It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Their electronic money is worth only as much that we believe it is worth, believing in the international money and stocks system is merely a religion

in which people believe that these numbers in machines actually mean something.

Man work and natural resources, this is real wealth.

All will crumble the day we say : "Hey, your money isn't worth anything it's just numbers that we believed in."

Man work and natural resources, this is real wealth.

All will crumble the day we say : "Hey, your money isn't worth anything it's just numbers that we believed in."

Apparently it's not just Newsmax who is indicating an upcoming correction. This is from yesterdays Wall Street Journal.

So a prediction of 65 - 72% drop within a couple of years. Regardless of whether it's going to happen very soon or a couple years out people may want to be taking action if they are able.

United-ICAP chief market technician Walter Zimmerman said the Dow Industrials could still rally another 4% or so first, to a high around 17150, before the great reversal begins. And for those who thought 2008 was the worst bear market they will ever see, just wait.

“Based on our longer-term time cycles the present stock market rally must be considered the bubble to end all bubbles,” Mr. Zimmerman wrote in a note to clients.

He doesn’t believe the Dow Industrials will hit a long-term cycle low until 2016, somewhere in the 5770 to 4650 range. The Dow hasn’t seen those levels, which are 65% to 72% below current prices, since late-1995 to mid-1996. WSJ..

So a prediction of 65 - 72% drop within a couple of years. Regardless of whether it's going to happen very soon or a couple years out people may want to be taking action if they are able.

reply to post by Bassago

Every asset class is over valued, save for one. The reason why assets are overvalued is very simple, interest rates have been kept artificially low - and quantitive easing has added a lot more money to commercial banks to allow them to buy things up.

Interest rates set the price of all income producing assets, because they determine the rate of interest on deposits. As interest rates fall, money goes looking for yield - wherever it can find it. Take for example a bond that pays $10 annual interest, if the price of the bond is $100, then the interest rate returned from that bond is 10% - so when you can only get 1% interest everywhere else, you buy that bond - which pushes up its price. If the perceived risk of that bond is the same as the investment that is paying 1%, then the correct price of that bond suddenly becomes $1,000 (1% interest on $1,000 = $10).

Rising interest rates of course have the reverse effect, asset prices fall. In the stock market this is primarily due to stocks on margin (that is money is loaned out for the purpose of buying stocks). As the interest rates on the margin loans increase, it becomes necessary to sell the stocks to maintain equivalent value.

The massive problem is that all stock markets, and now bond markets are correlated - and transactions can be done instantly.

There is also a critical trigger point that is based on the derivative market - a huge opaque $1 quadrillion dollar market. A great deal of this market is in interest rate derivatives (its essentially insurance against rates rising above a certain point). Due to the interconnected and opaque nature of this market, even a small amount of interest rate dependent derivatives activating can easily lead to a global chain reaction. The hard truth is, there is not enough money to cover all the derivatives in existence, not by a long chalk.

To use an analogy, imagine if a single company had insured every Japanese household against the threat of radioactive contamination - and would have to pay out for a new home in another nation, plus all the moving expenses. So that insurance company hedges by insuring against that outcome with some banks. Then Fukushima melts down and the entirety of Japan has to be evacuated.

The insurance company will demand that the banks pay it out, but they simply wont have enough money to do so - and it certainly would not have enough money around to pay out itself. The result would be that the insured people get pennies, and all the banks plus insurance corporation go bankrupt.

The problem though with the derivatives, is it is slightly more complex than that - because they are all interconnected and will all be trying to make their claim first (while their counter party still has some money they might claim) - the end result will be total chaos, and whoever is holding the cash will probably try and run off with it.

This event is becoming almost certain to happen due to failure to enforce the rule of law, and make sure that real assets exist, collateral, against which claims can be made. The world treats debt as if it were an asset, but debt is worth nothing when people cannot pay it.

When this paper tsunami explodes, only those who own unencumbered real assets will retain any wealth - everything else will be swept away like the worthless paper it is.

So, as I alluded to in the beginning - there is one asset classes that is so hated by governments and international bankers that they have contrived to depress its price right down to bare production costs. That asset class is of course precious metals, specifically gold and silver.

