It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

12

share:

As U.S. consumers are grappling with historic levels of price inflation across nearly every category of goods and services, attempts have been made by

the media and politicians to assign blame on a diverse set of factors, including the Russia-Ukraine conflict, supply chain instability, and most

importantly, the COVID pandemic.

The aim of this post is examine the current bout of inflation we're dealing with here in the U.S., and to highlight the very strong correlation this inflationary period has with a rise in the price of hydrocarbon-based commodities, e.g. oil, natural gas. The tacit assumption, which won't be discussed in detail, is the very contentious policy the current POTUS and his administration have adopted towards fossil fuels and the portion of the energy sector dealing with oil/natural gas.

While it's probable that this inflationary phenomenon we're experiencing extends beyond the U.S., here we focus only the expression of price inflation in the U.S., mainly because the available data we have at our fingertips to investigate this comes from the site bls.gov. There's plenty of useful info on this site, if you're interested in poking around and researching this yourself.

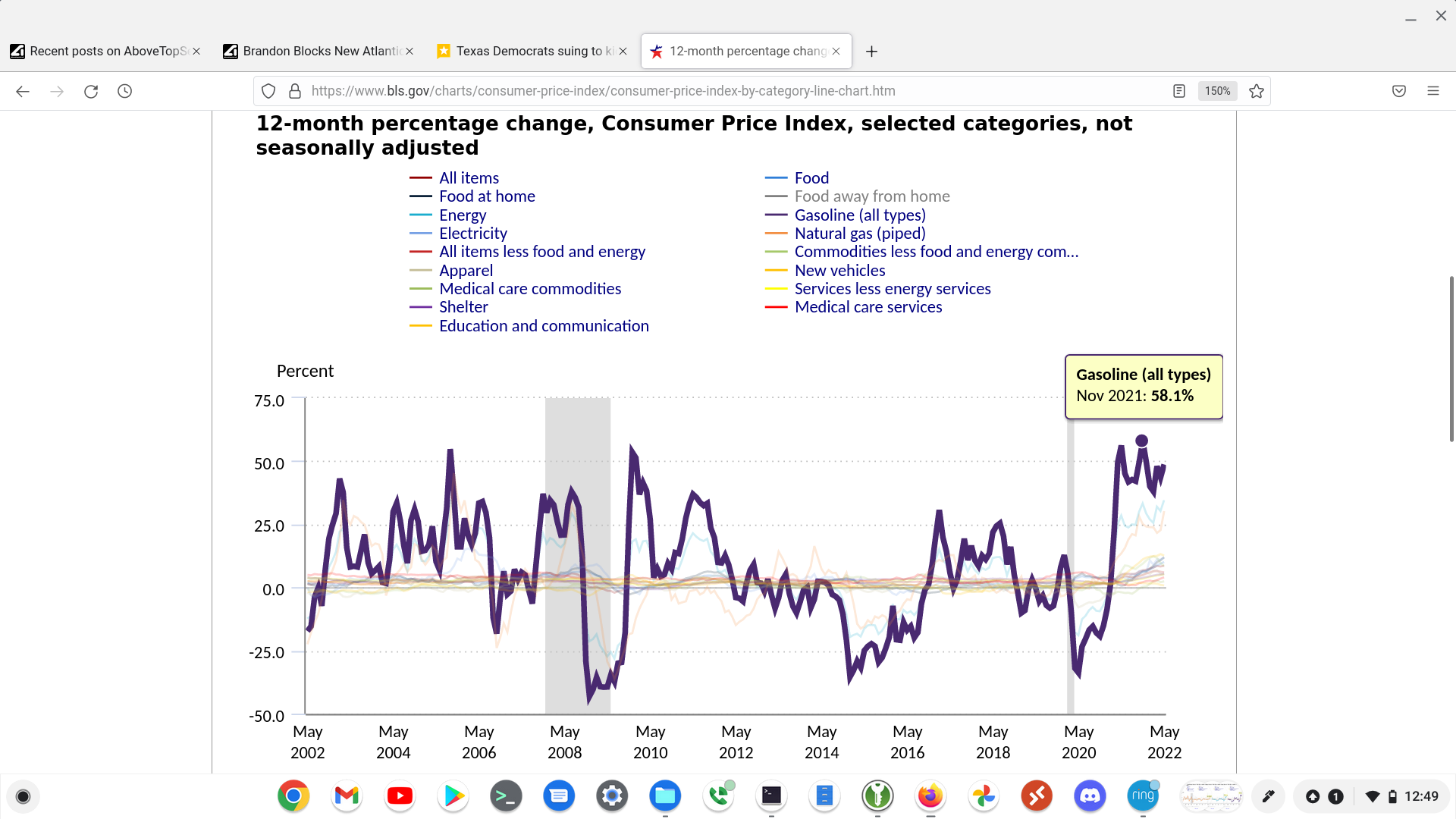

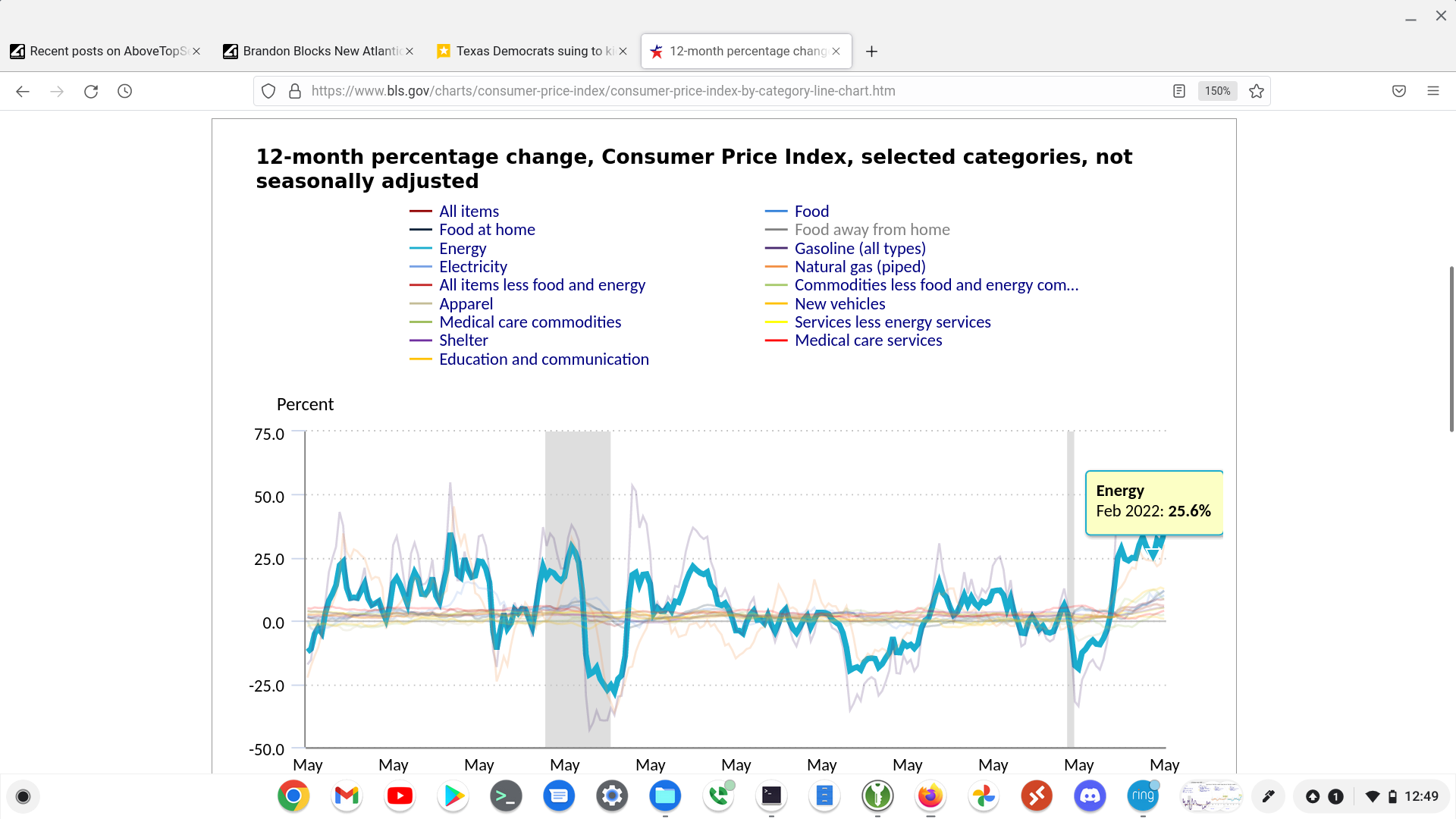

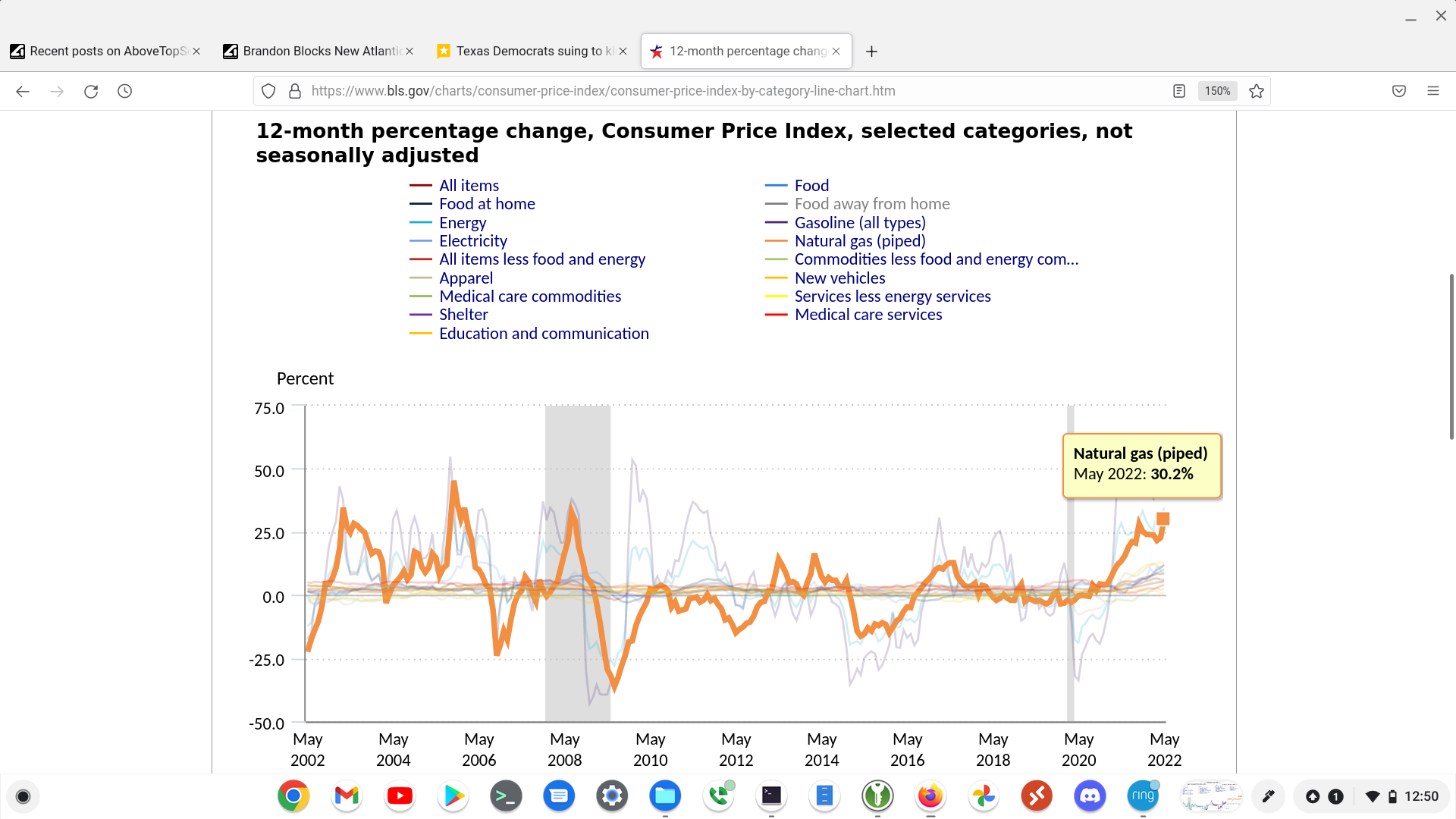

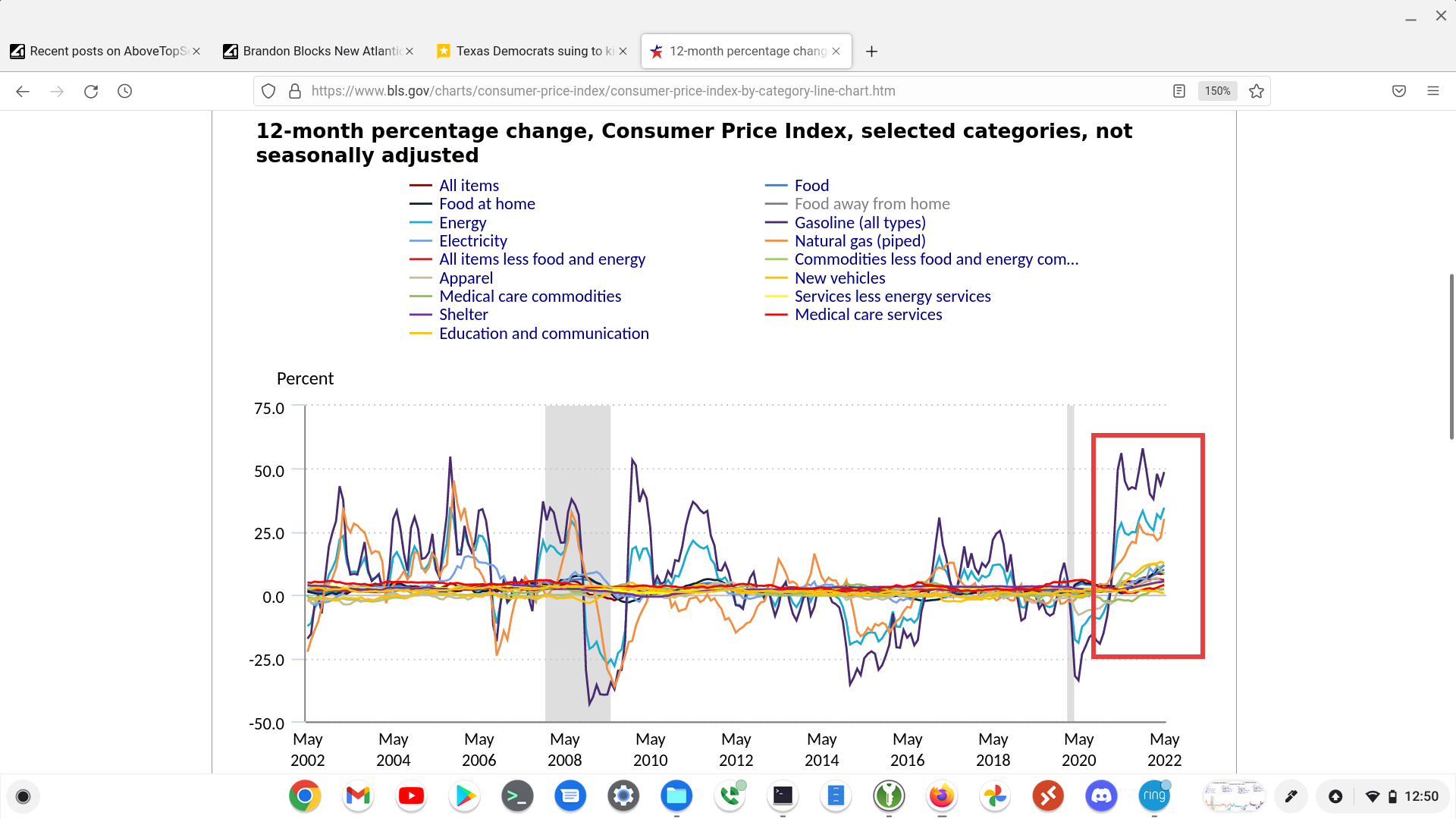

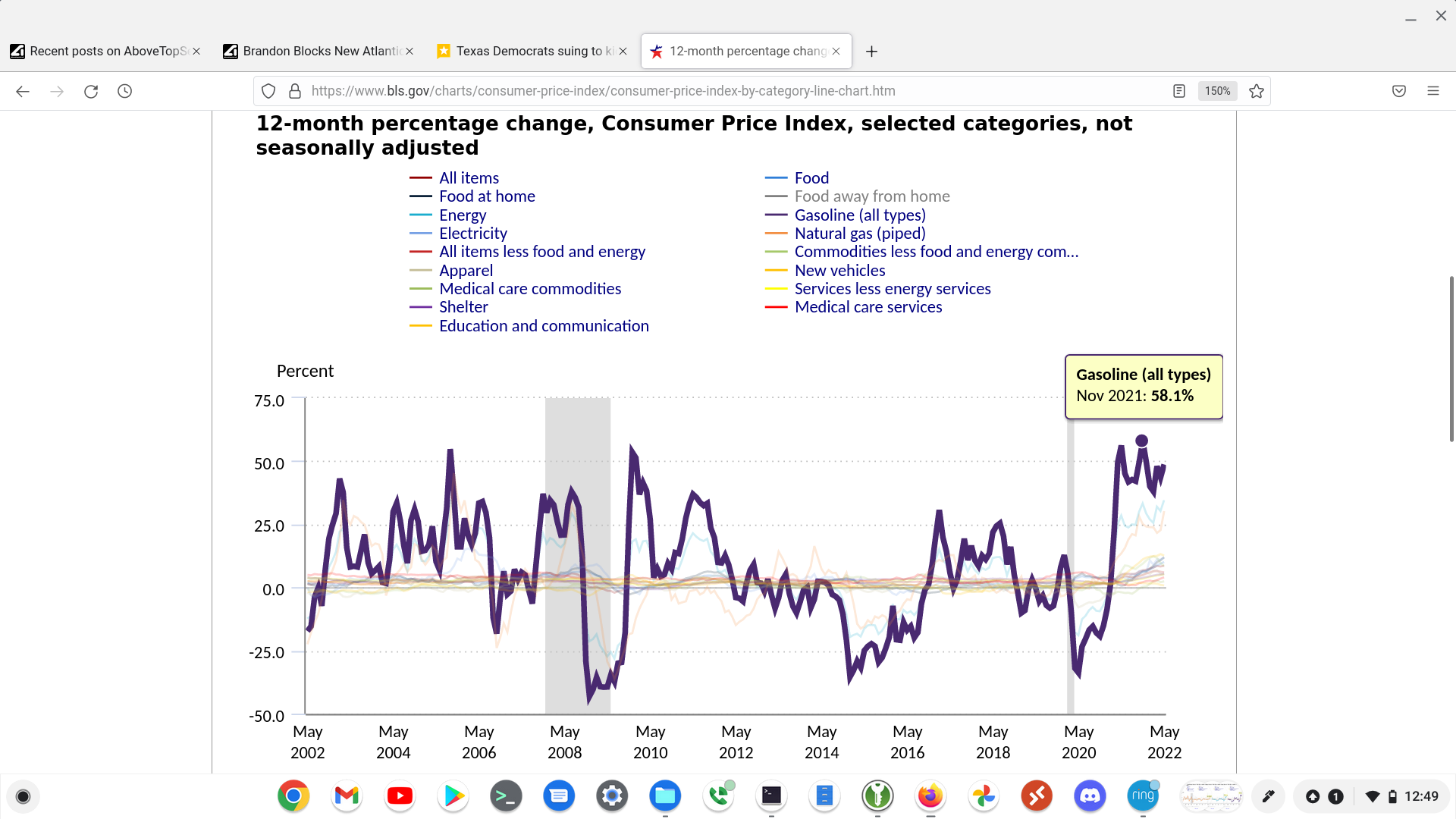

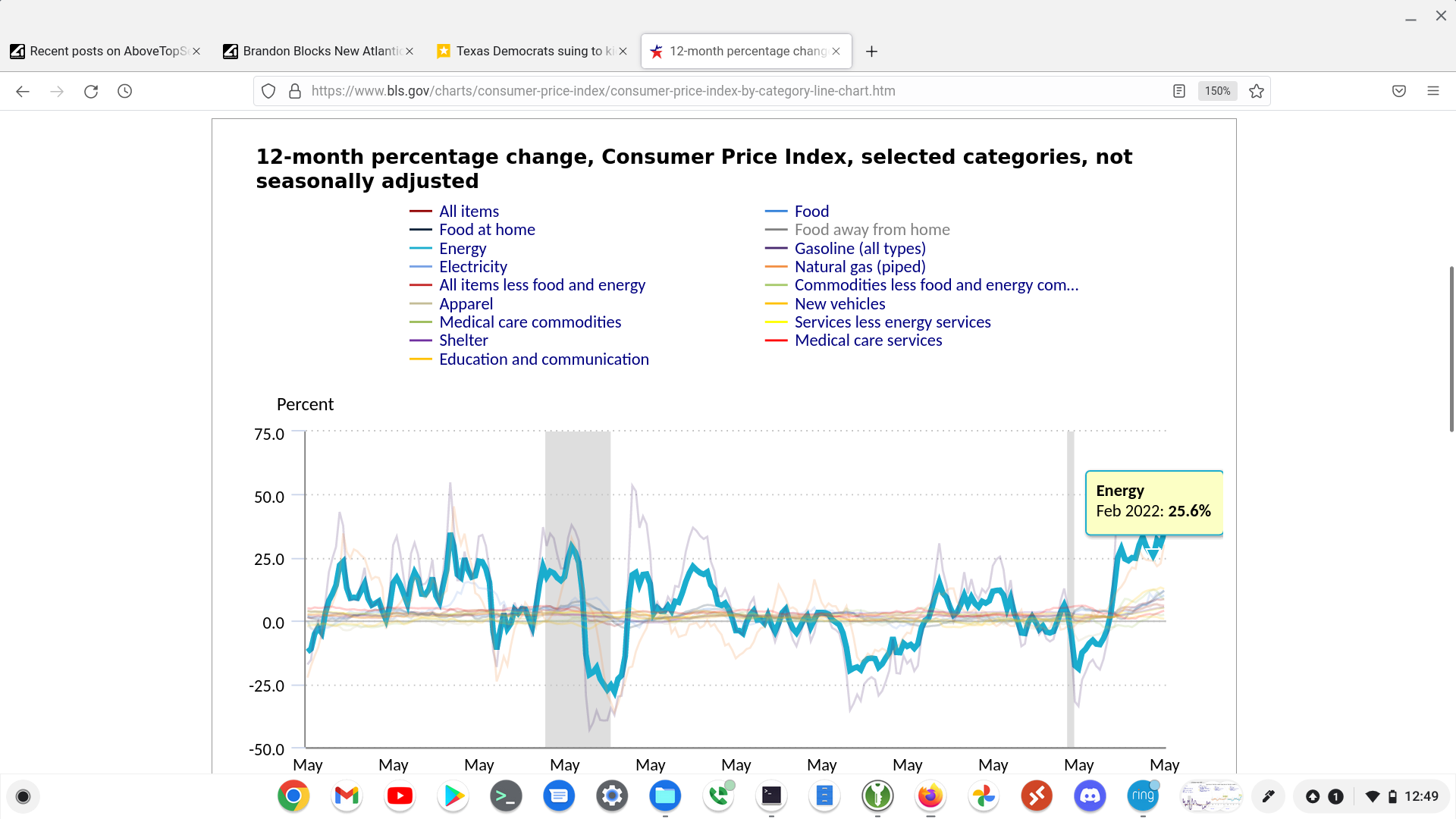

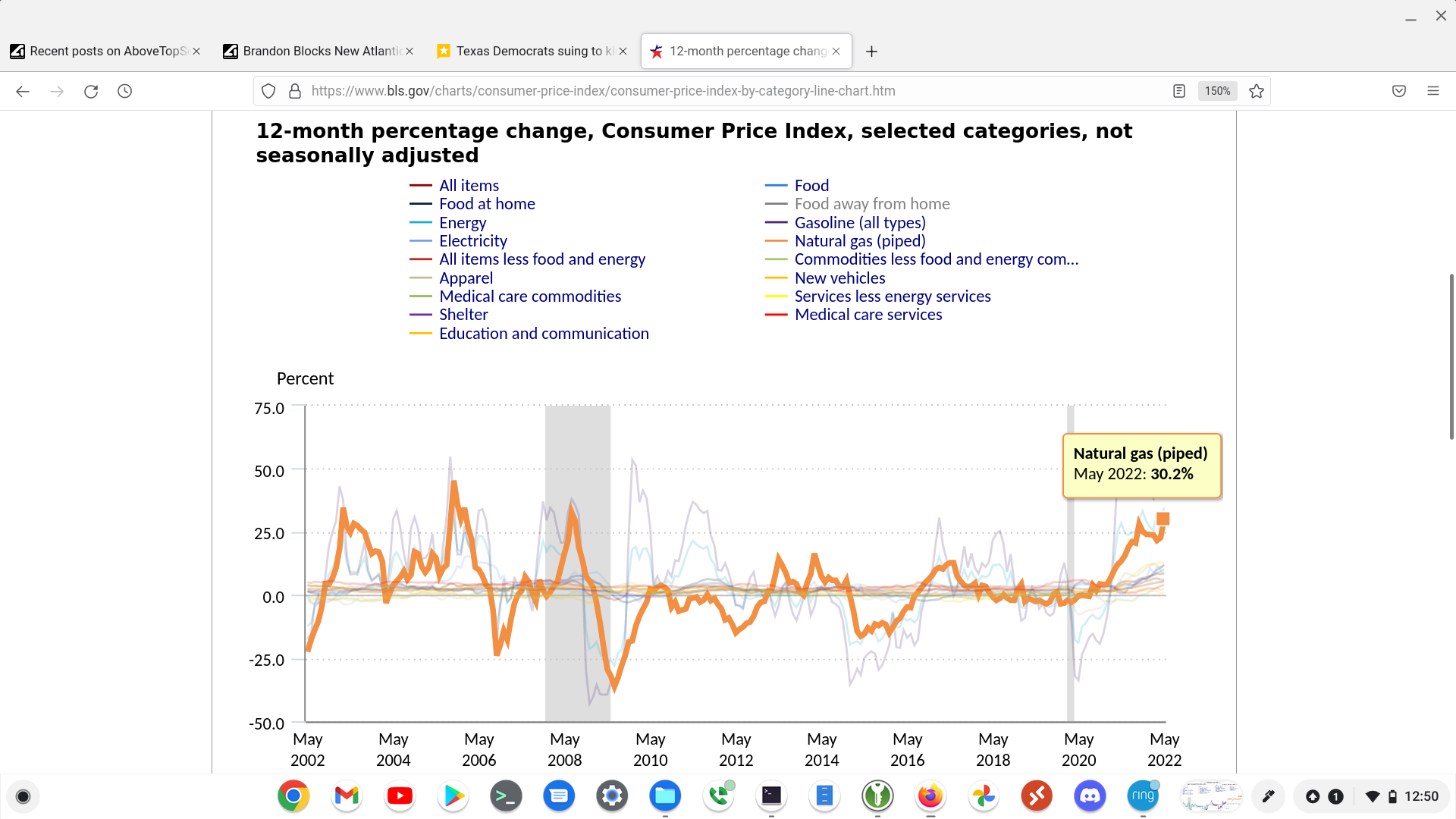

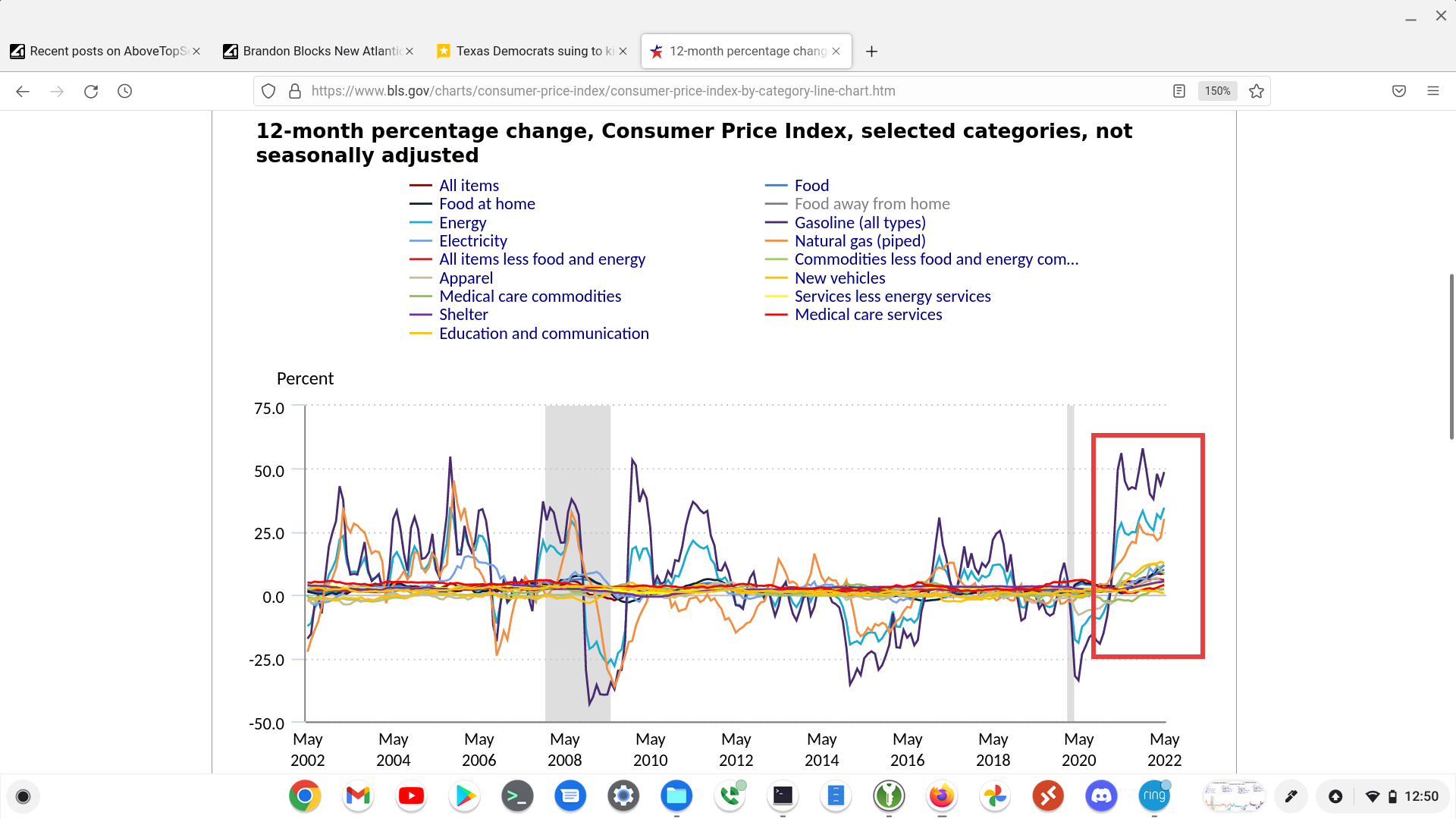

First, lets look at the the leading commodities among the categories that experienced extreme price inflation over the past 24 months. If you've been paying attention to the granular trends in price inflation, it shouldn't surprise you that the commodities with the most share price inflation are energy and oil/gas products:

I've included the price trends in the graph for other commodities (food, apparel, medicine) to provide a comparative view of how pricing for other goods/services have been trending over the past 48 months.

A few things should jump out at you in looking at these charts.

Number one, notice the sharp, exponential jump of pricing for gasoline, oil, energy.

In contrast with the pricing of commodities listed, we can see that the price of gas/oil/energy has essentially a parabolic slope in its price rise, whereas the other commodities (in the red box) are growing at much slower and gradual, likely linear rate.

It's a well-known and fundamental property of economics that, if a major influx of currency is injected into an economy, without an increase in GDP/output, this will lead to price inflation. Simply put, increasing the available pool of money in a system without a corresponding increase in productivity/manufacturing/creation means there is more money to go around to use for buying the same pool of "stuff" that's available for sale. If scarcity drives value, then the inverse (abundance) lowers value, in this case, dollars. Capitalism 101.

With that understanding, it is a valid and reasonable observation that the recent "COVID stimulus" tranches injected more money in the U.S. economy, and could be a driver of inlfation. However, let's look at the timing of the rounds of stimulus:

- First round, from the CARES Act, March 2020

- Second round, from the Consolidated Appropriations Act, December 2020

- Third round, from the American Rescue Plan Act, March 2021

So, in turning back to our CPI graphs, we'll notice that the timing of stimulus tranches doesn't neatly align with major jumps in inflation. For non energy/fuel commodities, we see that the upward trend in pricing seems to have began around May 2021, which is more than a year after the first COVID stimulus went out.

One could argue, "Hey, the ripple effect of currency dilution is not instantaneous; it'll take a little while to manifest in pricing". This is a pretty reasonable assumption, but, if we turn our focus to the CPI charting of energy/fuels, we see that around early 2020, these commodities transitioned from negative inflation trends to a positive increase, and a very steep one at that. Cross referencing the general commodity price index, we see that the marked price growth trends didn't really start to take off around mid-2021, which just so happens to match the peak price growth for the energy/fuel commodities. So, based on timing, the data seems to indicate that the sensitivity in price increase in general consumer categories is more attuned to fuel price than the COVID stimulus schedule. If not, then why didn't we see positive price slopes ramping up more dramatically throughout and immediately after the injection of currency from the COVID relief stimulus checks?

While it certainly makes sense to lump the COVID stimulus packages as inflation drivers, to a degree, the data indicates that rising fuel prices are a more impactful force in driving prices of other commodities up. This is a very rational deduction: oil prices dictate the prices of nearly every sector of the U.S. economy. When goods are transported long distances from origin to the the consumer, a key property of the "Just In Time" supply chain model, the further the distance traveled, the more fuel is consumed. The greater the price of