It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

things keep getting allot more expensive. wages go up very little.

i remember back around 2000 i was making around 9 bucks a hour and i felt like i was doing ok.. i had my own apartment and it always seemed like i had money for fun or things i wanted plus i had some money to put in the savings too not much but i have a few thousand bucks saved up which was probably good for a 20 year old that liked to buy expensive crap

now making around 15 bucks a hour even when pinching your penny feels like you are are poor and cant afford much extra and you only wish you could buy expensive crap lol

i remember back around 2000 i was making around 9 bucks a hour and i felt like i was doing ok.. i had my own apartment and it always seemed like i had money for fun or things i wanted plus i had some money to put in the savings too not much but i have a few thousand bucks saved up which was probably good for a 20 year old that liked to buy expensive crap

now making around 15 bucks a hour even when pinching your penny feels like you are are poor and cant afford much extra and you only wish you could buy expensive crap lol

originally posted by: tadaman

a reply to: AugustusMasonicus

Also, cash still exists. I havent had a working bank account in almost a year.

Congrats, BOA f'd me over about 10 years ago, haven't had a bank account since. I use a reloadable Visa to pay stuff online, and have a credit card, amazingly, my credit score has improved greatly.

originally posted by: nOraKat

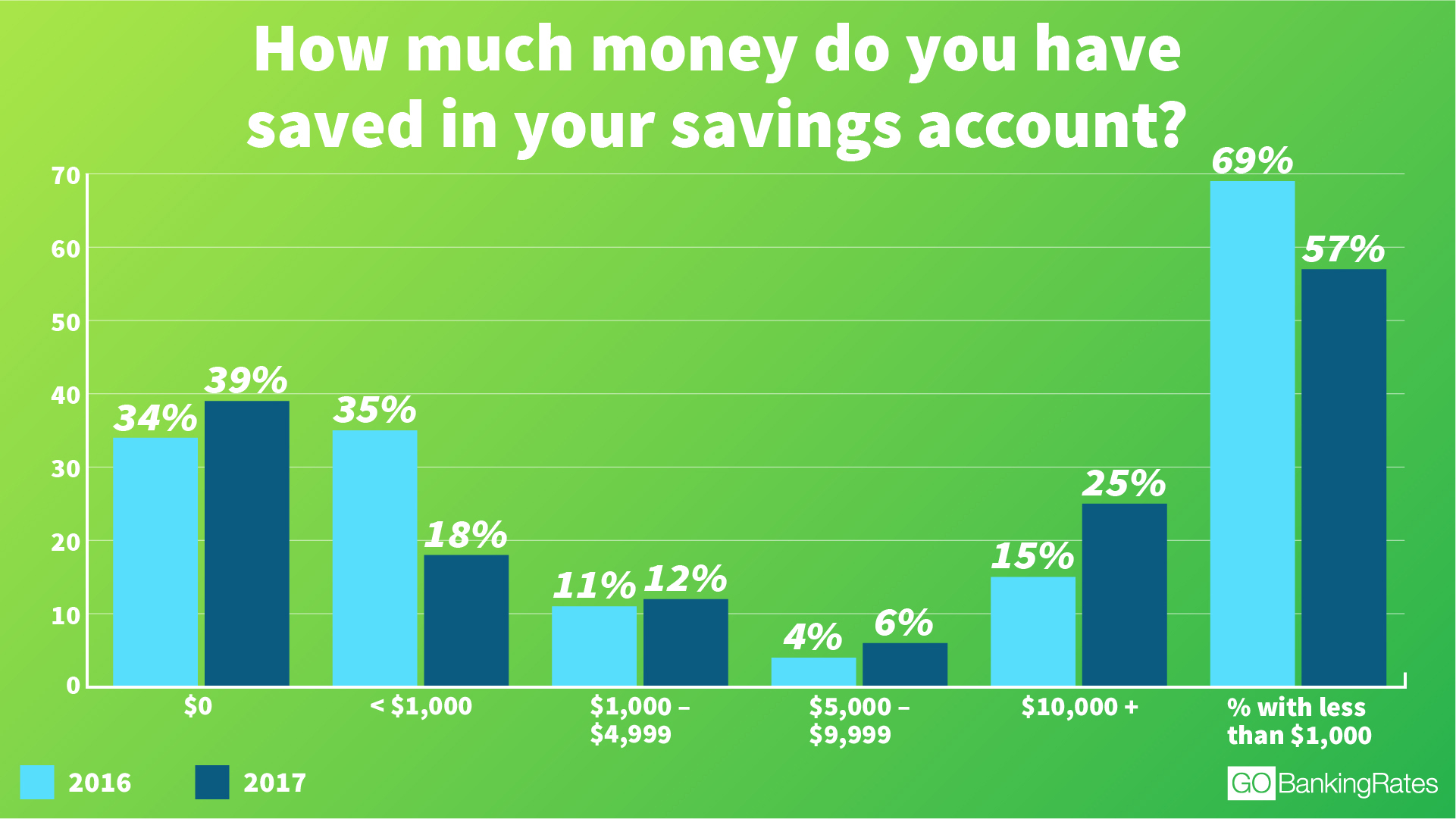

According to several articles, more than half (57 %) of the US population has less than $1000 in total savings in 2017, and 39% have $0 savings!

Well if you're broke, at least you're not alone.

I was very surprised to find that out.

It tells you a lot about our current economy despite other reports.

Here's how much money Americans have in their savings accounts

6 in 10 Americans don't have $500 in savings

Most Americans have less than $1,000 in savings

How Much Money Does the Average American Have in Their Bank Account?

I quoted the OP's opening thread so that further along here can be appreciated the points that he listed along with what I have to add which is: Those statistics and figures pale in comparison with the credit card debt that most of those same people labor under. Credit cards give a false sense of security and are too easily abused.