While it is true that real estate can be considered a hard asset - the price of real estate world wide is still very over priced - and with an economic disaster, who knows if war may come, or govts or banks may simply steal peoples land.

Gold and silver in the hand are a very good insurance against the economic risks that are present in the world. Now there is also BitCoin and general crypto currencies which are outside the control of bankers and govts which may yield some safety for wealth preservation.

I do not know when, nor can I even be certain if economic events on this scale may come to pass - all I can do is observe that such a risk exists, and it is far from a tail risk - it is a looming and present danger.

Given such an outcome, it makes sense to be as independent as possible - being able to supply your own basic needs for food, water, defense and so on makes a great deal of sense at any time, but now I consider it as personal insurance - and its very worthwhile.

Every asset class is over valued, save for one. The reason why assets are overvalued is very simple, interest rates have been kept artificially low - and quantitive easing has added a lot more money to commercial banks to allow them to buy things up.

Interest rates set the price of all income producing assets, because they determine the rate of interest on deposits. As interest rates fall, money goes looking for yield - wherever it can find it. Take for example a bond that pays $10 annual interest, if the price of the bond is $100, then the interest rate returned from that bond is 10% - so when you can only get 1% interest everywhere else, you buy that bond - which pushes up its price. If the perceived risk of that bond is the same as the investment that is paying 1%, then the correct price of that bond suddenly becomes $1,000 (1% interest on $1,000 = $10).

Rising interest rates of course have the reverse effect, asset prices fall. In the stock market this is primarily due to stocks on margin (that is money is loaned out for the purpose of buying stocks). As the interest rates on the margin loans increase, it becomes necessary to sell the stocks to maintain equivalent value.

The massive problem is that all stock markets, and now bond markets are correlated - and transactions can be done instantly.

There is also a critical trigger point that is based on the derivative market - a huge opaque $1 quadrillion dollar market. A great deal of this market is in interest rate derivatives (its essentially insurance against rates rising above a certain point). Due to the interconnected and opaque nature of this market, even a small amount of interest rate dependent derivatives activating can easily lead to a global chain reaction. The hard truth is, there is not enough money to cover all the derivatives in existence, not by a long chalk.

To use an analogy, imagine if a single company had insured every Japanese household against the threat of radioactive contamination - and would have to pay out for a new home in another nation, plus all the moving expenses. So that insurance company hedges by insuring against that outcome with some banks. Then Fukushima melts down and the entirety of Japan has to be evacuated.

The insurance company will demand that the banks pay it out, but they simply wont have enough money to do so - and it certainly would not have enough money around to pay out itself. The result would be that the insured people get pennies, and all the banks plus insurance corporation go bankrupt.

The problem though with the derivatives, is it is slightly more complex than that - because they are all interconnected and will all be trying to make their claim first (while their counter party still has some money they might claim) - the end result will be total chaos, and whoever is holding the cash will probably try and run off with it.

This event is becoming almost certain to happen due to failure to enforce the rule of law, and make sure that real assets exist, collateral, against which claims can be made. The world treats debt as if it were an asset, but debt is worth nothing when people cannot pay it.

When this paper tsunami explodes, only those who own unencumbered real assets will retain any wealth - everything else will be swept away like the worthless paper it is.

So, as I alluded to in the beginning - there is one asset classes that is so hated by governments and international bankers that they have contrived to depress its price right down to bare production costs. That asset class is of course precious metals, specifically gold and silver.

While it is true that real estate can be considered a hard asset - the price of real estate world wide is still very over priced - and with an economic disaster, who knows if war may come, or govts or banks may simply steal peoples land.

Gold and silver in the hand are a very good insurance against the economic risks that are present in the world. Now there is also BitCoin and general crypto currencies which are outside the control of bankers and govts which may yield some safety for wealth preservation.

I do not know when, nor can I even be certain if economic events on this scale may come to pass - all I can do is observe that such a risk exists, and it is far from a tail risk - it is a looming and present danger.