fuel, then logistic companies need to raise rates to transport the goods, and the manufacturer/producer is simply going to raise their prices to compensate for higher shipping rates. Particularly of note: this isn't just applicable to shipping a finished, ready-to-use product to the consumer, but it involves every component, ingredient, element that goes into creating a product. So if you buy a Dell computer, and Dell is sourcing it's motherboard from Taiwan, disks from Vietnam, chassis/plastic components from China, YOU are going to foot the bill for the increase in shipping price that Dell incurs from assembling the raw materials it needs to build your computer. Speaking of raw materials, it may not be widely known, but refined oil/petroleum is a key ingredient to a wide, wide gamut of manufactured goods, basically anything containing plastic or polymers. So on top of the price increase for shipping, the actual materials that go into producing everything from tires to PCs to car parts to toys and everything in between, will cost more to fabricate, because the price of a key ingredient (oil) has gone up.

In conclusion:

- yes, the COVID stimulus programs were definitely going to drive inflation, and this was mentioned and highlighted here on ATS

- when we look at the CPI and pricing data, it's clear that a more critical contributor to price inflation is the price of oil/energy

- the political connotations and considerations are left to you, the reader, to ponder

- HINT for previous question: overlay the CPI inflation data on election calendars and see if you can find a link, most especially, in conjunction with the current administration's stated goal of diminishing the use and availability of hydrocarbon based fuel in the U.S.

