It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

originally posted by: ScepticScot

originally posted by: Edumakated

originally posted by: ScepticScot

a reply to: Edumakated

Yet strangely enough running an national economy isn't the same as dividing up a restaurant bill.

It is illustrating the math of tax cuts and that those who already aren't paying taxes don't get a cut. It has nothing to do with running an economy. It is explaining basic math using a restaurant to those who can't seem to grasp the concept due to their jealousy.

Because the only reason that someone would oppose tax plans, that make the already massive inequality worse, would be jealousy?

Your jealousy just drips from your comment...

Why don't you go ahead and define this "massive inequality"?

The Trump partisans are so enamored with the twitter in chief that they would rather see their taxes raised than have a vote in their own self

interest by the opposition.

Just like they would rather see a pedophile elected than vote for "real" family values.

MAGA indeed....

Just like they would rather see a pedophile elected than vote for "real" family values.

MAGA indeed....

edit on 21-11-2017 by olaru12 because: (no reason given)

originally posted by: Edumakated

originally posted by: ScepticScot

originally posted by: Edumakated

originally posted by: ScepticScot

a reply to: Edumakated

Yet strangely enough running an national economy isn't the same as dividing up a restaurant bill.

It is illustrating the math of tax cuts and that those who already aren't paying taxes don't get a cut. It has nothing to do with running an economy. It is explaining basic math using a restaurant to those who can't seem to grasp the concept due to their jealousy.

Because the only reason that someone would oppose tax plans, that make the already massive inequality worse, would be jealousy?

Your jealousy just drips from your comment...

Why don't you go ahead and define this "massive inequality"?

No jealousy. Just pointing out a fact. Tiny minority of the population owns majority of the wealth.

I like the eastern Europe tax structure. Same tax rate for everyone, regardless of income. It works very well. Not a fan of increasing tax rate for

higher income people.

originally posted by: ScepticScot

originally posted by: Edumakated

originally posted by: ScepticScot

originally posted by: Edumakated

originally posted by: ScepticScot

a reply to: Edumakated

Yet strangely enough running an national economy isn't the same as dividing up a restaurant bill.

It is illustrating the math of tax cuts and that those who already aren't paying taxes don't get a cut. It has nothing to do with running an economy. It is explaining basic math using a restaurant to those who can't seem to grasp the concept due to their jealousy.

Because the only reason that someone would oppose tax plans, that make the already massive inequality worse, would be jealousy?

Your jealousy just drips from your comment...

Why don't you go ahead and define this "massive inequality"?

No jealousy. Just pointing out a fact. Tiny minority of the population owns majority of the wealth.

That tiny minority also pays most of the taxes. When has there ever been income equality? There are always going to be instances where a tiny minority owns the vast majority of wealth. That is basic statistics.

originally posted by: Southern Guardian

We should ask Trumps advisors on whether the lower classes will see their taxes increased from this plan.

I know I sure as hell need a tax cut...I paid over 115k in Federal taxes the last two years.

originally posted by: Edumakated

originally posted by: ScepticScot

originally posted by: Edumakated

originally posted by: ScepticScot

originally posted by: Edumakated

originally posted by: ScepticScot

a reply to: Edumakated

Yet strangely enough running an national economy isn't the same as dividing up a restaurant bill.

It is illustrating the math of tax cuts and that those who already aren't paying taxes don't get a cut. It has nothing to do with running an economy. It is explaining basic math using a restaurant to those who can't seem to grasp the concept due to their jealousy.

Because the only reason that someone would oppose tax plans, that make the already massive inequality worse, would be jealousy?

Your jealousy just drips from your comment...

Why don't you go ahead and define this "massive inequality"?

No jealousy. Just pointing out a fact. Tiny minority of the population owns majority of the wealth.

That tiny minority also pays most of the taxes. When has there ever been income equality? There are always going to be instances where a tiny minority owns the vast majority of wealth. That is basic statistics.