Given such an outcome, it makes sense to be as independent as possible - being able to supply your own basic needs for food, water, defense and so on makes a great deal of sense at any time, but now I consider it as personal insurance - and its very worthwhile.

reply to post by Amagnon

Thank you Amagnon for that well written post. You're spot on with the derivative assessment I believe, that's one hammer that could take everything down worldwide. I believe it will actually bring the world to it's knees during the next collapse. Probably be the cause.

Seems like things always come full circle with these topics with the final result being: To prep for a financial collapse (or any other) have on hand gold, silver, food and water sources, weapons, medicine and tools. I guess when it comes down to it humanity hasn't changed much over the millennium.

Thank you Amagnon for that well written post. You're spot on with the derivative assessment I believe, that's one hammer that could take everything down worldwide. I believe it will actually bring the world to it's knees during the next collapse. Probably be the cause.

Seems like things always come full circle with these topics with the final result being: To prep for a financial collapse (or any other) have on hand gold, silver, food and water sources, weapons, medicine and tools. I guess when it comes down to it humanity hasn't changed much over the millennium.

reply to post by Bassago

The article is crap. These guys release their buys and sells every quarter, so each quarter they either add to a position, close one out, or sell some. They need to sell something to add to another position.

Then funny thing about this article is they only talk about what positions they have sold, not the positions they have added. BTW, Buffet added US stocks that deal with infrastructure, banking, DTV, oil, and many many more. It normal to take profits and seeing as they billionaires run hedge funds or other funds they have shareholders that expect consistent returns.

The economy is getting better and better, people have been claiming end of the world economic collapse since 2007 and every new year there is a post like this.

He also holds shares in Walmart, GM, UsBancorp. These are top ten stocks he owns in his portfolio

The article is crap. These guys release their buys and sells every quarter, so each quarter they either add to a position, close one out, or sell some. They need to sell something to add to another position.

Then funny thing about this article is they only talk about what positions they have sold, not the positions they have added. BTW, Buffet added US stocks that deal with infrastructure, banking, DTV, oil, and many many more. It normal to take profits and seeing as they billionaires run hedge funds or other funds they have shareholders that expect consistent returns.

The economy is getting better and better, people have been claiming end of the world economic collapse since 2007 and every new year there is a post like this.

edit on 5-1-2014 by tide88 because: Sp

He also holds shares in Walmart, GM, UsBancorp. These are top ten stocks he owns in his portfolio

edit on 5-1-2014 by tide88 because: Add

six67seven

Gold & silver, Guns & bullets, Food & water

Forget gold and silver....they have long been move to the speculation market. Gold at 1500 an ounce is at that price only because speculators have driven it. Gold now follows the stock market and if the stock market falls so does gold.

One thing that never looses value is bullets...

Xtrozero

six67seven

Gold & silver, Guns & bullets, Food & water

Forget gold and silver....they have long been move to the speculation market. Gold at 1500 an ounce is at that price only because speculators have driven it. Gold now follows the stock market and if the stock market falls so does gold.

One thing that never looses value is bullets...

Maybe silver, because it is a usable metal and has value there, but gold is basically a worthless metal.

tide88

reply to post by Bassago

The economy is getting better and better, people have been claiming end of the world economic collapse since 2007 and every new year there is a post like this.

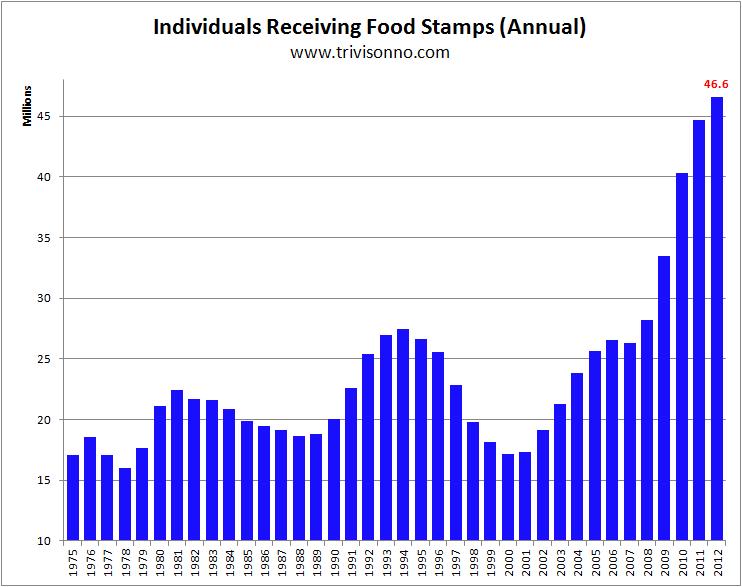

Of course it is. Everyone knows the economy is all rainbows and unicorns for everyone except:

People on food-stamps

People unemployed

If you really believe things are rosy more power to you, I disagree.