originally posted by: Lucidparadox

originally posted by: olaru12

If you didn't get on the bitcoin train at the beginning....then you are riding a donkey.

Money is so 2001

Im 1 step ahead of you.

You forget, the house always wins.

I have 20,350 Ripple XRP

Im on the Ripple train

Thanks for the tip!! That looks like an interesting choo choo!!!!

What is your feelings on Monero, Dash and TBL??

Should we diversify? Like in the Fake money mkts.

edit on 26-11-2017 by olaru12 because: (no reason given)

There is no way to fix this kind of economy disaster,wealth gap is far far worse after the bailout...The debt is crazy to even believe..

I'm not sure how much I have in savings to be honest. I have over 100k in retirement funds though.

originally posted by: AugustusMasonicus

originally posted by: queenofswords

Maybe people prefer to purchase real estate or other investment assets rather than stick it in a low-interest savings account where all it does is just sit there.

Exactly. You are never going to grow your investment with a 1.5% APY.

# I would love a 1.5% APY savings account...I think mine is like .01% or some bull#

I think the term savings must refer to a specific account type called savings where banks pay you almost nothing. I looked up average IRA amounts for

Americans and the averages ranged from around $13,000 for a 20 something up to about $200,000 plus for a 70 year old. I did not look up 401k's unless

that was included.

www.fool.com...

I will admit that I have had zero in a savings account for many years. I have checking accounts and Ira accounts. Who wants a savings account that pays almost nothing? Not many.

www.fool.com...

I will admit that I have had zero in a savings account for many years. I have checking accounts and Ira accounts. Who wants a savings account that pays almost nothing? Not many.

originally posted by: AnonymousMoose

# I would love a 1.5% APY savings account...I think mine is like .01% or some bull#

I was being very generous with some promotional rates that are out there. You can move it around to capture enhanced rates but I think the time is not worth the result when you can have it in higher yield instruments.

a reply to: rickymouse

That's net worth, the aims of this study are liquidity.