They pay the most taxes because they own the most wealth, earn the most income & benefit the most from society.

Inequality is getting worse and most analysis suggests this tax plan will only accelerate that process.

a reply to: Edumakated

The people with kids in the upper middle class is where the tax increase will sting.

As well as the national debt inflation cpi problems that come from lowering revenue without lowering the budget.

Hedging a bet the tax break increases spending in the economy has literally never worked out.

The people with kids in the upper middle class is where the tax increase will sting.

As well as the national debt inflation cpi problems that come from lowering revenue without lowering the budget.

Hedging a bet the tax break increases spending in the economy has literally never worked out.

a reply to: luthier

It is typically those making say $250k/yr - $500k household income who get screwed. You make enough so that the lower classes envy you and lump you in with millionaires and billionaires, but you don't really make enough to be truly rich. It is the perfect group to be suckers for politicians. Basically the upper middle class (doctors, lawyers, middle managers, small business owners, etc).

It is typically those making say $250k/yr - $500k household income who get screwed. You make enough so that the lower classes envy you and lump you in with millionaires and billionaires, but you don't really make enough to be truly rich. It is the perfect group to be suckers for politicians. Basically the upper middle class (doctors, lawyers, middle managers, small business owners, etc).

a reply to: Edumakated

Yep. So California for instance is screwed. The cost of living creates higher wages to pull talent in. So some people in high cost cities and primo real estate locations are middle class even lower believer it or not in that bracket. Like being poor in San Francisco at 240k a year.

The main focus should be to control spending first. I don't care about the ponzi scheme they always pretend with these cuts.

I want to see you stop raising the budget without balancing the revenue to support the budget. The tax cut as far as I am concerned is a major gimmick.

Yep. So California for instance is screwed. The cost of living creates higher wages to pull talent in. So some people in high cost cities and primo real estate locations are middle class even lower believer it or not in that bracket. Like being poor in San Francisco at 240k a year.

The main focus should be to control spending first. I don't care about the ponzi scheme they always pretend with these cuts.

I want to see you stop raising the budget without balancing the revenue to support the budget. The tax cut as far as I am concerned is a major gimmick.

The more I read and see analysis of it, the worse this plan seems. I don't feel good about it. We'll see what happens next year. I would LOVE to

see a plan to shrink our government a little though. We're way too bloated. Remember the Good old days when we ONLY really had the CIA and the FBI.

Let's go back to those days.

edit on 21-11-2017 by amazing because: (no reason given)

originally posted by: Southern Guardian

Are you Taxed Enough Already? Well this should give you enough reason to take out those old TEA Party hats. Right? No? Oh it's Trump so it's ok. It's ok I guess?

Trump spoke as the Tax Policy Center said that while all income groups would see tax reductions, on average, under the Senate bill in 2019, 9 percent of taxpayers would pay higher taxes that year than under current law. By 2027, that proportion would grow to 50 percent, largely because the legislation's personal tax cuts expire in 2026, which Republicans did to curb budget deficits the bill would create.

www.abovetopsecret.com...

Non-Partisan Tax Policy Center.

So which is it - are you concerned about the deficit or aren't you - because you are trying to have it both ways - you are opposed to taxes going up after 10 years on half the middle class - but you are also opposed to increasing the deficit due to the tax reductions over the next 10 years.

Further:

In 2019, those making less than $25,000 would get an average $50 tax reduction, or 0.3 percent of their after-tax income. Middle-income earners would get average cuts of $850, while people making at least $746,000 would get average cuts of $34,000, or 2.2 percent of income.

The center also said the Senate proposal would generate enough economic growth to produce additional revenue of $169 billion over a decade. That's far short of closing the near $1.5 trillion in red ink that Congress' nonpartisan Joint Committee on Taxation has estimated the bill would produce over that period.

So it's heavily favored to the top side of the income bracket. How predictable. Still, $169 billion in additional revenue is great for the country. That outta cover it right? What, that's $16.9 billion a year? Pocket change me thinks. Doesn't put much of a dent in the $1.5 trillion deficit this congress is set to create.