Thanks for the post.

tide88

reply to post by Bassago

The article is crap. These guys release their buys and sells every quarter, so each quarter they either add to a position, close one out, or sell some. They need to sell something to add to another position.

Then funny thing about this article is they only talk about what positions they have sold, not the positions they have added. BTW, Buffet added US stocks that deal with infrastructure, banking, DTV, oil, and many many more. It normal to take profits and seeing as they billionaires run hedge funds or other funds they have shareholders that expect consistent returns.

The economy is getting better and better, people have been claiming end of the world economic collapse since 2007 and every new year there is a post like this.edit on 5-1-2014 by tide88 because: Sp

He also holds shares in Walmart, GM, UsBancorp. These are top ten stocks he owns in his portfolio

edit on 5-1-2014 by tide88 because: Add

These articles and even guys like Peter Schiff, Gerald Celente and others get air time but they are a type of fear porn.

If you want to see stock ownership changes, go to something like whalewisdom.com and read what mutual funds do quarterly when they release their 13-F SEC filings. They are quarterly and after the fact, so you cannot predict a collapse. Usually corrections come fast and are triggered by sour news and algorithmic trading allowed to take a market down. Many bubble stocks exist that will fall to half their value long before the blue chips do. Bubble stocks took the markets down in 2000 and similarly in 2008 but they differed somewhat. I believe that the fear porn people act like a short position. They draw in their fans and get some people to exit the market way too early. I was listening to a radio show a few months back. The host said a friend of his exited the market at the end of 2012 and had a stock portfolio of 3 million. He missed out on the 35-40% or more gains of 2013.

Don't fall for newsmax style fear porn. Rather, learn the market and make it your b1tch. Make the market work for you, don't run from it. My portfolio is up strongly from last year. Luck, skill and determination all made it so.

edit on 5-1-2014 by bonaire because: (no reason

given)

theMediator

Their electronic money is worth only as much that we believe it is worth, believing in the international money and stocks system is merely a religion in which people believe that these numbers in machines actually mean something.

Man work and natural resources, this is real wealth.

All will crumble the day we say : "Hey, your money isn't worth anything it's just numbers that we believed in."

Spot on. Your time is the only currency there is. Everything else is just a marker for it. There are many folks on this thread who have shared some good insight and ideas. (Bassago, 6/7 and some others.) I'm no expert in the market, but I did work for a little over a year at a company that designs stock market trend analysis software. This got me interested in market watching and trading etc. Right now the individual trader has little chance to be successful in the market. The best you can hope for is to identify a trend and make a little cash before the trend dies out.

With that said, I don't believe anyone should be long right now. If you think the market is going to grow over the next few years you are insane. Sure it may tick up a couple hundred points before it collapses, but collapse it will. Unemployment is super high, we don't manufacture hardly anything here any more, social programs are sucking the middle class dry and we have been in a depression for at least 5 years but the stock market is the highest its ever been? How does that make sense? Our prospects are the lowest I have seen them in my lifetime, yet the market is the highest? No sense there. 95% of all trading is now Bots, Banks and Institutions. The Fed buying our own bonds to keep the charade going. It WILL all correct. It has to. And it WILL be ugly when it does.

