo, who pushed vaccine shots on CNN, admits Moderna vaccine destroyed his health

Mainstream News: 9 hours ago, 20 flags -

Court of Appeals Agrees to Hear Trump Appeal to Flush Fani Willis

US Political Madness: 4 hours ago, 8 flags -

History Shows; Many Crisis Are Artificial I'm Order To Enslave People

Political Conspiracies: 9 hours ago, 6 flags -

Crocodile Reported in Water near a Buckinghamshire village in the UK

Pets: 7 hours ago, 6 flags -

President Bidens Health is Declining Faster 5.8.2024 - He Should Stay Home.

2024 Elections: 3 hours ago, 5 flags -

I "lost" a manuscript.

Rant: 6 hours ago, 3 flags -

Pentagon UFO Hunter Reveals What He Knows About Aliens: Nothing

Aliens and UFOs: 2 hours ago, 1 flags -

New House GOP Bill To Send Pro Hamas College Law Breakers to Gaza for 6 Months

Social Issues and Civil Unrest: 45 minutes ago, 1 flags

active topics

-

The Reactionary Conspiracy 13. The plot’s theology.

General Conspiracies • 174 • : MarxistDebunker2 -

History Shows; Many Crisis Are Artificial I'm Order To Enslave People

Political Conspiracies • 5 • : Anunak -

Judge Postpones Trump Classified Docs Trial INDEFINITELY

US Political Madness • 49 • : chr0naut -

Chris Cuomo, who pushed vaccine shots on CNN, admits Moderna vaccine destroyed his health

Mainstream News • 48 • : Anunak -

ATS HOF What Are Some of Your Favorite Threads

Members • 16 • : Coelacanth55 -

New House GOP Bill To Send Pro Hamas College Law Breakers to Gaza for 6 Months

Social Issues and Civil Unrest • 2 • : WannabeeAuCourant -

Mood Music Part VI

Music • 3163 • : paviabari -

Breaking--Hamas Accepts New Cease Fire

Middle East Issues • 291 • : firerescue -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 879 • : daskakik -

To all ATS members of Faith - Prayer request

Religion, Faith, And Theology • 26 • : lilzazz