It is really hard to cut taxes on the poor when they already almost all pay nothing - 45% pay no income tax under the existing law.

That is why this bill is cuts for the middle class - you can't cut anymore for the poor - so stop saying this is cruel to the poor that is absolute horse crap - it will help the poor by causing increased wages, and providing more jobs.

As far as their prediction of $169 billion increase in tax revenue over 10 years - I think that is way lower than it will actually be. Afterall just a few months ago people were saying 3% GDP was impossible - We have already accomplished that with no tax cuts. Show me one of these estimates that has been anywhere close to correct, they just aren't. I don't think it will add a trillion to the deficit but if it did - and it accomplishes 4-5% gdp increase it will be well worth it.

As far as complaining about adding to the deficit - you do realize Obama added 9+ trillion to the deficit in 8 years which is nearly as much debt as the country accumulated in the 230+ years prior right?

Look the truth is we can't pay back our debt at this point. Neither can Europe. Neither can Japan. China's economy is a house of cards too. The name of the game right now is don't be the first country to experience economic collapse - throwing fuel on the fire is the best way to accomplish that at this point. It sure as heck beats the obama admin plan of just giving money to the banks who horded it - at least this way private citizens will get the money, and we will build some things of substance with the money that will have positive impact on the economy for years to come.

originally posted by: Edumakated

Some may have seen this before, but it does a really good job explaining things...

How Taxes Work . . .

Let’s put tax cuts in terms everyone can understand. Suppose that every day, ten men go out for dinner. The bill for all ten comes to $100. If they paid their bill the way we pay our taxes, it would go something like this:

The first four men — the poorest — would pay nothing; the fifth would pay $1, the sixth would pay $3, the seventh $7, the eighth $12, the ninth $18, and the tenth man — the richest — would pay $59.

That’s what they decided to do. The ten men ate dinner in the restaurant every day and seemed quite happy with the arrangement — until one day, the owner threw them a curve (in tax language a tax cut).

“Since you are all such good customers,” he said, “I’m going to reduce the cost of your daily meal by $20.” So now dinner for the ten only cost $80.00.

The group still wanted to pay their bill the way we pay our taxes. So the first four men were unaffected. They would still eat for free. But what about the other six — the paying customers? How could they divvy up the $20 windfall so that everyone would get his “fair share?”

The six men realized that $20 divided by six is $3.33. But if they subtracted that from everybody’s share, then the fifth man and the sixth man would end up being PAID to eat their meal. So the restaurant owner suggested that it would be fair to reduce each man’s bill by roughly the same amount, and he proceeded to work out the amounts each should pay.

And so the fifth man paid nothing, the sixth pitched in $2, the seventh paid $5, the eighth paid $9, the ninth paid $12, leaving the tenth man with a bill of $52 instead of his earlier $59. Each of the six was better off than before. And the first four continued to eat for free.

But once outside the restaurant, the men began to compare their savings. “I only got a dollar out of the $20,” declared the sixth man who pointed to the tenth. “But he got $7!”

“Yeah, that’s right,” exclaimed the fifth man, “I only saved a dollar, too … It’s unfair that he got seven times more than me!”.

“That’s true!” shouted the seventh man, “why should he get $7 back when I got only $2? The wealthy get all the breaks!”

“Wait a minute,” yelled the first four men in unison, “We didn’t get anything at all. The system exploits the poor!”

The nine men surrounded the tenth and beat him up. The next night he didn’t show up for dinner, so the nine sat down and ate without him. But when it came time to pay the bill, they discovered, a little late what was very important. They were FIFTY-TWO DOLLARS short of paying the bill! Imagine that!

