It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

If anything BTC will bring fairness into the world.

People making ignorant comments do not understand the corruption of centralized banks.

Dollar is not going anywhere. BTC will exist alongside.

BTC has a huge disadvantage which is transaction time. It is not instantaneous like a credit card. Who is going to use it to buy stuff online?

It also uses a lot of power.

People making ignorant comments do not understand the corruption of centralized banks.

Dollar is not going anywhere. BTC will exist alongside.

BTC has a huge disadvantage which is transaction time. It is not instantaneous like a credit card. Who is going to use it to buy stuff online?

It also uses a lot of power.

a reply to: ParasuvO

I agree with this, this is the reality of the situation. The more people who catch on to this reality, the more will switch to crytos. And there is a problem with this scheme, and it is that the first people in will get SUPER rich.

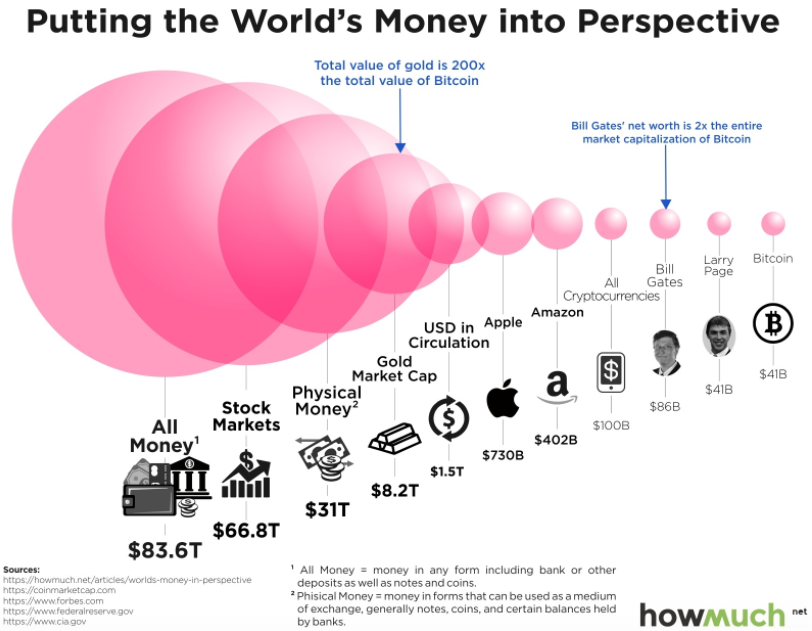

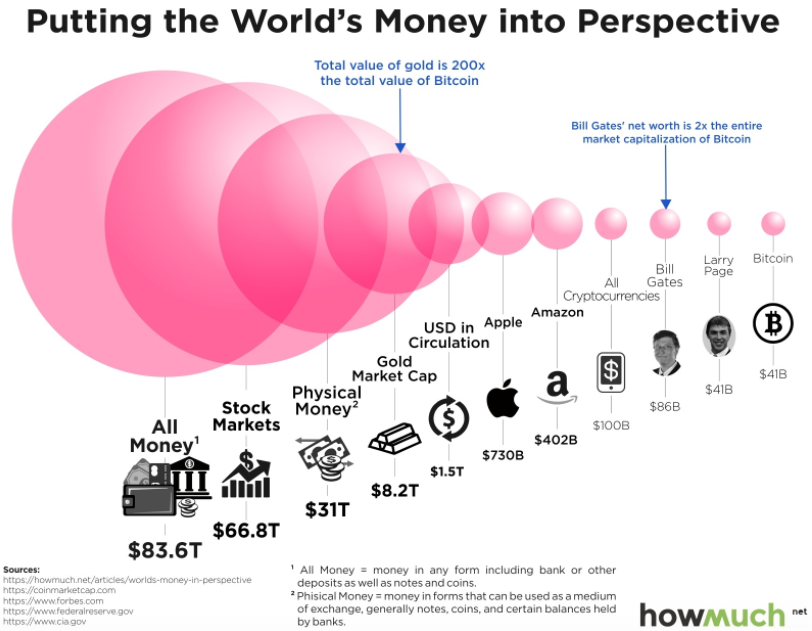

But aren't the first people in already? No. I found this chart. So right now,

Investopedia

Look at this. There are $66.8 trillion dollars being traded in stocks. If people gain wind of the first-in-highest-win crypto scheme, investors will start to rush to get into crypto first. This could potentially drain up to $66.8 trillion dollars from stocks directly into crypto, making its collective value 668x what is it now.