Buy and hold is dead. I read one persons reply that stated "Why not just buy the stock and if the value falls, just hold on to it until it makes a profit?" For those who don't know, that is about the worst thing you can do. If you truly believe in the stock and it devalues when you buy it, you buy more. You have probably heard a saying something similar to: "I liked it at $30/share and now I love it at $15/share." The thought behind that is that you have done your due diligence researching a stock before you bought it. The stock looked like a deal at X price (Say $30/share). Now that the stock is half that and nothing has changed fundamentally, its a much better deal at $15/share or half the price you originally paid. So you double down, get more shares and wait for it to correct. I don't recommend buying stocks right now, but if you are then this is how it has been done for a while and it seems to work. My mind says the only place to be right now is in a DOW Contra ETF. You will make a mint when this thing corrects. (I don't recommend this though for one simple reason. When it all happens and the markets go to crap, you will have a crap ton of worthless money. Sure, you made the right call, but so what? Now you have a ton of paper that won't buy you anything. When this thing pops, rich and poor alike will all be in the same boat. IMHO its all a waste of time.)

Back on topic, the DOW at 16,000+ is pure fantasy. A correction is coming. Precious Metals are better than nothing, but you can't eat them. If you want to retain some type of wealth through whats coming, sure PM's might be the way to go, but I think wealth is part of the paradigm that will fade soon. If you agree that your time is the only real currency then Wealth is just an idea. A nice thought, but its all going away. Invest in you. Make you a valuable commodity. Learn to be a person that can not only survive but thrive in any situation and you will be rich in any situation. Those who can produce goods or services will be the most valuable when it all hits the fan. For those of you (like me) who work in the computer field or the finance field or other fields that are not basic necessities wont have any marketable skills in the coming turmoil. (I work in IT for the financial sector, so I am pretty much screwed in one sense) So you MUST have skills that will make you valuable or at least an asset during lean times. Luckily for me, bushcraft and survival have been a part of my life since I was 12. But when I look around, I don't see too many others that have these skills. Most guys can't even change their own oil nowadays. Its sad to see how many folks have no real skills and will probably perish when it all goes down. Learn how to make a generator or dig a well. Learn to build shelters or farm food. Real world skills are the only hedge against the disasters that are coming. Just my two cents. Good work OP.

reply to post by tide88

Can you go into more detail as to why gold is worthless? I'd say its current standing show is worth so displace all that we use gold for with something that would be a better fit please.

I might even learn something when to tell me these things

Can you go into more detail as to why gold is worthless? I'd say its current standing show is worth so displace all that we use gold for with something that would be a better fit please.

I might even learn something when to tell me these things

reply to post by Bassago

I am just a poor sap raising his granddaughter with no money to invest sadly. Do have a few bullets, not near enough lol.

I would not worry to much, you have to look at their timing as well. It is the start of a new year, time to sell, raise some capital, buy something different or just spend some. They usually do allot of moving around this time every year.

Buffet however is one to watch little closer. He is the insider in inside information. I do admire that he has joined the gates group in giving away most of their money. Very kewl, I just wish they would take the blinders off and help people in their own country before they help people elsewhere, I mean they made their money here lol.

If I could afford it i would buy silver, read somewhere there is company here in states let's you buy as much or little as you want and they send it to you but lost link when computer crashed lol.

The Bot

I am just a poor sap raising his granddaughter with no money to invest sadly. Do have a few bullets, not near enough lol.

I would not worry to much, you have to look at their timing as well. It is the start of a new year, time to sell, raise some capital, buy something different or just spend some. They usually do allot of moving around this time every year.

Buffet however is one to watch little closer. He is the insider in inside information. I do admire that he has joined the gates group in giving away most of their money. Very kewl, I just wish they would take the blinders off and help people in their own country before they help people elsewhere, I mean they made their money here lol.

If I could afford it i would buy silver, read somewhere there is company here in states let's you buy as much or little as you want and they send it to you but lost link when computer crashed lol.

The Bot

reply to post by Fearthedarkforiaminit

Ok so how about helping us with the skills we will need while we still have electricity and computers to see it on. Would love to see pdf series on survival skills. I say that because you can print them and have them to follow when you no longer have electricity.

That would be a worthwhile endeavor and really help others. What you think.

The Bot

Ok so how about helping us with the skills we will need while we still have electricity and computers to see it on. Would love to see pdf series on survival skills. I say that because you can print them and have them to follow when you no longer have electricity.

That would be a worthwhile endeavor and really help others. What you think.

