It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

This was interesting. I hadn't seen it anywhere. After watching it I found a few other interesting exchanges which follow. One of the quotes I liked from Ben regarding taxing the rich a little more was "they are still going to be able to drive their Bentleys..." For those who can't view the video, encapsulated for you here.

economist Ben Stein joined Fox & Friends on Thursday where he stunned the hosts after he called for raising the tax rates on people making more than $2 million per year. He said that he did not think that the United States simply had a spending problem, and cited the early post-war period as an example of a time when you could have high tax rates and high growth. "I hate to say this on Fox -- I hope I'll be allowed to leave here alive -- but I don't think there is any way we can cut spending enough to make a meaningful difference," said Stein. "We're going to have to raise taxes on very, very rich people. People with incomes of, say, $2, $3, $4 million a year and up. And then slowly, slowly, slowly move it down. $250,000 a year, that's not a rich person." Stein said that the government has a spending problem, but they also have a "too low taxes problem." "With all due respect to Fox, who I love like brothers and sisters, taxes are too low," said Stein. "That sounds like Bowles-Simpson," said Gretchen Carlson. "It is Bowles-Simpson," Stein replied. "The evidence is that there is no clear connection between the level of taxation and the level of economic activity," said Stein. "The biggest growth and prosperity we've ever had in this country was from roughly 1941 to 1973. That was the best years we've ever had and those were years of much higher taxes than we have now." "Taxes were at 70, 80 percent then," said Steve Doocy. "And yet, we were very prosperous," Stein replied. "The highest rate was in the 90s during parts of the 50s, and yet we were very prosperous."

Bill O'Reilly Slapped Around By Ben Stein!

Bill O'Reilly was taken bey surprise when his conservative guests - including Ben Stein - strongly disagreed with the idea that president Obama was a negative force in the American economy and that taxing the rich is a bad idea. The Young Turks host Cenk Uygur explains.

We Must Raise Taxes On The Rich Says Ben Stein

Ben Stein: Taxing the rich is fair

Economist Ben Stein tells CNN's Brooke Baldwin that raising taxes on millionaires is fair and necessary to avoid default.

CNN Transcript for those without video capabilities

Following is a portion of the transcript from above...

STEIN:We cannot run these enormous deficits forever and the best place to get them on is who have lots of it and that would be very rich people.

BALDWIN: I also want to talk though also about how the IRS, you know, breaks pays what in taxes, because we keep hearing that the majority of Americans, they pay, take a look at the chart with me. They pay 15 percent or less, so the poor and the very rich, right, the folks on the opposite end of the spectrum, they get the breaks. But the folks who are paying the higher rate are those who are the middle to upper middle range. Not the wealthy, not the poor, probably a lot of people watching. The Buffett rule wouldn't affect them, so what's the solution?

STEIN: Well, I'm sorry to say the solution would be to raise taxes on almost everyone and at this point, we have roughly 50 percent of the population in the labor work force not paying any federal income tax. They should pay at least a little something so they have skin in the game. Look, we are running deficits on a scale, which is unheard of except during World War II. We just can't keep doing it. We have been running a low tax society living in a dream world for a long, long time now. That's got to stop. We have to live in the real world. We're not little children. We're grownups, we have to act like grownups and we have to pay more taxes if we want to spend more money. If they want to drastically cut entitlements then they can spend less money, but -- and won't have to raise taxes, but we're not going to do that.

BALDWIN: So these are all ideas posed by -- different ideas posed by whatever side of the political aisle you find yourself, but all this posturing and pontificating in Washington haven't gone very far, in terms of you know, concrete issues, right? So when you look at the brinkmanship in Washington, are you confident there will be real tax reform, or will we have to wait until after November?

STEIN: I think we're going to have to wait until doomsday. I mean, neither side is even close to facing reality in this situation. We have some very, very smart economists in this country who have made calculations that show we simply cannot avoid default unless we have mammoth inflation that washes away the debt. But then washes away everyone's savings so we have to do something quite drastic and I don't see any sign of Congress doing that. They're just nibbling at the edges when they do anything at all. We're really heading towards a very difficult spot here.