As some posters pointed out, China is mining bitcoin, which is smart for their nation, as they could eclipse the U.S. net worth by using this strategy. Japan is also enjoying a crypto craze, and this will give them a head start on the future world economy.

This situation could lead to war or the fall of the U.S. establishment, so it is worth taking seriously. And the collapse of the U.S. establishment and redistribution of wealth (which also means redistribution of power) is so massive that it would not necessarily be a positive thing.

At any rate, let's say I bought $50 of ethereum today, by the time the stock market shifts into crypto, it could be worth $33,000 in today's dollars. Of course, this is effected by which currencies the U.S. government accepts.

Even if the U.S. government bans certain cryptos, they could still be bought and sold in countries that did not ban them, giving them value.

I agree with this, this is the reality of the situation. The more people who catch on to this reality, the more will switch to crytos. And there is a problem with this scheme, and it is that the first people in will get SUPER rich.

But aren't the first people in already? No. I found this chart. So right now,

Bitcoin is, of course, the most well-known and highly valued cryptocurrency in the the global economy, but it is far from the only one. If we combine the net worth of Bitcoin with that of Litecoin, Monero, Ethereum and all other cryptocurrencies, it comes out close to $100 billion. According to howmuch.net, this is “about as much as the current GDP of Morocco - the 60th-largest economy in the world.” This is staggering, given the relatively recent advent of digital currency.

The $66.8 trillion worth of publicly traded shares at stock exchanges are highly fiduciary, too, and “a run towards or away from stocks would thoroughly deregulate the economy, and nothing more dramatic than a minus sign in front of this [$66.8 trillion] would lead to the collapse of global civilization.”

Investopedia

Look at this. There are $66.8 trillion dollars being traded in stocks. If people gain wind of the first-in-highest-win crypto scheme, investors will start to rush to get into crypto first. This could potentially drain up to $66.8 trillion dollars from stocks directly into crypto, making its collective value 668x what is it now.

As some posters pointed out, China is mining bitcoin, which is smart for their nation, as they could eclipse the U.S. net worth by using this strategy. Japan is also enjoying a crypto craze, and this will give them a head start on the future world economy.

This situation could lead to war or the fall of the U.S. establishment, so it is worth taking seriously. And the collapse of the U.S. establishment and redistribution of wealth (which also means redistribution of power) is so massive that it would not necessarily be a positive thing.

At any rate, let's say I bought $50 of ethereum today, by the time the stock market shifts into crypto, it could be worth $33,000 in today's dollars. Of course, this is effected by which currencies the U.S. government accepts.

Even if the U.S. government bans certain cryptos, they could still be bought and sold in countries that did not ban them, giving them value.

edit on 06amSat, 06 Jan 2018 06:16:34 -0600kbamkAmerica/Chicago by darkbake because: (no reason given)

a reply to: TinfoilTP

That is a looming possibility.

Already many international forums are bringing it up as being possibly used in "criminal" operations. Of course that is not the real concern of the banks.

These are already signs of it being attacked.

Ultimately you cannot kill it because its use is independent of laws. I believe (I am not certain) it can be used as long as there is an internet.

Also it being shut down will raise eyebrows and add to the unpopularity of our world government.

That is a looming possibility.

Already many international forums are bringing it up as being possibly used in "criminal" operations. Of course that is not the real concern of the banks.

These are already signs of it being attacked.

Ultimately you cannot kill it because its use is independent of laws. I believe (I am not certain) it can be used as long as there is an internet.