The Bot

Gold has been sought after, and held value since the beginning of civilization. Its not worthless, period.

Now, gold put in perspective:

If you're middle-class or below and the economy crashes, you dont necessarily want to be holding gold because youll need the basics (not that gold will be hard to get rid of, but you most likely wont be able to hold onto to it long enough to reap all the benefits) - for most everyone else gold is still very valuable.

Precious metals, like most investments, are seen as long-term investments. Which is why coins are often passed down in the family through generations.

Now, gold put in perspective:

If you're middle-class or below and the economy crashes, you dont necessarily want to be holding gold because youll need the basics (not that gold will be hard to get rid of, but you most likely wont be able to hold onto to it long enough to reap all the benefits) - for most everyone else gold is still very valuable.

Precious metals, like most investments, are seen as long-term investments. Which is why coins are often passed down in the family through generations.

reply to post by dlbott

If you have to be taught survival skills, you're already in trouble. Go camping for a week in the wilderness and see if you have any.

If you have to be taught survival skills, you're already in trouble. Go camping for a week in the wilderness and see if you have any.

reply to post by dlbott

Many of us in similar situations though luckily I'm not having to raise any grandkids.

Bullets are always going to be worthwhile and easy investment because you can buy them in small quantities. Personally I have bags of them. Recently sold a bunch at a garage sale by 20 count lots when I'd originally bought them by the ammo can. 400 - 500% return on investment so if things get bad you can imagine what they'll be worth.

Guess the main question is are we just going to have a market correction (worse than 08) or will SHTF? If the latter those bullets you have may be worth more than silver.

I am just a poor sap raising his granddaughter with no money to invest sadly. Do have a few bullets, not near enough lol.

Many of us in similar situations though luckily I'm not having to raise any grandkids.

Bullets are always going to be worthwhile and easy investment because you can buy them in small quantities. Personally I have bags of them. Recently sold a bunch at a garage sale by 20 count lots when I'd originally bought them by the ammo can. 400 - 500% return on investment so if things get bad you can imagine what they'll be worth.

Guess the main question is are we just going to have a market correction (worse than 08) or will SHTF? If the latter those bullets you have may be worth more than silver.

edit on 236pm5454pm102014 by Bassago because: (no reason given)

reply to post by Bassago

Just recently, I've switched my holding (401k) into the Bond Market.

It's out of the stock market.

Just recently, I've switched my holding (401k) into the Bond Market.

It's out of the stock market.

reply to post by Fearthedarkforiaminit

Thanks for your post.

Maybe you can comment on Beezzer's post on his move to bonds. Not sure how safe that will be. From what I understand if interest rates rise bond values fall. Not sure if this applies just to US treasuries or municipals as well.

Thanks for your post.

Maybe you can comment on Beezzer's post on his move to bonds. Not sure how safe that will be. From what I understand if interest rates rise bond values fall. Not sure if this applies just to US treasuries or municipals as well.

reply to post by Bassago

I was under the impression that the bond market would rise.

Perhaps I'm just screwed.

I was under the impression that the bond market would rise.

Perhaps I'm just screwed.

new topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 33 minutes ago -

Maestro Benedetto

Literature: 2 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 2 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 5 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 6 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 6 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 8 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 8 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 8 hours ago -

Weinstein's conviction overturned

Mainstream News: 10 hours ago

top topics

-

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 11 hours ago, 9 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 14 hours ago, 8 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 11 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 10 hours ago, 7 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 6 hours ago, 7 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 8 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 8 hours ago, 5 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 5 hours ago, 4 flags -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 33 minutes ago, 4 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 6 hours ago, 2 flags

active topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 237 • : cherokeetroy -

Is AI Better Than the Hollywood Elite?

Movies • 5 • : 5thHead -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 62 • : pianopraze -

Alternate Electors vs Fake Electors - What is the Difference.

2024 Elections • 115 • : WeMustCare -

Sunak spinning the sickness figures

Other Current Events • 24 • : NoCorruptionAllowed -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 95 • : Irishhaf -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 14 • : WeMustCare -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 44 • : theshadowknows -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 0 • : WeMustCare -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology • 31 • : glend