The aim of this post is examine the current bout of inflation we're dealing with here in the U.S., and to highlight the very strong correlation this inflationary period has with a rise in the price of hydrocarbon-based commodities, e.g. oil, natural gas. The tacit assumption, which won't be discussed in detail, is the very contentious policy the current POTUS and his administration have adopted towards fossil fuels and the portion of the energy sector dealing with oil/natural gas.

While it's probable that this inflationary phenomenon we're experiencing extends beyond the U.S., here we focus only the expression of price inflation in the U.S., mainly because the available data we have at our fingertips to investigate this comes from the site bls.gov. There's plenty of useful info on this site, if you're interested in poking around and researching this yourself.

First, lets look at the the leading commodities among the categories that experienced extreme price inflation over the past 24 months. If you've been paying attention to the granular trends in price inflation, it shouldn't surprise you that the commodities with the most share price inflation are energy and oil/gas products:

I've included the price trends in the graph for other commodities (food, apparel, medicine) to provide a comparative view of how pricing for other goods/services have been trending over the past 48 months.

A few things should jump out at you in looking at these charts.

Number one, notice the sharp, exponential jump of pricing for gasoline, oil, energy.

In contrast with the pricing of commodities listed, we can see that the price of gas/oil/energy has essentially a parabolic slope in its price rise, whereas the other commodities (in the red box) are growing at much slower and gradual, likely linear rate.

