It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Mind reset please. this IS NOT about America.

Its about worldwide debt, so please put out QE, China out of equation. Dont pollute the thread with your country problem. Stick with the subject - worldwide.

On with the show.

The debt need not to be paid in full, but in return, obey future orders. Which will bring us another ...something like this also.

I'm agree to the mentioning of single monetary instruments, with USA trillions of dollar debt, entire world is bound to collapse. Can we list up "standalone" country that might able to handle the swing ? I'm strating with the obvious

North Korea

Iceland

Its about worldwide debt, so please put out QE, China out of equation. Dont pollute the thread with your country problem. Stick with the subject - worldwide.

On with the show.

The debt need not to be paid in full, but in return, obey future orders. Which will bring us another ...something like this also.

I'm agree to the mentioning of single monetary instruments, with USA trillions of dollar debt, entire world is bound to collapse. Can we list up "standalone" country that might able to handle the swing ? I'm strating with the obvious

North Korea

Iceland

I mentioned countries plural, and I made no reference to quantitative easing. Do you pick and choose what you want to read?

DeadSeraph

reply to post by xuenchen

So the entire planet is $100 trillion in debt. In debt to whom? Why is the whole world in debt to a handful of people? Who gave them the keys to the earth? This system is a joke, and they know it. Laughing all the way to the banks they themselves created, spending money they print at will, while enslaving the human race with interest rates on debts we will never be able to pay back. Must be nice to issue currency out of thin air and then demand to be paid back interest for it after you "lend" it out.

The best part about it? They drill it into our heads from the time we are young that this is the only way it can work. There are no better systems. This is as good as it gets. You just have to play by the rules and accept the way it is.edit on 9-3-2014 by DeadSeraph because: (no reason given)

You summed it up, they drill it into our heads, then they distract with all of the basic animal instincts. Sex, Violence, and Fear! It truly is a remarkable system that they have created, built into every sytem that they profit off of us in.

Now what gives me the neverending optimism that I have is that even with their attempts to keep the next generation from realizing its true potential through drugs, education that only develops the left side of the brain, entertainment that makes anysense of us being divine beings laughable, we still see the collective humanity coming together. We are remembering who and what we are, and sure there is going to be some upheaval with the collective karma of the world there is no way for there not to be, however as it all works itself out we will see the new systems spring up and inevitably the control grid will cease. It has already lost its effectiveness, and we are seeing them cling to the last vantage of hope they have FEAR.

brazenalderpadrescorpio

I mentioned countries plural, and I made no reference to quantitative easing. Do you pick and choose what you want to read?

What made you think I'm picking on you ? Because I'm posting after you ?

I'm referring to the thread in general. Just a reminder to stick to the topic. Because this is a VERY important topic.

---------------------------------------------------------------------------------------------

Ok, back to topic, heres few more probable winner and losers

Winners

Hong Kong --- 3.34% --- being China product gateway, business will be slow

Russia Woahhh----10.06%, recession ? whats that ?

Australia ---- 19.28% --- life is normal here

Norway --- 29.56% -- not hurt by recession

South Korea --- 37% --- looks OK, but with heavy dependency on gadget export, who knows

Japan --- 16.79% --- I guess nothing much hurt them, probably will still keep their 0% interest

Swiss --- 17.57% --- what do you expect ? Its swiss!

Fair fairen

Germany --- 79.60% not so shabby, still OK

Losers

Singapore at whooping 115.37%, its hard to not to notice

USA 103.18% --- expect depression

UK --- 87.09% -- severely affected

France --- 94.40% -- ouch, expect some stone throwing

Belgium ---- 105.76% --- Uhhh, hidden story ?

Lets check how the PIIGS countries performing, weirdly Turkey 44% performing nice, I think I dont need to add Cyprus to the PIIGS, its sort of part of Greece (regional)

Cyprus -- 2,031.20% -- hey how its doing ? (punched)

Greece --- 188.19% --- we know how it went

Portugal --- 131.19% --- get out fast

Ireland --- 107.58% --- severe, throwing stones

Italy --- 136.43% --- molotov cocktail prepared

Spain --- 96.01% --- tire ready to burn

All these from the world debt clock, focusing on the debt to GDP ratio. OP source is correct, big ones is having problem, those who supporting/working with them will be affected, however there a a few which will not be affected by the fall.

Things to notice -

Russia have very low debt to GDP, unexpected.

Belgium have problem, but no news about them, unexpected.

EU countries still have unfinished problem with the PIIGS

Lots of country not listed on that page

All other countries have variable degree of exposure to the fall.