This always leaves out the part that the 10th man made all his money by not compensating the rest of them fairly.

originally posted by: Greven

originally posted by: Greven

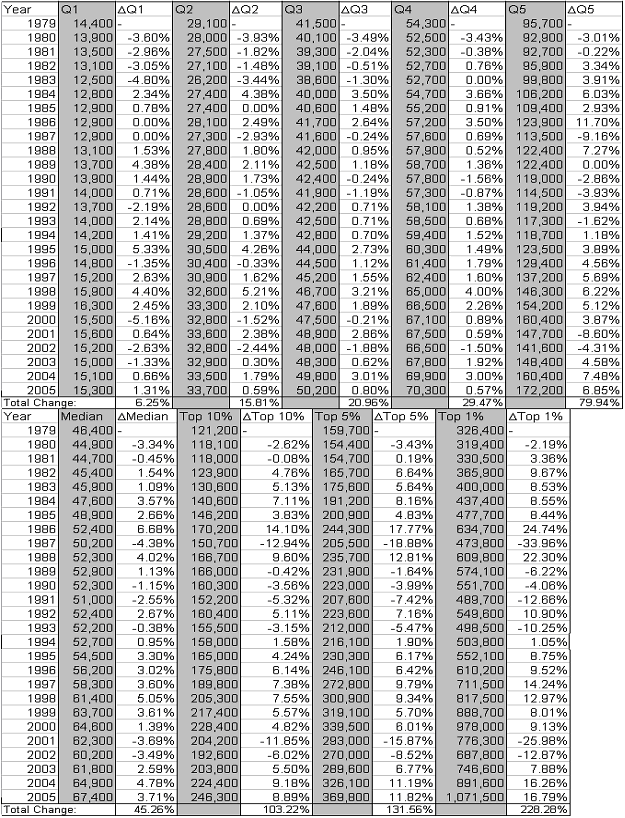

Checkout this thing I made years ago... I haven't looked at numbers in awhile, but this is how average income grew for 25 years:

(e: I should explain this a bit I guess, Q = Quintile; quintile = 20% of the overall population from poorest Q1 to richest Q5 - a standard metric used to look at how things are going, with the addition of further division of the top 20% into the top 10%, 5%, and 1% - most of the growth in those are actually in the top 1% which lifts up the others in that same group; Δ = delta, a.k.a. change)

Average income of the poor rose just over 6%, while average income of the rich rose over 225%.

Oh yeah, here's an interesting thing in this chart...

1979 share of income...

Q1: 14400 - 6.13% (poorest 20%)

Q2: 29100 - 12.38%

Q3: 41500 - 17.66%

Q4: 54300 - 23.11%

Q5: 95700 - 40.72% (richest 20%)

---extended---

top20% to top10%: 14.94%

...this includes top 1%, 5%... top10%: 121200 - 25.78%

top10% to top 5%: 8.78%

...this includes top 1%... top 5%: 159700 - 17.00%

top 5% to top 1%: 10.06%

top 1%: 326400 - 6.94%

2005 share of income...

Q1: 15300 - 4.48% (poorest 20%)

Q2: 33700 - 9.86%

Q3: 50200 - 14.69%

Q4: 70300 - 20.57%

Q5: 172200 - 50.40% (richest 20%)

---extended---

top20% to top10%: 14.36%

...this includes top 1%, 5%... top10%: 246300 - 36.04%

top10% to top 5%: 8.98%

...this includes top 1%... top 5%: 369800 - 27.06%

top 5% to top 1%: 11.38%

top 1%: 1071500 - 15.68%

Gains from 1979 to 2005 (losses denoted by []s):

Q1: [-1.65%] (poorest 20%)

Q2: [-2.52%]

Q3: [-2.97%]

Q4: [-2.54%]

Q5: +9.68% (richest 20%)

---extended---

top20% to top10%: [-0.58%]

...this includes top 1%, 5%... top10%: +10.26%

top10% to top 5%: +0.20%

...this includes top 1%...top 5%: +10.06%

top 5% to top 1%: +1.32%

top 1%: +8.74%

There is most certainly class warfare going on, and the rich are winning it.