Also it being shut down will raise eyebrows and add to the unpopularity of our world government.

edit on 6-1-2018 by nOraKat because: (no

reason given)

a reply to: nOraKat

Right, if bankers and the established government try to shut crypto down, it will look as if they are trying to save their asses. With the financial crisis of 2008, this will look dirty. People want to invest their money where they see fit! Why should they store their money in banks and stocks when they can get higher returns storing it in crypto?

The best course of action might be to make an official fed coin? There is value in the cryptocurrencies because they have better technology than paper money and even traditional digital money.

Unfortunately, our government could operate too slowly to react to this crisis in time.

Right, if bankers and the established government try to shut crypto down, it will look as if they are trying to save their asses. With the financial crisis of 2008, this will look dirty. People want to invest their money where they see fit! Why should they store their money in banks and stocks when they can get higher returns storing it in crypto?

The best course of action might be to make an official fed coin? There is value in the cryptocurrencies because they have better technology than paper money and even traditional digital money.

Unfortunately, our government could operate too slowly to react to this crisis in time.

edit on 06amSat, 06 Jan 2018 06:22:51

-0600kbamkAmerica/Chicago by darkbake because: (no reason given)

originally posted by: skunkape23

I'll trade two chickens for a six-pack.

A goat for a jar of moonshine.

Last I checked, a pair of mint obama kidz toke ‘n’ twerk beanies, even if the tags are slightly bent but

not creased,

will fetch a pound of the devil’s lettuce. This has alawys been and will always be.

If things go south, at least

you’re left holding something useful and not an invisble bag full of wasted electricity, lol.

Sure, if you can hold it in your hand, it too mean a paid fascist with a badge can shoot you in the head and take it away, so in that respect, crypto is useful. Cops are pretty simple animals. If they can see it, they will take it, or kill you trying (ie., life, liberty, property/cash, a grin etc). But all the dealers I run with convert back to fat stacks, even before the engine is cold after a hard run.

It is kinda funny. I smile as I imagine Underdog Shoeshine Boy trying to bite into a bitcoin....but I get wry mental pleasure picturing pigs who can see the smoke and smell the aromatic heterocyclic terpenes~lots and lots of terpenes, and they have the room cordoned off, the specks in cuffs and at gunpoint, but being unable to find even a trichome or twig. That is sorta why btc (and the buttplug craze) is hot. Dogs cannot

smell a bitcoin wallet...oh, wait a minute.

# 929

edit on 6-1-2018 by TheWhiteKnight because: (no reason given)

edit on 6-1-2018 by TheWhiteKnight because: (no reason

given)

Crypto currency will never replace the money we have now(fiat).

Simple fact once it's been mined (bitcoin). That's all she wrote.

The fed can't print more out of thin air.

All crypto is deflationary by nature.

All fiat is inflationary by nature.

Apples to oranges.

Simple fact once it's been mined (bitcoin). That's all she wrote.

The fed can't print more out of thin air.

All crypto is deflationary by nature.

All fiat is inflationary by nature.

Apples to oranges.

a reply to: worldstarcountry

The ease seems to only go to the elite.

Crypto pushes questions that people ask but are poo pood for saying.

One question is having to be a certified "investor" to take part in certain investments. Certified usually means having big $$$ and being invited to the investment party. Wealth gets wealth.

Another is acquisition of wealth. See the very very very wealthy's families do not have to work, they simply exist because great grand dad "found oil" (or diamonds or ran booze or founded a really good company). Then the family simply uses wealth to create wealth, and there are tons of ways that they and only they (for the most part) could make the wealth soar to new heights, sometimes with lobby $$$.

The introduction of crypto is a little guy's dream. I still can't believe that I can invest for pennies in a company that is going to stick a shiv into the back of the traditional money sending system like Western Union (ripple).

OR

I can invest in a company that is going to stick a shiv into the backs of almost all snooping govt officials that poop all over the constitution by tapping every thing I type (like right now) by investing in Digitalnote.

It is a scary new world, but it is scary because our Fed notes are not backed by anything. That is why we are $21,000,000,000,000,000 in debt.