It will depend on their own method, either survive or reform.

edit on 10-3-2014 by NullVoid because: (no reason given)

reply to post by xuenchen

Oh no I agree on the debt....excluding Norway...I think they are in the green...but if everything collapses its going to be countries like Cuba who have really gone to organic farming and solar energy and things like that....a large portion of their infrastructure is self sustaining...now on their ability to get parts to maintain and fix things that may be a different question entirely...they barely have tools.

Oh no I agree on the debt....excluding Norway...I think they are in the green...but if everything collapses its going to be countries like Cuba who have really gone to organic farming and solar energy and things like that....a large portion of their infrastructure is self sustaining...now on their ability to get parts to maintain and fix things that may be a different question entirely...they barely have tools.

reply to post by cosmicexplorer

Well, to be self sustaining is half of the war won already. I think youre right with Norway, I filter those thats under ~70% cause the effect is not so much. But the ones "unexpected" is really shocking to me. I did not expect that at all.

I think I gonna go to my trusted indicator in few days to see how major 8 is performing, I dont expect them to move at all. Last time I check (a month ago), USD is still lingering in the middle, still doing OK!

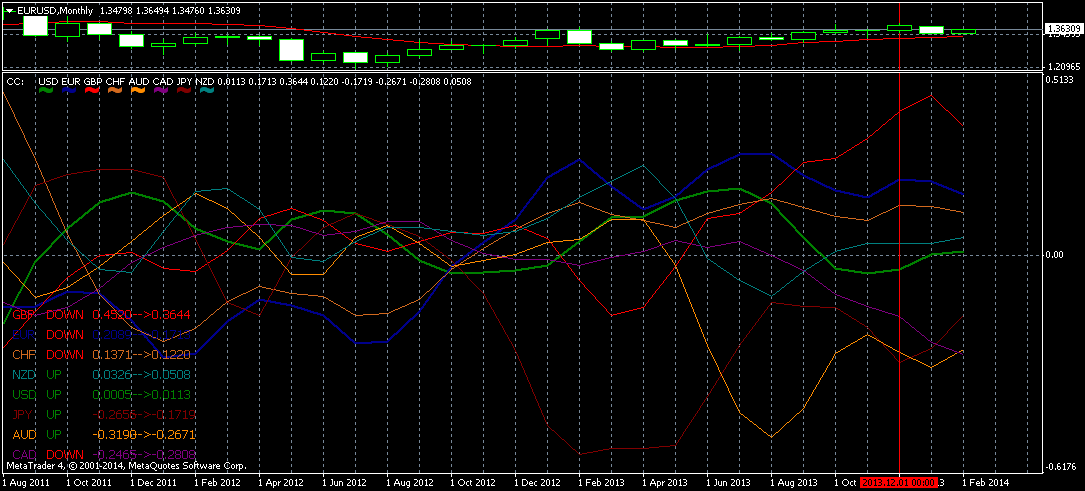

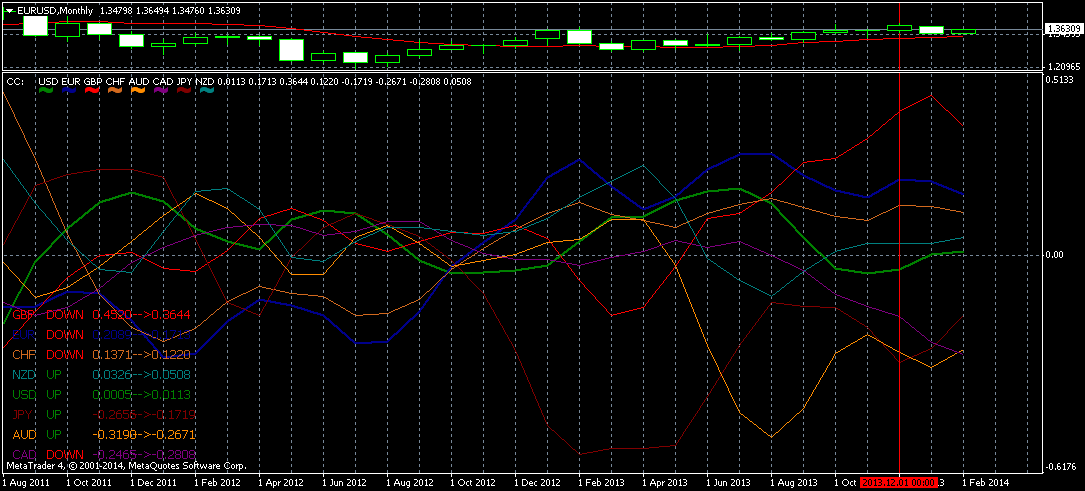

Here, a monthly chart, you see GBP, EUR and CHF gonna have problem soon, bad year for them. With that, I think recession, if happen at all, start with Europe.