BALDWIN: I don't like words like that, Mr. Stein.

STEIN: I don't like it, either.

edit on 26-10-2012 by newcovenant because: (no reason given)

reply to post by newcovenant

Ben Stein is an old school Republican, not an extreme tea partier.

Unfortunately, honest and logical talk like this will be attacked by the new extreme Republican party. They will call him names, bash him, and turn on him faster than they did Colin Powell after he endorsed Obama.

It's scary really, it's a total "If you aren't with us, you are against us" mentality.

Ben Stein is an old school Republican, not an extreme tea partier.

Unfortunately, honest and logical talk like this will be attacked by the new extreme Republican party. They will call him names, bash him, and turn on him faster than they did Colin Powell after he endorsed Obama.

It's scary really, it's a total "If you aren't with us, you are against us" mentality.

Fat chance Ben will ever see the inside of a FOX studio again. He'll likely have to surrender his Conservative group pass key as well. Poor Ben.

look what happened to greece...massive debt lead to cutting entitlements, wages, and benefits for the average person. it's called "austerity"...the

powers that be want the united states to go through that, and are using the republicans as their front men. so you keep cutting taxes, till you bleed

the country dry with a massive debt load.

americas federal income tax burden is at it's lowest in 60 years, google it if you don't believe me.

americas federal income tax burden is at it's lowest in 60 years, google it if you don't believe me.

Fox and Friends seemed baffled!

Blondie on the other hand... Genuinely offended. Ready to argue she was and kept trying to change it to the spending is the only problem Haaahaaa! Good on Ben Stein for upsetting the talking barbie, he spoke a lot of truth and it upset them.

O'Reilly... Well we know it's the 'no spin' zone...

I agree with Mr Stein 250k is not overly wealthy but if you are pulling in 3-4 million a yr... Yeah, I'm sure if you had to pay a lil more tax it wouldn't put you in the poor house, by any means. They hate when Ben Stein is hitting them with facts. Oreilly wrong again, imagine that.

Blondie on the other hand... Genuinely offended. Ready to argue she was and kept trying to change it to the spending is the only problem Haaahaaa! Good on Ben Stein for upsetting the talking barbie, he spoke a lot of truth and it upset them.

O'Reilly... Well we know it's the 'no spin' zone...

I agree with Mr Stein 250k is not overly wealthy but if you are pulling in 3-4 million a yr... Yeah, I'm sure if you had to pay a lil more tax it wouldn't put you in the poor house, by any means. They hate when Ben Stein is hitting them with facts. Oreilly wrong again, imagine that.

edit

on 26-10-2012 by Komonazmuk because: (no reason given)

Ben is actually talking about taxing the rich. Not the"Rich" that basically means the upper middle class and middle class.

He is not supporting a redistribution but paying down the debt. He is underplaying the fact that government is way too big and spends too much but that's a debatable point.

I find it laughable that anybody is shocked by common sense but there it is.

He is not supporting a redistribution but paying down the debt. He is underplaying the fact that government is way too big and spends too much but that's a debatable point.

I find it laughable that anybody is shocked by common sense but there it is.

Originally posted by Taiyed

reply to post by newcovenant

Ben Stein is an old school Republican, not an extreme tea partier.

Unfortunately, honest and logical talk like this will be attacked by the new extreme Republican party. They will call him names, bash him, and turn on him faster than they did Colin Powell after he endorsed Obama.

It's scary really, it's a total "If you aren't with us, you are against us" mentality.

And that is the very scary part of it. How the extremist seem to hijack the party.

There are many Republicans I like, Huntsman for example, but they laugh at guys like that. He was shoved aside for the "wild cards" in the GOP.