It's a well-known and fundamental property of economics that, if a major influx of currency is injected into an economy, without an increase in GDP/output, this will lead to price inflation. Simply put, increasing the available pool of money in a system without a corresponding increase in productivity/manufacturing/creation means there is more money to go around to use for buying the same pool of "stuff" that's available for sale. If scarcity drives value, then the inverse (abundance) lowers value, in this case, dollars. Capitalism 101.

With that understanding, it is a valid and reasonable observation that the recent "COVID stimulus" tranches injected more money in the U.S. economy, and could be a driver of inlfation. However, let's look at the timing of the rounds of stimulus:

- First round, from the CARES Act, March 2020

- Second round, from the Consolidated Appropriations Act, December 2020

- Third round, from the American Rescue Plan Act, March 2021

So, in turning back to our CPI graphs, we'll notice that the timing of stimulus tranches doesn't neatly align with major jumps in inflation. For non energy/fuel commodities, we see that the upward trend in pricing seems to have began around May 2021, which is more than a year after the first COVID stimulus went out.

One could argue, "Hey, the ripple effect of currency dilution is not instantaneous; it'll take a little while to manifest in pricing". This is a pretty reasonable assumption, but, if we turn our focus to the CPI charting of energy/fuels, we see that around early 2020, these commodities transitioned from negative inflation trends to a positive increase, and a very steep one at that. Cross referencing the general commodity price index, we see that the marked price growth trends didn't really start to take off around mid-2021, which just so happens to match the peak price growth for the energy/fuel commodities. So, based on timing, the data seems to indicate that the sensitivity in price increase in general consumer categories is more attuned to fuel price than the COVID stimulus schedule. If not, then why didn't we see positive price slopes ramping up more dramatically throughout and immediately after the injection of currency from the COVID relief stimulus checks?

While it certainly makes sense to lump the COVID stimulus packages as inflation drivers, to a degree, the data indicates that rising fuel prices are a more impactful force in driving prices of other commodities up. This is a very rational deduction: oil prices dictate the prices of nearly every sector of the U.S. economy. When goods are transported long distances from origin to the the consumer, a key property of the "Just In Time" supply chain model, the further the distance traveled, the more fuel is consumed. The greater the price of fuel, then logistic companies need to raise rates to transport the goods, and the manufacturer/producer is simply going to raise their prices to compensate for higher shipping rates. Particularly of note: this isn't just applicable to shipping a finished, ready-to-use product to the consumer, but it involves every component, ingredient, element that goes into creating a product. So if you buy a Dell computer, and Dell is sourcing it's motherboard from Taiwan, disks from Vietnam, chassis/plastic components from China, YOU are going to foot the bill for the increase in shipping price that Dell incurs from assembling the raw materials it needs to build your computer. Speaking of raw materials, it may not be widely known, but refined oil/petroleum is a key ingredient to a wide, wide gamut of manufactured goods, basically anything containing plastic or polymers. So on top of the price increase for shipping, the actual materials that go into producing everything from tires to PCs to car parts to toys and everything in between, will cost more to fabricate, because the price of a key ingredient (oil) has gone up.

In conclusion:

- yes, the COVID stimulus programs were definitely going to drive inflation, and this was mentioned and highlighted here on ATS

- when we look at the CPI and pricing data, it's clear that a more critical contributor to price inflation is the price of oil/energy

- the political connotations and considerations are left to you, the reader, to ponder

- HINT for previous question: overlay the CPI inflation data on election calendars and see if you can find a link, most especially, in conjunction with the current administration's stated goal of diminishing the use and availability of hydrocarbon based fuel in the U.S.

I almost forgot: as an exercise, try to line up the beginning of hostilities in Ukraine-Russia with the trends for price inflation in fuel commodities

in the CPI graphs.

The fighting, I believe, started early March 2022.

Go back through the graphs, and consider when the price inflation for oil/gas really started to pick up steam.

The fighting, I believe, started early March 2022.

Go back through the graphs, and consider when the price inflation for oil/gas really started to pick up steam.

a reply to: SleeperHasAwakened

Just in time supply chains and China hasn't fully recovered from the pandemic yet. Both, China, and the well oiled supply chain fed the oil industry a constant stream of revenue.

Mix that with the high demand for natural gas right now, oil company's are just stuck with supplying what they have with an extreme demand.

The pandemic, ukraine, China, and healing supply chains, nations like canada, Australia, dumping interest rates for housing to keep their economies afloat, all added their toppings on the cake and then of course the injection of stimulus packages and now mass scale quantities tightening... the perfect storm for inflation to brew. And it has begun. The petro dollar is on thin ice pretty much.

Will we recover to any sort of resemblance to what was life like before? That's the question I ask.

Just in time supply chains and China hasn't fully recovered from the pandemic yet. Both, China, and the well oiled supply chain fed the oil industry a constant stream of revenue.

Mix that with the high demand for natural gas right now, oil company's are just stuck with supplying what they have with an extreme demand.

The pandemic, ukraine, China, and healing supply chains, nations like canada, Australia, dumping interest rates for housing to keep their economies afloat, all added their toppings on the cake and then of course the injection of stimulus packages and now mass scale quantities tightening... the perfect storm for inflation to brew. And it has begun. The petro dollar is on thin ice pretty much.

Will we recover to any sort of resemblance to what was life like before? That's the question I ask.

a reply to: strongfp

I'm not sure what the Canadian perspective is on fossil fuel energy, but here in the U.S., the political winds are blowing in the opposite direction of oil/gas.

Biden reverses Trump move to open up more oil drilling in Arctic

Biden Administration Cancels Drilling Sales in Alaska and Gulf of Mexicol

Biden pulls 3 offshore oil lease sales, curbing new drilling this year

Biden Shrinks U.S. Land Open for New Oil and Gas Drilling

Regarding China, they have been reducing manufacturing/supply output across the board for months, with the stated justification being Xi's "zero COVID" policy, i.e. closing plants to prevent any spread. In my opinion, this is a pretext to keep the supply pipeline in a trickle, but either way, the reality is, if China's production is down, their demand for oil is down, which _should_ translate to less demand and a drop in oil prices. Clearly that aspect is being overwhelmed by other factors, for instance, the Russian oil embargo, and the flood of Biden directives to curtail U.S. oil production.

Quantitative tightening and raising rates should help counteract inflation, in theory, but it's very late in the game. The Federal Reserve, for months, claimed that the inflation we're seeing was "transitory" which turned out to be utterly wrong.

Ultimately, the party in power in the U.S. has stated, for years, that they wish to make gas/oil products more expensive to incentivize "green" energy. Yet, they seemingly forgot about the peripheral details, that EVs require electric power to charge (with swaths of the U.S. teetering on power rationing due to supply issues), and that deliberately hiking oil prices would create a knock on effect that'd make EVERYTHING more expensive.

The cart was completely put in front of the horse in the "green" energy transition, without working out sensible solutions to how millions of EVs will not buckle the already fragile power grid, and how to replace oil as the dominant material substrate for like, everything that is manufactured on Earth.

I'm not sure what the Canadian perspective is on fossil fuel energy, but here in the U.S., the political winds are blowing in the opposite direction of oil/gas.