Heres my assumption/scenario:

PIIGS country will continue to bring down EUR thus affecting France and other EU nation.

USD will have improvement in value, brought it to top.

When EUR accelerate its down fall, then USD will start sinking, from top of course.

While EUR still on its drop journey, USD will follow

While all thse happening, AUD and CAD will appreciate slowly in value, reflecting what they relate/represent - Gold and Oil.

Gold and Oil will appreciate in value, Gold quite close to hitting resistance now, buy buy buy!. Oil I dont know, dont care.

I'm expecting the event start from circa June (the GBP is falling now and EUR will fall later) and December for the USD effect, by Dec 2015, a year after, the recession should be partially over.

But that just my assumption based on this chart (gold chart not displayed).

Always follow the money. So, enjoy reading chart guys!

Well, to be self sustaining is half of the war won already. I think youre right with Norway, I filter those thats under ~70% cause the effect is not so much. But the ones "unexpected" is really shocking to me. I did not expect that at all.

I think I gonna go to my trusted indicator in few days to see how major 8 is performing, I dont expect them to move at all. Last time I check (a month ago), USD is still lingering in the middle, still doing OK!

Here, a monthly chart, you see GBP, EUR and CHF gonna have problem soon, bad year for them. With that, I think recession, if happen at all, start with Europe.

Heres my assumption/scenario:

PIIGS country will continue to bring down EUR thus affecting France and other EU nation.

USD will have improvement in value, brought it to top.

When EUR accelerate its down fall, then USD will start sinking, from top of course.

While EUR still on its drop journey, USD will follow

While all thse happening, AUD and CAD will appreciate slowly in value, reflecting what they relate/represent - Gold and Oil.

Gold and Oil will appreciate in value, Gold quite close to hitting resistance now, buy buy buy!. Oil I dont know, dont care.

I'm expecting the event start from circa June (the GBP is falling now and EUR will fall later) and December for the USD effect, by Dec 2015, a year after, the recession should be partially over.

But that just my assumption based on this chart (gold chart not displayed).

Always follow the money. So, enjoy reading chart guys!

edit on 10-3-2014 by NullVoid because: (no reason given)

cosmicexplorer

reply to post by xuenchen

Oh no I agree on the debt....excluding Norway...I think they are in the green...but if everything collapses its going to be countries like Cuba who have really gone to organic farming and solar energy and things like that....a large portion of their infrastructure is self sustaining...now on their ability to get parts to maintain and fix things that may be a different question entirely...they barely have tools.

In other words, they are so close to the ground already that a fall would barely stir the dust.

edit on 10-3-2014 by greencmp because: (no

reason given)

reply to post by greencmp

haha I guess ya there is some truth in that but if you look into some of Cuba's farming industry and energy usage they are doing some interesting things.....this may be a horrible example but I like to think of Cuba as a big hippie commune that is trying to be self sustaining.....most of their tech isnt impresssive if you exclude some of their biotech which is pretty damn good from what ive read only.

haha I guess ya there is some truth in that but if you look into some of Cuba's farming industry and energy usage they are doing some interesting things.....this may be a horrible example but I like to think of Cuba as a big hippie commune that is trying to be self sustaining.....most of their tech isnt impresssive if you exclude some of their biotech which is pretty damn good from what ive read only.

brazenalderpadrescorpio

Does anyone know where all this money goes to, that all these countries are indebted to? I don't buy the idea that the money is scattered all over the place. Break it down into hillbilly for me, even though I'm not a hillbilly. I guess the simple answer is China, but I personally don't think that the answer is that obvious.

brazenalderpadrescorpio

reply to post by NullVoid

That said, no one has answered my question.

Ok, for your question, where the money goes.

The answer is - everywhere, but in consolidated manner. Its everywhere but belong to a few.

The money once created will changed hands, between countries etc, and later will settle into few type of wealth. Mostly in forms of bank holding - paper money/warrants/bonds/gold/properties. By that time, most of the money suddenly "gone", but in real terms, its transfered to other areas in the world. Lets take JPMorgan as example. It have operation around the world, it transfer money all around the world. Money (profit in USA transferred to Europe, open new bank, give loans for profit), repeat.

These money later used to empower the bankers to fund their operations, by operations I meant - moving the money to bigger bank - IMF mostly, its not your typical counter. IMF in turn, will lend to countries, with lots of demands to the country, which in long term will bring the country to deeper problem (usually). The countries mostly reject, but HAVE to borrow to continue. IMF in short term = countries loan shark. In longer term, the country have to pay back, and to rub salt to wound, the IMF demands already accepted, which the government usually pass the burden to people.