See, Mr. Rich guy?

edit on 18Tue, 21 Nov 2017 18:35:11 -0600America/ChicagovAmerica/Chicago11 by Greven because: (no reason given)

originally posted by: proximo

originally posted by: Southern Guardian

Are you Taxed Enough Already? Well this should give you enough reason to take out those old TEA Party hats. Right? No? Oh it's Trump so it's ok. It's ok I guess?

Trump spoke as the Tax Policy Center said that while all income groups would see tax reductions, on average, under the Senate bill in 2019, 9 percent of taxpayers would pay higher taxes that year than under current law. By 2027, that proportion would grow to 50 percent, largely because the legislation's personal tax cuts expire in 2026, which Republicans did to curb budget deficits the bill would create.

www.abovetopsecret.com...

Non-Partisan Tax Policy Center.

So which is it - are you concerned about the deficit or aren't you - because you are trying to have it both ways - you are opposed to taxes going up after 10 years on half the middle class - but you are also opposed to increasing the deficit due to the tax reductions over the next 10 years.

Further:

In 2019, those making less than $25,000 would get an average $50 tax reduction, or 0.3 percent of their after-tax income. Middle-income earners would get average cuts of $850, while people making at least $746,000 would get average cuts of $34,000, or 2.2 percent of income.

The center also said the Senate proposal would generate enough economic growth to produce additional revenue of $169 billion over a decade. That's far short of closing the near $1.5 trillion in red ink that Congress' nonpartisan Joint Committee on Taxation has estimated the bill would produce over that period.

So it's heavily favored to the top side of the income bracket. How predictable. Still, $169 billion in additional revenue is great for the country. That outta cover it right? What, that's $16.9 billion a year? Pocket change me thinks. Doesn't put much of a dent in the $1.5 trillion deficit this congress is set to create.

It is really hard to cut taxes on the poor when they already almost all pay nothing - 45% pay no income tax under the existing law.

That is why this bill is cuts for the middle class - you can't cut anymore for the poor - so stop saying this is cruel to the poor that is absolute horse crap - it will help the poor by causing increased wages, and providing more jobs.

As far as their prediction of $169 billion increase in tax revenue over 10 years - I think that is way lower than it will actually be. Afterall just a few months ago people were saying 3% GDP was impossible - We have already accomplished that with no tax cuts. Show me one of these estimates that has been anywhere close to correct, they just aren't. I don't think it will add a trillion to the deficit but if it did - and it accomplishes 4-5% gdp increase it will be well worth it.

As far as complaining about adding to the deficit - you do realize Obama added 9+ trillion to the deficit in 8 years which is nearly as much debt as the country accumulated in the 230+ years prior right?

Look the truth is we can't pay back our debt at this point. Neither can Europe. Neither can Japan. China's economy is a house of cards too. The name of the game right now is don't be the first country to experience economic collapse - throwing fuel on the fire is the best way to accomplish that at this point. It sure as heck beats the obama admin plan of just giving money to the banks who horded it - at least this way private citizens will get the money, and we will build some things of substance with the money that will have positive impact on the economy for years to come.

What, exactly, do you think the 'middle class' is?

What income range is it?

This tax plan was made for taxpayers,the only ones who are affected are the ones recieving benefit's,and the way money is used,perhaps do away with

earned income credit,some get 8 to 10k back for having multiple children,we need to get rid of taxpayers give away,this is incentive to work,not

collect welfare

originally posted by: Greven

originally posted by: proximo

originally posted by: Southern Guardian

Are you Taxed Enough Already? Well this should give you enough reason to take out those old TEA Party hats. Right? No? Oh it's Trump so it's ok. It's ok I guess?

Trump spoke as the Tax Policy Center said that while all income groups would see tax reductions, on average, under the Senate bill in 2019, 9 percent of taxpayers would pay higher taxes that year than under current law. By 2027, that proportion would grow to 50 percent, largely because the legislation's personal tax cuts expire in 2026, which Republicans did to curb budget deficits the bill would create.

www.abovetopsecret.com...