Did you get a chunk of that debt? The bankers did in the 2008 goat screw, and as long as there is no gold or silver backing our $$$. There is going to be a crypto looking to satisfy a person who can see we are doomed with the Fed notes. Not because it is a bad system, but because of bad people (greed).

.

The ease seems to only go to the elite.

We are being lured into our own demise with the promise of easy wealth. Tell us, when has wealth ever been an easy acquisition in the history of man? When has the promise of it being easy been nothing more than a transparent lie?

Crypto pushes questions that people ask but are poo pood for saying.

One question is having to be a certified "investor" to take part in certain investments. Certified usually means having big $$$ and being invited to the investment party. Wealth gets wealth.

Another is acquisition of wealth. See the very very very wealthy's families do not have to work, they simply exist because great grand dad "found oil" (or diamonds or ran booze or founded a really good company). Then the family simply uses wealth to create wealth, and there are tons of ways that they and only they (for the most part) could make the wealth soar to new heights, sometimes with lobby $$$.

The introduction of crypto is a little guy's dream. I still can't believe that I can invest for pennies in a company that is going to stick a shiv into the back of the traditional money sending system like Western Union (ripple).

OR

I can invest in a company that is going to stick a shiv into the backs of almost all snooping govt officials that poop all over the constitution by tapping every thing I type (like right now) by investing in Digitalnote.

It is a scary new world, but it is scary because our Fed notes are not backed by anything. That is why we are $21,000,000,000,000,000 in debt.

Did you get a chunk of that debt? The bankers did in the 2008 goat screw, and as long as there is no gold or silver backing our $$$. There is going to be a crypto looking to satisfy a person who can see we are doomed with the Fed notes. Not because it is a bad system, but because of bad people (greed).

.

edit on 6-1-2018 by seasonal because: (no reason given)

originally posted by: scubagravy

Would a world wide EMP screw bitcoin ?

A WW emp would screw every form of wealth you cannot shoot, eat or heat with.

a reply to: neo96

Thanks for joining the discussion, Neo. I hear you know your stuff. So a cryptocurrency like Bitcoin will continue to rise in value over time, doesn't that make it a more attractive investment to everyone else than cash?

So why would a smart person hold on to cash?

I'm guessing over time, more and more people will catch on.

Thanks for joining the discussion, Neo. I hear you know your stuff. So a cryptocurrency like Bitcoin will continue to rise in value over time, doesn't that make it a more attractive investment to everyone else than cash?

So why would a smart person hold on to cash?

I'm guessing over time, more and more people will catch on.

a reply to: seasonal

I agree, thank you. This new system allows the little guy to invest his or her money and make money with money, just like the banks usually do with the money that everyone gives the FOR NEARLY FREE to do the same thing.

One problem is if the bankers figure out this scheme, they might try to shut it down. I have a thread here:

Cryptocurrency and Decentralized Business Models

This thread is a new business model that I am still working on.

Basically, anyone can mint a new ico and if their idea is good enough, it will catch on, causing more people to invest in it instead of leaving their money in savings. If the project is good enough and adds more value to society than it drains, then everyone involved should see the benefits of that, especially if workers are paid in the coin. In the decentralized model, workers and investors can communicate on forums or on Discord.

Those first into an investment will have a greater say, as they got their coins cheaper, or even for free if they were the initiators. If a new coin first attracts those who need something, like a place to live, or want something, like a new superhero movie, those initial investors will have the most say for their money.

I'm still working on the details of a system like this.

I agree, thank you. This new system allows the little guy to invest his or her money and make money with money, just like the banks usually do with the money that everyone gives the FOR NEARLY FREE to do the same thing.

One problem is if the bankers figure out this scheme, they might try to shut it down. I have a thread here:

Cryptocurrency and Decentralized Business Models

This thread is a new business model that I am still working on.

Basically, anyone can mint a new ico and if their idea is good enough, it will catch on, causing more people to invest in it instead of leaving their money in savings. If the project is good enough and adds more value to society than it drains, then everyone involved should see the benefits of that, especially if workers are paid in the coin. In the decentralized model, workers and investors can communicate on forums or on Discord.