Biden reverses Trump move to open up more oil drilling in Arctic

Biden Administration Cancels Drilling Sales in Alaska and Gulf of Mexicol

Biden pulls 3 offshore oil lease sales, curbing new drilling this year

Biden Shrinks U.S. Land Open for New Oil and Gas Drilling

Regarding China, they have been reducing manufacturing/supply output across the board for months, with the stated justification being Xi's "zero COVID" policy, i.e. closing plants to prevent any spread. In my opinion, this is a pretext to keep the supply pipeline in a trickle, but either way, the reality is, if China's production is down, their demand for oil is down, which _should_ translate to less demand and a drop in oil prices. Clearly that aspect is being overwhelmed by other factors, for instance, the Russian oil embargo, and the flood of Biden directives to curtail U.S. oil production.

Quantitative tightening and raising rates should help counteract inflation, in theory, but it's very late in the game. The Federal Reserve, for months, claimed that the inflation we're seeing was "transitory" which turned out to be utterly wrong.

Ultimately, the party in power in the U.S. has stated, for years, that they wish to make gas/oil products more expensive to incentivize "green" energy. Yet, they seemingly forgot about the peripheral details, that EVs require electric power to charge (with swaths of the U.S. teetering on power rationing due to supply issues), and that deliberately hiking oil prices would create a knock on effect that'd make EVERYTHING more expensive.

The cart was completely put in front of the horse in the "green" energy transition, without working out sensible solutions to how millions of EVs will not buckle the already fragile power grid, and how to replace oil as the dominant material substrate for like, everything that is manufactured on Earth.

edit on 3-7-2022 by SleeperHasAwakened because: (no reason given)

edit on 3-7-2022 by SleeperHasAwakened because: (no

reason given)

edit on 3-7-2022 by SleeperHasAwakened because: (no reason given)

a reply to: SleeperHasAwakened

The tightening of gas and oil production within the US and the lack of China filling a void is definitely hurting the US citizen more than anywhere in the world I find.

Gas prices here are pretty high, diesel is up the most, which trickles down into everything obviously.

I'm not against green energy movement, but do agree, the push was rather unnatural to the free market, and it's not going smoothly. The biden admin in my opinion should have given more relief for standard energy ventures and used that to spear head the green energy movement.

Now nations that depended on oil and gas are going to look to goal, causing more of a mess for the environment.

I think after all is said and done, the world economic structure has brought to light just how interconnected we really are.

The tightening of gas and oil production within the US and the lack of China filling a void is definitely hurting the US citizen more than anywhere in the world I find.

Gas prices here are pretty high, diesel is up the most, which trickles down into everything obviously.

I'm not against green energy movement, but do agree, the push was rather unnatural to the free market, and it's not going smoothly. The biden admin in my opinion should have given more relief for standard energy ventures and used that to spear head the green energy movement.

Now nations that depended on oil and gas are going to look to goal, causing more of a mess for the environment.

I think after all is said and done, the world economic structure has brought to light just how interconnected we really are.

a reply to: SleeperHasAwakened

" the COVID stimulus programs were definitely going to drive inflation "

The Fake Covid-19 Plandemic was Artificially Designed to Create Run Away Inflation in the First Place . This is in itself is a Declaration of War Against Humanity . Who is REALLY Behind All of this is the ONLY QUESTION People should be Asking Themselves Right Now . Know Your Enemy !

" the COVID stimulus programs were definitely going to drive inflation "

The Fake Covid-19 Plandemic was Artificially Designed to Create Run Away Inflation in the First Place . This is in itself is a Declaration of War Against Humanity . Who is REALLY Behind All of this is the ONLY QUESTION People should be Asking Themselves Right Now . Know Your Enemy !

a reply to: SleeperHasAwakened

You're supposed to hate ' The-Other-Side™ ', and hate your fellow brothers, over BS ideological bagatelles.

And never, never, dig into who and what is behind these magical little Globalist™ ' Policies™ ', and their origins.

We're being played like a cheap used ukulele.

And we still dance.

And begin to hate our brothers and sisters, just like they want us to...

Divided folks, are conquered folks.

Nobody has ever voted their way out-of Tyranny™.

( Emphasis mine. )

... The tacit assumption, which won't be discussed in detail, is the very contentious policy the current POTUS and his administration have adopted towards fossil fuels and the portion of the energy sector dealing with oil/natural gas. ...

You're supposed to hate ' The-Other-Side™ ', and hate your fellow brothers, over BS ideological bagatelles.

And never, never, dig into who and what is behind these magical little Globalist™ ' Policies™ ', and their origins.

We're being played like a cheap used ukulele.

And we still dance.

And begin to hate our brothers and sisters, just like they want us to...

Divided folks, are conquered folks.

Nobody has ever voted their way out-of Tyranny™.

a reply to: SleeperHasAwakened

A big key issue here that keeps getting overlooked is that Biden ran on the same structures as the "New Green Deal", it was even pointed out at his political campaign site. Everything we see going on over the faulting economy, food crisis, oil scarcity, and over all political climate can be traced back to the "New Green Deal" and this nonsense over the "Great Reset".

The Ukraine issue has nothing to do with any of this, as you pointed out. All this global crisis started way before Russia went into Ukraine. Covid was just an excuse too. What we are seeing take place is by design.

A big key issue here that keeps getting overlooked is that Biden ran on the same structures as the "New Green Deal", it was even pointed out at his political campaign site. Everything we see going on over the faulting economy, food crisis, oil scarcity, and over all political climate can be traced back to the "New Green Deal" and this nonsense over the "Great Reset".

The Ukraine issue has nothing to do with any of this, as you pointed out. All this global crisis started way before Russia went into Ukraine. Covid was just an excuse too. What we are seeing take place is by design.

originally posted by: strongfp

a reply to: SleeperHasAwakened

The tightening of gas and oil production within the US and the lack of China filling a void is definitely hurting the US citizen more than anywhere in the world I find.

Gas prices here are pretty high, diesel is up the most, which trickles down into everything obviously.

I'm not against green energy movement, but do agree, the push was rather unnatural to the free market, and it's not going smoothly. The biden admin in my opinion should have given more relief for standard energy ventures and used that to spear head the green energy movement.

Now nations that depended on oil and gas are going to look to goal, causing more of a mess for the environment.

I think after all is said and done, the world economic structure has brought to light just how interconnected we really are.

I'm not against "Green" energy, in principal. If we can harness energy sources that are efficient, clean and don't require mining/drilling to access supplies deep underground, then that's terrific. "Green" energy sounds great on paper, but in reality, we are not ready to simply pull the plug on fossil fuels and shift, en masse, to "Green" energy.

When you press folks about the fine print on "Green" energy, there is often a good deal of hand waving and glossing over important details. For instance, how will all those EVs be charged on our existing, shaky power grid? what happens to the chemicals in those "Green" batteries when they are no longer able to be recycled? do allegedly "environmentally safe" energy sources like wind turbines actually impact environment/ecosystems too?

Think of the push for "Green" energy as a modern day gold rush cloaked in the unassailable goal of "trying to fight Climate Change(tm)!" Those that act quickly are in the front of the line, in terms of monetizing all of these novel "Green" energy technologies and processes.

I personally don't think the best way to incentivize folks to switch to "Green" energy is to devise ways to price the Average Joe out of purchasing gasoline and any devices/implements that use it. But looking at the data, and the on-the-record statements of certain political and "philanthropic" organizations, a program of intentionally driving up the price of oil products to make it an unattainable commodity for only the affluent seems to be exactly what is going on.

a reply to: SleeperHasAwakened

I am surprised why you didn't include sanctions.

The sanctions are driving the gas prices higher.

including the Russia-Ukraine conflict, supply chain instability

I am surprised why you didn't include sanctions.

The sanctions are driving the gas prices higher.

originally posted by: Nothin

a reply to: SleeperHasAwakened

( Emphasis mine. )

... The tacit assumption, which won't be discussed in detail, is the very contentious policy the current POTUS and his administration have adopted towards fossil fuels and the portion of the energy sector dealing with oil/natural gas. ...