I seriously think it's who ever can whip up an audience frenzy because bottom line it is about money and donations. When you see how much money these campaigns raise you gotta think they are skimming a little off the top or something, because it isn't about the Presidency anymore, it's like a big charity ball every 4 years.

I have read many times, many places the Republican Party used to look like today's Democrats and today's Democrats were more like the Republicans.

This is where people get the idea Republicans where responsible for emancipation & abolition of slavery.

It's because they were.

Somewhere late in the last century these two parties completely traded places, switched ideologies and their positions.

edit on 26-10-2012 by newcovenant because: (no reason given)

This part deserves repeating.

"The evidence is that there is no clear connection between the level of taxation and the level of economic activity," said Stein. "The biggest growth and prosperity we've ever had in this country was from roughly 1941 to 1973. That was the best years we've ever had and those were years of much higher taxes than we have now."

reply to post by newcovenant

Yes, it is very sad when Palin and Trump are viewed by the Republican base as the smart ones.

And Colin Powell and Ben Stein are viewed as "traitors".

Yes, it is very sad when Palin and Trump are viewed by the Republican base as the smart ones.

And Colin Powell and Ben Stein are viewed as "traitors".

Originally posted by Taiyed

reply to post by newcovenant

Yes, it is very sad when Palin and Trump are viewed by the Republican base as the smart ones.

And Colin Powell and Ben Stein are viewed as "traitors".

I completely agree.

Maybe our future is in moderate Republicans and Blue Dog Democrats?

Ben Ben Ben... I understand what he's trying to say but taxing the super wealthy to the hilt won't make a difference as long as the govt. is

running $1 trillion plus in annual deficits. That is exactly what has happened in the last 4 years and will continue to happen if the current admin.

holds on to the White House. Those deficits are projected to be even higher when the bill comes due for Obamacare. So, all those taxes on the super

wealthy may keep govt. running for about a month...

We're not living in the 1950's during a post WWII economic rebuild... Back then those high taxes were funding the nation's Eisenhower Interstate Highway system. Remember Obama's pledge to rebuild the nations infrastructure with "shovel ready jobs" to justify the $787 billion American Reinvestment and Recovery Act.?? Those jobs never existed as Obama backed down on his remarks well after he got what he wanted...

Something needs to change or it will be just more of the same...