Those first into an investment will have a greater say, as they got their coins cheaper, or even for free if they were the initiators. If a new coin first attracts those who need something, like a place to live, or want something, like a new superhero movie, those initial investors will have the most say for their money.

I'm still working on the details of a system like this.

edit on 06amSat, 06 Jan 2018 09:11:23 -0600kbamkAmerica/Chicago by darkbake because:

(no reason given)

edit on 06amSat, 06 Jan 2018 09:12:01 -0600kbamkAmerica/Chicago by darkbake because: (no reason given)

originally posted by: neo96

It will change someday.

All systems of money does.

Yes, sir, I believe it will change someday as well. I was worried for a minute that the change would happen so fast that it would cripple anyone not able to get out of cash soon enough. Do you think it will be slower than that?

There’s a looming problem with bitcoin as well. As it is a a decentralized currency it relies on users/miners to process transactions into the

global ledger.

Right now it would cost you 32 dollars for a 2 dollar coffee. 30 transaction fees

This transaction fee will only grow as the blocks get harder to mine.

There is some technology going to be implemented to expand the block sizes for more transactions but how would that be any different than “quantitative easing”

Fiat currency is based on the GDP of the country, so when you hear someone say..it was detached from the gold standard! It’s just paper!...that is a half truth because as we know, there is more to quantifying wealth and stores of wealth than one single metal.

Right now it would cost you 32 dollars for a 2 dollar coffee. 30 transaction fees

This transaction fee will only grow as the blocks get harder to mine.

There is some technology going to be implemented to expand the block sizes for more transactions but how would that be any different than “quantitative easing”

Fiat currency is based on the GDP of the country, so when you hear someone say..it was detached from the gold standard! It’s just paper!...that is a half truth because as we know, there is more to quantifying wealth and stores of wealth than one single metal.

edit on 6-1-2018 by ADUB77

because: Spelling

a reply to: ADUB77

All right, so I was thinking about a solution to this. There might end up being millions of different coins. Ones like Bitcoin would be where to store your assets with less risk, however, you will pay a higher transaction fee and there will be more transaction time.

However, once currencies spring up to represent something local, then those could branch out into sub-currencies, etc. Using this mechanism, an investor could invest in the city of Seattle, for example, and maybe the Seattle coin (which would have a local mining colony) would have a faster transaction time and be usable in all Seattle markets.

Think about it, this is where we are headed. The last time I checked, financial experts had never seen anything like cryptocurrency before and had no idea what kinds of patterns or whatever it has. I've been analyzing it myself.

All right, so I was thinking about a solution to this. There might end up being millions of different coins. Ones like Bitcoin would be where to store your assets with less risk, however, you will pay a higher transaction fee and there will be more transaction time.

However, once currencies spring up to represent something local, then those could branch out into sub-currencies, etc. Using this mechanism, an investor could invest in the city of Seattle, for example, and maybe the Seattle coin (which would have a local mining colony) would have a faster transaction time and be usable in all Seattle markets.

Think about it, this is where we are headed. The last time I checked, financial experts had never seen anything like cryptocurrency before and had no idea what kinds of patterns or whatever it has. I've been analyzing it myself.

edit on 06amSat, 06 Jan 2018 09:40:01 -0600kbamkAmerica/Chicago

by darkbake because: (no reason given)

edit on 06amSat, 06 Jan 2018 09:49:01 -0600kbamkAmerica/Chicago by darkbake because: (no reason given)

Some coins could have a GDP if they were tied to a city or business, for example. This is where I think we should go. Great point, it made me think.

edit on 06amSat, 06 Jan 2018 09:50:36 -0600kbamkAmerica/Chicago by darkbake because: (no reason given)

I think it would be interesting to explore the dollar backed by A crypto.

Best of both worlds.

I think the future is some type of hybrid system.

Best of both worlds.

I think the future is some type of hybrid system.

edit on 6-1-2018 by neo96 because: (no reason given)

a reply to: neo96

Yeah that is exactly what I was thinking just now. Then it would be backed by a GDP. Although I like the idea of being able to have coins for each city and business, too, and exchanges.