You're supposed to hate ' The-Other-Side™ ', and hate your fellow brothers, over BS ideological bagatelles.

And never, never, dig into who and what is behind these magical little Globalist™ ' Policies™ ', and their origins.

We're being played like a cheap used ukulele.

And we still dance.

And begin to hate our brothers and sisters, just like they want us to...

Divided folks, are conquered folks.

Nobody has ever voted their way out-of Tyranny™.

BOTH mainstream political parties have members that are embracing the path of "Green" energy and this de facto, controlled demolition of the global market for oil-based products. Just track which members of U.S. congress switch their investment portfolios from oil/gas to solar/EV/battery assets.

I think the left is much more wedded to this, but that doesn't mean there aren't supporters and advocates on the right.

Messing around with America's energy independence, and manipulating market forces to control commodity prices, should be an apolitical issue.

a reply to: SleeperHasAwakened

If green energy was what they really wanted, then they could go nuclear. It's the cheapest and cleanest energy source we have to date.

Most of the so-called 'Evils" are nothing when compared to the other waste products of alternative energy sources.

If green energy was what they really wanted, then they could go nuclear. It's the cheapest and cleanest energy source we have to date.

Most of the so-called 'Evils" are nothing when compared to the other waste products of alternative energy sources.

originally posted by: vNex92

a reply to: SleeperHasAwakened

including the Russia-Ukraine conflict, supply chain instability

I am surprised why you didn't include sanctions.

The sanctions are driving the gas prices higher.

As mentioned in the OP, I wasn't going down the rabbit hole into the diverse geo-political matters that are being wielded and brought to bear on, in my view, the deliberate effort to force oil prices up, not to increase profits, but to force the average, middle class consumer to divorce themselves from fossil fuel and "Go Green".

The Russia-Ukraine situation is just another facet of a complex matter. I have been very vocal and unequivocal since this started that I feel this conflict has been pumped up and propped up, and set for the long haul. Take a look at how it has diverted attention from COVID. Also, it is no coincidence in my view that this war is aiding the agenda of the "Green" energy crowd by jacking up oil prices.

There are already enough threads on the sanctions and intricacies of that dispute. Pricing everyone out of oil is a long running game that precedes the Ukraine-Russia issue, and this dust up is just another means to that end, in part.

originally posted by: Guyfriday

a reply to: SleeperHasAwakened

If green energy was what they really wanted, then they could go nuclear. It's the cheapest and cleanest energy source we have to date.

Most of the so-called 'Evils" are nothing when compared to the other waste products of alternative energy sources.

Nuclear has a public stigma thanks to a few isolated but very damaging incidents, Cherynobl, Fukushima.

Building and planning of nuclear plants are serious endeavors requiring a lot of care and good engineering. Putting up wind turbines is much lower risk. But more importantly, the "low hanging fruit" and profit center, for the "Green" energy gold rush is the new battery tech. This is a relatively cheap way to profitize "Green energy", without tackling complex engineering tasks, or waging PR battles to convince the public that it's safe and stable (unlike nuclear power). And nobody really asks tough questions about new battery tech like they do concerning, say, nuclear waste and where to dispose it. But rest assured, when lithium and other chemicals from batteries start showing up in water tables, on a scale we've never before seen, then more scrutiny will be put on how "Green" the "Green energy" fad really is.

It is kind of too late to go back. Once Grocery Prices goes up, they never go back down til they are expired. Has always been that way since after

WW2. Lets not forget the Gov increasing on Taxes for everyone.

edit on 4-7-2022 by arcticscouthunter because: (no reason given)

In a nation this big where the majority of goods are delivered via big trucks runaway gas prices are going to gut the market.

Throw in a touch to much money and shortage of goods and you get a snip storm that will last years and years.

Throw in a touch to much money and shortage of goods and you get a snip storm that will last years and years.

a reply to: SleeperHasAwakened

Resident liberal here most will disagree with..

I do feel I know exactly why gas prices are the way they are. Its not what I've seen anyone mention anywhere either.

Its real simple. The price per barrel isnt anywhere near its all time high, its just high at the pump. That means the ones jacking up the prices are further down the supply chain. The storage facilities, refiners, distributers and merchants..

So why would they do that?

Remember the week we initiated the government lockdowns for Covid in 2020?

A week or so later, Oil futures went NEGATIVE for the first time ever. Thats because everyonenwas locked at home, so the demand for oul went to nearly 0 relatively.

Oil futures are contracts to STORE/WAREHOUSE oil. Instantly, it cost more money to store oil than it was worth. There was too much oil and no demand. Companies had to sell their oil at a massive loss and had to pauly people to store and manage it.. and it took time for the supply chain to slow down and manage the surplus.

Fast forward 2 years later, we are finally back up and running at full steam.. and those middle men want all their money back they lost wjen the futures went negative.. so they jack up the prices artificially.

Resident liberal here most will disagree with..

I do feel I know exactly why gas prices are the way they are. Its not what I've seen anyone mention anywhere either.

Its real simple. The price per barrel isnt anywhere near its all time high, its just high at the pump. That means the ones jacking up the prices are further down the supply chain. The storage facilities, refiners, distributers and merchants..

So why would they do that?

Remember the week we initiated the government lockdowns for Covid in 2020?

A week or so later, Oil futures went NEGATIVE for the first time ever. Thats because everyonenwas locked at home, so the demand for oul went to nearly 0 relatively.

Oil futures are contracts to STORE/WAREHOUSE oil. Instantly, it cost more money to store oil than it was worth. There was too much oil and no demand. Companies had to sell their oil at a massive loss and had to pauly people to store and manage it.. and it took time for the supply chain to slow down and manage the surplus.

Fast forward 2 years later, we are finally back up and running at full steam.. and those middle men want all their money back they lost wjen the futures went negative.. so they jack up the prices artificially.

Fast forward to Sept. 2023

Why are gas prices rising again?

We here in CA are seeing close to $6 per gallon.

Here comes the next cycle of inflation of everything else.

What are others seeing in their regions?

Why are gas prices rising again?

We here in CA are seeing close to $6 per gallon.

Here comes the next cycle of inflation of everything else.

What are others seeing in their regions?

An interesting datapoint, if available, would be the wealth accumulation of those in charge of various segments, industries and businesses that

benchmark those trends.

I really doubt we'll see any decline.

Analyze all you want but at the end of of the day.....Capitalism (greed) wins

my opinion anyway

I really doubt we'll see any decline.

Analyze all you want but at the end of of the day.....Capitalism (greed) wins

my opinion anyway

new topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 3 minutes ago -

America's Greatest Ally

General Chit Chat: 48 minutes ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 5 hours ago -

Maestro Benedetto

Literature: 7 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 7 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 10 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 5 hours ago, 26 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 17 hours ago, 9 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 12 hours ago, 8 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 16 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 15 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 14 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 10 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 13 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 11 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 7 hours ago, 3 flags

active topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 0 • : charlest2 -

America's Greatest Ally

General Chit Chat • 1 • : BingoMcGoof -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 35 • : annonentity -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 49 • : Freeborn -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 30 • : Asher47 -

Electrical tricks for saving money

Education and Media • 8 • : anned1 -

Is AI Better Than the Hollywood Elite?

Movies • 16 • : 5thHead -

Hate makes for strange bedfellows

US Political Madness • 48 • : Terpene -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 17 • : BingoMcGoof -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 90 • : Lumenari

12