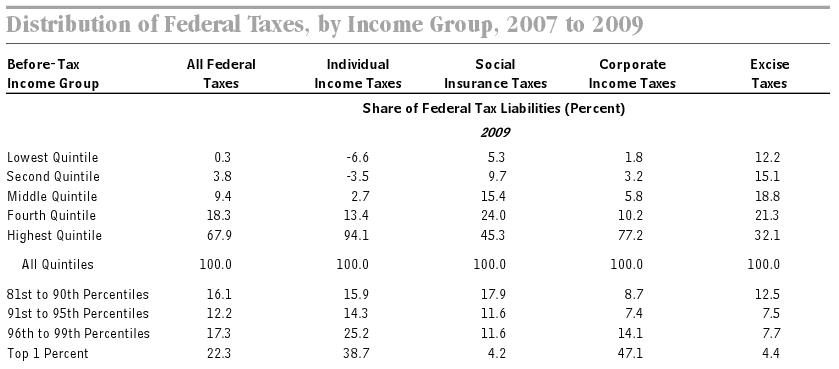

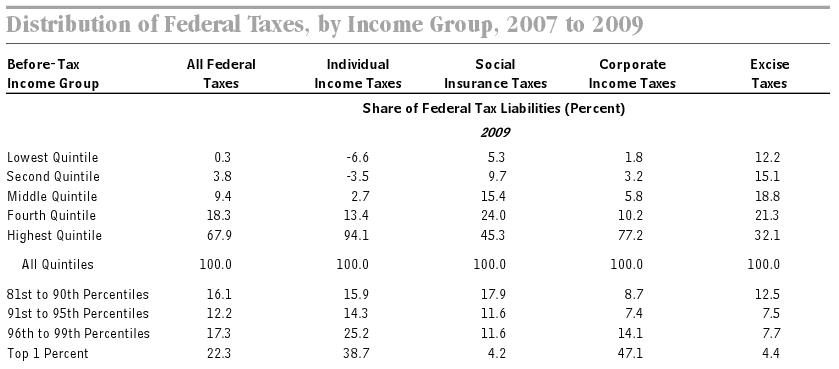

Stein needs to do his homework on History. In the 1950's the middle class was also paying a much higher effective rate. In fact, the middle class was paying a much bigger percentage of the overall tax burden than they do today. Furthermore, as the top tax rates dramatically decreased in the 80’s and 90’s, the share of income taxes that the highest earning 1% paid actually went up. Back in 1979, with the highest marginal tax rate being 70%, the richest 1% of Americans were paying just slightly over 30% of the total income tax burden. Fast forward to the present where the same 1% (at a top marginal rate of only 35%) is paying close to 40% of the total income tax.

If the government taxed the top 1% of taxpayers at 100%, that would still only generate around $940 billion in total tax revenue for that 1%, which is not enough to even begin to close the budget gap. Therefore the tax increases will eventually be pushed down to the middle class in order to cover the deficit.

ITS Simple and I'm surprised that Stein does not get it!!

This graphic paints a vivid picture

The tax burden on this class of people continues to trend UP!! Where does it stop????

We're not living in the 1950's during a post WWII economic rebuild... Back then those high taxes were funding the nation's Eisenhower Interstate Highway system. Remember Obama's pledge to rebuild the nations infrastructure with "shovel ready jobs" to justify the $787 billion American Reinvestment and Recovery Act.?? Those jobs never existed as Obama backed down on his remarks well after he got what he wanted...

Something needs to change or it will be just more of the same...

Stein needs to do his homework on History. In the 1950's the middle class was also paying a much higher effective rate. In fact, the middle class was paying a much bigger percentage of the overall tax burden than they do today. Furthermore, as the top tax rates dramatically decreased in the 80’s and 90’s, the share of income taxes that the highest earning 1% paid actually went up. Back in 1979, with the highest marginal tax rate being 70%, the richest 1% of Americans were paying just slightly over 30% of the total income tax burden. Fast forward to the present where the same 1% (at a top marginal rate of only 35%) is paying close to 40% of the total income tax.

If the government taxed the top 1% of taxpayers at 100%, that would still only generate around $940 billion in total tax revenue for that 1%, which is not enough to even begin to close the budget gap. Therefore the tax increases will eventually be pushed down to the middle class in order to cover the deficit.

ITS Simple and I'm surprised that Stein does not get it!!

This graphic paints a vivid picture

The tax burden on this class of people continues to trend UP!! Where does it stop????

Reply to post by jibeho

Jibeho, it's you that doesn't get it.

Taxing the wealthy at the same exact rate as the middle class is not a solution to paying down the debt. That is what you are trying to make it out to be.

The idea behind having the wealthy pay the same rates is so the middle class (the largest consumer base) is not forced to continually pick up the slack for the cuts the wealthy receive!

How can middle class working families send their kids to college or shop when they have to pay 35% in taxes because wealthy individuals arent't putting their 30% in. Middle class families being forced to make up the difference is why the economy suffers. It's not the generosity in the wealthy heart that creates jobs. It's demand. When middle class people are doing better and are able to shop beyond their bills and taxes, it creates jobs.

Ben Stein is right.

Posted Via ATS Mobile: m.abovetopsecret.com

Jibeho, it's you that doesn't get it.

Taxing the wealthy at the same exact rate as the middle class is not a solution to paying down the debt. That is what you are trying to make it out to be.

The idea behind having the wealthy pay the same rates is so the middle class (the largest consumer base) is not forced to continually pick up the slack for the cuts the wealthy receive!