Yeah that is exactly what I was thinking just now. Then it would be backed by a GDP. Although I like the idea of being able to have coins for each city and business, too, and exchanges.

edit on 06amSat, 06 Jan 2018 09:49:47 -0600kbamkAmerica/Chicago by darkbake because: (no reason

given)

There is literally so much money invested not only in the stock market but in other ventures and holdings.

The crypto market is just a blip on the radar. It only seems so massive because of all of the media attention and hype. I know that a trillion dollar industry seems like a big blip on the radar, but remember people want to turn the crypto that they make back into dollars also.

What do they do with those dollars? They buy tangible goods, which in turn drives stock prices and the demand for those products up. Say Johnny puts $10,000 in the crypto market. A week later he sells some crypto makes $100,000 and puts that back into his American bank account. Well now Johnny wants to add to his computing power to be able to keep up with the ever faster internet exchanges. He builds a better computer setup at the tune of $7,000. This computer company just sold $7,000 worth of its goods to someone who wouldn't have spent that money without his gains from crypto. Not only that he decided to purchase that $80,000 Ford truck with all of the bells and whistles. Ford wouldn't have ever sold that truck to Johnny if he hadn't made all of that money in the crypto market.

I believe that it will drive all world markets up, not down. There is literally so much money hidden and in circulation that a lot of people do not need to withdraw from the stock market to invest in crypto, hell Johnny had that $10,000 under his bed beside his shotgun.

Crypto is the shiny new toy to play with, but in the long run kids end up going back to the old reliable toy(cash) to make them feel warm and fuzzy.

The crypto market is just a blip on the radar. It only seems so massive because of all of the media attention and hype. I know that a trillion dollar industry seems like a big blip on the radar, but remember people want to turn the crypto that they make back into dollars also.

What do they do with those dollars? They buy tangible goods, which in turn drives stock prices and the demand for those products up. Say Johnny puts $10,000 in the crypto market. A week later he sells some crypto makes $100,000 and puts that back into his American bank account. Well now Johnny wants to add to his computing power to be able to keep up with the ever faster internet exchanges. He builds a better computer setup at the tune of $7,000. This computer company just sold $7,000 worth of its goods to someone who wouldn't have spent that money without his gains from crypto. Not only that he decided to purchase that $80,000 Ford truck with all of the bells and whistles. Ford wouldn't have ever sold that truck to Johnny if he hadn't made all of that money in the crypto market.

I believe that it will drive all world markets up, not down. There is literally so much money hidden and in circulation that a lot of people do not need to withdraw from the stock market to invest in crypto, hell Johnny had that $10,000 under his bed beside his shotgun.

Crypto is the shiny new toy to play with, but in the long run kids end up going back to the old reliable toy(cash) to make them feel warm and fuzzy.

new topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 3 hours ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 9 hours ago -

Maestro Benedetto

Literature: 11 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 9 hours ago, 28 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 16 hours ago, 8 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 3 hours ago, 8 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 14 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 17 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 15 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 11 hours ago, 3 flags -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 17 hours ago, 1 flags -

Maestro Benedetto

Literature: 11 hours ago, 1 flags

active topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 5 • : Myhandle -

Supreme Court to decide if states can control fate of social media

Education and Media • 14 • : SMMPanelPro -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 35 • : Lazy88 -

Definitive 9.11 Pentagon EVIDENCE.

9/11 Conspiracies • 426 • : Lazy88 -

Alternate Electors vs Fake Electors - What is the Difference.

2024 Elections • 117 • : ADVISOR -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 691 • : Imbackbaby -

Victoria government has cancelled the commmonwealth games, no money.

Regional Politics • 3 • : nazaretalazareta -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 19 • : ADVISOR -

When an Angel gets his or her wings

Religion, Faith, And Theology • 22 • : AcrobaticDreams1 -

King Charles 111 Diagnosed with Cancer

Mainstream News • 321 • : FlyersFan