For net worth, the median net worth is about $80k. but a large portion of the population does have a negative net worth.

That's net worth, the aims of this study are liquidity.

For net worth, the median net worth is about $80k. but a large portion of the population does have a negative net worth.

originally posted by: Dfairlite

a reply to: rickymouse

That's net worth, the aims of this study are liquidity.

For net worth, the median net worth is about $80k. but a large portion of the population does have a negative net worth.

The figures on net worth are purposely skewed. Even your house value drops considerably in a depression if it effects the housing market. A half million dollar house can drop down to fifty thousand if things get bad. To keep the house from getting repossessed, it draws from your savings.

Everyone should strive to have at least six months of money saved incase something happens. Otherwise you can lose your house and all equity in it. You can lose your car worth fifteen grand because you cannot make your payment and you only owe three grand on it. I have seen this kind of thing happen dozens of times in my life, people I knew personally went into a headspin and crashed.

originally posted by: Skywatcher2011

Are these stats taken AFTER BLACK FRIDAY store sales?

In a non joking way we are a consumer society and so every spends spends spends like there ain't no end....

Just face it the US is doomed to fail. We all been hoodwinked by federal reserve banking cartel. So with that we are paying inflated prices for basic

essentials. Housing, Food, Water, Electricity, Transportation, Medical. Just about everything has increased. Solution to that was to increase wages,

less hours, more taxes and kick the can down the road and pay more for less. Welcome to the game of survival, crime, tyranny, poverty, war and death.

That's what I see that comes next. Any questions?

a reply to: nOraKat

Less than $1000 doesn't tell the full story.

money.cnn.com...

6 in 10 people in the US do not have the financial resources (available credit or savings) to cover an unexpected $400 bill.

That was as of the beginning of this year.

Less than $1000 doesn't tell the full story.

money.cnn.com...

6 in 10 people in the US do not have the financial resources (available credit or savings) to cover an unexpected $400 bill.

That was as of the beginning of this year.

originally posted by: AugustusMasonicus

a reply to: nOraKat

Does that take into account people like myself who don't have a savings account because a savings account is a joke when it comes to investing?

Never been asked the survey questions myself, but from what I understand they ask about assets. Usually that's cash on hand, in savings accounts, in checking accounts, and so on. In some cases, such as my link in the previous post it even takes into account available limits on credit cards.

Let that sink in for a moment. Including available credit, 6 in 10 people in the US cannot cover an unexpected $400 expense.

new topics

-

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 41 minutes ago -

Falkville Robot-Man

Aliens and UFOs: 55 minutes ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 1 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 2 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 2 hours ago -

Biden "Happy To Debate Trump"

Mainstream News: 3 hours ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 3 hours ago -

What is the white pill?

Philosophy and Metaphysics: 5 hours ago -

Mike Pinder The Moody Blues R.I.P.

Music: 5 hours ago -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 8 hours ago

top topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 13 hours ago, 21 flags -

Biden "Happy To Debate Trump"

Mainstream News: 3 hours ago, 7 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 5 hours ago, 7 flags -

What is the white pill?

Philosophy and Metaphysics: 5 hours ago, 5 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 2 hours ago, 5 flags -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 1 hours ago, 5 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 3 hours ago, 4 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 2 hours ago, 4 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 8 hours ago, 3 flags -

Falkville Robot-Man

Aliens and UFOs: 55 minutes ago, 1 flags

active topics

-

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 801 • : Vermilion -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order • 3 • : Athetos -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 17 • : WeMustCare -

Biden "Happy To Debate Trump"

Mainstream News • 35 • : WeMustCare -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 297 • : cherokeetroy -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 699 • : Thoughtful3 -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works • 25 • : SchrodingersRat -

Ditching physical money

History • 22 • : StudioNada -

Falkville Robot-Man

Aliens and UFOs • 3 • : KKLOCO -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest • 10 • : xuenchen