How can middle class working families send their kids to college or shop when they have to pay 35% in taxes because wealthy individuals arent't putting their 30% in. Middle class families being forced to make up the difference is why the economy suffers. It's not the generosity in the wealthy heart that creates jobs. It's demand. When middle class people are doing better and are able to shop beyond their bills and taxes, it creates jobs.

Ben Stein is right.

reply to post by jibeho

OH, well if you say so, then I guess Ben Stein (a respected economic mind) is just wrong.

I'm sure you have credentials that match or exceed Mr Steins, right? Could we hear what those credentials are?

OH, well if you say so, then I guess Ben Stein (a respected economic mind) is just wrong.

I'm sure you have credentials that match or exceed Mr Steins, right? Could we hear what those credentials are?

reply to post by spinalremain

Am I?? Just pointing out the flaws in Steins logic... Look at History

taxfoundation.org...

Look at the tax burden distribution over the years. Nearly 50% of the population pay no Federal Income Tax today. The nation is out of balance and when people have no skin in the game at all, its dangerous!! What will their reaction be when they have to start paying Federal income tax again when the economy finally recovers and adjusts to a balanced level...

The whole system needs to change. Flatten the tax rates and DECREASE $1 trillion in annual deficit spending. Cuts cuts cuts... stop the bleeding before there is nothing left.

You think you can just whack the rich and everything will be ok?? Look at the failed European model. That kind of tax idea is just a panic response to a huge problem.

Taxing the wealthy at the same exact rate as the middle class is not a solution to paying down the debt. That is what you are trying to make it out to be.

Am I?? Just pointing out the flaws in Steins logic... Look at History

taxfoundation.org...

Look at the tax burden distribution over the years. Nearly 50% of the population pay no Federal Income Tax today. The nation is out of balance and when people have no skin in the game at all, its dangerous!! What will their reaction be when they have to start paying Federal income tax again when the economy finally recovers and adjusts to a balanced level...

The whole system needs to change. Flatten the tax rates and DECREASE $1 trillion in annual deficit spending. Cuts cuts cuts... stop the bleeding before there is nothing left.

You think you can just whack the rich and everything will be ok?? Look at the failed European model. That kind of tax idea is just a panic response to a huge problem.

Originally posted by Taiyed

reply to post by jibeho

OH, well if you say so, then I guess Ben Stein (a respected economic mind) is just wrong.

I'm sure you have credentials that match or exceed Mr Steins, right? Could we hear what those credentials are?

Too Funny!!

Just look up what I said. I study history...

So, its wrong to think that Stein may be on the wrong side of history....???

Whatever floats your boat buddy...

edit on 26-10-2012 by jibeho because: (no reason given)

Reply to post by jibeho

Your straw man argument is gaining strength.

No one who supports wealthy tax rates being equal to middle class rates believes this will solve the debt. No one. Thats a straw man. My previous point stands.

Of course the government needs to cut spending too, but to limit your opponents argument to a debt issue is a falacy. Just be clear that you understand what your opponents are calling for before you judge it. It was never about balancing the budget, but about taking the brunt off of the middle class.

Posted Via ATS Mobile: m.abovetopsecret.com

Your straw man argument is gaining strength.

No one who supports wealthy tax rates being equal to middle class rates believes this will solve the debt. No one. Thats a straw man. My previous point stands.

Of course the government needs to cut spending too, but to limit your opponents argument to a debt issue is a falacy. Just be clear that you understand what your opponents are calling for before you judge it. It was never about balancing the budget, but about taking the brunt off of the middle class.

reply to post by spinalremain

Sweet God.....someone actually understand Supply and Demand!? Kudos to you!

It is very few and far between that people recognize that jobs and wealth are created by the demands and needs of the people. The rich do not create jobs out of the kindness of their hearts, they do it because there is demand and a chance to profit from it.

Trickle down economics, along with massive spending, is what created our current issues and it will never be solved until we go back to a bottom-up structure.

Thanks for your contribution!

Sweet God.....someone actually understand Supply and Demand!? Kudos to you!