This is the form of enslavement that I'm talking about. The in debt country face. A fine example is Greece. They got down because of gov spending too much on Olympic, the gov need to pay debt, they take people pension money to pay debt, the debt is from IMF/big bankers/other country. IMF/big bankers got the money from lots of bank, which have profited from other country, which is in debt to them, which...it repeat. Get it ?

In short, money created then spent then recollected and transfered to be reloaned somewhere else to create more money, again, again and again.

All these activities empower the bankers more, getting bigger and even more powerful, hence why Federal Reserve/bankers dont really care why USA have so much debt, because, in the end - it return to them back, one way or another.

Who on earth want to loan somebody else trillions for nothing in return ? Not me and not the banks.

Who on earth want to loan somebody else trillions ? Only the banks eagerly to do it.

The money you see on streets and trading with China etc etc, is miniscule compared to what these bank have.

My chart you see above ? lets see....

2 trillion per day x 30 days = 60 trillion....and that just a single vertical line/bar on that chart.

Always follow the money. For now, GBP money is being taken out to other country, good luck UK!

edit on 10-3-2014 by NullVoid because: (no

reason given)

reply to post by Floydshayvious

Yes, but its much much better if the government print the money instead of loaned it.

Rothchilds quotes are so true. I'm siding with him to save myself.

Break away countries suffer less from recession, but look at them, growth is pretty slow.

Yes, but its much much better if the government print the money instead of loaned it.

Rothchilds quotes are so true. I'm siding with him to save myself.

Break away countries suffer less from recession, but look at them, growth is pretty slow.

edit on 10-3-2014 by NullVoid because: (no reason

given)

DeadSeraph

reply to post by xuenchen

So the entire planet is $100 trillion in debt. In debt to whom? Why is the whole world in debt to a handful of people? Who gave them the keys to the earth? This system is a joke, and they know it. Laughing all the way to the banks they themselves created, spending money they print at will, while enslaving the human race with interest rates on debts we will never be able to pay back. Must be nice to issue currency out of thin air and then demand to be paid back interest for it after you "lend" it out.

The best part about it? They drill it into our heads from the time we are young that this is the only way it can work. There are no better systems. This is as good as it gets. You just have to play by the rules and accept the way it is.edit on 9-3-2014 by DeadSeraph because: (no reason given)

Islam had interest free mortgages, but they factored in a 10% profit margin for the lender, so it works out the same but without the varying interest rates.

We used to have local merchant banks that worked for the benefit of the community. They provided a safe place to store money, along with the ability to lend to benefit local businesses. The interest charged went purely on administration costs and interest to savers. They didn't have "shareholders" who expected 20% profit share dividends otherwise they would take their money elsewhere and liquidate the bank.

xuenchen

According the Bank for International Settlements, global debts worldwide have increased 40% since 2007 to over $100 Trillion.

The bank of international settlements numbers are whack. Global debt is way, way worse than they are letting on.

The US medicare, prescription drug, and social security program's unfunded liabilities alone are well over $128 trillion and rising $100,000 a second. Just those 3 programs. Just in the US.

stormcell

Islam had interest free mortgages, but they factored in a 10% profit margin for the lender, so it works out the same but without the varying interest rates.

I have to correct you.

Islam have 0% interest on everything. In fact its a sin to take interest, it is not a sin to pay interest.

Its a sin to even receive flat rate profit from investment, because naturally, investment returns should varies.

This is the main reason the Islamophobia you see everywhere, everyone brainwashed by 911, etc etc to hate Islam,

so "this 0% interest cult can be removed from earth".

However, with current situation, that Islam doctrine was avoided with lots of ways (bankers always have ways to cheat), thus we can see Islamic bank have almost no difference from common bank. Its a sad state.

edit on 11-3-2014 by NullVoid because: (no reason given)

new topics

-

Mike Pinder The Moody Blues R.I.P.

Music: 37 minutes ago -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 3 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 8 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 13 hours ago, 31 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 8 hours ago, 13 flags -

Is AI Better Than the Hollywood Elite?

Movies: 15 hours ago, 4 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 37 minutes ago, 2 flags -

Maestro Benedetto

Literature: 15 hours ago, 1 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 3 hours ago, 1 flags

active topics

-

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 15 • : IndieA -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works • 13 • : CriticalStinker -

Alternate Electors vs Fake Electors - What is the Difference.

2024 Elections • 120 • : Threadbarer -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 58 • : matafuchs -

Truth Social goes public, be careful not to lose your money

Mainstream News • 132 • : matafuchs -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 67 • : Ophiuchus1 -

Mike Pinder The Moody Blues R.I.P.

Music • 1 • : RussianTroll -

Mood Music Part VI

Music • 3106 • : TheWoker -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 275 • : Vermilion -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 22 • : 320MPH