Non-Partisan Tax Policy Center.

So which is it - are you concerned about the deficit or aren't you - because you are trying to have it both ways - you are opposed to taxes going up after 10 years on half the middle class - but you are also opposed to increasing the deficit due to the tax reductions over the next 10 years.

Further:

In 2019, those making less than $25,000 would get an average $50 tax reduction, or 0.3 percent of their after-tax income. Middle-income earners would get average cuts of $850, while people making at least $746,000 would get average cuts of $34,000, or 2.2 percent of income.

The center also said the Senate proposal would generate enough economic growth to produce additional revenue of $169 billion over a decade. That's far short of closing the near $1.5 trillion in red ink that Congress' nonpartisan Joint Committee on Taxation has estimated the bill would produce over that period.

So it's heavily favored to the top side of the income bracket. How predictable. Still, $169 billion in additional revenue is great for the country. That outta cover it right? What, that's $16.9 billion a year? Pocket change me thinks. Doesn't put much of a dent in the $1.5 trillion deficit this congress is set to create.

It is really hard to cut taxes on the poor when they already almost all pay nothing - 45% pay no income tax under the existing law.

That is why this bill is cuts for the middle class - you can't cut anymore for the poor - so stop saying this is cruel to the poor that is absolute horse crap - it will help the poor by causing increased wages, and providing more jobs.

As far as their prediction of $169 billion increase in tax revenue over 10 years - I think that is way lower than it will actually be. Afterall just a few months ago people were saying 3% GDP was impossible - We have already accomplished that with no tax cuts. Show me one of these estimates that has been anywhere close to correct, they just aren't. I don't think it will add a trillion to the deficit but if it did - and it accomplishes 4-5% gdp increase it will be well worth it.

As far as complaining about adding to the deficit - you do realize Obama added 9+ trillion to the deficit in 8 years which is nearly as much debt as the country accumulated in the 230+ years prior right?

Look the truth is we can't pay back our debt at this point. Neither can Europe. Neither can Japan. China's economy is a house of cards too. The name of the game right now is don't be the first country to experience economic collapse - throwing fuel on the fire is the best way to accomplish that at this point. It sure as heck beats the obama admin plan of just giving money to the banks who horded it - at least this way private citizens will get the money, and we will build some things of substance with the money that will have positive impact on the economy for years to come.

What, exactly, do you think the 'middle class' is?

What income range is it?

It varies by state and local economies.

I'll save $1,400 next year and $650 after 2027. Much better than I would have fared with Hillary trying to make federal programs for everything. Still need to get the Libertarian party going, though.

Thanks Republicans, I'll take it.

new topics

-

What is the white pill?

Philosophy and Metaphysics: 8 minutes ago -

Mike Pinder The Moody Blues R.I.P.

Music: 52 minutes ago -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 3 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 8 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 14 hours ago, 31 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 8 hours ago, 13 flags -

Is AI Better Than the Hollywood Elite?

Movies: 15 hours ago, 4 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 52 minutes ago, 2 flags -

Maestro Benedetto

Literature: 15 hours ago, 1 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 3 hours ago, 1 flags -

What is the white pill?

Philosophy and Metaphysics: 8 minutes ago, 1 flags

active topics

-

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 60 • : FlyersFan -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 17 • : ToneD -

Hate makes for strange bedfellows

US Political Madness • 51 • : network dude -

Alternate Electors vs Fake Electors - What is the Difference.

2024 Elections • 122 • : matafuchs -

The Acronym Game .. Pt.3

General Chit Chat • 7755 • : F2d5thCavv2 -

What is the white pill?

Philosophy and Metaphysics • 0 • : kwaka -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 16 • : Threadbarer -

Democrats Introduce Bill That Will Take Away Donald Trumps Secret Service Protection

2024 Elections • 75 • : TzarChasm -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 68 • : baablacksheep1 -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works • 14 • : RussianTroll