It is very few and far between that people recognize that jobs and wealth are created by the demands and needs of the people. The rich do not create jobs out of the kindness of their hearts, they do it because there is demand and a chance to profit from it.

Trickle down economics, along with massive spending, is what created our current issues and it will never be solved until we go back to a bottom-up structure.

Thanks for your contribution!

Well, it's just a wild thing to see who has what opinions these days, isn't it? Take this one for instance...

Of course, his moment of clarity was short and he was corrected for the proper party line to stick to in very short order....but I think his first impressions were probably his honest ones. Amazing just who ends up being behind what positions this cycle. Thank goodness it's almost over.

By the way....this, from their own reports:

How is it the Rich don't pay their fair share? The Federal Government simply SPENDS MORE than even this tax structure can support and that's going quite a distance.

“I’m very sorry for what happened. I thought something had to be done on the fiscal cliff before the election,” Clinton told CNN’s Wolf Blitzer, referring to comments he made this week suggesting the Bush tax cuts should be extended - something Obama vehemently opposes. “I support [Obama’s] position [on the Bush tax cuts], and I think on the merits, upper-income people will have to contribute to long-term debt reduction.”

Source

Last week, Clinton praised Republican presidential candidate Mitt Romney’s record as “sterling” - a comment that was followed with an appearance on CNBC in which he claimed the economy was “in recession” and that delaying changes in the Bush tax cuts was “probably the best thing to do right now.”

Of course, his moment of clarity was short and he was corrected for the proper party line to stick to in very short order....but I think his first impressions were probably his honest ones. Amazing just who ends up being behind what positions this cycle. Thank goodness it's almost over.

By the way....this, from their own reports:

How is it the Rich don't pay their fair share? The Federal Government simply SPENDS MORE than even this tax structure can support and that's going quite a distance.

edit on 26-10-2012 by Wrabbit2000 because: (no reason given)

The fact of this issue is that supply side is nothing more than a scam.

If supply side economics was a job creator, why are we suffering unemployment upward of 8% right now?

We tried it for decades. It doesn't work and now the public knows it doesn't work. Stop pushing the elite agenda and start using your brain, people.

Posted Via ATS Mobile: m.abovetopsecret.com

If supply side economics was a job creator, why are we suffering unemployment upward of 8% right now?

We tried it for decades. It doesn't work and now the public knows it doesn't work. Stop pushing the elite agenda and start using your brain, people.

new topics

-

Where should Trump hold his next rally

2024 Elections: 2 hours ago -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 3 hours ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 4 hours ago -

Falkville Robot-Man

Aliens and UFOs: 4 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 5 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 5 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 6 hours ago -

Biden "Happy To Debate Trump"

2024 Elections: 6 hours ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 6 hours ago -

What is the white pill?

Philosophy and Metaphysics: 8 hours ago

top topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 16 hours ago, 21 flags -

Blast from the past: ATS Review Podcast, 2006: With All Three Amigos

Member PODcasts: 9 hours ago, 13 flags -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 5 hours ago, 12 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 5 hours ago, 11 flags -

Biden "Happy To Debate Trump"

2024 Elections: 6 hours ago, 10 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 9 hours ago, 8 flags -

What is the white pill?

Philosophy and Metaphysics: 8 hours ago, 6 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 6 hours ago, 5 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 6 hours ago, 5 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 12 hours ago, 4 flags

active topics

-

What is the white pill?

Philosophy and Metaphysics • 19 • : TheDiscoKing -

Biden "Happy To Debate Trump"

2024 Elections • 43 • : WeMustCare -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 29 • : lincolnriley -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest • 11 • : TheWoker -

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections • 59 • : TzarChasm -

Salvador Dali's Moustaches

People • 29 • : GENERAL EYES -

Mood Music Part VI

Music • 3111 • : TheWoker -

Where should Trump hold his next rally

2024 Elections • 12 • : StudioNada -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 310 • : SchrodingersRat -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 815 • : Annee